Electric Vehicle Insulation Market Size, Share, Trends and Forecast by Product Type, Insulation Type, Application, Propulsion Type, and Region, 2025-2033

Electric Vehicle Insulation Market Size and Share:

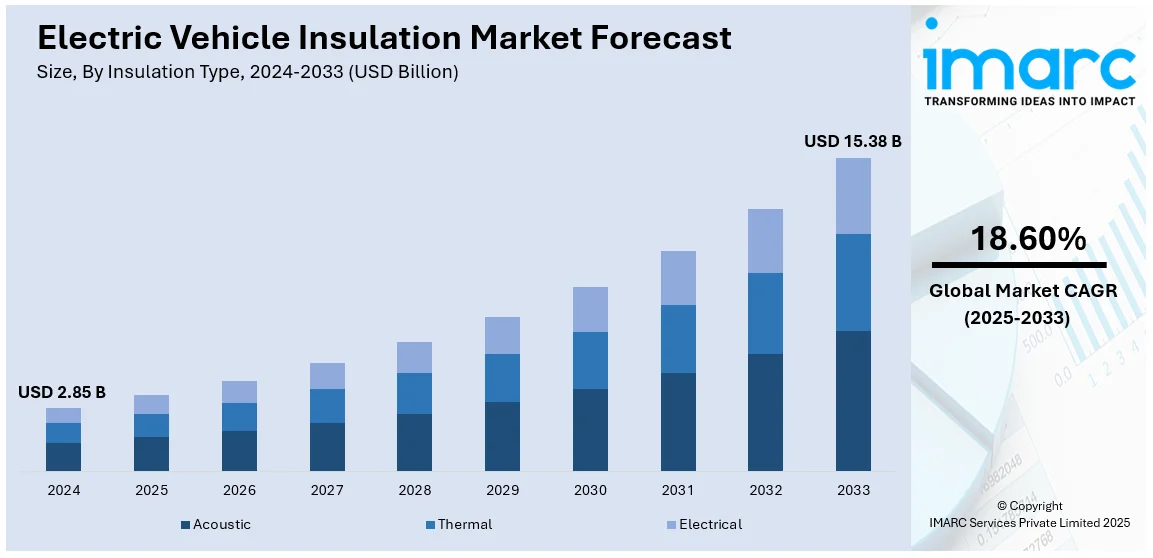

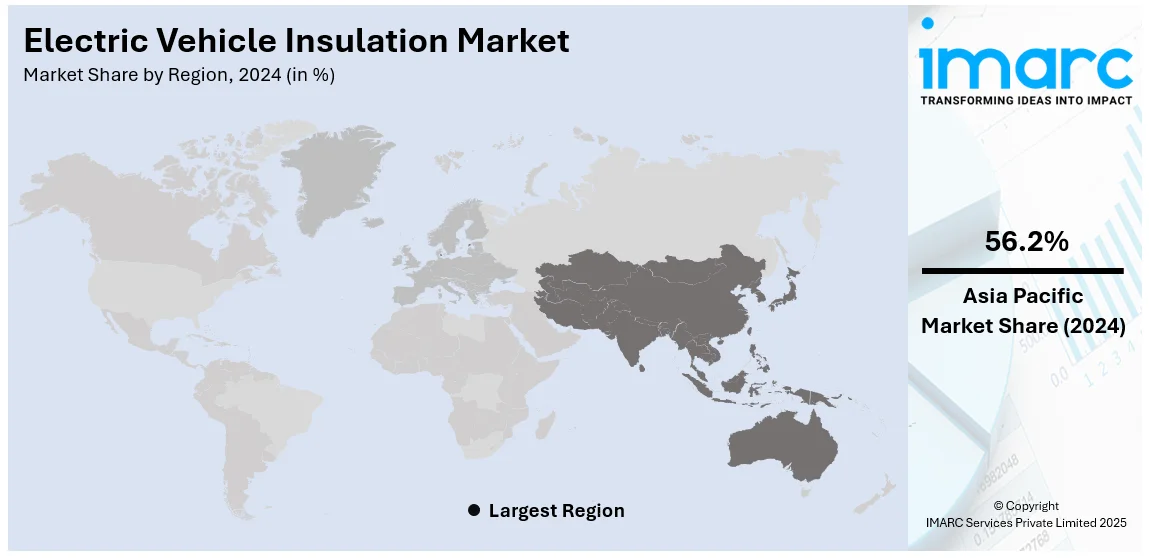

The global electric vehicle insulation market size was valued at USD 2.85 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.38 Billion by 2033, exhibiting a CAGR of 18.60% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 56.2% in 2024. The rising electric vehicle (EV) adoption, rapid technological advancements in insulation materials, global manufacturing growth, stricter safety regulations, and increasing focus on vehicle efficiency and lightweight solutions, are some of the major factors bolstering the electric vehicle insulation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.85 Billion |

| Market Forecast in 2033 | USD 15.38 Billion |

| Market Growth Rate (2025-2033) | 18.60% |

Governments and regulatory organizations around the globe are implementing more stringent safety standards for electric vehicles, urging manufacturers to adopt improved insulation technologies. With high-voltage systems becoming standard in most modern EVs, the risks associated with electrical failures or thermal runaways have also increased. For example, data from the National Transportation Safety Board indicates that electric vehicles experience an average of 25 fires per 100,000 units sold. Similarly, about 3,475 hybrid vehicles are involved in fires for every 100,000 sold. To address these concerns, stringent guidelines for fire safety, thermal management, and electrical insulation are being enforced. For example, the UN Regulation No. 100 and similar standards in the U.S. and EU mandate specific safety measures, including robust insulation materials, to prevent fires or battery malfunctions. As these regulations grow more comprehensive, manufacturers are forced to prioritize high-quality insulation to ensure compliance.

The United States is a major market disruptor as range anxiety remains one of the biggest hurdles to wider EV adoption in the country, and improving insulation materials directly impacts this challenge. In the US, over 70 electric vehicle models are available for purchase, and in 2023, Americans bought 1.2 million EVs, accounting for less than 8% of all new car sales. A key factor contributing to this relatively low adoption is range anxiety, along with the inconvenience of charging. As a result, the demand for effective thermal insulation is rising as it ensures that batteries operate within their ideal temperature range, which is crucial for maximizing energy efficiency and extending