Electronic Weighing Machines Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Electronic Weighing Machines Market Size and Share:

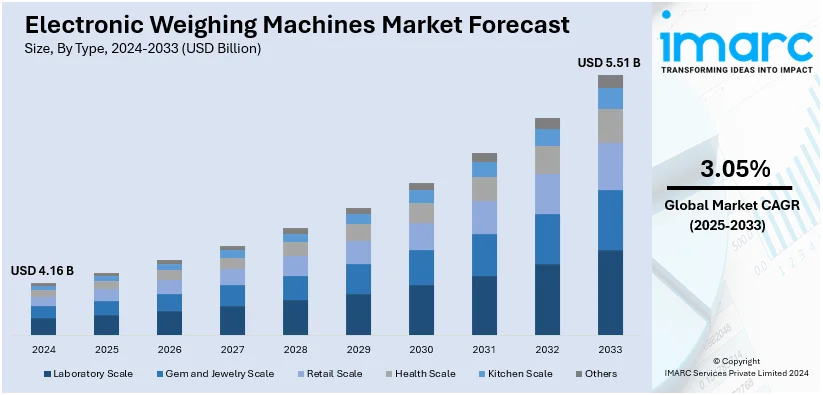

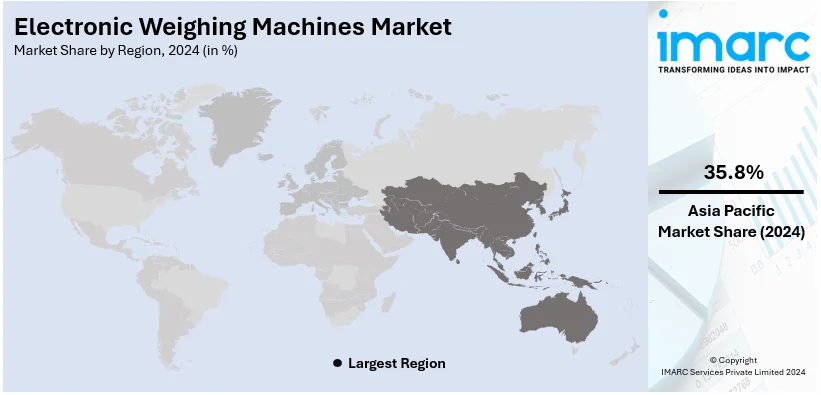

The global electronic weighing machines market size was valued at USD 4.16 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.51 Billion by 2033, exhibiting a CAGR of 3.05% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 35.8% in 2024. The market is witnessing steady growth driven by the rising demand in retail, healthcare, and industrial sectors for precise weight measurements. Advancements in digital technologies, user-friendly interfaces and widespread adoption of compact, portable designs are enhancing their popularity. The market is also benefiting from automation trends and regulatory compliance in trade ensuring accuracy and reliability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.16 Billion |

|

Market Forecast in 2033

|

USD 5.51 Billion |

| Market Growth Rate (2025-2033) | 3.05% |

The electronic weighing machines market is growing due to an increasing demand for precision and efficiency across industries like retail, healthcare, and logistics. Technological advancements, such as digital connectivity and touch interfaces, are enhancing user experience and boosting adoption. For instance, in February 2024, Newtec launched the 2008PCM/Memory Pans weighing solution designed for the processed food sector offering high speed and accuracy with a capacity of 140 portions per minute. The rise in ecommerce and global trade is driving the need for accurate weight measurement solutions. Additionally, regulatory requirements for standardized weighing systems and the shift toward automation in industrial processes are fueling market expansion. With growing awareness of product accuracy in both commercial and personal applications electronic weighing machines are becoming essential tools in modern operations.

The U.S. electronic weighing machines market is driven by advancements in digital technologies and the rising need for precision in industries, such as retail, healthcare, and logistics. For instance, in August 2024, Carematix launched an innovative Cellular Weight Scale featuring patented weight asymmetry technology enhancing remote patient monitoring. This advanced device accurately measures weight distribution improving orthopedic patient care and early disease detection. The growth of ecommerce and stringent regulations for weight measurement accuracy are facilitating the product demand. Additionally, automation trends in manufacturing and supply chain processes are boosting adoption. Consumer preferences for compact, user-friendly designs, and smart features like wireless connectivity are further fueling market growth. The healthcare sector's need for reliable weighing solutions in diagnostics and patient care is also contributing significantly, alongside a broader focus on efficiency and compliance across various commercial sectors.

