Electrical Enclosure Market Size, Share, Trends and Forecast by Type, Material Type, Mounting Type, Form Factor, Product Type, Design, End-User, and Region, 2025-2033

Electrical Enclosure Market Size and Share:

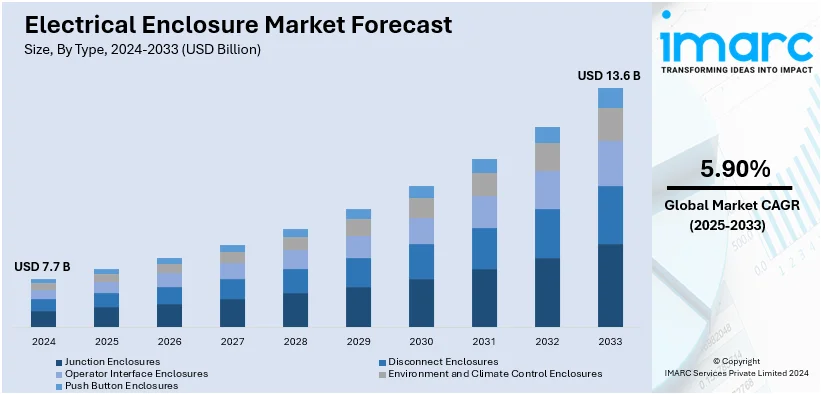

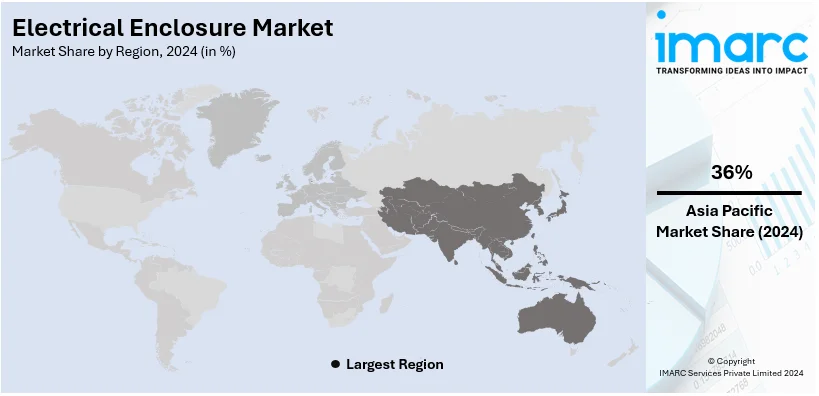

The global electrical enclosure market size reached USD 7.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.6 Billion by 2033, exhibiting a growth rate CAGR of 5.90% during 2025-2033. Asia Pacific currently dominates the market with 36% of the market share in 2024. This region’s dominance is driven by rapid industrialization, infrastructure development, and increasing adoption of advanced automation technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.7 Billion |

| Market Forecast in 2033 | USD 13.6 Billion |

| Market Growth Rate (2025-2033) | 5.90% |

The increasing use of industrial automation is a major factor fueling the demand for electrical enclosures. Industries are increasingly incorporating advanced machinery and automation technologies, necessitating robust enclosures to safeguard electrical components from environmental hazards and operational disruptions. These enclosures ensure system reliability, safety, and compliance with stringent regulatory standards, particularly in sectors such as manufacturing, oil and gas, and energy. As automation expands into diverse industries, the need for durable, customizable, and efficient enclosures is rising. For instance, in November 2024, nVent showcased its latest industrial automation and systems protection technologies at the 2024 Automation Fair. Highlights included the nVent HOFFMAN Design to Manufacturing (DTM) software, enabling 2D/3D digital workflows to optimize electrical enclosure design and manufacturing. This trend aligns with the broader push for operational efficiency and reduced downtime, positioning electrical enclosures as a critical component in modern industrial infrastructure.

