Electric Vehicle Aftermarket Size, Share, Trends and Forecast by Replacement Part, Propulsion Type, Vehicle Type, Certification, Distribution Channel, and Region, 2026-2034

Electric Vehicle Aftermarket Size and Share:

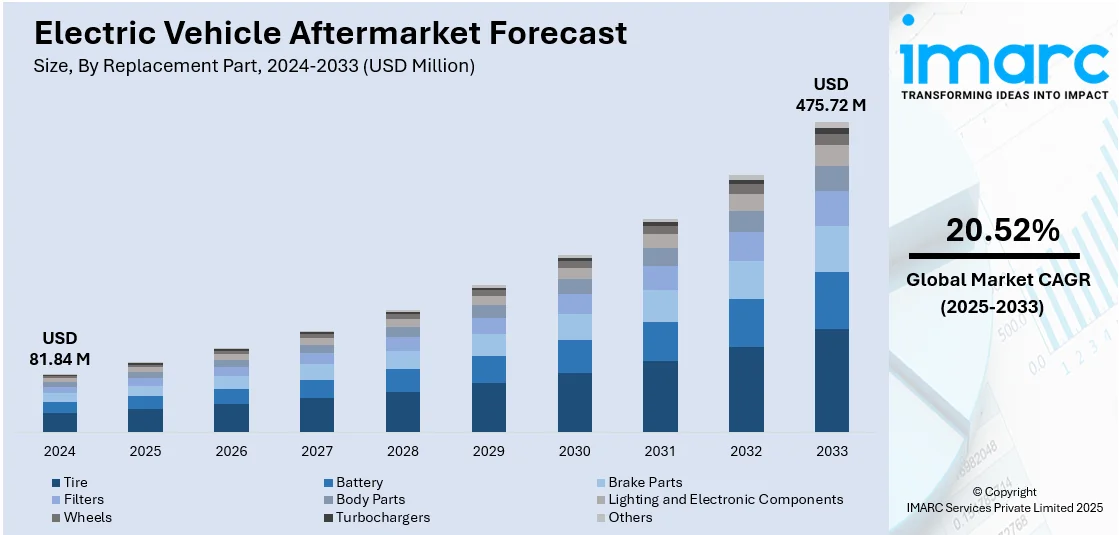

The global electric vehicle aftermarket size was valued at USD 81.84 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 475.72 Million by 2034, exhibiting a CAGR of 20.52% from 2026-2034. North America currently dominates the market, holding a market share of 35.2% in 2024. The electric vehicle aftermarket share in the North American region is growing because of strong EV sales, supportive government policies, and a well-established automotive service ecosystem. High user awareness, increasing investments in EV infrastructure, and the presence of major technology and auto players contribute to rapid development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 81.84 Million |

|

Market Forecast in 2034

|

USD 475.72 Million |

| Market Growth Rate 2026-2034 | 20.52% |

The worldwide movement for more eco-friendly transportation is resulting in a consistent rise in EV sales. Nations are providing incentives, establishing emission reduction goals, and advocating for prohibitions on internal combustion engine (ICE) vehicles, all of which expedite EV adoption. With the rising number of EVs on the streets, the need for aftermarket services also grows, encompassing parts, maintenance, diagnostics, and enhancements specific to electric powertrains and systems. Besides this, in contrast to conventional vehicles, EVs depend significantly on software for performance oversight, safety, energy efficiency, and user interaction. Owners frequently seek updates to improve battery performance, add new functionalities, or resolve issues. Telematics systems also contribute to predictive maintenance and data-informed diagnostics, establishing a new aftermarket sector focused on software services and digital enhancement.

The United States plays a vital role in the market, fueled by the expansion of modular repair solutions, which requires aftermarket by enabling cost-effective, in-vehicle servicing of complex electric components. This reduces downtime and enhances workshop efficiency, especially when paired with targeted technician training programs. In 2024, ZF Aftermarket introduced 25 Electric Axle Drive Repair Kits in the US and Canada, allowing workshops to fix EVs without the need to detach the electric drive. These kits catered to 25 distinct repair situations and were included in ZF’s growing collection for electric and hybrid automobiles. Technicians needed to complete high voltage training to operate the kits safely. Furthermore, the increasing quantity of delivery services, logistics firms, and local transit systems are converting their fleets to electric. These business operators need reliable servicing, replacement parts, and maintenance agreements that prioritize uptime. Aftermarket companies are focusing on this area with predictive maintenance solutions and supply agreements for parts.

