Electric School Bus Market Size, Share, Trends and Forecast by Type, Capacity Design Type, Sales Channel, Application, and Region 2026-2034

Electric School Bus Market Size and Share:

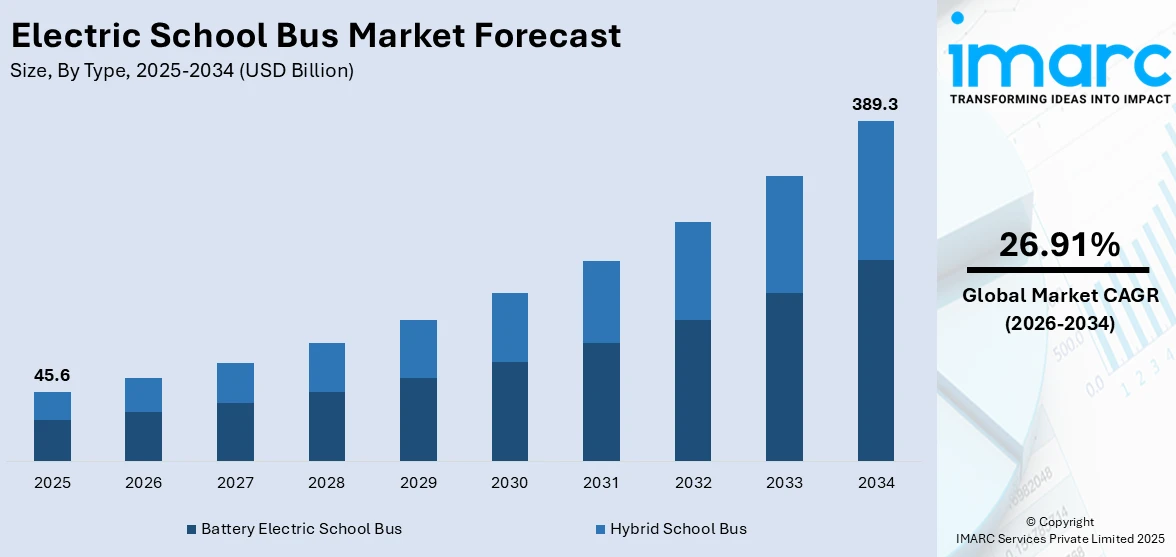

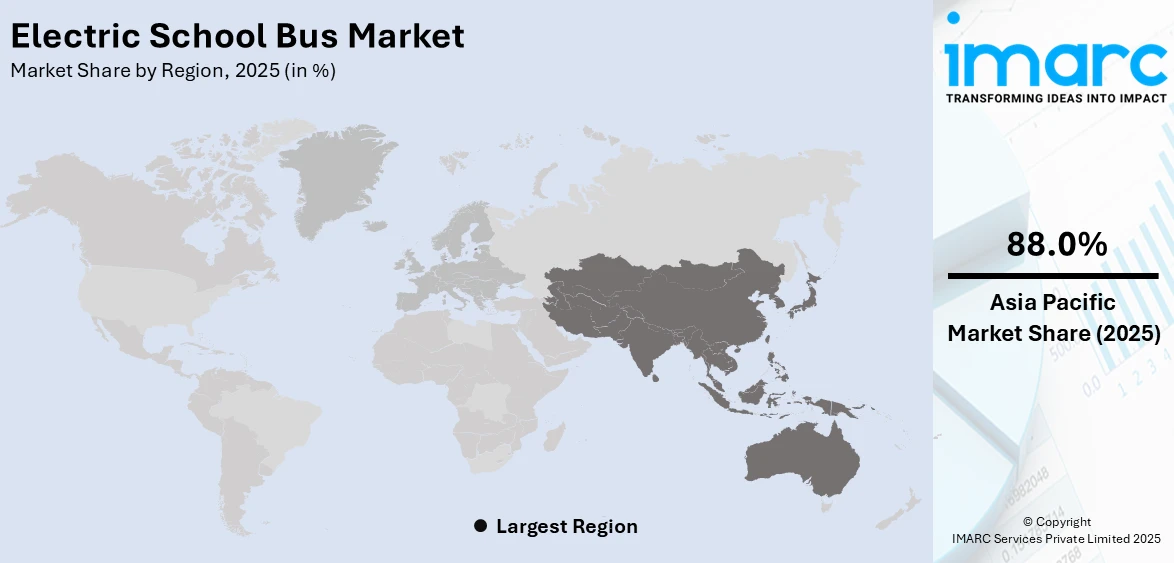

The global electric school bus market size was valued at USD 45.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 389.3 Billion by 2034, exhibiting a CAGR of 26.91% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 88.0% in 2025. The electric school bus market share is primarily driven by escalating environmental concerns, imposition of various government initiatives, rapid technological advancements, widespread vehicle demand to improve air quality, growing emphasis on sustainability, and the increasing number of public awareness campaigns.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 45.6 Billion |

|

Market Forecast in 2034

|

USD 389.3 Billion |

| Market Growth Rate (2026-2034) | 26.91% |

The electric school bus market growth is being increasingly driven by environmental concerns as governments and communities seek to reduce carbon emissions and improve air quality. According to the United Nations, the total amount of carbon emissions in 2024 was calculated to reach 41.6 Billion Tons, recording a significant increase from the previous year. As a result, increasing regulations aimed at reducing vehicle emissions and the growing focus on sustainability are encouraging schools to adopt electric buses. Advancements in battery efficiency and cost reduction are also making electric buses more affordable. Besides this, supportive government incentives and grants further enhance the adoption rate, while growing public awareness about climate change and the benefits of electric vehicles help propel the electric bus market demand.

To get more information on this market Request Sample

The United States has emerged as a key regional market for electric school buses, driven by a combination of environmental policies, economic factors, and technological advancements. Federal and state-level regulations aimed at reducing carbon emissions and improving air quality are propelling school districts to adopt electric buses. As per recent industry reports, carbon emissions from the United States represented 13% of total global CO2 emissions in 2024. Additionally, technological improvements in battery efficiency, charging infrastructure, and vehicle performance are making electric buses more practical and cost-effective. Furthermore, government incentives, grants, and the growing public demand for sustainable transportation are creating a positive electric bus market outlook. Increased awareness about the health benefits for students also plays a significant role in the shift.

