Egypt Commercial Real Estate Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Egypt Commercial Real Estate Market Size and Share:

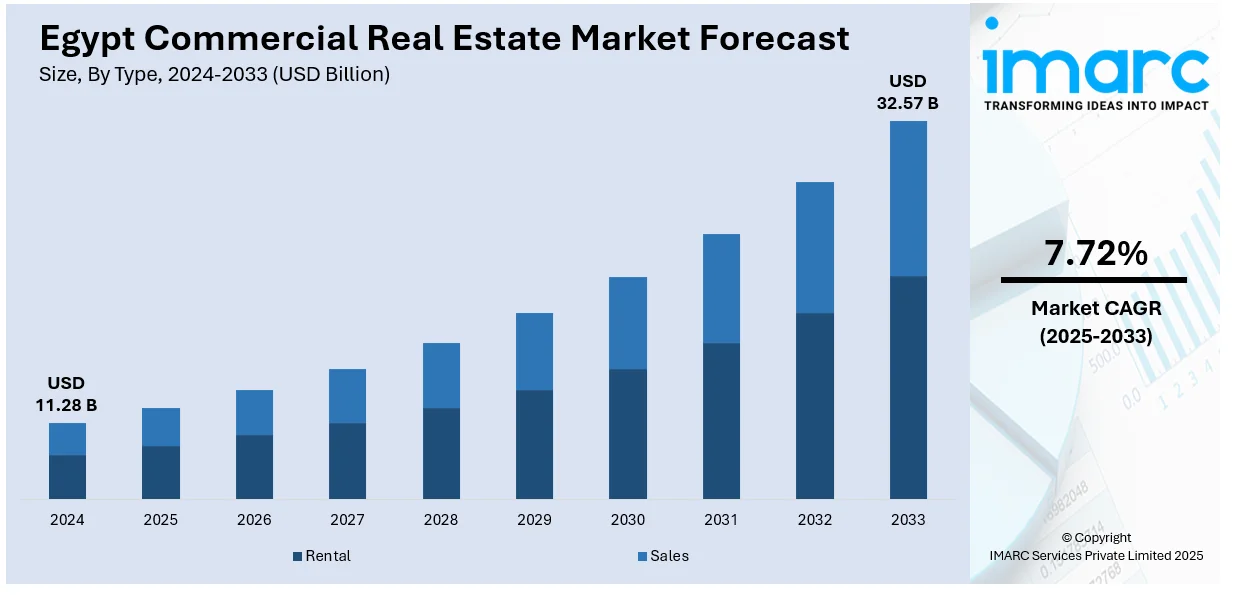

The Egypt commercial real estate market size was valued at USD 11.28 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 32.57 Billion by 2033, exhibiting a CAGR of 7.72% during 2025-2033. Greater Cairo currently dominates the market, holding a significant market share of over 56.9% in 2024. The market is driven by the demand for office and retail space, supported by the growth of businesses and retail chain operations in Egypt. The supportive government initiatives and infrastructure investments, including new cities and transport initiatives, is also promoting the development of the market. Moreover, increased foreign investments and the introduction of pro-business policies are constantly attracting international developers, which is a major factor expanding the Egypt commercial real estate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.28 Billion |

| Market Forecast in 2033 | USD 32.57 Billion |

| Market Growth Rate (2025-2033) | 7.72% |

The market is propelled by economic growth, as the country's improving GDP and rising income levels fuel demand for commercial spaces. Moreover, the country's strategic location, connecting Africa and the Middle East, attracts foreign investments and multinational corporations looking for a base in the region. The development of the infrastructure, such as the major transportation and urban developments, improves the accessibility and popularity of different commercial areas. According to the report by the Minister of Investment and Foreign Trade on September 24, 2024, Egypt has invested USD 300 Billion in the country's infrastructure over the past decade. Also, the urbanization of cities such as Cairo and Alexandria also contribute to the expansion of the market as companies look for places to provide services to expanding customer bases.

