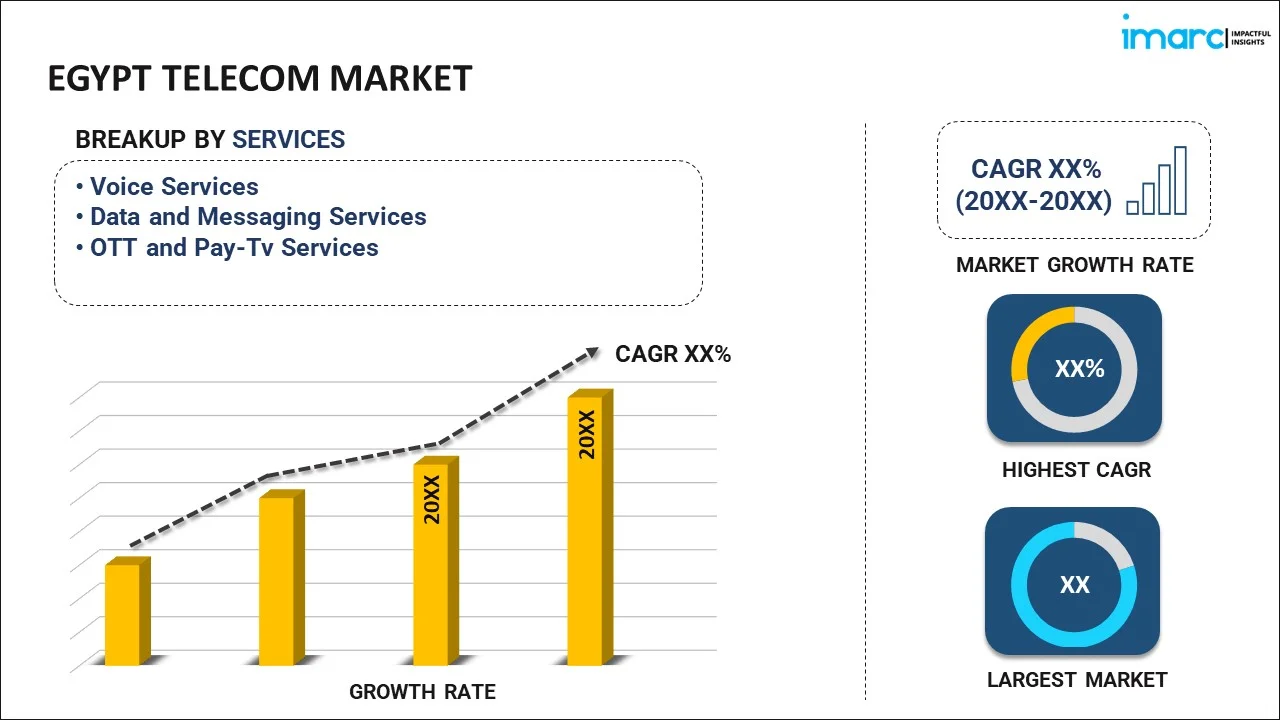

Egypt Telecom Market Report by Services (Voice Services, Data and Messaging Services, OTT and Pay-Tv Services), and Region 2026-2034

Egypt Telecom Market Overview:

The Egypt telecom market size reached USD 3.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.5 Billion by 2034, exhibiting a growth rate (CAGR) of 3.85% during 2026-2034. The increasing usage of mobiles and cell phones, government investments in ICT infrastructure, growing demand for high-speed internet services, the rise of digital services such as mobile banking and e-commerce, and advancements in 4G and 5G are some of the major other propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.9 Billion |

| Market Forecast in 2034 | USD 5.5 Billion |

| Market Growth Rate (2026-2034) | 3.85% |

Access the full market insights report Request Sample

Egypt Telecom Market Trends:

Increasing Mobile Penetration

The rising number of mobile users in Egypt boosts demand for telecom services, including voice, data, and value-added services. According to the industry report, mobile phone services were first introduced in Egypt in 1996. By 2000, about 1.98% of the population were subscribed to mobile phone services. Since then, mobile penetration has grown in leaps and bounds. For the year 2020, the Egypt Ministry of Communications and Information Technology announced that 98.8% of Egyptian households and 95% of individuals owned mobile phones. According to Datareportal, there were 95.75 million mobile connections in Egypt in January 2021, equivalent to 92.7% of the total population and a 2.9% increase compared to the previous year.

Government Investments in ICT Infrastructure

Significant government initiatives and investments in improving the country's ICT infrastructure enhance network coverage and quality, driving market growth. According to the Ministry of Communications and Information Technology, ICT 2030 strategy contributes to achieving the objectives of Egypt's Vision 2030, through building Digital Egypt. These objectives entail developing the ICT infrastructure; fostering digital inclusion; achieving the transition to a knowledge-based economy; building capacities and encouraging innovation; fighting corruption; ensuring cybersecurity; and promoting Egypt's position at the regional and international levels. Digital Egypt is an all-encompassing vision and plan, which lays the foundations for the transformation of Egypt into a digital society. The "Digital Egypt" strategy is built on three main planks, including Digital Transformation, Digital Skills and Jobs, and Digital Innovation. These three pillars are standing on two extremely important bases: Digital Infrastructure and Legislative Framework.

