East Africa Renewable Energy Market Report by Type (Hydropower, Solar, Wind, and Others), and Country 2026-2034

East Africa Renewable Energy Market Size:

East Africa renewable energy market size reached USD 4.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.1 Billion by 2034, exhibiting a growth rate (CAGR) of 5.66% during 2026-2034. The market is propelled by the rising energy demand, availability of abundant solar and wind resources, supportive government policies promoting clean energy, significant investments in infrastructure projects, decreasing renewable energy costs, and rising international funding and technological innovations for regional energy security amidst fossil fuel volatility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.3 Billion |

| Market Forecast in 2034 | USD 7.1 Billion |

| Market Growth Rate (2026-2034) | 5.66% |

Access the full market insights report Request Sample

East Africa Renewable Energy Market Analysis:

- Major Market Drivers: The major drivers for East Africa renewable energy market share include rising energy demand owing to population growth and urbanization, favorable government policies and incentives toward clean energy projects, and growing international investments and funding from organizations like the World Bank and African Development Bank. Furthermore, the region’s rich natural resources, including solar, wind, and geothermal, provide a concrete foundation for the development and expansion of renewable energy infrastructure.

- Key Market Trends: Some of the major East Africa renewable energy trends involve the widespread adoption of off-grid and mini-grid systems to improve rural electrification, the incorporation of energy storage solutions to ensure a stable energy supply, and the growing utilization of digital technologies for smart grid management. In line with this, there is a growing emphasis on public-private partnerships to accelerate project development and enhance the sustainability and efficiency of renewable energy systems, which is serving as another crucial key development in the market growth.

- Competitive Landscape: The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- Challenges and Opportunities: Opportunities in the East Africa renewable energy market forecast include harnessing the region's abundant renewable resources, attracting international funding and investments, and expanding rural electrification through off-grid solutions. However, challenges such as inadequate infrastructure, regulatory hurdles, and limited access to financing can impede market growth. Addressing these challenges requires coordinated efforts between governments, private sector stakeholders, and international organizations to create an enabling environment for renewable energy development.

East Africa Renewable Energy Market Trends:

Increasing Energy Demand

With rapid population growth and urbanization, the demand for energy in East Africa is rising significantly. According to the African Union Development Agency, the energy needs of the African continent are expected to increase, i.e., more than triple by 2040. Moreover, according to the data by the World Bank, by FY23, 25 million people in Eastern and Southern Africa had gained new or improved electricity access. Uganda saw an increase in electricity access for 8.8 million individuals over seven years. In Tanzania, 6 million people gained electricity access across two IDA cycles in recent years. Mozambique's ProEnergia project has benefited 1.7 million people. Ethiopia has provided new on-grid electricity services to almost 4.7 million people, while 1.2 million people in Rwanda have gained access to off-grid solar electricity. Additionally, 173,000 new grid connections have been established in Malawi. Renewable energy offers a sustainable solution to meet this growing demand, reduce energy poverty, and support economic development across the region. This, in turn, is contributing to the market growth.

Government Policies and Incentives

Supportive policies, such as feed-in tariffs, tax incentives, and subsidies for renewable energy projects, are crucial drivers. These policies create a favorable investment climate, encourage private sector participation, and facilitate the growth of the renewable energy sector. For instance, the USAID-funded East Africa Energy Program (EAEP) aimed to optimize power supply, expand electricity access, and support economic development in East Africa. It facilitated 5.2 million direct grid connections and generated 294 MW of clean energy. The program promoted gender equity by helping 111 women secure full-time jobs in the energy sector. It also supported regional power trade, with significant projects like the Ethiopia-Kenya power trade and Rwanda-Uganda interconnection. Additionally, 1,531.2 km of transmission lines were constructed or upgraded, and 97 laws and policies were proposed or implemented to enhance energy governance.

Rising International Investments and Funding

Substantial financial support for renewable energy projects in East Africa comes from major international organizations like World Bank and African Development Bank. For instance, the Energy Sector Management Assistance Program (ESMAP), in partnership with the World Bank and over 20 development partners, plays a crucial role in advancing energy access in Eastern and Southern Africa. ESMAP supports innovative technologies, business models, and financial instruments, and provides technical support for mini-grids, off-grid solutions, and cross-cutting topics like public facility electrification and productive electricity use. Through initiatives like the ASCENT MPA and the DARES platform, ESMAP aims to accelerate electrification and explore synergies with clean cooking in the region. These investments are crucial for infrastructure development, technological advancements, and capacity building, thereby driving the expansion of the renewable energy market in the region. As per a report by the International Renewable Energy Agency (IRENA) and the African Development Bank (AfDB), Africa added over 26 GW of renewable capacity in the last decade, with annual investments rising from under USD 0.5 billion to USD 5 billion. Transitioning to renewable energy could increase GDP by 6.4%, jobs by 3.5%, and the welfare index by 25.4% by 2050 under IRENA's 1.5°C Scenario.