Electric School Bus Market Trends:

Increasing environmental concerns

The urgency to mitigate climate change is exerting significant pressure on various industries, including transportation, to reduce their carbon footprint. For instance, according to industry reports, total CO2 emissions are expected to reach 41.6 Billion Tons in 2024, increasing from 40.6 Billion Tons in 2023. School buses, traditionally fueled by diesel, are viewed as potential agents of environmental harm due to their greenhouse gas (GHG) emissions and air pollutants, such as nitrogen oxides and particulate matter. These emissions contribute to global warming and also have a detrimental impact on local air quality. In line with this, municipalities, school districts, and parents are increasingly advocating for the transition to electric school buses as a means of environmental stewardship. As a result, this growing consciousness about the environment is a fundamental driver that is persuading decision-makers to adopt more sustainable practices.

Imposition of various government initiatives

Governments worldwide are increasingly recognizing the benefits of electric vehicles (EVs) and are consequently implementing various fiscal incentives to stimulate their adoption. According to industry reports, from just 1,500 in 2020, there are now over 12,000 public charging stations, recording a substantial rise. In line with this, electric school buses are being incentivized in the form of grants, tax credits, or subsidies aimed at offsetting the initial higher costs associated with EVs. Furthermore, many jurisdictions also offer reduced electricity rates for vehicle charging and prioritize electric buses in public procurement processes. These financial incentives are a strong motivational factor for school districts and private operators to switch from traditional diesel-fueled buses to electric variants. Additionally, governments are initiating pilot programs and partnerships with manufacturers to demonstrate the effectiveness and efficiency of electric school buses, thus creating a conducive ecosystem for market growth.

