Electric Vehicle Traction Motor Market Size, Share, Trends and Forecast by Type, Power Output, Propulsion Type, Vehicle Type, and Region, 2025-2033

Electric Vehicle Traction Motor Market Size and Trends:

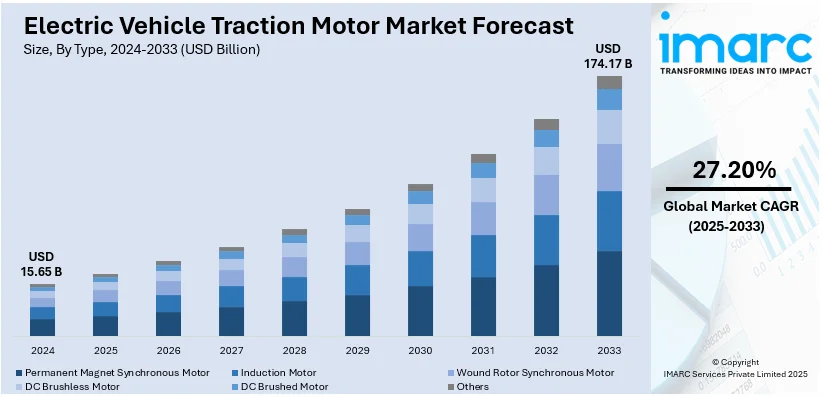

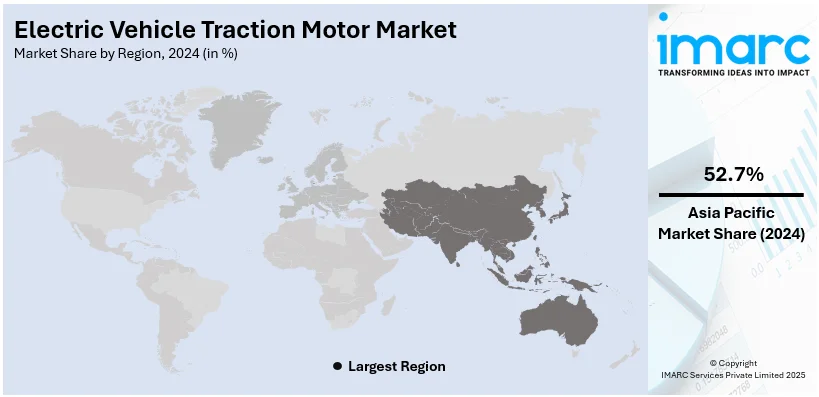

The global electric vehicle traction motor market size was valued at USD 15.65 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 174.17 Billion by 2033, exhibiting a CAGR of 27.20% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 52.7% in 2024. The market is driven by rapid urbanization, government incentives, strong manufacturing capabilities, and a growing shift towards clean energy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.65 Billion |

| Market Forecast in 2033 | USD 174.17 Billion |

| Market Growth Rate (2025-2033) | 27.20% |

The global electric vehicle (EV) traction motor market is driven by stringent government regulations and incentives, as they are promoting manufacturers and consumers toward eco-friendly options. For instance, the Society of Motor Manufacturers and Traders (SMMT) in the United Kingdom has encouraged the government to reduce the VAT on new electric vehicles and public charging points to half for the next three years. In addition to this, ongoing technological advancements in motor efficiency and design and declining battery costs make EVs more affordable and attractive, aiding the market growth. Moreover, fluctuating fuel prices make EVs a more cost-effective choice, boosting the market demand. Besides this, rapid urbanization and traffic congestion are encouraging the adoption of EVs, which is providing an impetus to the market. Furthermore, commitments by automakers to increase EV production are thereby strengthening the market share.

The United States holds a share of 88.70% in the EV traction motor market. The demand in the region is expanding due to the increasing adoption of EVs in commercial fleets, driven by lower total cost of ownership and corporate sustainability goals. In line with this, the growth of EV-related manufacturing hubs in the U.S. is improving local production capabilities and reducing supply chain reliance, fueling the market growth. Concurrently, continuous advancements in fast-charging technologies are enhancing the attractiveness of EVs, encouraging consumer adoption, and supporting the market demand. Additionally, significant investments in renewable energy (RE) and grid modernization are contributing to the market expansion. Apart from this, the tightening of fuel economy standards and the shift towards zero-emission zones in urban areas is therefore propelling the market forward.