East Africa Renewable Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on type.

Breakup by Type:

To get detailed segment analysis of this market Request Sample

- Hydropower

- Solar

- Wind

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes hydropower, solar, wind, and others.

The primary driver for hydropower segment in East Africa renewable energy market is the region's abundant water resources, which provide a reliable and consistent source of energy. Governments are investing in large-scale hydropower projects to meet growing energy demands and reduce dependence on fossil fuels. Additionally, hydropower offers significant potential for rural electrification, improving access to electricity in remote areas.

The solar energy segment is driven by East Africa's high solar insolation levels, which offer immense potential for harnessing solar power. The decreasing cost of solar panels and advancements in solar technology have made it more affordable and accessible. Government policies and incentives promoting renewable energy adoption, along with the versatility of solar installations, from small-scale home systems to large solar farms, supports diverse applications and rapid deployment. Additionally, the region's commitment to reducing carbon emissions and achieving energy independence fuels the growth of the solar energy sector.

Wind energy development in East Africa is propelled by favorable wind conditions, particularly in coastal and highland areas. The potential for large-scale wind farms to provide substantial amounts of clean energy drives investment in this sector. Government initiatives and regulatory frameworks supporting renewable energy attract both domestic and international investors to wind projects. The scalability of wind energy, combined with its relatively low environmental impact, makes it a key component of the region's renewable energy strategy.

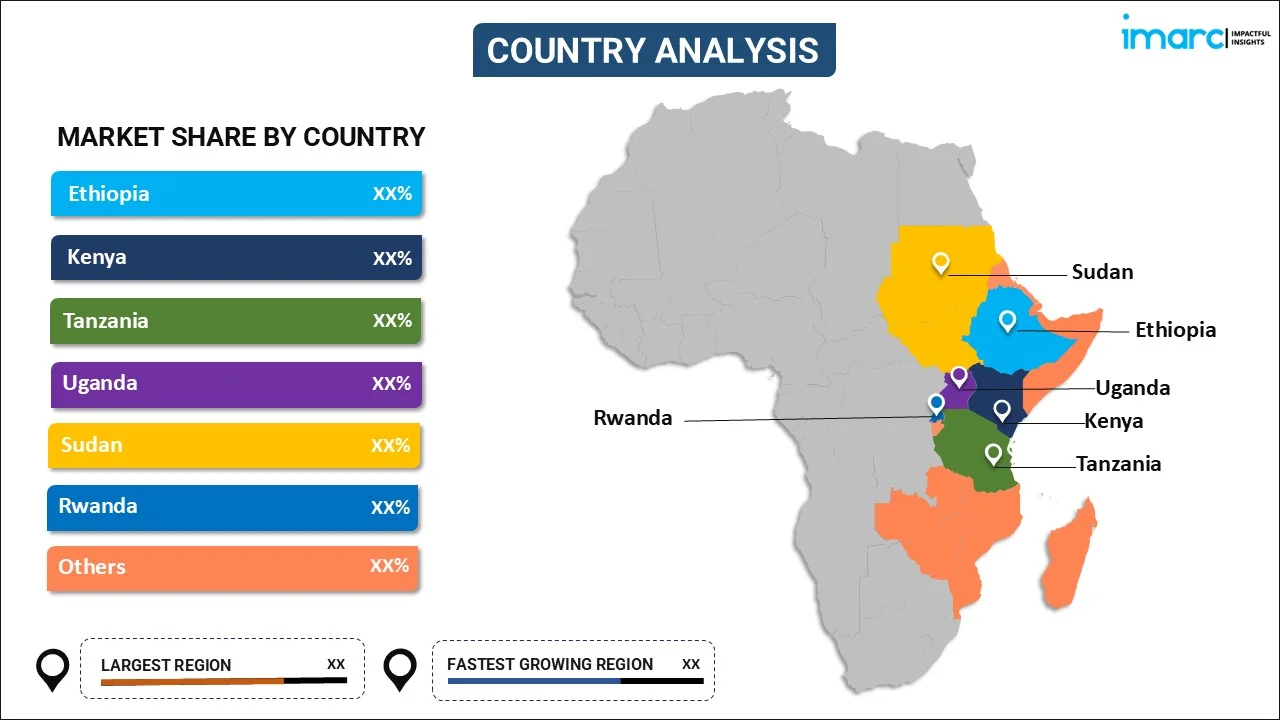

Breakup by Country:

To get detailed regional analysis of this market Request Sample

- Ethiopia

- Kenya

- Tanzania

- Uganda

- Sudan

- Rwanda

- Others

The report has also provided a comprehensive analysis of all the major markets in the region, which include Ethiopia, Kenya, Tanzania, Uganda, Sudan, Rwanda, and others.

