Edtech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2026-2034

Edtech Market Size and Share:

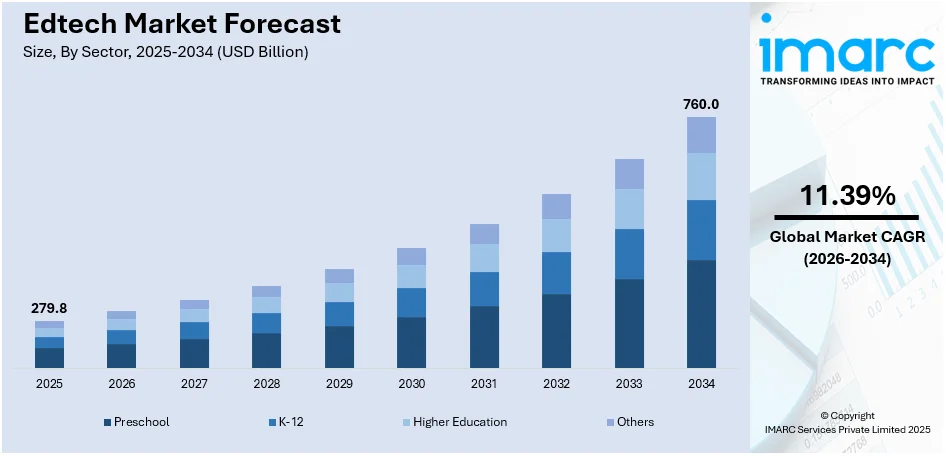

The global edtech market size was valued at USD 279.8 Billion in 2025. Looking forward, the market is estimated to reach USD 760.0 Billion by 2034, exhibiting a CAGR of 11.39% during 2026-2034. North America dominated the market, holding a significant market share of over 38.7% in 2025. The market is experiencing steady growth driven by rising demand for digital learning for enhanced user experience, adaptive assessments, and intelligent tutoring systems, increasing focus on lifelong learning and professional development, and the growing popularity of gamification and coding education to boost engagement and practical skill development.

Key Insights:

- In terms of region, North America held the leading position with a revenue share of 38.7% in 2025.

- Among sectors, K-12 generated the highest revenue in 2025 with around 45.2% of market share.

- Hardware was the top-performing type segment with around 46.4% of market share in 2025.

- On-premises emerged as the primary deployment mode in the market with around 60.2% of market share.

Market Size and Forecast

- Market Size in 2025: USD 279.8 Billion

- Projected Market Size in 2034: USD 760.0 Billion

- CAGR (2026-2034): 11.39%

- Largest Market in 2025: North America

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 279.8 Billion |

|

Market Forecast in 2034

|

USD 760.0 Billion |

| Market Growth Rate 2026-2034 | 11.39% |

The market is driven by the rising adoption of immersive learning experiences through augmented and virtual reality tools. Additionally, increased private equity investments in digital learning startups are supporting innovation and scale. Moreover, the push for multilingual platforms to reach diverse student populations is creating new growth avenues, which is an emerging edtech market trend. For instance, on April 3, 2024, edtech startup GUVI launched a suite of Large Language Models (LLMs) designed to translate English-language educational content into various Indian vernacular languages. This initiative aims to enhance accessibility for learners more comfortable with regional languages, thereby expanding GUVI's reach across India's diverse linguistic landscape. The platform enables users to upload English course videos and receive translations in their preferred colloquial language, fostering inclusive digital learning. Furthermore, public-private partnerships in underserved regions are enabling broader technology penetration, further strengthening the market.

To get more information on this market Request Sample

The market in the United States is significantly expanding due to the implementation of strategic government initiatives promoting technology-enabled instruction, particularly in Title I schools, which are creating favorable conditions for edtech expansion. According to an industry survey conducted in the United States, 18% of K–12 teachers reported actively using AI for teaching, while an additional 15 percent had experimented with AI tools at least once, as of Fall 2023. This growing engagement highlights a broader shift toward AI-enabled classroom environments. This contributes to the personalization of learning paths, real-time feedback, and early intervention strategies for students requiring additional support. Also, the continued digitization of standardized testing is fueling demand for adaptive testing platforms and supporting market growth. Besides this, the corporate sector's growing preference for upskilling via mobile-based training is contributing to enterprise edtech demand.

Edtech Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth due to rising internet penetration and growing demand for personalized and flexible learning models among students and working professionals across both urban and rural regions.

- Key Market Trends: The growing development of artificial intelligence (AI) driven adaptive learning platforms is offering a favorable edtech market outlook.

