Electric Kettle Market Size, Share, Trends and Forecast by Raw Material, Application, and Region, 2026-2034

Electric Kettle Market Size and Share:

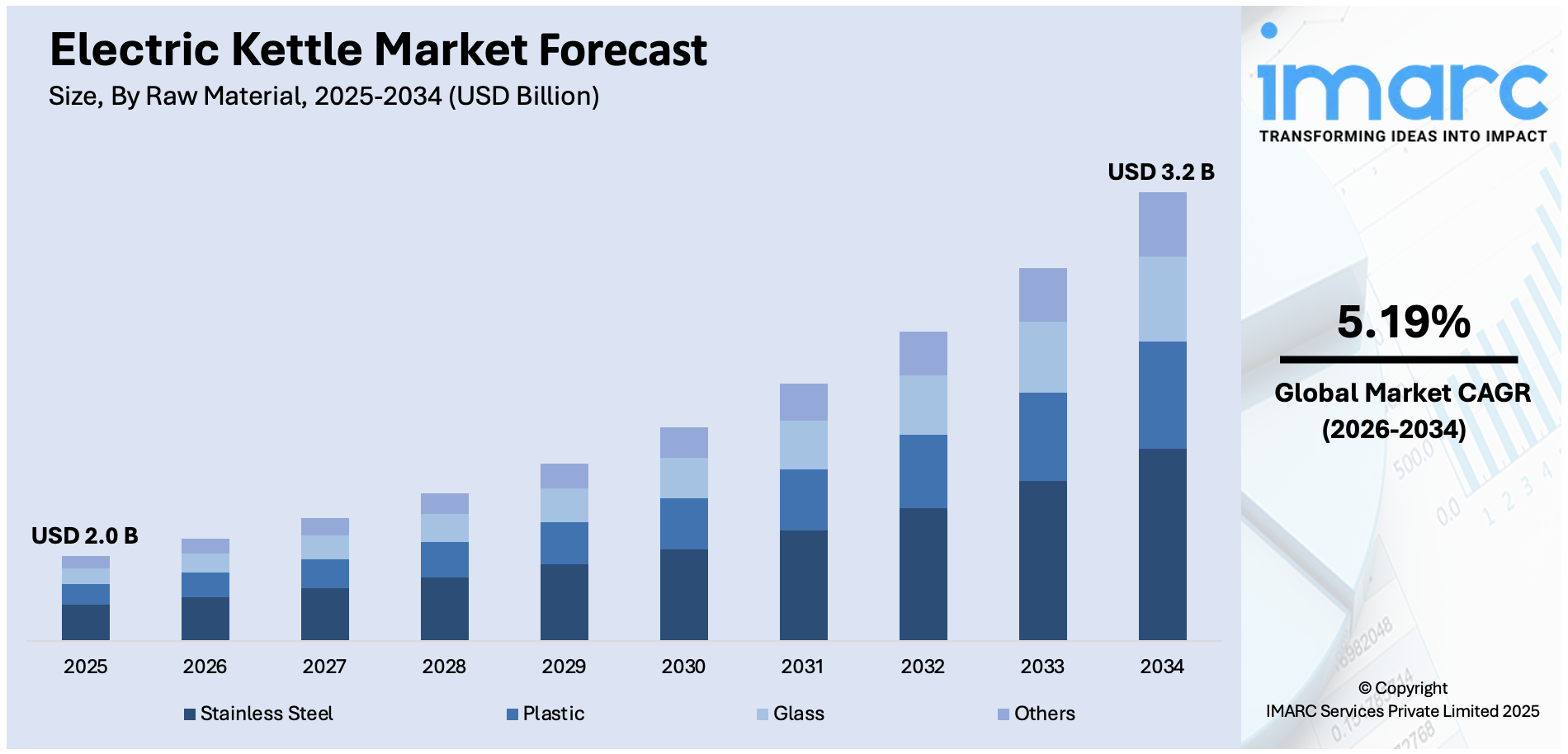

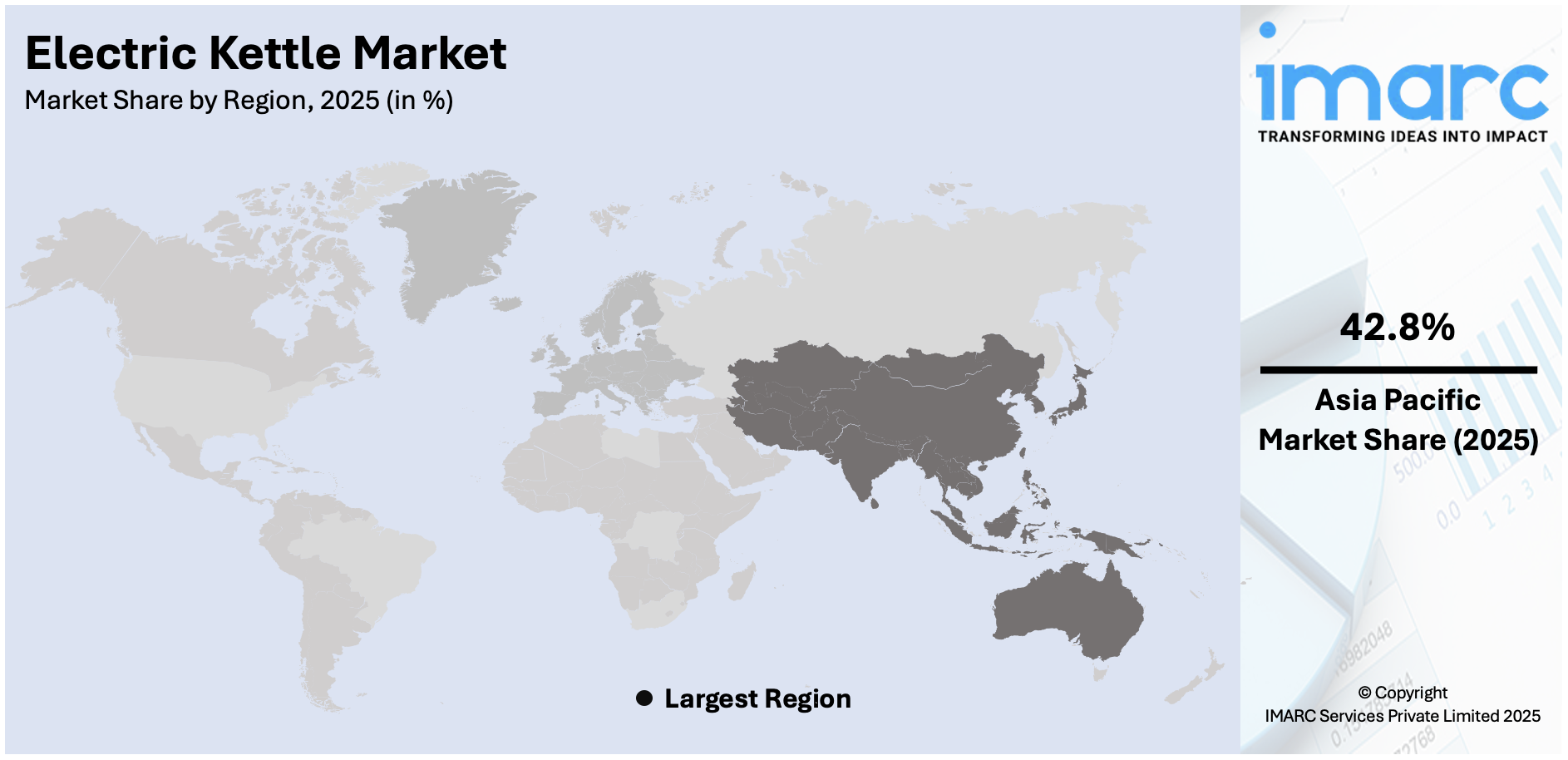

The global electric kettle market size was valued at USD 2.0 Billion in 2025. The market is projected to reach USD 3.2 Billion by 2034, exhibiting a CAGR of 5.19% from 2026-2034. Asia-Pacific currently dominates the market, holding a market share of 42.8% in 2025. The growing popularity of high-end electronic devices and modern consumer durables in the commercial and residential sectors, along with the increasing number of food and beverage (F&B) service outlets, is propelling the electric kettle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.0 Billion |

