Edible Animal Fat Market Size, Share, Trends, and Forecast by Type, Source, End User, and Region, 2025-2033

Edible Animal Fat Market Size and Share:

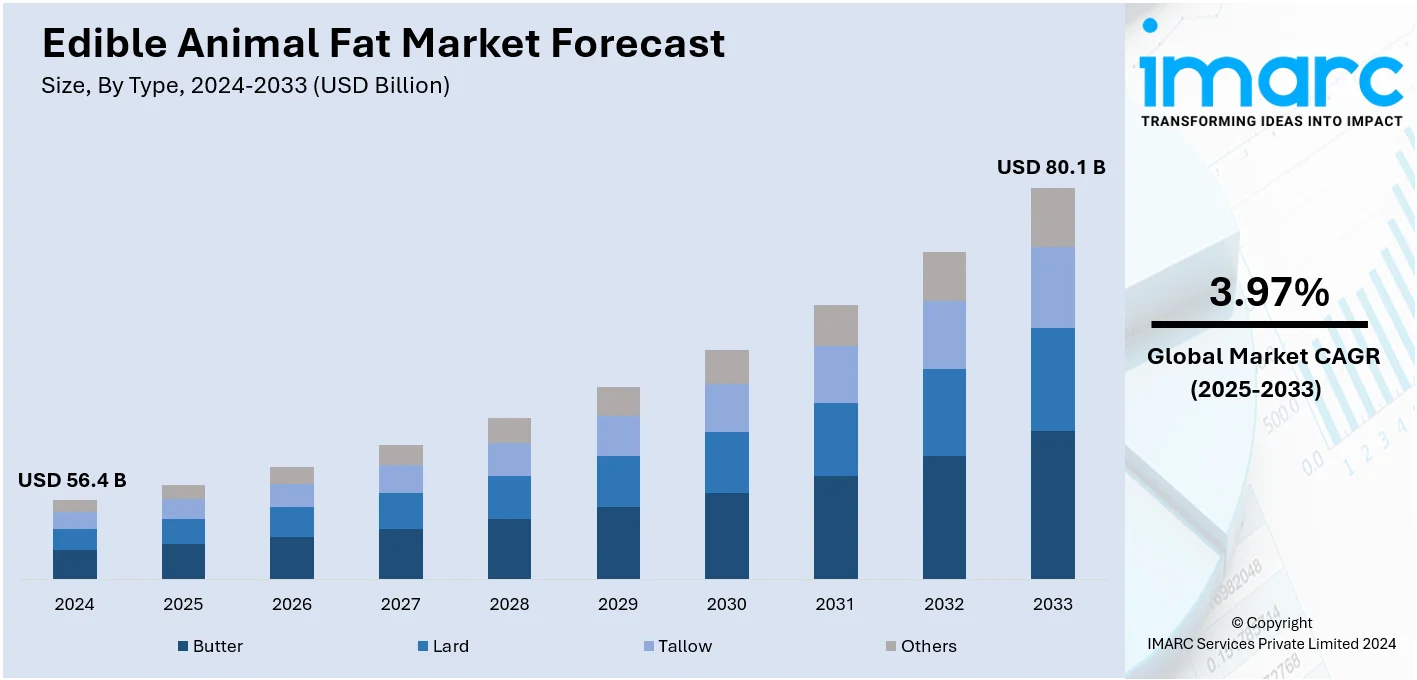

The global edible animal fat market size was valued at USD 56.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 80.1 Billion by 2033, exhibiting a CAGR of 3.97% during 2025-2033. North America currently dominates the market, holding a significant market share of over 32.8% in 2024. The growing population across the globe, rising meat consumption, rapid advancements in food processing technologies, an increasing demand for natural and organic food products, and rising awareness about the health benefits of animal fats are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 56.4 Billion |

|

Market Forecast in 2033

|

USD 80.1 Billion |

| Market Growth Rate 2025-2033 | 3.97% |

Key drivers in the edible animal fat market include an increasing demand for processed foods, the versatility of animal fats in cooking and baking, and their cost-effectiveness as compared to vegetable oils. The growing popularity of traditional and regional cuisines further boosts the demand. The cosmetic and biofuel industries leverage animal fats, thereby broadening market opportunities. Product innovation and the introduction of unique offerings are shaping the edible animal fat market. For instance, in September 2024, All Things Butter announced its plans to launch a category-first chocolate butter in Waitrose. The product aims to expand flavored butter use beyond traditional applications. Health-conscious trends promoting fats as essential dietary components and the availability of sustainable and traceable sourcing practices also contribute to the market's expansion.