The United States serves as a key contributor to the electrical enclosure market through its advanced manufacturing capabilities, strong industrial base, and focus on technological innovations. The country is home to numerous leading manufacturers that produce high-quality, customizable enclosures catering to diverse industries such as energy, transportation, and healthcare. Safety measures and performance in the U.S. further drive the development of durable and compliant solutions. Additionally, increasing investments in infrastructure and the adoption of automation technologies across industries enhance the demand for electrical enclosures, solidifying the U.S. as a significant player in the global market. For instance, in March 2024, Schneider Electric announced plans to invest $140 million to expand its U.S. manufacturing operations, creating 750 jobs. The investment includes $85 million for transforming a 500,000 sq. ft. facility in Mt. Juliet, Tennessee, and upgrading operations in Smyrna, Tennessee. These facilities will manufacture electrical switchgear and power distribution products.

Electrical Enclosure Market Trends:

Popularity of Connected Enclosures

The widespread of IoT devices and the expanding smart infrastructures are growing the demand for smart electrical enclosures, which, in turn, is stimulating the market globally. For example, in December 2023, Legrand introduced the Legrand Structured Wiring Enclosure UPS (UPS-SC600) for connected smart homes. Moreover, it features six surge-protected outlets, usually connected to a battery backup system. It comes in a small form factor to fit practically anywhere, even within a structured wiring enclosure. Additionally, in February 2023, SPAN, one of the residential energy storage device providers, developed a smart electrical enclosure that provides monitoring and load balancing of up to 32 circuits. In line with this, it is compatible with any grid-tied solar inverter and with battery backup systems. Furthermore, the growing popularity of enclosures that are equipped with connectivity features and sensors that enable remote monitoring and management of electrical systems also represents one of the electrical enclosure market opportunities. For instance, in March 2024, RMC Switchgears expanded its manufacturing capacity for SMC smart metering enclosures mainly to cater to the escalating demand for advanced metering infrastructure for smart payment (AMISP) projects. Similarly, in March 2024, Virgin Media O2 successfully trialed an innovative new way of expanding and improving mobile services by bringing together its fixed network infrastructure with new smart poles, which aid in boosting mobile coverage in local areas across the UK. It is further integrated with digital electricity technology. Apart from this, the growing need for protective casings that can safeguard sensitive sensors and data communication hardware is expected to catalyze the market over the forecasted period. For example, in May 2024, OKW extended its RAILTEC B range of DIN rail enclosures. It is a space-saving flat-profile variant for individual electronic devices that do not require multiple terminations. The ends are closed for mounting customer-specified connections and interfaces, including D-sub, USB, power supply, etc. The product variant is further ideal for applications such as smart factories, automation, building and safety technology, HVAC, measurement, communications, smart homes, lighting control, etc.

Increasing Number of Data Centers

Continuous improvements in cloud computing and data centers are augmenting the need for streamlining business operations and enhancing consumer services. This, in turn, is elevating the electrical enclosure market value. For example, in March 2024, one of the U.S. power management companies, Eaton, launched a novel modular data center solution that combines racks, cooling, and service enclosures designed to support equipment loads of up to 150kW. Moreover, it is specifically designed for organizations looking to meet the increasing demand for machine learning, edge computing, AI, etc. Additionally, in March 2024, Rockwell Automation, Inc., one of the companies dedicated to industrial automation and digital transformation across the Asia Pacific, announced the regional availability of its CUBIC product line. CUBIC specializes in IEC-61439-compliant modular enclosure systems for the construction of power and electrical panels. In line with this, the variants cater to the data centers. Furthermore, as a brand of Elecprime, E-Abel provides custom electrical enclosures for data centers to ensure a stable data storage system. Besides this, the rising adoption of networking equipment is projected to offer lucrative opportunities to the industry players over the foreseeable future. For instance, in March 2024, Rittal LLC, one of the global manufacturers of industrial and IT enclosures, introduced the wall mount vented (WMV) outdoor UL 3R-type rated enclosure. This new variant accommodates easy in-field maintenance and features various core advantages, including integrated cooling, a durable design, easy access for routine maintenance, optimum corrosion protection, etc.

