Electronic Toll Collection Market Size, Share, Trends and Forecast by Technology, System, Subsystem, Offering, Toll Charging, Application, and Region, 2025-2033

Electronic Toll Collection Market Size and Share:

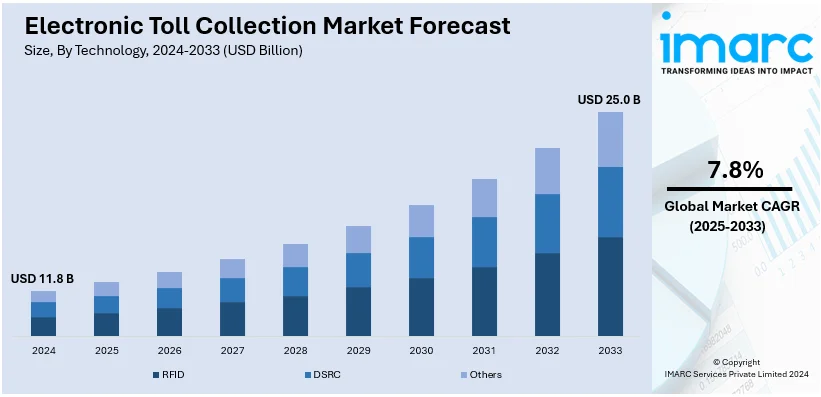

The global electronic toll collection market size was valued at USD 11.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.0 Billion by 2033, exhibiting a CAGR of 7.8% during 2025-2033. North America currently dominates the market, holding a market share of over 31.0% in 2024. The market is primarily driven by rapid technological advancements, an enhanced focus on traffic management efficiency, and government initiatives for infrastructure modernization, driving widespread adoption of seamless and automated tolling systems for enhanced transportation effectiveness and reduced congestion.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.8 Billion |

| Market Forecast in 2033 | USD 25.0 Billion |

| Market Growth Rate (2025-2033) | 7.8% |

The market is majorly driven by the growing adoption of cashless payment systems and increasing government initiatives to improve transportation infrastructure. The need for efficient traffic management and reduced congestion in toll plazas has fueled demand for advanced tolling technologies. Additionally, the rise in vehicle ownership and the expansion of road networks globally have accelerated the deployment of ETC systems. Technological advancements, such as RFID and GPS-based tolling, offer improved accuracy and convenience, further propelling market growth. On 12th September 2024, the Indian government announced introducing satellite-based toll collection on national highways by April 2025. The technology, GPS enabled, calculates toll on the basis of distance traveled without the requirement of having a physical toll plaza and relies on the usage of GNSS along with OBUs within a vehicle. A 1,000 km trial stretch gave free-running toll collection without any breakages. There are provisions for up to 20 km per day/week in toll exemption on account of locals and supports digitization within India's transport sector. Besides this, environmental concerns and the push toward sustainable transportation have also encouraged the adoption of ETC solutions to minimize emissions caused by idling vehicles, creating a positive outlook for the market.

The United States stands out as a key regional market, primarily driven by the rising need to modernize aging tolling infrastructure and the increasing focus on reducing travel time for commuters. The push for interoperability among tolling systems across different states is fostering broader adoption of ETC technologies. High vehicle density in urban areas necessitates efficient toll collection solutions to alleviate traffic bottlenecks. Federal and state-level investments in intelligent transportation systems (ITS) are further driving the implementation of ETC systems. Additionally, public-private partnerships (PPPs) in infrastructure development are facilitating the deployment of advanced tolling solutions. Furthermore, growing consumer preference for contactless and automated payment systems also contributes to the market’s expansion, reflecting a strong shift toward digitalization in the transportation sector.

Electronic Toll Collection Market Trends:

Rapid technological advancements and innovation

The market is propelled by continuous technological advancements and innovations in tolling systems. As the transportation industry is growing, toll collection systems are integrating cutting-edge technologies such as RFID (Radio-Frequency Identification), GPS (Global Positioning System), and advanced sensors. For instance, Verizon Connect recently published its 2025 Fleet Technology Trends Report for Europe, showcasing the increasing adoption of advanced fleet management technologies by European businesses. According to the report, 78% of fleets are now using GPS tracking technology, representing a 5% increase from the previous year. These innovations enhance the efficiency of toll collection by enabling seamless and real-time transactions, reducing traffic congestion, and improving overall operational effectiveness. The adoption of these technologies not only streamlines toll collection processes but also contributes to the development of intelligent transportation systems, fostering a more connected and automated transportation infrastructure.