Electronic Weighing Machines Market Trends:

Growing Demand from Healthcare and Retail Sectors

Increasing demand in the health-care sector for accurate, efficient, and portable weighing systems together with the growing demand from the retail sector, specifically in supermarkets and pharmacies, which have a need to develop streamlined transaction handling and management of stock, are considerable factors driving the market forward. The global population is aging rapidly, making weight measurements in health care crucial and even more necessary with precise measurements. 1 in 6 people worldwide will be aged 60 years or older by 2030, with the population aged 60 and above increasing from 1 billion in 2020 to 1.4 billion, as per world bank estimates. The demographic shift raises the importance of proper monitoring of weight to counter health issues like obesity, cardiovascular diseases, and diabetes due to aging. Thus, electronic weighing machines are going to become a necessity in both health monitoring and commercial transactions by guaranteeing precise measurement standards for better healthcare practice and efficient business practices.

Advancements in Technology

The integration of innovative technologies such as digital sensors, connectivity (IoT), and better designs of load cells has increased the accuracy, efficiency, and ease of use of electronic weighing machines. These technologies can send data in real time, remotely monitor, and connect with other devices or systems, thus being adopted by industries in various fields. For instance, Anker's sub-brand, Eufy, launched the Smart Weighing Scale C1 in India in December 2020. This smart weighing scale is equipped with smartphone connectivity and intelligent features that assist a user in monitoring health and tracking fitness goals. Upon connection to the EufyHome app, it measures 12 parameters such as muscle mass, visceral fat, and lean body mass. Such innovations reflect the growing demand for much more connected and intelligent weighing systems, further fuelling the adoption of these products in both healthcare and retail sectors.

Regulatory Compliance and Safety Standards

Increasing regulatory requirements and safety standards for accurate measurements, especially in industries like pharmaceuticals, food processing, and logistics, are driving the demand for electronic weighing machines. For instance, in the pharmaceutical industry, Good Manufacturing Practices set by regulatory bodies such as the U.S. The FDA and the European Medicines Agency require to weigh accurately to ensure an accurate dosage of drugs by reducing the risk of drug contamination or incorrect formulations. Correspondingly, in food processes, HACCP regulations and ISO 22000 standards require accurate weighing that would ensure product quality or food safety, especially where there is packaging, labelling, and mixing processes of ingredients. In the logistics sector, the regulations such as ISO 9001 in quality management and weight-based guidelines from the U.S. Department of Transportation (DOT) require accurate weight measurements for inventory management, shipping, and freight weighing to prevent overloading and fines resulting from non-compliance with international trade rules. Such standards not only help preserve consumer safety but also lead to operational efficiency, thereby setting up further demands for precise, reliable electronic weighing systems.

Electronic Weighing Machines Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global electronic weighing machines market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on type and distribution channel.

Analysis by Type:

- Laboratory Scale

- Gem and Jewelry Scale

- Retail Scale

- Health Scale

- Kitchen Scale

- Others

Retail scale leads the market with around 33.6% of market share in 2024. Retail scales dominate the electronic weighing machines market by type driven by their widespread use in grocery stores, supermarkets, and specialty retail outlets. These scales offer precise weight measurements, integrated pricing capabilities and advanced features like barcode printing and wireless connectivity streamlining retail operations. The growing adoption of point-of-sale (POS) systems further enhances their utility enabling seamless integration with billing and inventory management processes. Increasing consumer demand for pre-packaged and accurately weighed goods is fueling their deployment. Retailers are also embracing digital and touch-enabled scales to improve customer experience and operational efficiency. As the retail industry evolves the demand for versatile, durable and smart weighing solutions continues to propel the dominance of retail scales in the market.

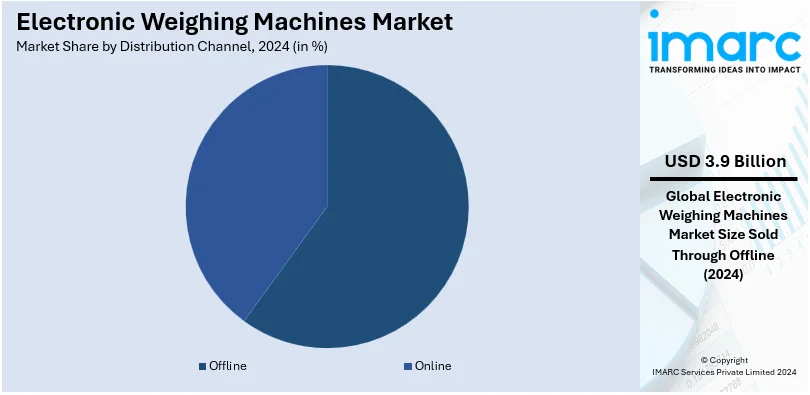

Analysis by Distribution Channel:

