Egypt Facility Management Market Report by Type (Inhouse, Outsourced), Offering (Hard FM, Soft FM), End User (Commercial, Institutional, Public/Infrastructure, Industrial, and Others), and Region 2025-2033

Egypt Facility Management Market Overview:

The Egypt facility management market size reached USD 2.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.1 Billion by 2033, exhibiting a growth rate (CAGR) of 6.37% during 2025-2033. The growth of the construction sector, development of real estate, and the increasing emphasis on sustainability and energy efficiency represents some of the key factors driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Market Growth Rate (2025-2033) | 6.37% |

Egypt Facility Management Market Trends:

Growing Construction and Real Estate Development

The expansion of the Egypt facility management market is largely attributed to the rising construction and real estate industries. In November 2022, DM Development signed an MoU with Apleona GMBH to establish the first destination for recreational medical tourism in Egypt, with investments estimated at EGP 300 million. Through this partnership, Apleona provides specialized services at The Grove Resort (Ain Sokhna-Al-Galala) and established the first health destination, with a private hotel attached to it, to meet the demands of people visiting the resort. As new buildings are constructed to accommodate modern scrapers and the government increases investment in infrastructure development, there is a growing need for comprehensive facility management services. Modern architectural constructions, including new houses, offices, and production buildings, require consistent care, protection, and administrative services to be sustainable and effective. This demand is only increasing with the growth of smart buildings and interconnected facilities, which necessitates comprehensive facility management to coordinate these technologies effectively. Besides, this construction boom also leads to immediate demand and long-term business prospects for facility management providers in Egypt.

Increasing Emphasis on Sustainability and Energy Efficiency

Another significant factor contributing to the growth of the facility management market in Egypt is the increased emphasis on sustainability and energy conservation initiatives. Cairo Facility Management (CFM) have integrated sustainable plastic solutions to reduce greenhouse gas emissions. They also announced that the Science Based Targets initiative has approved their net-zero science-based target by 2046. The awareness among organizations and property owners about sustainability and its benefits for both the environment and cost savings has been increasing. There is a high demand for energy and waste management solutions, as well as services geared towards obtaining green building certifications. This shift is supported by government regulations and international standards that promote environmentally friendly operations. Companies are increasingly focusing on corporate social responsibility and reducing operational costs. Improvements in facility management services, with a strong focus on sustainability and energy efficiency, have played a significant role in driving the growth of the facility management market.

Egypt Facility Management Market News:

- In November 2023, EFS Facilities Services, a leading global provider of comprehensive facilities management solutions, announced a significant milestone in its financial performance, securing over AED 1.5 billion worth of flagship projects in 2023. This remarkable achievement reflects the company’s unwavering commitment to excellence, client retention, and strategic expansion.

Egypt Facility Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on type, offering, and end user.

Type Insights:

- Inhouse

- Outsourced

- Single FM

- Bundled FM

- Integrated FM

The report has provided a detailed breakup and analysis of the market based on the type. This includes inhouse and outsourced (single FM, bundled FM, and integrated FM).

Offering Insights:

- Hard FM

- Soft FM

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes hard FM and soft FM.

End User Insights:

- Commercial

- Institutional

- Public/Infrastructure

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes commercial, institutional, public/infrastructure, industrial and others.

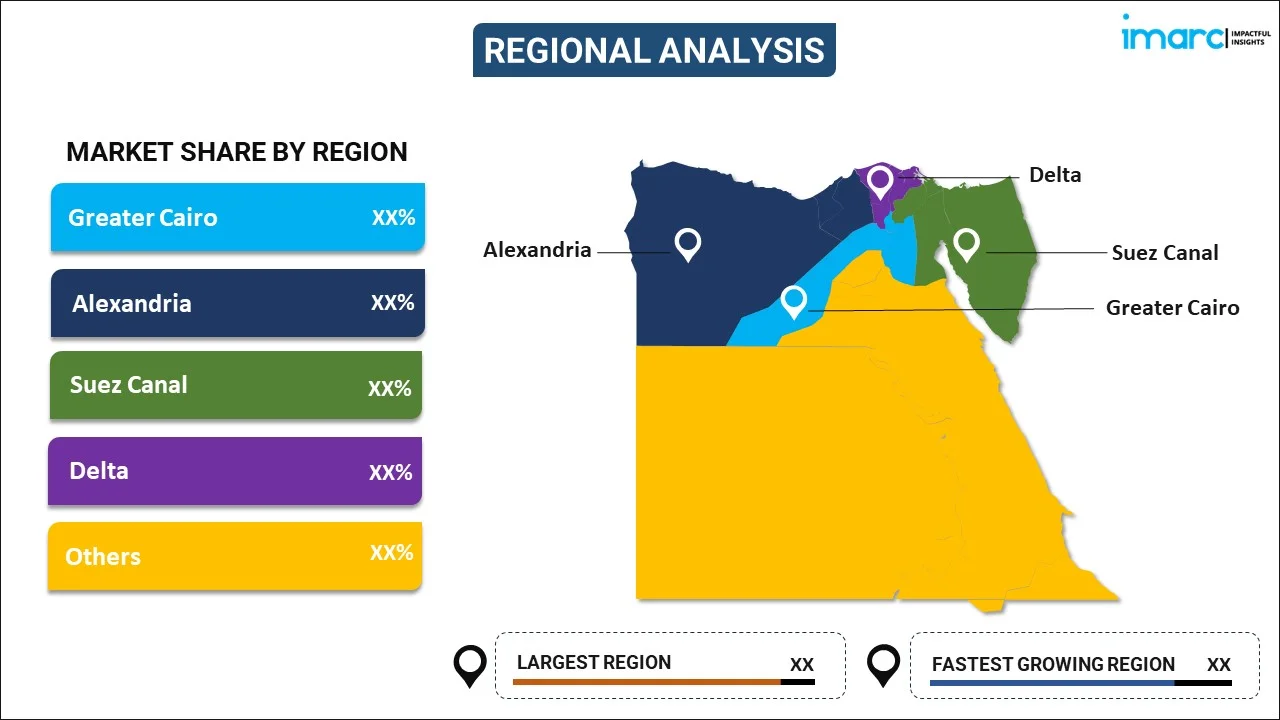

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Facility Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Offerings Covered | Hard FM, Soft FM |

| End Users Covered | Commercial, Institutional, Public/Infrastructure, Industrial, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt facility management market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Egypt facility management market?

- What is the breakup of the Egypt facility management market on the basis of type?

- What is the breakup of the Egypt facility management market on the basis of offering?

- What is the breakup of the Egypt facility management market on the basis of end user?

- What are the various stages in the value chain of the Egypt facility management market?

- What are the key driving factors and challenges in the Egypt facility management?

- What is the structure of the Egypt facility management market and who are the key players?

- What is the degree of competition in the Egypt facility management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt facility management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt facility management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt facility management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)