Electric Vehicle Market Size, Share, Trends and Forecast by Component, Charging Type, Propulsion Type, Vehicle Type, and Region, 2025-2033

Electric Vehicle Market Size and Share:

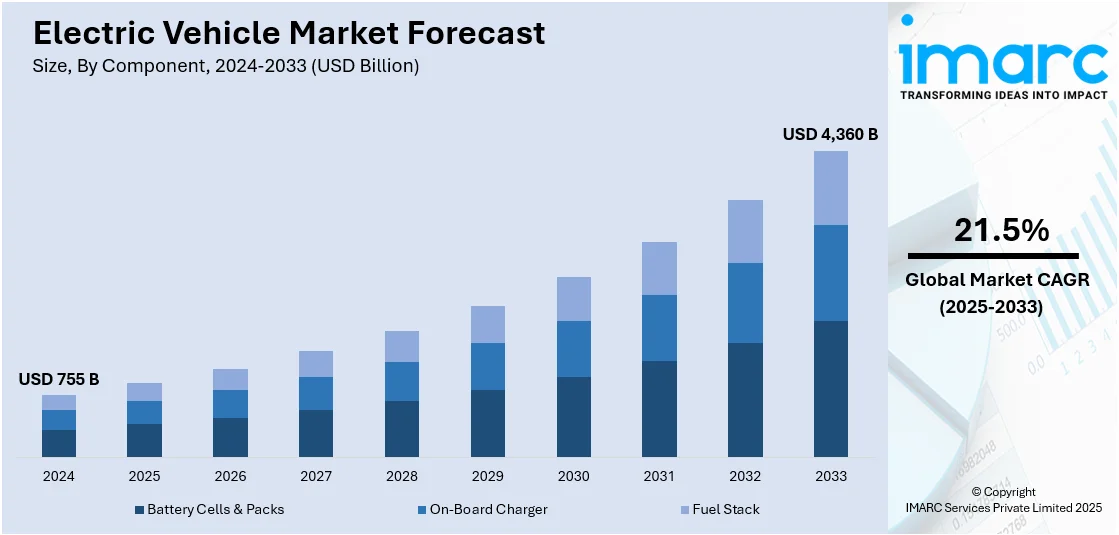

The global electric vehicle market size was valued at USD 755 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4,360 Billion by 2033, exhibiting a CAGR of 21.5% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 46.5% in 2024. The increasing concerns over environmental sustainability, the need to reduce emissions, advancements in battery technology, supportive government policies and incentives, growing public awareness, and investments in renewable energy sources are few of the factors accelerating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 755 Billion |

|

Market Forecast in 2033

|

USD 4,360 Billion |

| Market Growth Rate (2025-2033) | 21.5% |

Expansion of charging infrastructure becomes the focus of development and forms an avenue for growth in the electric vehicle (EV) market. As per the current findings, the public infrastructure for charging may reach almost 25 million in the year 2035 compared to nearly 4 million in 2023. There is major investment from governments, private companies, and automakers in terms of developing and deploying extensive networks of charging stations. This includes fast-charging stations along highways, installing workplace and residential charging facilities, and creating urban charging hubs, so that people can have their vehicles charged super easily and quickly. There are advances like ultra-fast charging technology, which greatly reduce charge time and make use of an electric vehicle more practical. In addition, charging networks are integrated with renewable energy sources that have the same green image when it comes to EVs and value sustainability even further.

In the United States, the growth of the electric vehicle (EV) market has been remarkable with a strong push from government supportive policies, the rapid pace of advancing technologies, and changing consumer preferences. The 117th Congress has passed the Infrastructure Investment and Jobs Act, and the Inflation Reduction Act deals with hundreds of millions of dollars in investment in the EV sector. Even Federal and state incentives such as tax credits or rebates reduce EV ownership costs and make them more affordable. For example, the government suspended the 12%-federal excise tax for zero-emission trucks. Also, a growing charging network ameliorates range anxiety and enhances convenience for users. Through the Bipartisan Infrastructure Law, $5 billion goes into building a network for EV charging along highways (along alternative fuel corridors), complemented with another $2.5 billion in competitive grant funding to push additional construction of charging infrastructure.

