Electric Insulator Market Size, Share, Trends and Forecast by Material, Voltage, Category, Installation, Product, Rating, Application, End Use Industry, and Region, 2025-2033

Electric Insulator Market - Global Industry Research Report:

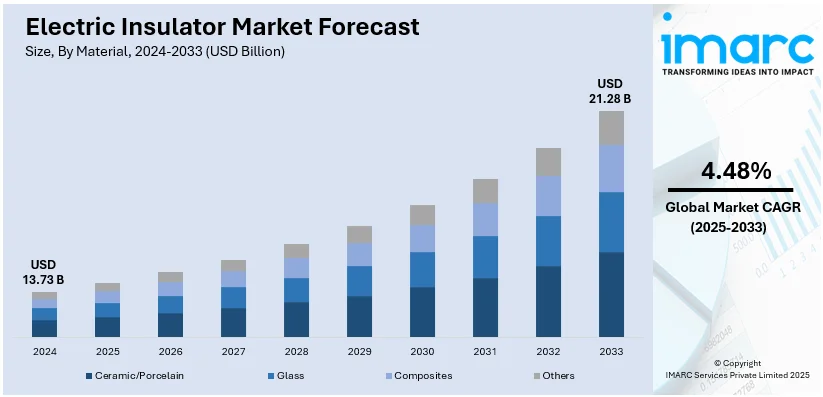

The global electric insulator market size was valued at USD 13.73 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 21.28 Billion by 2033, exhibiting a CAGR of 4.48% during 2025-2033. Asia-Pacific currently dominates the market with 37.5% in 2024. The expansion of offshore wind power systems, increasing demand for insulators in substations, growing number of remote area electrification projects, and escalating electricity consumption are some of the key factors propelling the electric insulator market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.73 Billion |

|

Market Forecast in 2033

|

USD 21.28 Billion |

| Market Growth Rate (2025-2033) | 4.48% |

The rising demand for power transmission and distribution infrastructure due to increasing urbanization, industrialization, and electrification, mainly in emerging economies, is driving the global electric insulator market. According to the United Nations, 68% of the global population is expected to reside in urban area by 2050. Such an approach also requires grid systems with advanced capabilities in order to manage high-voltage electricity, which can be achieved using efficient insulators for renewable energy sources like wind and solar power. Rising investments in smart grid technologies and modernization of aging power infrastructure further boost the electric insulator market growth. Furthermore, growing adoption of electric vehicles and increasing electric vehicle charging networks require high-quality electrical insulation solutions to ensure safety and efficiency. Strict regulations and safety standards imposed by the government to minimize power losses and enhance operational reliability stimulate the adoption of high-quality insulators. Technological advancements, in the form of polymer-based insulators, further provide superior strength, resistance against extreme weather conditions, and cost-effectiveness, which significantly boosts electric insulator market demand. The pace at which the access to electricity is being built in remote and rural areas through off-grid and microgrid systems also significantly contributes to growth in the market.

The United States stands out as a key market disruptor, driven by the rising renewable energy sources, including wind and solar power across the region. There is a growing need for high-performance transmission and distribution networks that depend on efficient and reliable electric insulators. With increasing adoption of electric vehicles and building of EV charging infrastructure, there is a demand for high-quality insulation solutions that can support growing power loads. Federal and state government initiatives are also promoting energy efficiency, grid resilience, and renewable energy integration, and the regulations mandating the use of safe and durable materials in electrical systems are some of the other drivers. Technological advancements include the use of insulators based on polymers, which provide better performance under extreme environmental conditions and weigh less, save on cost, and have maintenance-free properties. The need for reliability in grids accelerates in regions with possibility of extreme weather events; thus, durable insulators leading to reduction of outages and losses in power are needed.

