Egypt Data Center Market Size, Share, Trends and Forecast by Component, Type, Enterprise Size, End User, and Region, 2025-2033

Egypt Data Center Market Size and Share:

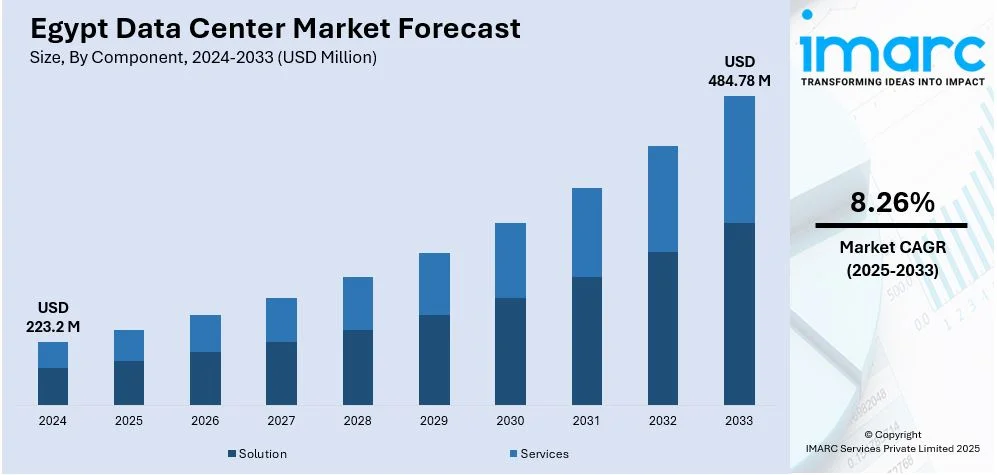

The Egypt data center market size was valued at USD 223.2 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 484.78 Million by 2033, exhibiting a CAGR of 8.26% from 2025-2033. The market is expanding rapidly driven by digital transformation, cloud adoption, and advancements in connectivity. Strategic initiatives like "Digital Egypt" and investments in hyperscale and colocation facilities are fostering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 223.2 Million |

|

Market Forecast in 2033

|

USD 484.78 Million |

| Market Growth Rate (2025-2033) | 8.26% |

The Egypt data center market growth is primarily driven by growing digital transformation initiatives across industries along with government programs such as "Digital Egypt" to enhance IT infrastructure and connectivity. Cloud adoption, big data analytics, and IoT applications are boosting the demand for modern data center facilities. Rapid urbanization and the growth of a tech-savvy population accelerate digital consumption and require advanced infrastructure. Strong investments by global and local players in colocation and hyperscale facilities also support market growth. For instance, in December 2024, Africa50 announced an investment of USD15 million in Raya Data Center to enhance operations and establish a new tier III facility in Egypt. This partnership intends to boost the digital economy and startup ecosystem aligning with efforts for sustainable development and renewable energy transition in the region's growing data center market.

Another significant driver is Egypt's strategic location as a connectivity hub linking Europe, Africa, and the Middle East. This geographical advantage supports the deployment of submarine cables improving data transmission capabilities and attracting global cloud service providers. In addition to this, positive government policies, tax incentives and programs to encourage the use of renewable energy in data centers are also fostering sustainable growth. For instance, in December 2023, the UAE and Egypt announced the signing of a Memorandum of Understanding (MoU) to invest in Egypt's digital infrastructure aiming for 1GW of data center capacity. The initial phase will develop 100MW supporting Egypt's Digital Egypt initiative. Expansion of 5G networks and the rising enterprise demand for secure and scalable IT infrastructure are other important factors for market expansion.

Egypt Data Center Market Trends:

Expansion of Cloud Services

Expansion of cloud services in Egypt is the biggest driver of the data center market where most enterprises and government entities are shifting towards cloud platforms for efficiency and scalability. This trend is fueled by the growing need for flexible IT infrastructure to support digital transformation initiatives including "Digital Egypt." Cloud adoption is particularly prominent in sectors like banking, education and healthcare which require robust data storage and real-time processing capabilities. Global cloud providers are partnering and investing in local data centers to ensure low-latency services and compliance with data sovereignty regulations further accelerating Egypt data center market growth. For instance, in November 2024, Huawei Cloud launched Flexus in Cairo a new suite of cloud services tailored for Egyptian businesses. Aimed at enhancing digital transformation Flexus offers high-performance, scalable and cost-effective solutions. The launch emphasizes collaboration with local partners and introduces the Pioneer Experience Program to accelerate cloud adoption across various industries.

