eDiscovery Market Report by Component (Services, Software), Deployment Type (On-premises, Cloud-based, Hybrid), End-User (Government/Federal Agencies, Legal and Regulatory Firms, Enterprises), Vertical (BFSI, Retail and Consumer Goods, Manufacturing, Legal, IT and Telecommunication, Government, Energy and Utilities, Healthcare and Life Science, and Others), and Region, 2026-2034

eDiscovery Market Size:

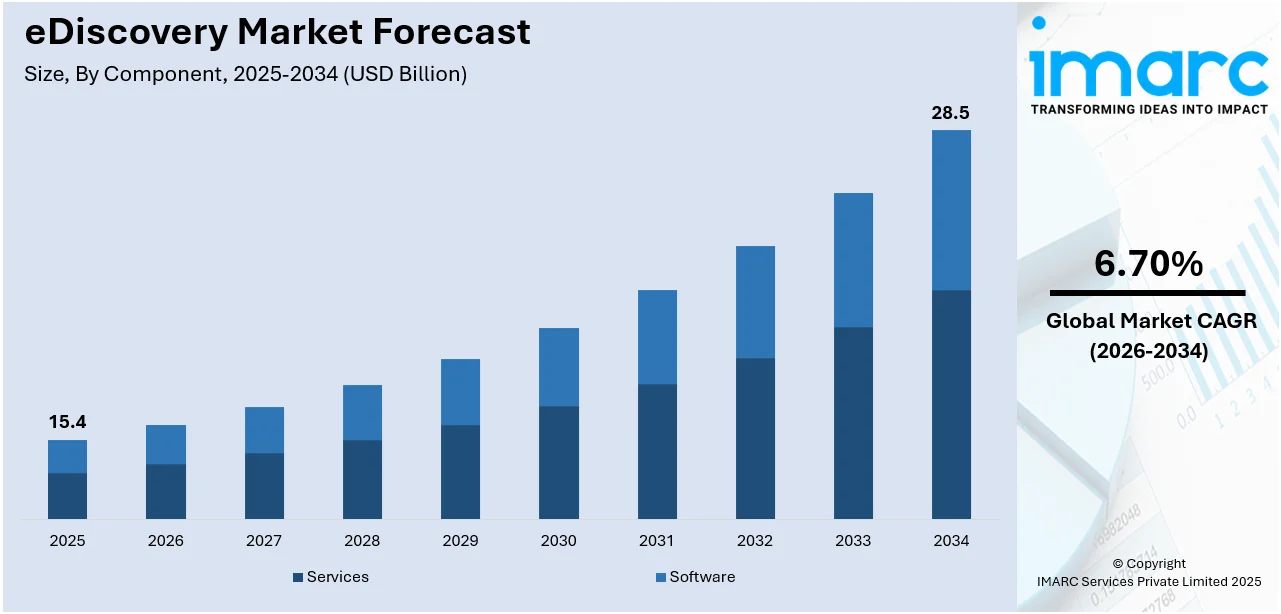

The global eDiscovery market size reached USD 15.4 Billion in 2025. Looking forward, the market is expected to reach USD 28.5 Billion by 2034, exhibiting a growth rate (CAGR) of 6.70% during 2026-2034. The market is experiencing steady growth driven by the escalating volumes of electronically stored information (ESI) and the stringent legal and regulatory frameworks, the increasing incidence of litigation and compliance requirements across industries, and continuous technological advancements in artificial intelligence (AI) and cloud computing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 15.4 Billion |

|

Market Forecast in 2034

|

USD 28.5 Billion |

| Market Growth Rate 2026-2034 | 6.70% |

eDiscovery Market Analysis:

- Major Market Drivers: According to the eDiscovery market report, the main drivers of the eDiscovery market include the growing volume of electronically stored information and a high demand for data governance in the context of virtually all industries. Furthermore, the regulatory and compliance requirements continue to escalate, demanding heavy-duty tools to process data at scale reliably and afford extensive reviews and audits.

- Key Market Trends: AI and machine learning components are increasingly integrated into eDiscovery offerings to optimize data processing and analytics. Cloud solutions are gaining traction due to their cost-effectiveness and scalability, and their capacity to support substantial data sets and shared workflows.