Electric Insulator Market Trends:

Rapid expansion of power infrastructures

The escalating demand for electricity is bolstering the need to expand and upgrade power transmission and distribution networks, which is primarily catalyzing the market for electric insulators. Furthermore, the government authorities of various nations are taking the initiative to electrify developing cities and rural areas, which is creating a positive electric insulator market outlook for the overall market. For instance, Africa aims to achieve universal electricity access by 2025, prioritizing clean and renewable energy options. This objective entails the need for 160 GW of new generation capacity, 130 Million on-grid connections, 75 Million off-grid connections, and ensuring clean cooking solutions for 150 Million households. Similarly, in February 2024, the Government of India launched PM Surya Ghar: Muft Bijli Yojana. This is a government scheme that will offer free electricity to the households of India. In this scheme, the government will give subsidy to the households for installing solar panels on their roofs. The subsidy will be given for up to 40% of the cost of the solar panels. One crore household in India are expected to benefit from this scheme. The government is likely to save Rs. 75,000 crore per year on electricity costs with this scheme. The increasing number of initiatives to electrify rural and semi-urban areas is anticipated to positively impact the electric insulator market outlook in the coming years.

Emergence of electric vehicles

The increasing adoption of EVs among the masses across the globe is contributing to the growth of the market. In electric vehicles (EVs), electric insulators are crucial components used to ensure the safe and efficient operation of various electrical systems. Moreover, the expanding EV market is offering lucrative growth opportunities to the overall market. For instance, according to IMARC, the global electric vehicle market size reached 25.6 Million Units in 2023. Looking forward, IMARC Group expects the market to reach 381.3 Million Units by 2032, exhibiting a growth rate (CAGR) of 34% during 2024-2032. In line with this, the increasing number of electric vehicle charging stations across the globe is acting as one of the significant electric insulator market growth factors. Electric insulators play a critical role in EV charging stations by ensuring the safe and efficient transmission of electricity from the grid to the vehicle. Various power companies are increasingly investing in developing the public charging infrastructure to cater to the escalating need for faster and more affordable charging solutions. For instance, in October 2022, Ather Energy announced the installation of the 580th public fast charging point, the Ather Grid, across 56 cities in India. The increasing uptake of EVs and the expansion of EV charging stations are anticipated to further catalyze the growth of the electric insulator market in the years to come.

Rising product utilization in telecommunication towers

The rising utilization of electric insulators in telecommunication towers is catalyzing the market. The global telecom tower market size reached 4.8 Million Units in 2023 and expected to reach 5.9 Million Units with a CAGR of 2.1% during 2024-2032. With the rapid expansion of global communication networks, telecommunication towers are essential for maintaining seamless connectivity. Insulators are crucial in these towers, preventing electrical leakage and ensuring equipment and personnel safety. As telecommunication networks expand to remote and challenging environments, the demand for insulators that can withstand harsh weather conditions and environmental factors grows. Furthermore, various telecommunication market players are increasingly investing in expansion projects, which are also contributing to the market growth. For instance, in February 2024, Hi-COM Network Private Limited, a leading internet service provider, announced its collaboration with Indus Towers Limited, the largest telecom tower company in the world, to enhance telecommunications infrastructure and drive sustainability efforts. Similarly, in March 2024, Phoenix Tower secured investments from Grain and BlackRock to continue expansion. The investment will support Phoenix tower’s future growth in providing critical tower infrastructure to new and existing markets around the world. Rapid expansion in telecommunication towers is projected to positively impact the electric insulator market dynamics in the coming years.

Electric Insulator Industry Segmentation

IMARC Group provides an analysis of the key trends in each segment of the global electric insulator market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on material, voltage, category, installation, product, rating, application, and end use industry.

Analysis by Material:

- Ceramic/Porcelain

- Glass

- Composites

- Others

Ceramic/porcelain stand as the largest component in 2024 holding 48.1% of market share, due to their excellent electrical and mechanical properties, making them suitable for high-voltage applications. These insulators usually have a higher dielectric constant, which does not vary much with varying temperatures, unlike glass, which conducts more electricity at elevated temperatures, i.e., the dielectric constant of glass varies with temperature. According to IMARC's market share analysis of the electric insulator market, demand for ceramic electrical insulators will be spurred by the expansion of a transmission and distribution network driven by increasing energy consumption and penetration of renewables in the global energy mix, among other factors. By the close of 2022, renewable energy capacity is projected to surge by up to 90%, with a substantial portion anticipated from large utility-scale projects. This is a positive indicator for the transmission and distribution market, offering a bright market outlook for ceramic electric insulators over the coming years.