Electric Vehicle Aftermarket Trends:

Technological Advancements and Customization Options

As EV manufacturers roll out new models and improvements, aftermarket firms capitalize on these advancements to develop innovative products and services that improve the overall experience of owning an EV. This technological advancement provides customization options that address varied user preferences. EV owners look for aftermarket products to enhance their vehicle's performance, battery features, and charging alternatives. Furthermore, the growing accessibility of advanced battery technologies propels the aftermarket as businesses provide enhanced battery packs that extend range and enhance overall battery longevity. Significantly, the International Energy Agency announced that worldwide battery production capacity hit 3 TWh in 2024, after years of investment. Technological progress creates a competitive environment where aftermarket suppliers consistently aim to deliver innovative solutions, thereby enhancing the development of the EV aftermarket.

Infrastructure Expansion and Charging Solutions

With the rapid increase in EV adoption, the demand for easily accessible and convenient charging stations rises significantly. Aftermarket firms capitalize on this chance by providing innovative charging options that meet diverse charging needs. These options vary from sophisticated home charging stations to portable chargers and also include wireless charging pads. Moreover, the aftermarket provides enhancements for EV charging features, including quicker charging times and support for various charging standards. As governments and companies invest in the development of charging infrastructure, aftermarket providers tailor their services to support these efforts, establishing a mutually beneficial relationship that promotes EV adoption and growth in the aftermarket sector. As reported by the U.S. Department of Energy, the second quarter of 2024 experienced a 6.3% growth in EV charging ports listed in the Station Locator, with public ports growing by 6.5% and private ports increasing by 4.4%. As an increasing number of individuals adopt EVs, the need for adaptable and efficient charging solutions encourages the EV aftermarket to innovate products that address charging issues.

Enhanced Aesthetics and Comfort Upgrades

EV owners aim to instill their vehicles with unique styles and comforts that resonate with their tastes and ways of living. Aftermarket businesses meet these needs by providing various products, including distinctive body kits, paint wraps, custom lighting, and interior upgrades. These options enable personal expression while fostering a feeling of exclusivity among EV owners. Additionally, enhancements in comfort, such as high-end seating, audio systems, and cutting-edge infotainment systems enhance the overall experience inside the vehicle. Significantly, it has been noted that worldwide EV sales increased by 25% to 17 million in 2024, underlining the growing EV market. As EVs move away from conventional design norms, aftermarket suppliers bridge the gap by providing various choices to improve the aesthetics and comfort of EVs.

Electric Vehicle Aftermarket Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric vehicle aftermarket, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on replacement part, propulsion type, vehicle type, certification, and distribution channel.

Analysis by Replacement Part:

- Tire

- Battery

- Brake Parts

- Filters

- Body Parts

- Lighting and Electronic Components

- Wheels

- Turbochargers

- Others

Tire stands as the largest component in 2024, holding 28.7% of the market because of the increased wear rates linked to performance traits specific to EVs. EVs provide immediate torque, resulting in increased tire stress during acceleration and leading to quicker tread wear in comparison to internal combustion engine vehicles. Moreover, EVs tend to be heavier owing to battery packs, which raises the strain on tires and impacts their longevity. The requirement for low rolling resistance and noise reduction increases the need for specially engineered tires that fulfill EV performance and efficiency criteria. Both fleet operators and individual owners emphasize regular tire inspections and on-time replacements to ensure safety and enhance range. Tire producers are developing EV-focused designs that include strengthened sidewalls, unique tread materials, and improved load capabilities. With the rise in EV adoption, awareness about tire maintenance increases, making tires the most commonly replaced part in the EV aftermarket. Their regular cycle of replacements guarantees a continuous demand in both commercial and individual EV markets.