In addition to this, Egypt's favorable real estate laws and incentives, such as tax breaks for developers and investors, encourage investment in the market. Furthermore, the government's interest in new administrative capital schemes and smart city development fosters a shift in commercial real estate investments, diversifying the market. According to industry reports, the rate of incoming visitors in Egypt has increased by 59.6%, from 9.9 million in 2014 to 15.8 million in 2024. Besides, the nation aims to welcome 30 million tourists by 2032. This growth in the tourism sector has resulted in a heightened need for hotels and office spaces, which is driving market growth. The growth in digital infrastructure and online shopping also fuels demand for warehouses and logistics space.

Egypt Commercial Real Estate Market Trends:

Rise of Smart and Sustainable Commercial Spaces

The market is shifting towards smart and sustainable buildings, driven by government policies, investor demand, and corporate sustainability goals. Developers are integrating eco-friendly designs, solar energy systems, and water reuse technologies to minimize environmental footprint and lower operational expenses. Moreover, LEED-certified office buildings and eco-friendly retail spaces are gaining popularity, which is acting as a crucial growth-inducing factor. Businesses are prioritizing green certifications to enhance brand reputation and attract eco-conscious tenants. For instance, in February 2025, Earth Development launched operations in Egypt, planning to invest EGP 30 Billion (about USD 596.7 Million) in sustainable and innovative real estate projects. This is favorably contributing to the Egypt commercial real estate market growth. Furthermore, this trend aligns with the country's Vision 2030 initiative, emphasizing sustainability and modern infrastructure in urban development.

Increasing Foreign Direct Investment (FDI) in Commercial Real Estate

The market is attracting strong foreign investment, driven by economic reforms, infrastructure projects, and incentives for international developers. The government has eased ownership regulations for foreign investors, encouraging large-scale projects in business districts, retail centers, and logistics parks. The New Administrative Capital is a focal point for global investors, offering state-of-the-art commercial spaces and smart city infrastructure. Demand from Gulf investors, European firms, and multinational corporations is rising, further fueling market expansion. For instance, according to industry reports, it was estimated that GCC investments in Egypt's real estate sector reached USD 115 Billion in 2023. In line with this, approximately 60% of GCC nationals’ own property, and 94% of wealthy investors plan to expand their real estate holdings in Egypt. Besides this, the country's strategic location and economic policies further enhances the Egypt commercial real estate market outlook.

Expansion of Logistics and Industrial Real Estate

The rapid growth of e-commerce and manufacturing sectors is driving demand for logistics hubs, warehouses, and industrial parks in Egypt. For instance, as per industry reports, in 2024, Egypt's e-commerce sector played a role in the global expansion rate of 7.6%. Additionally, retailers, online platforms, and multinational companies are investing in distribution centers and fulfillment hubs near major cities like Cairo, Alexandria, and Suez to optimize supply chains. The government's focus on special economic zones (SEZs) and improved transport infrastructure supports this trend, making industrial real estate a lucrative sector. Developers are constructing modern, high-tech warehouses with automated storage solutions, catering to the increasing demand for efficient, scalable logistics facilities across Egypt's growing commercial landscape.

Egypt Commercial Real Estate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Egypt commercial real estate market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and end use.

Analysis by Type:

- Rental

- Sales

Rental leads the market with around 74.3% of market share in 2024. As the country's economy grows and demand for business space rises, rental properties are available to a diverse range of businesses, from retail premises to office buildings and warehouses. Rental is flexible and provides lower capital outlay than outright ownership, making it a desirable choice for businesses. Investors view rental properties as a reliable source of income, with high demand in city centers such as Cairo and Alexandria. The nation's increasing infrastructure development also drives the growth of the market, attracting both domestic and international companies. Egypt's geographical position in the MENA region also adds to its attractiveness, making rental premises a foremost asset for companies establishing regional offices. As a result, the segment remains a crucial for both businesses and investors in Egypt's commercial real estate landscape.