Analysis by Voltage:

- Low

- Medium

- High

Low voltage leads, with around 40.6% of electric insulator market share in 2024, propelled by the evolving power generation, transmission, and distribution landscape. The market's expansion is closely tied to various voltage segments, each catering to distinct electrical applications. The expansion of low power segment across residential, commercial, and industrial electrical installations is a key driver. The growing urbanization and electrification of rural areas contribute to an increased demand for insulators that ensure safety and reliability.

Analysis by Category:

- Bushings

- Other Insulators

Bushings lead the market holding 54.2% market share in 2024. The market is undergoing dynamic growth, and a significant contributing factor to this expansion is the segment focused on bushings. Bushings play a crucial role in electrical systems by providing insulation and support where power lines or conductors pass through barriers such as walls, transformers, or enclosures. The growth of the bushings segment is attributed to a variety of factors. One key driver is the increasing demand for reliable and efficient power transmission and distribution systems. Furthermore, the expansion in the power transmission and distribution sector is offering lucrative growth opportunities to this segment. For instance, in January 2024, the Sharjah Electricity, Water, and Gas Authority (SEWA) announced the operation of 4 power transmission stations with 33 kV and the completion of the building of 7 stations with 33 kV throughout 2023. Moreover, as grids are upgraded and modernized, there's a heightened need for high-quality bushings that can handle various voltage levels and environmental conditions.

Analysis by Installation:

- Distribution Networks

- Transmission Lines

- Substations

- Railways

- Others

Distribution networks lead the market holding 39.8% market share in 2024. The market is witnessing significant growth, propelled by the distinct segments of distribution networks and transmission lines. These installations play a pivotal role in the efficient and reliable conveyance of electricity, which drives the demand for insulators. The distribution networks segment is a crucial contributor to market expansion. As urbanization and population growth continue, the demand for electricity at the local level increases. Distribution networks carry power from substations to homes, businesses, and industries. Furthermore, various distribution networks and transmission market players are increasingly investing in expansion projects. For instance, Singapore’s GIC and Sterlite joined hands to expand India’s power transmission network. The JV will mainly focus on power transmission projects nationwide to be put into operation according to the energy evacuation demands increasing rapidly across the country.

Analysis by Product:

- Pin Insulator

- Suspension Insulator

- Shackle Insulator

- Others

Pin insulator leads the market with 45.9% market share in 2024. The market is experiencing robust growth, propelled by the diverse products within the pin and suspension insulator segments. These products are critical components in power distribution and transmission systems, driving insulator demand. As per the electric insulator market insights by IMARC, the pin insulator segment is a significant contributor to market expansion. Pin insulators are used to support power lines on distribution poles and substations. As power grids expand to accommodate growing energy needs, the demand for pin insulators that offer durability and efficient electrical insulation increases. They are pivotal in maintaining safe and reliable energy distribution, particularly in urban and rural areas.

Analysis by Rating:

- <11 kV

- 11 kV

- 22 kV

- 33 kV

- 72.5 kV

- 145 kV

- Others

22 kV leads the market with around 15.5% of market share in 2024. The 22 kV segment is equally significant, serving applications that require higher voltage transmission. As renewable energy installations and power generation projects expand, the need for reliable insulators to handle these increased voltages becomes crucial. 22 kV insulators are integral to transmitting electricity over distances while minimizing losses.

