Egypt Cold Chain Logistics Market Report by Type (Refrigerated Warehouses, Refrigerated Transportation), Application (Fruits and Vegetables, Bakery and Confectionary, Dairy and Frozen Desserts, Meat, Fish, and Sea Food, Drugs and Pharmaceuticals, and Others), and Region 2026-2034

Egypt Cold Chain Logistics Market Overview:

The Egypt cold chain logistics market size reached USD 1,143.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,074.1 Million by 2034, exhibiting a growth rate (CAGR) of 11.03% during 2026-2034. The market is primarily driven by the significant growth of the Suez Canal, significant government investments in logistics infrastructure, and initiatives promoting food security emphasizing the importance of efficient cold chain logistics in reducing post-harvest losses and enhancing supply chain efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,143.8 Million |

|

Market Forecast in 2034

|

USD 3,074.1 Million |

| Market Growth Rate 2026-2034 | 11.03% |

Access the full market insights report Request Sample

Egypt Cold Chain Logistics Market Trends:

Suez Canal Expansion

The Suez Canal's influence on Egypt's cold chain sector is multidimensional. Additionally, the Suez Canal's smooth functioning makes it easier to import and export perishable items like fruits, vegetables, and seafood, critical components of the cold chain. The canal's rapid passage guarantees that these items get to their destinations on time, reducing spoiling risk and ensuring quality. The Suez Canal is critical to global marine operations, and its performance in the fiscal year 2022-2023 emphasizes this importance, with record revenues of $9.4 billion. On June 21, 2023, Osama Rabie, Chairman of the Suez Canal Authority (SCA), reported that the Suez Canal's income increased by 35% in the fiscal year 2022-2023, reaching $9.4 billion, up from $7 billion the previous year. He also disclosed intentions for the SCA to list a 20% interest in Canal Rope on the Egyptian Exchange (EGX) as part of Egypt's government IPO program. Furthermore, Egypt's strategic location along the Suez Canal makes it an excellent center for cold chain logistics activities. Besides, companies in the cold chain industry benefit from the canal's closeness to key markets in Europe, Asia, and Africa by establishing distribution hubs and transportation networks. Thus, this strengthens Egypt's position as a regional hub for cold chain services and attracts investment across the region.

Government Investments in Logistics Infrastructure

Government improvements in Egypt's logistics infrastructure are projected to benefit the cold chain business. In addition, the government is increasing the overall efficiency and capacity of Egypt's logistics industry by expanding port facilities, warehouse capacities, and other essential components of the logistics network. This development has the potential to immediately assist the cold chain sector by improving infrastructure for storing and delivering perishable items, such as food and medicines, at regulated temperatures. For instance, Egypt, in collaboration with the European Bank for Reconstruction and Development, has secured two grants totaling 28 million pounds. These funds are earmarked for initiatives aimed at modernizing locomotives and enhancing railway freight forwarding systems. Moreover, Egypt's standing in the International Logistics Opportunities Index has improved, climbing from 23rd place in 2020 to 21st place in 2023, attributed to the nation's robust infrastructure quality. Also, in fiscal year 2022-2023, the Egyptian government increased transportation sector investments by 27.5%, with a total target of LE 307 billion. These developments in Egypt's logistics and transportation infrastructure are expected to have a substantial impact on the growth of the cold chain logistics industry. Furthermore, the expanded port facilities, railway systems, and road networks will allow for the smooth transit of perishable commodities across the region's supply chain, assuring quality and safety across the region.

Egypt Cold Chain Logistics Market News:

- May 2024: SulleX launched Egypt's premier integrated city tailored for logistics and refrigerated manufacturing services, known as SulleX-TRC. It is situated amidst the vast terrain of Giza Governorate, this ambitious venture represents a significant investment of $150 million, covering an extensive area of 510,000 square meters. SulleX-TRC aims to revolutionize the agricultural and pharmaceutical sectors through cutting-edge storage facilities, advanced logistics solutions, and a strong commitment to environmental sustainability. This strategic endeavor marks a pivotal moment in the evolution of Egypt's logistics and manufacturing landscape, setting a new standard for the industry. SulleX is transforming the area into a refrigerated logistics industrial zone known as SulleX-TRC which will cater to several governorates, including Giza, Fayoum, Beni Suef, Minya, and Assiut.

