Edge Data Center Market Size, Share, and Trends by Component, Facility Size, Vertical, Region, and Forecast 2025-2033

Edge Data Center Market Size and Share:

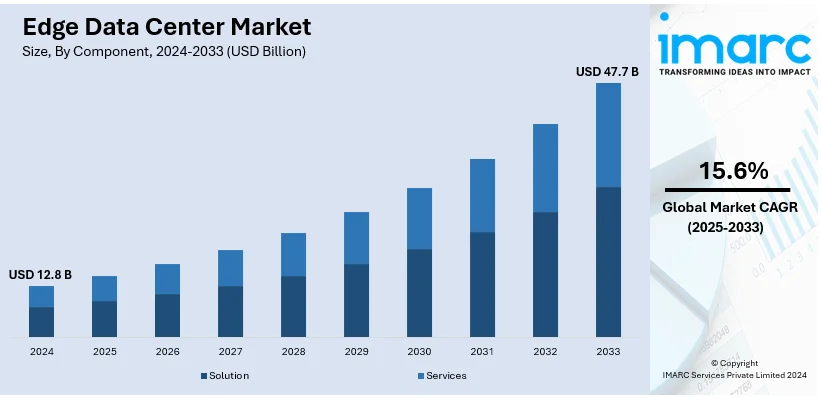

The global edge data center market size was valued at USD 12.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 47.7 Billion by 2033, exhibiting a CAGR of 15.6% from 2025-2033. North America currently dominates the market, holding a market share of over 33.1% in 2024. The growing adoption of hybrid and multi-cloud strategies, ongoing advancements in AI and ML for real-time data processing, and the rising need for enhanced security and data privacy are some of the major factors reshaping the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.8 Billion |

| Market Forecast in 2033 | USD 47.7 Billion |

| Market Growth Rate 2025-2033 |

15.6%

|

The edge data center market is rapidly expanding, driven by the growth of IoT devices, which is anticipated to increase by 13% to 18.8 billion by the end of 2024, up from 16.6 billion in 2023, marking a 15% rise from 2022, according to the State of IoT Summer 2024 report by IoT Analytics. This rise necessitates localized data processing for reduced latency and real-time analytics. The adoption of 5G networks accelerates the need for edge facilities to handle high-speed data transmission. Autonomous vehicles and smart cities depend on distributed data centers for uninterrupted operations. Businesses are decentralizing IT infrastructure for scalability and security, while data sovereignty regulations and energy-efficient solutions further bolster the edge computing ecosystem.

The United States is emerging as key contributor to the edge data center market, majorly driven by the augmenting need for localized data processing due to data-intensive applications. In line with this, the increasing popularity of streaming services, AR/VR, and online gaming is fueling demand for edge facilities to reduce latency and enhance user experience. A recent survey shows that Gen Z and Millennials are particularly active with AR/VR, with 63% of Gen Z and 51% of Millennials using AR, and 75% of Gen Z and 53% of Millennials using VR, with gaming being the top use case (54%). Additionally, decentralized digital ecosystems like blockchain require distributed data processing, while disaster recovery and data redundancy further boost the demand for edge data centers.

Edge Data Center Market Trends:

The increasing proliferation of IoT, big data, and AI technologies

The advent of IoT, big data, and AI technologies has resulted in the generation of massive volumes of data that require rapid processing and analysis, which, in turn, is propelling the demand for edge data centers. IoT devices, in particular, continuously create data that needs immediate processing to generate real-time insights and optimize functionality. In addition to this, AI and machine learning systems demand quick data access for efficient learning and decision-making processes. According to industry reports, global investment in AI is expected to reach approximately US$ 200 Billion by 2025, which, in turn, will drive the demand for edge data centers. Besides this, expanding applications of big data across various sectors, such as finance, healthcare, retail, and others, are positively impacting the market growth. Furthermore, edge data centers, due to their proximity to data sources, are ideal for addressing these increasing demands, providing lower latency and higher data processing speeds.

Rapid digitalization across various industrial verticals

With the global e-commerce market projected to reach 3.6 billion users by 2029, the digital transformation is becoming a strategic imperative for businesses in various sectors and the need for robust data management infrastructure has heightened. The retail sector is leveraging digital platforms for e-commerce, customer data management, and inventory tracking, which, in turn, is fueling the need for edge data center for efficient data handling and storage. In addition, sectors such as healthcare are utilizing digital tools and platforms for telemedicine, remote patient monitoring, and digital health records, necessitating reliable and rapid data services. Furthermore, the expanding adoption of Industry 4.0 practices across the manufacturing sector and the growing penetration of connected devices and automation tools that generate enormous amounts of data are aiding in market expansion.

