Edible Packaging Market Size, Share, Trends and Forecast by Material Type, Source, End User, and Region, 2025-2033

Edible Packaging Market Size and Share:

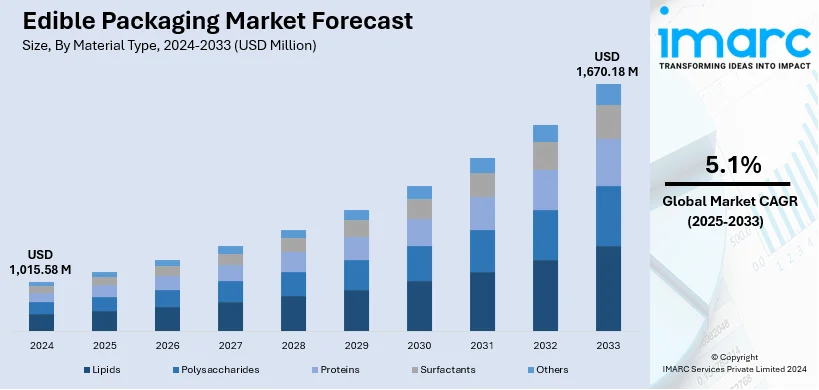

The global edible packaging market size was valued at USD 1,015.58 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,670.18 Million by 2033, exhibiting a CAGR of 5.1% from 2025-2033. North America currently dominates the market, holding a market share of over 43.0% in 2024. The market is primarily driven by the growing packaged food industry, increasing consumer demand for sustainable packaging, and implementation of government regulations against plastic waste which is encouraging innovations in edible packaging.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,015.58 Million |

|

Market Forecast in 2033

|

USD 1,670.18 Million |

| Market Growth Rate (2025-2033) | 5.1% |

The increasing focus on health and hygiene is acting as a growth-inducing factor. Antimicrobial properties of these edible packaging materials add to the food safety and consumer demand of hygienic products since they can inhibit the growth of pathogenic microorganisms, thus prolonging shelf life and reducing the chances of foodborne infections. For instance, chitosan, derived from chitin, is a biopolymer and comes with its own inherent antimicrobial action, hence repeatedly being used as edible films to preserve numerous food products. A 2023 survey has reported that 75% of U.S. consumers regard hygiene and food safety as an important aspect when considering product packaging. This has led to a great demand for packaging solutions that not only shield the food from impurities but also actively contribute towards its safety.

The USA is emerging as a leading market with 84.30% share. The growth of the edible packaging market in the United States is driven by increasing consumer demand for sustainable packaging solutions and the rising awareness of plastic waste's environmental impact. With approximately 42 million tons of plastic waste generated annually in the U.S., edible packaging is emerging as a viable alternative, reducing dependency on single-use plastics. The food and beverage (F&B) industry's push for eco-friendly innovations, driven by regulatory pressures and consumer preferences, is fueling market growth. For instance, the Food and Drug Administration (FDA) has supported advancements in edible films and coatings for food safety and shelf-life extension. Additionally, the rising popularity of plant-based diets and natural ingredients has encouraged the adoption of edible packaging made from seaweed, rice, and starch-based polymers.

Edible Packaging Market Trends:

Increasing Consumer Preference for Sustainable Packaging

The packaging sector is influenced by consumer awareness regarding environmental concerns such as marine plastic pollution, which pushed edible packaging and other sustainable solutions to the forefront. This shift is driven by the evident effects of plastic waste, encouraging consumer preference for items that support environmental conservation. According to the United Nations Environment Programme, over 8 million tons of plastic garbage end up in the ocean each year, encouraging governments to impose stronger regulations on the use of plastic. Up to 80% of all the debris discovered in the oceans is due to plastic. As a result, producers are forced to use edible packaging options to satisfy customers and adhere to legal requirements. This consumer-driven demand creates a robust market for innovations in biodegradable and edible packaging, thus creating a positive edible packaging market outlook.

