Electric Vehicle Charging Station Market Size, Share, Trends and Forecast by Charging Station Type, Vehicle Type, Installation Type, Charging Level, Connector Type, Application, and Region, 2026-2034

Electric Vehicle Charging Station Market Size and Share:

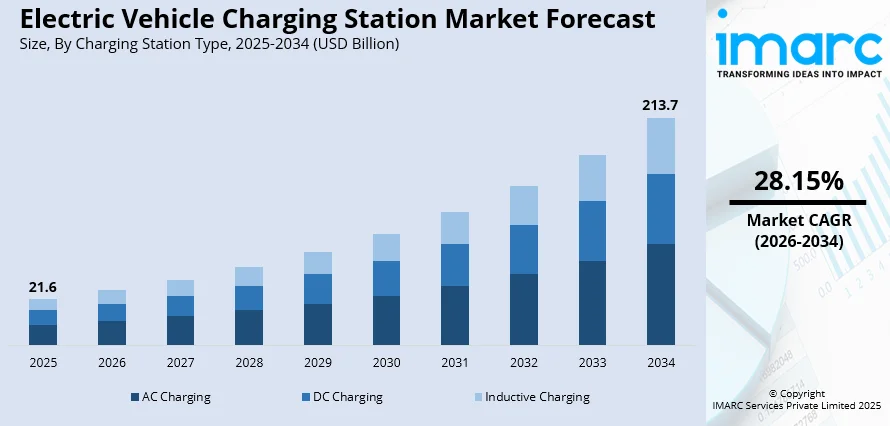

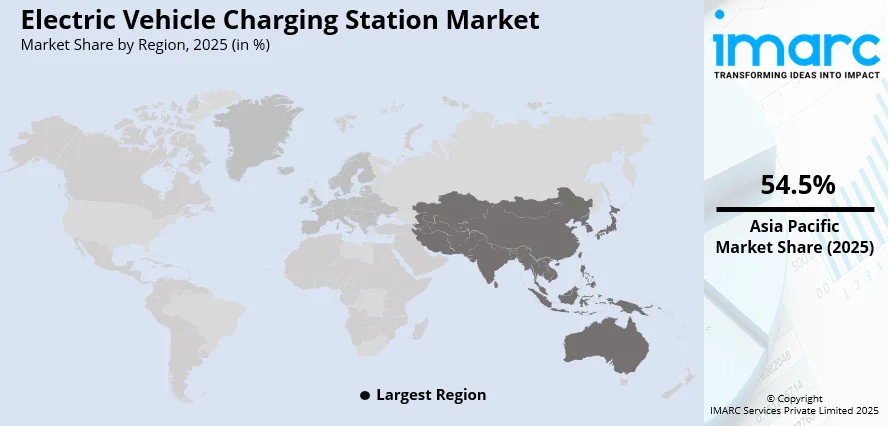

The global electric vehicle charging station market size was valued at USD 21.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 213.7 Billion by 2034, exhibiting a CAGR of 28.15% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 54.5% in 2025. The region leads the market based on robust government stimulus, fast growth of electric vehicles (EVs), massive infrastructure spending on a large scale, urbanization, and the location of key EV manufacturing bases fueling ongoing expansion of charging networks in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 21.6 Billion |

|

Market Forecast in 2034

|

USD 213.7 Billion |

| Market Growth Rate (2026-2034) | 28.15% |

Globally, the most influential factor in driving the electric vehicle (EV) charging station industry is the co-alignment of government policies and climate objectives as well as sustainability in the environment. Many countries have implemented policy, subsidy, and tax-break initiatives to help cut greenhouse gas emissions and assist the shift toward electric mobility. Such initiatives cover national EV target adoption, funding for the provision of charging points, and legislating zero-emission vehicles. Moreover, global climate pacts have promoted transnational cooperation in clean transport initiatives, further spurring infrastructure development. Urban design now often includes EV charging points in residential properties, business locations, and public transport systems. For example, in February 2023, L-Charge introduced the world's first mobile, extremely fast, off-grid EV charging service in Amsterdam, facilitating on-demand charging via an app to fill infrastructural gaps with clean fuel-burning, movable stations. Furthermore, the worldwide transition towards decarbonization is also driving electricity grids to be ready for clean energy sources, complementing the development of EV infrastructure. Since transportation is among the highest emitters, global policy harmonization guarantees a sustained and coordinated effort in favor of electric vehicle charging station installation globally.