Rapid technological advancements

According to the electric school bus market trends, the evolution of battery technology is contributing substantially to industry expansion. The International Energy Association reports that the demand for electric vehicle (EV) batteries reached over 750 GWh in 2023, recording a substantial increase of 40% from 2022, primarily due to innovations in battery technologies and longer running times. Electric buses were initially hindered by limited range and long charging times, making them impractical for many routes. However, recent advancements in lithium-ion batteries, which have dramatically improved energy density, charging speed, and overall reliability, are positively influencing market growth. Furthermore, electric motors have also seen significant upgrades, offering better performance and requiring less maintenance. These technological improvements have made electric school buses more comparable to their diesel counterparts in terms of operational efficacy. They are also now capable of covering longer distances on a single charge and can be quickly recharged, enabling them to meet the daily requirements of most schools and educational institutions.

Electric School Bus Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric school bus market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, capacity design type, sales channel, and application.

Analysis by Type:

- Battery Electric School Bus

- Hybrid School Bus

Battery electric school bus stands as the largest component in 2025, holding around 67.6% of the market. Battery electric school buses are dominating the market as they produce no tailpipe emissions, thus meeting the most stringent environmental standards and aligning with public sentiment for eco-friendly transportation solutions. Additionally, they have fewer moving parts than their hybrid or diesel counterparts, which translates into lower maintenance costs and fewer repairs over the lifespan of the vehicle. Besides this, the recent advancements in battery technology, offering increased energy density and faster charging times, are positively influencing the market growth. In addition, battery electric school buses are inherently more energy-efficient compared to vehicles with internal combustion engines or even hybrid systems, as they can effectively convert more of the grid energy to power for the wheels. Moreover, they are mechanically simpler than hybrid systems, which often require complex systems to manage both electric and internal combustion elements.

Analysis by Capacity Design Type:

- Type A

- Type C

- Type D

Type C represents the leading market segment in 2025. Type C is dominating the market as it offers a balanced seating capacity, which makes it suitable for most school routes, thereby appealing to a broader range of potential customers, including both small and large school districts. Additionally, they are versatile in handling both urban and rural routes, making them a practical choice for varied geographical settings. Furthermore, the Type C configuration is what most individuals recognize as the 'traditional' school bus design. This familiarity makes school districts more comfortable in procuring them. Besides this, they offer a more favorable balance between initial cost, operating expenses, and long-term durability, which makes them a financially prudent choice for many educational institutions. Moreover, they are equipped with various safety measures, including reinforced steel bodies and advanced braking systems.