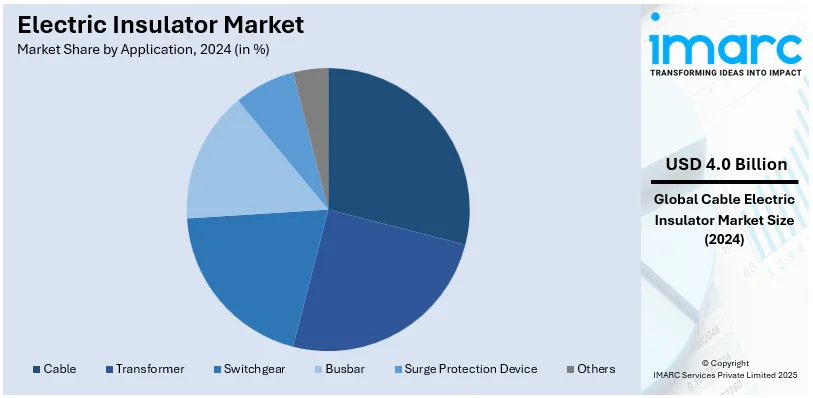

Analysis by Application:

- Transformer

- Cable

- Switchgear

- Busbar

- Surge Protection Device

- Others

Cable leads the market in 2024 with 28.8% of market share. As per the electric insulator industry insights, the cable sector significantly influences the electric insulator market. Cables are vital for transmitting electricity underground or underwater, supporting urban infrastructure and connecting power sources. As urbanization expands and renewable energy initiatives grow, there's an increasing need for insulators capable of enduring the specific challenges posed by cables. These insulators ensure the electrical integrity and insulation of cables across diverse terrains and environmental conditions.

Analysis by End Use Industry:

- Utilities

- Industries

- Others

The market is growing substantially, largely propelled by the diverse needs within the utilities and industries' end-use sectors. These sectors are pivotal in power distribution and usage, driving the demand for reliable insulators. The utilities segment is a major driver of market expansion. Electric utilities generate, transmit, and distribute electricity to residential, commercial, and industrial consumers. As power grids are upgraded and expanded to accommodate growing energy demands, the need for high-quality insulators to ensure the safe and reliable flow of electricity becomes increasingly critical. These insulators are vital in maintaining electrical isolation, supporting substations, and preventing power outages.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 37.5%. The electric insulator market forecast by IMARC indicates that the Asia Pacific region stands out as a major driver of market expansion. Rapid urbanization, industrialization, and population growth in countries like China, India, and Southeast Asian nations have led to increased electricity consumption. Various telecommunication service providers and power transmission and distribution systems market players are exponentially investing in expansion projects for electrification and making communication smoother. For example, Adani Group's subsidiary, Adani Transmission Limited, announced the completion of the 897-circuit km power transmission line in Uttar Pradesh, India, and that is likely to increase demand for electric insulators in India. Similarly, China, by 2030, one-fifth of the country's electricity consumption is forecasted to come from non-fossil fuel sources. Moreover, the transmission and distribution expenditure in India is witnessing significant growth due to increasing power generation capacity and privatization of the distribution sector. During 2020 (up to October 2020), 11,921 circuit kilometers (ckm) of transmission lines (220 kV and above) were added in India. During the same period, transformation capacity addition was 35,760 MVA, which resulted in huge demand for electric insulators. Consequently, elements like the incorporation of renewable energy sources, growth of the current T&D infrastructure, and installation of electric vehicle charging stations are anticipated to propel the electric insulator market in the area throughout the projected period.

Electric Insulator Market Regional Takeaways:

United States Electric Insulator Market Analysis

In 2024, the United States accounts for over 78.90% of the electric insulator market in North America. The adoption of electric insulators is expanding rapidly as power infrastructure projects increase, particularly in businesses involved with HVAC systems in the United States. According to reports, there are 114,157 Heating & Air-Conditioning Contractors businesses in the US as of 2024. This demand surge stems from the rising need for reliable and durable electrical insulation solutions to support modernizing grid systems and HVAC technology. The growing reliance on electricity across sectors, including residential, industrial, and commercial spaces, has amplified the need for robust insulation. As power plants and substations are updated and expanded, the high performance and efficiency of electric insulators are required to meet these evolving demands. The ongoing projects involving power generation, transmission, and distribution infrastructures aim to enhance energy reliability, further propelling the demand for advanced electric insulators. These advancements in infrastructure support HVAC systems' improved energy distribution and safety, promoting the widespread adoption of electric insulators for long-term power stability.

