Egypt Warehouse Market Report by Sector (Industrial Warehouses, Agricultural Warehouses), Ownership (Private Warehouses, Public Warehouses, Bonded Warehouses), Types of Commodities Stored (General Warehouses, Speciality Warehouses, Refrigerated Warehouses), and Region 2026-2034

Egypt Warehouse Market Overview:

The Egypt warehouse market size reached USD 167.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 255.1 Billion by 2034, exhibiting a growth rate (CAGR) of 4.55% during 2026-2034. The increasing e-commerce activities, strategic geographic location, rising demand for efficient storage solutions, expanding infrastructure development, favorable government incentives, technological advancements in logistics, and the expanding manufacturing sector are some of the key factors contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 167.4 Billion |

| Market Forecast in 2034 | USD 255.1 Billion |

| Market Growth Rate (2026-2034) | 4.55% |

Access the full market insights report Request Sample

Egypt Warehouse Market Trends:

Surge in e-commerce

Changing consumer behavior toward online shopping, driven by the rise in online shopping platforms and increasing internet usage is presenting lucrative opportunities for market expansion. This trend necessitates efficient storage and rapid distribution solutions to meet the growing demand for quick and reliable delivery services. E-commerce giants and local online retailers are investing heavily in warehousing facilities to manage their inventory effectively and ensure timely deliveries. This surge in e-commerce activity is boosting the demand for more warehousing space and for advanced warehousing solutions that can handle the complexities of inventory management, order fulfillment, and last-mile delivery. Consequently, there is a growing emphasis on modern, strategically located warehouses that can serve as central hubs for e-commerce operations, which is contributing to the market growth.

Strategic infrastructure development

The Egyptian government has been actively investing in infrastructure projects, including the expansion of transportation networks, the construction of new industrial zones, and the development of ports. The purpose of these endeavors is to strengthen Egypt's standing as a regional center for logistics. Better connectivity across various regions, made possible by improved infrastructure, facilitates the efficient transportation of goods from ports to warehouses and ultimately to retail locations or final customers. For instance, the expansion of the Suez Canal and the development of the Suez Canal Economic Zone (SCZone) have created opportunities for establishing large-scale logistics and warehousing facilities that can serve both domestic and international markets. Such strategic infrastructure projects attract foreign investment and encourage local businesses to expand their warehousing capabilities to leverage the improved logistics network.

Advancements in logistics technology

The expanding adoption of innovative technologies like automation, the Internet of Things (IoT), and warehouse management systems (WMS) have revolutionized warehouse operations by enhancing operational efficiency, accuracy, and scalability. Automation technologies, including robotic pickers and automated storage and retrieval systems (AS/RS), increase the speed and accuracy of warehousing operations, reducing reliance on manual labor. Moreover, Internet of Things (IoT) devices enable real-time monitoring of warehouse conditions, such as temperature and humidity, ensuring that goods are stored under optimal conditions. The integration of these advanced technologies improves the overall efficiency of warehousing operations and provides a competitive edge to businesses by enabling faster and more reliable delivery services, thereby creating a positive outlook for market expansion.

Egypt Warehouse Market News:

- In May 2024, GB Logistics unveiled a 350,000 square kilometer bonded warehouse in Egypt, expanding its logistical capabilities in the region.

- In August 2023, Supply Minister Ali El-Moselhy inaugurated a new phase of a national project for food warehouses in Luxor, laying the foundation for a second strategic warehouse. As part of the initial phase, the project aims to enhance food security following the previous launch in the Suez governorate.

Egypt Warehouse Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on sector, ownership, and type of commodities stored.

Sector Insights:

To get detailed segment analysis of this market Request Sample

- Industrial Warehouses

- Agricultural Warehouses

The report has provided a detailed breakup and analysis of the market based on the sector. This includes industrial warehouses and agricultural warehouses.

Ownership Insights:

- Private Warehouses

- Public Warehouses

- Bonded Warehouses

A detailed breakup and analysis of the market based on the ownership have also been provided in the report. This includes private warehouses, public warehouses, and bonded warehouses.

