Electric Power Steering Market Size, Share, Trends and Forecast by Component, Mechanism, Type, Vehicle Type, and Region, 2025-2033

Electric Power Steering Market Size and Share:

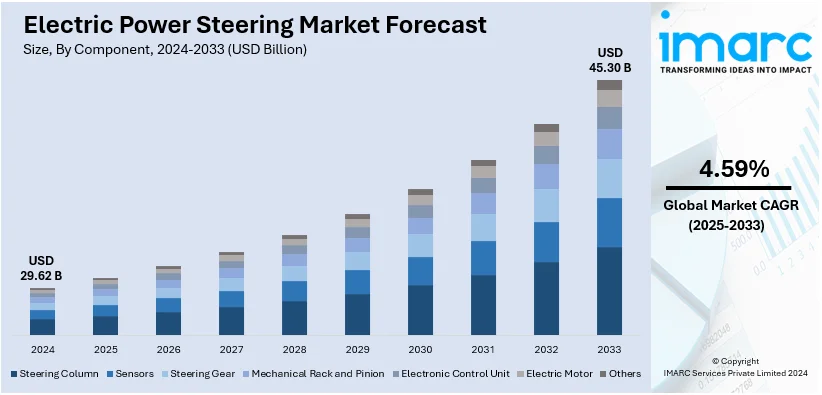

The global electric power steering market size was valued at USD 29.62 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 45.30 Billion by 2033, exhibiting a CAGR of 4.59% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 50.5% in 2024. The rising demand for fuel-efficient vehicles, the growing adoption of electric and hybrid cars, the increasing implementation of government regulations promoting eco-friendly transportation, advancements in electric power steering technology, and the introduction of torque sensor systems represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 29.62 Billion |

|

Market Forecast in 2033

|

USD 45.30 Billion |

| Market Growth Rate (2025-2033) | 4.59% |

The global market is growing due to rising demand for fuel-efficient and eco-friendly vehicles, as EPS eliminates hydraulic fluids and reduces engine load. Furthermore, rapid integration with advanced driver-assistance systems (ADAS) is enhancing steering precision, driving product adoption. Consumer preference for improved vehicle safety and driving comfort is further propelling market expansion. Besides this, strict emission regulations are pushing manufacturers to incorporate EPS into designs, aligning with sustainability goals. Moreover, the increasing production of electric and hybrid vehicles, where EPS is a key component, is significantly supporting market growth. For instance, Autovista24 states that, global EV demand increased 35% in 2023, reaching 14.2 million units (16.7% market share), with PHEVs (up 47%) outpacing BEVs (up 30%). In 2024, EV sales are forecast to grow 17%, reaching 16.6 million units (19.2% share).

The United States is a key regional market and is expanding due to the increasing adoption of electric and hybrid vehicles, supported by government incentives and infrastructure advancements. In line with this, rising consumer demand for fuel-efficient, low-emission vehicles is driving manufacturers to incorporate EPS systems. The automotive sector’s growing focus on integrating advanced technologies, such as autonomous driving features, is enhancing the need for precise and reliable EPS solutions. Advanced safety systems, like AcuraWatch, launched on April 9, 2024, which includes Collision Mitigation Braking System (CMBS™), Lane Keeping Assist, and Adaptive Cruise Control, is further propelling EPS adoption. These systems rely on EPS for improved performance, safety, and driver awareness. Additionally, the rising production of light commercial vehicles and SUVs in the U.S. significantly supports market growth due to EPS compatibility.

Electric Power Steering Market Trends:

Rising Adoption of Electric and Hybrid Vehicles

The rising adoption of electric and hybrid vehicles is another major driver of the EPS market, as automakers shift toward more energy-efficient technologies to meet environmental and regulatory demands. As the consumer preference towards sustainable transportation continue to grow, an increasing demand for electric and hybrid vehicles is likely to be accompanied by greater EPS system demand. The International Energy Agency (IEA) reported that global electric vehicle sales reached 10.5 million units in 2022, a 55% increase from the sales made in 2021. With the increasing sales of electric vehicles, the demand for Electric Power Steering (EPS) systems is also expected to grow. EPS systems also enhance the overall performance of vehicles, which are expected to provide not only efficiency and sustainability but also advanced features such as automatic parking and lane-keeping capabilities, making them increasingly desirable in the production of electric and hybrid vehicles. As such, this will continue and expand the EPS market outlook in the global aspects.