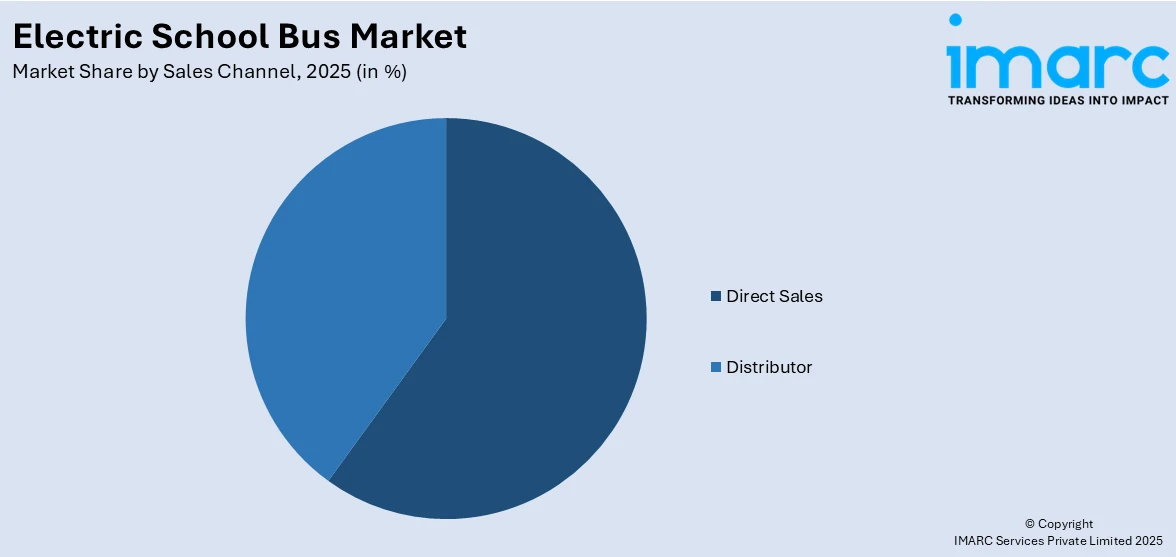

Analysis by Sales Channel:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Distributor

Direct sales exhibit a clear dominance in the market in 2025. Direct sales eliminate the need for intermediaries, reducing the overall cost of the vehicles. In addition, direct interaction with the manufacturer allows for greater customization options, enabling school districts to specify features such as battery range, seating capacity, and other functionalities tailored to their needs. Moreover, it facilitates better and faster communication between the buyer and the manufacturer, speeding up the process of problem-solving, modifications, or negotiations. Besides this, purchasing directly from the manufacturer increases the transparency of the transaction, enabling a better understanding of warranties, maintenance plans, and long-term running costs. Along with this, manufacturers specialize in their products and can offer deep insights and recommendations that a third-party dealer might not possess, thereby enhancing the buying experience.

Analysis by Application:

- Preschool Education

- Primary School

- Others

Primary school leads the market in 2025. Primary schools are dominating the market as their routes are generally shorter, making them ideally suited for electric buses that have a limited range compared to diesel buses. Furthermore, electric buses are more efficient in stop-and-go traffic, which is a common characteristic of primary school routes where the bus makes frequent stops to pick up children. Additionally, parents of younger children are more concerned about the impact of pollutants and exhaust fumes on their children's health. Electric buses address these concerns by offering a zero-emission alternative. Besides this, the slower speeds and shorter routes associated with primary school transportation align well with the safety features of electric school buses, such as smoother acceleration and braking. Moreover, the integration of electric buses in primary schools can serve as an educational tool for teaching children about sustainability and renewable energy, creating a lasting impression at a formative age.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 88.0%. The imposition of various policies and support by regional governments promoting electric vehicles (EVs), including school buses, through subsidies and other incentives is contributing substantially to market growth in this region. Furthermore, the Asia Pacific region's large population and corresponding need for mass transit make electric school buses a viable and scalable solution for student transportation. Additionally, the fast pace of urban development in many Asia Pacific countries is creating a demand for cleaner and more efficient modes of transportation, including electric school buses. Besides this, the rising urgency to adopt zero-emission vehicles, such as electric school buses, in the region owing to the rising pollution levels is propelling industry expansion. Moreover, Asia Pacific is at the forefront of electric vehicle technology, including battery development and manufacturing, giving them a competitive edge in the electric school bus market.

Key Regional Takeaways:

United States Electric School Bus Market Analysis

The electric school buses market is highly influenced by the growing importance of clean energy solutions in the United States. For example, clean energy investment in the United States tripled from 2018 to 2023, as annual clean investment totaled almost USD 248 Billion, rising to record levels in June 2024. The rise in carbon emissions and pollution from transportation has led to a mass movement to switch to zero-emission vehicles. This movement is driven by ever-increasing public awareness about the negative environmental and health impacts of traditional fuel-based buses, especially those that affect children. Developing concerns about climate change and poor air quality have also fueled the demand for cleaner, greener options, such as electric school buses. Improved battery efficiency, coupled with increasingly ambitious infrastructure development, has also made electric buses more practicable in many contexts. Besides this, government incentives, such as funding for clean transportation initiatives, along with favorable regulations targeting emission reduction, are also contributing to the widespread acceptance of electric school buses. The combination of environmental, economic, and health benefits is strengthening the focus on electric school buses across various regions, enhancing their popularity.