range. Poor insulation can lead to energy loss, reduced battery life, and inefficient powertrain performance, all of which diminish the user experience. By investing in cutting-edge insulation technologies, manufacturers can significantly enhance vehicle efficiency. Additionally, improved thermal management systems enable better integration of fast-charging technologies, further addressing consumer concerns about convenience.

Electric Vehicle Insulation Market Trends:

Rising Adoption of Electric Vehicles (EVs)

The rising popularity of EVs is one of the major reasons for the electric vehicle insulation market growth. In 2023, nearly 14 million new electric cars were registered globally, representing a 35% rise compared to 2022. This growth brought the total number of electric vehicles on the road to 40 million. As governments, businesses, and individuals place greater emphasis on sustainability, EVs have emerged as a popular choice for lowering carbon footprints. Countries worldwide are introducing ambitious targets to phase out traditional internal combustion engine vehicles, leading to exponential growth in EV sales. For example, nations like Norway aim for 100% EV adoption for new car sales within a few years, and larger markets like China and the EU are following similar trajectories with robust incentives and mandates. This surging demand for EVs directly fuels the need for effective insulation materials, as they are crucial for safety, efficiency, and performance. Batteries and electronic components in EVs generate significant heat and require high-performance insulation to maintain optimal operating temperatures and ensure passenger safety.

Technological Advancements in Insulation Materials

As per the electric vehicle insulation market forecast, the evolution of insulation technologies is playing a significant role in driving the market forward. Traditional materials like fiberglass and foam are now being replaced or enhanced by advanced options, such as aerogels, polyimide films, and silicone-based materials. These newer materials offer superior properties, including lightweight construction, excellent thermal resistance, and improved fire retardancy. These innovations are especially important for EV applications, where space is limited, and weight savings can significantly improve vehicle range and efficiency. Additionally, advances in nanotechnology have enabled the development of more compact and effective thermal management systems, which help optimize energy use in EVs. With manufacturers constantly pushing boundaries, insulation materials are being designed to withstand extreme conditions, such as the intense heat generated during battery charging and discharging.