Increased focus on traffic management and congestion reduction

The growing concerns over traffic congestion and the need for efficient traffic management drive the adoption of these collection systems. By automating toll payments, these systems minimize vehicle queuing at toll booths, leading to smoother traffic flow and reduced travel time. According to a survey, 91% of respondents use electronic toll collection (ETC), with 43% offering Open Road Tolling (ORT) on some lanes. This increase in automatic toll payments reflects societal demand for cashless options, enhancing throughput and service quality without significant capital investment, benefiting both users and facility owners. Governments and transportation authorities recognize the role of this toll collection in mitigating congestion-related issues, making it a key solution for enhancing overall road network efficiency. As urbanization continues and traffic volumes increase, these systems become integral components of smart city initiatives, contributing to sustainable and streamlined urban mobility.

Rising government initiatives for infrastructure modernization

Government initiatives aimed at modernizing transportation infrastructure play a pivotal role in driving the market. According to reports, India's infrastructure investment is projected to rise from 5.3% of GDP in FY24 to 6.5% of GDP by FY29, driving modernization that will enhance the efficiency and scalability of electronic toll collection systems. Various countries are investing in upgrading their tolling systems to electronic platforms as part of broader infrastructure development plans. These initiatives are often driven by the need to improve road safety, reduce toll evasion, and enhance overall transportation efficiency. Governments recognize the cost-effectiveness and long-term benefits of these toll collection systems, leading to widespread implementation and integration into national and regional transportation strategies. As a result, public-private partnerships and government-led projects fuel the expansion of electronic toll collection across extensive road networks, contributing to the market's sustained growth.

Electronic Toll Collection Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electronic toll collection market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, system, subsystem, offering, toll charging, and application.

Analysis by Technology:

- RFID

- DSRC

- Others

RFID stand as the largest component in 2024, holding around 42.3% of the market as they are affixed to vehicles, facilitating automatic identification and deduction of toll charges as vehicles pass through toll booths. This technology provides a seamless and rapid toll collection process, contributing to reduced congestion and enhanced overall traffic flow. The RFID segment's widespread adoption is driven by its reliability, cost-effectiveness, and compatibility with various tolling environments, making it the preferred choice for many transportation authorities and toll operators globally.

Analysis by System:

- Transponder - or Tag-Based Toll Collection Systems

- Other Toll Collection Systems

Transponder - or tag-based toll collection systems lead the market, holding around 82.5% of the market. The transponder- or tag-based toll collection systems emerge as the largest segment in the market, offering a seamless and efficient tolling experience. These systems utilize in-vehicle transponders or tags equipped with RFID technology, enabling automatic toll deduction as vehicles pass through toll booths. Drivers benefit from the convenience of hands-free transactions, reducing traffic congestion and improving overall road network efficiency. The widespread adoption of transponder-based systems is attributed to their user-friendly nature, accuracy, and ability to facilitate rapid toll processing, making them the preferred choice for both toll operators and motorists.

Analysis by Subsystem:

- Automated Vehicle Identification

- Automated Vehicle Classification

- Violation Enforcement System

- Transaction Processing

Automated vehicle classification leads the market, holding around 28.6% of the market. The automated vehicle classification playing a pivotal role in categorizing vehicles based on size, weight, and other criteria for accurate toll calculations. This subsystem utilizes advanced technologies such as sensors, cameras, and machine learning algorithms to automatically classify vehicles, ensuring precise toll charges. With a focus on optimizing toll collection processes and enhancing efficiency, automated vehicle classification systems contribute significantly to the overall effectiveness of toll operations, making them a cornerstone in the electronic toll collection landscape.

Analysis by Offering:

- Hardware

- Back Office and Other Services

Hardware stands out as the largest component in 2024, holding around 69.8% of the market. The hardware segment encompasses the physical components essential for toll collection systems, including RFID readers, transponders, cameras, sensors, and other infrastructure elements deployed at toll booths. The demand for robust and efficient hardware solutions stems from the need for accurate vehicle identification, seamless toll transactions, and overall system reliability. Continuous advancements in hardware technologies contribute to enhanced performance, increased durability, and the ability to handle high traffic volumes, making it a crucial element for the successful implementation of electronic toll collection systems.