- October 2023: Egypt unveiled its Green Food Hub initiative, to create 17 green food centers dedicated to the wholesale distribution of fruits and vegetables. These logistics hubs, as outlined by the Ministry of Supply and Internal Trade, will be equipped with refrigeration, packing, and sorting facilities, catering to domestic markets and export needs. Spearheaded by the Ministry of Supply and Internal Trade, this project has been realized through partnerships with the Ministry of International Cooperation (MOIC), the Internal Trade Development Authority (ITDA), and the French Development Agency (AFD).

Egypt Cold Chain Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Refrigerated Warehouses

- Refrigerated Transportation

- Railways

- Airways

- Roadways

- Waterways

The report has provided a detailed breakup and analysis of the market based on the type. This includes refrigerated warehouses and refrigerated transportation (railways, airways, roadways, and waterways).

Application Insights:

- Fruits and Vegetables

- Bakery and Confectionary

- Dairy and Frozen Desserts

- Meat, Fish, and Sea Food

- Drugs and Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fruits and vegetables, bakery and confectionary, dairy and frozen desserts, meat, fish, and sea food, drugs and pharmaceuticals, and others.

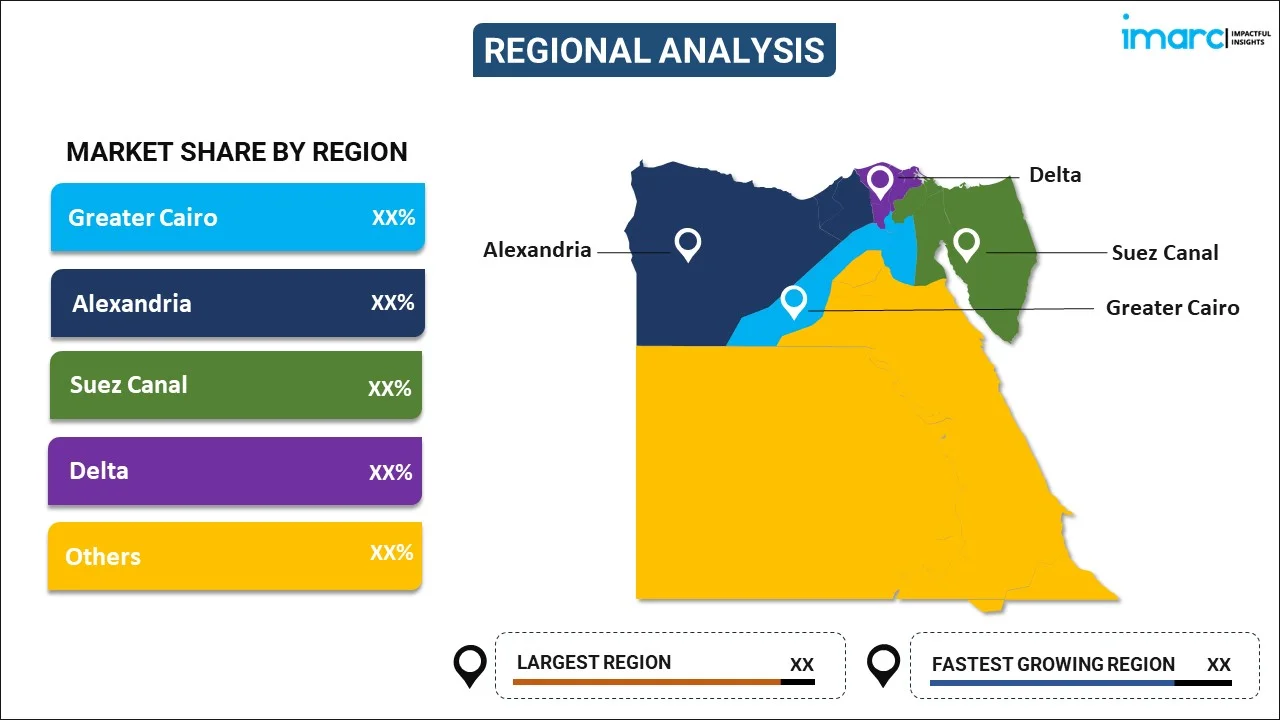

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Cold Chain Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Fruits and Vegetables, Bakery and Confectionary, Dairy and Frozen Desserts, Meat, Fish, and Sea Food, Drugs and Pharmaceuticals, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt cold chain logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt cold chain logistics market on the basis of type?

- What is the breakup of the Egypt cold chain logistics market on the basis of application?

- What are the various stages in the value chain of the Egypt cold chain logistics market?

- What are the key driving factors and challenges in the Egypt cold chain logistics?

- What is the structure of the Egypt cold chain logistics market and who are the key players?

- What is the degree of competition in the Egypt cold chain logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt cold chain logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt cold chain logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt cold chain logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)