Egypt Pharmaceutical Market Report by Type (Pharmaceutical Drugs, Biologics), Nature (Organic, Conventional), and Region 2026-2034

Egypt Pharmaceutical Market Overview:

The Egypt pharmaceutical market size reached USD 7,072.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14,497.9 Million by 2034, exhibiting a growth rate (CAGR) of 8.05% during 2026-2034. There are various factors that are driving the market, which include the growing geriatric population, increasing number of pharma exhibitions, favorable government initiatives, and rising cases of numerous chronic diseases.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 7,072.0 Million |

|

Market Forecast in 2034

|

USD 14,497.9 Million |

| Market Growth Rate 2026-2034 | 8.05% |

Access the full market insights report Request Sample

Egypt Pharmaceutical Market Trends:

Rising Geriatric Population

There is a rise in the need for a wide variety of pharmaceuticals among elderly individuals because they are more prone to chronic diseases such as hypertension, diabetes, arthritis, cardiovascular diseases, and respiratory conditions. Elderly patients often require multiple medications simultaneously to manage various health conditions. In addition, the increasing emphasis on preventive healthcare among individuals is contributing to the market growth. There is a rise in the focus on vaccinations, vitamins, and supplements to maintain health and prevent diseases. This contributes to the increased demand for diverse pharmaceutical products. Besides this, there is a rise in the need for personalized and customized treatment plans for elderly patients, who often have complex health profiles, necessitating a broader range of pharmaceutical options to cater to their specific needs. The number of persons aged 60+ is anticipated to more than double between 2020-2050 from 8.4 million to 22 million in Egypt, as claimed by the United Nations Population Fund (UNFPA).

Increasing Number of Pharma Exhibitions

On 4 September 2023, Dozens of Chinese pharmaceutical companies participated in Pharmaconex 2023, an international pharma exhibition held in Egypt's capital Cairo, in order to explore business opportunities in Egypt and the rest of Africa and the Middle East. The three-day exhibition gathered pharmaceutical companies from countries including Egypt, China, India, the United States, Italy, France, Belgium, Saudi Arabia, and the United Arab Emirates. Furthermore, pharmaceutical exhibitions provide a platform for industry professionals to network, exchange ideas, and forge partnerships. This facilitates collaboration between local and international companies, leading to business expansion and growth. Exhibitions serve as a stage for companies to showcase their latest products, technologies, and innovations. This exposure helps in promoting new pharmaceutical products and attracting potential buyers and investors. Moreover, these events offer valuable insights into market trends, consumer preferences, and emerging technologies. Participants can gain a better understanding of the market landscape, enabling them to make informed business decisions.

Egypt Pharmaceutical Market News:

- 19 March 2024: Egypt-based healthtech Pharmacy Marts raised a six-figure bridge round, led by Acasia Ventures. Pharmacy Marts aims to digitize the pharmaceutical sector’s supply chain to improve patient access to medication.

- 4 December 2023: Valu, MENA’s leading universal financial technology powerhouse, and GSK, a science-led global healthcare company, announced a partnership that aims at providing flexible financing solutions for a range of GSK’s vaccines available at a wide range of pharmacies across Egypt. By introducing innovative financing options, the collaboration endeavors to make the purchase of GSK’s vaccines more attainable for a wider demographic, thereby positively impacting the healthcare landscape in Egypt. In this collaboration, Valu and GSK focus on creating a more inclusive and equitable healthcare ecosystem, aligning with their shared vision of advancing public health and well-being in Egypt.

Egypt Pharmaceutical Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and nature.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Pharmaceutical Drugs

- Cardiovascular Drugs

- Dermatology Drugs

- Gastrointestinal Drugs

- Genito-Urinary Drugs

- Hematology Drugs

- Anti-Infective Drugs

- Metabolic Disorder Drugs

- Musculoskeletal Disorder Drugs

- Central Nervous System Drugs

- Oncology Drugs

- Ophthalmology Drugs

- Respiratory Diseases Drugs

- Biologics

- Monoclonal Antibodies (MAbS)

- Therapeutic Proteins

- Vaccines

The report has provided a detailed breakup and analysis of the market based on the type. This includes pharmaceutical drugs (cardiovascular drugs, dermatology drugs, gastrointestinal drugs, genito-urinary drugs, hematology drugs, anti-infective drugs, metabolic disorder drugs, musculoskeletal disorder drugs, central nervous system drugs, oncology drugs, ophthalmology drugs, and respiratory diseases drugs) and biologics (monoclonal antibodies (MAbS), therapeutic proteins, and vaccines).