- Geographical Trends: According to the eDiscovery market overview, North America accounts for a significant share of the current eDiscovery market, reflecting tough legislation and regulation across the continent. Simultaneously, the APAC market is developing actively due to more digitization, the growing volume of generated data, and changes in legislation affecting eDiscovery in states such as China and India.

- Competitive Landscape: Industry leaders are marked by the presence of both long-standing industry players and newly formed businesses aggressively engaged in the M&A process to enhance their services and expand their global activities. Industry leaders include companies such as IBM, Relativity, or Logikcull, whereas their competition relies on solution novelty, buyer-centric approach, and offering size.

- Challenges and Opportunities: The challenge lies in the abundance of the format of data to collect and process. On the contrary, the eDiscovery market recent opportunities include developing and selling more complex tools, which are better suited to store and communicate with more diverse data and compliant with international regulations.

To get more information on this market Request Sample

eDiscovery Market Trends:

Increasing complexity of data

The increasing complexity of data is shaping how organizations approach eDiscovery. It's no longer just about handling emails and documents; now, data comes from collaboration tools, encrypted messaging apps, cloud platforms, and IoT devices, often spread across jurisdictions. This trend is forcing legal and compliance teams to rethink their strategies. Traditional tools can’t keep up with the variety, volume, and velocity of information. The rise of unstructured data, mixed formats, and constantly changing sources is pushing demand for smarter eDiscovery solutions that can adapt quickly. Legal teams now need systems that can search across diverse environments, process multimedia content, and maintain context across fragmented data. It’s also increasing pressure to ensure defensible processes that comply with regional regulations like GDPR or CCPA. As the sources and formats of data grow more intricate, so does the risk of missing critical evidence or falling short of legal requirements, making this trend a key factor driving innovation in the eDiscovery market.

Rising volume of electronically stored information (ESI) and regulatory compliance requirements

The growing demand to access and manage electronic data is a major factor driving the expansion of the eDiscovery market. It's estimated that over 97% of business records are now generated and stored digitally, and global email traffic has reached nearly 250 billion messages each day, excluding text and social media communications. This surge in digital data is boosting the need for eDiscovery tools. At the same time, stronger data privacy and governance rules, such as GDPR in Europe and HIPAA in the US, are pushing organizations to adopt solutions that help them stay compliant. With the increasing complexity and volume of data involved in legal processes, companies are relying on advanced technologies to reduce legal risk, support accurate data retrieval, and meet regulatory timelines.

Technological advancements and integration with cloud computing

Technological progress, especially in artificial intelligence (AI) and machine learning, has reshaped how eDiscovery operates. A key development in the market is the integration of these tools into eDiscovery platforms, which improves their ability to manage vast datasets. This has enhanced speed and accuracy while reducing mistakes and expenses. AI has automated key tasks like predictive coding, tagging, and organizing documents, making these tools more appealing to law firms and in-house legal teams. Support has also grown through the adoption of cloud-based eDiscovery platforms. These cloud systems offer adaptable storage solutions that are cost-effective, especially for small and mid-sized businesses, by making data storage more efficient and scalable. The traditional linear method is also evolving into a more connected and user-friendly system. This allows participants to collaborate remotely and access legal data in real time, helping streamline workflows and raise the overall efficiency of legal operations.

Global digitalization and legal system modernization

The global shift toward digital operations, seen across both emerging and mature economies, plays a key role in driving eDiscovery adoption. As organizations and government entities work to digitize records and workflows, the need to manage electronic data in line with legal standards grows stronger. In rapidly digitizing areas like Asia Pacific, legal institutions face pressure to upgrade systems to handle evolving forms of electronically stored information (ESI). This push for modernization supports the growth of the eDiscovery market and opens doors for solution providers able to align with specific regional demands. The eDiscovery market share analysis highlights that success in developing regions often depends on flexibility in processing various data types, compliance with regional regulations, and multilingual functionality. These features are increasingly critical for expanding eDiscovery adoption, particularly where the market is less saturated, allowing providers to build a foothold and contribute to the industry’s broader expansion.

eDiscovery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on component, deployment type, end-user and vertical.