- Geographical Trends: North America dominates the market due to widespread digital infrastructure, strong government support for e-learning and high adoption of advanced educational technologies.

- Competitive Landscape: Some of the major market players in the education technology market include 2U Inc., BYJU'S, Chegg Inc., Class Technologies Inc., Coursera Inc., Edutech, Google LLC (Alphabet Inc.), Instructure Inc., Lenovo Group Limited, SMART Technologies ULC (Hon Hai Precision Industry Co. Ltd.), Udacity Inc., and upGrad Education Private Limited, among others.

- Challenges and Opportunities: The lack of access to digital devices and reliable internet connectivity, especially in rural and low-income regions, limits the reach of edtech solutions and affects market revenue. However, opportunities lie in developing low-cost learning platforms and forming public-private partnerships to expand digital education infrastructure and user adoption.

Edtech Market Trends:

Rising Demand for Digital Learning

The growing adoption of edtech on account of the inflating demand for digital learning among the masses across the world is primarily driving the edtech market growth. Learners are increasingly seeking flexible and accessible learning options. In response to this demand, edtech platforms are launching solutions that can be accessed anytime, anywhere, using smartphones, tablets, personal computers (PCs), and laptops. For instance, in January 2023, Creative Galileo, an ed-tech startup, announced the release of Toondemy, an educational learning app. The app offers a complete educational journey for students aged 3-10 years in line with NEP, NCERT, and CBSE to construct cognitive capabilities and strong foundational concepts, learn phonics, and conceive new innovative skills. In addition to this, a few leading players are developing and introducing learning platforms and apps for specially abled children. For instance, in January 2022, Texthelp Ltd., a prominent assistive technology provider for the edtech market, launched OrbitNote, a pdf-enabled app that would be helpful for visually impaired students to access documents by leaving voice notes. Such innovations are anticipated to catalyze the growth of the edtech market in the coming years.

Technological Advancements

The integration of next-generation technologies, such as AI, ML, augmented reality (AR), and virtual reality (VR), with EdTech platforms is acting as significant factor augmenting edtech market share. Artificial intelligence (AI) and machine learning (ML) enable personalized learning experiences, adaptive assessments, and intelligent tutoring systems. Consequently, numerous leading players in the market are integrating these advanced technologies to make the learning experience more interactive and inclusive. For instance, in March 2022, ViewSonic Corporation, a global provider of communication and electronics, launched its new cloud-based platform, myViewBoard, an AI-driven technology for students to help them engage in the classroom. Further, it determines whether or not students are paying attention by assessing human posture and ambient elements that may influence students' concentration. This would help teachers use this information and make changes to their lessons. Similarly, in January 2022, Teevra Edutech Pvt Ltd, an edtech platform in India, announced the expansion of its business across the country using AI-powered tools such as a recommendation engine, analytical dashboard, and personalized improvement plan. With such innovations, the global edtech market will continue to grow significantly in the coming years.

Increasing Focus on Lifelong Learning and Professional Development

The rising focus on lifelong learning and professional development is catalyzing the edtech market demand. Edtech platforms offer flexible and accessible learning options that cater to individuals seeking to engage in lifelong learning and continuous professional development. Various working professionals seek online modes of learning and upskilling while doing a full-time job. According to an industry survey, as of early 2020, 46.2% of the respondents had bachelor's degrees, and 22.8% had attained a master's degree in some form. Moreover, the global edtech market size in 2025 is expected to increase substantially across several key segments. Various edtech providers are collaborating with universities and corporates to offer upskilling courses to students and employees. For instance, in February 2022, Greenfield Community College (GCC) partnered with Upright Education to offer new skills in software development and technology, including user experience design (UX) and user interface (UI). The partnership would allow students of GCC to focus on self-employment and create a hub for a career in technology training.

Edtech Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global edtech market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on sector, type, deployment mode, and end user.

Analysis by Sector:

- Preschool

- K-12

- Higher Education

- Others

K-12 leads the market with around 45.2% of market share in 2025. The increasing adoption of digital learning tools in K-12 in schools is supporting the market growth. AI-powered adaptive learning platforms, interactive educational apps, and gamified learning experiences are transforming K-12 education. Various edtech companies and schools are collaborating with each other to facilitate remote and distance learning in an interactive manner. For instance, in April 2020, Blackboard Inc. announced the debut of its K-12 remote learning solution, Blackboard Unite for K-12, a holistic suite of tools and resources providing K-12 districts with the tools and best practices needed to transition to a virtual learning model. Similarly, in January 2023, Leadership Boulevard Private Limited, India's one of immense School edtech companies announced the acquisition of Pearson's K-12 learning business in India. The acquisition intends to boost its product portfolio to benefit more than 5 Lakh private schools in the country and expand the company's reach to more than 9,000 schools.

