Egypt Foodservice Market Report by Foodservice Type (Cafes and Bars, Cloud Kitchen, Full Service Restaurants, Quick Service Restaurants), Outlet (Chained Outlets, Independent Outlets), Location (Leisure, Lodging, Retail, Standalone, Travel), and Region 2026-2034

Egypt Foodservice Market Overview:

The Egypt foodservice market size reached USD 12,385.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 40,887.1 Million by 2034, exhibiting a growth rate (CAGR) of 13.48% during 2026-2034. The market is being favored by increasing urbanization, a growing young population base with high disposable income, and an expanding tourism sector. The expansion of international and local food chains, alongside a growing interest in diverse culinary experiences, also significantly contribute to the market's growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 12,385.0 Million |

|

Market Forecast in 2034

|

USD 40,887.1 Million |

| Market Growth Rate 2026-2034 | 13.48% |

Access the full market insights report Request Sample

Egypt Foodservice Market Trends:

Expanding Tourism Sector

The tourism sector represents a key factor propelling the Egypt foodservice market. The market benefits from it because of a continuous and diverse influx of international visitors, leading to a steady demand for varied and quality dining experiences. In the early months of 2024, Egypt's tourism sector saw a promising 6% increase in tourist arrivals compared to the previous year. Minister of Tourism and Antiquities, Ahmed Issa, announced during the 71st Africa Regional Conference of the Airports Council International, ambitious targets to boost Egypt's global tourism presence as the government aims to increase Egypt's share of global tourism from 1.6% to 1.7% by 2028 and attract 30 million tourists annually, reflecting a 25-30% growth in inbound tourism each year. This strategy follows a notable rise in tourist arrivals in 2023, totaling nearly 15 million, and a 33% increase in Egypt's global tourism share from 2019. Henceforth, this leads to an increase in employment opportunities and accelerates economic growth in related industries. According to a study, the tourism sector is one of the largest employers in Egypt, providing 3.1 million jobs or 9.5% of the total workforce.

Growing Young Population

A rising youth is spearheading the Egypt foodservice market due to varied demographics. According to UNICEF, Egypt's youthful demographic is expanding quickly. Approximately 17 million adolescents, aged 10-19, make up about 19% of the nation's total population. When combined with the 9 million young adults aged 20-24, these two groups together constitute nearly one-third of Egypt's entire population. Furthermore, the Egyptian youth is more inclined towards experimenting with new cuisines based on social media trends, hence being loyal customers of more cafes and restaurants. This demographic shift accelerates the growth of quick-service and casual dining establishments, as well as a thriving café culture, which are tailored to meet the social and convenience-oriented dining preferences of the younger population. Consequently, foodservice providers are focusing on innovative, fast, and dynamic offerings to attract this vital segment. According to industry reports, the number of quick-service restaurants (QSRs) rose from 17,626 to 18,324 between 2020 and 2022 in Egypt. This increase is attributed to the expansion of international fast-food brands through both company-operated and franchised stores, which enhances their presence in the country. Major global brands like KFC, Buffalo Burger, and Domino’s Pizza predominantly operate through franchised outlets. For example, by 2022, KFC operated 164 restaurants, Buffalo Burger had 45 outlets, and Domino’s Pizza maintained 114 locations, all managed by various franchisees within the nation.

Egypt Foodservice Market News:

- In February 2024, SSP Group, a UK-based foodservice company, secured a new agreement with the Egyptian Airports Company to oversee dining venues in Terminal 1 of Hurghada International Airport. This contract introduces popular brands like KFC, Costa Coffee, Camden Food Co, and Levito Pizza & Pasta to the airport's offerings. These new additions will join the existing lineup of SSP-managed brands at Hurghada International Airport, including Burger King, FloCafe, Coffee Lab, Ritazza, and Upper Crust.

- In September 2023, New Sina, a leading company in the Egyptian beverage sector, unveiled its plans to invest $32.4 million in the expansion of its operations in the first quarter of 2024.

Egypt Foodservice Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on foodservice type, outlet, and location.

Foodservice Type Insights:

To get detailed segment analysis of this market Request Sample

- Cafes and Bars

- By Cuisine

- Bars and Pubs

- Cafes

- Juice/Smoothie/Desserts Bars

- Specialist Coffee and Tea Shops

- By Cuisine

- Cloud Kitchen

- Full Service Restaurants

- By Cuisine

- Asian

- European

- Latin American

- Middle Eastern

- North American

- Others

- By Cuisine

- Quick Service Restaurants

- By Cuisine

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

- By Cuisine

The report has provided a detailed breakup and analysis of the market based on the foodservice type. This includes cafes and bars (bars and pubs, cafes, juice/smoothie/desserts bars, and specialist coffee and tea shops), cloud kitchen, full service restaurants (asian, european, latin american, middle eastern, north american, and others), and quick service restaurants (bakeries, burger, ice cream, meat-based cuisines, pizza, and others).