Expansion of EV Manufacturing Globally

The global spread of EV production is another major factor behind the growing demand for insulation materials. Automakers are establishing new facilities worldwide to meet rising demand, with many shifting their focus from conventional vehicles to EV-centric production lines. For instance, China's leading EV manufacturer, BYD, plans to complete a $1 billion production plant in Indonesia by the end of 2025, with an annual capacity of 150,000 EVs primarily targeting the export market. Meanwhile, Europe and North America are also ramping up their EV output, with automakers like Tesla, Volkswagen, and General Motors investing billions in new facilities and technologies. As production scales up globally, the demand for reliable, high-performance insulation materials grows in parallel. Insulation is critical in every phase of EV manufacturing, from battery pack assembly to motor and power electronics integration, making it an indispensable part of the supply chain.

Electric Vehicle Insulation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric vehicle insulation market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, insulation type, application, and propulsion type.

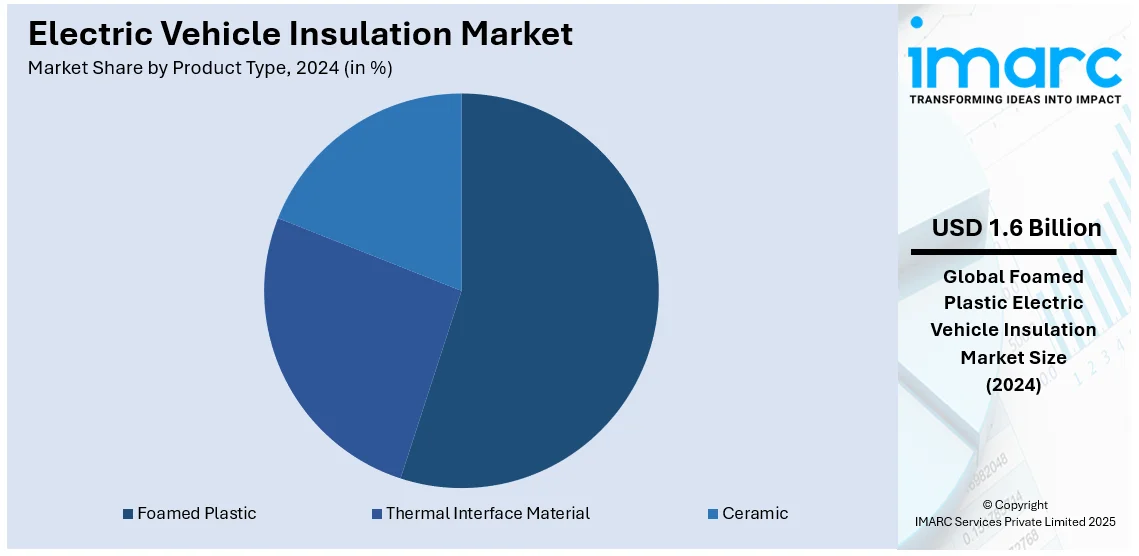

Analysis by Product Type:

- Thermal Interface Material

- Ceramic

- Foamed Plastic

Foamed plastic leads the electric vehicle insulation market share in 2024 with 55.2%. This dominance is attributed to its lightweight nature, superior thermal resistance, and affordability. Widely used in battery packs, thermal barriers, and cabin insulation, foamed plastics like polyurethane and polystyrene offer superior performance in managing heat and enhancing vehicle efficiency. Their adaptability to complex designs and compatibility with sustainable manufacturing practices further reinforce their dominance in the market. As EV adoption surges, the demand for foamed plastic solutions is projected to grow substantially, making it a cornerstone of thermal and electrical insulation strategies in modern EVs. The electric vehicle insulation market forecast indicates growth, driven by advancements in material technologies and increasing demand for energy-efficient EV components.

Analysis by Insulation Type:

- Acoustic

- Thermal

- Electrical

Thermal represents the largest market share in 2024 with 53.6%, reflecting its critical role in managing the heat generated by high-voltage components and batteries. It ensures optimal performance for the battery, improved safety of the vehicle, and increased energy efficiency by keeping operating temperatures stable. Some commonly used materials include aerogels, foamed plastics, and ceramic-based solutions that provide excellent thermal resistance with lightweight properties. Increasing demand for high-performance batteries and fast-charging technologies heightens the importance of advanced thermal insulation. This is further enhanced by regulatory standards that emphasize thermal management to reduce risks such as thermal runaways and overheating in EVs.