Asia Pacific Electric School Bus Market Analysis

In the Asia-Pacific region, government initiatives aimed at sustainability and pollution reduction are driving the growth of electric school buses. As per the India Brand Equity Foundation, as of December 2023, electric vehicle manufacturers received a subsidy of USD 637 Million for selling 11,79,669 electric vehicles under Phase II of the FAME India Scheme. The number of regional governments that have announced policies to foster the shift toward electric vehicles has also increased, but this time focused on school transport. Such policies are being matched by large investments in EV infrastructure, including developing charging stations and battery manufacturing. Many governments within this region prioritize cleaner energy options to reduce dependence on fossil fuels and mitigate urban air pollution impacts. In response to such initiatives, the school districts have been embracing electric buses as they are environment-friendly and economically viable in the long term. As the cost of EVs decreases and performance improves, the market for electric school buses in this region is expected to expand further, with both public and private institutions taking the lead in greener school transport solutions.

Europe Electric School Bus Market Analysis

The increasing electric school buses in Europe are driven by the rising concerns about carbon emissions from road transport. For example, carbon dioxide emissions through road transport in the EU increased by 21% since 1990. In Europe, the use of electric vehicles in cities is also expanding significantly, driven by tighter environmental regulations to curtail greenhouse gas emissions. Electric school buses are viewed as an important transition to achieving regional climate goals, especially those targeting the carbon footprint of the transportation sector. A number of cities and municipalities have also undertaken local initiatives, such as providing subsidies or tax incentives for electric vehicles, including school buses. The continued integration of renewable power, such as wind and solar energy, also bolsters the electric bus segment. Besides this, institutions such as universities are becoming increasingly mindful of the air pollution from older diesel buses, increasing efforts to establish greener schools.

Latin America Electric School Bus Market Analysis

With respect to electric school buses, the adoption is accelerating in Latin America due to environmental concerns, regulatory incentives, and advancements in battery technology. For example, 118,145 hybrid and electric vehicles were registered in the year 2021 in Latin America, demonstrating a rise of 107.1% compared with 57,078 units reported in 2020. Governments and educational institutions are also prioritizing sustainable transportation to reduce emissions. Thus, there have been efforts to promote more funding and subsidies for fleet electrification. Moreover, high-capacity batteries enhance the school bus's range, increasing its efficiency and making electric models an alternative to diesel variants. Fleet operators also find that the operational cost is lower with electric buses because these buses have fewer maintenance and fueling requirements. Other aspects of supporting the wider rollout are the charging infrastructure and removing concerns over limited routes. The increase in public awareness and advocacy toward cleaner school transportation also helps promote adoption. Manufacturers continue to innovate with models that are more cost-effective, thus further shifting toward electric school buses as part of broader sustainable mobility initiatives.

Middle East and Africa Electric School Bus Market Analysis

In recent times, adoption rates for electric school buses in the Middle East and Africa are increasingly rising as more schools open across regions with increased interest in making learning centers greener. For example, schools in the UAE are expected to rise from 1,258 in 2022 to 1,308 by 2027. With the growing urbanization in the region, the clientele for clean and efficient transportation is on the rise, especially in more urbanized cities that emphasize modern infrastructure. This region's academic institutions are also realizing the need for ways to satisfy both environmental goals and the high demand for easy, affordable transport for students within this region. Electric school buses can be effective solutions, offering affordable alternatives and environmentally sound transport. Increasingly, government bodies in the region are stepping up investments in clean energy options, which encourage the use of electric vehicles more.

Competitive Landscape:

Key players in the electric school bus market are undertaking significant measures to advance the market growth. Blue Bird, Thomas Built Buses, and Lion Electric are some major manufacturers investing significant amounts in designing more advanced electric buses with greater battery life, faster charging capabilities, and efficient vehicle performance. The electric bus manufacturers are also collaborating with school districts and implementing pilot projects and fleet replacements. Furthermore, companies are teaming up with the government to leverage funds, grants, and incentives that reduce the preliminary cost of electric buses. Industry leaders are also expanding their charging infrastructure and offering long-term maintenance solutions for schools to facilitate the switch toward sustainable means of transport.