Electric Vehicle Market Trends:

Environmental sustainability and emission reduction

The global electric vehicle market is being driven by a pressing concern for environmental sustainability and the urgent need to mitigate climate change. As conventional fossil fuel-powered vehicles contribute significantly to greenhouse gas emissions and air pollution, governments, environmental organizations, and individuals are increasingly advocating for cleaner transportation alternatives. According to the World Meteorological Organization (WMO), the atmospheric concentration of carbon dioxide (CO2), the primary greenhouse gas driving climate change, has risen by 11.4% over the past 20 years. Electric vehicles offer a promising solution, as they produce zero tailpipe emissions, reducing harmful pollutants and their impact on air quality. The rising awareness of the environmental consequences of traditional vehicles has sparked a growing demand for EVs as a cleaner and more sustainable mode of transportation.

Advancements in battery technology and improved range

The progress in battery technology is a pivotal driver of the global electric vehicle market. One of the primary concerns with EVs has been limited driving range and the availability of charging infrastructure. However, significant strides in battery research and development have led to improved energy storage capacity and efficiency. According to reports, Advancements in battery technology and improved EV range have driven global battery demand to exceed 750 GWh in 2023 according to IEA, marking a 40% increase from 2022. The United States and Europe led with over 40% year-on-year growth, while China contributed 415 GWh, sustaining its market dominance. Modern lithium-ion batteries, coupled with innovative battery management systems, have extended the driving range of electric vehicles. These advancements have bolstered consumer confidence in EVs as practical daily-use vehicles, making them a viable option for a broader audience. As battery technology continues to evolve, it is expected to further enhance the performance and affordability of electric vehicles, thereby fueling the market growth.

Supportive government policies and incentives

Government support through favorable policies and incentives has been instrumental in driving the adoption of electric vehicles worldwide. Many governments have introduced a range of incentives, such as tax credits, subsidies, reduced registration fees, and access to carpool lanes, to encourage consumers to switch to electric vehicles. Additionally, several regions have imposed strict emissions regulations and set ambitious targets for the adoption of EVs, compelling automakers to invest heavily in electric vehicle production. For instance, according to PIB, supportive government policies and incentives have driven a 16% rise in EV registrations in India in H1 2024 compared to H1 2023, alongside 16,344 public charging stations and 10,756 fast charging points. Governments are also collaborating with private stakeholders to develop and expand charging infrastructure, further incentivizing consumers to embrace electric mobility. These supportive measures have created a conducive environment for the growth of the electric vehicle market, stimulating both manufacturers and consumers to transition to greener transportation alternatives.

Electric Vehicle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric vehicle market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, charging type, propulsion type, and vehicle type.

Analysis by Component:

- Battery Cells & Packs

- On-Board Charger

- Fuel Stack

The increase in energy density and range, along with the rise in research and development (R&D) investments in battery technology, are all key drivers for the battery cells & packs segment in the electric vehicle market. The requirement for highly efficient battery solutions has been further stimulated by helpful governmental policies and increased demand for electric vehicles across the globe. The on-board charger segment relies heavily on the expanding electric vehicle infrastructure that governments and private companies are putting together for the installation of charging networks. Technologies that improve efficiency in charging and reduce the time it takes to charge have also influenced the segment. Also, the focus by the automotive companies on making the integration of the charging systems in the EVs seamless is boosting the market growth. Fuel cell stack development itself receives the most significant boost from the hydrogen fuel cell technology, which holds tremendous promise as a clean energy source for future electric vehicles. Investment in research within fuel cells by governments encourages the development of this segment within the electric vehicle market.

Analysis by Charging Type:

- Slow Charging

- Fast Charging

Slow charging leads the market with around 71.2% of market share in 2024. The slow charging segment in the global electric vehicle market is influenced by various factors. Slow charging systems are usually more cost-effective and easier to install, thus attracting home users and small-scale charging stations. Lower power demand decreases the pressure on the existing electrical grid, allowing easy integration without a huge investment in infrastructure upgrades. Slow charging is typically preferred with EV batteries, thus preserving their lifespan and efficiency. Its use will be ideal at night or when cars are left standing for long hours in the car park of workstations or dwelling places. Public policies to conserve energy by encouraging slow charging are also included. In total, this encompasses affordability, ease in installation, existing infrastructure compatibility, consideration of the health and lifespan of batteries, and energy conserving goals to propel the relatively slow charging category of the market for electric vehicles.