The advent of 5G and the need for real-time data processing

The widespread deployment of 5G technology, offering significantly higher speeds and lower latency than its predecessors, is presenting remunerative growth opportunities for the market. For example, according to market research, 5G networks are expected to reach approximately 33% of the global population by 2025. Edge data centers, due to their inherent design, are ideal for this requirement, providing the necessary low-latency, high-bandwidth data services. Moreover, the expanding real-time applications such as autonomous vehicles, telemedicine, and smart cities, needing instantaneous data analysis for a safe and effective operation, ensuring minimal lag and real-time responsiveness, are creating a favorable outlook for the market.

Edge Data Center Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global edge data center market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, facility size, vertical, and region.

Analysis by Component:

- Solution

- Services

Solution leads the market with around 87.5% of market share in 2024. The growing demand for tailored and integrated systems that enable efficient data processing closer to end-users positions solutions as leader in the market. These solutions, encompassing software, hardware, and networking technologies, are pivotal for industries leveraging IoT, AI, and 5G, where low latency and real-time data analysis are critical. Solutions providers offer advanced tools for workload optimization, energy efficiency, and data security, meeting the specific needs of diverse sectors. By enabling scalable and cost-effective edge computing, solutions drive adoption and innovation, cementing their leadership in the edge data center market.

Analysis by Facility Size:

- Small and Medium Facility

- Large Facility

Large facility leads the market with around 79.5% of market share in 2024. These facilities dominate the edge data center market due to their ability to support high-density workloads and offer scalability for expanding data needs. These facilities are equipped with robust infrastructure to handle the demands of various industries, which require efficient data processing and storage at the edge. Their advanced cooling systems, power management, and security features render them ideal for supporting new technologies. Additionally, large facilities can accommodate multi-tenant setups, attracting enterprises seeking reliable, cost-effective edge computing solutions to enhance performance and reduce latency.

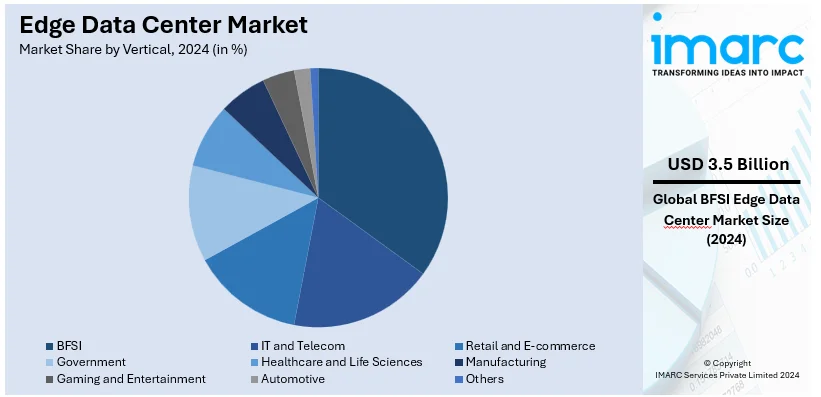

Analysis by Vertical:

- IT and Telecom

- BFSI

- Retail and E-commerce

- Government

- Healthcare and Life Sciences

- Manufacturing

- Gaming and Entertainment

- Automotive

- Others

BFSI sector leads the market with around 27.5% of market share in 2024. The leadership in the market is due to its critical need for low-latency data processing and real-time decision-making. Financial institutions require edge data centers to handle high volumes of transactional data, support digital banking, and ensure seamless customer experiences. The sector’s reliance on technologies such as AI for fraud detection and blockchain for secure transactions further drives demand. Additionally, compliance with stringent data protection regulations necessitates localized data storage and processing. By leveraging edge data centers, BFSI firms enhance operational efficiency, improve security, and maintain business continuity in a fast-paced, data-intensive environment.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.1%. The rising adoption of emerging technologies, such as IoT, AI, and 5G networks, in North America represents the key factor driving the market growth. Concurrent with this, the increasing demand for content delivery services and cloud computing, and the need to support autonomous systems are propelling the demand for edge data centers in the region.

In addition to this, the increasing digitalization across various industrial verticals in Europe, combined with the escalating focus on data sovereignty and privacy regulations, are presenting remunerative growth opportunities for the market. Apart from this, the large population and a high concentration of mobile users in the Asia Pacific region, resulting in significant data generation and consumption, is acting as another significant growth-inducing factor. Moreover, the rapid adoption of IoT and AI technologies and the expanding deployment of 5G networks in countries, such as China, South Korea, and Japan, is fueling the demand for edge data centers to support enhanced network capabilities.