Analysis by Toll Charging:

- Distance Based

- Point Based

- Time Based

- Perimeter Based

Distance based leads the market in 2024, holding around 47.0% of the market. Distance-based toll charging leverages technology to calculate toll fees based on the distance traveled by a vehicle. This method ensures a more accurate and fair toll assessment, aligning costs with actual road usage. Distance-based tolling is increasingly favored by transportation authorities for its efficiency in reflecting the impact on infrastructure and encouraging sustainable travel practices. It provides a transparent and equitable tolling model that resonates with both toll operators and motorists, contributing significantly to the overall market share.

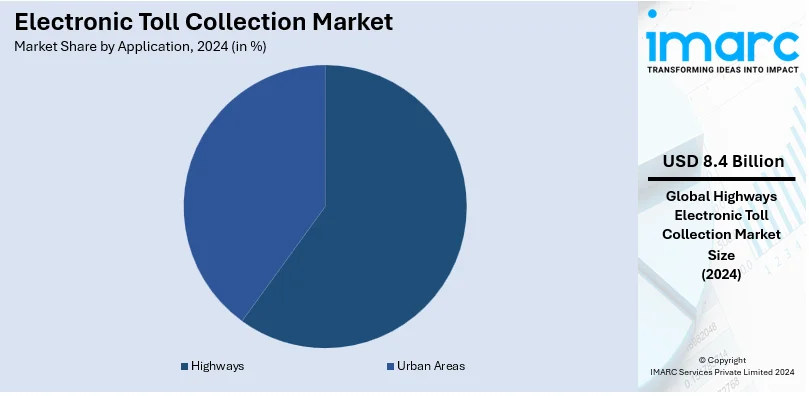

Analysis by Application:

- Highways

- Urban Areas

Highways leads the market with around 71.1% of market share in 2024. The highways segment reflects the widespread adoption of tolling systems on major road networks. Electronic toll collection plays a pivotal role in optimizing toll collection processes on highways, ensuring seamless transactions for vehicles covering long distances. The efficiency and convenience offered by these systems contribute to reduced congestion at toll plazas, enhancing overall traffic flow on highways. Governments and transportation authorities worldwide recognize the importance of electronic tolling in funding highway maintenance and expansion projects, further solidifying the dominance of this segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share, holding around 31.0% of the market driven by a robust transportation infrastructure and a high level of technology adoption. The region's well-developed road networks, particularly in the United States and Canada, have led to extensive implementation of electronic tolling systems on highways. Regulatory support and a strong emphasis on improving transportation efficiency contribute to North America's dominance in the market. The continuous technological advancements and a mature market landscape position North America as a key player, with ongoing investments in intelligent transportation systems and electronic toll collection technologies.

Key Regional Takeaways:

United States Electronic Toll Collection Market Analysis

In 2024, North America accounted for the largest market share of over 79.20%. The adoption of Electronic Toll Collection (ETC) in the United States is driven by the increasing need for traffic congestion management. With urbanization and rising vehicular volumes, toll booths create significant delays, making ETC an attractive solution. Technological advancements in toll collection systems, such as RFID and GPS-based systems, have facilitated smoother operations, reduced manual labour costs and improved the accuracy of toll fees. The rising demand for improved transportation infrastructure and government incentives for upgrading toll systems have also supported ETC growth. According to U.S. Department of Transportation, the Biden-Harris Administration has announced USD 1.8 Billion in RAISE grants for 148 infrastructure projects, part of a USD 7.2 Billion total investment, enhancing road safety and efficiency, which directly benefits Electronic Toll Collection by improving infrastructure resilience and reducing traffic congestion. Additionally, environmental concerns, such as reducing vehicle idling time, contribute to the shift toward ETC, aligning with broader sustainability goals. The push toward smart city solutions and automated transportation also plays a crucial role in expanding ETC in the country. Furthermore, public-private partnerships and government-led initiatives to modernize road infrastructure are creating favorable conditions for ETC adoption, ensuring faster toll transactions, and reducing the need for physical toll booths. With the convenience of seamless payments and better traffic flow, ETC continues to gain momentum across major highways, toll bridges, and tunnels, contributing significantly to reducing operational costs and improving user experience.