Analysis by Propulsion Type:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

Hybrid electric vehicle (HEV) leads the market with around 61.3% of market share in 2024. The hybrid electric vehicles (HEVs) segment is booming due to strict emission regulations and other environmental constraints. An HEV operates with lower emissions and higher fuel efficiency; in this way, it bridges conventional internal combustion engines and fully electric vehicles, thus alluring most of the customers focused on the environment. Moreover, the advancement of hybrid technology maximized and specialized power-train systems result in a relatively high performance and driving experience in HEVs. Moreover, the rise in fuel prices has caused an anti-inflationary trend for the public, which would eventually drive them towards economical fuel alternatives that could integrate an internal combustion engine with electric propulsion. In support of the aforementioned, governments around the world have made incentives and subsidies available to adopt HEVs, which will further increase market growth. Awareness toward the sustainable travel alternatives and increasing demand for green transportation options are adding to the HEV segment development.

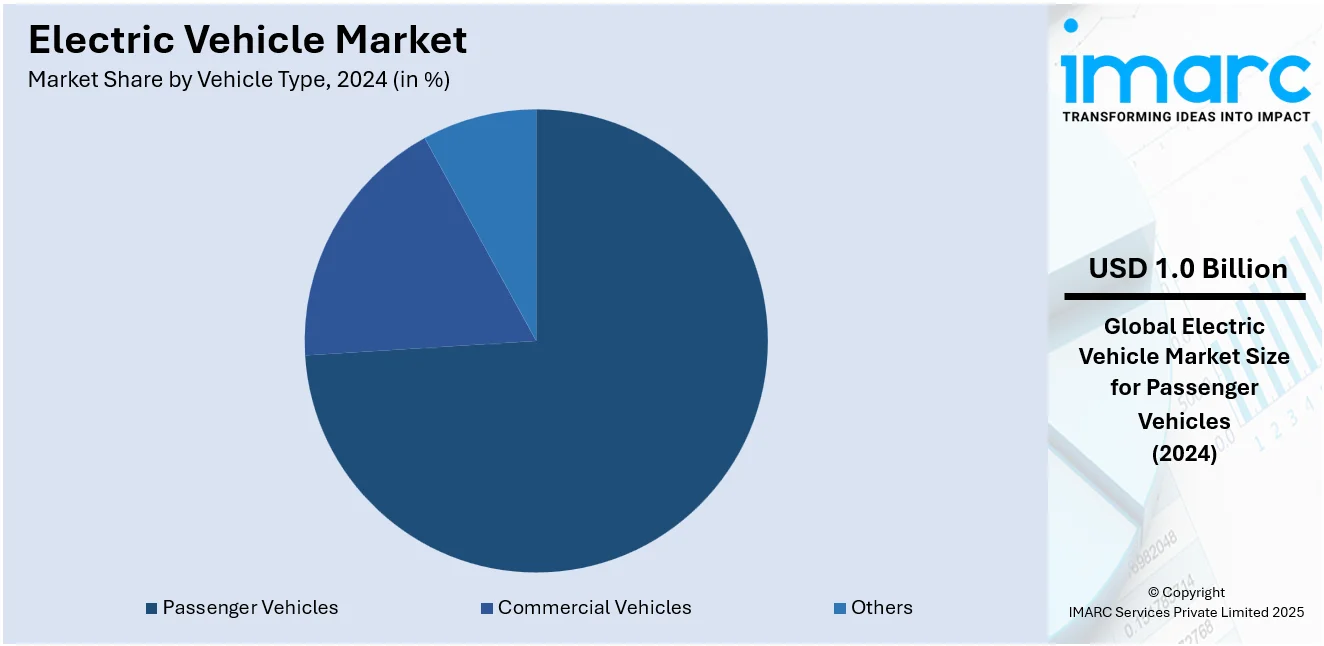

Analysis by Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Others

Passenger vehicles lead the market with around 73.5% of market share in 2024. The passenger vehicles segment is witnessing significant growth, primarily driven by the evolving consumer preferences and lifestyle changes. Moreover, rapid urbanization and increasing disposable incomes in emerging economies are fueling the desire for personal mobility, leading to higher car ownership rates. In line with this, technological advancements in the automotive industry, such as autonomous driving capabilities, connected car features, and electric mobility solutions, are attracting consumers and driving innovation in passenger vehicles. Additionally, stringent emission regulations and sustainability concerns are encouraging automakers to invest in electric and hybrid passenger cars, contributing to market expansion. Furthermore, favorable financing options and low-interest rates are making car ownership more accessible to a broader population. Besides this, the growing popularity of ride-sharing and car-sharing services is transforming the way consumers perceive car ownership, influencing their decisions in the passenger vehicles segment.