Type of Commodities Stored Insights:

- General Warehouses

- Speciality Warehouses

- Refrigerated Warehouses

The report has provided a detailed breakup and analysis of the market based on the type of commodities stored. This includes general warehouses, speciality warehouses, and refrigerated warehouses.

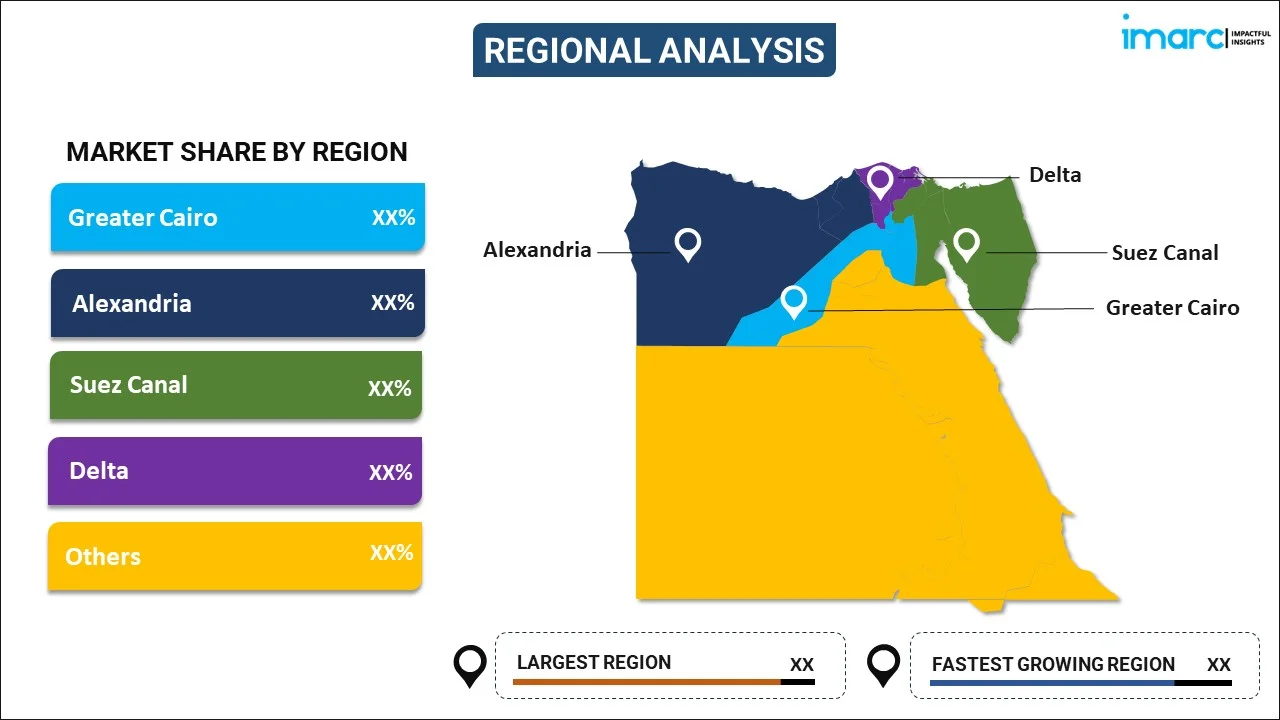

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Warehouse Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Industrial Warehouses, Agricultural Warehouses |

| Ownerships Covered | Private Warehouses, Public Warehouses, Bonded Warehouses |

| Types of Commodities Stored Covered | General Warehouses, Speciality Warehouses, Refrigerated Warehouses |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt warehouse market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt warehouse market on the basis of sector?

- What is the breakup of the Egypt warehouse market on the basis of ownership?

- What is the breakup of the Egypt warehouse market on the basis of type of commodities stored?

- What are the various stages in the value chain of the Egypt warehouse market?

- What are the key driving factors and challenges in the Egypt warehouse?

- What is the structure of the Egypt warehouse market and who are the key players?

- What is the degree of competition in the Egypt warehouse market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt warehouse market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt warehouse market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt warehouse industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)