- Online

- Offline

Offline leads the market with around 94.5% of market share in 2024. Offline channels dominate the electronic weighing machines market due to their strong presence in retail stores, specialty shops and authorized dealerships. Customers prefer purchasing these machines offline for hands-on product inspection, personalized demonstrations and immediate availability. Retailers provide post-purchase support, warranties and service fostering trust and customer satisfaction. Industries like retail, healthcare and manufacturing rely on offline suppliers for bulk procurement and tailored solutions. Local distributors play a crucial role in catering to specific regional demands. Despite the rise of ecommerce the offline segment remains a preferred choice for businesses and individuals seeking reliability, support and direct interaction with vendors.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 35.8%. Asia Pacific holds the largest share in the electronic weighing machines market driven by rapid industrialization, urbanization and the growth of retail, healthcare and manufacturing sectors. Countries like China, India and Japan are key contributors due to their expanding trade activities and increasing adoption of advanced technologies. The rising demand for precise weighing solutions in ecommerce, logistics and food processing industries further fuels market growth. Additionally, government regulations mandating accurate weight measurement systems support widespread adoption. Affordable pricing, local manufacturing capabilities and a growing middle-class population seeking modern weighing solutions for personal and commercial use strengthen Asia Pacific's market dominance.

Key Regional Takeaways:

North America Electronic Weighing Machines Market Analysis

North America is a key market for electronic weighing machines driven by the diverse applications across industries such as agriculture, logistics, retail and healthcare. The region's growth is fueled by increasing demand for precise and efficient weighing systems to enhance operational accuracy. The agriculture sector is contributing significantly to GDP relies heavily on advanced weighing solutions for quality control and compliance in food production. The logistics and ecommerce boom further amplifies the need for IoT-enabled systems to optimize supply chain operations. In healthcare, the rising focus on health monitoring and obesity management supports the adoption of smart weighing scales with advanced features. Additionally, robust infrastructure in manufacturing and retail fosters the integration of digital weighing technologies ensuring sustained demand and innovation in the North American market.

United States Electronic Weighing Machines Market Analysis

In 2024, United States accounted for a share of 88.60% of the North America market. The United States electronic weighing machine market is experiencing significant growth, driven by technological advancements and expanding applications across key industries such as agriculture, food processing, and healthcare. According to an industrial report, in 2023, agriculture, food, and related industries contributed approximately USD 1.530 Trillion to the U.S. GDP, underscoring the critical need for accurate and efficient weighing systems in ensuring quality control and operational efficiency in food production and distribution.

In the healthcare sector, rising health concerns and obesity rates—impacting over 2 in 5 U.S. adults according to the CDC—have amplified demand for health monitoring solutions, including smart weighing scales equipped with IoT capabilities. These devices play a vital role in tracking weight-related health metrics, addressing chronic conditions, and promoting fitness goals. Additionally, technological advancements such as enhanced load cell designs and connectivity features have streamlined operations across retail and logistics sectors, making electronic weighing machines indispensable for maintaining accuracy and regulatory compliance. This confluence of industry-specific needs and cutting-edge innovations positions the U.S. market for continued expansion.

Europe Electronic Weighing Machines Market Analysis

The food and drink industry is one of the EU's largest manufacturing sectors, and it strongly supports the European electronic weighing machine market. As per OECD data, in 2023, the industry supported 4.6 million jobs, produced around Euro 1.1 trillion (USD1.16 Trillion), and added around Euro 229 billion (USD 241 Billion) in value to the regional economy. It is necessary to have accurate weighing systems to ensure food safety compliance, quality control, and operational efficiency. Advanced weighing solutions, such as IoT-enabled and automated systems, are being increasingly adopted to streamline processes and meet stringent EU regulations, with growing emphasis on precision and traceability. The trend of eco-friendly packaging and digital integration in production lines further drives the demand for innovative weighing machines, solidifying their role in supporting the efficiency and sustainability goals of Europe's food and beverage manufacturing sector. Furthermore, the increasing demand for higher standards in food traceability and labelling, both from consumers and regulatory requirements, is speeding up the adoption of advanced electronic weighing technologies. The demand for accurate measurement solutions in the retail and logistics sectors also contributes to the steady market growth, ensuring that the European electronic weighing machine market remains vital for both industrial and commercial applications.

Latin America Electronic Weighing Machines Market Analysis

By 2028, Latin America and the Caribbean are expected to account for more than 25% of global exports of agricultural and fishery products, as reported by the Food and Agriculture Organization (FAO) and the Organization for Economic Cooperation and Development (OECD). This significant growth in agricultural exports will drive the demand for accurate, reliable electronic weighing machines, which are essential for ensuring compliance with international quality standards and for maintaining efficiency in the production, packaging, and transportation of food products. As the region's agricultural output increases, the need for advanced weighing systems to handle larger volumes of goods, particularly in the food processing and export sectors, will become even more critical. This trend highlights the growing role of electronic weighing systems in supporting Latin America's expanding agricultural and food industries, contributing to the overall growth of the market in the region.