Electric Vehicle Traction Motor Market Trends:

Shift toward high-efficiency and compact motors

The rising shift towards higher efficiency and compact motors is driving the market demand. Customers are concentrating their efforts on obtaining better-performance traction motors that are compact size and lightweight. This change has been necessitated by the ever-increasing demand to have longer electric mileage and better efficiency of electric cars. For example, the median range of all-electric vehicles for model year 2024 set a new record at 283 miles per charge, up 13 miles from the previous year. This is due to an increase in the efficiency of motors and better body structure of the vehicle. Compact motors also enable automakers to take advantage of the space diva, where you can get rid of space and accommodate either a larger battery or some other part of the vehicle. Moreover, new trends in motor technologies that include Permanent Magnet Synchronous Motors (PMSM) and Axial Flux motors are creating an opportunity to boost the power-to-weight ratio. This is the key determinant of EV performance and energy efficiency. This trend further persists as consumers request EVs which have higher capabilities of range and performance rates from the manufacturers, thus impelling the market growth.

Integration of advanced materials for enhanced motor performance

The use of diversified materials like rare earth magnets, high-strength steel alloys, and lightweight composites is emerging in contributing to the market expansion. They assist manufacturers in attaining higher power density, improved clamping of heat, and greater durability that boosts general motor functionality. Additionally, one type of magnet that is growing in use is rare-earth magnets, because they can generate high levels of magnetic fields in smaller motor sizes. For example, in 2024, the National Renewable Energy Laboratory (NREL) integrated sophisticated devices into its Electric Vehicle Research Infrastructure assessment system. This enhancement fosters creative, systems-embedded research, which supports the advancement of improved EV technologies. Furthermore, the variability in the prices of these materials is compelling researchers to look for alternative sustainable materials. This increasing trend towards advanced materials is important to optimize EV motors, decrease the weight, and increase the performance and efficiency of electric vehicles to align with the customer and regulatory requirements, thereby strengthening the market share.

Advancement in motor control systems and software

The growing reliance on advanced motor control systems and software to optimize performance is fueling the market demand. The integration of sophisticated control algorithms and real-time data analytics allows for more precise management of motor functions, such as torque delivery, speed control, and energy regeneration. These technology-driven systems contribute to a more seamless driving experience, improved energy efficiency, and extended battery life. This trend is further supported by continuous advancements in artificial intelligence (AI) and machine learning (ML) technologies. Concurrently, with the rise of autonomous vehicles, enhanced motor control technologies are essential for delivering seamless performance in various driving conditions. For example, in 2023 the percentage of enterprises within the EU using AI technologies that had 10 or more employees was 8%. Besides this, as EV manufacturers emphasize improving the intelligence of their vehicles, the development and implementation of developed motor control software is becoming a critical factor, which is driving the market forward.

Electric Vehicle Traction Motor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global EV traction motor market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, power output, propulsion type, and vehicle type.

Analysis by Type:

- Permanent Magnet Synchronous Motor

- Induction Motor

- Wound Rotor Synchronous Motor

- DC Brushless Motor

- DC Brushed Motor

- Others

The permanent magnet synchronous motor (PMSM) segment holds the largest market share, due to the superior efficiency and performance of PMSM. They offer high power density, compact design, and minimal energy loss, making them ideal for EV applications where range and energy efficiency are crucial. The increasing need for a longer driving range and enhanced energy efficiency of EVs is the primary reason for the increased use of PMSMs. In addition, innovative magnet technologies, especially rare earth magnets, are improving motor performance while at the same time decreasing the size and weight, enhancing the performance of EVs. Furthermore, the increased production of EVs across the globe, especially in the Asia Pacific and Europe is driving the need for PMSMs since automobile manufacturers seek efficient and effective power systems. Also, the constant trend towards the use of non-emitting vehicles and the growing requirement for fairly strict environmental standards are supporting the market growth.

Analysis by Power Output:

- Less than 100kW

- 100kW to 250 kW

- More than 250 kW

The less than 100kW power output segment is growing due to the rising demand for smaller, urban EVs, such as city cars and entry-level EVs. These vehicles are ideal for short commutes, making them cost-effective for consumers. The affordability and efficiency of motors in this range, lower battery costs, and government incentives are significantly boosting the market demand.

The 100kW to 250kW segment is witnessing robust growth, driven by the increasing popularity of mid-range EVs like sedans and compact SUVs. Consumers are seeking vehicles with a balance of performance and range, making this power output ideal for both urban and highway driving. As automakers expand their EV portfolios, this segment benefits from the demand for versatile and efficient powertrains, thus providing an impetus to the market.