Key drivers in the United States edible animal fat market include the rising demand for animal fats in processed foods, baked goods, and traditional American cuisines. The growing interest in high-fat and low-carb diets like keto and paleo has boosted the appeal of animal fats for their nutritional value. The market is also witnessing product innovations with brands introducing new offerings to meet evolving consumer preferences. For instance, in August 2024, Kerrygold launched 1LB Butter Sticks available in salted and unsalted options featuring four 4 oz. sticks per box. This innovative product maintains the brand's commitment to quality made from milk sourced from Irish grass-fed cows free of artificial additives. Expanding applications in biofuels and pet food manufacturing also fuel market growth. Consumer focus on sustainable and locally sourced ingredients aligns with the availability of traceable animal fat products in the United States market.

Edible Animal Fat Market Trends:

Growing population across the globe

The escalating population across the globe, leading to an increasing demand for food, is positively influencing the market growth. According to the United Nations (UN), the world's population is expected to reach 10.3 Billion people in the next 50 to 60 years. In line with this, the growing need for fats essential for cooking and food processing is acting as a growth-inducing factor. Along with this, the escalating demand for affordable and accessible food options, which makes edible animal fats a convenient choice, given their economic affordability and longer shelf life, is creating a positive outlook for the market growth. Additionally, the expanding population accompanied by urbanization, leading to changes in dietary habits, is supporting the market growth. In confluence with this, the increasing prevalence of fast food and convenience meals, which utilize animal fats for their preparation, is anticipated to drive the market growth. Furthermore, the emergence of dual-income households, with increased disposable income, leading to the consumption of meat and, by extension, animal fats, is supporting the edible animal fat market growth.

Rising meat consumption

The rising disposable incomes of consumers, leading to an increasing consumption of edible animal fat, are stimulating the market growth. As per industry reports, countries like Luxembourg have the highest gross domestic product (GDP) per capita that is 143,743 in 2023. Besides this, the evolving dietary patterns and changing consumer preferences that include animal-based proteins are also supporting the market growth. Along with this, the increasing meat consumption driving down costs that make animal fats even more accessible and affordable to consumers is acting as a growth-inducing factor. Apart from this, the growing popularity of meat-rich diets that incorporate cooking methods benefiting from animal fats, such as frying and sautéing, is anticipated to drive the market growth. Furthermore, the rising consumption of edible animal fat in commercial sectors like restaurants and food manufacturers is also positively influencing the market growth. They adapt their menus and products to cater to changing consumer preferences, often leading to an uptick in the use of animal fats in their offerings.

Rapid advancements in manufacturing technologies

The rapid technological advancements in food processing are bolstering the market growth. In line with this, the increasing innovations in extraction and refinement methods leading to higher yields and superior quality that allow for a broader range of product applications are anticipated to drive the market growth. Moreover, the widespread adoption of modern technologies to remove impurities and undesirable flavors more efficiently, which leads to a purer end-product, is stimulating the market growth. Furthermore, the increasing utilization of advanced analytics and quality control methods, ensuring compliance with stringent food safety standards, is favoring the market growth. The research report of the IMARC Group states that the global food safety testing market size reached USD 25.2 Billion in 2024. Apart from this, the growing research and innovation focusing on reducing the levels of saturated fats in the product, making it healthier without sacrificing its unique culinary advantages, is offering remunerative growth opportunities thereby creating a positive edible animal fat market outlook.

Edible Animal Fat Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global edible animal fat market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, source, and end user.

Analysis by Type:

- Butter

- Lard

- Tallow

- Others

Butter leads the market in 2024, holding around 46.1% of the market. Butter is dominating the market as it is used in an array of culinary applications ranging from baking and frying to serving as a spread or a flavor enhancer, making it a staple in many households. Moreover, butter is considered an essential ingredient in certain recipes, especially baked goods, which imparts a distinct flavor and texture that alternatives like margarine or vegetable oils cannot emulate. In line with this, its unique melting characteristics contribute to the texture of pastries, making it a preferred choice for home cooks and professional chefs. Additionally, butter also benefits from established supply chains, given its long history of consumption. Dairy farming infrastructure is well-developed in many parts of the world, ensuring a steady supply of raw materials, further propelling the market growth.