Advancements in 4G and 5G Technologies

The rollout and adoption of advanced mobile technologies, such as 4G and 5G, cater to the growing demand for high-speed internet and digital services, further propelling the telecom market. For instance, telecom Egypt secured the first fifth-generation (5G) license in the country from the National Telecommunications Regulatory Authority (NTRA) for US$150 million, placing it in a good position to launch the technology. The Egyptian government reportedly announced 5G plans in October 2023, and Telecom Egypt is the first telco to be awarded a license. Telecom Egypt's 5G license follows a trend of other African countries either launching or announcing plans to launch the technology.

Egypt Telecom Market News:

- In March 2024, Telecom Egypt, Egypt’s first integrated telecom operator and one of the largest subsea cable operators in the region, and EXA Infrastructure, a leading European fiber backbone, and transatlantic subsea cable infrastructure provider, announced their partnership to reshape East-to-West traffic flows entering the Mediterranean, and reinforce Egypt's role as a pivotal hub for global telecommunications. At a signing ceremony, executives from Telecom Egypt and EXA Infrastructure expressed their commitment to launch a new era of cooperation that will see them work more closely together to support digital infrastructure initiatives.

- In March 2024, Tejas Networks announced that it has signed a Memorandum of Understanding (MoU) with Telecom Egypt (TE), ITIDA (Information Technology Industry Development Agency), and NTI (National Telecom Institute) to replicate its experience of implementing the Bharatnet (Rural Broadband Project) and NKN (National Knowledge Network) projects in Egypt. Other broad areas of cooperation include capacity building of Egyptian engineers and technicians on state-of-the-art telecom and networking technologies; establishing local manufacturing and R&D facilities for Fiber-to-the-Home (FTTH) products; and setting up technical support services in Egypt both for customers within the country as well as for the larger Africa and Middle East region.

Egypt Telecom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on services.

Services Insights:

To get detailed segment analysis of this market Request Sample

- Voice Services

- Wired

- Wireless

- Data and Messaging Services

- OTT and Pay-Tv Services

The report has provided a detailed breakup and analysis of the market based on the services. This includes voice services (wired and wireless), data and messaging services, and OTT and pay-tv services.

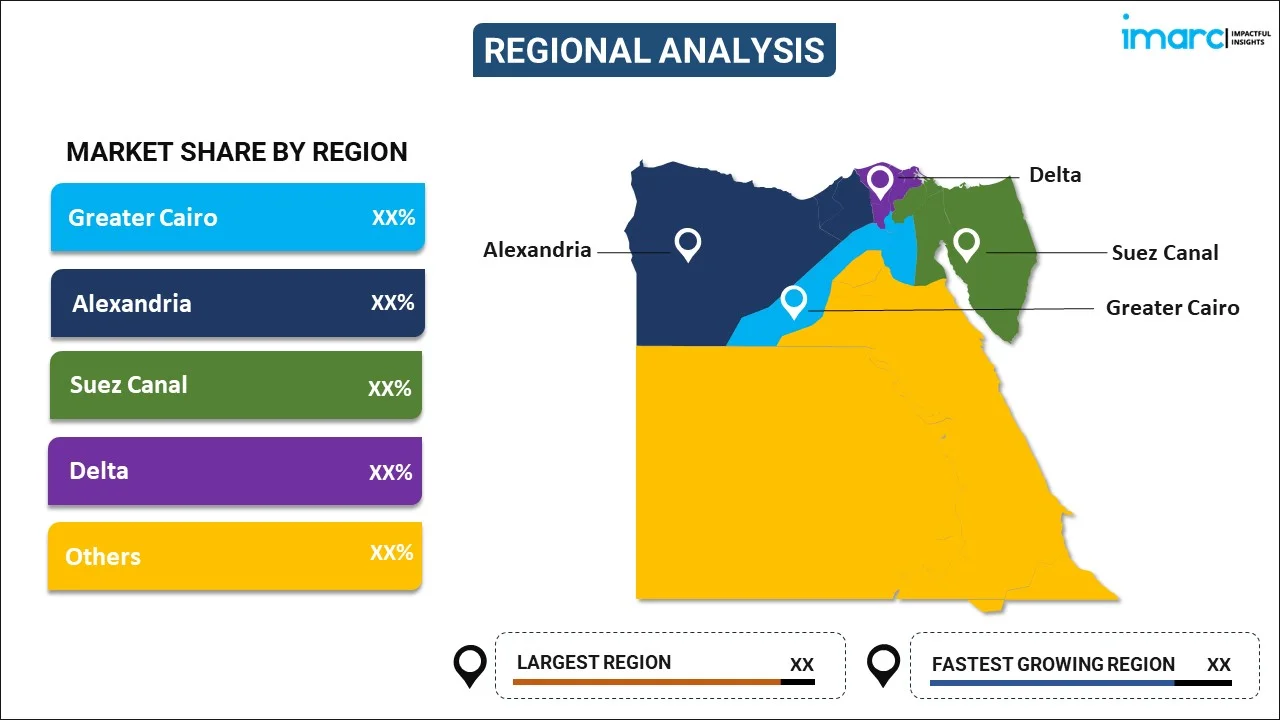

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Telecom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt telecom market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt telecom market on the basis of services?

- What are the various stages in the value chain of the Egypt telecom market?

- What are the key driving factors and challenges in the Egypt telecom?

- What is the structure of the Egypt telecom market and who are the key players?

- What is the degree of competition in the Egypt telecom market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt telecom market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt telecom market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt telecom industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)