Breakup by Component:

- Services

- Software

Services account for the majority of the market share

The report has provided a detailed breakup and analysis of the eDiscovery market based on the component. This includes services and software. According to the report, services represented the largest segment.

The largest component segment of the eDiscovery market is services, which are fueled by the increasing complexity of processing and analyzing large amounts of electronically stored information (ESI). This segment includes various types of services, such as consulting, implementation, training, and support, which are vital for the proper implementation of eDiscovery solutions. Due to the continued pressure on law firms and corporate legal departments to speed up reviews and reduce costs, these services are in high demand among clients who seek to simplify the eDiscovery process. Along with this, the importance of eDiscovery service providers is also underlined by the fact that these experts help companies remain compliant with current laws and the most up-to-date regulations, thus decreasing the risks of managing data. Moreover, the high and growing volume of data and its diversity leads to the development of highly specialized services that focus on specific industries, which strengthens the position of service companies in the market.

Breakup by Deployment Type:

- On-premises

- Cloud-based

- Hybrid

On-premises accounts for the majority of the market share

A detailed breakup and analysis of the eDiscovery market based on the deployment type has also been provided in the report. This includes on-premises, cloud-based, and hybrid. According to the report, on-premises accounted for the largest market share.

On-premises solutions dominate the eDiscovery deployment type segment. This is primarily due to the high level of control, the security of data, and data governance. These include businesses working within the finance, healthcare, and government industries, among others, which prioritize data sensitivity and adhere to various industry regulatory requirements. A survey, conducted by Spiceworks based on interviews with more than 500 IT leaders, established that 98% of businesses continue to use on-premises IT infrastructure. In addition, on-premises eDiscovery solutions permit organizations to use their IT infrastructure with complete control, enforcing data handling procedures aligned with demanding data security standards and regulatory constraints. This deployment method makes it possible to incorporate existing security policies and procedures, reducing the chance of data breaches and unauthorized access. Furthermore, corresponding eDiscovery solutions are critical to large companies that have large amounts of data to audit. Large-scale legal evaluations or audits need high levels of scalability and performance on the part of corresponding eDiscovery options. Thus, this segment is creating a positive eDiscovery market outlook, notwithstanding the growth of cloud offerings.

Breakup by End-User:

- Government/Federal Agencies, Legal and Regulatory Firms

- Enterprises

Government/federal agencies, legal and regulatory firms represent the leading market segment

The report has provided a detailed breakup and analysis of the eDiscovery market based on the end-user. This includes government/federal agencies, legal and regulatory firms, and enterprises. According to the report, government/federal agencies, legal and regulatory firms represented the largest segment.

Government and federal agencies, along with legal and regulatory firms, form the largest end-user segment in the eDiscovery market. These sectors are the primary consumers of eDiscovery tools due to their immense legal responsibilities. All of these organizations perform systematic review, collection, and assessment of considerable amounts of electronically stored information as a means of sustaining actions under the law and compliance. eDiscovery tools are essential in these sectors and the environment given they assist in maintaining the legal requirements, enforcing compliance, managing securely sensitive information, and performing efficiently. Additionally, the tools help to ease the process of identifying, collecting, and producing documents regarding litigation, audits, and investigations. Moreover, when it comes to whether or not the government promotes enhanced transparency and accountability, it stands out that such government entails a balance concerning the essential use of eDiscovery tools that their sector and environment demand as much as these organizations also require them for managing their workflow and mitigating risks to ensure the legal process integrity.