Analysis by Propulsion Type:

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

- Plug-in Hybrid Electric Vehicles

Battery electric vehicles (BEVs) is a crucial segment due to their all-electric powertrain, which necessitates specialized servicing for battery health, thermal systems, and electronic components. With no internal combustion engine, BEVs have fewer mechanical parts but require high-voltage expertise and regular diagnostics. The need for battery replacement, software upgrades, and tire maintenance contributes significantly to aftermarket demand.

Hybrid electric vehicles (HEVs) contribute steadily to the aftermarket by combining conventional engines with electric drive systems, creating unique servicing requirements. Their dual-powertrain configuration demands skilled labor familiar with both engine maintenance and electric component calibration. Aftermarket demand includes replacement parts like regenerative braking systems, power control modules, and battery packs.

Fuel cell electric vehicles (FCEVs) represent a niche but a growing segment in the aftermarket, driven by advancements in hydrogen technology. Their unique propulsion system, involving fuel cells, hydrogen tanks, and electric motors, calls for highly specialized maintenance protocols. Due to limited infrastructure and lower adoption rates, the aftermarket for FCEVs is currently centered around parts replacement for thermal control units, fuel cell stacks, and electronic control systems.

Plug-in hybrid electric vehicles (PHEVs) offer flexibility in propulsion, using both a rechargeable battery and a conventional engine. Their aftermarket footprint includes services and parts for both power sources, making them a high-demand segment. Owners require battery maintenance, inverter replacements, and combustion engine servicing. PHEVs often involve more complex system diagnostics, encouraging use of authorized service centers.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Passenger cars lead the market with 78.9% of market share in 2024 because of their significant share in EV uptake and greater frequency of personal ownership. These vehicles undergo more regular usage trends, resulting in a higher need for scheduled maintenance, battery checks, and spare parts. As the number of electric models in the passenger category increases, car manufacturers are broadening their service options to cater to EV-specific requirements, including thermal management, regenerative braking systems, and software updates for onboard systems. The presence of governmental incentives and regulatory backing is making electric passenger vehicles more attainable, contributing to their increased prevalence on the road. Owners of passenger EVs are also more inclined to pursue software updates, personalization, and aesthetic improvements, increasing demand in the aftermarket. Additionally, ride-sharing and personal mobility trends lead to greater usage intensity, resulting in more frequent wear-and-tear services. The streamlined design and advanced electronics of passenger EVs position them as prime candidates for certified aftermarket solutions provided by specialized companies.

Analysis by Certification:

- Genuine Parts

- Certified Parts

- Uncertified Parts

Genuine parts represent the largest segment, accounting 46.2% of market share attributed to their assured compatibility, dependable performance, and adherence to OEM specifications. These components are engineered and evaluated by the original makers, guaranteeing accurate fit and operation, which is particularly crucial in EVs where battery integration, powertrain systems, and thermal management demand exact tolerances. Genuine parts support vehicle performance, safety, and warranty coverage, promoting user choice over unverified options. Car manufacturers and service providers also advertise authentic parts via certification programs and unique service contracts, enhancing their trustworthiness in the industry. These parts typically include official documentation and traceability, offering guarantees of authenticity and quality assurance. Utilizing them minimizes the chances of malfunctions or system incompatibility, potentially resulting in expensive repairs or safety concerns. With EVs utilizing increasingly intricate electronic systems and software-based functionalities, the need for certified genuine parts grows, bolstered by digital tracking solutions and OEM-integrated repair networks within authorized channels.

