Electrical Steel Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033

Electrical Steel Market 2024, Size and Trends:

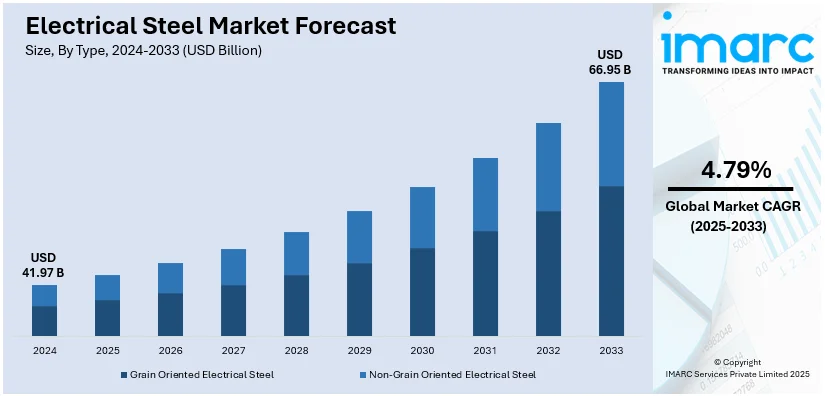

The global electrical steel market size was valued at USD 41.97 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 66.95 Billion by 2033, exhibiting a CAGR of 4.79% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant electrical steel market share of over 72.8% in 2024. The market is experiencing steady growth driven by increasing investments in smart grid technologies, government initiatives promoting energy efficiency and sustainability, the escalating demand for electric vehicles (EVs) requiring high-performance materials, and continual technological advancements in power infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 41.97 Billion |

|

Market Forecast in 2033

|

USD 66.95 Billion |

| Market Growth Rate (2025-2033) | 4.79% |

The global electrical steel market is propelled by the accelerating need for energy-efficient services across key applications including industrial, power generation, and transmission. Elevating growth in the deployment of renewable energy systems and purchase of electric vehicles (EVs) has substantially bolstered the requirement for electrical steel in generators, transformers, and motors. Furthermore, rapid modernization of aging power grids, especially in developed economies, and the magnification of infrastructure in emerging nations further fuel electrical steel market growth. In addition to this, electrical steel is widely used in the cores of transformers, electric motors, generators, inductors, magnetic relays, and actuators, enhancing energy efficiency and performance in various electrical and electronic systems.

The United States accounts for a critical market for electrical steel, bolstered by heavy investments in energy infrastructure, its resilient industrial base, and leading-edge manufacturing segment. The escalating sales of electric vehicles, along with shift towards renewable energy systems has fueled the requirement for electrical steel in electric motors, transformers, and generators. For instance, in January 2025, Convergent Energy and Power, a major U.S.-based energy storage services firm, announced securing USD 584.5 million loan from the U.S. Department of Energy’s Loan Programs Office. This investment will assist the construction of a solar photovoltaic system. In addition to this, adherence with strict energy saving policies and modernization of aging power grids further aid market expansion. Furthermore, government ventures to lower dependency on imports and bolster domestic manufacturing capacity, combined with active innovations in steel production technologies, establish the U.S. as a crucial player in the global electrical steel industry.

Electrical Steel Market Trends:

Growing Demand for Electric Vehicles (EVs)

A significant increase in electric vehicle penetration across the globe is one of the main factors driving the electrical steel market. Electric Vehicles (EVs) have seen a significant increase in global demand due to growing concerns over cleaner energy and lower emissions, with the automotive and governmental sectors promoting the same, leading to a rise in demand for lightweight materials that can add to the improved performance of the EVs. The International Energy Agency (IEA) reports that approximately 14 million electric vehicles were registered globally in 2023. Along with this, the future of motor and transformer design in EVs rests on electrical steel, a material renowned for its impressive magnetic qualities and high electrical resistivity. Meanwhile, the accelerated development of EV technology has aligned with growing investment in charging infrastructure to drive up demand for top-grade electrical steel even higher. As a result, this trend aids in developing the market globally as the automotive sector is a huge consumer of electrical steel, thereby fostering the electrical steel market demand.