|

Market Forecast in 2034

|

USD 3.2 Billion |

| Market Growth Rate 2026-2034 | 5.19% |

At present, the market is influenced by an increasing need for convenience, as electric kettles offer quick boiling in contrast to conventional stovetop techniques, making them perfect for hectic lifestyles. Rising urbanization, shifting eating patterns, and the growing popularity of tea and coffee are further enhancing their acceptance. Advancements in technology, including cordless designs, automatic shut-off features, and customizable temperature controls, are improving user satisfaction and safety. The expansion of smart home appliances is also stimulating the market growth, as connected kettles appeal to tech-savvy users. Moreover, the ongoing shift towards sustainability and energy-efficient appliances is offering a favorable electric kettle market outlook.

To get more information on this market Request Sample

The United States has emerged as a major region in the electric kettle market owing to many factors. The market is driven by rising preferences for quick, convenient, and energy-efficient appliances, particularly as busy lifestyles are demanding faster meal and beverage preparation. The growing popularity of tea, coffee, and specialty drinks has significantly boosted electric kettle usage. As per the IMARC Group, the US coffee market size was valued at USD 28.0 Billion in 2024. Technological advancements, including variable temperature controls, automatic shut-off, cordless designs, and smart connectivity features, are appealing to tech-savvy and safety-conscious users. Additionally, the desire for stylish, multifunctional kitchen gadgets is fueling the electric kettle market growth.

Electric Kettle Market Trends:

Launch of Innovative Product Variants

Key players are launching product variants of electric kettles, such as variable temperature-controlled kettles, which are usually equipped with various temperature settings that allow users to set the desired temperature for boiling beverages. For example, Stoke Voltaics, a leading innovator in outdoor cooking equipment, revealed the creation of the Stoke Voltaics Electric Kettle Pot in March 2024, a device that transformed the way adventurers could cook and enjoy meals on the road. It was specifically designed for the modern overlander and was a compact, versatile, and electrically powered cooking appliance that simplified and enhanced outdoor culinary experiences. The rising trend of smart homes and the elevating adoption of the Internet of Things (IoT) technology are increasing the popularity of enhanced electric kettle variants, as they can be remotely monitored and controlled via voice assistants and smartphone apps, providing users with improved flexibility and control.

Technological Advancements

The rising integration of advanced features, such as wireless fidelity (Wi-Fi) connectivity and temperature control, with electric kettles that help users to monitor and customize their boiling experience remotely, is among the major electric kettle market trends. Innovations, including rapid heating technology and energy efficiency, are further contributing to an efficient and seamless user experience. In line with this, advancements improve convenience and cater to the escalating demand for eco-friendly and smart appliances among tech-savvy users. For instance, in July 2024, Tiger Corporation, a global leader in thermal regulation technology, revealed plans to introduce the Electric Kettle ‘QUICK&SAFE+’ on September 1, 2024. Due to Tiger's unique technology, steam was directed through the most direct route to the steam detection sensor located on the handle. The sensor could promptly sense steam and shut off the power immediately when the water reached a boil to enable fast boiling.

Limited Use of Fuel-based Sources

Increasing awareness about the conservation of sources, including gasoline and oil, is inflating the popularity of eco-friendly electric kettles as a sustainable source in household applications. Additionally, the rising fuel prices for conventional gas kettles are catalyzing the demand for electric kettles. Electric kettles provide faster boiling, consistent heating, and improved safety compared to stovetop options, reducing dependence on gas or other fuels. This shift is further supported by the growing urbanization, where electric appliances are more accessible and practical in modern kitchens. As per the UNFPA, the population residing in urban areas is projected to increase to approximately 5 Billion by 2030. Additionally, electric kettles align with the rising demand for energy-optimized solutions, offering convenience and sustainability. Their adaptability, ease of use, and lower maintenance requirements make them a preferred alternative.

Electric Kettle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric kettle market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on raw material and application.

