Egypt Hospitality Market Report by Type (Chain Hotels, Independent Hotels), Segment (Service Apartments, Budget and Economy Hotels, Mid and Upper Mid-scale Hotels, Luxury Hotels), and Region 2026-2034

Egypt Hospitality Market Overview:

The Egypt hospitality market size reached USD 6,356.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 9,090.2 Million by 2034, exhibiting a growth rate (CAGR) of 3.85% during 2026-2034. The rise of ecotourism and sustainable practices, ongoing digital transformation and technology integration, and the increasing demand for cultural tourism and authentic experiences, reflecting both global trends and local initiatives are some of the key trends influencing the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 6,356.5 Million |

|

Market Forecast in 2034

|

USD 9,090.2 Million |

| Market Growth Rate 2026-2034 | 3.85% |

Access the full market insights report Request Sample

Egypt Hospitality Market Trends:

Rise of Ecotourism and Sustainable Practices

With growing awareness about environmental conservation and sustainable living, tourists are seeking destinations and accommodations that prioritize eco-friendly initiatives. In Egypt, this trend is evident in the development of eco-lodges, sustainable resorts, and tours that promote responsible tourism practices. The country's rich natural resources, including the Red Sea coral reefs, desert landscapes, and diverse wildlife, present opportunities for eco-friendly tourism initiatives. Moreover, the Egyptian government has recognized the potential of ecotourism in driving economic growth while preserving the environment. Policies and incentives supporting sustainable tourism development, such as tax breaks for eco-friendly businesses and regulations to protect natural habitats, are encouraging investment in eco-tourism infrastructure. Additionally, consumer preferences are shifting towards eco-conscious travel experiences. As a result, hotels and resorts in Egypt are adopting green practices to attract environmentally conscious travelers, thereby strengthening the market growth.

Digital Transformation and Technology Integration

In today's digitally connected world, travelers expect seamless and personalized services, from booking accommodations to accessing amenities during their stay. Hotels and resorts in Egypt are leveraging technology to enhance guest satisfaction and operational efficiency. This includes implementing mobile check-in and check-out services, providing virtual concierge platforms for guest inquiries and recommendations, and deploying smart room features for climate control, entertainment, and security. Moreover, the widespread utilization of data analytics and artificial intelligence (AI) technologies allows hospitality providers to gain insights into guest preferences and behavior, enabling them to offer tailored experiences and targeted marketing campaigns. Furthermore, digital platforms and online travel agencies (OTAs) play a significant role in driving bookings and promoting destinations in Egypt, thus creating a positive outlook for market expansion.

Cultural Tourism and Authentic Experiences

Tourists are increasingly seeking immersive experiences that allow them to connect with local culture, traditions, and communities. This trend has led to the development of cultural tourism initiatives such as heritage tours, culinary experiences, and artisanal workshops. As one of the cradles of civilization with a rich historical and cultural heritage, Egypt offers a plethora of attractions ranging from ancient monuments and archaeological sites to vibrant markets and traditional festivals. Moreover, the revival of cultural events and festivals, coupled with efforts to preserve and showcase intangible cultural heritage, contributes to the appeal of Egypt as a cultural tourism destination. By embracing cultural tourism, hotels and resorts are differentiating themselves in a competitive market while providing guests with memorable and meaningful experiences, which is propelling the market forward.

Egypt Hospitality Market News:

- In January 2024, Abu Dhabi wealth fund ADQ agreed to acquire a 40.5% stake in ICON, the hospitality arm of Egypt's Talaat Moustafa Group (TMG), allowing it to own several luxury hotels in the country. The deal involves a capital increase by a special purpose vehicle owned by ADQ and its unit ADNEC, with respective 49% and 51% holdings. The deal includes the acquisition of a stake in seven iconic heritage hotels, including Four Seasons properties in Cairo, Sharm El Sheikh, and Alexandria, and the Kempinski Nile Hotel in Cairo.

- In December 2023, Palm Hill Development Company, a leading Egyptian real estate firm, partnered with Marriott International to construct a new hotel in Cairo. This project is part of Marriott's expansion strategy in the region and aims to cater to the growing demand for luxury accommodations in Egypt.