Advancements in Power Infrastructure

The market for electrical steel is also majorly driven by the increased installation and up-gradation of power infrastructure. Additionally, electrical steel helps build transformers, inductors, and the key parts of the power grid that enable effective energy transmission and distribution. Investments are being made across the globe as countries update their power grids to handle more renewable energy, to keep up with the demand for electrical steel. The global renewable energy market size reached USD 960.9 Billion in 2024. Therefore, this is powered by the infrastructure development needed to supply increasing energy demands and sustainability goals. Moreover, increased grid reliability and the adoption of smart grid technologies are also driving the growing reliance on electrical steel.

Renewable Energy Expansion

The electrical steel market size is also being affected due to the rising trend of using renewable energy sources with a shift from coal, oil, and gas towards wind and solar power. Some of the most important systems used to generate renewable electricity provide peak efficiency if they incorporate electrical steel in the production generators and transformers to convert and dispose of renewable energy. According to the World Economic Forum, the global renewable capacity increased by over 50% in 2023 compared to 2022. In addition, increasing government initiatives and incentives for green energy technology adoption, coupled with continuous technological upgrades in renewable energy systems including solar, e-v charging stations, wind, and others are generating more demand for electrical steel. The global demand for Asia Pacific high-performance electrical steel is also increasing as countries worldwide are working to reduce carbon footprints and adopt cleaner energy sources, creating an opportune landscape for the sales of electrical steel materials, and driving market growth and sustainability efforts worldwide, along with shaping a positive electrical steel market outlook.

Electrical Steel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global keyword market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end use industry.

Analysis by Type:

- Grain Oriented Electrical Steel

- Non-Grain Oriented Electrical Steel

Non-grain-oriented electrical steel stand as the largest type in 2024, holding around 73.5% of the market. Non-grain-oriented (NGO) electrical steel holds dominance due to its widespread applications in various industries, especially in the manufacturing of electric motors, generators, and transformers. NGO electrical steel is known for its isotropic magnetic properties, which allow it to give peak performance in rotating machinery regardless of the direction of the magnetic flux, and the automotive industry is a key end-user of this type. Along with this, the growing demand for electric vehicles and the upcoming trends in power generation and distribution are enhancing the utilization of NGO electrical steel. Moreover, the cheaper price of NGO electrical steel when compared to grain-oriented electrical steel makes it a highly major type due to the preferences of manufacturers.

Analysis by Application:

- Transformers

- Motors

- Generators

- Others

Motors lead the market in 2024. Electric motors are the major application segment in the electrical steel market, which is mainly from the rising needs in the automotive, industrial machinery, and household appliances sectors. One of the major drivers for the increased demand is the growth in the production of electric vehicles (EVs), which require advanced electrical steel to improve the efficiency and performance of motors that power them. Moreover, the growing application of electric motors in manufacturing processes and the emphasis on industrial automation further influence the demand for this segment. Electric steel offers excellent magnetic properties, especially its low energy loss property which increases efficiency. Additionally, it is valuable as it necessitates far fewer components to keep in stock, but the efficiency aspect is key in driving waste and energy costs down, matching the trend across the globe towards sustainability and energy conservation. Amidst the ongoing perpetual technological innovation that teases the limits of motor performance, and efficiency, motor applications are accelerating usage rates in premium electrical steel, accentuating its predominance in the electrical steel domain.

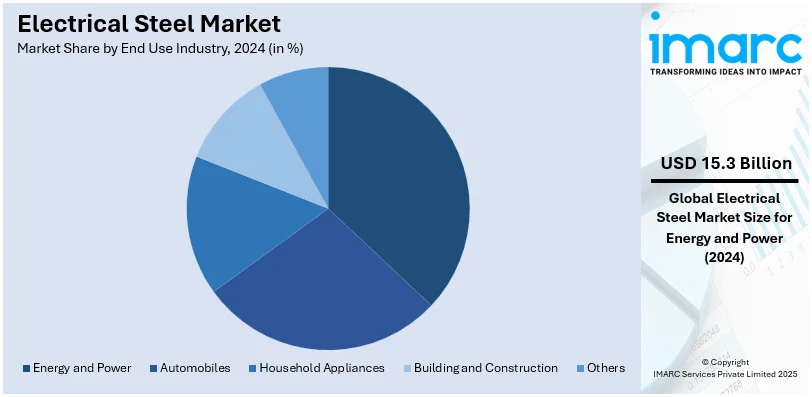

Analysis by End Use Industry:

- Energy and Power

- Automobiles

- Household Appliances

- Building and Construction

- Others

Energy and power leads the market with around 36.5% of market share in 2024. Energy and power are the largest end-use industry segments in the electrical steel market, primarily due to the indispensability of electrical steel in power generation, transmission, and distribution. Electrical steel is also used for different parts of the electrical power grid such as transformers and generators, ensuring low energy conversion loss. Furthermore, the increasing global transition to renewable energy, particularly wind and solar power is raising the need for high-efficiency electrical steel, which is a core component of energy-efficient renewable energy systems. Additionally, the modernization and extension of power infrastructure for rising energy demand and grid reliability are fueling this segment's revenues during the forecast period. In confluence with this, initiatives taken by the government and investments made to achieve various energy efficiency and sustainability targets also raise the demand for electrical steel in the energy and power sector. Cumulative emphasis on energy efficiency and the incorporation of sustainable energy generation solutions are propelling the market dominance of high-grade electrical steel in the global steel landscape.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, based on the electrical steel market forecast, Asia-Pacific accounted for the largest market share of over 72.8%. The Asia-Pacific (APAC) region is a significant driver of the electrical steel market, with countries like China, Japan, and India leading the way. The region’s rapid industrialization and urbanization are key factors; according to the World Bank, East Asia and the Pacific is the world’s most rapidly urbanizing region, with an average annual urbanization rate of 3 percent. This growth increases the demand for electrical steel, particularly in power transmission and distribution systems. China’s push towards renewable energy, especially in wind power, has further boosted the market, with electrical steel playing a vital role in wind turbine production. The growing adoption of electric vehicles across APAC, fueled by government incentives and rising sustainability awareness, is also driving demand. Moreover, the development of smart grid infrastructure in countries like Japan and South Korea supports the need for high-efficiency electrical steel. With thriving automotive, electronics, and manufacturing sectors, APAC continues to experience substantial demand for electrical steel.

Key Regional Takeaways:

United States Electrical Steel Market Analysis

In 2024, the United States accounted for 75% of the market share in North America. The growing need for energy-efficient solutions and renewable energy systems is propelling the electrical steel market in the United States. A notable factor is the surge in electric vehicle (EV) adoption, with nearly 1.2 million U.S. vehicle buyers opting for EVs in 2023, marking a record high, according to data from Kelley Blue Book, a Cox Automotive company. This transition is driving a considerable increase in the need for electrical steel, a critical material used in the production of high-performance electric motors for these vehicles. Furthermore, the growing construction sector, particularly in urban areas, is increasing the use of electrical steel in transformers and generators. Government initiatives focused on modernizing the power grid infrastructure also play a crucial role in propelling market growth. Additionally, U.S. policies promoting clean energy, such as tax incentives for renewable energy projects, further fuel the demand for electrical steel. Innovations in manufacturing techniques, producing higher-grade steel alloys, are enhancing the performance and efficiency of electrical steel products. As industrial automation and renewable energy projects, including wind turbines, continue to expand, the U.S. electrical steel market is set for a stable expansion.

North America Electrical Steel Market Analysis

North America holds a crucial position for the global electrical steel industry, mainly influenced by a robust focus on energy-saving technologies and its leading-edge manufacturing segment. The region's escalating implementation of renewable energy systems and bolstering ownership of electric vehicles (EVs) has significantly elevated the requirement for electrical steel in applications, majorly including generators, transformers, and motors. For instance, as per industry reports, EV sales in the U.S. are anticipated to grow substantially in 2025, with an estimated 10% of new vehicle sales being electric. It is projected that 1 out of every 4 vehicles sold in 2025 will be electric. In addition to this, the United States, as the leading contributor in the region, intensely profits from heavy investments in grid stability and infrastructure modernization. Besides this, the establishment of major industry players and emendation of stricter energy efficiency policies further boost expand electrical steel market share in this region. Moreover, rising industrialization, together with innovations in electrical steel manufacturing methodologies, guarantees North America remains a key driver of this evolving market.