Middle East and Africa Electronic Weighing Machines Market Analysis

The Middle East and Africa electronic weighing machine market is expected to experience strong growth due to several key developments. The UAE's National Strategy for Food Security, which aims to make the country the global leader in the Global Food Security Index by 2051, is driving demand for precision in food processing and agriculture. As the country focuses on enhancing its agricultural capabilities, the need for accurate and efficient weighing systems in food production and distribution becomes more critical. Furthermore, as per industry reports, the GCC and Iraq are set to invest USD 1 Trillion in new construction projects by 2030, driving the growth of the infrastructure and construction sectors. This surge in investment will require accurate weighing systems for material handling, logistics, and supply chain management in these growing industries. These developments in food security initiatives and infrastructure investment contribute significantly to the rising demand for electronic weighing machines in the Middle East and Africa.

Competitive Landscape:

The electronic weighing machines market is highly competitive characterized by the presence of established global players and emerging regional manufacturers. Key companies focus on product innovation, such as integrating IoT capabilities, advanced sensors, and user-friendly interfaces to gain a competitive edge. Market leaders prioritize R&D investments to enhance accuracy and functionality. Regional players leverage cost advantages and local distribution networks to cater to specific market demands. The growing emphasis on sustainability and energy efficient designs also shapes competitive strategies. Strategic partnerships, mergers and acquisitions are prevalent as companies aim to expand their geographic footprint and technological expertise further intensifying competition in this evolving and dynamic market. For instance, in July 2024, Avery Weigh-Tronix introduced its new ZT Digital Load Cell engineered for durability and precision in extreme conditions. Key features include a 66,000 lb capacity, IP68 waterproofing, integrated lightning protection and a patented design allowing easy retrofitting into existing BridgeMont Truck Scales enhancing operational efficiency and security.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- A&D Company Limited

- Avery Weigh-Tronix LLC. (Illinois Tool Works Inc.)

- BONSO Electronics International Inc.

- Doran Scales Inc.

- Essae-Teraoka Pvt. Ltd.

- Fairbanks Scales Inc.

- Kern & Sohn GmbH

- Mettler-Toledo International Inc.

- Sartorius AG

- Shimadzu Corporation.

Latest News and Developments:

- May 2024: A&D Company, Limited, based in Tokyo, reports that it has finalized a USD 1 Million investment contract with Aevice Health Pte Ltd, a Singaporean company specializing in remote respiratory monitoring technologies.

- September 2023: The government of India launched an initiative to check against ration shop frauds by inter-linking e-POS weighing machines. This initiative aimed to eliminate weight tampering and measurements. The primary target of this initiative is to eradicate black market.

- July 2023: Italian espresso machine manufacturer Victoria Arduino launched a 'Virtual Intelligent Scale' (VIS) to be integrated into Eagle One commercial espresso machines. The company developed VIS to enable Eagle One Owners to enjoy a faster workflow than that of the previous version.

Electronic Weighing Machines Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Laboratory Scale, Gem and Jewelry Scale, Retail Scale, Health Scale, Kitchen Scale, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A&D Company Limited, Avery Weigh-Tronix LLC. (Illinois Tool Works Inc.), BONSO Electronics International Inc., Doran Scales Inc., Essae-Teraoka Pvt. Ltd., Fairbanks Scales Inc., Kern & Sohn GmbH, Mettler-Toledo International Inc., Sartorius AG and Shimadzu Corporation. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electronic weighing machines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global electronic weighing machines market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the electronic weighing machines industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Electronic weighing machines are advanced devices designed for accurate weight measurement across various applications, including retail, healthcare, logistics, and industrial sectors. These machines utilize digital technologies and sensors to ensure precision, reliability, and ease of use, often integrating smart features like IoT connectivity.

The global electronic weighing machines market was valued at USD 4.16 Billion in 2024.

IMARC estimates the global electronic weighing machines market to exhibit a CAGR of 3.05% during 2025-2033.

The market is driven by growing demand in retail, healthcare, and logistics for precise measurements, technological advancements like IoT integration, touch interfaces, and increasing regulatory compliance to ensure accuracy and safety in trade operations.

In 2024, Retail Scale represented the largest segment by type, driven by widespread use in supermarkets, integrated pricing, and barcode printing capabilities.

Offline channels lead the market by distribution channel owing to strong retail presence, personalized service, and immediate product availability.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global electronic weighing machines market include A&D Company Limited, Avery Weigh-Tronix LLC. (Illinois Tool Works Inc.), BONSO Electronics International Inc., Doran Scales Inc., Essae-Teraoka Pvt. Ltd., Fairbanks Scales Inc., Kern & Sohn GmbH, Mettler-Toledo International Inc., Sartorius AG and Shimadzu Corporation., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)