Regional Analysis:

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Norway

- Netherlands

- Sweden

- United Kingdom

- France

- Germany

- Others

- North America

- United States

- Canada

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Others

In 2024, Asia-Pacific accounted for the largest market share of over 46.5%. The Asia Pacific region is witnessing a surge in electric vehicle adoption, fueled by the region's strong commitment to environmental sustainability and reducing air pollution, which has led governments to implement stringent emissions regulations and ambitious targets for electric vehicle penetration. In line with this, rapid urbanization and population growth in many Asian countries have heightened concerns over congestion and air quality, prompting a shift towards electric mobility as a viable solution. Besides this, advancements in battery technology, coupled with increasing investments in research and development, have bolstered the performance and affordability of electric vehicles, making them a more attractive option for consumers. Moreover, supportive government policies and incentives, including tax incentives, subsidies, and infrastructure development, are accelerating EV adoption across the region. Additionally, a burgeoning middle class with increasing disposable income is driving demand for personal transportation, and electric vehicles offer an environmentally friendly choice. Furthermore, strategic partnerships and collaborations between automakers, technology firms, and governments are facilitating the growth of charging infrastructure, addressing range anxiety concerns and promoting electric vehicle accessibility.

Electric Vehicle Market Regional Takeaways:

Electric Vehicle Industry Analysis in North America

The EV market in North America is being driven by increasing environmental concerns, government support towards electrified vehicles through the establishment and promotion of charging infrastructure, and other incentives such as tax credits, rebates, and grants from governments. Massive investment in research and development (R&D) is also paving the way for companies to bring forth vehicles that possess high battery life, extended driving range, and sophisticated features, making these vehicles more attractive in the eyes of a wider audience. Corporate fleet electrification is yet another factor, as companies would wish to drive in ways that are aligned with the sustainability goals they espouse. In addition, there are several occasions where the public becomes aware of climate change and zero-emission vehicles become credible to an increasingly environmentally minded populace.

Electric Vehicle Industry Analysis in United States

In 2024, US accounted for around 89.5% of the total North America electric vehicle market. The United States is making significant strides in sustainability by embracing electric vehicles (EVs) across states like California, Texas, and New York. This shift is reducing carbon emissions and reliance on fossil fuels, particularly in urban areas such as Los Angeles and Austin, where air quality has been a long-standing concern. Federal incentives, like tax credits, have encouraged EV adoption, while states like Colorado are implementing infrastructure upgrades with charging networks spanning highways. Companies such as Tesla, headquartered in Texas, and Rivian, operating out of Illinois, are driving innovation, making EVs more accessible nationwide. Cities like Seattle and Miami are integrating electric public transport, cutting costs and emissions. The expanding infrastructure for charging stations, with a 7.7% increase in EV charging ports in Q3 of 2023 according to the U.S. Department of Energy, coupled with advancements in battery technology offering greater range and faster charging, further bolsters market growth. This progress demonstrates the role EVs play in advancing environmental goals while fostering economic growth through clean energy initiatives and manufacturing advancements.

Electric Vehicle Industry Analysis in Europe

The Europe's strategic position as a hub for green innovation is evident in its rapid adoption of electric vehicles (EVs), driving significant environmental and economic benefits across countries. Northern European nations such as Norway and Sweden lead the charge, with their widespread EV usage reducing carbon emissions and promoting sustainable urban mobility. Meanwhile, countries like Germany and France are strengthening their automotive industries by investing in EV manufacturing, creating jobs, and fostering technological advancements. Southern states, including Spain and Italy, are also transitioning to greener transport by introducing incentives for EV buyers and enhancing charging infrastructure. For instance, in 2023, according to European Environment Agency, electric vehicles made up 22.7% of new car registrations and 7.7% of van registrations across Europe. EU targets aim for 100% zero-emission new cars and vans by 2035 to meet climate neutrality goals. Cities like Amsterdam and Copenhagen exemplify progress with extensive EV-friendly policies and urban planning that prioritize electric mobility over traditional vehicles. This transformation aligns with the EU’s commitment to achieving net-zero emissions by 2050, positioning Europe as a global leader in sustainable transportation. By adopting EVs, Europe is shaping a cleaner, more sustainable future while enhancing its global competitiveness.