Analysis by Raw Material:

- Stainless Steel

- Plastic

- Glass

- Others

Stainless steel held 45.8% of the market share in 2025. It is widely adopted due to its durability, safety, and premium appeal. Unlike plastic, stainless steel is resistant to heat damage, corrosion, and odor absorption, ensuring long-lasting performance and preserving the natural taste of water, tea, and coffee. Its sleek and modern appearance also aligns with the growing demand for stylish kitchen appliances that complement contemporary interiors. Additionally, stainless steel kettles are perceived as safer and more hygienic, as they do not leach harmful chemicals when exposed to high temperatures, making them especially appealing to health-conscious buyers. The material’s ability to retain heat efficiently and withstand frequent usage makes it suitable for both residential and commercial settings. Increasing disposable incomes and user willingness to invest in durable, premium appliances are further driving stainless steel’s dominance.

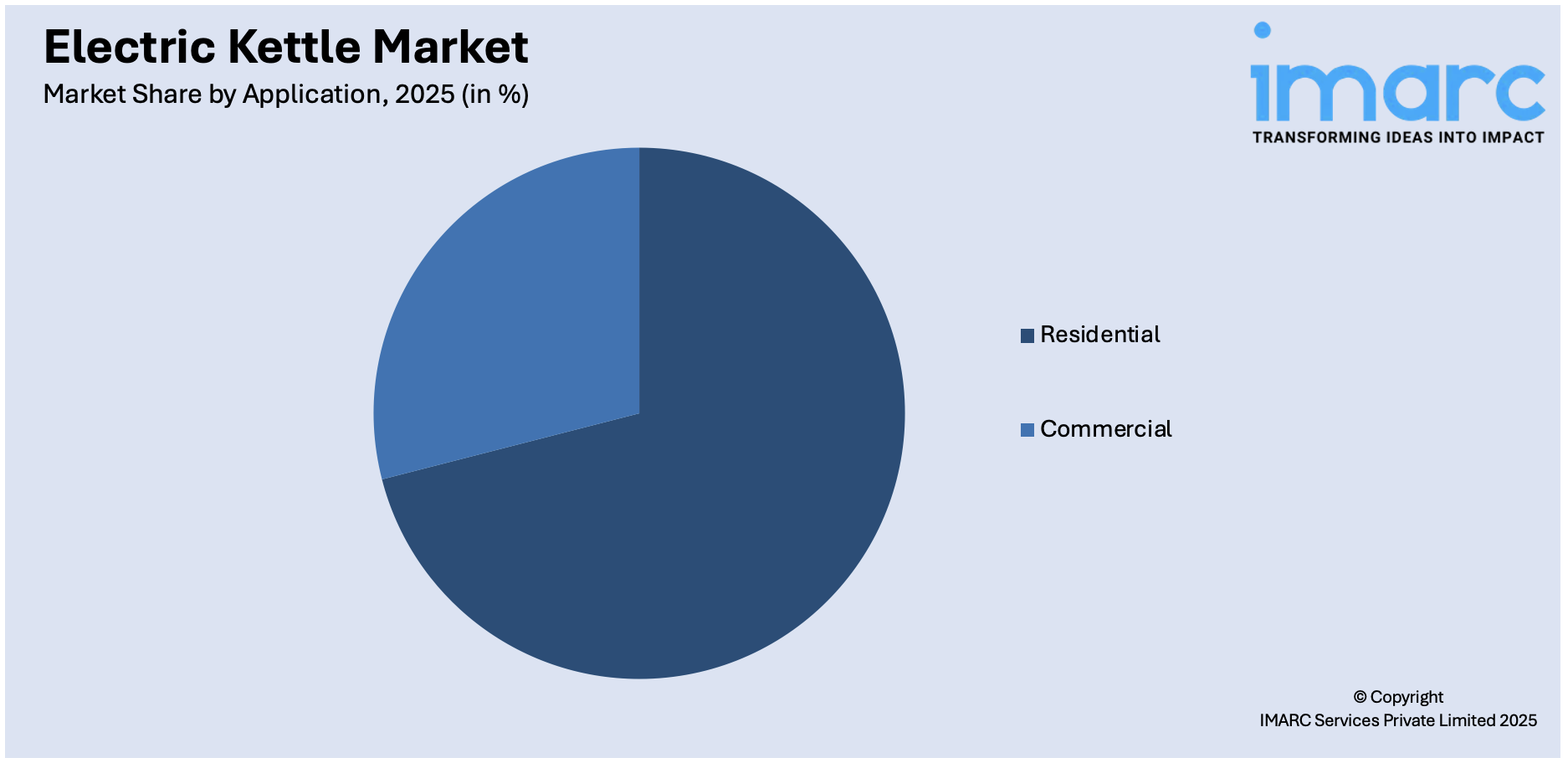

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential accounts for 70.6% of the market share because of the widespread use of kettles in households for everyday needs like preparing tea, coffee, instant noodles, and other hot beverages. With rising urbanization, busier lifestyles, and an increasing number of nuclear families, people prefer appliances that save time and offer convenience, making electric kettles a popular household choice. The affordability and availability of a wide range of models, ranging from basic to advanced smart kettles, is further driving adoption among residential users. Additionally, the growing café culture and rising tea and coffee consumption trends at home are amplifying the demand. Health-conscious individuals also prefer kettles for hygienic boiling compared to traditional stovetop methods. Expanding e-commerce platforms and retail networks have made electric kettles easily accessible to households across both urban and semi-urban regions. According to the electric kettle market forecast, with evolving lifestyles and product innovations, the residential segment will continue to hold dominance.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 42.8%, enjoys the leading position in the market. The region has a deep-rooted tradition of tea consumption in countries like China, India, and Japan, which creates a naturally high demand for kettles. Rapid urbanization and the fast-paced lifestyles of the working population are further increasing the need for quick and convenient appliances, making electric kettles a preferred choice over conventional methods. Rising disposable incomes and the growing middle class is enabling people to invest in modern kitchen solutions that combine efficiency with affordability. Additionally, the expansion of online retail and the availability of a wide range of global and local brands are making electric kettles more accessible across diverse user groups. Seasonal offers and festive discounts are enhancing the market reach across the region. In September 2024, in honor of the festive season, TTK Prestige introduced ‘Shubhutsav,’ a unique campaign that was set to continue until November 15, 2024. Customers could take advantage of substantial discounts and obtain free gifts when buying TTK Prestige items. The Judge SS Electric Kettle, originally priced at INR 1,265, could be purchased for a remarkable INR 599, offering a discount of 52%.