To get more information on this market Request Sample

In the United States, one of the most influential drivers of the market is the strenuous focus on infrastructure investment alongside long-term planning for cities with a market share of 88.70% in 2024. Federal and state governments are making large investments in creating a vast and inclusive EV charging network with access in both urban and rural communities. For instance, In January 2025, Brooklyn-based Itselectric revealed plans to grow New York City's curbside EV chargers from 1,400 in 2024 to 10,000 by 2030, filling key urban charging infrastructure gaps. Moreover, such investments enable Level 2 and DC fast charger installations along major highways, public places, neighborhoods, and underserved communities. Municipal governments are adding EV-friendly zoning regulations and building codes requiring the incorporation of charging stations into new developments. Concurrently, utility providers and local governments are working together to enhance power grids and introduce smart charging systems. Integrating EV infrastructure into urban transport planning not only supports cleaner mobility but also local economies and job generation. This integrated approach is making the U.S. a developing and strategically planned market for the deployment of EV charging stations.

Electric Vehicle Charging Station Market Trends:

Rising adoption of electric vehicles (EVs)

The rising demand for EV charging stations due to the increasing adoption of EVs among the masses across the globe is contributing to the electric vehicle charging station market growth. According to the International Energy Agency (IEA), in 2023, sales of electric cars were 3.5 Million more as compared to the previous year, recording a growth of 35% annually. In 2024, the revenue in the electric vehicle market is projected to reach a staggering US$ 623.3 Billion worldwide. Moreover, the unit sales of the electric vehicle market are anticipated to reach 17.07 million vehicles units by 2028. In addition, there is a rising concern about environmental sustainability and the need to reduce greenhouse gas (GHG) emissions. Additionally, various key market players are extensively investing in the development of electric vehicle charging stations. For instance, in October 2022, Octopus Energy Generation made its first investment in the UK EV charging infrastructure. It is planning to invest up to GBP 110 Million in a Manchester-based EV public charging network Be. EV on behalf of its Sky fund (ORI SCSp) to scale and install new charge points across the United Kingdom. The agreement will contribute to the expansion of Be.EV's 150-strong public charge point network, with Be.EV committing to adding 1,000 more charge points across the North of England and beyond. Such initiatives are anticipated to create a positive electric vehicle charging station market outlook.

Advancements in Battery Technology

Various manufacturers are rapidly advancing their battery technologies in the EV sector. In line with this, they are working on technologies such as wireless charging and autonomous charging robots, which may make vehicle charging convenient. For instance, Siemens AG launched a new high-power charger, Sicharge D. It features scalable, high charging power of up to 300 kW. The charging station also supports voltages between 150 and 1,000 volts and charging currents of up to 1,000. Moreover, the integration of higher-voltage Level 2 chargers and rapid DC fast chargers that provide quicker charge times and enhance the overall EV ownership experience is also contributing to market growth. Apart from this, various power companies are increasingly investing in developing the public charging infrastructure to cater to the escalating need for faster and more affordable charging solutions. For instance, in October 2022, Ather Energy announced the installation of the 580th public fast charging point, the Ather Grid, across 56 cities in India. As the company expands its national footprint, Ather Energy plans to install 820 more grids, bringing the total to 1400 by the end of FY23. Ather Grids are strategically installed across markets, with 60% of current installations in tier-II and tier-III cities.

Favorable Government Initiatives

The government authorities of several countries are encouraging the adoption of cleaner and more sustainable transportation solutions, which is offering a positive market outlook. They are implementing stringent rules and regulations to combat air pollution and reduce carbon emissions in the environment across the globe. According to the United Nations World Meteorological Organization (WMO), total carbon dioxide emissions were calculated to reach 41.6 Billion Tons in 2024. Moreover, concerned government bodies worldwide are also introducing various schemes and initiatives to encourage buyers to choose electric vehicles over conventional vehicles. For instance, the Japanese government aims to transform all the new cars sold in the country into electric or hybrid vehicles by 2050. Similarly, the California ZEV program, which aims to have 1.5 million electric vehicles on the road by 2025, is one such initiative. India, China, the United Kingdom, South Korea, France, Germany, Norway, and the Netherlands are some of the countries offering various incentives for people looking to purchase an electric vehicle. Apart from this, the concerned regulatory bodies and authorities are incentivizing the deployment of EV charging infrastructure through grants, subsidies, and tax benefits, which is further bolstering the growth of the market. Additionally, municipalities in several countries are implementing zero-emission targets to achieve sustainability goals.