Electric Vehicle Industry Analysis in Asia Pacific

Asia-Pacific, comprising diverse countries like China, Japan, India, South Korea, and emerging economies in Southeast Asia, is at the forefront of adopting electric vehicles (EVs) to combat rising environmental concerns and reduce dependency on fossil fuels. Urban centers such as Beijing, Tokyo, and Delhi are implementing policies to accelerate EV adoption, supported by expanding charging infrastructure and government incentives. For instance, China, a global leader, drives the transition with extensive EV production and subsidies, while India emphasizes affordable electric two-wheelers for urban and rural mobility. According to IEA, China has also begun to support more sustainable charging behavior, with the aim that 60% of EV charging will occur off-peak by 2025. Additionally, China has set a target for EV sales to account for 40% of all vehicle sales by 2030. This milestone underscores Asia-Pacific's dominance in the EV market, driven by strong demand for BEVs and PHEVs. Meanwhile, Singapore and South Korea are integrating smart technologies into their EV ecosystems. This shift is fostering cleaner air, reduced greenhouse gas emissions, and technological advancements across the region, demonstrating how EVs are reshaping Asia-Pacific’s transport landscape while addressing climate change and urbanization challenges.

Electric Vehicle Industry Analysis in Latin America

Latin America is witnessing a transformative shift in mobility as countries like Brazil, Mexico, and Chile embrace electric vehicles (EVs) to address environmental concerns and reduce reliance on fossil fuels. A total of 118,191 hybrid and electric vehicles were registered in 2021 in Latin America, more than 100% compared to 2020, when 57,078 units were registered, according to data from the National Association of Sustainable Mobility of Colombia. In major cities such as São Paulo, Santiago, and Mexico City, governments are promoting EV adoption through incentives, public charging infrastructure, and urban sustainability initiatives. Chile, for instance, leads with robust EV policies, while Colombia is expanding its electric public transportation networks. This regional transition aligns with global carbon reduction goals, enhancing energy efficiency and fostering eco-friendly transportation across Latin America's diverse urban and rural landscapes.

Electric Vehicle Industry Analysis in Middle East and Africa

The Electric Vehicle (EV) market in the Middle East and Africa (MEA) is witnessing significant growth, largely driven by government initiatives to diversify economies, reduce carbon emissions, and promote sustainability. Saudi Arabia's Vision 2030 and the UAE's National Electric Vehicle Strategy, which aims to have EVs make up 50% of all vehicles on the roads by 2050, are central to this push. Both countries are investing heavily in green technologies, including the development of electric vehicles, to create a more sustainable transportation ecosystem. Additionally, rising fuel costs and a growing focus on reducing the environmental impact of transportation are encouraging both consumers and businesses to adopt EVs. The availability of incentives, subsidies, and supportive policies, such as tax exemptions and reduced registration fees, is further aiding the transition to electric transportation in the region. The expansion of charging networks and continued reduction in EV prices are crucial factors for the market's future growth. Nevertheless, the increasing focus on sustainability, along with government support and private investments, is positioning the MEA region as a key player in the global electric vehicle market.

Electric Vehicle Companies, Leading Brands, & Manufacturers:

Leading players in the global electric vehicles (EV) market are accelerating advancements across manufacturing, infrastructure, and innovation to gain competitive edges. Major automakers are expanding their production capacities, focusing on streamlining supply chains and increasing battery manufacturing to meet growing demand. Companies are also launching new EV models that cater to diverse consumer preferences, including SUVs, trucks, and luxury vehicles, to capture a broader market share. In parallel, collaborations with battery technology firms are intensifying as market players prioritize solid-state and high-energy-density battery development to improve range and reduce charging times. Investments in charging infrastructure by companies in partnership with governments and private stakeholders, are ensuring robust networks of fast-charging stations to enhance consumer adoption.

The report provides a comprehensive analysis of the top companies, leading brands, & manufacturers in the electric vehicle market with detailed profiles of all major companies, including:

- BYD Company Limited

- BMW Group

- Chevrolet (General Motor Company)

- Ford Motor Company

- Hyundai Motor Group

- Mercedes-Benz Group AG

- Mitsubishi Motors Corporation

- Nissan Motor Corporation

- Tesla, Inc.