Rising Focus on Vehicle Safety and Performance

The increasing focus on vehicle safety and performance is a primary growth driver for the market due to consumers and manufacturers focusing more on enhancing safety features, along with better driving experiences. EPS plays a crucial role in supporting various advanced driver-assistance systems that are integral to modern vehicles. In addition to enhancing vehicle safety, EPS governs essential features such as lane-keeping assistance, automatic emergency steering, and adaptive cruise control in contemporary vehicles. This increased emphasis on vehicle performance is further aligned with consumer preferences for improved handling responsiveness and reduced driver fatigue, which fulfills regulatory demands and addresses the changing needs of drivers. According to an industrial report, the U.S. is at the forefront of ADAS adoption, capturing close to 75% market share due to the existence of major automotive manufacturers and advancements in technology. This fact is accompanied by a growing focus on the safety and performance of vehicles as one of the key growth drivers for the electric power steering (EPS) market. As manufacturers strive to comply with increasingly stringent safety regulations and meet growing consumer expectations, the demand for EPS systems has risen significantly.

Growing Adoption of EPS to Improve Driving Experience

The adoption of electric power steering (EPS) systems is increasing in modern vehicles, given their numerous advantages over conventional hydraulic power steering systems. EPS not only enhances fuel efficiency by reducing energy consumption but also offers superior control and precision, contributing to a more refined and responsive driving experience. It also provides varying levels of steering assistance. Moreover, EPS is more commonly used than hydraulic power steering since EPS systems are typically lighter than hydraulic systems. This aids in decreasing mechanical intricacy and results in reduced maintenance needs. As manufacturers increasingly prioritize efficiency and performance in vehicle design, there is a rising demand for EPS systems, which is contributing to the growth of the market. According to an industrial report, due to tighter fuel regulations and the proliferation of vehicles with ADAS (Advanced Driving Assistant System), the global adoption of EPS systems is on the rise, notably accelerating in North America and China during 2021, where installations faced delays, resulting in a global electrification of steering reaching 85.5%.

Electric Power Steering Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric power steering market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, mechanism, type, and vehicle type.

Analysis by Component:

- Steering Column

- Sensors

- Steering Gear

- Mechanical Rack and Pinion

- Electronic Control Unit

- Electric Motor

- Others

Sensors are leading the market segment due to their critical role in developing high-performance accuracy and safety for power-steering electric systems. Torque, position, and speed sensors allow for real-time data that could be feasible only in producing precision steering and vehicle stability control, crucial for both electric and autonomous vehicles. In addition, sensor technologies can also improve the power use of steering to help reduce the consumption of fuel. Besides this, sensor technologies are augmenting reliability while reducing cost. All of these reasons have contributed positively to their growth in adoption worldwide over vehicle segments.