Rising Renewable Energy Projects

The growing inclination towards smart grid energy solutions, owing to the escalating electricity requirements, is increasing the electrical enclosure market demand. For example, in July 2023, Weidmuller USA released a product line of DC combiner boxes for the solar industry that offer users the ability to integrate short-circuit and overvoltage protection. Moreover, the rising emphasis on renewable energy solutions also requires robust electrical enclosures that can withstand elements like high winds, salt water, extreme temperatures, etc., which is acting as another significant growth-inducing factor. For example, nVent ERIFLEX provides low-voltage connection and distribution products for numerous applications, including fast DC chargers, battery packs, inverters, energy storage systems, transformers, combiner boxes, recombiners, the interconnection between electrical systems, etc. Apart from this, key players are focusing on protecting sensitive electronic components for energy storage solutions, thereby fueling the overall market. In April 2024, Schneider Electric launched a battery energy storage system (BESS) equipped with a small and hybrid 7-ft NEMA 3R enclosure. Additionally, with the capacity to store energy for immediate access during outages, BESS can deliver up to 2 MW of power when needed.

Electrical Enclosure Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the electric enclosure market, along with forecast at the global and regional levels for 2025-2033. Our report has categorized the market based on the type, material type, mounting type, form factor, product type, design, and end-user.

Analysis by Type:

- Junction Enclosures

- Disconnect Enclosures

- Operator Interface Enclosures

- Environment and Climate Control Enclosures

- Push Button Enclosures

Junction enclosures leads the market in 2024. Junction enclosures play a vital role in safeguarding electrical connections against environmental hazards, thus making it safe and reliable for electrical systems. The junction enclosures are made to house junctions at the point where more than two cables or wires are joined to prevent exposure to moisture, dust, and other contaminants. Junction enclosures are constructed of durable materials like plastic, metal, or fiberglass, making them strong against physical damage and corrosion. They are most commonly used in residential, commercial, and industrial settings; they provide flexible solutions for a very wide range of applications. For example, in July 2023, Pratley, one of the manufacturers of innovative electrical termination products, launched the Flameproof Ex d Envirobox, a corrosion-resistant, direct-entry, polymeric, and flameproof junction enclosure. Apart from protection, junction enclosures allow easy access for maintenance, while being properly wired to minimize electrical faults and enhance overall system performance. According to the segmentation in the electrical enclosure market, it is an integral part of the current modern electrical infrastructure, having flexibility in diverse environmental conditions as well as the ability to support a wide range of regulatory standards. In April 2024, Amphenol Industrial Operations officially announced the beginning of solar junction box manufacturing at its new factory in Arizona, U.S., producing approximately 3,000 junction boxes per day.

Analysis by Material Type:

- Metallic

- Nonmetallic

Nonmetallic leads the market with around 53.6% of the market share in 2024. Due to their distinct advantages and versatility, non-metallic materials are widely used in electrical enclosures. Polycarbonate, fiberglass, and thermoplastics, for example, offer better corrosion resistance and are suitable for use in severe environments where metallic enclosures could deteriorate over time. For instance, in July 2023, Allied Moulded Products, Inc. unveiled their new 1099-AB adjustable fiberglass outlet box that provides optimal strength and durability, while also being lightweight and easy to handle. Non-metallic enclosures provide excellent electrical insulation, enhancing safety by minimizing the risk of short circuits and electrical hazards. In June 2023, AttaBox Enclosures, one of the manufacturers of high-performing non-metallic electrical and industrial enclosures, introduced its AttaBox weight distribution shelf and side panel that exhibits rugged support and improves installation quality. They are also very versatile, enabling manufacturers to create enclosures with certain shapes, sizes, and features that meet the different requirements of various industries. Their resistance to high temperatures and UV rays makes them suitable for outdoor and industrial applications, which is driving the growth rate of the electrical enclosure market in this segment.