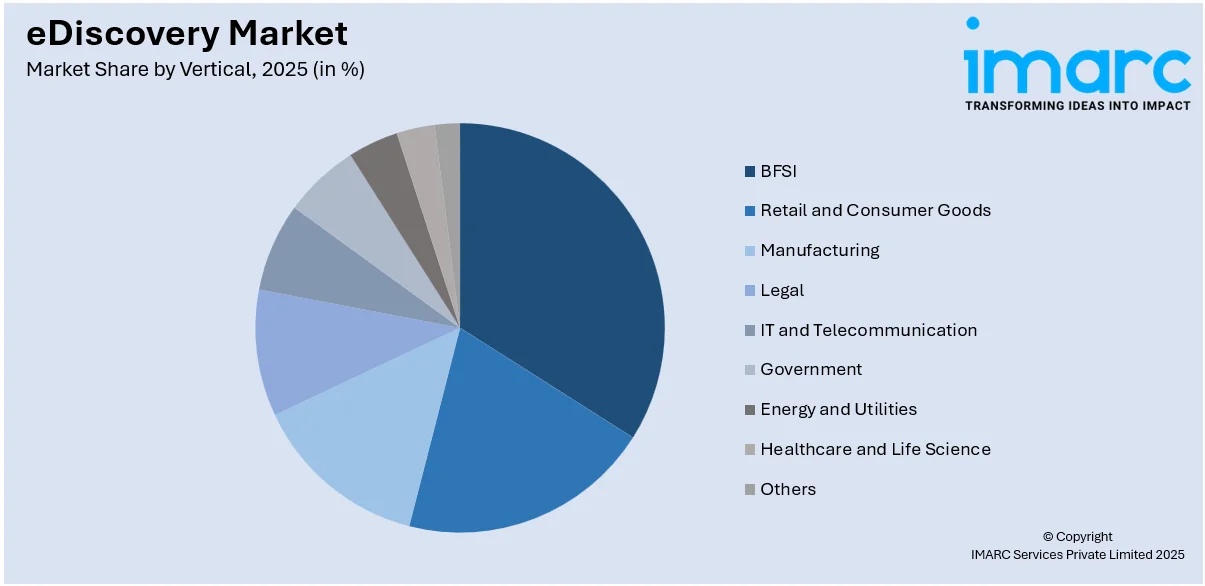

Breakup by Vertical:

Access the comprehensive market breakdown Request Sample

- BFSI

- Retail and Consumer Goods

- Manufacturing

- Legal

- IT and Telecommunication

- Government

- Energy and Utilities

- Healthcare and Life Science

- Others

Government exhibits a clear dominance in the market

A detailed breakup and analysis of the eDiscovery market based on the vertical has also been provided in the report. This includes BFSI, retail and consumer goods, manufacturing, legal, IT and telecommunication, government, energy and utilities, healthcare and life science, and others. According to the report, the government sector accounted for the largest market share.

The government sector is the largest vertical in the eDiscovery market, driven by the sector’s critical need for robust data management and compliance measures. Numerous government processes and working methods entail extensive handling of sensitive and, in some cases, classified information. Therefore, the legal framework prescribes the means of data retrieval, preservation, and analysis, necessitating eDiscovery solutions that ensure these needs are comprehensively fulfilled. Additionally, the variety of communications and decision-making procedures in government requires eDiscovery systems that can support a wide array of document types, which help conduct accurate and secure legal investigations and audits. Moreover, as public-sector actors, government bodies need eDiscovery tools for managing freedom of information requests and other public disclosures. According to the eDiscovery market forecast, the union of the vast and specific needs of government-facing organizations is making this sector a critical and massive market for eDiscovery, where leading vendors continuously innovate their services and technologies.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest eDiscovery market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for eDiscovery.

North America is the largest regional segment of the eDiscovery market. The advanced legal infrastructure and active use of digital solutions in various legal practices have contributed to the leadership of North America, where the United States sets the prominent eDiscovery market trends. In addition, the development and growth of eDiscovery tools have been largely facilitated by the complex litigation in the United States and the increased regulatory pressure. The Federal Rules of Civil Procedure require eDiscovery tools to effectively manage and produce electronic evidence during legal procedures in North America. Apart from this, the extensive network of multinational corporations and a high level of digitalization in the public sector contribute to large volumes of data and challenging new circumstances, thus stimulating further demand for eDiscovery solutions. Leading eDiscovery providers are also located in North America, which drives the region’s market leadership further, enabling continuous technological advancements and further development of services tailored to specific legal and regulatory requirements in the United States and Canada.