Rising Investment in Hyperscale Facilities

Investments in hyperscale facilities are forwarding the Egypt data center market growth regionally as global players establish large-scale infrastructure to meet the growing regional demand for data processing and storage. Hyperscale facilities with their enormous capacity and advanced technologies are a prerequisite for supporting cloud services, big data analytics and AI-driven applications. For instance, in November 2023, Egypt announced its plans to establish its first hyperscale data centre through a partnership between Khazna Data Centers and Benya Group with over $250 million investment. The facility aims to enhance AI development and support businesses in expanding globally bolstering the nation's digital infrastructure. Companies are investing in such facilities attracted by Egypt's strategic location as a connectivity hub. These developments cater to enterprises requiring high-performance infrastructure while enabling cost efficiencies. Hyperscale facilities are also driving innovation and further enhancing Egypt's position as a regional leader in data center services.

Growing Shift Towards Green Data Centers

The move towards green data centers in Egypt is a reflection of the growing commitment to sustainability in the digital infrastructure sector. Data centers are embracing renewable energy sources such as solar and wind to power operations, reducing carbon footprints and energy costs. Energy-efficient technologies including advanced cooling systems, virtualization and optimized power management are being integrated to minimize environmental impact. Government policies and incentives promoting green practices further encourage this transition. For instance, in September 2024, the Egyptian government announced plans for a renewable-powered data center to enhance digital sovereignty and support a goal of $9 billion in digital services exports by 2026. Companies are moving toward sustainable solutions in line with global environmental standards and corporate social responsibility goals. Such efforts will not only help in saving costs in terms of operations but also increase Egypt's appeal as a sustainable technology hub.

Egypt Data Center Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Egypt data center market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, type, enterprise size, and end user.

Analysis by Component:

- Solution

- Services

The solution segment in Egypt's data center market comprises hardware, software, and infrastructure necessary for data storage, processing and management. Key components include servers, storage systems, networking equipment and cooling systems supporting the growing demand for robust digital infrastructure. Advancements in technologies like AI, cloud computing and virtualization drive investments in scalable high-performance solutions. As enterprises digitize and approach cloud services, solution providers are focusing on efficiency, reliability and cost-effectiveness to ensure that each business operation is optimized while working seamlessly across diverse industries.

The services segment is expected to hold significant Egypt data center market share. It includes consulting, integration, managed services and maintenance which are critical to supporting data center operations in Egypt. These services ensure smooth deployment, scalability and ongoing optimization of data center infrastructure. Providers assist in designing tailored solutions integrating with existing IT systems and offering training for workforce readiness. Managed services help enterprises outsource operations enabling focus on core business activities. With the growth in cloud adoption and digital transformation initiatives demand for professional services is increasing to enhance efficiency and ensure continuous availability.

Analysis by Type:

- Colocation

- Hyperscale

- Edge

- Others

The colocation segment in Egypt's data center market provides shared infrastructure solutions enabling organizations to rent space, power and cooling while managing their own hardware. This model is cost-effective for organizations seeking reliable facilities without high capital investments. As demand for scalability and security increases colocation providers are focusing on enhanced connectivity, redundant systems and compliance with data regulations making it a preferred choice for enterprises and SMEs in the region.

Hyperscale data centers in Egypt cater to massive data processing and storage needs which are driven by cloud service providers and tech giants. These facilities provide immense scalability, energy efficiency and advanced infrastructure to support high-demand applications like AI, IoT and big data. Investments by global and regional players underline the market's potential and hyperscale centers enable enterprises to handle rapid digital growth while aligning with Egypt's vision for technological leadership.