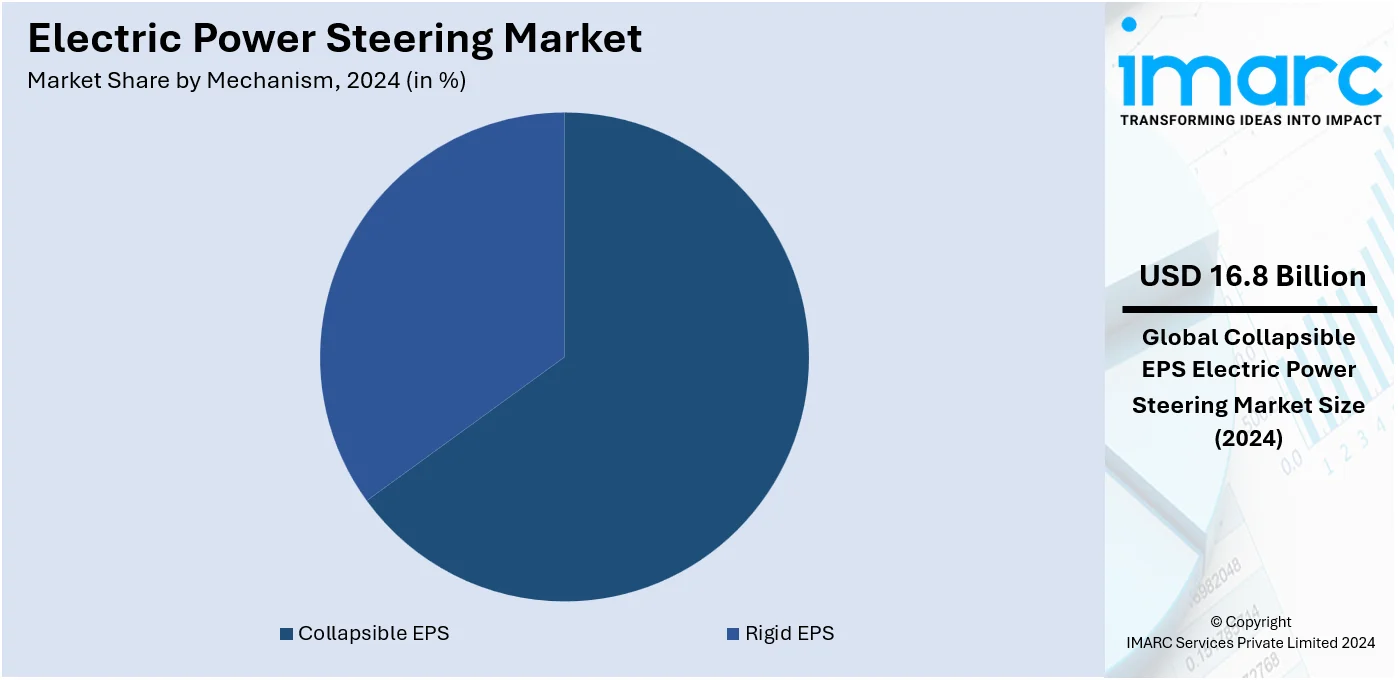

Analysis by Mechanism:

- Rigid EPS

- Collapsible EPS

Collapsible EPS leads the market with around 56.7% of market share in 2024. This is due to its superior safety capabilities and increased adaptability in different vehicle types. The EPS system is so designed to collapse in the event of an accident with minimum impact on the driver that most auto majors are inclined toward using this EPS for their vehicle lines. The collapsible EPS is also less heavy compared to the traditional hydraulic system. The flexibility related to mounting and being an integral part of compact car designs has made it more attractive in many regions where small and medium-sized vehicles are highly in demand. The increasing adoption of electric and hybrid vehicles is creating further demand for collapsible EPS, which in turn is enhancing market leadership for this type.

Analysis by Type:

- Rack Assist Type (REPS)

- Column Assist Type (CEPS)

- Pinion Assist Type (PEPS)

According to the electric power steering market research report, column assist type (CEPS) is the leading segment with around 36.8% of market share in 2024, due to its widespread adoption in small and mid-sized passenger vehicles. CEPS, for example, is very space-efficient in design but easy to package into vehicle architectures. Furthermore, it is low-cost, hence very suitable for lightweight cars. The system itself helps in improving the efficiency of vehicles through the saving of fuel consumption on the use of the hydraulic pump. Its capability of providing greater steering control and other safety-enhancing functions like lane keeping and parking assistance makes it popular among automobile manufacturers who focus on driver-assistance systems.

Analysis by Vehicle Type:

- Passenger Car

- Commercial Vehicle

Passenger car leads the market with around 68.6% of market share in 2024, attributed to the rising demand for fuel efficiency and technology-savvy vehicles. With individuals increasingly adopting electric and hybrid cars worldwide, the EPS system in the passenger vehicle has been receiving the attention of automotive developers in order to enhance fuel efficiency and reduce emissions. The systems prove their competence by bolstering the performance of vehicles with better gripping and lesser steering torque, thereby satisfying the preferences of customers for smooth driving experiences. The increasing need for EPS is also due to government regulations in their attempt to minimize carbon emissions. Besides this, with safety features like lane-keeping assistance and automated driving, there's also rising consumption of electric power steering systems in passenger cars.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 50.5%. The market is primarily driven by the augmenting demand for energy-efficient vehicles which can be attributed to the growing emphasis on reducing carbon emissions and enhancing fuel efficiency across the region. Governments in countries like China, Japan, and India have implemented strict regulations promoting cleaner transportation solutions, thereby pushing automakers to adopt electric power steering (EPS) systems that contribute to overall vehicle efficiency. This, in turn, is creating a positive electric power steering market outlook. Additionally, rapid urbanization and rising disposable incomes have led to increased vehicle ownership, further bolstering demand for advanced automotive technologies. Technological innovations such as the integration of electric power steering in electric and hybrid vehicles, and the development of steer-by-wire systems, are also contributing to market growth. These systems not only reduce vehicle weight but also offer improved safety, handling, and steering performance, aligning with consumer preferences for enhanced driving experiences. Furthermore, growing investments in research and development (R&D) by automakers to produce cost-effective and reliable EPS systems present new opportunities for market expansion and electric power steering market demand in the region.