Key Regional Takeaways:

United States eDiscovery Market Analysis

The United States eDiscovery market is driven by rising volumes of electronically stored information (ESI), including emails, social media, and messaging platforms. Legal teams need tools that can manage this volume efficiently, especially during litigation or regulatory investigations. There's also growing demand from corporations to reduce legal costs by bringing eDiscovery processes in-house. The rise in data privacy regulations, like the California Consumer Privacy Act (CCPA), pushes firms to adopt tools that can ensure compliance. Cybersecurity incidents and internal investigations also boost usage, particularly in highly regulated industries such as finance and healthcare. Cloud-based eDiscovery platforms are gaining popularity because they support remote access and flexible data processing, especially useful for hybrid work environments. Additionally, artificial intelligence and machine learning are now key to speeding up document review and improving accuracy. Together, these factors are making eDiscovery not just a legal necessity but a core part of corporate risk and compliance strategy. For instance, in May 2025, eDiscovery AI joined the EDRM Trusted Partner Network, reinforcing its role in AI-powered legal tech. As data security and privacy standards grow more complex, AI-driven eDiscovery solutions are becoming essential for litigation, compliance, and investigation needs. With hybrid work environments demanding secure data handling and collaboration, eDiscovery AI's expertise in privacy-focused, AI-enabled discovery tools positions it as a critical player in modern legal data management.

Europe eDiscovery Market Analysis

The Europe eDiscovery market is experiencing growth driven by the growing complexity of legal and regulatory environments across the region. Organizations face increasing pressure to manage large volumes of digital information in compliance with GDPR and sector-specific rules. Rising cross-border investigations and antitrust cases are prompting companies to adopt advanced tools that can handle diverse file types and languages. The shift toward digital workflows, remote collaboration, and hybrid work models is also pushing demand for cloud-based eDiscovery solutions. Legal departments and law firms are turning to automation and AI-driven tools to reduce review time and improve accuracy. Data privacy concerns, cybersecurity incidents, and the need for audit-ready processes are further reinforcing the role of eDiscovery in risk management strategies. For example, in September 2024, Reveal launched its Logikcull platform in Europe, expanding its AI-driven eDiscovery and investigations offerings. The move introduces a self-service solution alongside its enterprise-grade platform, both powered by advanced AI. This dual-platform strategy allows legal teams greater flexibility in handling investigations and legal discovery. Reveal’s expansion strengthens its position in the European market, meeting varied legal needs with scalable, AI-powered eDiscovery technology tailored to different organizational demands.

Asia Pacific eDiscovery Market Analysis

The Asia Pacific eDiscovery market is driven by rapid digitalization, increasing adoption of cloud services, and growing awareness of legal compliance across emerging economies. Countries like India, China, and Singapore are experiencing a rise in corporate litigation, regulatory audits, and cross-border investigations, boosting demand for reliable eDiscovery tools. Expanding data privacy laws and cybersecurity concerns are pushing businesses to adopt solutions that ensure the secure handling and review of digital evidence. Multilingual data processing and the integration of AI for faster document analysis are also influencing adoption across industries in the region. In February 2025, BRG expanded its cyber forensics and eDiscovery services in the Asia Pacific region by appointing a cybersecurity expert in Hong Kong. The move strengthens its ability to support clients with end-to-end solutions, including data security, compliance, risk management, and incident response. This expansion reflects growing demand in APAC for integrated eDiscovery capabilities paired with cybersecurity expertise to address legal and regulatory pressures in digital environments.

Latin America eDiscovery Market Analysis

The Latin America eDiscovery market is witnessing growth due to rising digital data volumes, increasing regulatory scrutiny, and the growth of corporate litigation. Governments and industries are gradually adopting data protection laws, prompting businesses to invest in compliance-focused tools. Cross-border legal matters and internal investigations are also contributing to demand. Additionally, the shift toward cloud computing and remote work is encouraging the adoption of scalable, AI-enabled eDiscovery platforms across sectors like finance, telecom, and healthcare. For instance, in March 2024, Everest Discovery LLC and Relativity co-hosted a webinar focused on helping Latin American law firms enhance their eDiscovery capabilities. Topics include early case assessment, flexible managed review, collaboration, and choosing the right partner. The event highlighted how tools like RelativityOne can support firms in adopting more effective and modern eDiscovery practices.