Electric Vehicle Charging Station Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric vehicle charging station market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on charging station type, vehicle type, installation type, charging level, connector type, and application.

Analysis by Charging Station Type:

- AC Charging

- DC Charging

- Inductive Charging

In 2025, AC Charging leads the world electric vehicle charging station market forecast with a strong share of 88.1%. This is due to extensive use of alternating current (AC) chargers in both residential and commercial areas. AC chargers are cheaper to install and operate compared to DC fast chargers, and hence they are the preferred solution for home installations, offices, and public charging stations. These chargers are generally slower but sufficient for overnight charging or extended stops, providing a balance between cost and charging time. The growing use of electric vehicles, along with government incentives and encouragement of EV infrastructure, has helped fuel the ongoing expansion of AC charging stations. As the demand for electric vehicles on the road increases, so will the need for AC charging stations, particularly in inner cities where the ability to charge conveniently and at a low cost is vital for EV owners.

Analysis by Vehicle Type:

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

The Battery Electric Vehicle (BEV) category maintains the highest market share of 78.8% in the EV market in 2025. BEVs are plug-in vehicles powered solely by rechargeable batteries, providing zero-emission transportation. Their success is due to the increased demand for green cars and the drive to decarbonize the transport industry. With technological improvements in battery technology, charging stations, and car ranges, BEVs are increasingly becoming the practical everyday choice. Governments across the world have also launched supportive regulations and incentives for the use of BEVs, including tax rebates, EV purchase rebates, and investment in EV infrastructure. Also, leading auto makers are turning to BEVs, replacing ICE vehicles, further solidifying the expansion of the BEV segment. As the EV market matures on a global scale, the BEV segment will maintain its leading position with its environmental advantages and rising affordability for consumers.

Analysis by Installation Type:

- Portable Charger

- Fixed Charger

Fixed Chargers lead the installation type in the electric vehicle charging station market by 93.2% in 2025. Fixed chargers are installed at home, business, and public places permanently and give a steady and trustworthy charging facility. Fixed chargers give a more long-term solution than mobile charging units, which are portable but not so trustworthy for daily use. Fixed chargers are best suited for both domestic and public charging requirements since they provide stable power and an effortless experience to the users. With the rise in electric vehicle adoption on roads, demand for fixed charging infrastructure keeps increasing. Fixed chargers are also easier and cheaper to maintain, thus becoming a desired choice for extensive infrastructure development. Both private and public sector investment in EV infrastructure is picking up, especially in urban cities, where fixed chargers are pivotal in delivering convenient charging solutions for making accessible services available to serve the expanding demand of EV users.

Analysis by Charging Level:

- Level 1

- Level 2

- Level 3

Level 2 charging level holds 69.7% electric vehicle charging station market value in 2025. They run on a 240V supply and provide a quicker charging process compared to Level 1 chargers, which use household power outlets. Level 2 chargers suit home use since they offer a full charge overnight, generally taking 4 to 8 hours based on the size of the vehicle's battery. They are also extensively employed in public and commercial charging points, where they provide a satisfactory cost and charging speed combination. The high market penetration of Level 2 chargers is attributed to their extensive availability and affordability. As the adoption of electric vehicles is on the rise, the requirement for Level 2 chargers will keep growing, especially in places where fast charging facilities (Level 3) have not been made available. This will propel the installation of Level 2 chargers in residential and public infrastructure, catalyzing additional EV adoption.

Analysis by Connector Type:

- Combines Charging Station (CCS)

- CHAdeMO

- Normal Charging

- Tesla Supercharger

- Type-2 (IEC 621196)

- Others

The CHAdeMO connector type has a 30.3% market share in 2025. CHAdeMO is one of the most common DC fast charging standards, used notably in Japan and for cars such as the Nissan Leaf. It facilitates quick charging, tending to slash charging time immensely in comparison to AC chargers or Level 1 chargers. CHAdeMO's sustained popularity is due in part to its early adoption among large Chinese and Japanese automakers and because it has been used to give EVs fast, convenient charging in residential as well as public stations. Nevertheless, with other fast-charging standards such as CCS (Combined Charging System) gaining popularity around the world, CHAdeMO's market share will be threatened. Nevertheless, CHAdeMO remains significant as a charging standard where it has significant Japanese automaker influence. It is still an important component of the worldwide fast-charging network and will probably remain a primary charging solution for some EV models in the near future.