Egypt Hospitality Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and segment.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Chain Hotels

- Independent Hotels

The report has provided a detailed breakup and analysis of the market based on the type. This includes chain hotels and independent hotels.

Segment Insights:

- Service Apartments

- Budget and Economy Hotels

- Mid and Upper Mid-scale Hotels

- Luxury Hotels

A detailed breakup and analysis of the market based on the segment have also been provided in the report. This includes service apartments, budget and economy hotels, mid and upper mid-scale hotels, and luxury hotels.

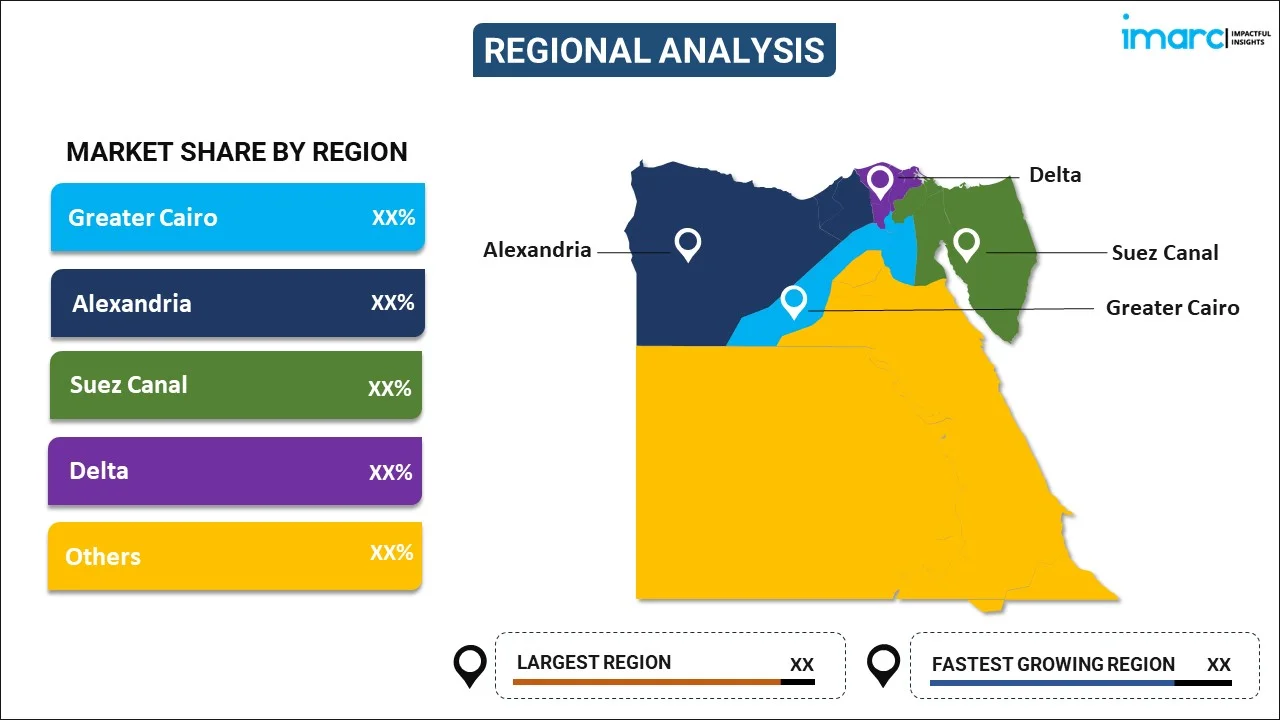

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Hospitality Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chain Hotels, Independent Hotels |

| Segments Covered | Service Apartments, Budget and Economy Hotels, Mid and Upper Mid-scale Hotels, Luxury Hotels |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt hospitality market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt hospitality market on the basis of type?

- What is the breakup of the Egypt hospitality market on the basis of segment?

- What are the various stages in the value chain of the Egypt hospitality market?

- What are the key driving factors and challenges in the Egypt hospitality?

- What is the structure of the Egypt hospitality market and who are the key players?

- What is the degree of competition in the Egypt hospitality market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt hospitality market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt hospitality market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt hospitality industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)