The more than 250kW segment is expanding as the demand for high-performance EVs, such as sports cars and luxury EVs, increases. These vehicles require powerful traction motors to deliver rapid acceleration and extended range. Continued advancements in battery technology and consumer preference for high-performance EVs, alongside growing investments from automakers into premium electric models are aiding in the market expansion.

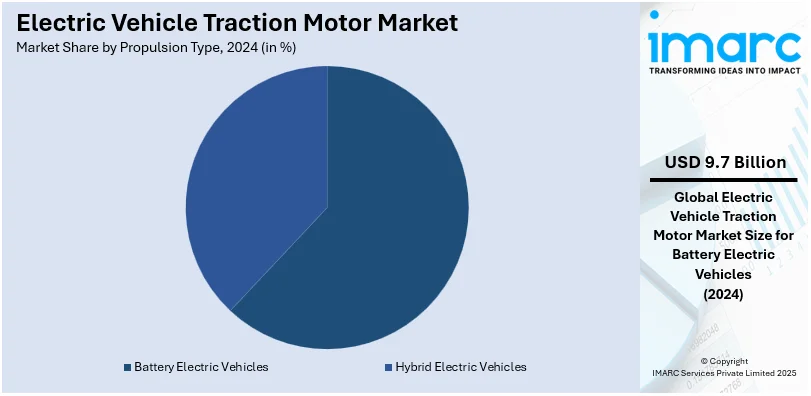

Analysis by Propulsion Type:

- Hybrid Electric Vehicles

- Pure Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Battery Electric Vehicles

The battery electric vehicle (BEV) dominates the market, holding a 61.7% share. This segment is growing due to the absence of emissions, which is in sync with increasing environmental consciousness and increased government regulation on emissions. The main advantages of BEVs are that with improvements in battery technology and especially in energy density and charging times, BEVs are getting better in terms of range and charging time and therefore are more attractive to customers. In addition, BEVs are cheaper to maintain than internal combustion engine vehicles, which translates to large savings after some time. They also include government incentives like tax credits and subsidies which promote the adoption of cloud computing services. The growth is also driven by the expansion of charging infrastructure and the increasing availability of BEV models across various price ranges. This segment is experiencing strong growth as more automakers produce BEVs, and the utilization of RE surges, leading to sustainable mobility, thereby catalyzing the market growth.

Analysis by Vehicle Type:

- Passenger Vehicles

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Two-wheelers

The passenger vehicle accounts for 72.5% of the market share. The primary factors fueling this segment include increasing consumer demand for sustainable and cost-effective transportation solutions, along with growing concerns over air pollution and carbon emissions. Government policies and incentives, including tax rebates, subsidies, and stricter emissions regulations, are speeding up the adoption of electric passenger vehicles. Additionally, continuous improvements in battery efficiency, cost reductions, and enhanced range have made electric cars more appealing to a wider audience. The growth of charging infrastructure is also alleviating concerns about range, further boosting adoption. Additionally, the entry of both traditional automakers and new players into the electric passenger vehicle market, along with expanding model choices across different price ranges, is surging the demand for EVs. Apart from this, the continued push toward green mobility and the growing availability of affordable EV options is supporting the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

The Asia Pacific region leads the market, holding a significant share of 52.7%. The demand in the region is primarily driven by a combination of government policies, technological advancements, and strong manufacturing capabilities. China has the largest EV market in the world and plays a pivotal role in driving the market forward. This trend is further supported by substantial government incentives, subsidies, and ambitious targets for EV adoption as part of its green energy transition. The region's rapid urbanization, growing environmental consciousness, and increasing demand for cleaner transportation are driving the adoption of EVs. Additionally, the presence of major EV manufacturers and suppliers in countries like Japan, South Korea, and China, coupled with continuous advancements in battery technology and charging infrastructure, has positioned Asia Pacific as a key hub for EV production. Besides this, the region’s significant investments in RE and electric mobility infrastructure are transforming electric transportation, which is propelling the market growth.