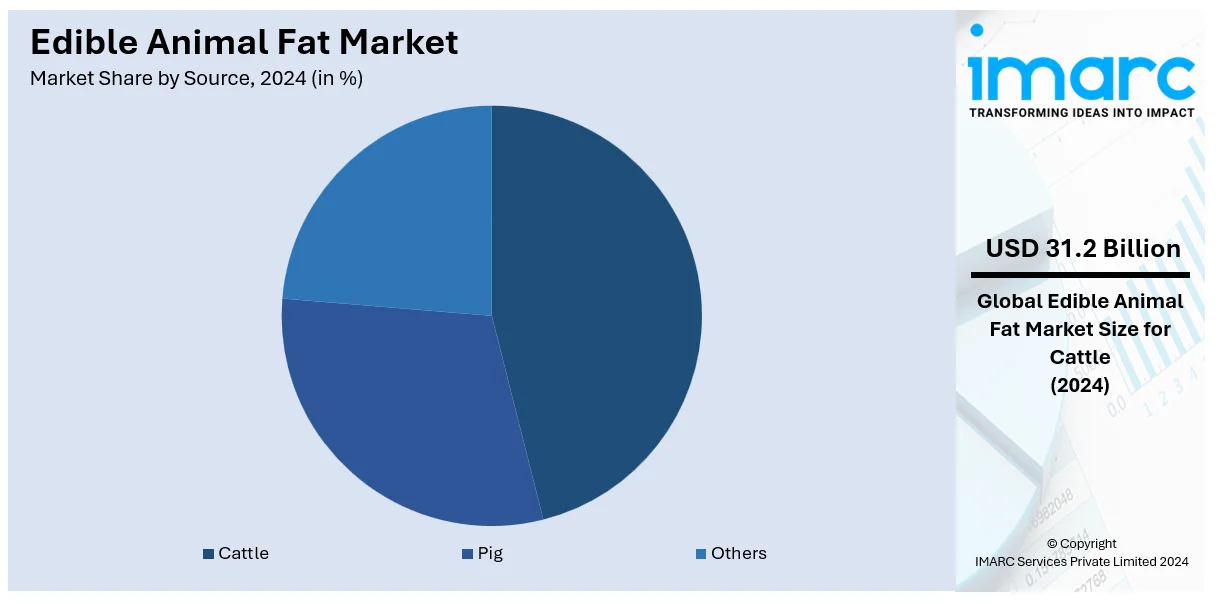

Analysis by Source:

- Cattle

- Pig

- Others

Cattle leads the market with around 55.3% of edible animal fat market share in 2024. Cattle dominates the market share as it provides tallow, beef fat, and butter, which is pivotal in various applications, spanning from culinary to industrial uses. Moreover, the versatility of cattle-derived fats, as they are used for frying, baking, and flavoring, is favoring the market growth. Along with this, the widespread utilization of tallow in the production of soaps and candles is strengthening the market growth. Additionally, rapid technological advancements in the processing of animal fats, such as enhanced methods of rendering, purification, and even genetic improvements in cattle breeds, leading to higher yields and superior quality fats, are providing a thrust to the market growth. Furthermore, the widespread utilization of cattle by-products, like bones and hides, sold for additional revenue, making the overall economics of cattle-derived fats more attractive for producers, is stimulating the market growth.

Analysis by End-User:

- Food-Industry

- Non-Food Industry

Based on the edible animal fat market forecast, the food industry has the largest end-user share in the edible animal fat market owing to its widespread utilization of tallow, lard, and butter in cooking, baking, frying, and flavoring. Moreover, rapid advancements in food technology, such as improved fat extraction, purification, and processing methods, which have resulted in high-quality animal fats that meet the stringent standards of the food industry, further reinforcing the sector’s reliance on these ingredients, is bolstering the market growth. Besides this, the changing consumer preference for sensory attributes such as flavor, aroma, and mouthfeel, keeping the food industry at the forefront of edible animal fat consumption is creating a positive outlook for the market growth. Furthermore, the operational efficiencies within the food industry, as animal fats often have higher smoke points compared to many plant-based oils, making them ideal for high-temperature cooking methods like frying, are propelling the market growth.