Analysis by Type:

- Hardware

- Software

- Content

Hardware leads the market with around 46.4% of market share in 2025. Hardware includes devices such as interactive whiteboards, tablets, laptops, desktop computers, VR headsets, and educational robotics kits. Schools and educational institutions are investing in technology infrastructure to support digital learning initiatives. Educational hardware is used across all levels of education, ranging from K-12 schools to higher education institutions and corporate training centers. Various leading market players are offering immersive headsets, laptops, and tablets to facilitate fun and interactive lectures. For instance, in February 2022, Veative Labs., a prominent leader in virtual reality for the edtech market, provided its virtual reality headsets to Smt. Godavari Devi Saraf Senior Secondary School in Andhra Pradesh, India, to let students feel what they are studying. The school gives daily 20 minutes to use the virtual reality headsets. Further, this helps students to have a live experience of what they are learning in subjects like science, where they could learn about the human heart with the help of headsets.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

On-premises leads the market with around 60.2% of market share in 2025. On-premises deployment involves installing and running edtech solutions on local servers or infrastructure within the premises of educational institutions. On-premises deployment is common in institutions where strict data governance policies or regulations exist, such as some K-12 schools, higher education institutions, and government-funded educational organizations. Various universities and schools are increasingly integrating edtech solutions in their education systems to facilitate smooth and interactive learning experiences, which is positively impacting edtech market outlook. For instance, in March 2022, DY Patil International School in India launched its Mars1 Preschool, an AI-driven interactive learning school. With AI technology, kids are exposed to learning by audio, visual, and kinaesthetic learning. Besides, they are able to learn from Cubetto, a wooden robot that helps to develop their problem-solving skills and computational thinking.

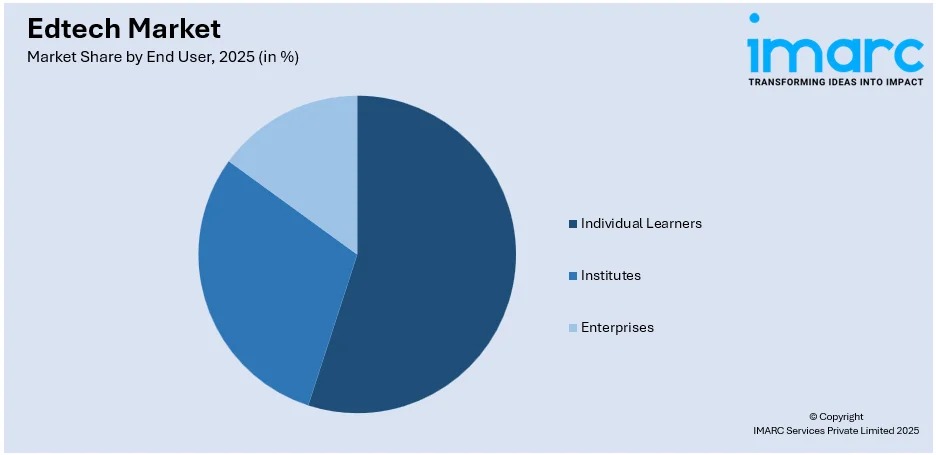

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Individual Learners

- Institutes

- Enterprises

Individual learners lead the market with around 44.3% of market share in 2025. Individual learners shape the direction and acceleration of innovation through platforms and models of content delivery. They are the drivers of demand for tailored learning experiences, adaptable timetables, and engaging formats in response to different learning preferences. As more learners are looking to upskill or reskill, particularly in response to changing labor markets and technology, edtech providers are increasingly tailoring content to match learner goals, from language acquisition to certification prep and career advancement. Learner feedback also plays a critical role in refining algorithms, improving user interfaces, and shaping future curricula. Mobile access, gamified learning, and AI-based recommendations are gaining traction largely due to the preferences of individual users. Their choices not only influence product features and pricing strategies but also guide partnerships between edtech firms and content creators. In this way, individual learners are not just consumers but active participants in the market's evolution.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 38.7%. This can be attributed to the rising adoption of new technologies to enhance teaching and learning experiences. In addition, North America is home to many leading edtech companies, startups, and educational content providers. Furthermore, favorable government initiatives and extensive investments in the field by private entities are propelling the market growth in the region. For instance, in July 2021, Class Technologies Inc., a U.S.-based edtech platform, raised its funding worth approximately USD 105 Million in Series B funding. This funding would help them expand their global presence outside the U.S. and stay resourced to help universities teach the impacted students during the pandemic. Similarly, in March 2022, ViewSonic Corporation, a U.S.-based provider of communication and electronics, launched its new cloud-based platform, myViewBoard, an AI-driven technology for students to help them engage in the classroom. Further, it determines whether or not students are paying attention by assessing human posture and ambient elements that may influence students' concentration.