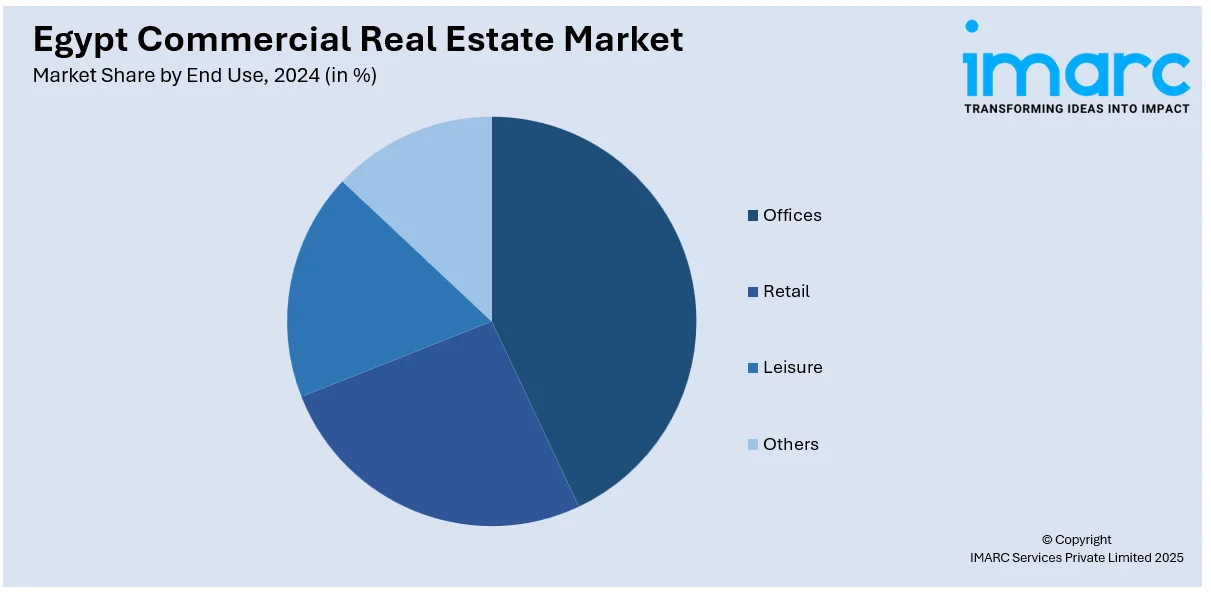

Analysis by End Use:

- Offices

- Retail

- Leisure

- Others

Offices leads the market with around 43.2% of market share in 2024. With Egypt's economy still growing, demand for offices, especially in metropolitan areas such as Cairo, is increasing. The growth of both local and foreign companies establishing business has fueled the demand for new, adaptive office space. Due to Egypt's location at the center of the MENA region, several international companies see the country as a strategic hub for regional operations, which is fueling the market demand. Further, the growth of coworking spaces and the shift towards more flexible work environments has introduced diversity in office offerings, serving startups and small enterprises. Investors view offices as a secure source of income, particularly with Egypt's economic reforms and infrastructure development attracting more companies. As the market continues to evolve, the office segment stands as an integral part of the market.

Regional Analysis:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

In 2024, Greater Cairo accounted for the largest market share of over 56.9%. The region encompasses Cairo, Giza, and surrounding areas, where most of the nation's commercial activity takes place. With its dense population, strategic location, and developed infrastructure, the region attracts local and international businesses looking for office, retail, and industrial spaces. The region's central business districts, such as Downtown Cairo and New Cairo, offer prime locations for offices, while suburban areas like 6th of October and Sheikh Zayed are emerging as key areas for mixed-use developments and industrial parks. The demand for commercial properties in Greater Cairo is fueled by economic growth, urban expansion, and government-led infrastructure projects like the New Administrative Capital. As the region continues to grow, it remains the focal point of commercial real estate investments in the country, offering opportunities across various sectors.