Analysis by Mounting Type:

- Wall-Mounted Enclosure

- Floor-Mounted/Free-Standing Enclosure

- Underground

Floor-mounted/free-standing enclosure lead the market in 2024. Floor-mounted or free-standing enclosures play a crucial role in electrical systems, providing effective protection and housing for larger electrical equipment and control panels. These types of enclosures are designed to directly sit on the floor, providing stable and secure housing for such critical electrical components. Usually made with durable materials like steel or aluminum, floor-mount enclosures are engineered to withstand extremely harsh industrial conditions, from dust and moisture to mechanical impacts. For instance, in February 2024, Deye, one of the inverter manufacturers based in China, developed an all-in-one energy storage system (ESS) with 50 kW of output and 61.4 kWh of storage capacity. It is equipped with a floor-mount enclosure that provides an IP55-rated interior environment to protect the batteries and other sensitive components from moisture, dust, and other contaminants. They provide enough room to accommodate complicated wiring and bulky devices, making it easier to access for maintenance and upgrade purposes. In addition, enclosures can be fitted with accessories such as mounting panels, ventilation systems, and cable management solutions to increase functionality. According to the outlook of the electrical enclosure industry, their flexibility and durability make them a favorite in ensuring safety and efficiency in electrical infrastructure for demanding environments.

Analysis by Form Factor:

- Small

- Compact

- Full-size

Small and compact enclosures are usually deployed in residential and commercial applications where there is less space, and the electrical components are simpler. Such enclosures house small circuit breakers, switches, and control panels that need to be protected against dust, moisture, and accidental contacts, and it is essential for their maintenance and profile.

Full-size enclosures are designed for industrial and commercial applications with big dimensions where a large area space is needed to install and contain complex electrical systems. Full-size enclosures can be relied on for maximum protection of electrical components against dust, moisture, and mechanical shocks that can harm such a device. The form factor of an enclosure is important, since it directly affects the ease of installation, accessibility for maintenance, and overall system efficiency, allowing for solutions that can be tailored to the specific demands of each application.

Analysis by Product Type:

- Drip-Tight

- Hazardous Environment

- Flame/Explosion Proof

- Dust-Tight

- Others

Drip-tight enclosures are designed to keep electrical components away from dripping water and light moisture and can be used indoors where exposure to water may occur sometimes. By protecting sensitive equipment, they help ensure safety in operations and extend the life of housed electrical components.

An enclosure for hazardous location builds such that it takes various forms to withstand extreme and sometimes unbearable temperatures of corrosive conditions with elevated humidity. Their usage, consequently, ensures both the electrical systems' reliability and endurance in industrial plants while, at the same time reducing operating hazards or environmental damage with equipment essential for performance and optimal results under harsh settings.

Flame and explosion-proof enclosures are very essential, especially in oil and gas industries where a fire hazard or explosion is very probable, and the enclosures would be engineered to contain all internal ignition and prevent spreading to the external atmosphere. In this case, they would give maximum safety and compliance with rigorous industrial standards.

The dust tight enclosures provide the perfect isolated environment in manufacturing and processing plants against dusts and particulate matter sensitive to the electrical components. Special application enclosures include, amongst others, weather proofing, submersible and EMI/RFI shielded enclosures to afford tailor made protection against environmental and other exposures of electrical systems to provide desired reliability and safety of use.

Analysis by Design:

- Standard Type

- Custom Type

Standard-type enclosures are made in standard sizes and configurations. Therefore, they are a cost-effective and readily available solution for common electrical applications. They are ideal for general-purpose use and provide reliable protection for the electrical components in a wide range of settings, from residential to industrial environments. Their versatility and affordability make them a popular choice for routine installations and projects.

Custom type enclosures can be made to specific requirements, providing the ability to change sizes, shapes, materials, and internal layouts to adapt to unique operational demands. Custom enclosures are mainly useful in complex or specialized applications where standard solutions may not supply adequate protection or functionality. For instance, industries that have unique environmental challenges or specific regulatory compliance needs may prefer custom-designed enclosures to ensure optimal performance and safety. Every aspect of the enclosure, from entry points and mounting options to cooling systems and finish, can be customized to ensure that the final product precisely matches the needs of the application, providing enhanced protection, efficiency, and durability.