Key Regional Takeaways:

United States Edtech Market Analysis

The United States holds a substantial share of the North America edtech market with 91.20% in 2025. The market is primarily driven by the widespread integration of learning management systems across educational institutions. An industry report indicates that digital adoption is widespread in U.S. education, with 63% of high school students and 45% of elementary students engaging with online learning tools. Additionally, 85% of teachers incorporate digital platforms to assign educational activities and support student learning. In line with this, the growing demand for flexible, remote learning options, supported by increasing broadband penetration and device accessibility, is fostering market expansion. Furthermore, institutions are increasingly prioritizing data-driven education strategies, offering advanced analytics and learner insights, encouraging the higher adoption of platforms. Similarly, favorable federal and state-level initiatives promoting digital equity and school infrastructure upgrades and accelerating technology implementation, are propelling market growth. The increasing investment in immersive learning tools, including gamified content and simulation-based platforms, is reshaping engagement strategies and stimulating market appeal. Additionally, growing collaborations between edtech firms and higher education providers expanding adaptive learning ecosystems, is impelling the market. Moreover, the growing emphasis on cybersecurity and student data privacy prompting institutions to adopt more secure, compliant edtech solutions, is providing an impetus to the market.

Europe Edtech Market Analysis

The edtech market in Europe is advancing due to numerous national education reform policies across EU member states encouraging digital transformation within classrooms. Similarly, rising cross-border academic collaboration and student mobility under programs like Erasmus+ increasing the demand for scalable, multilingual edtech platforms, is driving the market growth. The growing interest in personalized learning pathways prompting institutions to adopt AI-powered tutoring and assessment tools, is strengthening the market demand. The UK government, on January 2025, awarded GBP 1 Million to 16 EdTech firms to develop AI tools for marking and feedback. Backed by a GBP 3 Million AI content store, these tools aim to cut teacher workload by 50% and improve feedback accuracy to 92%. Furthermore, strong public-private partnerships fostering innovation in digital curriculum development are bolstering the market reach. The increasing efforts to close the digital divide, particularly in rural and underserved regions, augmenting government-funded technology rollouts, is escalating market expansion. Moreover, European startups benefit from access to regional innovation grants and accelerators, fueling product development in the market. Besides this, a growing ecosystem of open educational resources supporting the shift towards cost-effective, accessible digital education solutions across the continent, is expanding the market scope.

Asia Pacific Edtech Market Analysis

The market in Asia-Pacific is being driven by rapid urbanization and increased mobile internet penetration widening access to digital education in both urban and semi-urban areas. In accordance with this, rising government-backed digital education missions in countries like India, China, and Indonesia promoting large-scale technology integration in public education, is enhancing the market accessibility. Over the past decade, the Indian government prioritized the digitization of more than one million public schools. Under the Digital India programme, a projected USD 1.7 Billion is set to be spent between 2021 and 2026. In the latest Union Budget, education is expected to receive 6.6% of the total GDP allocation. Furthermore, escalating cross-border education demand, especially for language learning and international curriculum support, encouraging the development of specialized EdTech solutions, is bolstering the market demand. Moreover, growth in venture capital funding driving innovation, supporting AI tools, gamified learning, and scalable cloud platforms adapted to local languages and teaching methods, is creating lucrative market opportunities.

Latin America Edtech Market Analysis

In Latin America, the edtech market is propelled by increased smartphone penetration and mobile-first internet usage across diverse socio-economic groups. In addition to this, the growing demand for bilingual and international curriculum content encouraging the development of region-specific edtech platforms, is enhancing market accessibility. The rising investor confidence in AI-driven, teacher-focused platforms enhancing efficiency, local curriculum alignment, and access to quality education, is supporting market demand. As such, Teachy raised USD 7 Million in Series A funding led by Goodwater Capital and Reach Capital. The AI-powered platform supports 1 million teachers, aiming to expand across LATAM by enhancing features and hiring engineering talent. Moreover, various global tech and local education partnerships are delivering digital tools tailored to national standards and cultural contexts, which is impelling the market.