Competitive Landscape:

The market in Egypt is very competitive, propelled by both local and international developers, massive government investments, and increasing foreign projects. For instance, in December 2024, the Egyptian government announced its plan to launch the Green Industry Program in the first quarter of 2025. This green initiative will provide USD 281.44 Million in funding to support the industrial sector. With the growing focus on economic reforms and infrastructure development, office spaces, retail hubs, and logistics centers have gained momentum. Apart from this, while large-scale developments dominate, smaller players are focusing on niche segments to meet specific demands, such as eco-friendly buildings and flexible office spaces. According to the Egypt commercial real estate market forecast, the growth in e-commerce will lead to increased requirements for state-of-the-art manufacturing and distribution hubs in key regions across Egypt. This, in turn, will contribute to the market development. Furthermore, developers are keen on positioning themselves differently through sustainability, smart buildings, and mixed-use developments.

The report provides a comprehensive analysis of the competitive landscape in the Egypt commercial real estate with detailed profiles of all major companies.

- Amer Group

- Orascom Construction PLC

- Palm Hills Developments

- The Arab Contractors

- Talaat Moustafa Group

- Secon Egypt

- Dorra Group

- Emaar Properties

- Hassan Allam Holding

- Rowad Modern Engineering

Latest News and Developments:

- May 2025: Valero Developments achieved a swift sell-out of the first phase of its CITALIA project in New Obour City within just two days, generating EGP 500 million in sales. Spanning 13 acres, the development integrates residential units with a commercial section designed to serve both residents and the broader community, highlighting strong demand in Egypt’s commercial real estate sector.

- March 2025: The Abu Dhabi Fund for Development (ADFD) laid the groundwork for the Sofitel Legend Pyramids Giza, a USD 120 million hospitality project in Egypt. The Sofitel Legend Pyramids Giza is a five-star hotel with 302 luxurious rooms featuring the latest amenities. The hotel will also feature a number of foreign dining options and entertainment venues, marking the property as an international destination for luxurious services.

- March 2025: Cairo-based Al Ismaelia for Real Estate Investment announced that it will commit an investment of USD 5.93 million in property development across Egypt in 2025. This move is part of Al Ismaelia’s 2025 strategy of expansion. The company is also focusing on the development of two boutique hotels that will be operational by the end of 2026 as part of its ongoing efforts to grow its hospitality industry.

- January 2025: Egyptian prop-tech company Nawy announced the acquisition of property management star-tup ROA, launching "Nawy Unlocked" to transform underutilized or unfinished properties into income-generating assets. The service offers property finishing, furnishing, and rental management, with financing options covering up to 50% of finishing costs, aiming to streamline property monetization for owners.

- December 2024: LMD Egypt announced the launch of a 150-feddan project in New Zayed, Sheikh Zayed City, scheduled for early 2025. The development, located near Sphinx International Airport, will feature residential, hotel, commercial, and recreational spaces, with an EGP 10 billion investment.

- December 2024: Emtelaak partnered with Uptown 6 October to enter the Egyptian market, introducing a new approach to property investment. This collaboration allows individual investors to purchase shares in commercial, residential, and administrative projects, expanding access to Egypt’s real estate market.

Egypt Commercial Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rental, Sales |

| End Uses Covered | Offices, Retail, Leisure, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Companies Covered | Amer Group, Orascom Construction PLC, Palm Hills Developments, The Arab Contractors, Talaat Moustafa Group, Secon Egypt, Dorra Group, Emaar Properties, Hassan Allam Holding, Rowad Modern Engineering, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt commercial real estate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Egypt commercial real estate market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt commercial real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial real estate market in Egypt was valued at USD 11.28 Billion in 2024.

The growth of the Egypt commercial real estate market is driven by the rapid urbanization, increasing demand for office and retail spaces, and significant infrastructure investments. The government's focus on economic reforms, improved business environment, and real estate developments, such as new cities and industrial zones, has attracted both local and international investors, further facilitating market growth.

The commercial real estate market in Egypt is projected to exhibit a CAGR of 7.72% during 2025-2033, reaching a value of USD 32.57 Billion by 2033.

Rental account for the largest share of the Egypt commercial real estate market type. This segment's dominance is driven by the growing demand for flexible and cost-effective leasing options, particularly among businesses seeking short-term commitments in a dynamic market. Rental properties, especially in key urban areas, provide greater accessibility and lower entry costs for tenants.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)