Key Regional Takeaways:

United States Electric Power Steering Market Analysis

In 2024, the United States accounted for 74.90% of the North America electric power steering (EPS) market. The U.S. EPS market is growing mainly on account of technological advancements in the automobile industry and rising adoption of energy-saving automobiles. According to the projections given by the U.S. Energy Information Administration, 2023 witnessed 16% of light-duty new vehicle sales as either EVs or HEVs. There is a continued increasing preference for energy-efficient transportations. As manufacturers of EVs and HEVs seek better fuel efficiency and lightweight designs, EPS systems are in greater demand. Nexteer Automotive and JTEKT, among the most prominent companies, are leading advancements in EPS technology, focusing on integration with driver-assist systems. Government policies, including incentives for electrification and domestic manufacturing under the Inflation Reduction Act, further promote this growth. The U.S. has strong automotive manufacturing capabilities and EPS innovations that are export-oriented, making the country a global leader in advanced steering solutions.

Europe Electric Power Steering Market Analysis

Strong policies aimed at protecting the environment enable European regions thrive in electric power steering, supported by the automotive industry emphasis on sustainability. According to European Automobile Manufacturers Association (ACEA), more than 9 Million cars were made by the European Union in the year 2023 and a substantial portion of which integrate EPS systems. Germany, France, and other top countries lead innovation due to strong government-backed R&D programs. According to Eurostat, 15 percent new vehicle registrations in 2023 were electric vehicles thus contributing faster EPS adoption. State-of-the-art innovations like steer-by-wire have picked up pace, where organizations like Robert Bosch and ZF Friedrichshafen are leading the innovation process. EU legislation calling for a reduction in CO2 emissions and improvement in fuel efficiency expands the demand for EPS. Moreover, joint ventures between vehicle manufacturers and technology companies help develop highly integrated EPS solutions while promoting Europe as the new hub of environmentally friendly automotive technologies.

Asia Pacific Electric Power Steering Market Analysis

The Asia Pacific EPS market is growing at a fast pace, due to increased automotive production and a move toward electrification. China Association of Automobile Manufacturers estimates that 30.16 Million vehicles were produced in China in 2023, of which a high percentage were equipped with EPS systems. India is also on the rise, with Society of Indian Automobile Manufacturers reporting more than 4.1 Million passenger vehicle sales in 2023, encouraged by the incentives offered by the government through the FAME initiative. Technological collaborations like NSK collaborating with Chinese OEMs are helping innovation in cost-effective EPS solutions. The growth of electric vehicles in Japan and South Korea is adding fuel to the market growth. Investment in the Asia Pacific region in autonomous vehicle technology is improving the uptake of advanced EPS features, placing it as a prominent contributor to the global EPS market.

Latin America Electric Power Steering Market Analysis

Latin America's demand for EPS grows with its automotive market as the population purchases more cars and this industry shifts to more fuel-efficient designs. As per an industrial report, Brazil produced some 2.12 Million of vehicles in the first ten months of 2024, and mid-to-top-end models featured EPS from the production. Development is furthered through local policies that encourage cleaner automotive technologies. Companies like Nexteer and Mando have already formed partnerships with regional OEMs to upgrade their manufacturing facilities. The middle class is expanding with increasing urbanization, creating a higher level of ownership of vehicles and supporting the EPS market. Hybrid and electric vehicle programs led by the government will continue the trend towards the long-term EPS market growth in Latin America. Infrastructure investment is also increasing and will continue to increase in the market.

Middle East and Africa Electric Power Steering Market Analysis

The Middle East and Africa EPS market is progressing steadily due to increased automobile production and modernization trends. CEIC points out that Saudi Arabia experienced the sale of around 758,791 vehicles in its automotive market in 2023, where EPS systems had a higher demand in the luxury and electric models. The UAE and South Africa are major contributors, though, with energy-efficient cars being their main focus for fluctuating fuel prices. Regional automotive assembly plants, such as those based in Morocco and Egypt, are adopting advanced steering systems to meet export standards. Government-backed programs to spur adoption of EVs are contributing to the demand for EPS, especially in urban areas. Companies like Nexteer will partner with local manufacturers in the region to establish their production hubs, thus establishing EPS growth in this market.

Competitive Landscape:

Key players in the market are driving the market growth through strategic innovations and collaborations aimed at enhancing product efficiency and meeting changing automotive demands. Several companies are heavily investing in research and development to improve steering technology, focusing on reducing system weight and energy consumption while enhancing overall performance. These players are also expanding their product portfolios by introducing advanced steering systems, such as dual-pinion and steer-by-wire technologies, to support the growing shift toward electric and autonomous vehicles. Partnerships and joint ventures with automotive manufacturers are further fueling the market expansion. Additionally, players are also leveraging their expertise to provide innovative solutions that meet stringent government regulations on fuel efficiency and emissions, aligning with future market demands. These factors significantly contribute to the positive electric power steering market forecast in the coming years.