Key Regional Takeaways:

North America Electric Kettle Market Analysis

The North America electric kettle market is primarily driven by rising demand for convenient, efficient, and time-saving kitchen appliances that align with modern lifestyles. Busy working professionals and students increasingly prefer electric kettles for quick preparation of tea, coffee, instant soups, and other hot beverages, which is fueling the adoption. Besides this, the growing popularity of specialty teas and coffee brewing at home is offering a favorable market outlook, as electric kettles with precise temperature control cater to evolving user preferences. Technological advancements, including cordless designs, automatic shut-off, variable temperature settings, and smart connectivity features, enhance safety, convenience, and appeal to tech-savvy buyers. Rising health awareness is also catalyzing the demand, as people are utilizing kettles for safe water boiling and healthy beverage preparation. The higher purchasing power in North America is encouraging spending on premium, durable, and stylish appliances, particularly stainless steel and smart models. Furthermore, the expansion of e-commerce channels and strong distribution networks is making a wide variety of electric kettles easily accessible. The Census Bureau from the Department of Commerce revealed that the projected US retail e-commerce sales for the second quarter of 2025 were USD 304.2 Billion, representing a rise of 1.4% (±0.9%) compared to the first quarter of 2025.

United States Electric Kettle Market Analysis

The United States holds 83.20% of the market share in North America. The market in the United States is witnessing steady expansion, fueled by the rising demand for energy-efficient and time-saving kitchen appliances. A growing emphasis on convenient beverage preparation, particularly tea and specialty drinks, is influencing user purchasing behavior. The integration of smart home technology and the proliferation of connected appliances are enhancing product functionality and appeal. Notably, the Fiber Broadband Association reported that in 2024, approximately 45% of households with internet access in the US possessed at least one smart home device, increasing the appeal of smart kettles integrated with voice control and remote-access features. Additionally, the growing adoption of minimalistic kitchen aesthetics has driven preferences for sleek, compact designs. The trend of health-conscious consumption is also contributing to the market, as people are inclined towards appliances that support quick preparation of herbal infusions and detox drinks. Furthermore, evolving lifestyles and the rise in remote working culture have significantly increased the frequency of at-home hot beverage consumption. Online retail growth, coupled with rising digital engagement, provides greater visibility and accessibility to a wide range of products. In addition, the increasing use of electric kettles in non-residential sectors, such as shared workspaces and hospitality settings, is broadening the market base across the country.