Nature Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the nature have also been provided in the report. This includes organic and conventional.

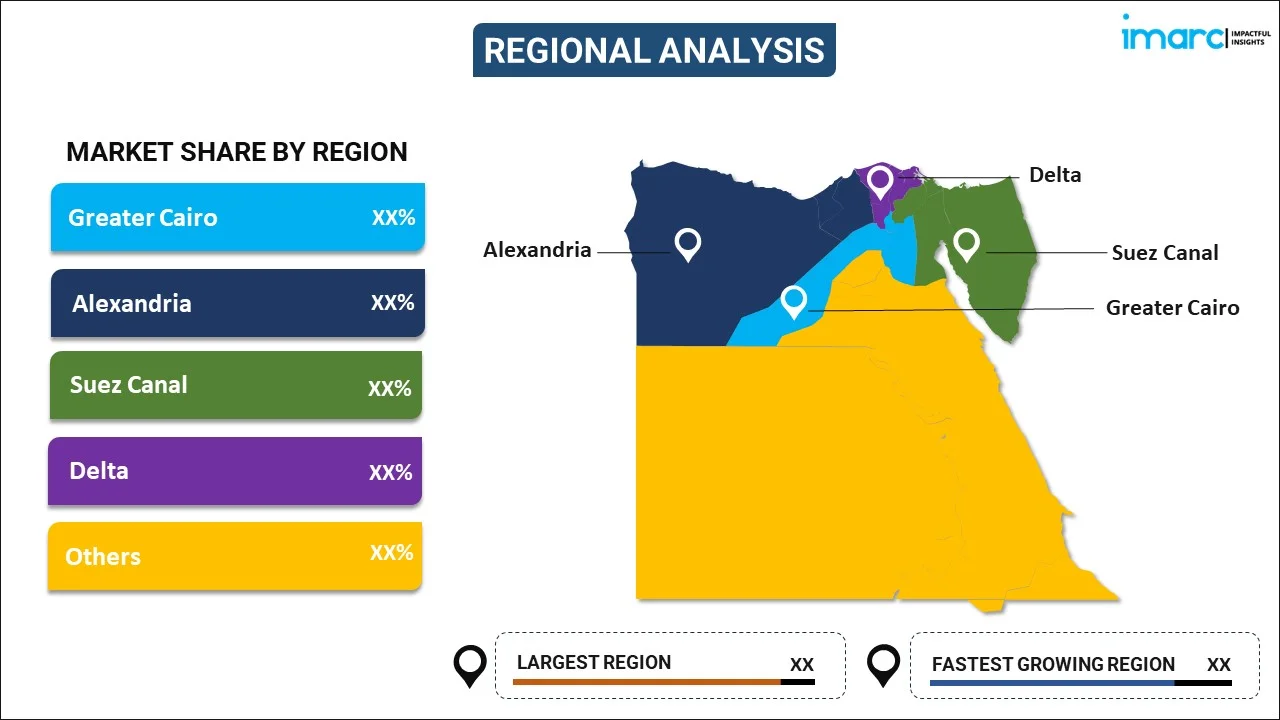

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Pharmaceutical Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Natures Covered | Organic, Conventional |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt pharmaceutical market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt pharmaceutical market on the basis of type?

- What is the breakup of the Egypt pharmaceutical market on the basis of nature?

- What are the various stages in the value chain of the Egypt pharmaceutical market?

- What are the key driving factors and challenges in the Egypt pharmaceutical?

- What is the structure of the Egypt pharmaceutical market and who are the key players?

- What is the degree of competition in the Egypt pharmaceutical market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt pharmaceutical market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt pharmaceutical market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt pharmaceutical industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)