Egypt Banking Market Report by Type (Retail Banking, Commercial Banking, Investment Banking), Provider (Commercial Banks, Community Banks, Credit Unions, and Others), Service (Investment Services, Insurance Services, Tax and Accounting Services, and Others), and Region 2026-2034

Egypt Banking Market Overview:

The Egypt banking market size reached USD 141.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 442.7 Million by 2034, exhibiting a growth rate (CAGR) of 12.87% during 2026-2034. The market is experiencing steady growth driven by the increasing collaboration between banks and fintech companies enhancing service delivery, the Central Bank of Egypt's supportive policies fostering a resilient banking system, and the rapid adoption of digital banking solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 141.1 Million |

| Market Forecast in 2034 | USD 442.7 Million |

| Market Growth Rate (2026-2034) | 12.87% |

Access the full market insights report Request Sample

Egypt Banking Market Trends:

Digital transformation and fintech integration

The shift towards digital transformation is taking place in Egyptian with the banking sector due to the progress of Payment platforms as well as the introduction of financial technology (fintech). Along with this, the increasing demand for convenient, secure financial services is providing opportunities for mobile banking, online payment platforms, and digital wallets, epitomizing the trend. Banks are collaborating with fintech companies to improve their digital reach, and operational efficiency and deliver innovative solutions and services to customers. This partnership enhances the experience of the customer and helps banks reach out to a wider range of demographics including the Untouched to the Unbanked revenue sector. Moreover, the CBE has been working to promote this transformation by providing regulatory support and carrying out initiatives that advance financial inclusion and accelerate the adoption of digital solutions in the banking field as a part of the journey toward the cashless economy.

Regulatory reforms and financial inclusion

The Egyptian banking market is currently experiencing important regulatory reforms aiming to enhance stability and access to finance. To strengthen the regulatory landscape, promote transparency, and adhere to international banking norms, the Central Bank of Egypt (CBE) has also issued a regulatory package. These reforms are intended to forge a more financial system secure enough to withstand an economic storm. Additionally, the CBE further aims to disseminate financial services in unserved or underserved areas, including remote villages, in order to expand banking services to all parts of society. Furthermore, financial inclusion initiatives such as promoting microfinance and SME support are necessary to drive Egypt's economic growth and reduce poverty levels in the country. The implementation of digital banking services is another key aspect of these reforms, enhancing accessibility and convenience for consumers. Efforts to educate the public about financial literacy are also being intensified, ensuring that citizens can make informed decisions regarding their finances. Collaborations between the government, private sector, and non-governmental organizations are critical in achieving these goals.

Economic diversification and investment growth

Egypt's drive to expand its economy and attract foreign investment benefits the banking sector. They include the Suez Canal economic zone and the planned new administrative capital, as well as heavyweight investments in banking and financial services. For instance, tightening in construction is a welcome step that has a further impact on employment and banks are coming forward to support the flow of money as different sectors such as manufacturing, and tourism keep expanding. In addition, an emphasis on infrastructure and on fostering a good business environment is attracting investment, at both the domestic and international levels, leading to economic growth and a competitive banking environment. Furthermore, this economic diversification is crucial to sustaining growth and stability in the banking market. The creation of special economic zones is stimulating regional development and opening up new opportunities for investment. Strategic partnerships with international financial institutions are also playing a pivotal role in modernizing the banking sector. Enhanced regulatory frameworks are providing greater security and confidence for investors, encouraging further capital inflows. This multi-faceted approach not only aims to boost economic performance but also to establish Egypt as a key player in the global financial landscape.

Egypt Banking Market News:

- February 09, 2024: Mastercard announced a collaboration with the Egyptian Banks Company to support more sustainable and inclusive economic activities and enhance Egypt's digital payments environment. Through Mastercard with the Egyptian Banks Company (EBC), which is an advanced payments network and domestic operator in Egypt. The partnership represents an important evolution towards broader economic growth efforts and the continuous digitization of payments and financial inclusion in Egypt.

- October 24, 2023: Banque Misr, one of the largest Egyptian banks and a pioneer in the field of electronic payment solutions signed a cooperation agreement with Etisalat Misr to launch SuperPay, the latest Electronic Payment Company in Egypt using the most advanced technologies in the field. The partnership will serve as a landmark in the evolution of Egypt's FinTech landscape as one of the country's leading financial institutions, Banque Misr, partners with the world's leading telecommunications group, Etisalat.