Analysis by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 32.8%. North America has established a clear leadership position in the edible animal fat market owing to the region's high consumption of meat, particularly beef. Additionally, North American culinary traditions are heavily influenced by meat-centric diets, which naturally generate a substantial demand for animal fats like tallow and butter. Furthermore, rapid technological advancements in food processing and fat extraction across the region, yielding high-quality products that satisfy stringent regulatory and consumer standards, are favoring the market growth. Moreover, North America benefits from a mature and highly developed agri-food industry, leading to a stable and scalable supply chain for animal fats. Apart from this, the changing consumer preferences in the region skewing towards food items that incorporate animal fats, such as baked goods and fast food, is strengthening the market growth.

Key Regional Takeaways:

United States Edible Animal Fat Market Analysis

In 2024, the United States captured 82.00% of revenue in the North American market. The United States edible animal fat market is shaped by several key factors driving its demand and supply. One of the primary drivers is its use in various industries, including food processing, animal feed, biodiesel production, and oleochemical manufacturing. Edible animal fats, such as lard and tallow, are valued for their functional properties, including flavor enhancement, texture improvement, and shelf-life extension in numerous food products. Their versatility makes them a staple in both industrial applications and household kitchens. In addition, the growing interest in biodiesel as a renewable energy source is positively influencing the market. As per the U.S. Energy Information Administration, U.S. capacity to produce biofuels increased 7% in 2023. Animal fats serve as a cost-effective feedstock for biodiesel production, driving their demand in the energy sector. Concurrently, the food industry's ongoing preference for natural and traditional cooking ingredients supports the use of animal fats over synthetic alternatives. Besides this, consumer preferences also play a role, with trends leaning toward sustainably sourced and minimally processed fats. On the supply side, the market is influenced by livestock production trends, rendering processes, and regulatory standards. Challenges persist, such as competition from plant-based fats and oils and shifting dietary preferences toward vegan or low-fat diets. However, the ongoing focus on renewable energy and sustainable food production keeps edible animal fats a relevant component of the broader agricultural and industrial landscape.

Asia Pacific Edible Animal Fat Market Analysis

The Asia Pacific edible animal fat market is driven by a combination of cultural, economic, and industrial factors. In many countries across the region, traditional cuisines rely heavily on animal fats, such as lard and tallow, prized for their flavor and ability to enhance the texture and shelf life of dishes. The growing popularity of processed and convenience food items also contributes to the demand, as animal fats are used in manufacturing baked goods, snacks, and other ready-to-eat (RTE) products. People are increasingly preferring these RTE food items owing to changing lifestyles and rapid urbanization. The CIA states that the urban population in India in 2023 was 36.4% of total population. In line with this, the region’s expanding middle class and increasing disposable incomes are leading to higher meat consumption, indirectly boosting the supply of animal fats as a by-product of meat processing. Concurrently, rapid industrialization is spurring the use of animal fats in non-food applications, including soap production, oleochemicals, and biodiesel. Furthermore, the market benefits from the affordability of animal fats as compared to plant-based oils, making them an attractive option in price-sensitive economies within the region. Additionally, the emergence of biodiesel as a renewable energy source is creating new avenues for growth, as animal fats are increasingly used as feedstock in the energy sector.

Europe Edible Animal Fat Market Analysis

The European edible animal fat market is influenced by diverse factors across its food, energy, and industrial sectors. A significant driver is the traditional culinary culture in many European countries, where animal fats like lard and tallow are integral to recipes, especially in baked goods and fried food items. Their natural flavor-enhancing and texture-improving properties sustain their demand in the food industry. In addition, the rising focus on sustainability and circular economy practices is amplifying the use of animal fats in non-food applications, particularly in biodiesel production. European regulations promoting renewable energy sources, such as the EU Renewable Energy Directive (RED II), encourage the utilization of animal fats as an eco-friendly and cost-effective feedstock for biofuels, boosting demand in this sector. According to the International Energy Agency (IEA) five-year biofuel demand growth in Europe is expected to reach 4.6 Billion litres per year between 2023-2028. The market also benefits from the ongoing push for waste reduction and by-product utilization in the meat industry. Animal fats, derived as a by-product of meat processing, align with sustainable practices by minimizing waste and finding economic use in various industries. Moreover, consumer trends toward natural and traditional ingredients further bolster the use of animal fats, particularly in premium and artisanal food products.