Analysis by Application:

- Battery Pack

- Under The Bonnet

- Interiors

- Others

Battery pack is an important application area in the electric vehicle insulation industry since it directly affects vehicle performance and safety. Battery pack insulation is crucial for thermal control, avoiding overheating, and guaranteeing steady battery performance. Aerogels and ceramic-based materials are examples of advanced solutions that are frequently utilized to improve heat resistance and lower the danger of fire. The need for specialized insulation in battery packs is growing as fast-charging technologies and high-energy-density batteries become more widely used.

For under-the-bonnet applications, insulation is essential for controlling the heat produced by high-voltage parts such as inverters and electric motors. In order to shield components from high temperatures and minimize noise, this segment focuses on materials that offer thermal and electrical insulation. Foamed polymers, silicone-based materials, and polyimide films are frequently utilized to maximize durability and heat management in small areas. Under-the-bonnet insulation solutions are getting more complex as EV designs change to accommodate more efficient and smaller powertrains, making this market crucial to the lifetime and performance of vehicles.

As per the electric vehicle insulation market outlook, interior insulation focuses on enhancing passenger comfort by managing cabin temperatures, reducing noise, and improving acoustic performance. Materials like foamed plastics, fiberglass, and multilayer composites are widely utilized to create quieter, more energy-efficient cabin environments. Additionally, interior insulation supports sustainable vehicle design by integrating lightweight and recyclable materials. With the growing emphasis on luxury and comfort in EVs, especially in premium models, the demand for advanced interior insulation solutions is steadily increasing, solidifying its importance within the market.

Analysis by Propulsion Type:

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PEHV)

- Fuel Cell Electric Vehicle (FCEV)

- Hybrid Electric Vehicle (EEV)

In 2024, hybrid electric vehicle (EEV) leads the markets share with 52.5%. This is a result of its broad use as an intermediate solution between conventional internal combustion engine vehicles and fully electric models. HEVs combine electric motors with conventional engines, generating significant heat that requires advanced thermal and electrical insulation solutions. Materials like high-performance foams and polyimide films are commonly used to manage heat, reduce noise, and enhance efficiency. The segment's dominance is bolstered by its ability to appeal to a broad consumer base seeking fuel efficiency and lower emissions without fully transitioning to pure EVs. With governments incentivizing hybrid technology and automakers expanding their HEV offerings, this segment continues to drive demand for innovative insulation materials.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market share in 2024 with 56.2%. This growth is because of its status as the global hub for EV production and consumption. Countries such as China, Japan, and South Korea have dominated the market at the forefront with their advanced manufacturing capabilities, robust supply chains, and strong government support through subsidies and policies promoting electric mobility. China alone accounted for over 60% of global EV sales in 2023, revealing regional domination. High performance of major EV manufacturers like BYD and Tata Motors along with battery suppliers such as CATL and LG Energy Solution also contribute to increasing the demand for insulation materials. Increased urbanization and growing environmental consciousness along with investments in the region to build a considerable infrastructure for EVs have additionally promoted sustainable growth, and therefore, Asia Pacific is considered as the focal point for innovation and boosts the electric vehicle insulation market demand.

Key Regional Takeaways:

North America Electric Vehicle Insulation Market Analysis

North America is a rapidly growing market for electric vehicle insulation, driven by the accelerating adoption of EVs and robust government support. In 2023, EV sales in North America surpassed 1.8 million units, with the United States and Canada leading the charge. Federal initiatives like the Inflation Reduction Act in the U.S. have allocated billions to EV subsidies, battery production, and charging infrastructure, significantly boosting the market. With this, automakers like Tesla, General Motors, and Ford continue to increase production capacities to respond to the increased demand from consumers. Canada also emerges as an important player by agreeing to phase out internal combustion engines by 2035, in step with broader climate goals. Cold climates in the region also create a need for advanced thermal insulation solutions to guarantee battery efficiency and safety. With maturation of the EV ecosystem, North America will be a prime hub for electric vehicle insulation markets in the coming years.