Key Regional Takeaways:

North America Electric Vehicle Traction Motor Market Analysis

The North America EV traction motor market is steadily rising because of the rising customer awareness about green mobility and government incentives. For instance, the base models of electric vehicles, such as the Tesla Cybertruck, are even eligible for a federal IRS tax credit of $7,500 in early 2025 apart from the dealer’s discount. In line with this, federal tax inducement, rebates, and improved CO2 emission standards are driving the adoption of electric cars in the region. Besides this, the increasing number of key players in the global market and local investments in the production of EVs and their parts are contributing to the market expansion. Furthermore, improvements in other traction motor technologies, for instance, higher efficiency and lightweight, are improving vehicle performance, making EVs more appealing, and boosting the market demand. Furthermore, the region is dedicated to reducing greenhouse gas (GHG) emissions and advancing the use of clean energy. This is increasing the requirement for EVs, and traction motors, bolstering the market growth.

United States Electric Vehicle Traction Motor Market Analysis

The United States EV traction motor market is growing significantly due to the government’s initiative towards the decarbonization of transportation systems. Government policies from the Biden administration's clean energy plan are helping to promote the use of EVs by offering tax credits, grants, and supporting infrastructure to increase demand for electric vehicles and therefore traction motors. For example, in the United States, the Inflation Reduction Act emphasizes the development of local and regional supply chains for EVs, EV batteries, and battery minerals, as outlined in the clean vehicle tax credit standards. Moreover, the growing concerns for the environment and fuel economy are encouraging consumers to switch towards EVs. Also, ongoing technological advancements in EVs such as better lighter motors are enhancing EVs with longer ranges leading consumers to consider these vehicles. At the same time, rising fuel costs and growing concerns about energy self-sufficiency are driving the transition from traditional internal combustion engine (ICE) vehicles to electric vehicles. The increase in manufacturing of EVs from big automotive giants such as Tesla, Ford, GM, and others, coupled with advancements in charging point networks will further help in traction motor sales, which is providing an impetus to the market.

Europe Electric Vehicle Traction Motor Market Analysis

The Europe EV traction motor market is growing due to the government’s target to embrace green energy and emission regulations in the European region. EU emissions standards and various national incentives including subsidies for EV purchase along with tax exemptions are fueling the use of EVs. According to reports, the European Union passed the Net Zero Industry Act in March 2023, to aim for 90% local sourcing of annual EV traction motor demand by 2030 to have a sustainable manufacturing capacity of 550 GWh and more for sustainable mobility. The countries that have adopted the policy on the use of EVs include Norway, Germany, and the Netherlands among others. The constant enhancements in the traction motor efficiency, performance, and costs are also driving the market growth. The transition to EVs is also driven by the growing demand for environmentally friendly vehicles, sales of which have been boosted across the continent by the growing availability of charging stations. Furthermore, major car manufacturers in Europe such as Volkswagen, BMW, and Renault are investing broadly in the production of EVs, which in turn is creating high demand for high-performance traction motors. Some of the risks inherent in the EV traction motor market include battery supply constraints which may be a threat to the traction motor market in Europe, however, the general trend towards decarbonization of the European economy is strengthening the market share.

Asia Pacific Electric Vehicle Traction Motor Market Analysis

The market for EV traction motors in the Asia Pacific region is growing at an unprecedented rate due to the support it has received from its government, especially China, Japan, and South Korea. China. The largest market of EVs provides deep-pocket subsidies and also invests heavily in infrastructure for such vehicles. South Korea and Japan are also spending significantly on EV solutions, and car manufacturers such as Toyota, Hyundai, and BYD are progressively enhancing motor technologies. In addition, the region boasts a robust supply chain for essential materials, such as rare earth metals. For instance, India is working to enhance domestic production of electric vehicles and batteries through its Production Linked Incentive (PLI) schemes. Also, it raises concerns for the environment and regulatory measures to reduce emissions, along with consumers’ need for environmentally friendly vehicles to spur the sales of EVs and traction motors in the region.

Latin America Electric Vehicle Traction Motor Market Analysis

The Latin America EV traction motor market is expanding because of the increasing awareness about pollution and government policies. Some countries such as Brazil and Mexico are already beginning to put up infrastructures for EVs and providing incentives for its usage. In Brazil, automakers are leading the way in the creation of “flex hybrids” vehicles designed to run on electricity and ethanol produced from sugarcane. The strategy underpins the country’s infrastructure and consumers’ demand, for more sustainable and diversified energy. Besides this, the increasing fuel costs coupled with rising consumer awareness of environmentally friendly ways of transport are providing an impetus to the market. Local manufacturers are starting to come up with traction motors to sell, putting Latin America in a vantage for steady market growth in the future years.