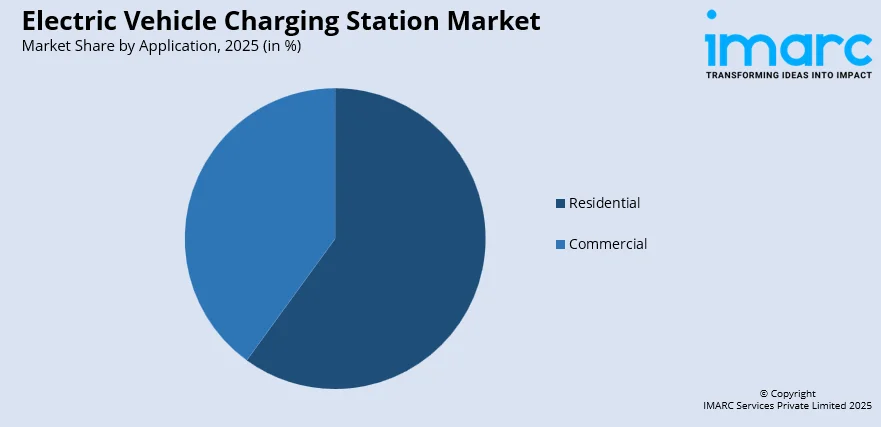

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

In 2025, the Residential segment dominates the application category, with 61.1% of the electric vehicle charging station market. Residential charging is the most prevalent type of EV charging because many EV users find it more convenient to charge their cars at home. Through home chargers, customers simply need to plug in their cars overnight and drive off in the morning with a fully charged battery. This level of convenience renders residential charging highly appealing to EV users who are not interested in depending on public charging points. Increased traffic from the rising population of electric vehicles, together with the support provided by governments to help home charge installation costs, should drive subsequent expansion within the market segment. The increase in the population of EVs is making charging solution demands from domestic residents keep rising, mainly because urban and suburban populations are gradually becoming proponents of using electric cars as well as deploying supporting technology at their homes for home charging.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, the Asia-Pacific region has the largest market share of the EV charging station market, at 54.5%. This is mainly due to the speedy adoption of electric vehicles in the countries of China, Japan, and South Korea, which are leading the world in the EV movement. Regional government policies are highly conducive to the adoption of EVs, with subsidies, tax breaks, and investment in charging infrastructure being primary growth drivers. China, the world's biggest EV market, has invested heavily in the development of its charging infrastructure, which further fuels the growth of electric vehicles. The Asia-Pacific region also houses some of the biggest EV manufacturers, adding to the high demand for charging stations. As the market keeps expanding, more expansion of EV charging infrastructure is anticipated, with growing investments from both public and private sectors to cater to the increasing number of electric vehicles on the road.

Key Regional Takeaways:

North America Electric Vehicle Charging Station Market Analysis

In 2025, the North America electric vehicle (EV) charging station market maintains its steady growth, fueled by expanding EV adoption and consistent government support for clean transportation. The region is seeing more investments in charging infrastructure in urban, suburban, and highway networks to make EV charging more convenient and accessible for consumers. Public and private sectors are working actively to increase the coverage of both Level 2 and DC fast-charging stations, with a specific focus on fixed installations in residential and commercial locations. Level 2 chargers continue to be dominant because of their cost versus charging speed balance, catering to daily commuting requirements. Residential installations are also increasing at a fast pace as more EV owners find home charging convenient. North America's emphasis on decreasing carbon footprints and embracing clean energy solutions is also driving the evolution of high-end EV infrastructure. Therefore, the continent is becoming an integral player in the growth of the world's EV charging station market.

United States Electric Vehicle Charging Station Market Analysis

The United States electric vehicle (EV) charging station market is fueled mainly by the increasing usage of electric vehicles, driven by higher environmental concerns and government subsidies. In line with the International Energy Agency (IEA), the United States registered 10% of new EVs registered worldwide in 2023. Additionally, it is estimated through industry reports that, by the year 2030, 26.4 Million EVs will be operating on American highways, representing 10% of all vehicles on the road. This has massively increased demand for accessible and easy-to-use charging infrastructure. State and federal policies, like tax credits, grants, and plans to invest in infrastructure, are further driving this transformation. Also, improved charging technology, such as fast-charging technology, is becoming increasingly simpler and faster to recharge EVs, making them more desirable for consumers. Increasing public-private partnerships and investments from major auto companies and energy providers are also building out infrastructure throughout urban and rural settings. In addition, the presence of Level 3 DC fast chargers and the emergence of new technologies, including wireless charging, are making it easier to own EVs. Combined, these trends are driving the high growth of the electric vehicle charging station market in the United States, keeping charging infrastructure up with EV sales.