Europe Electric Kettle Market Analysis

The electric kettle market in Europe is experiencing consistent growth, driven by strong cultural integration of tea and coffee consumption across various age groups. People are increasingly prioritizing sustainability and eco-friendly living, which is encouraging a shift towards electric kettles designed with recyclable materials and energy-efficient technology. According to the Agriculture and Horticulture Development Board (AHDB), UK natural gas prices increased again, with futures reaching 89.1p/therm on 20 May 2025, up from 76.7p/therm in 2024. This surge in energy costs is leading individuals to opt for electric kettles that offer quicker boiling and better energy conservation. In addition, the demand for appliances that support precise temperature adjustments is rising due to the popularity of artisanal and specialty beverages. The market for kitchen appliances is gaining momentum due to a surge in aesthetics, urbanization, and hygiene awareness. Manufacturers are offering modern, customizable kettles, while people are seeking durability, safety, and style.

Asia-Pacific Electric Kettle Market Analysis

In the Asia Pacific region, the market is expanding rapidly due to the increasing influence of modern lifestyles and time-saving habits. Rapid urbanization and the growing working-class population have driven the demand for convenient kitchen appliances that support fast-paced routines. By 2050, the urban population in Asia is set to increase by 50%, which is equivalent to an additional 1.2 Billion people. This growing market size reflects rising household spending on appliances, such as electric kettles. The increasing popularity of instant food items and ready-to-make beverages is further fueling the adoption across both urban and semi-urban households. Digital platforms are influencing product awareness and preferences. Improved electrification and affordable appliances in rural areas are expanding the market. Safety features and compact designs are popular among nuclear families and shared accommodations. Additionally, changing dietary habits and health-centric hot beverages like herbal teas and infused waters are catalyzing the demand for electric kettles across various user segments.

Latin America Electric Kettle Market Analysis

The electric kettle market in Latin America is growing steadily, supported by a shift in user preferences towards quick and easy meal and beverage preparation. The rise of dual-income households and extended working hours is contributing to increased demand for appliances that reduce time spent on everyday kitchen tasks. The regional smart home market is also maturing. According to IMARC Group, the Brazil smart home market reached USD 2.68 Billion in 2024 and is set to grow to USD 6.68 Billion by 2033. This trend is bolstering the adoption of connected appliances, including smart kettles. Changing user habits, especially among younger populations adopting modern lifestyles, are encouraging the replacement of traditional boiling methods. Social media and lifestyle influencers are impacting kitchen gadget preferences, while retail distribution channels are enhancing accessibility. Manufacturers' promotions and affordable pricing aid in attracting first-time buyers, driving the regional market's appeal for kitchen convenience.

Middle East and Africa Electric Kettle Market Analysis

In the Middle East and Africa, the electric kettle market is advancing due to the growing user interest in modern home appliances that support simplified living. The increasing prevalence of fast-paced daily routines, due to rising working population, is creating a favorable environment for time-saving kitchen solutions. As per the World Bank Group, in South Africa, the female labor force participation rate stood at 53%, while the male rate was at 64.5% for 2024. Electric kettles are gaining popularity due to hospitality expansion, home-centric lifestyles, digital connectivity, and improved electricity infrastructure, attracting users across diverse socio-economic segments.