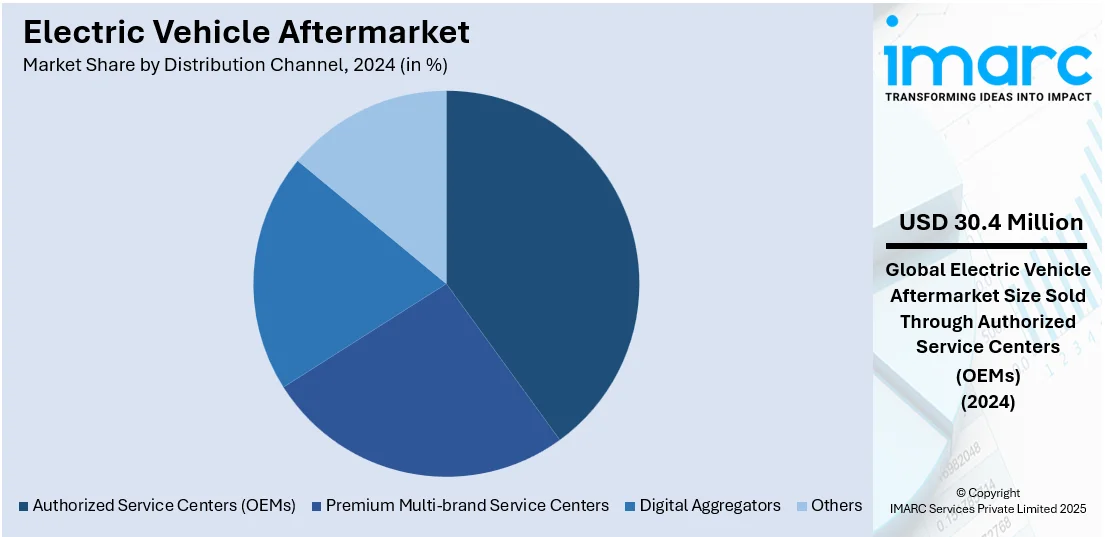

Analysis by Distribution Channel:

- Authorized Service Centers (OEMs)

- Premium Multi-brand Service Centers

- Digital Aggregators

- Others

Authorized service centers (OEMs) dominate the market with 37.1% of market share in 2024. The dominance of the segment is attributed to their unique access to proprietary software, specialized tools, and authentic spare parts necessary for EV maintenance. These centers frequently serve as the sole locations able to manage intricate battery diagnostics, software upgrades, and calibration activities, necessitating specialized knowledge and tools from the manufacturer. Customers trust authorized centers more for maintaining warranty compliance and ensuring that repairs adhere to OEM standards. Moreover, numerous EV manufacturers provide combined service plans or prolonged warranties that are redeemable solely at authorized locations, enhancing client loyalty. OEM service networks gain from enhanced training initiatives that ensure technicians stay informed about advancing EV technologies. Their incorporation with digital service platforms enables efficient scheduling, remote diagnostics, and predictive maintenance, resulting in a more convenient and transparent service experience.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America dominated the electric vehicle (EV) aftermarket with a 35.2% share, driven by strong tech infrastructure, policy incentives, and consumer engagement. Government initiatives, such as tax rebates, zero-emission mandates, and funding for charging networks, continue to accelerate EV adoption, creating a ripple effect in demand for aftermarket services. The region's integrated supply chain and dense network of workshops support the rapid growth of EV-specific maintenance and upgrades. High vehicle ownership and a culture of proactive upkeep fuel recurring needs like battery checks, parts replacements, and software updates. The presence of leading automotive and tech firms contributes to innovations in predictive maintenance, telematics, and mobile servicing. Notably, in 2025, SK On and Nissan signed a major agreement to supply nearly 100GWh of US-produced batteries from 2028 to 2033, supporting Nissan’s EV operations in Mississippi. With $661 million in investments and 1,700 jobs, this marks SK On’s first collaboration with a Japanese automaker, reinforcing North America’s role in electrification and amplifying demand for EV-tailored aftermarket solutions.

Key Regional Takeaways:

United States Electric Vehicle Aftermarket Analysis

In North America, the share of the market attributed to the United States was 85.40% due to the rise in EV adoption and improvements in battery technology. The need for EV parts like batteries, charging tools, powertrains, and software enhancements is growing as an increasing number of individuals shift towards sustainable transportation. The growth of EV service networks and dedicated repair facilities is also aiding market expansion. Moreover, software-based improvements, such as over-the-air updates, telematics, and intelligent diagnostics, are reshaping the aftermarket sector, enhancing vehicle performance and reducing downtime. The growth of remanufactured and recycled EV parts is enhancing sustainability initiatives, minimizing waste, and promoting a circular economy. According to the Center for American Progress, more than USD 45 Billion has been allocated to domestic manufacturing of EV batteries, modules, and chargers since the Inflation Reduction Act (IRA) was enacted, improving the aftermarket supply chain and promoting local production. The incorporation of digital platforms for predictive maintenance, remote diagnostics, and online marketplaces for EV components has increased consumer access to aftermarket services. The US electric vehicle aftermarket forecast predicts consistent growth driven by technological progress, government regulations, and an increasing number of EV users.