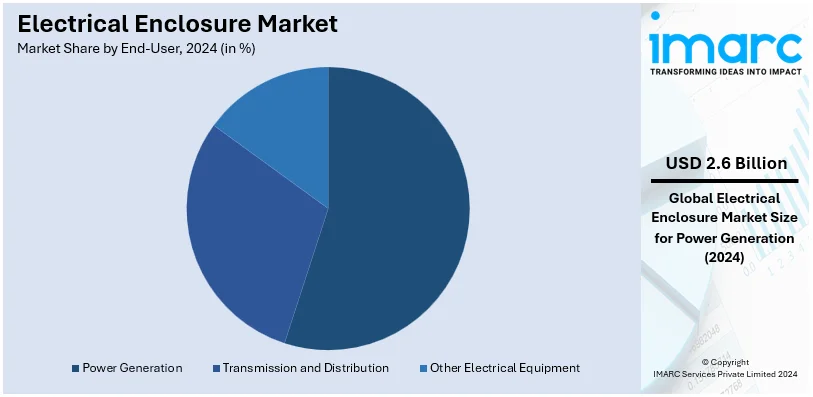

Analysis by End-User:

- Power Generation

- Transmission and Distribution

- Other Electrical Equipment

Power generation leads the market with around 33.8% of market share in 2024. Electrical enclosures for power generation are a critical safeguard against the critical electrical infrastructure which ensures continuous and efficient production of energy. Such enclosures protect sensitive equipment, like generators, transformers, switchgear, and control systems, from environmental hazards, mechanical impacts, and unauthorized access. For instance, last June 2023, Weidmuller USA launched PV DC combiner boxes with engineered enclosures that provide exceptional performance and reliability with flexibility for various solar power applications in the industry. The integrity of electrical components and reliability made by these enclosures enable the prevention of downtime; reduce maintenance costs; increase the overall safety and efficiency of power generation operations; and enhance performance. Their design is also considered in terms of accessibility and maintenance to ensure that critical systems continue to operate and respond to the changing power generation needs.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest market share of over 36%. The Asia Pacific electric enclosure market is growing significantly due to rapid industrialization, urbanization, and increased investment in infrastructure development. Many of the booming economies are found in this region, namely China and India, which see a rising demand for the most advanced electrical systems throughout the manufacturing, energy, and transportation industries. Hitachi Energy announced the opening of a new factory for high-voltage direct current and power quality in Chennai, India, in February 2023 to foster the integration of renewable sources as well as speed the shift toward energy. Increased focus on the growing number of renewable energy-related projects and smart grids boosts the market as the installations require specialized enclosures in order to be safely connected and integrated. For instance, in March 2024, Rockwell Automation, Inc., one of the companies devoted to industrial automation and digital transformation across Asia Pacific, released regional availability of its CUBIC product line. The product line CUBIC offers modular enclosure systems compliant with IEC-61439 for power and electrical panel construction. Technological advancements and high safety standards are also fueling the demand for superior enclosures. For example, in April 2024, OCulink unveiled its new GPU enclosure that targets particular industrial needs in China.

Key Regional Takeaways:

United States Electrical Enclosure Market Analysis

US accounts for 82.6% of the market share in North America in 2024. The major drivers of the electrical enclosures market in the United States include the rapid growth in industrial automation, renewable energy programs, and stringent safety regulations. As per an industrial data, with an annual growth of nearly 9%, the booming industrial automation industry is driving the demand for high-quality enclosures that can be used to protect sensitive electrical components. Renewable energy, primarily in the form of solar and wind energy, is playing a major role in this market. The United States introduced the Grid Resilience Innovative Partnership (GRIP) Program back in 2022, availing a USD 10.5 Billion funding opportunity with a purpose of promoting modernization as well as growth in US electric grids, statistics from International Energy Agency reports. For this reason, strong cases or enclosures had to ensure electrical connections' protection due to adverse weather conditions.