United States Electric Vehicle Insulation Market Analysis

The United States is a fast-developing market for electric vehicle insulation, owing to rising consumer demand and major infrastructural improvements. In 2024, electric cars accounted for more than 20% of new car sales in the country, because of government incentives like the Inflation Reduction Act, which provided billions of dollars for EV subsidies and charging infrastructure. Major manufacturers such as Tesla, General Motors, and Ford are also developing production facilities, including Tesla's Gigafactory in Texas, which focuses on battery technology and car assembly. Furthermore, governments such as California are leading the transition by prohibiting the sale of new gas-powered vehicles by 2035, hence increasing EV adoption. This growth is directly affecting the insulation industry because manufacturers want improved materials to provide safety, thermal management, and energy.

Europe Electric Vehicle Insulation Market Analysis

Due to its strict pollution regulations and ambitious climate goals, Europe has become a major market for electric vehicle insulation. About 15% of all automobile sales in 2024 were battery electric cars (BEVs), indicating high customer demand bolstered by government incentives and subsidies. Nations such as Norway, where more than 80% of new automobile sales are electric, serve as models for other European countries. By investing in cutting-edge manufacturing processes and materials, automakers like Volkswagen, BMW, and Renault are increasing the production of electric vehicles. The need for high-performance insulating solutions is being further accelerated by the European Union's aim for zero-emission automobiles by 2035. Furthermore, the area is seeing notable developments in battery technology, which leads to the development of creative insulating materials to handle electrical and thermal issues. With a growing network of EV charging infrastructure and widespread adoption across commercial and passenger vehicles, Europe is a dynamic contributor to the global insulation market.

Asia Pacific Electric Vehicle Insulation Market Analysis

Asia Pacific continues to remain the largest region for electric vehicle insulation, mainly because of its excellent manufacturing capabilities and high adoption of EVs. In 2023, sales of EVs in China reached more than 60% of the global share, with high government support, including subsidies and tax incentives, that encourage high adoption rates. Japan and South Korea are also essential players, where companies like Toyota and Hyundai invest heavily in producing and innovating EVs. Besides passenger vehicles, the region is at the forefront of electric buses and two-wheelers, which in turn is increasing the demand for advanced insulation solutions. The ecosystem is led by battery manufacturers like CATL and LG Energy Solution, which ensures an integrated supply chain for insulation materials. In addition, governments across the region are focusing on renewable energy and sustainable transportation, thus creating a conducive environment for market growth. The region will continue to dominate as the infrastructure and technology of EVs evolve.

Latin America Electric Vehicle Insulation Market Analysis

Latin America is slowly building its electric vehicle insulation market through the efforts of governments and private sectors to popularize green transport. Brazil, the largest automobile market in Latin America, is at the forefront of this shift by implementing EV-friendly policies and incentives. Mexico is fast becoming an EV production hub, with some of the world's biggest car manufacturers investing in local manufacturing facilities. Even though adoption rates remain modest compared to other regions, Latin America is advancing in the electric bus deployments as a solution to urban pollution. The need for insulation material will increase in the coming years due to improvement in infrastructure and battery safety and efficiency in energy consumption.

Middle East and Africa Electric Vehicle Insulation Market Analysis

As per the electric vehicle insulation market trends, the market in Middle East and Africa region is steadily moving ahead, mainly due to factors such as energy source diversification and oil refineries stopping or curbing the export of oil. Countries such as the UAE and Saudi Arabia are strongly encouraging the adoption of electric vehicles by investing in charging infrastructure and offering tax incentives for EVs. South Africa is emerging as a regional leader with a growing network of EV-friendly policies and increasing private sector involvement. While the market is still emerging, the growing demand for sustainable transportation is creating opportunities for providers of insulation materials. Harsh climate conditions in many parts of the region also underscore the importance of advanced thermal insulation to enhance battery performance and vehicle safety.