Latin America Edible Animal Fat Market Analysis

The Latin America edible animal fat market is shaped by traditional culinary practices, industrial applications, and growing energy needs. As per the International Energy Agency (IEA), total primary energy demand has doubled in Brazil since 1990. In addition, animal fats, such as lard and tallow, hold a significant role in regional cuisines, particularly in baked and fried goods, where their flavor-enhancing and texture-improving properties are highly valued. The affordability of animal fats as compared to plant-based oils drives their use in price-sensitive sectors, while their versatility extends to non-food applications, including soap production, cosmetics, and biodiesel. The region's expanding biodiesel industry, supported by government initiatives promoting renewable energy, is becoming a key growth driver. The increasing focus on sustainability and efficient use of by-products in the meat industry is contributing to the market growth.

Middle East and Africa Edible Animal Fat Market Analysis

The Middle East and Africa edible animal fat market is influenced by traditional food practices, industrial demand, and regional energy needs. In many parts of the region, animal fats, such as tallow are commonly used in cooking and baking, especially in rural and low-income areas where affordability is crucial. Their long shelf life and availability make them a staple in local diets. In line with this, industrial applications, including soap production and oleochemicals, further drive demand for animal fats. The GCC bath soap market is expected to grow at a CAGR of 5.18% during 2024-2032, as reported by the IMARC Group. Additionally, the expanding biodiesel industry in certain African countries, supported by initiatives to adopt renewable energy, boosts the utilization of animal fats as a feedstock.

Competitive Landscape:

The edible animal fat market is characterized by intense competition among established players and emerging producers. Companies focus on product innovation, sustainable sourcing, and expanding application areas to capture market share. The rise in the consumer demand for natural and high-quality fats has pushed producers to emphasize traceability and transparency in their supply chains. Strategic partnerships, acquisitions, and expansions are common to enhance market presence. Advancements in processing technologies and diversification into sectors such as cosmetics, pet food and biofuels are shaping the competitive environment. Price volatility of raw materials and the increasing popularity of plant-based alternatives add pressure compelling market participants to adopt agile strategies to stay competitive while maintaining quality and addressing consumer trends effectively.

The report provides a comprehensive analysis of the competitive landscape in the edible animal fat market with detailed profiles of all major companies, including:

- Baker Commodities Inc.

- Cargill Inc.

- Colyer Fehr Group

- Piermen B.V.

- Saria Limited

- Ten Kate Holding B.V.

Latest News and Developments:

- 2024: Westcombe Dairy in Somerset announced its Lard product. This new product was being rendered from the leftover fat lining the belly, which is known as leaf fat.

- August 2023: Taranaki Bio Extracts launched Butler, which is compromised of the company’s beef bone broth and extracts range of ingredients aimed at food manufacturers. The ingredients offer high protein content, collagen, glucosamine, and amino acids such as glycine and proline.

- April 2023: Omsco expanded its Grass Roots Dairy Co range with the launch of a new organic salted butter. The butter is produced in small batches using traditional methods and is made with 100% organic cream from Omsco Members' free-range, grass-fed cows.

- December 2022: KTC Edibles introduced Premio Italian Lard, a premium lard option for UK food manufacturers, ideal for baking, frying, and roasting. Made from pigs fed a varied diet, this lard boasts a smooth texture and lower melting point, enhancing pastries and pies.

Edible Animal Fat Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Butter, Lard, Tallow, Others |

| Sources Covered | Cattle, Pig, Others |

| End Users Covered | Food-Industry, Non-Food Industry |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Baker Commodities Inc., Cargill Inc., Colyer Fehr Group, Piermen B.V., Saria Limited, Ten Kate Holding B.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the edible animal fat market from 2019-2033.

- The edible animal fat market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the edible animal fat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Edible animal fats are rendered fats derived from animals, including tallow, lard, and butter, used in cooking, baking, and as ingredients in processed foods. They are valued for their flavor, texture, and functional properties across various food and non-food applications.

The edible animal fat market was valued at USD 56.4 Billion in 2024.

IMARC estimates the global edible animal fat market to exhibit a CAGR of 3.97% during 2025-2033.

Key drivers include rising meat consumption, demand for processed and convenience foods, advancements in food processing technologies, and increased awareness of the culinary and health benefits of animal fats.

In 2024, butter represented the largest segment by type, driven by its versatility in cooking, baking, and flavor enhancement.

Cattle leads the market by source owing to the widespread use of tallow, butter, and beef fat in culinary and industrial applications.

The food industry is the leading segment by end-user, driven by the extensive use of animal fats in cooking, baking, and food processing.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global edible animal fat market include Baker Commodities Inc., Cargill Inc., Colyer Fehr Group, Piermen B.V., Saria Limited, Ten Kate Holding B.V., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)