Asia Pacific Electronic Toll Collection Market Analysis

In Asia-Pacific, the electronic toll collection is driven by rapid urbanization and increasing road congestion in major metropolitan areas. The growing middle class and vehicle ownership across countries such as China, India, and Southeast Asia have significantly raised demand for more efficient transport solutions. According to reports, the 34% increase in passenger vehicle (PV) sales in FY 2023, along with a 92% year-on-year rise in September, reflects growing consumer confidence during the festive season, driving higher vehicle ownership and benefiting electronic toll collection systems by enhancing toll revenue and efficiency. Governments in the region are investing heavily in toll collection infrastructure to streamline traffic flow and reduce bottlenecks. The push for reducing carbon emissions and promoting green technologies also supports the adoption of ETC, as it minimizes vehicle idling and emissions. Advances in technology, particularly mobile payments, and contactless cards, are further driving ETC adoption, as they offer greater convenience and efficiency for commuters. The region is also seeing an increasing number of highway projects, often funded through public-private partnerships, which rely on toll collection systems to generate revenue. Furthermore, the growing emphasis on integrated transportation systems, where tolling can be part of a broader mobility-as-a-service offering, accelerates the shift to ETC. The lack of sufficient toll booths and manual systems in rural areas is another challenge, pushing countries to adopt automated tolling solutions. The overall economic growth and infrastructure developments in Asia-Pacific continue to encourage the expansion of ETC systems.

Europe Electronic Toll Collection Market Analysis

In Europe, regulatory measures to promote road safety and reduce congestion in roads are the leading factors driving the adoption of electronic toll collection. A uniform ETC solution adopted by a country is, in many cases, motivated by the European Union's efforts to harmonize tolling systems and achieve interoperability across borders. Implementation of tolling schemes on major highways and roads in urban areas is gathering momentum as governments search for alternative sources of revenue to finance projects. In addition, the policies on environmental regulation of decreasing air pollution and reduction in vehicle emissions create the propensity for the use of ETC, since this technique reduces congestion and idle time at toll booths. The European market is also influenced by the region’s growing interest in smart cities and connected mobility, where seamless travel experiences are essential. Furthermore, the increasing adoption of electric vehicles and hybrid cars, which often enjoy preferential treatment on toll roads, boosts the appeal of ETC systems. For instance, in 2023, electric vehicles (EVs) represented 22.7% of new car registrations and 7.7% of new van registrations in Europe, with 2.4 Million new electric cars and 91,000 electric vans registered, reflecting a 37% growth in battery electric cars. This rise in EV adoption enhances the potential for electronic toll collection systems, offering more streamlined, efficient tolling solutions across the continent. The need for enhanced traffic management systems to support growing transportation demands in urban and rural areas fuels the shift towards electronic tolling. Public-private partnerships, offering more efficient toll collection solutions, also contribute to the widespread adoption of ETC in the region. Lastly, the European desire to improve road user experience through seamless, automated systems ensures a bright future for ETC.

Latin America Electronic Toll Collection Market Analysis

In Latin America, factors compelling the use of ETC include increasing traffic volumes and the need for more efficient means of transportation. Urban congestion is severe, making human toll collection inefficient with mounting urbanization. According to reports, Latin America's urbanization rate has increased from 62% in 1980 to 81% in 2011, projected to reach 89% by 2050, offering a growing market for electronic toll collection systems as cities increasingly focus on sustainable, low-carbon development through initiatives such as ESCI. Governments are implementing ETC to alleviate traffic jams, reduce road maintenance costs, and improve toll collection accuracy. Moreover, the region’s growing emphasis on sustainability and environmental protection drives ETC adoption, as electronic systems can reduce emissions associated with vehicle idling. The desire to modernize infrastructure and the development of public-private partnerships further push the adoption of ETC. The regional governments are also introducing regulations to ensure better traffic management and improve road safety, making ETC a vital tool in the transport sector.

Middle East and Africa Electronic Toll Collection Market Analysis

In the Middle East and Africa, rapid urbanization coupled with an increasing number of road vehicles is driving the demand for electronic toll collection systems. The two countries that lead the rest are the UAE and South Africa, which are investing in automated tolling solutions to help improve traffic flow and road safety. The increasing demand for sustainability and decongesting has made the government consider ETC as an environmentally friendly measure. Additionally, the incorporation of high technology, such as mobile applications for toll collection and RFID-based systems, makes it highly adopted throughout the main highways and toll roads. For instance, in November 2024, with over 90% smartphone penetration in the UAE, the rise in mobile app usage creates significant opportunities for electronic toll collection, offering seamless, tech-driven solutions for both B2C and B2B markets. Additionally, increased investments in infrastructure and public-private partnerships help fuel ETC implementation across the region, fostering greater economic growth and smoother transportation networks.