Key Regional Takeaways:

United States Edge Data Center Market Analysis

In 2024, the US dominated the North America market with a market share of 71.2%. The growing need for low-latency data processing, which is being driven by the growth of IoT devices, 5G networks, and cloud computing, is driving the edge data center market in the United States. Currently, the number of IoT devices in the entire North America region stands at more than 3.2 Billion, most of which are from the United States. This number is expected to nearly double and reach 6.2 Billion in 2030, showcasing an increase of 93%. Moreover, as edge data centers are positioned strategically near end users, applications such as online gaming, driverless cars, and smart city infrastructure can benefit from faster data transfer and better performance. Telecom companies are making significant investments in edge data centers to maximize network efficiency and enable ultra-reliable low-latency communications, as the United States is spearheading the global rollout of 5G.

Demand is further accelerated by the expansion of the e-commerce and content delivery industries, since edge facilities improve user experience and lower latency in applications such as virtual reality, online shopping, and video streaming. The growth of edge data centers is also being aided by developments in AI and machine learning, which call for real-time data processing. Important sectors including manufacturing, healthcare, and retail are progressively implementing edge solutions to handle vital data locally, guaranteeing adherence to data protection laws and reducing downtime.

The existence of significant players such as Equinix, EdgeConneX, and Switch, who are constantly developing and growing their infrastructure to satisfy rising demand, augments the U.S. market. Additionally, it is anticipated that government programs promoting digital transformation and rural broadband development would augment the deployment of edge data centers in not so developed areas.

Europe Edge Data Center Market Analysis

The growing focus on digital transformation in the region, which is aided by programs such as the European Digital Strategy, is largely driving the European edge data center market. Industry processing and data storage near consumers for real-time applications is made possible by the growth of 5G networks and the increasing use of IoT devices. The robust internet infrastructure and high rates of sophisticated technology adoption in nations including Germany, France, and the UK are driving this expansion.

Another factor driving demand for edge data centers is the increased focus on data sovereignty and adherence to laws such as GDPR, which call for regional data processing and storage. The demand for edge data centers is also being increased by the move toward smart cities, the integration of renewable energy, and autonomous mobility options. Significant contributions are also made by the entertainment and e-commerce industries, which use cutting-edge technologies to enhance client satisfaction and content distribution.

Europe's data center infrastructure market is seeing significant change as a result of global trends like sustainable practices and technology breakthroughs. In line with Europe's ambitious goal of being the first climate-neutral continent by 2050, many organizations are now striving to significantly reduce carbon emissions from the building of data centers and to deliver 100% renewable energy to their clients, mostly by 2030. Businesses such as Schneider Electric and Digital Realty are spearheading innovation, making sure that cutting-edge facilities satisfy growing demand while adhering to environmental regulations.

Asia Pacific Edge Data Center Market Analysis

The extensive use of 5G, IoT, and cloud-based applications is driving the market for edge data centers in Asia-Pacific. Large populations, urbanization, and growing digitalization are driving nations such as China, India, Japan, and South Korea to the forefront. Low-latency content distribution is highly desired due to the growing popularity of OTT platforms, online gaming, and e-commerce; edge data centers can successfully meet this need. Leading-edge data centers and other edge operators, for example, are making significant investments to open several edge data centers in Indonesia, Australia, Malaysia, the Philippines, Thailand, India, Vietnam, and other countries. For instance, with the construction of a state-of-the-art data center in Bangkok, Thailand, EDGNEX Data Centers by DAMAC announced its most recent expansion in the Asia-Pacific (APAC) area. The multi-story, 19,000-square-meter Tier 3 colocation data center's first phase is expected to be finished by 2026. The data center will serve a variety of customers, such as hyperscale edge nodes, retail, and wholesale.

Additionally, Asia-Pacific's production centers are progressively implementing edge solutions to empower automation and real-time monitoring via IoT and AI technologies. The region's emphasis on connected infrastructure initiatives and smart cities, such as India's Smart Cities Mission, is another important economic engine. Telecom companies and local governments are making significant investments in edge infrastructure to facilitate 5G rollout and improve access in underserved areas.

Latin America Edge Data Center Market Analysis

The rise of digital services and rising internet penetration in nations including Brazil, Mexico, and Argentina are driving the market's steady growth. Localized data processing is becoming necessary to lower latency and enhance user experience as e-commerce platforms, content streaming, and gaming have grown in popularity. The need for edge data centers is being further fueled by the introduction of 5G networks and the use of IoT in industries including manufacturing, healthcare, and agriculture. Additionally, efforts to upgrade digital infrastructure and the arrival of international cloud providers are opening up new markets in this area.