Middle East and Africa Electric Vehicle Traction Motor Market Analysis

The Middle East and Africa EV traction motor market growing, due to the stringent government regulations in countries such as the United Arab Emirates (UAE) and Saudi Arabia, as they have developed policies on clean mobility and GHG emissions reduction that include incentives for EVs and the development of infrastructure. Recently, the Ethiopian government has put into practice the policy of not allowing the importation of non-electric private cars in the country in a bid to popularize the use of electric cars in the country to curb fuel dependence. Global consumption of gasoline and diesel is increasing the prices and awareness of the environmental effects is causing people to embrace EVs. Furthermore, a shortage of charging stations and low demand for EVs in the region remain challenges, but these issues are expected to diminish as infrastructure and accessibility improve, thereby aiding the market growth.

Competitive Landscape:

The EV traction motor market is highly competitive with a high rate of innovations and strategic partnerships. Market participants are actively involved in the creation of high-efficiency traction motors that would enhance the performance, driving range, and energy density of electric vehicles. One trend is the use of high-cost materials like rare earth magnets and high-strength alloys to increase motor power-to-weight ratios and reliability. Also, the demand for permanent magnet synchronous motors (PMSM) and axial flux motors is increasing due to their compact structures and higher efficiency. They are also entering into partnerships with motor suppliers and battery manufacturers to achieve the best fit for the powertrain system. Furthermore, there is a clear tendency towards vertical integration, as players aim at gaining more direct control over the supply chain to optimize costs, increase production volume, and satisfy the regulatory and customer requirements for more efficient and affordable solutions for electric mobility.

The report provides a comprehensive analysis of the competitive landscape in the EV traction motor market with detailed profiles of all major companies, including:

- ABB Ltd

- Continental Engineering Services

- Dana TM4 Inc.

- Delta Electronics, Inc

- e-comer Srl

- GEM Motors d.o.o

- LG Magna e-Powertrain Co., Ltd

- Nidec Motor Corporation

- Robert Bosch GmbH

- Turntide

- Valeo

- YASA Limited

Latest News and Developments:

- In September 2024, DeepDrive, a German startup, closed an equity round of $33.5 million, to ramp up manufacturing of highly efficient and affordable ‘dual rotor’ motors for EVs, working with leading auto manufacturers to improve the efficiency of EVs.

- In March 2024, ABB secured a $150 million contract to provide complete traction packages for 65 new six-car passenger trains under the Queensland Train Manufacturing Program (QTMP). As part of the project, a Traction Center of Excellence will also be established in Fraser Coast, Queensland.

- In February 2024, Nidec collaborated with AIR to design a new electric vertical takeoff and landing (eVTOL) motor for the AIR ONE aircraft to change the personal air mobility landscape.

Electric Vehicle Traction Motor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Permanent Magnet Synchronous Motor, Induction Motor, Wound Rotor Synchronous Motor, DC Brushless Motor, DC Brushed Motor, Others |

| Power Outputs Covered | Less than 100 kW, 100kW to 250 kW, More than 250 kW |

| Propulsion Types Covered | Hybrid Electric Vehicles, Battery Electric Vehicles |

| Vehicle Types | Passenger Vehicles, Heavy Commercial Vehicles, Light Commercial Vehicles, Two-wheelers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Continental Engineering Services, Dana TM4 Inc., Delta Electronics, Inc, e-comer Srl, GEM Motors d.o.o, LG Magna e-Powertrain Co. Ltd, Nidec Motor Corporation, Robert Bosch GmbH, Turntide, Valeo, YASA Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the EV traction motor market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global EV traction motor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the EV traction motor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global EV traction motor market was valued at USD 15.65 Billion in 2024.

The global EV traction motor market is estimated to reach USD 174.17 Billion by 2033, exhibiting a CAGR of 27.20% from 2025-2033.

Key factors driving the global EV traction motor market include government incentives, stricter emissions regulations, rising environmental awareness, technological advancements in motor efficiency, declining battery costs, and the increasing shift toward sustainable transportation.

Asia Pacific currently dominates the market, holding a market share of over 52.7% in 2024. The market is driven by rapid urbanization, government incentives, strong manufacturing capabilities, and a growing shift towards clean energy.

Some of the major players in the global EV traction motor market include Electronics Inc., e-comer Srl, GEM Motors d.o.o, LG Magna e-Powertrain Co. Ltd, Nidec Motor Corporation, Robert Bosch GmbH, Turntide, Valeo, YASA Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)