Asia Pacific Electric Vehicle Charging Station Market Analysis

The market for electric vehicle (EV) charging stations in the Asia Pacific region is growing as a result of rising urbanization and a mounting demand for environmentally friendly means of transportation in high-density areas. According to estimates by reports, in the year 2024, 52.9% of the Asia population resided in urban cities, translating to 2,545,230,547 people. With increasing urbanization, the need for cleaner means of mobility is on the increase, compelling governments and companies to give top priority to the rollout of EV charging infrastructure. Coupled with speedy innovations in smart grid technology and integrating charging points with mobile applications for convenient accessibility, user experience and adoption are also being fueled by EV. The growing array of affordable electric cars has further increased the demand for a robust charging network. In addition, robust government policies and incentives, especially in emerging economies like India, are reducing the barriers to EV adoption, while high investments in grid infrastructure are making charging stations more accessible in both urban and rural regions.

Europe Electric Vehicle Charging Station Market Analysis

The European Union electric vehicle (EV) charging station market is growing rapidly, driven by the region's high level of commitment to sustainability and decarbonization objectives as part of the European Union's Green Deal and its ambitious greenhouse gas emission reduction targets by 2030. GHG emissions in the European Union fell by 2.6% in Q2 2024 compared to the same quarter in 2023, according to reports. The EU regulatory support, such as strict emission standards for vehicles and EV purchase incentives, is further driving the mass adoption of electric vehicles in European nations.

Consequently, there is a growing demand for a widespread and affordable EV charging network to support the rising number of EVs on the roads. Government investment in the development of charging networks, coupled with private sector participation, is essential to this process. Technological innovation in quick-charging technologies, including ultra-fast chargers and intelligent charging systems, further improves convenience and shortens charging time, drawing more customers into adopting electric vehicles. Apart from this, the increasing trend of awareness regarding environmental concerns, as well as favorable incentives like subsidies, grants, and tax incentives, is also fueling demand for EVs and their charging points, making the European market one of the most vibrant in the globe.

Latin America Electric Vehicle Charging Station Market Analysis

The Latin American market for electric vehicle (EV) charging stations is significantly contributing to the rise in environmental awareness and government policies that favor environmentally friendly transportation. The implementation of various government initiatives like tax reductions and subsidies to popularize the use of electric vehicles. For example, there were 52,000 new EV registrations in Brazil in 2023, showing a rise of 181.1% from the preceding year. As urbanization increases and pollution concerns rise, the demand for cleaner alternatives to traditional vehicles is boosting the need for EV charging infrastructure. Furthermore, urban planning initiatives are increasingly incorporating EV infrastructure in new developments, making charging stations more accessible. Increased supply of electric buses and commercial vehicles, especially in nations like Brazil and Mexico, is also stimulating the need for a widespread charging network to facilitate fleet changes.

Middle East and Africa Electric Vehicle Charging Station Market Analysis

The Middle East and Africa electric vehicle (EV) charging station market is heavily impacted by increasing investments in green technology as well as the growth of renewable energy infrastructure. The Middle East market for renewable energy will grow at a CAGR of 13.53% between 2024 and 2032, the IMARC Group report states. Since governments of nations in the region are looking to diversify the sources of energy and move away from oil, there is increased emphasis on the electrification of the transport sector. The growing availability of affordable EV models is also driving consumer uptake, while government efforts to cut fuel usage and air pollution are driving demand for charging stations. Moreover, the growing presence of international automakers and energy firms in the region is also driving the growth of strong charging networks to cater to the growing demand for electric vehicles.

Competitive Landscape:

The competitive environment in the electric vehicle (EV) charging station industry is one of fast technology evolution and increasing infrastructure. Competitors are shifting attention to maximizing charging efficiency, increasing coverage, and providing simple-to-use digital interfaces. Advances in charging technology, particularly in Level 2 and DC fast charging, have led to the deployment of more efficient and convenient stations across urban, residential, and highway settings. Strategic collaborations among technology providers, utility companies, and infrastructure investors are facilitating large-scale implementation. Most participants are also converging smart charging solutions that facilitate remote management, scheduling, and energy optimization. The focus on sustainability and renewable energy integration is also creating the need for solar-powered and grid-responsive systems. There is also an increasing trend toward modular and scalable station designs that can be configured for varied environments. As the demand rises, the market continues to be active, with stakeholders continually refining their products to aid in the rapid adoption of electric cars.