Competitive Landscape:

To deal with the rising demand for high-performance advanced insulation solutions, key market players are engaged in innovation, sustainability, and global expansion. This is accompanied by developing light-weight materials that have superior thermal and electrical properties, which can contribute to vehicle performance and safety enhancement. Companies are also focusing on research and development of new materials of insulation to suit the needs arising from high voltage components, fast-charging batteries, and compact designs for EVs. In terms of product development, they are also creating strategic partnerships with automotive and battery makers to ensure a streamlined integration process. They are majorly focused on increasing their manufacturing capacity in places where electric vehicle adoption is rising, such as Asia Pacific and North America. Additionally, they have aligned their offerings with stringent safety regulations and green goals by adopting eco-friendly processes and recyclable materials for their production. These strategic steps position market leaders to capitalize on the accelerating shift toward electrified transportation.

The report provides a comprehensive analysis of the competitive landscape in the electric vehicle insulation market with detailed profiles of all major companies, including:

- 3M

- BASF SE

- Morgan Advanced Materials

- Adler Pelzer Holding GmbH

- Saint-Gobain

- DuPont

- Zotefoams Plc

- Autoneum

- Elmelin Ltd

- Unifrax

- Toyota Boshoku Corporation

- Armacell International S.A.

- Sumitomo Riko Company Limited

Latest News and Developments:

- July 2024: CATL launched its first EV battery brand for commercial applications, CATL TIANXING, offering two products for light commercial vehicles: the superfast charging edition and long-range edition. These batteries feature advanced technologies like no thermal propagation and aircraft-level thermal insulation for safety.

- June 2024: Delignit AG and Amorim Cork Composites launched FiberCork, a sustainable range of materials for EV batteries. Combining cork's low density and thermal insulation with beech wood's durability, FiberCork enhances performance while reducing environmental impact. This innovative solution aims to support the rising need for environment-friendly, high-performance materials in the electric mobility sector.

- June 2024: Oerlikon introduced advanced safety components for Battery Electric Vehicles (BEVs), including heat shields, gas guidance systems, and cell separators, to enhance heat protection and prevent thermal runaway. The components feature innovative thermal insulation to improve battery strength and meet stringent safety standards. Series production commenced in Bremen in early 2024.

- In January 2025, BASF introduced its newly developed flame retardant (FR) grade of Ultramid T6000 polyphthalamide (PPA) for use in terminal block applications. This upgraded solution is said to replace non-FR material and enhance safety for the inverter and motor system in EVs. It bridges the gap between traditional PA66 and PA6T by providing enhanced mechanical and dielectric properties, especially in humid environments and at high temperatures.

- In June 2024, DuPont has launched the Pyralux® ML Series, a new line of double-sided metal-clad laminates designed for high-performance applications in sectors such as aerospace, defense, and industrial markets. These laminates are engineered to enhance thermal management, making them ideal for flexible printed circuits, sensors, heaters, and thermocouples that require reliable performance in extreme environments.

Electric Vehicle Insulation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Thermal Interface Material, Ceramic, |

| Insulation Types Covered | Acoustic, Thermal, Electrical |

| Applications Covered | Battery Pack, Under the Bonnet, Interiors, Others |

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PEHV), Fuel Cell Electric Vehicle (FCEV), Hybrid Electric Vehicle (EEV) |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M, BASF SE, Morgan Advanced Materials, Adler Pelzer Holding GmbH, Saint-Gobain, DuPont, Zotefoams Plc, Autoneum, Elmelin Ltd, Unifrax, Toyota Boshoku Corporation, Armacell International S.A., Sumitomo Riko Company Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric vehicle insulation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global electric vehicle insulation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric vehicle insulation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric vehicle insulation market was valued at USD 2.85 Billion in 2024.

IMARC estimates the electric vehicle insulation market to exhibit a CAGR of 18.60% during 2025-2033.

The electric vehicle insulation market is driven by the rising EV adoption, rapid technological advancements in insulation materials, increasing focus on thermal management for safety, global expansion of EV manufacturing, stricter safety regulations, growing demand for lightweight materials, and advancements in battery technologies enhancing efficiency and range.

Asia Pacific currently dominates the market, driven by high EV adoption rates, robust manufacturing capabilities, government incentives, and the presence of leading battery and EV manufacturers.

Some of the major players in the electric vehicle insulation market include 3M, BASF SE, Morgan Advanced Materials, Adler Pelzer Holding GmbH, Saint-Gobain, DuPont, Zotefoams Plc, Autoneum, Elmelin Ltd, Unifrax, Toyota Boshoku Corporation, Armacell International S.A., Sumitomo Riko Company Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)