Growth in the Packaged Food Industry

Additionally, the expansion of the packaged food sector has significantly impacted edible packaging due to the growing consumer preferences for sustainability. According to the IMARC Group report, the global packaged food market was valued at USD 2,441.3 Billion in 2023. As per the forecast, the market will grow with a compound annual growth rate (CAGR) of 7% from 2024 to 2032. As the industry continues to innovate, the focus is placed on edible packaging owing to the growing demand for convenient and environmentally friendly packaging options. This concept of making edible packing facilitates the organization to follow the corporal world practise of sustainable measures which is also effective and means less wastage. Hence, more people are inclined toward products with the least impact on the environment thus generating a positive edible packaging market revenue. This trend is likely to gain momentum generally with firms and consumers seeking to adopt responsible consumption practices.

Implementation of Government Initiatives

Governmental policies are a significant factor that influences the market trends for edible packaging. For instance, the European Union’s Single-Use Plastics Directive drives improvements across the board by limiting plastic use, thus nurturing the use of edible packaging and other substitutes. The directive also specifies conditions that from 2025, polyethylene terephthalate (PET) bottles must be made with at least 25% recycled content, increasing to 30% by 2030. Besides, the domino effect is that such policies are increasing edible packaging demand in areas that have strict anti-pollution laws. These regulations enhance environmental policies encouraging manufacturers to search for biodegradable materials or products to avoid penalties. It is going to grow in the future as many more countries follow the example of their counterparts who are looking for a sustainable solution to the issue of packaging waste.

Growing Demand for Biodegradable Solutions

As awareness grows regarding the detrimental effects of traditional plastic packaging on the environment, both companies and individuals are opting for biodegradable and sustainable options. Edible packaging, made from natural, plant-derived, or biodegradable substances, is becoming a vital solution to minimize plastic waste while maintaining product safety and freshness. This change is additionally backed by more stringent environmental regulations and government efforts that encourage sustainable packaging options in sectors like food and drink, pharmaceuticals, and cosmetics. Edible packaging provides environmental advantages while also increasing user attractiveness through its functionality and innovation. Moreover, as companies work to align with sustainability objectives and cater to the preferences of environmentally aware consumers, funding for research and development (R&D) aimed at enhancing the quality and adaptability of edible packaging materials is rising, thereby fueling market growth. In 2024, Pakka introduced a new line of compostable flexible packaging options for the FMCG industry. The collection features paper-based packaging that offers excellent barrier qualities and sealability for heat and cold, aimed at addressing the increasing need for sustainable options in food packaging. These items focus on minimizing packaging waste while providing sustainable options to traditional non-biodegradable packaging.

Edible Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global edible packaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material type, source, and end user.

Analysis by Material Type:

- Lipids

- Polysaccharides

- Proteins

- Surfactants

- Others

Lipids lead the market as they are known for their barrier qualities that efficiently stop tastes, carbon dioxide, and oxygen from migrating, which is essential for preserving product integrity and extending shelf life. Lipid-based edible packaging also includes combinations of oils, fats, and waxes that are especially popular in the dairy, confectionery, and bread industries. These substances are prized for their capacity to improve sensory attributes, adding glossiness while simultaneously effectively preserving food. Besides, the versatility and natural origin of lipids align with the increasing consumer demand for sustainable and environmentally friendly packaging solutions, further propelling the market growth. Furthermore, several innovations focus on improving the performance and aesthetic appeal of lipid-based edible packaging to broaden its application across various food products, which in turn, is increasing the edible packaging market value.

Analysis by Source:

- Plant

- Animal

Plant leads the market with around 67.6% of market share in 2024. The plant is widely employed due to the growing customer preference for ecologically friendly and sustainable packaging choices. Additionally, a variety of naturally occurring materials, including cellulose, starch, and plant proteins are frequently derived from renewable resources, that are biodegradable which are used to create plant-based edible packaging. Moreover, the versatility of plant materials allows for numerous applications in packaging everything from fresh produce to ready-to-eat (RTE) meals. As consumers seek eco-friendly products, the demand for plant-based packaging solutions continues to influence market growth. This trend is further supported by advancements in food science and technology that improve the functional properties of plant-based materials, making them more appealing to manufacturers and end-users looking for sustainable alternatives to conventional plastic packaging, thus contributing to the edible packaging market growth. Hence key players are introducing advanced product variants to meet these needs.