Ethiopia's renewable energy market is driven by its substantial hydropower potential, accounting for over 90% of the country's electricity generation. Government initiatives such as the Growth and Transformation Plan aim to expand energy access and reduce reliance on biomass. Additionally, the country's commitment to reducing carbon emissions and mitigating climate change impacts encourages investments in wind and solar energy projects. Foreign investment and development assistance also play a crucial role in financing large-scale renewable projects.

Kenya is a leader in the East African renewable energy sector, with significant investments in geothermal, wind, and solar energy. The country's Vision 2030 development plan prioritizes renewable energy to achieve universal electricity access and sustainable economic growth. The favorable regulatory environment, including feed-in tariffs and tax incentives, attracts private sector investment. Kenya's strategic geographic location provides excellent conditions for geothermal and wind energy exploitation, further driving market growth.

Tanzania's renewable energy market is driven by the need to improve energy access in rural areas, where a significant portion of the population lacks electricity. The government’s initiatives like the Rural Energy Master Plan aim to promote off-grid solar and mini-hydro projects. Tanzania's abundant natural resources, including solar and wind potential, provide opportunities for diversifying the energy mix. International support and funding from organizations such as the World Bank also bolster the renewable energy sector.

Uganda's renewable energy market growth is supported by its abundant hydropower resources, which form the backbone of the country's electricity supply. The Renewable Energy Policy aims to increase the share of renewables in the energy mix and improve energy security. Government efforts to attract foreign direct investment and partnerships with international agencies facilitate the development of solar, biomass, and small hydro projects. The need to address energy access disparities between urban and rural areas further drives market expansion.

Sudan's renewable energy market is driven by the urgent need to address energy shortages and reduce dependence on fossil fuels. The country's high solar irradiance levels offer substantial potential for solar energy development. Government initiatives to reform the energy sector and attract foreign investment are crucial in driving renewable energy projects. Additionally, international support for climate resilience and sustainable development projects encourages the adoption of renewable energy solutions.

Rwanda's renewable energy market is propelled by the government's commitment to achieving universal electricity access by 2024, with a strong emphasis on renewable sources. The National Strategy for Transformation outlines plans to increase the share of renewables, particularly solar and hydro, in the energy mix. Rwanda's focus on innovative financing mechanisms and public-private partnerships attracts investment in renewable energy projects. The country's efforts to improve grid infrastructure and promote off-grid solutions also contribute to market growth.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- The competitive landscape of the East Africa renewable energy market is characterized by a mix of local and international players, including energy producers, technology providers, and financial investors. The market is driven by the increasing demand for clean energy, government support, and international funding. Companies are focusing on innovative solutions such as off-grid systems and mini-grids to cater to rural electrification needs. Technological advancements and the development of large-scale renewable projects, particularly in solar, wind, and hydroelectric power, are key competitive strategies. Collaborations and partnerships between public and private sectors are common to leverage resources and expertise. The market also sees significant involvement from international development agencies and financial institutions, providing funding and technical assistance to enhance market growth. For instance, in October 2023, Kenya Electricity Generating Company PLC (KenGen) received Cabinet approval to launch the Gogo Hydropower Redevelopment Project in Western Kenya. The project, located on the banks of River Kuja in Migori County, will increase the dam's electricity generation capacity from 2MW to 8.6MW, bringing substantial benefits to the region and enhancing climate resilience.

East Africa Renewable Energy Market News:

- In July 2024, d.light, a global leader in providing products and finance for low-income households, announced that it has secured a $176 million securitization facility from African Frontier Capital (AFC) to expand solar energy in East Africa. This financing will purchase receivables in Kenya, Tanzania, and Uganda, allowing d.light to scale its PayGo consumer finance offering. The initiative aims to provide reliable, renewable energy to approximately six million people in these countries over the next three years, enhancing access to solar-powered products for low-income households and communities without electricity.

- In July 2024, Kenya Electricity Generating Company (KenGen) announced that it aims to add 42.5MW of solar energy in Seven Forks area in a move to scale up Kenya’s green energy deployment. The project is expected to last for twenty-eight (28) months and seeks to install a 42.5MW solar power plant in the home of the Seven Forks dams where KenGen generates most of its hydroelectricity.

East Africa Renewable Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydropower, Solar, Wind, Others |

| Countries Covered | Ethiopia, Kenya, Tanzania, Uganda, Sudan, Rwanda, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the East Africa renewable energy market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the East Africa renewable energy market?

- What is the breakup of the East Africa renewable energy market on the basis of type?

- What are the various stages in the value chain of the East Africa renewable energy market?

- What are the key driving factors and challenges in the East Africa renewable energy market?

- What is the structure of the East Africa renewable energy market, and who are the key players?

- What is the degree of competition in the East Africa renewable energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the East Africa renewable energy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the East Africa renewable energy market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the East Africa renewable energy industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)