Europe Electrical Steel Market Analysis

The European electrical steel market is experiencing significant growth, driven by a combination of energy efficiency regulations, rising electric vehicle (EV) adoption, and investments in renewable energy infrastructure. As reported by the International Energy Agency (IEA), Europe saw nearly 3.2 million new electric vehicle registrations in 2023, reflecting a growth of close to 20% compared to the previous year. In the European Union, sales amounted to 2.4 Million, with similar growth rates. This surge in EV demand is directly impacting the electrical steel market, as electrical steel is essential in the production of high-efficiency electric motors and batteries for these vehicles. Additionally, Europe’s commitment to sustainability, reflected in policies such as the European Green Deal, continues to drive investments in renewable energy, including wind and solar power. These developments are increasing the need for electrical steel, particularly in the manufacturing of transformers, generators, and other energy-efficient components. The increasing adoption of smart grids and energy storage technologies is driving the need for sophisticated electrical steel products. Europe’s strong manufacturing base, coupled with technological advancements and supportive government policies, ensures a favorable environment for the electrical steel market. As the region accelerates its transition to green energy and electric mobility, the demand for electrical steel is expected to continue growing.

Latin America Electrical Steel Market Analysis

In Latin America, the electrical steel market is driven by industrial growth, infrastructure development, and a shift towards renewable energy. According to reports, Latin American steel consumption reached 67.8 Million Tons in 2022, highlighting the region’s expanding manufacturing capacity. Countries like Brazil and Mexico are investing heavily in modernizing power grids and boosting energy efficiency, which increases the demand for electrical steel in transformers and generators. The automotive industry’s focus on electric vehicles also contributes to market growth. Government initiatives to promote renewable energy projects, such as wind and solar power, are further strengthening the demand for electrical steel in the region.

Middle East and Africa Electrical Steel Market Analysis

In the Middle East, the electrical steel market is experiencing growth driven by rapid infrastructure development, particularly in energy and construction. Saudi Arabia, for instance, saw its steel market valued at USD 8.7 Billion in 2024, reflecting increased demand for steel in the region’s growing industrial base. The expansion of power generation and distribution capacities is boosting the need for electrical steel, especially in transformers and energy-efficient applications. Additionally, investments in renewable energy projects, particularly wind and solar power in the Middle East, are further fueling the demand for electrical steel, supporting long-term market prospects.

Competitive Landscape:

The market is exhibited by extensive competition among major players, propelled by magnifying requirement across both automotive and industrial segments and technological innovations. Leading manufacturers are currently gravitating on tactical collaborations, product enhancements, and capacity proliferation, to fortify their market foothold. For instance, in December 2024, Tata Steel announced a strategic partnership with JCB for the supply of green steel, highlighting a critical move in both firms' decarbonization initiatives. This collaboration facilitates JCB will be supplied with low carbon steel from Tata, with a joint investment of EUR 1.25 billion. This agreement also encompasses development of a new electric arc furnace to lower emissions. In addition, the utilization of innovative production methods, encompassing annealing processes and precision rolling, improves product efficacy and quality, offering firms a competitive edge. Furthermore, regional players also play a critical role, adhering to localized needs and facilitating competition. Moreover, strict regulatory needs for energy-efficient materials and the accelerating requirement for electrical steel in EVs and renewable energy framework further bolster the competitive ecosystem within this revolutionizing industry.

The report provides a comprehensive analysis of the competitive landscape in the electrical steel market with detailed profiles of all major companies, including:

- Aperam

- ArcelorMittal

- Baoshan Iron & Steel Co. Ltd. (China Baowu Steel Group Corp. Ltd.)

- China Steel Corporation

- JFE Holdings Inc.