Europe Electric Vehicle Aftermarket Analysis

The European EV aftermarket is seeing substantial growth as a result of increased EV adoption and favorable regulatory conditions. The market is being transformed by cutting-edge battery management systems, autonomous service providers, and digital platforms. The need for refurbished batteries and second-life uses is rising, encouraging sustainability and diminishing electronic waste. The European Commission reports that the EU set a record in September 2024, reaching a 17.21% market share for battery electric vehicles (BEVs) and a 7.07% share for plug-in hybrid electric vehicles (PHEVs) in the M1 category. The expanding share of the EV market is increasing the need for aftermarket parts like charging infrastructure, power electronics, and intelligent connectivity solutions. The focus on circular economy principles, such as recycling and repurposing of EV parts, enhances the aftermarket potential of the region. As EV adoption rises, the European EV aftermarket is poised to grow, presenting significant chances for service providers, component makers, and technology innovators.

Asia Pacific Electric Vehicle Aftermarket Analysis

The EV aftermarket in the Asia Pacific is expanding quickly, fueled by increased EV manufacturing and growing user acceptance. The growing demand for battery replacements, charging systems, and powertrain parts is offering a favorable electric vehicle aftermarket outlook. The emergence of digital service platforms for predictive maintenance and remote diagnostics is changing the aftermarket landscape. Software improvements, such as optimizing vehicle performance and telematics solutions, are becoming essential to the market. The increasing availability of battery recycling programs and second-life uses is aiding sustainability initiatives. Reports indicate that the Chinese EV market was valued at around USD 305.57 Billion in 2024 and is expected to grow to USD 674.27 Billion by 2029. This large market size suggests significant opportunities for aftermarket services, such as affordable repair options, remanufacturing, and add-ons. With the increasing adoption of EVs in the area, fueled by economic expansion and environmental consciousness, the need for aftermarket parts is anticipated to grow significantly.

Latin America Electric Vehicle Aftermarket Analysis

The EV aftermarket in Latin America is growing because of heightened adoption and the development of charging infrastructure. The need for battery replacements, software updates, and energy management solutions is rising. Dedicated repair facilities enhance accessibility, whereas battery renewal and recycling support a sustainable market framework. Digital technologies enhance the efficiency of aftermarket services. Reports suggest that Brazil might have 30,000 EV charging stations by 2029 and 60,000 by 2034, reflecting a major growth in the charging infrastructure. This expansion will probably boost the need for aftermarket services, such as charger upkeep, part replacements, and software upgrades. With the rise of EV adoption throughout the region, the aftermarket industry is anticipated to experience additional progress and innovation, presenting opportunities for service providers, component makers, and technology creators to enhance their footprint.

Middle East and Africa Electric Vehicle Aftermarket Analysis

The EV aftermarket in the Middle East and Africa is flourishing because of rising awareness regarding sustainable mobility options, a surge in demand for EV parts, dedicated service providers, intelligent diagnostics, software-based performance enhancements, and battery recycling efforts, which boost accessibility, efficiency, and sustainability. Reports indicate that a segment of Morocco's strategic initiative targets having electric vehicles make up to 60% of the nation's car exports by 2030. This bold objective is anticipated to enhance the regional EV ecosystem, increasing the need for aftermarket parts, maintenance services, and tech advancements. With the rise in EV adoption throughout the region, the EV aftermarket is projected to expand, generating fresh opportunities for service providers and component manufacturers while facilitating the shift toward cleaner, more sustainable transportation options.