Competitive Landscape:

The ETC market has a highly competitive landscape, as players have made strategic efforts to strengthen their market positions. Companies focus on technological innovations and have developed advanced solutions for tolling, including RFID, GPS-based systems, and cloud-enabled platforms to make it efficient and more user-friendly. In addition, common strategies to secure large-scale infrastructure projects are partnerships with government bodies and transportation authorities. Firms are also increasing their global footprint by entering emerging markets with tailored solutions. Moreover, many are also investing in research and development activities in order to integrate the ETC systems with wider intelligent transportation networks. Subscription-based models coupled with data analytics capabilities will now be the differentiator in this competitive market that aims to optimize toll operations.

The report provides a comprehensive analysis of the competitive landscape in the electronic toll collection market with detailed profiles of all major companies, including:

- Conduent Incorporated

- EFKON GmbH

- International Road Dynamics Inc.

- Kapsch Trafficcom AG

- Mitsubishi Heavy Industries, Ltd.

- Q-Free

- Skytoll

- Thales Group

- The Revenue Markets Inc.

- Trans Core

Latest News and Developments:

- November 2024: The NHAI is introducing a paradigm shift in toll collection by partnering with a bank to implement India's first multi-lane free flow (MLFF) electronic toll collection system on the Dwarka Expressway. The toll will be collected electronically via sensors and field equipment mounted on gantries, eliminating the need for physical toll plazas. Bids are invited for selecting an acquirer bank, with the highest revenue share offering gaining the tolling rights.

- January 2024: Neology signed a contract with the Humber Bridge Board (HBB) in the UK to provide comprehensive tolling solutions. Neology will supply roadside systems, back-office infrastructure, and digital solutions, including a website and mobile app. This partnership aims to enhance the management and maintenance of the Humber Bridge's tolling operations.

- November 2024: Ausol Autopistas del Sol, the largest toll concessionaire in Argentina, has selected TransCore’s RFID technology to upgrade its electronic toll collection (ETC) system. This initiative aims to enhance interoperability among all nine toll systems in Buenos Aires, which collectively manage a 120 km roadway network serving over 900,000 vehicles daily.

Electronic Toll Collection Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | RFID, DSRC, Others |

| Systems Covered | Transponder - or Tag-Based Toll Collection Systems, Other Toll Collection Systems |

| Subsystems Covered | Automated Vehicle Identification, Automated Vehicle Classification, Violation Enforcement System, Transaction Processing |

| Offerings Covered | Hardware, Back Office and Other Services |

| Toll Charging Covered | Distance Based, Point Based, Time Based, Perimeter Based |

| Applications Covered | Highways, Urban Areas |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Conduent Incorporated, EFKON GmbH, International Road Dynamics Inc., Kapsch Trafficcom AG, Mitsubishi Heavy Industries, Ltd., Q-Free, Skytoll, Thales Group, The Revenue Markets Inc., Trans Core, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electronic toll collection market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global electronic toll collection market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electronic toll collection industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electronic toll collection market was valued at USD 11.8 Billion in 2024.

The electronic toll collection market is projected to exhibit a CAGR of 7.8% during 2025-2033, reaching a value of USD 25.0 Billion by 2033.

The electronic toll collection market is majorly driven by the rapid technological advancements, increasing adoption of cashless payment systems, government initiatives for infrastructure modernization, and the need to reduce congestion at toll plazas and environmental concerns and demand for sustainable transportation.

North America currently dominates the market, accounting for a share of around 31.0%. The dominance is driven by the rising traffic congestion, increasing adoption of cashless payments, advanced infrastructure development, government initiatives for smart transportation, and growing demand for efficient toll management systems.

Some of the major players in the electronic toll collection market include Conduent Incorporated, EFKON GmbH, International Road Dynamics Inc., Kapsch Trafficcom AG, Mitsubishi Heavy Industries, Ltd., Q-Free, Skytoll, Thales Group, The Revenue Markets Inc., and Trans Core, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)