Asia Pacific Electric Insulator Market Analysis

In the Asia-Pacific region, the increased adoption of electric insulators is driven by the region’s growing power consumption. According to India Brand Equity Foundation, power consumption in India in FY23 logged a 9.5% growth to 1,503.65 Billion units (BU). The rise in energy demand due to rapid urbanization and economic development necessitates the expansion and modernization of power grids to ensure stable electricity supply. The fast-growing population and industrial activities place significant strain on existing infrastructures, requiring robust insulating solutions to maintain grid reliability. Power plants and electrical substations, critical to managing the rising power load, demand reliable insulators to withstand high-voltage environments, prevent power failures, and ensure continuous operations. The increasing integration of renewable energy sources, such as solar and wind, further drives the need for advanced insulator technologies to meet the evolving power transmission demands.

Europe Electric Insulator Market Analysis

The growing demand for electric insulators in Europe is fuelled by the booming industrial sector and rising production activities across multiple industries. According to reports, the EU's industrial production in 2021 is increased by 8.5% compared with 2020. It continued with an increase in 2022 by 0.4% compared with 2021. As manufacturing, construction, and other heavy industries expand, there is an increasing need for reliable power distribution systems. Electric insulators are essential components in protecting electrical networks from damage and ensuring efficient energy transmission across diverse industrial applications. Furthermore, Europe’s push toward sustainable energy solutions, including the integration of renewable energy sources into the grid, is boosting demand for insulators. The development of smart grids and high-voltage transmission systems to accommodate renewable energy generation from wind and solar farms further requires advanced insulating materials to ensure operational stability. This growth in industrial production, alongside energy sector modernization, drives the continued adoption of electric insulators in Europe.

Latin America Electric Insulator Market Analysis

The telecom sector in Latin America is driving increased demand for electric insulators, as the rapid expansion of mobile networks, fibre optics, and 5G infrastructure requires robust power systems to ensure consistent connectivity. For instance, with over 121 Million active broadband subscriptions in the country, Mexico is one of the largest telecommunications markets in Latin America and the world. As telecom services reach more remote areas, power grids must be strengthened, leading to the adoption of higher-quality electric insulators to maintain the transmission of energy and signals. Ensuring continuous power supply to telecom towers and base stations is critical, as interruptions in service can result in widespread outages. With the expanding telecom infrastructure, the need for durable, reliable, and efficient electric insulators becomes crucial to maintaining system resilience and meeting growing communication demands.

Middle East and Africa Electric Insulator Market Analysis

The growing adoption of electric vehicles in the Middle East and Africa is significantly driving the demand for electric insulators. As the number of electric vehicles (EVs) on the roads increases, the requirement for reliable, efficient charging infrastructure intensifies. According to the Global Electric Mobility Readiness Index published in 2022, demand for EVs in the UAE market has witnessed a steady rise over the past years and is projected to see a compound annual growth rate (CAGR) of 30% between 2022 and 2028. Electric insulators play a vital role in ensuring safe and efficient power transmission within EV charging stations. With the rise in EV adoption, power networks need to be reinforced to handle higher loads while maintaining safety standards. Electric insulators are critical in facilitating this transition, enabling the installation of charging points that ensure stable and secure energy flow to support the growing electric vehicle market across these regions.

Leading Electric Insulator Companies:

The key players in the electric insulator market are making tremendous efforts to drive growth and meet the changing demands of the industry. In order to gain recognition in this industry, these market leaders offer specialized insulators designed for high-voltage applications in wind farms, solar power plants, and offshore energy projects to cater to the ever-growing demand for renewable energy. Digitalization initiatives, including smart insulator technologies integrated with monitoring systems, are gaining momentum to support smart grid infrastructure. Moreover, key players are enhancing their manufacturing capacities and adopting automation to ensure scalability and cost-efficiency while maintaining product quality. The efforts to comply with stringent government regulations and safety standards drive the production of high-performance insulators that meet international benchmarks. Through these proactive approaches by most industry leaders, the global electric insulator market expands and becomes robust.