The report provides a comprehensive analysis of the competitive landscape in the electric power steering market with detailed profiles of all major companies, including:

- HELLA GmbH & Co. KGaA (Faurecia SE)

- Hycet Technology Co. Ltd (Great Wall Motor Company Limited)

- JTEKT Corporation

- Mitsubishi Electric Corporation

- Nexteer Automotive

- NSK LTD

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- ThyssenKrupp AG

- TT Electronics plc

- ZF Friedrichshafen AG

Latest News and Developments:

- December 2024: According to ZF Automotive Technologies (Shanghai), the company agreed to expand electronic power steering systems (EPS) production in China through signing an investment agreement with Shanghai Anting Economic Development Centre on November 29. Following the completion of the first phase in May 2023, volume production is scheduled to start by 2025.

- August 2024: JTEKT India Limited announced that it is working on the development of a next-generation Column-Assist Electric Power Steering (CEPS) system. This innovative technology is designed to enhance the performance of modern automobiles while offering improved efficiency.

- August 2024: Nexteer Automotive introduced its Modular Pinion-Assist Electric Power Steering (mPEPS) system, expanding its cost-effective and modular EPS solutions to include both Single-Pinion and Dual-Pinion systems. This innovative mPEPS system is designed to be cost-efficient, flexible, and scalable. By utilizing Nexteer’s established EPS components, mPEPS allows for greater scalability, providing original equipment manufacturers (OEMs) with time and cost savings.

- July 2024: Rane Holdings announced that they acquired a 51% stake in Rane NSK Steering Systems from NSK Limited and made it a wholly owned subsidiary. The company would be renamed Rane Steering Systems Private Limited. This deal would further strengthen the Rane Group's position in the global automotive steering systems market.

- July 2024: The European Investment Bank (EIB) agreed to provide ZF Friedrichshafen AG, a leading German automotive supplier, with a €425 million loan. This will help the company invest in developing advanced braking and steering technologies, such as steer-by-wire, for the transition towards automated driving and better control and stability as well as improved safety.

Electric Power Steering Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Steering Column, Sensors, Steering Gear, Mechanical Rack and Pinion, Electronic Control Unit, Electric Motor, Others |

| Mechanisms Covered | Rigid EPS, Collapsible EPS |

| Types Covered | Rack Assist Type (REPS), Column Assist Type (CEPS), Pinion Assist Type (PEPS) |

| Vehicle Types Covered | Passenger Car, Commercial Vehicle |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | HELLA GmbH & Co. KGaA (Faurecia SE), Hycet Technology Co. Ltd (Great Wall Motor Company Limited), JTEKT Corporation, Mitsubishi Electric Corporation, Nexteer Automotive, NSK LTD, NXP Semiconductors N.V., Robert Bosch GmbH, ThyssenKrupp AG, TT Electronics plc, ZF Friedrichshafen AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric power steering market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global electric power steering market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric power steering industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Electric power steering (EPS) refers to an advanced steering system that uses an electric motor to assist the driver in turning the steering wheel. Unlike traditional hydraulic systems, EPS operates without fluid, providing improved fuel efficiency, precise control, and reduced maintenance, making it a key component in modern vehicles.

The electric power steering market was valued at USD 29.62 Billion in 2024.

IMARC estimates the global electric power steering market to exhibit a CAGR of 4.59% during 2025-2033.

The global market is primarily driven by rising demand for fuel-efficient vehicles, increasing adoption of electric and hybrid cars, stringent government regulations promoting eco-friendly transportation, advancements in EPS technology, and integration with advanced driver-assistance systems (ADAS).

In 2024, sensors represented the largest segment by component, driven by their critical role in ensuring precise steering and vehicle stability.

Collapsible EPS leads the market by mechanism attributed to its superior safety capabilities and adaptability across various vehicle types.

The column assist type (CEPS) is the leading segment by type, driven by its space-efficient design and widespread adoption in small passenger vehicles.

In 2024, passenger car represented the largest segment by vehicle type, driven by rising demand for fuel-efficient, technology-savvy, and low-emission vehicles.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global electric power steering market include HELLA GmbH & Co. KGaA (Faurecia SE), Hycet Technology Co. Ltd (Great Wall Motor Company Limited), JTEKT Corporation, Mitsubishi Electric Corporation, Nexteer Automotive, NSK LTD, NXP Semiconductors N.V., Robert Bosch GmbH, ThyssenKrupp AG, TT Electronics plc, and ZF Friedrichshafen AG, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)