These can then support and ensure that the need for safe, efficient enclosures meets safety and environmental standards with added enforcement from rule-carrying bodies like OSHA and NEMA. Such sophistication does make enclosures an element essential in smart cities and related infrastructural projects. In addition, the requirement for electrical enclosures in EV charging stations is witnessing impetus due to the rocketing trend of electric vehicles (EVs), whose sales exceeded 1.4 Million in 2023. The increasing use of IoT devices and connected sectors in the United States is making electrical enclosures the growth engine in the country.

Europe Electrical Enclosure Market Analysis

The emphasis on industrial digitalization and renewable energy in Europe is driving demand for electrical enclosures in that region. The European Environment Agency reports, With the EU set to have a 42.5% share of renewable energy in total consumption in 2030, nations such as Germany, France, and the United Kingdom are emerging as green energy powerhouses. Consequently, renewable energy installations demand strong electrical enclosures to protect critical components. Automation in Europe is another driver for the enclosures' demand. Not only will these products protect delicate equipment but also house automation control systems. Strict safety requirements and regulations, including IP ratings, ensure the adoption of premium quality enclosures. In addition, At the end of 2022, the European Commission published the EU action plan titled "Digitalisation of the energy system." The Commission reports that by 2030, the European electricity grid will attract investments of about EUR 584 Billion (USD 633 Billion), out of which EUR 170 Billion (USD 184 Billion) will be for digitalisation (smart meters, automated grid management, digital technologies for metering, and improved field operations). Market expansion is further driven by the fact that the region emphasizes sustainability and energy efficiency.

Asia Pacific Electrical Enclosure Market Analysis

Asia-Pacific is rapidly urbanizing and industrializing with emerging renewable energy projects, which drives the electrical enclosures market. China and India lead the area, as China's industrial sector comprises more than 25% of its GDP in 2023. These countries require advanced enclosures for automation and power distribution equipment as their manufacturing bases expand. Other factors are an increasing use of renewable energy; the Indian Government plans to reach 500 GW of renewable energy capacity by 2030, as mentioned by Ministry of New and Renewable Energy, Indian Government. Housing for solar and wind systems must be durable enough to withstand harsh weather conditions. The smart city projects in the region have a massive requirement for technologically advanced enclosures. IoT applications and 5G networks are growing in the region.

Latin America Electrical Enclosure Market Analysis

The electrical enclosures market in Latin America is mainly boosted by the growth of industrial sectors and renewable energy initiatives. Countries such as Mexico and Brazil are investing heavily in renewable energy projects; in 2024, Brazil's wind energy capacity have exceeded 25 GW, as per industry reports. Such projects require rugged enclosures to protect electrical systems from extreme weather conditions. Regional infrastructural development and urbanization are also stimulating the demand for enclosures. The Latin American building industry is expected to grow at an impressive rate, thereby witnessing an increase in the usage of enclosures in electrical installations. Specialized enclosures are also being spur by investments in data centers and IT infrastructure that have recently gained momentum in Mexico.

Middle East and Africa Electrical Enclosure Market Analysis

The main drivers behind the MEA electrical enclosures market are investments made in the oil and gas industry, initiatives for renewable energies, and infrastructure development.

Durable enclosures are required in such countries as Saudi Arabia and the United Arab Emirates, which are now raising their solar and wind energy capacities to more than 7 GW combined by 2023. Smart city projects like Saudi Arabia's NEOM and continuous urbanization require advanced electrical solutions, including enclosures. With more than USD 25 Billion in foreign financing each year, growing electrification initiatives are bringing the market for electrical enclosures in Africa for safe and effective energy distribution.

Competitive Landscape:

The electrical enclosure market is characterized by intense competition among global and regional players, driven by innovation, quality, and customization capabilities. Prominent companies focus on developing advanced solutions to meet diverse industry demands while adhering to stringent regulatory standards. Key players emphasize strategic partnerships, mergers, and acquisitions to expand their market presence and product portfolios. Additionally, the adoption of advanced materials and smart enclosure technologies is a significant focus area. Regional manufacturers leverage cost-effective production and localized offerings to compete with global leaders. This competitive environment fosters continuous innovation, improving product efficiency, durability, and adaptability across various applications. For instance, in 2024, Schneider Electric introduced new Battery Energy Storage Systems for microgrids, featuring 7ft and 20ft enclosures with power capacities ranging from 60 kW to 500 kW, offering flexible storage configurations.

