Egypt Home Appliances Market Report by Product (Major Appliances, Small Appliances), Distribution Channel (Multi-brand Stores, Exclusive Stores, Online, and Others), and Region 2026-2034

Egypt Home Appliances Market Overview:

The Egypt home appliances market size reached USD 7,381.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14,218.9 Million by 2034, exhibiting a growth rate (CAGR) of 7.18% during 2026-2034. The rising disposable income in Egypt, rapid urbanization and housing development, recent technological developments, changing consumer lifestyles, and imposition of various government initiatives and subsidies to improve the living standards of its citizens are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 7,381.5 Million |

|

Market Forecast in 2034

|

USD 14,218.9 Million |

| Market Growth Rate 2026-2034 | 7.18% |

Access the full market insights report Request Sample

Home Appliances Market Trends:

Rising Disposable Income

The rise in disposable incomes in Egypt is a critical factor driving the growth of the home appliances market. An increasing number of households have access to more financial resources as the nation's economy grows, which they can utilize to raise their standard of living. With more money available to them, customers may now invest in contemporary, energy-efficient household appliances that were previously out of reach thanks to this increase in disposable income. This financial uplift allows consumers to prioritize convenience and efficiency in their homes, driving demand for various appliances, like refrigerators, washing machines, air conditioners, and microwaves. Additionally, higher disposable incomes are often associated with increased consumer confidence, which further stimulates spending on household goods.

Urbanization and Housing Development

Rapid urbanization and the surge in housing development projects across Egypt are major contributors to the growth of the home appliances market. The country is transitioning from rural to urban living, necessitating the construction of new housing infrastructure to serve the expanding urban population. This urban expansion leads to the construction of new residential buildings and housing complexes, each requiring a suite of home appliances, such as refrigerators, ovens, washing machines, and air conditioning units, to meet the modern lifestyle needs of their inhabitants. Moreover, urban living often brings with it a higher standard of living and greater expectations for convenience and comfort, which in turn drives the adoption of advanced and smart home appliances.

Technological Advancements

Technological advancements are a key driving force behind the growth of the home appliances market in Egypt. The continuous innovation in appliance technology has led to the development of products that offer greater efficiency, convenience, and user-friendly features, making them highly attractive to consumers. Energy-efficient appliances, for instance, are becoming increasingly popular as they help reduce household energy consumption and lower utility bills, appealing to the environmentally conscious consumer. Additionally, the rise of smart appliances, which can be controlled remotely via smartphones and integrated into smart home systems, is revolutionizing the way people interact with their household devices. These advancements not only enhance the functionality and performance of home appliances but also provide a higher level of comfort and convenience, meeting the evolving needs of modern households.

Egypt Home Appliances Market News:

- In May 2023: Samsung launched its new range of semi-automatic washing machines that come with new features like Dual Magic Filter and Soft Closing Toughened Glass Lid. These features make it an ideal purchase for an effortless laundry experience.

- In March 2023: Haier launched a new line-up of anti-scaling top load washing machines. This new range is powered by Haier’s bionic magic filter and 3D rolling wash technologies and complements modern lifestyle needs making the laundry experience simple and efficient.

Egypt Home Appliances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

To get detailed segment analysis of this market Request Sample

- Major Appliances

- Refrigerators

- Freezers

- Dishwashing Machines

- Washing Machines

- Ovens

- Air Conditioners

- Others

- Small Appliances

- Coffee/Tea Makers

- Food Processors

- Grills and Roasters

- Vacuum Cleaners

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes major appliances (refrigerators, freezers, dishwashing machines, washing machines, ovens, air conditioners, and others) and small appliances (coffee/tea makers, food processors, grills and roasters, vacuum cleaners, and others).

Distribution Channel Insights:

- Multi-brand Stores

- Exclusive Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes multi-brand stores, exclusive stores, online, and others.

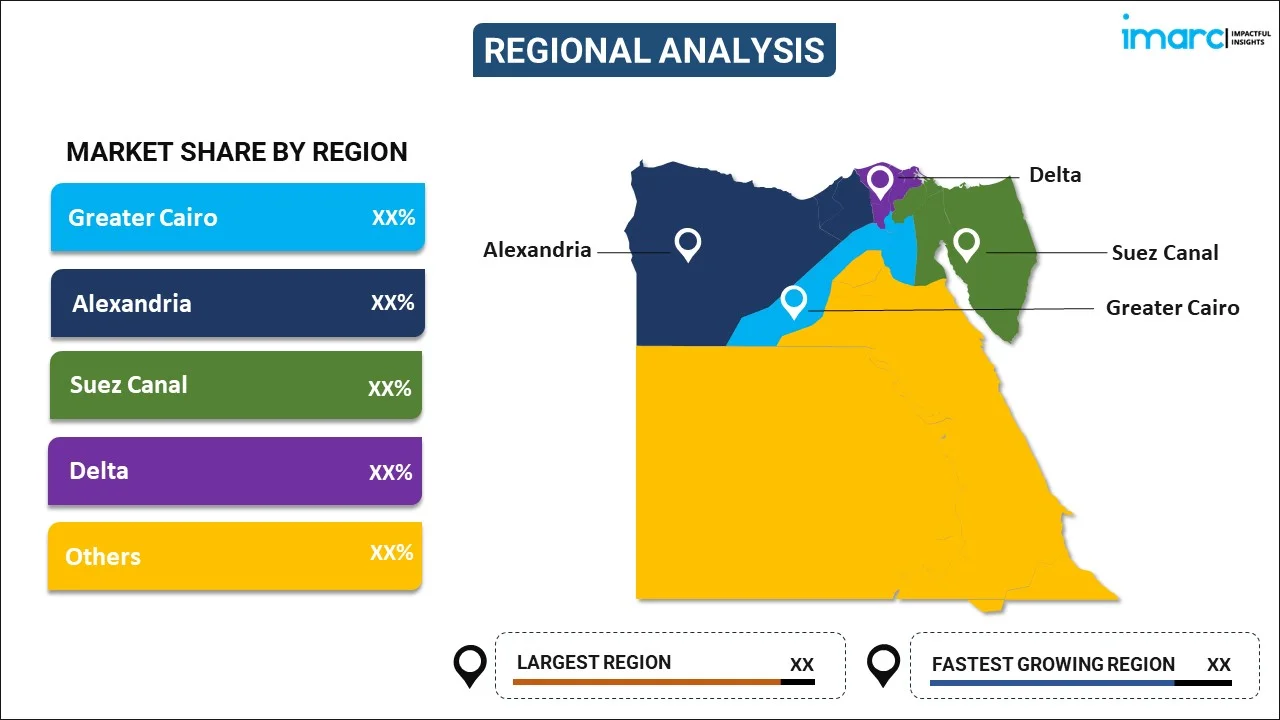

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Home Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Distribution Channels Covered | Multi-brand Stores, Exclusive Stores, Online, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt home appliances market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt home appliances market on the basis of product?

- What is the breakup of the Egypt home appliances market on the basis of distribution channels?

- What are the various stages in the value chain of the Egypt home appliances market?

- What are the key driving factors and challenges in the Egypt home appliances?

- What is the structure of the Egypt home appliances market and who are the key players?

- What is the degree of competition in the Egypt home appliances market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt home appliances market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt home appliances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt home appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)