Competitive Landscape:

Major participants in the sector are concentrating on broadening service networks, creating sophisticated diagnostic tools, and improving their skills in EV-related maintenance. They are funding training initiatives to enhance the skills of technicians and guarantee alignment with electric drivetrains and battery technologies. Numerous organizations are enhancing collaborations with OEMs and technology firms to gain access to exclusive software and data, facilitating more effective servicing. Businesses are also developing digital platforms to optimize repair processes, parts acquisition, and client interaction. Sustainability is prioritized through the use of remanufactured parts and environment-friendly service methods. Ongoing advancements in battery testing, thermal control, and remote diagnostics are crucial for maintaining competitiveness in this changing market. In 2024, Aftermarket service provider myTVS launched a mobility-as-a-service platform aimed at EV fleet operators and aimed to add 10,000 electric two-wheelers by March 2025. The platform offered services like leasing, fleet management, and maintenance under one system.

The report provides a comprehensive analysis of the competitive landscape in the electric vehicle aftermarket with detailed profiles of all major companies, including:

- 3M

- ABB Ltd.

- EVBox Group

- ChargePoint Inc.

- Webasto SE

- Siemens AG

- Bosch Automotive Service Solution Inc.

- Schneider Electric SE

- Continental AG

- Denso Corporation

Latest News and Developments:

- April 2025: Polestar, an EV manufacturer, announced the launch of battery health certificates and incentives to boost confidence in pre-owned EVs. This initiative aims to address concerns about battery degradation in used EVs by improving transparency for buyers and creating incentives for the used EV market.

- October 2024: Hyundai Motor Co. and Kia Corp. announced a strategic collaboration to strengthen their position in the emerging electric vehicle battery technology. The companies planned to co-develop lithium iron phosphate battery cathode material manufacturing technology in South Korea.

- September 2024: Siemens announced plans to reinforce its eMobility business to harness significant opportunities in the dynamic electric vehicle infrastructure sector.

- May 2024: Heliox announced the launch of 60 KW EV charger designed specifically for the North American market. The charger delivers continuous 150 A output for a charge rate of 60 kW.

- September 2024: MG announced plans to launch a solid-state battery EV by Q2 2025, potentially ahead of competitors like Volkswagen. Solid-state batteries, offering greater energy density, faster charging, and increased safety, could lower EV costs by up to 30%. MG also planned to release the MGS5 electric SUV in November 2024.

Electric Vehicle Aftermarket Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Replacement Parts Covered | Tire, Battery, Brake Parts, Filters, Body Parts, Lighting and Electronic Components, Wheels, Turbochargers, Others |

| Propulsion Types Covered | Battery Electric Vehicles, Hybrid Electric Vehicles, Fuel Cell Electric Vehicles, Plug-In Hybrid Electric Vehicles |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Certifications Covered | Genuine Parts, Certified Parts, Uncertified Parts |

| Distribution Channels Covered | Authorized Service Centers (OEMs), Premium Multi-Brand Service Centers, Digital Aggregators, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M, ABB Ltd., EVBox Group, ChargePoint Inc., Webasto SE, Siemens AG, Bosch Automotive Service Solution Inc., Schneider Electric SE, Continental AG, Denso Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric vehicle aftermarket from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global electric vehicle aftermarket.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric vehicle aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric vehicle aftermarket was valued at USD 81.84 Million in 2024.

The electric vehicle aftermarket is projected to exhibit a CAGR of 20.52% during 2025-2033, reaching a value of USD 475.72 Million by 2033.

The market is driven by rising EV adoption, government incentives, and a growing demand for battery replacements, software upgrades, and charging infrastructure. Increasing vehicle personalization, advancements in telematics, and the shift toward sustainable mobility further fuel growth, encouraging innovation across maintenance, repair, and performance enhancement segments tailored specifically for EV technologies.

North America currently dominates the electric vehicle aftermarket, accounting for a share of 35.2%. The dominance of the region is driven by strong EV sales, supportive government policies, and a well-established automotive service ecosystem. High user awareness, increasing investments in EV infrastructure, and the presence of major technology and auto players contribute to rapid development. The region also benefits from early adoption of advanced diagnostics and software solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)