Competitive Landscape:

Key players are continuously innovating and introducing advanced features that cater to evolving user preferences. They focus on developing energy-efficient models, incorporating safety features, such as automatic shut-off, and integrating smart technology, to attract tech-savvy buyers. Leading companies are also investing in stylish designs and premium materials to appeal to modern households seeking both functionality and aesthetics. Aggressive marketing strategies, endorsements, and wide product availability through online and offline retail channels are expanding user reach. Moreover, competitive pricing and product differentiation aid in attracting diverse income groups. Collaborations with e-commerce platforms and offering after-sales services are further enhancing customer trust and loyalty. Through innovations, distribution, and branding strategies, key players are significantly influencing market expansion. For instance, in January 2025, Drew Barrymore’s Beautiful kitchen collection at Walmart introduced a 1.7L electric kettle in a rosé shade. At a cost of USD 40, it combined functionality and design, reflecting the brand's chic, practical philosophy. The debut came alongside other complementary devices designed for visually unified, contemporary kitchen improvements for users in the US.

The report provides a comprehensive analysis of the competitive landscape in the electric kettle market with detailed profiles of all major companies, including:

- Aroma Housewares Company

- bonavitaworld.com

- Breville USA Inc. (Breville Group Ltd)

- Chef's Choice

- Electrolux AB

- Hamilton Beach Brands Inc.

- Koninklijke Philips N.V.

- Morphy Richards Ltd.

- Zhejiang Supor Co. Ltd (Groupe SEB)

- Zojirushi America Corporation (Zojirushi Corporation)

Latest News and Developments:

- June 2025: Xiaomi introduced the Mijia Constant Temperature Electric Kettle 3, featuring a 1.7L capacity, four temperature settings, and dual water modes. It had a 316L stainless-steel interior, silent 24-hour heat retention, and an actual digital display in real time. Offered at 169 Yuan (USD 24), it featured various safety functions and a design that facilitated easy cleaning.

- February 2025: Portronics launched the AnyMeal Multicook Electric Kettle, marking its entry into the kitchen appliance market. Crafted for versatile purposes such as boiling, steaming, and cooking, it provided a 1.5L capacity, non-stick surface, tempered glass cover, and cool-touch exterior. With a price tag of INR 1,999, it aimed at swift-moving households looking for compact, safe, and stylish features.

- January 2025: Balmuda unveiled the Monkettle in South Korea, offering 1-degree temperature adjustments from 50°C to 100°C and a 30-minute warming feature. Featuring a 900ml capacity and a crescent-shaped handle for accurate pouring, it merged practicality with appealing design and was sold for 339,000 Won in both black and white options.

- January 2025: RCA launched a 1.5L glass electric kettle with a color LED touchscreen and six temperature settings. The kettle provided accurate heating for drinks, such as tea and milk, combining contemporary design with practicality. It stressed affordability and accessible features at a price of USD 54.99.

Electric Kettle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Stainless Steel, Plastic, Glass, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Asia-Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aroma Housewares Company, bonavitaworld.com, Breville USA Inc. (Breville Group Ltd), Chef's Choice, Electrolux AB, Hamilton Beach Brands Inc., Koninklijke Philips N.V., Morphy Richards Ltd, Zhejiang Supor Co. Ltd (Groupe SEB) and Zojirushi America Corporation (Zojirushi Corporation) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric kettle market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global electric kettle market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric kettle industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric kettle market was valued at USD 2.0 Billion in 2025.

The electric kettle market is projected to exhibit a CAGR of 5.19% during 2026-2034, reaching a value of USD 3.2 Billion by 2034.

Rising preferences for convenience and quick boiling solutions are a major growth driver, as electric kettles save time compared to traditional stovetop methods. Increasing urbanization and the rising number of working professionals are also catalyzing the demand, with more people seeking efficient appliances for tea, coffee, and instant meals. Technological advancements, such as energy-efficient designs, automatic shut-off, variable temperature settings, and cordless models, are enhancing product appeal.

Asia-Pacific currently dominates the electric kettle market, accounting for a share of 42.8% in 2025, due to its strong tea culture, rapid urbanization, and rising disposable incomes. Large population base, increasing middle-class demand for convenient appliances, and expanding online retail are further strengthening the region’s dominance.

Some of the major players in the electric kettle market include Aroma Housewares Company, bonavitaworld.com, Breville USA Inc. (Breville Group Ltd), Chef's Choice, Electrolux AB, Hamilton Beach Brands Inc., Koninklijke Philips N.V., Morphy Richards Ltd., Zhejiang Supor Co. Ltd (Groupe SEB), Zojirushi America Corporation (Zojirushi Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)