Outlet Insights:

- Chained Outlets

- Independent Outlets

A detailed breakup and analysis of the market based on the outlet have also been provided in the report. This includes chained outlets and independent outlets.

Location Insights:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

The report has provided a detailed breakup and analysis of the market based on the location. This includes leisure, lodging, retail, standalone, and travel.

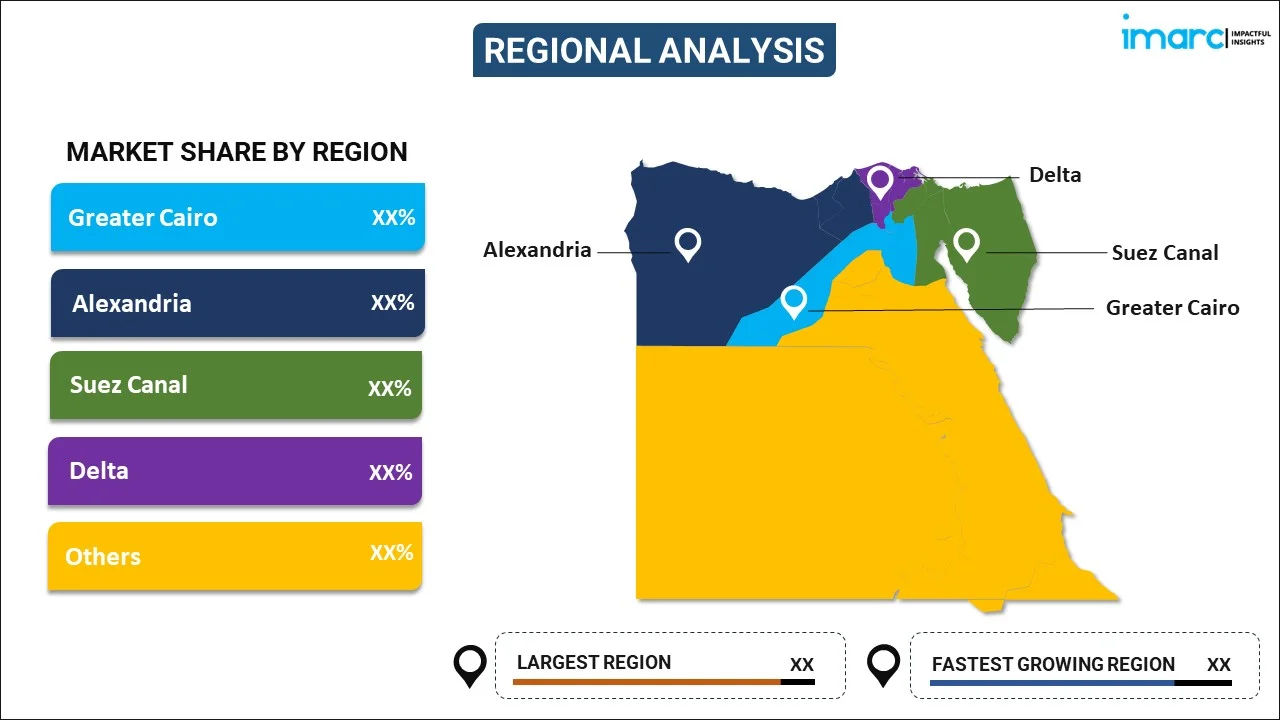

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Foodservice Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Foodservice Types Covered |

|

| Outlets Covered | Chained Outlets, Independent Outlets |

| Locations Covered | Leisure, Lodging, Retail, Standalone, Travel |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt foodservice market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt foodservice market on the basis of foodservice type?

- What is the breakup of the Egypt foodservice market on the basis of outlet?

- What is the breakup of the Egypt foodservice market on the basis of location?

- What are the various stages in the value chain of the Egypt foodservice market?

- What are the key driving factors and challenges in the Egypt foodservice?

- What is the structure of the Egypt foodservice market and who are the key players?

- What is the degree of competition in the Egypt foodservice market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt foodservice market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt foodservice market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt foodservice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)