- JSW Steel Ltd.

- Nippon Steel Corporation

- POSCO

- SIJ - Slovenian Steel Group d. d.

- Steel Authority of India Limited

- Sumitomo Corporation

- Tata Steel Limited

- ThyssenKrupp AG

- United States Steel Corporation

- Voestalpine AG

Latest News and Developments:

- November 2024: Transformers & Rectifiers India (TARIL) has signed a Term Sheet to acquire a controlling stake in Posco Poggenamp Electrical Steel. This strategic investment aims to enhance supply chain management, improve operational efficiency, and strengthen TARIL's market position, particularly in the energy and infrastructure sectors. The acquisition also supports India's clean energy initiatives and marks a significant step toward TARIL becoming a fully backward-integrated company.

- October 2024: JFE Steel and JSW Steel have agreed to acquire thyssenkrupp Electrical Steel India Private Limited through their joint venture, JSW JFE Electrical Steel Private Limited. The deal is pending regulatory approval and will speed up their entry into the Indian market for electrical steel.

- February 2024: JSW Steel announced plans to develop a grain-focused electrical steel manufacturing facility via a joint venture with JFE Steel Corporation. The estimated investment for this project is over INR 5,500 Crore (USD 640 Million). JFE Corporation, based in Japan, holds a 15% stake in JSW Steel.

- October 2023: United States Steel Corporation launched a non-grain oriented (NGO) electrical steel line at its Big River Steel facility in Osceola, Arkansas. The line, the largest of its kind in the U.S., primarily produced InduX™ steel for the electric vehicle market. It utilized up to 90% scrap steel and reduced carbon emissions by up to 80% compared to traditional methods, aligning with U.S. Steel’s sustainability goals and addressing growing market demand.

- March 2022: ArcelorMittal invested over EUR 300 Million (USD 309 Million) to establish a 200,000-tons electrical steel production unit at its Mardyck site in France, which began operations in 2024. The unit produces steels for electric motors and vehicles, complementing the company's Saint-Chély d'Apcher plant. The project, supported by the French government, aims to support electromobility and help meet EU CO2 reduction goals.

Electrical Steel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Grain Oriented Electrical Steel, Non-Grain Oriented Electrical Steel |

| Applications Covered | Transformers, Motors, Generators, Others |

| End Use Industries Covered | Energy and Power, Automobiles, Household Appliances, Building and Construction, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aperam, ArcelorMittal, Baoshan Iron & Steel Co. Ltd. (China Baowu Steel Group Corp. Ltd.), China Steel Corporation, JFE Holdings Inc., JSW Steel Ltd., Nippon Steel Corporation, POSCO, SIJ - Slovenian Steel Group d. d., Steel Authority of India Limited, Sumitomo Corporation, Tata Steel Limited, ThyssenKrupp AG, United States Steel Corporation, Voestalpine AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electrical steel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global electrical steel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electrical steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electrical steel market was valued at USD 41.97 Billion in 2024.

IMARC estimates the market to reach USD 66.95 Billion by 2033, exhibiting a CAGR of 4.79% during 2025-2033.

Key factors boosting the market encompass rapid modernization of power grids, escalating requirement for energy-efficient materials, proliferating EVs production, and amplifying renewable energy infrastructure. Furthermore, industrialization in developing nations and strict energy efficiency policies further bolster market growth worldwide.

Asia Pacific currently dominates the electrical steel market, accounting for a share exceeding 72.8%. This dominance is strengthened by its resilient industrial base, magnifying infrastructure ventures, and substantial need from key industries like energy or automotive.

Some of the major players in the electrical steel market include Aperam, ArcelorMittal, Baoshan Iron & Steel Co. Ltd. (China Baowu Steel Group Corp. Ltd.), China Steel Corporation, JFE Holdings Inc., JSW Steel Ltd., Nippon Steel Corporation, POSCO, SIJ - Slovenian Steel Group d. d., Steel Authority of India Limited, Sumitomo Corporation, Tata Steel Limited, ThyssenKrupp AG, United States Steel Corporation, Voestalpine AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)