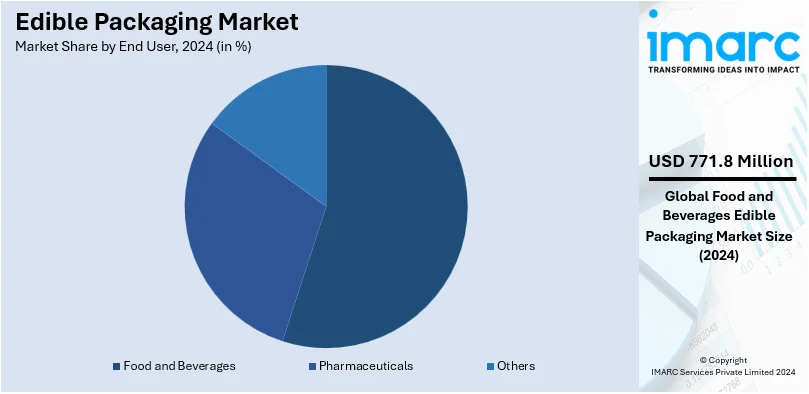

Analysis by End User:

- Food and Beverages

- Pharmaceuticals

- Others

Food and beverages lead the market with around 76.0% of market share in 2024. The food and beverages sector is primarily driven by the growing consumer demand for sustainable and innovative packaging solutions within the food industry. Additionally, edible packaging offers a dual purpose which reduces environmental impact and adds value to the consumer experience by being consumable. Moreover, companies are increasingly exploring edible packaging to enhance product shelf life, maintain food quality, and minimize waste. This trend is especially evident in the snack, dairy, and ready-to-eat (RTE) meal industries where convenience and sustainability are highly desired. According to the edible packaging market forecast, as strict regulations on single-use plastics are implemented and customer tastes move toward more environmentally friendly goods, edible packaging usage in the food and beverage industry is anticipated to expand significantly. For instance, on 30 January 2024, Apeel Sciences, a leader in supply chain innovations for the fresh fruit industry like edible coating to preserve food products without the need for plastic packaging, made a notable presence at the Berlin Fruit Logistica. The firm has unveiled several strategic initiatives as it prepares to engage with leading retailers and suppliers in the region to improve collaborations and optimize processes across Europe, the Middle East, and Africa (EMEA) market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 43.0%. According to the edible packaging market overview, North America is the leading market due to its strong regulatory framework supporting sustainable practices and high consumer awareness about environmental issues. Additionally, the region benefits from having numerous innovative companies that are constantly expanding the range of edible packaging solutions. For instance, in January 2024, Wyld, a prominent player in the North American edibles market, declared a new alliance with TIPA, a leader in biodegradable packaging solutions. With this agreement, the partnership aims to solve the environmental problems associated with single-use, non-recyclable flexible plastics and bring sustainable, alternative-plastic packaging to the North American legal edible packaging market. Additionally, Wyld will utilize TIPA’s 608 home compostable laminate, recently made available for local production in North America, for individual wraps for its edibles and larger pouches and bags. Starting in 2024, Wyld plans to distribute its products throughout the U.S. and Canada using this environmentally friendly packaging.

Key Regional Takeaways:

United States Edible Packaging Market Analysis

The U.S. edible packaging market is booming and will continue to do so because of the growing environmental consciousness and consumer demand for green packaging solutions. The growth is fueled by the increasing pressure to reduce plastic waste, as evidenced by the U.S. Environmental Protection Agency (EPA) data. In 2018, the United States produced 35.7 million tons of plastic waste accounting for 12.2% of MSW, while recycling only 3 million tons of plastic or 8.7% and significantly lower for containers of PET and HDPE plastics. These recycling problems require alternatives, like edible packaging. In 2018, 27 million tons of plastic were landfilled, which indicates the kind of environmental burden edible packaging aims to reduce. More and more companies, including Nestlé and Coca-Cola, are embracing edible packaging solutions in response to consumers' demand for environmentally friendly options.