Middle East and Africa eDiscovery Market Analysis

The Middle East and Africa eDiscovery market is driven by expanding digital infrastructure, rising cyber threats, and growing legal and regulatory activities across sectors like banking, energy, and government. Countries such as the UAE and South Africa are strengthening data protection frameworks, pushing organizations to adopt secure and compliant eDiscovery solutions. Increased cross-border business and international arbitration cases are also fueling demand. The adoption of cloud-based platforms and AI tools for faster document processing is gaining traction, particularly as enterprises seek greater efficiency in managing digital evidence and legal workflows.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the largest eDiscovery companies in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the eDiscovery industry include:

- Arctera

- Casepoint

- Commvault Systems Inc.

- Conduent Incorporated

- CS DISCO, Inc.

- Deloitte

- FTI Consulting, Inc.

- KLDiscovery

- KPMG

- Logikcull

- Open Text Corporation

- Relativity ODA LLC

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

eDiscovery companies are increasingly adopting sophisticated technologies, including artificial intelligence and machine learning. Along with this, the incorporation of eDiscovery products with workflow automation, real-time analytics, and predictive coding increases the capacity to review variable data and assess it more quickly and cost-effectively than before. Acquisitions or collaboration with local firms are also allowing these market leaders to rapidly expand their global reach. This strategic approach helps them access broader markets, expand their service portfolios, and rapidly grow their customer base. These activities are critical for ensuring a competitive advantage and retaining a high eDiscovery market share.

eDiscovery Market News:

- April 29, 2024: Commvault Systems Inc. launched a new type of “cleanroom” for data recovery services that allows businesses to restore disaster recovery and ransomware-affected work and data from any location to a secure, quarantined environment in the cloud.

- April 29, 2024: Conduent Incorporated launched an initiative with Microsoft to embed generative AI into its global client services. Via the Microsoft Azure OpenAI Service, this cooperation will drive quality, productivity, and velocity in healthcare claims management, customer service, fraud detection, and other critical client solutions.

eDiscovery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Services, Software |

| Deployment Types Covered | On-premises, Cloud-based, Hybrid |

| End-Users Covered | Government/Federal Agencies, Legal and Regulatory Firms, Enterprises |

| Verticals Covered | BFSI, Retail and Consumer Goods, Manufacturing, Legal, IT and Telecommunication, Government, Energy and Utilities, Healthcare and Life Science, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arctera, Casepoint, Commvault Systems Inc., Conduent Incorporated, CS DISCO, Inc., Deloitte, FTI Consulting, Inc., KLDiscovery, KPMG, Logikcull, Open Text Corporation, Relativity ODA LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the eDiscovery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global eDiscovery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the eDiscovery industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The eDiscovery market was valued at USD 15.4 Billion in 2025.

AI automation, cloud-native tools, and advanced analytics shape eDiscovery in 2025, with a strong focus on privacy compliance, cost control, and managing data from chat platforms like Slack and Teams.

We expect the global eDiscovery market to exhibit a CAGR of 6.70% during 2026-2034.

The extensive utilization of eDiscovery solutions by numerous government organizations to enforce compliance and data security, owing to the rising instances of felonies, is primarily driving the global eDiscovery market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing adoption of eDiscovery solutions across numerous organizations for providing remote access to digital data related to legal, constitutional, political, and privacy issues.

Based on the component, the global eDiscovery market has been segmented into services and software. Currently, services hold the majority of the total market share.

Based on the deployment type, the global eDiscovery market can be divided into on-premises, cloud-based, and hybrid. Among these, on-premises currently exhibit a clear dominance in the market.

Based on the end user, the global eDiscovery market has been categorized into government/federal agencies, legal and regulatory firms and enterprises. Currently, government/federal agencies account for the majority of the global market share.

Based on the vertical, the global eDiscovery market can be segregated into BFSI, retail and consumer goods, manufacturing, legal, IT and telecommunication, government, energy and utilities, healthcare and life science, and others. Among these, the government sector accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global eDiscovery market include Arctera, Casepoint, Commvault Systems Inc., Conduent Incorporated, CS DISCO, Inc., Deloitte, FTI Consulting, Inc., KLDiscovery, KPMG, Logikcull, Open Text Corporation, Relativity ODA LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)