The report provides a comprehensive analysis of the competitive landscape in the electric vehicle charging station market with detailed profiles of all major companies, including:

- ABB E-mobility

- Alfen N.V.

- Blink Charging Co.

- Bosch Automotive Service Solutions LLC.

- bp pulse

- ChargePoint, Inc

- Eaton Corporation plc

- Efacec

- Evbox

- EVgo Services LLC

- Schneider Electric

- Tesla, Inc.

Latest News and Developments:

- February 2025: TATA.ev launched a groundbreaking initiative to raise the number of electric vehicle charging points in India to 400,000 by 2027. The firm is also expanding its collaboration with leading Charging Point Operators (CPOs) to set up around 30,000 new public charging points.

- December 2024: Networked electric vehicle (EV) charging services leader ChargePoint partnered with General Motors (GM) to enhance support for the development and growth of EV infrastructure in the United States. Under this partnership, the companies hope to establish multiple hundred ultra-fast charging stations in strategic locations across the United States that incorporate the latest innovations in EV charging technologies. GM and ChargePoint intend to open the facilities and open them up to the public by late 2025.

- September 2024: Schneider Electric, the digitalization solutions leader in the energy industry, launched the game-changing Schneider Charge Pro Level 2 AC Commercial Electric Vehicle Charger. Schneider Charge Pro offers strength, rapid assembly, and built-in features to enable commercial EV charging. Schneider Charge Pro is also engineered to deliver cost-efficient and sustainable commercial fleet, office, residential home, and destination charging.

- July 2024: BP plc, a global oil and gas leader headquartered in London, entered into a deal with Simon Property Group for the development of electric vehicle charging stations across the United States. Under this deal, BP's global EV charging business, BP Pulse, will install and operate Gigahubs for EV charging across 75 Simon properties. This pact will offer over 900 fast EV charging facilities that accept nearly all models and brands of electric cars in the market. The initial sites will be opened for public use by early 2026.

- March 2024: Servotech Power Systems Ltd., an Indian green charging solutions company, has won a contract for EV charging stations across Nashik Municipal Corporation area. The contract involves supply, construction, and commissioning of 20 electric vehicle (EV) charging stations in the area.

Electric Vehicle Charging Station Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Charging Station Types Covered | AC Charging, DC Charging, Inductive Charging |

| Vehicle Types Covered | Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV) |

| Installation Types Covered | Portable Charger, Fixed Charger |

| Charging Levels Covered | Level 1, Level 2, Level 3 |

| Connector Types Covered | Combines Charging Station (CCS), CHAdeMO, Normal Charging, Tesla Supercharger, Type-2 (IEC 621196), Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB E-mobility, Alfen N.V., Blink Charging Co., Bosch Automotive Service Solutions LLC., bp pulse, ChargePoint, Inc, Eaton Corporation plc, Efacec, Evbox, EVgo Services LLC, Schneider Electric, Tesla, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric vehicle charging station market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global electric vehicle charging station market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric vehicle charging station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric vehicle charging station market was valued at USD 21.6 Billion in 2025.

The electric vehicle charging station market is projected to exhibit a CAGR of 28.15% during 2026-2034, reaching a value of USD 213.7 Billion by 2034.

Key drivers of the electric vehicle charging station market are increasing adoption of electric vehicles, favorable government incentives and policies, increasing environmental concerns, technological progress in charging systems, and more investment in residential, commercial, and public space infrastructure development to facilitate sustainable transport solutions.

Asia Pacific currently dominates the electric vehicle charging station market, accounting for a share of 54.5%. The market is driven by robust government support, quick uptake of electric vehicles, large-scale infrastructure expansion, growth in urban populations, and ongoing technology innovations in charging technology in countries such as China, Japan, and South Korea.

Some of the major players in the electric vehicle charging station market include ABB E-mobility, Alfen N.V., Blink Charging Co., Bosch Automotive Service Solutions LLC., bp pulse, ChargePoint, Inc, Eaton Corporation plc, Efacec, Evbox, EVgo Services LLC, Schneider Electric, Tesla, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)