Europe Edible Packaging Market Analysis

The European edible packaging market is experiencing notable expansion, fueled by increasing environmental awareness and regulatory demands to decrease plastic waste. As per the European Commission, every individual in the EU generated an average of 36.1 kilograms of plastic packaging waste in 2021, which represents a 29% rise over the past ten years. In 2021, the EU produced a total of 16.13 million tonnes of plastic waste, with 6.56 million tonnes being recycled. This recycling rate indicates that plastic waste management is a significant problem, and edible packaging serves as a timely remedy to create packaging that is both edible and sustainable. As EU regulations tighten, exemplified by the EU Single-Use Plastics Directive, the need for sustainable and biodegradable options, such as edible packaging, is growing rapidly. Notpla, a company located in the UK, exemplifies Europe’s transition by creating edible packaging from seaweed as an alternative to plastic films.

Asia Pacific Edible Packaging Market Analysis

The edible packaging market in Asia Pacific is rapidly growing, driven by increasing consumer awareness about environmental sustainability and the need to address plastic waste. There is a trend towards edible alternatives, with startups like Cupffee in Bulgaria and Good-Edi in Australia making the most innovative and sustainable products. For instance, edible cups made by Good-Edi, from Australia, from locally sourced ingredients, respond directly to the 2.7 million takeaway cups thrown into landfills daily in Australia. Moreover, with the rising plastic pollution worldwide, organizations like Incredible Eats are producing edible packaging solutions such as cups, cutlery, and straws to minimize food waste and plastic pollution in oceans. The market is enjoying the rise in demand for green solutions, especially in countries such as Japan, South Korea, and Australia, which are increasingly appreciating green practices among consumers and businesses alike.

Latin America Edible Packaging Market Analysis

The market for edible packaging in Latin America is developing due to increasing worries regarding plastic pollution and its effects on the environment. Research indicates that almost 17,000 tons of plastic waste are produced each day in Latin America, with a significant portion ending up in open landfills, greatly harming aquatic ecosystems, public health, and the environment. The issue of plastic waste is driving innovation and the use of alternative materials for sustainability, such as food packaging. To tackle this issue, nations in the area have progressively turned to measures and programs focused on biodegradable plastics and cleaning efforts. For instance, Brazil, having a substantial consumer base, has experienced a rising demand for eco-friendly products like edible packaging. The continuous work in the area to tackle its plastic pollution issue will yield solutions that can diminish the quantity of plastic waste in landfills and oceans, making the edible packaging market a crucial part of Latin America's sustainability initiative.

Middle East and Africa Edible Packaging Market Analysis

In the Middle East and Africa, the edible packaging market is still in its infancy but is expected to grow due to increased environmental awareness and the region's emphasis on sustainable food packaging. The market is estimated to be valued at USD 300 million in 2023, with a projected CAGR of 4.7% by 2030, according to a market analysis report. Countries like the UAE and South Africa are starting to look into biodegradable and edible packaging options. For instance, companies such as Green Pod in the UAE are manufacturing edible food wraps from plant-based materials. The region's rising food processing industry is also pushing the demand for environmentally friendly packaging. Even though it is small compared to the markets of other regions, there is a drive to be sustainable, with regulations coming from local jurisdictions and collaboration through international agreements.

Competitive Landscape:

At present, major players in the market are strategically concentrating on innovation and cooperation to fortify their positions in the market and drive expansion. Furthermore, several industry leaders are making significant investments in research and development (R&D) to develop strong and adaptable edible packaging options that will appeal to a wider spectrum of food and beverage makers. Additionally, partnerships with academic institutions and research centers are seeking to use advanced scientific discoveries to enhance product offerings. Furthermore, partnerships between key industry players and major food brands are increasingly prevalent, as they work together to customize edible packaging solutions that meet specific product requirements and consumer preferences. These strategies enhance product functionality and appeal while helping expand market reach and consumer acceptance of edible packaging solutions.

The report provides a comprehensive analysis of the competitive landscape in the edible packaging market with detailed profiles of all major companies, including:

- Devro plc

- Glanbia plc

- Ingredion Incorporated

- JRF Technology LLC

- MonoSol LLC (Kuraray Co. Ltd.)

- Nagase & Co. Ltd.

- Notpla Limited

- Safetraces Inc.

- Tate & Lyle Plc

- TIPA Corp Ltd.