The report provides a comprehensive analysis of the competitive landscape in the electric school bus market with detailed profiles of all major companies, including:

- Beiqi Foton Motor Co. Ltd. (Beijing Automotive Group Co. Ltd.)

- Blue Bird Corporation

- BYD Company Ltd.

- Collins Bus Corporation (REV Group Inc.)

- Dominion Energy Inc.

- Mercedes-Benz Group AG

- Navistar International Corporation (Traton Group)

- The Lion Electric Company

Latest News and Developments:

- January 2025: Thomas Built Buses has recently launched the Saf-T-Liner C2 Jouley, its second-generation electric school bus that features Accelera by Cummins 14Xe eAxle. This revised model incorporated cutting-edge technology and user feedback, building upon the original 2017 edition. With this model, the company aims to improve the serviceability, performance, and overall efficiency of their electric school buses.

- December 2024: With the addition of 23 new electric school buses, Dixie County Public Schools (DCPS) now has one of the biggest fleets of electric buses in Florida. This initiative is being financed by a refund of USD 9 Million from the Clean School Bus Program of the EPA. The initiative intends to improve the district’s air quality and lower emissions. This milestone represents a substantial transition from school buses that run on diesel to those that run on electricity in DCPS.

- September 2024: The Red Lake School District has added two new electric school buses to its inventory, becoming one of the first school districts in the United States with an indigenous population of 98% to leverage the benefits of the Clean School Bus Program of the EPA. The district is leading the way in cleaner transportation while maintaining ties to its Ojibwe cultural legacy through its partnership with Highland Electric Fleets. This program integrates tradition with sustainability, improving the health of both students and the community.

- August 2024: In an effort to promote cleaner transportation methods, Blue Bird Corporation has delivered its 2000th electric school bus, marking an important milestone for the company. The Nevada Clark County School District in Nevada received the 2000th electric school bus, facilitating their shift to emission-free student transportation. This accomplishment demonstrated the dominance of Blue Bird in the market for electric school buses.

- April 2024: With the help of the Clean School Bus Program by the EPA, First Student has recently introduced six new electric school buses in Pennsylvania, becoming the first of its kind to receive government funding. By replacing six of the seven diesel buses in the Steelton-Highspire School District, the electric vehicles aim to improve the local air quality and benefit students, as well as the community. Moreover, the electric buses are estimated to lower greenhouse gas (GHG) emissions by 54,000 Pounds a year, contributing to healthier and cleaner environments.

Electric School Bus Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Battery Electric School Bus, Hybrid School Bus |

| Capacity Design Types Covered | Type A, Type C, Type D |

| Sales Channels Covered | Direct Sales, Distributor |

| Applications Covered | Preschool Education, Primary School, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Beiqi Foton Motor Co. Ltd. (Beijing Automotive Group Co. Ltd.), Blue Bird Corporation, BYD Company Ltd., Collins Bus Corporation (REV Group Inc.), Dominion Energy Inc., Mercedes-Benz Group AG, Navistar International Corporation (Traton Group), The Lion Electric Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric school bus market from 2020-2034.

- The electric school bus market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric school bus industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric school bus market was valued at USD 45.6 Billion in 2025.

IMARC estimates the electric school bus market to exhibit a CAGR of 26.91% during 2026-2034.

The electric school bus market is primarily driven by government regulations and emission reduction targets, technological advancements in battery efficiency, rising fuel costs and long-term cost savings, growing environmental and public health awareness, and availability of government incentives and grants.

Asia Pacific currently dominates the market due to strong government support for clean energy initiatives and rapid urbanization.

Some of the major players in the electric school bus market include Beiqi Foton Motor Co. Ltd. (Beijing Automotive Group Co. Ltd.), Blue Bird Corporation, BYD Company Ltd., Collins Bus Corporation (REV Group Inc.), Dominion Energy Inc., Mercedes-Benz Group AG, Navistar International Corporation (Traton Group), The Lion Electric Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)