- Toyota Motor Corporation

- Volkswagen Group

Latest News and Developments:

- October 2024: TDK, a Japanese electronics manufacturer, and supplier to Apple, has partnered with McLaren Racing to enhance its presence in the electric vehicle sector. The collaboration focuses on integrating TDK's technology into McLaren's Formula E cars, aiming to advance EV components like inverters and sensors. This move aligns with TDK's strategy to expand its role in the EV supply chain, leveraging its expertise in passive components and sensors. The partnership reflects a shared commitment to innovation and sustainability in electric mobility.

- November 2024: Switch Mobility Automotive Ltd., an electric bus and light commercial vehicle manufacturer, has entered into a partnership with Vertelo to deploy 1,000 electric commercial vehicles across India over the next 3-5 years. Vertelo will lease and fund Switch's electric buses and light commercial vehicles, facilitating access to sustainable transportation solutions for businesses and municipalities. This collaboration aims to accelerate the adoption of electric vehicles in India by addressing financial barriers and promoting sustainable mobility.

- In May 2023, Honda introduced the e:Ny1, its second fully electric vehicle, during a European Media Event held in Germany. The compact SUV is designed for the European market, emphasizing performance and environmental sustainability. With a sleek design and advanced battery technology, it reflects Honda’s commitment to accelerating EV adoption. The e:Ny1 also highlights the company’s strategy to electrify its entire European lineup by 2030.

- In August 2023, General Motors and EVgo celebrated the launch of their 1,000th DC fast-charging stall under their metropolitan charging partnership. This milestone strengthens the U.S. charging infrastructure, aiming to enhance EV accessibility and convenience in urban areas. The collaboration focuses on expanding fast-charging options for GM’s growing lineup of electric vehicles. The project underscores a joint commitment to achieving broader EV adoption and sustainability goals.

- In September 2021, BMW unveiled the BMW i Vision Circular, a futuristic concept vehicle designed for 2040 with a focus on sustainability and luxury. The compact four-seater is fully electric and built using circular economy principles, prioritizing recyclability and renewable materials. It showcases BMW’s innovative approach to reducing carbon footprints while offering premium performance. This vision reflects the company’s commitment to aligning its future models with environmental stewardship and customer expectations.

Electric Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Units |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Battery Cells And Packs, Onboard Chargers, Fuel Stacks |

| Charging Types Covered | Slow Charging, Fast Charging |

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV) |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Norway, Netherlands, Sweden, United Kingdom, France, Germany, United States, Canada, Turkey, Saudi Arabia, Iran, United Arab Emirates, Brazil, Mexico, Argentina, Colombia |

| Companies Covered | BYD Company Limited, BMW Group, Chevrolet (General Motor Company), Ford Motor Company, Hyundai Motor Group, Mercedes-Benz Group AG, Mitsubishi Motors Corporation, Nissan Motor Corporation, Tesla, Inc., Toyota Motor Corporation, Volkswagen Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric vehicle market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global electric vehicle market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Electric Vehicle Market Report Snapshots :

Key Questions Answered in This Report

An electric vehicle (EV) is a type of automobile powered by an electric motor instead of an internal combustion engine that uses fossil fuels like gasoline or diesel. EVs operate by drawing energy from a rechargeable battery pack, which supplies power to the motor, enabling the vehicle to move. The batteries are typically charged using an external power source, such as a home charging unit, public charging stations, or specialized fast chargers.

The global electric vehicle market was valued at USD 755 Billion in 2024.

IMARC estimates the global electric vehicle market to exhibit a CAGR of 21.5% during 2025-2033.

The global electric vehicle market is driven as a result of the expanding charging infrastructure across the globe, heightened sustainability and environmental concerns, rapid advancements in battery technology, and supportive government policies.

In 2024, slow charging represented the largest segment by charging type, due to its cost-effectiveness and easy installation. They also have lower power demand, which reduces strain on the existing electrical grid.

Hybrid electric vehicle (HEV) leads the market by propulsion type owing to strict environmental policies and concerns. Additionally, advancements in hybrid technology have led to more efficient powertrain systems, thus enhancing the overall performance and driving experience of HEVs.

The passenger vehicles are the leading segment by vehicle type, driven by changing consumer preferences and evolving lifestyles. Also, rapid urbanization and increasing expenditure capacities are further fueling the desire for personal mobility.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global electric vehicle market include BYD Company Limited, BMW Group, Chevrolet (General Motor Company), Ford Motor Company, Hyundai Motor Group, Mercedes-Benz Group AG, Mitsubishi Motors Corporation, Nissan Motor Corporation, Tesla, Inc., Toyota Motor Corporation, Volkswagen Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)