Latest News and Developments:

- November 2024: UPM Specialty Papers and Eastman introduced a new recyclable paper packaging solution for food that features a compostable bio-based coating. The packaging incorporates Eastman's bio-based Solus additives along with BioPBS polymer to offer grease and oxygen protection while ensuring recyclability. This advancement provides an eco-friendly solution for challenging-to-package foods and works seamlessly with current extrusion coating machinery.

- November 2024: TIPA Compostable Packaging announced the acquisition of Bio4Pack, the European leader in compostable packaging solutions. The acquisition solidifies TIPA's market presence in sustainable packaging with additional product lines: agricultural wastepaper packaging, trays, and nets. TIPA gains further European capabilities by having more sales representatives in each country and local warehousing both in the Netherlands and Germany. This strategic step is in line with TIPA's aim to address the global plastic waste crisis and expand its portfolio of circular packaging solutions. TIPA's compostable packaging mimics the high-end properties of traditional plastic but leaves zero waste behind.

- June 2024: Nestlé has launched a one-time, plant-based fork to be used with its Maggi cup noodles in India. Developed in partnership with a local startup, this two-piece edible fork has been made from wheat flour and salt, thereby enabling functionality without compromising on nutritional value and taste. Nestlé has committed to reduction of plastic usage in the packaging by redesigning of accessories such as straws, cups, and cutlery and exploring alternative materials across product categories.

- April 2024: Glanbia plc has reached an agreement to purchase Flavor Producers LLC, the top U.S. flavor company focusing on natural and organic flavors and extracts for the food and beverage sectors. The purchase, starting at a value of $300 million, is anticipated to enhance the abilities of Glanbia's Nutritional Solutions division in the natural and organic flavors sector.

- September 2023: Xampla introduced Morro, a new consumer brand aimed at positioning bio-based and edible packaging as a viable alternative to traditional plastics. It is a start-up originating from the University of Cambridge that introduced its consumer brand, Morro. This brand, which emerged from 15 years of research, marks products in supermarkets with the Morro marque to indicate packaging made from bio-based materials.

- 14 April 2023: SARIA expanded its product range by acquiring Devro, a prominent provider of collagen-based edible films and coatings. Devro's specialized collagen casings complement SARIA’s natural sausage casings operations. This merger will enhance the growth prospects of both entities and foster advancements in product innovation, benefiting customers, suppliers, and employees.

Edible Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Lipids, Polysaccharides, Proteins, Surfactants, Others |

| Sources Covered | Plant, Animal |

| End Users Covered | Food and Beverages, Pharmaceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Devro plc, Glanbia plc, Ingredion Incorporated, JRF Technology LLC, MonoSol LLC (Kuraray Co. Ltd.), Nagase & Co. Ltd., Notpla Limited, Safetraces Inc., Tate & Lyle Plc, TIPA Corp Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the edible packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global edible packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the edible packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Edible packaging is a type of sustainable packaging material designed to be safely consumed along with the product it contains. Made from natural, biodegradable ingredients such as starch, gelatin, seaweed, rice, milk proteins (casein), or other plant-based and animal-derived materials, edible packaging offers an eco-friendly alternative to traditional plastic or paper-based materials.

The edible packaging market was valued at USD 1,015.58 Million in 2024.

IMARC estimates the global edible packaging market to exhibit a CAGR of 5.1% during 2025-2033.

The market is driven by rising focus on health and hygiene, increasing consumer preferences for sustainable packaging, significant growth in packaged food industry, and supportive government policies.

In 2024, lipids represented the largest segment by material type due to their qualities that efficiently stop tastes, carbon dioxide, and oxygen from migrating, which is essential for preserving product integrity and extending shelf life.

Plants lead the market by source owing to growing consumer preferences for ecologically friendly and sustainable packaging choices.

The food and beverages is the leading segment by end user, driven by growing consumer demand for sustainable and innovative packaging solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global edible packaging market include Devro plc, Glanbia plc, Ingredion Incorporated, JRF Technology LLC, MonoSol LLC (Kuraray Co. Ltd.), Nagase & Co. Ltd., Notpla Limited, Safetraces Inc., Tate & Lyle Plc, and TIPA Corp Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)