The report provides a comprehensive analysis of the leading companies in the electric insulator market with detailed profiles of all major companies, including:

- ABB

- NGK Insulators Ltd

- Aditya Birla Nuvo

- Siemens AG

- General Electric

- Hubbell Incorporated

- Bharat Heavy Electricals Limited

- Toshiba

- Krempel

- MacLean-Fogg

- PFISTERER

- Seves Group

- WT Henley

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- July 2024: Kirkland & Ellis provided counsel to TJC in purchasing Insulation Technology Group (ITG) from PHI Industrial. ITG, a global leader in electric insulators, specializes in high and ultra-high voltage porcelain solutions for utility markets. The deal highlights TJC's investment focus on industrial technology and infrastructure. ITG operates manufacturing facilities across the U.S., Europe, and Brazil.

- June 2024: Navrattan Group has unveiled a new E-Bus made with advanced glass fiber composite technology, enhancing durability and efficiency. The innovative design incorporates electric insulator properties, reducing maintenance costs and improving sustainability. This lightweight E-Bus sets new benchmarks in public transport efficiency.

- May 2024: BASF has incorporated sustainable glass fibers from 3B Fibreglass into its Ultramid® A & B portfolio to reduce carbon emissions. Produced with green electricity and solar energy, these fibers support BASF’s goal of cutting Scope 3.1 emissions by 15% by 2030. This initiative aligns with BASF's commitment to achieving net-zero emissions by 2050. 3B’s innovations in renewable energy and reduced PCF further enhance the value chain's sustainability.

- April 2024: Maillefer has unveiled the THC 70/150 HE helical crosshead for producing medium and high-voltage polypropylene insulated cables. The innovative design improves electric insulator properties, optimizes wall thickness, and enhances production efficiency with quick setup and precise adjustments.

- April 2024: 3D printing service bureau, CRP Technology, announced that their glass fiber reinforced Windform thermoplastic composites for Selective Laser Sintering have demonstrated outstanding electrical insulation performance as confirmed by recent dielectric constant and dielectric strength tests.

Electric Insulator Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Ceramic/Porcelain, Glass, Composites, Others |

| Voltages Covered | Low, Medium, High |

| Categories Covered | Bushings, Other Insulators |

| Installations Covered | Distribution Networks, Transmission Lines, Substations, Railways, Others |

| Products Covered | Pin Insulator, Suspension Insulator, Shackle Insulator, Others |

| Ratings Covered | <11 kV, 11 kV, 22 kV, 33 kV, 72.5 kV, 145 kV, Others |

| Applications Covered | Transformer, Cable, Switchgear, Busbar, Surge Protection Device, Others |

| End Use Industries Covered | Utilities, Industries, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | ABB, NGK Insulators Ltd, Aditya Birla Nuvo, Siemens AG, General Electric, Hubbell Incorporated, Bharat Heavy Electricals Limited, Toshiba, Krempel, MacLean-Fogg, PFISTERER, Seves Group, WT Henley, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric insulator market from 2019-2033.

- The electric insulator market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric insulator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global electric insulator market was valued at USD 13.73 Billion in 2024.

IMARC estimates the global electric insulator market to exhibit a CAGR of 4.48% during 2025-2033.

The global electric insulator market is driven by the increasing demand for reliable power infrastructure, renewable energy integration, smart grid development, technological advancements in insulating materials, and the expansion of electric vehicle charging networks.

Asia Pacific dominates the market due to the region's expanding power generation capacity, growing investments in grid modernization, and increasing electricity demand in countries like China and India.

Some of the major players in the global Electric Insulator market include ABB, NGK Insulators Ltd, Aditya Birla Nuvo, Siemens AG, General Electric, Hubbell Incorporated, Bharat Heavy Electricals Limited, Toshiba, Krempel, MacLean-Fogg, PFISTERER, Seves Group, WT Henley, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)