Middle East and Africa Edtech Market Analysis

The Middle East and Africa market is gaining momentum attributed to distinct regional developments. Furthermore, numerous government-led national digital transformation strategies prioritizing education technology to improve learning outcomes and system efficiency, is driving market growth. A young, rapidly growing population driving demand for scalable digital education platforms, is expanding the market. Additionally, the rise of Arabic-language edtech content and localized platforms is expanding access and relevance for native speakers in the market. Apart from this, growing investment from sovereign funds and global educators fueling innovative, tech-enabled learning tailored to local needs, is positively influencing the market. According to a venture data platform, edtech ranked among the top five most-funded sectors in Saudi Arabia, with startups raising USD 50 Million in 2023, a 6% increase over 2022.

Competitive Landscape:

The edtech market is characterized by fierce competition fueled by the speed of digital take-up, growing demand for learning personalization, and increasing internet penetration. Players compete on content quality, technological integration, pricing models, and delivery formats. There's a noticeable shift towards AI-powered learning tools, gamified experiences, and adaptive platforms that cater to diverse learner profiles. Market segmentation ranges from K-12 to higher education, test prep, and upskilling, with each segment with customized approaches. Entry barriers are low, which encourages innovation but also overwhelms the category with comparable alternatives. Firms differentiate on algorithms, user experience, and scale. Also, strategic collaboration with institutions and governments is increasingly leveraged to expand reach and credibility. Regional preferences and regulatory norms further influence competitive positioning, requiring local adaptation. Continuous evolution in user expectations and tech capabilities ensures that the market remains dynamic and innovation centric.

The report provides a comprehensive analysis of the competitive landscape in the edtech market with detailed profiles of all major companies, including:

- 2U Inc.

- BYJU'S

- Chegg Inc.

- Class Technologies Inc.

- Coursera Inc.

- Edutech

- Google LLC (Alphabet Inc.)

- Instructure Inc.

- Lenovo Group Limited

- SMART Technologies ULC (Hon Hai Precision Industry Co. Ltd.)

- Udacity Inc.

- upGrad Education Private Limited

Latest News and Developments:

- January 2025: BrightChamps acquired K-12 edtech marketplace Edjust in a cash-and-stock deal to strengthen global reach and enforce ethical sales practices. Edjust, known for AI and EQ-driven customer targeting, will help expand BrightChamps’ presence across 30 countries with immersive AR/VR-based learning experiences and new subject-focused verticals.

- October 2024: Shell India launched new EdTech initiatives to enhance STEM education using AI and data analytics. Partnering with Pratham Infotech, Khan Academy, and others, the programs build on NXplorers’ success and will expand across Delhi NCR, Karnataka, and Maharashtra, alongside comprehensive teacher training and personalized learning support.

- September 2024: SMART Technologies launched its interactive displays in India, supporting local manufacturing and tailored education content. Partnering with schools and businesses, SMART named three Indian institutions as Exemplary Schools, showcasing commitment to enhancing classroom collaboration and advancing India’s educational and economic development.

- September 2024: Adda247 acquired placement prep platform PrepInsta to expand its reach in tech and digital job training. This marks its fourth acquisition, enhancing offerings in AI, ML, and cloud education. The move supports Adda247’s mission to bridge skill gaps and boost career readiness for tech aspirants.

- June 2024: Unacademy and K12 Techno began merger talks, aiming for a 50-50 joint entity. With shared investors and past acquisition attempts, the deal could help Unacademy move toward profitability. The move reflects consolidation amid funding challenges and declining demand in India’s post-pandemic edtech sector.

Edtech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | 2U Inc, BYJU'S, Chegg Inc., Class Technologies Inc., Coursera Inc., Edutech, Google LLC (Alphabet Inc.), Instructure Inc., Lenovo Group Limited, SMART Technologies ULC (Hon Hai Precision Industry Co. Ltd.), Udacity Inc., upGrad Education Private Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the edtech market from 2020-2034.

- The edtech market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the edtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The edtech market was valued at USD 279.8 Billion in 2025.

The market is estimated to reach USD 760.0 Billion by 2034.

The market is driven by the rising internet penetration, increasing smartphone adoption, and growing demand for personalized learning. The implementation of government initiatives promoting digital education, the popularity of interactive and gamified content, and the expansion of online certification programs are also contributing to market expansion.

North America currently dominates the edtech market, accounting for a share of 38.7% in 2025. The dominance is fueled by high digital literacy, strong infrastructure, widespread adoption of e-learning platforms, significant investments from venture capital firms, and an established ecosystem of edtech startups and institutions.

The top 10 edtech companies include 2U Inc, BYJU'S, Chegg Inc., Class Technologies Inc., Coursera Inc., Edutech, Google LLC (Alphabet Inc.), Instructure Inc., Lenovo Group Limited, and SMART Technologies ULC (Hon Hai Precision Industry Co. Ltd.).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)