Middle East and Africa Edge Data Center Market Analysis

The deployment of 5G and IoT technologies, especially in nations such as the United Arab Emirates, Saudi Arabia, and South Africa, is propelling the Middle East and Africa edge data center market. The region's emphasis on smart city initiatives, such as Saudi Arabia's NEOM and Dubai's Smart Dubai initiative, is a major factor driving edge data center growth by facilitating real-time data processing for connected infrastructure. Additionally, the need for localized data processing is being driven by the growing reliance of many businesses on digital platforms and cloud services. In order to improve operational efficiency and guarantee data security, the energy and oil industries are also implementing cutting-edge solutions.

Competitive Landscape:

The global edge data center market is characterized by intense competition among various players operating in the industry. The competitive landscape is dynamic and changing, with both established companies and new entrants striving to capture market share and meet the growing demand for edge data center solutions. Several major players dominate the market, including IT infrastructure providers, data center operators, telecommunications companies, and cloud service providers. These companies leverage their extensive resources, infrastructure, and technological expertise to offer comprehensive edge data center solutions to customers worldwide. Additionally, there are numerous smaller and niche players that focus on specific segments or regional markets. These players often offer specialized services, customized solutions, or innovative technologies to cater to specific industry needs or emerging trends.

The report provides a comprehensive analysis of the competitive landscape in the edge data center market with detailed profiles of all major companies, including:

- Compass Datacenters

- DC BLOX Inc.

- Dell Technologies Inc.

- EdgeConneX Inc.

- Equinix Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co. Ltd.

- International Business Machines Corporation

- Nvidia Corporation

- Rittal Limited (Friedhelm Loh Group)

- Schneider Electric SE

- Vapor IO Inc.

- Vertiv Group Corp.

Latest News and Developments:

- February 2024: NTT DATA and Schneider Electric formed a strategic partnership to deliver an innovative solution combining Edge Computing, Private 5G, IoT, and Modular Data Centers. This solution integrates NTT DATA's Edge as a Service with Schneider Electric's EcoStruxure modular data centers, enabling businesses to enhance energy efficiency and meet the high computational demands of Generative AI applications, including machine vision and predictive maintenance, at the edge.

- January 2024: IBM entered into a collaboration with American Tower to accelerate the deployment of a hybrid, multi-cloud computing platform at the edge. As part of the partnership, American Tower will enhance its Access Edge Data Center ecosystem by integrating IBM Hybrid Cloud capabilities and Red Hat OpenShift. This initiative aims to help businesses address changing customer needs and drive digital transformation through technologies such as IoT, 5G, AI, and network automation.

- July 2023: Ubiquity, digital infrastructure firm acquired EdgePresence, a provider of build-to-suit edge data centers, previously backed by investors including DataBank. The acquisition terms were not disclosed. EdgePresence was founded in 2017 and formerly known as Modular Life Solutions, specializes in deploying EdgePods (12ft by 30ft containers) with 100kW IT capacity—at cell tower locations across the United States.

Edge Data Center Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Facility Sizes Covered | Small and Medium Facility, Large Facility |

| Verticals Covered | IT and Telecom, BFSI, Retail and E-commerce, Government, Healthcare and Life Sciences, Manufacturing, Gaming and Entertainment, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Compass Datacenters, DC BLOX Inc., Dell Technologies Inc., EdgeConneX Inc., Equinix Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co. Ltd., International Business Machines Corporation, Nvidia Corporation, Rittal Limited (Friedhelm Loh Group), Schneider Electric SE, Vapor IO Inc., Vertiv Group Corp., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the edge data center market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global edge data center market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the edge data center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

An edge data center is a small, localized facility that processes and stores data closer to the end-users or devices that generate and consume the data. Unlike traditional centralized data centers, edge data centers are designed to reduce latency, enhance speed, and improve reliability for applications that require real-time processing.

The edge data center market was valued at USD 12.8 Billion in 2024.

IMARC estimates the global edge data center market to exhibit a CAGR of 15.6% during 2025-2033.

The growing adoption of IoT devices, the rise of 5G networks, increasing demand for low-latency processing, the need for localized data processing, and advancements in AI/ML, all driving the need for more edge data centers.

In 2024, solutions represented the largest segment by component, driven by the growing demand for tailored and integrated systems enabling efficient data processing close to end-users.

Large facilities lead the market by facility size attributed to their ability to support high-density workloads and offer scalability for expanding data needs.

The BFSI sector is the leading segment by vertical, driven by the critical need for low-latency data processing and real-time decision-making in financial services.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global edge data center market include Compass Datacenters, DC BLOX Inc., Dell Technologies Inc., EdgeConneX Inc., Equinix Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co. Ltd., International Business Machines Corporation, Nvidia Corporation, Rittal Limited (Friedhelm Loh Group), Schneider Electric SE, Vapor IO Inc., and Vertiv Group Corp., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)