The Edge data centers in Egypt help in the need for low-latency processing by bringing data closer to end users. Smaller and decentralized facilities are important for real-time applications like IoT, autonomous systems and streaming services. With the growth of 5G networks and demand for localized processing edge data centers play a vital role in enhancing speed reducing bandwidth usage and enhancing user experience thus being an important part of Egypt's evolving digital landscape.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises in Egypt's data center market require extensive infrastructure to support vast amounts of data and complex IT operations. These organizations demand solutions to support big data, AI and cloud applications with high performance, scalability and security. Data centers and colocation facilities are typical investments for these large enterprises in order to work efficiently and comply with regulations. As digital transformation accelerates across sectors such as banking, telecommunications and healthcare it is large enterprises that lead to significant demand for robust customized data center services to maintain a competitive advantage.

SMEs in Egypt are increasingly embracing data center services to support their growing digital needs without heavy capital investment. Colocation and managed services are the most popular among SMEs as they offer cost-effective access to reliable IT infrastructure. Cloud-based solutions enable scalability and flexibility helping businesses manage operations efficiently. As SMEs embrace ecommerce, digital payment systems and remote working their reliance on data centers grows fostering demand for tailored, affordable and secure data solutions in Egypt's expanding market.

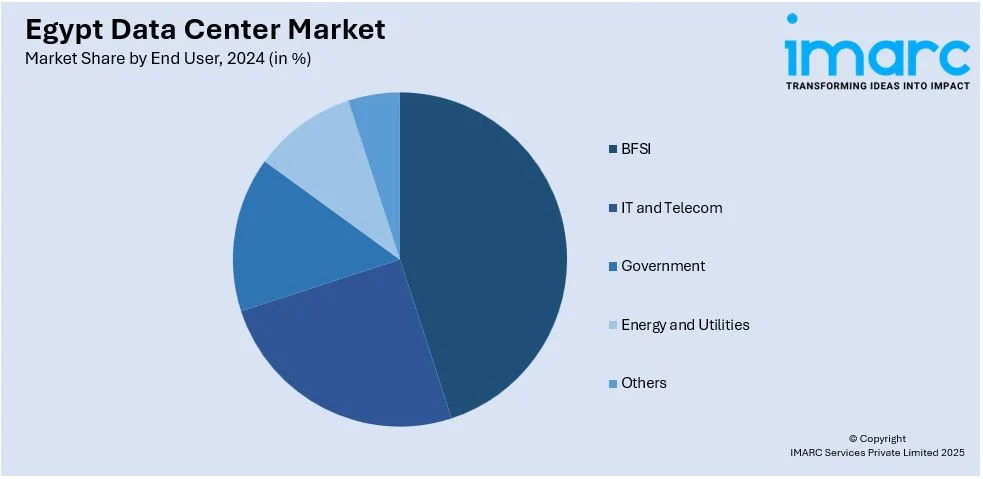

Analysis by End User:

- BFSI

- IT and Telecom

- Government

- Energy and Utilities

- Others

BFSI in Egypt's data center market requires secure and scalable infrastructure for digital banking, financial transactions and data storage. Data centers provide high availability, disaster recovery and regulatory compliance. BFSI organizations are increasingly investing in advanced solutions and colocation services with the rising adoption of mobile banking, fintech applications and AI-driven analytics to enhance operational efficiency and deliver seamless secure digital experiences to customers.

This sector of IT and telecom in Egypt forms a significant demand for data centers to support cloud computing, 5G networks as well as IoT applications. Data centers allow for seamless connectivity, low latency in services and scalable infrastructure to meet the needs of rapidly growing digital services. As the telecom operators expand the high-speed communication and data-intensive technologies through 5G and broadband networks investments into colocation facilities and hyperscale facilities rise as an infrastructure booster.

The Egyptian government is making use of data centers to enable its digital transformation agenda especially the "Digital Egypt" initiative. Data centers increase e-governance, delivery of public services and national security through safe and scalable infrastructure. The government is collaborating with private players to guarantee the implementation of efficient and resilient data centers which support the diversification of the economy and enhance citizen services.