Egypt Banking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, provider, and service.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Retail Banking

- Commercial Banking

- Investment Banking

The report has provided a detailed breakup and analysis of the market based on the type. This includes retail banking, commercial banking, and investment banking.

Provider Insights:

- Commercial Banks

- Community Banks

- Credit Unions

- Others

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes commercial banks, community banks, credit unions, and others.

Service Insights:

- Investment Services

- Insurance Services

- Tax and Accounting Services

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes investment services, insurance services, tax and accounting services, and others.

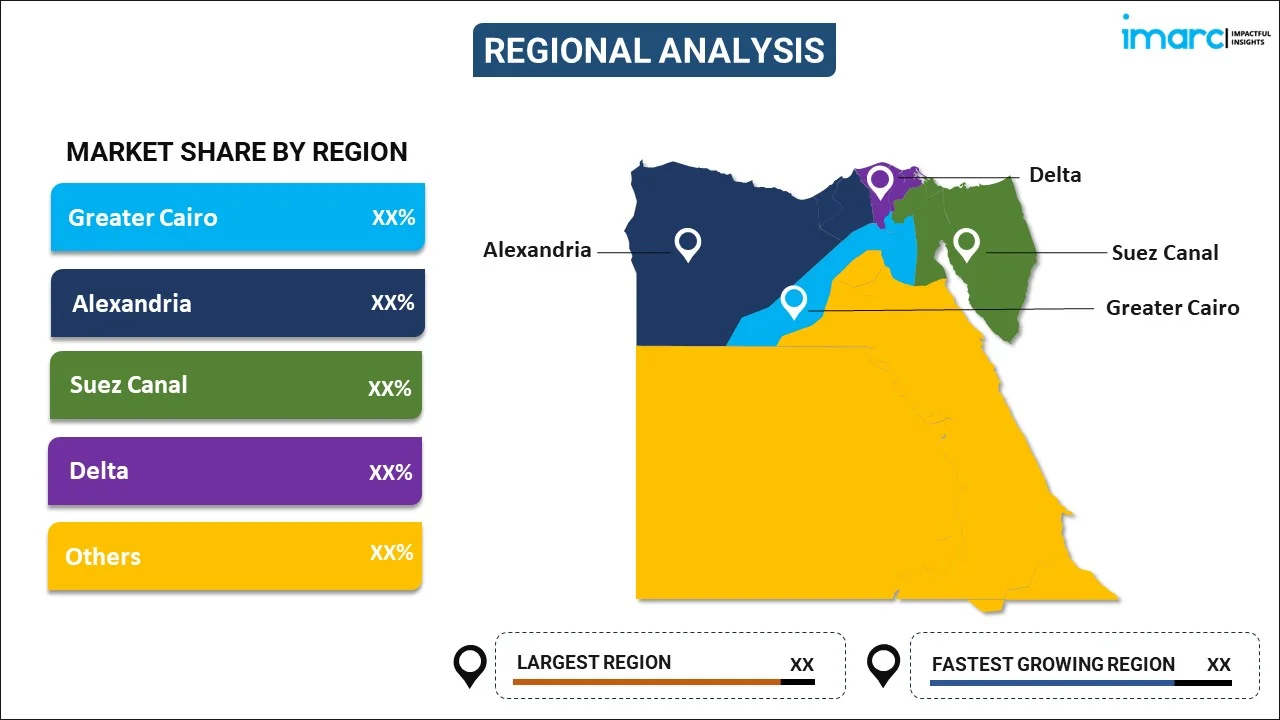

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Banking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Retail Banking, Commercial Banking, Investment Banking |

| Providers Covered | Commercial Banks, Community Banks, Credit Unions, Others |

| Services Covered | Investment Services, Insurance Services, Tax and Accounting Services, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt banking market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt banking market on the basis of type?

- What is the breakup of the Egypt banking market on the basis of provider?

- What is the breakup of the Egypt banking market on the basis of service?

- What are the various stages in the value chain of the Egypt banking market?

- What are the key driving factors and challenges in the Egypt banking?

- What is the structure of the Egypt banking market and who are the key players?

- What is the degree of competition in the Egypt banking market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt banking market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt banking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt banking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)