The report provides a comprehensive analysis of the competitive landscape in the electrical enclosure market with detailed profiles of all major companies, including:

- Schneider Electric

- ABB Group

- Eaton Corporation

- Adalet

- Emerson Electric Company

- Pentair

- Siemens Aktiengesellschaft

- Allied Moulded Products

- AZZ Incorporated

- Fibox Oy Ab

- General Electric Company

- Legrand SA

- Hubbell Incorporated

- Socomec Group SA

- Rittal GmbH & Co. Kg.

Recent Developments:

- June 2024: Rencol Components extended its range of enclosure hardware with four new types of hinges specifically designed for machinery and electrical cabinets.

- May 2024: OKW introduced its RAILTEC B range of DIN rail electric enclosures that do not require multiple terminations.

- April 2024: Schneider Electric, one of the energy management companies based in France, developed a novel battery energy storage system (BESS) for microgrids. It is commonly available in two enclosure sizes and has different storage configurations.

Electrical Enclosure Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Junction Enclosures, Disconnect Enclosures, Operator Interface Enclosures, Environment and Climate Control Enclosures, Push Button Enclosures |

| Material Types Covered | Metallic, Nonmetallic |

| Mounting Types Covered | Wall-Mounted Enclosure, Floor-Mounted/Free-Standing Enclosure, Underground |

| Form Factors Covered | Small, Compact, Full-Size |

| Product Types Covered | Drip-Tight, Hazardous Environment, Flame/Explosion Proof, Dust-Tight, Others |

| Designs Covered | Standard Type, Custom Type |

| End-Users Covered | Power Generation, Transmission and Distribution, Other Electrical Equipment |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Schneider Electric, ABB Group, Eaton Corporation, Adalet, Emerson Electric Company, Pentair, Siemens Aktiengesellschaft, Allied Moulded Products, AZZ Incorporated, Fibox Oy Ab, General Electric Company, Legrand SA, Hubbell Incorporated, Socomec Group SA Rittal GmbH & Co. Kg., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electrical enclosure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global electrical enclosure market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electrical enclosure industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

An electrical enclosure is a protective housing designed to shield electrical components such as switches, circuit breakers, and wiring from environmental factors like dust, moisture, and debris. These enclosures ensure the safety of electrical systems, prevent unauthorized access, and are commonly used in residential, commercial, and industrial applications for enhanced reliability.

The global Electrical Enclosure market was valued at USD 7.7 Billion in 2024.

IMARC estimates the global electrical enclosure market to exhibit a CAGR of 5.90% during 2025-2033.

Key factors driving the global electrical enclosure market include increasing industrial automation, stringent safety regulations, and rising demand for reliable power distribution systems. Growth in renewable energy projects, expanding data center infrastructure, and advancements in smart technologies further boost the adoption of enclosures to protect critical electrical components in various sectors.

In 2024, junction enclosures represented the largest segment by type, driven by their widespread application in industrial and commercial projects requiring secure and organized electrical wiring solutions.

Nonmetallic leads the market by material type owing to its lightweight nature, cost-effectiveness, superior corrosion resistance, and suitability for diverse applications in harsh environmental conditions.

The floor mounted/free standing enclosure is the leading segment by mounting type, driven by its versatility, ability to accommodate larger equipment, and widespread use in industrial and commercial applications requiring robust and easily accessible housing solutions.

Power generation is the leading segment by end user, driven by the growing demand for reliable and secure electrical systems to support renewable energy projects, grid modernization, and increased electricity generation capacity worldwide.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global electrical enclosure market include Schneider Electric, ABB Group, Eaton Corporation, Adalet, Emerson Electric Company, Pentair, Siemens Aktiengesellschaft, Allied Moulded Products, AZZ Incorporated, Fibox Oy Ab, General Electric Company, Legrand SA, Hubbell Incorporated, Socomec Group SA, Rittal GmbH & Co. Kg., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)