The energy and utilities sector in Egypt uses data centers to power smart grids, renewable energy projects and IoT-based monitoring systems. Data centers provide real-time data analysis, operational automation and secure storage for critical infrastructure data. Growing investments in reliable and sustainable data center solutions help the sector adopt AI and big data analytics ensuring no disruption in the operations and supporting Egypt's goal of energy diversification.

Regional Analysis:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

Greater Cairo is the largest data center market in Egypt driven by its role as the country’s economic and technological hub. It hosts numerous colocation, hyperscale and enterprise facilities supported by strong connectivity infrastructure. Proximity to businesses, financial institutions and government offices enhances its appeal. Major investments in smart city projects and digital transformation initiatives position Greater Cairo as a critical hub for data center expansion and innovation in Egypt.

Alexandria's strategic location along the Mediterranean supports its growing data center market bolstered by submarine cable connectivity and a thriving logistics industry. The region is emerging as a key player in hosting cloud and colocation facilities to serve businesses in trade, tourism and technology sectors. As digital adoption grows Alexandria’s role in supporting regional data processing needs is expanding attracting investments in scalable and energy-efficient data center solutions.

The Suez Canal region benefits from its global connectivity and strategic importance for international trade making it a promising area for data center development. The region’s infrastructure supports hyperscale and colocation facilities catering to logistics, maritime and energy industries. Investments in submarine cables and smart city projects are driving demand for data storage and processing positioning Suez Canal as a vital hub in Egypt’s expanding digital ecosystem.

The Delta region is an emerging data center market in Egypt driven by its growing industrial and agricultural activities. It offers opportunities for colocation and edge data centers to support local businesses and government operations. Investments in connectivity and renewable energy infrastructure are enhancing the region’s appeal for sustainable data center development. Delta’s focus on digital transformation and economic diversification is creating a demand for scalable and efficient IT solutions.

Competitive Landscape:

The Egypt data center market is characterized by increasing competition among global and local players driven by rising demand for scalable, secure and energy-efficient infrastructure. Companies are investing in hyperscale and colocation facilities to cater to growing needs from sectors such as BFSI, IT, telecom and government. The market sees significant activity in enhancing connectivity through submarine cables and expanding edge data centers to support low-latency applications. Emphasis on sustainability is prompting investments in green data centers powered by renewable energy and energy-efficient technologies. Strategic partnerships, innovation in cloud and AI-driven solutions and adherence to regulatory requirements are key competitive strategies. This dynamic landscape reflects Egypt's rapid digital transformation and its emergence as a regional technology hub.

The report provides a comprehensive analysis of the competitive landscape in the Egypt data center market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, Intro Technology and Oman Data Park signed a $450 million MoU to develop the Kemet Data Center in Egypt's Suez Canal Economic Zone. Spanning 80,000 sqm the facility will focus on cloud solutions and digital transformation partially utilizing solar energy enhancing the region's infrastructure and global connectivity.

- In November 2024, Egypt’s Prime Minister met with INTRO Holding to discuss the Kemet Data Centre in the Suez Canal Economic Zone, following the signing of a land contract. This $1 billion project aims to enhance Egypt's cloud computing capabilities, promote digital transformation and export services using renewable energy. The completion of the project is targeted for 2030.

- In April 2024, Egypt inaugurated its first government data and cloud computing centre enhancing its IT infrastructure. President emphasized the importance of this facility for centralized data management and disaster recovery promoting AI integration in government operations.

- In January 2024, the Egyptian government announced its plans to establish a green data center utilizing 200 MW of solar and wind energy through a partnership with INCOME, Record Digital Asset Ventures and SIC Investment. The project will unfold in two phases within private free zones, demonstrating the country's commitment to renewable energy and local industry growth.

Egypt Data Center Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Types Covered | Colocation, Hyperscale, Edge, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Users Covered | BFSI, IT And Telecom, Government, Energy and Utilities, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt data center market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Egypt data center market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt data center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Egypt market was valued at USD 223.2 Million in 2024.

The market is driven by digital transformation initiatives, cloud adoption, growing data consumption, strategic investments in hyperscale and colocation facilities, and advancements in 5G and connectivity infrastructure.

IMARC estimates the Egypt data center market to reach USD 484.78 Million by 2033, exhibiting a CAGR of 8.26% from 2025-2033

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)