East Africa Pizza Market Report by Type (Non-Vegetarian Pizza, Vegetarian Pizza), Crust Type (Thick Crust, Thin Crust, Stuffed Crust), Distribution Channel (Quick Service Restaurants (QSR), Full-Service Restaurants, and Others), and Country 2026-2034

East Africa Pizza Market Size:

East Africa pizza market size reached USD 705.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,305.3 Million by 2034, exhibiting a growth rate (CAGR) of 7.08% during 2026-2034. The market is propelled by the increasing urbanization across the region, rising disposable income level, increasing Western influence, rapid expansion of food delivery services, growing middle-class population, rapidly expanding food and beverage industry with a string presence of international and local pizza chains, and increasing popularity of Western cuisine and dining-out culture.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 705.4 Million |

| Market Forecast in 2034 | USD 1,305.3 Million |

| Market Growth Rate 2026-2034 | 7.08% |

Access the full market insights report Request Sample

East Africa Pizza Market Analysis:

- Major Market Drivers: The increasing urbanization, rising disposable income levels, and rising influence of Western culture is leading to a higher East Africa pizza market demand.

- Key Market Trends: Rising proliferation of online food delivery platforms, growing popularity of casual dining restaurants, and increasing demand for healthier and organic pizza options are some of the key market trends.

- Competitive Landscape: Some of the major market players in the East Africa pizza industry are. expanding their footprint by opening new outlets in cities like Nairobi, Addis Ababa, and Dar es Salaam. Several East African companies are also investing in digital transformation to enhance their online ordering systems, and provide seamless and convenient service.

- Challenges and Opportunities: Some of the challenges include increasing operational costs such as import duties on ingredients, rising competition from traditional local cuisines, and restricted supply chain and logistical issues. Whereas, rising digital and online food delivery platforms, increasing number of health-conscious easting individuals, and increasing investment from international pizza chains and franchise are propelling the East Africa pizza market growth.

East Africa Pizza Market Trends:

Rapid Urbanization across the East Africa

Rapid urbanization in East Africa is significantly driving the pizza market. As cities expand and rural populations migrate to urban centers, the demand for convenient, ready-to-eat foods such as pizza increases. Urban areas typically have better infrastructure, including a higher concentration of restaurants and delivery services, making it easier for consumers to access pizza. According to the United States Trade and Development (UNCTAD), Africa observed an increase of 4.6% in urbanization as of 2021. This urban growth fuels the demand for fast food and dining-out options, as busy urban lifestyles often necessitate quick meal solutions. The influx of international pizza chains and local entrepreneurs capitalizing on this urbanization trend further accelerates market growth.

Increasing Disposable Incomes

The rise in disposable incomes across East Africa is another crucial factor driving the pizza market. As economic conditions improve, more individuals have disposable income to spend on non-essential items, including dining out and ordering food. For instance, Kenya’s GDP has increased at an approximately 5.4% in 2023, from 4.8% in 2022, according to the WORLD BANK. Higher disposable incomes mean that consumers are more willing to spend on premium and international cuisines, including pizza. This economic shift allows for greater market penetration by international pizza brands and encourages local entrepreneurs to enter the market with innovative offerings, catering to the growing middle class.

Increasing Influence of Western Culture

The growing influence of Western cuisine in East Africa is also propelling the pizza market. Western food trends and dining habits are becoming increasingly popular, especially among the younger generation and urban dwellers. This shift is partly due to the proliferation of Western media and increased travel, exposing East Africans to diverse cuisines. This cultural shift toward Western dining preferences is bolstered by the presence of international pizza chains, which bring authenticity and brand recognition. Local pizza businesses are also adapting by incorporating popular Western ingredients and cooking styles, thereby attracting a broader consumer base.

East Africa Pizza Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on type, crust type, and distribution channel.

Breakup by Type:

To get detailed segment analysis of this market Request Sample

- Non-Vegetarian Pizza

- Vegetarian Pizza

The report has provided a detailed breakup and analysis of the market based on the type. This includes non-vegetarian pizza and vegetarian pizza.

The non-vegetarian pizza segment dominates the East Africa pizza market, primarily due to the strong preference of meat-based dishes across the East Africa. This segment includes pizzas topped with various meats such as chicken, beef, lamb, sausage, pepperoni, and seafood. Non-vegetarian pizzas are highly popular among East African consumers who enjoy protein-rich diets and the diverse flavors that different meat toppings offer. The demand for these pizzas is driven by both local tastes and the influence of international cuisine, as many global pizza chains prioritize meat-based pizzas in their menus.

The vegetarian pizza segment, while smaller compared to its non-vegetarian counterpart, is experiencing steady growth in East Africa. This segment includes pizzas topped with various vegetables, fruits, cheeses, and plant-based proteins. The rising trend of health consciousness and the growing awareness about the benefits of a vegetarian diet are key factors driving this segment. Consumers are increasingly seeking healthier, lighter food options, and vegetarian pizzas fit this demand perfectly.

Breakup by Crust Type:

- Thick Crust

- Thin Crust

- Stuffed Crust

A detailed breakup and analysis of the market based on the crust type have also been provided in the report. This includes thick crust, thin crust, and stuffed crust.

Thick crust pizza, often associated with styles such as Chicago deep-dish, holds a considerable East Africa pizza market share. This type of crust is characterized by its substantial base, which can be up to an inch or more in thickness. It is typically baked in a pan, giving it a dense, bread-like texture that can hold a significant number of toppings and sauce. The popularity of thick crust pizza in East Africa is driven by its ability to satisfy hunger and its compatibility with a variety of local ingredients.

Thin crust pizza, characterized by its crisp, crunchy texture and minimal dough, is gaining popularity in East Africa, especially among health-conscious consumers and those who prefer a lighter meal. This type of pizza allows for a more pronounced flavor of the toppings and sauce, as the crust does not overpower the other ingredients. Thin crust pizzas are often associated with Italian-style pizzas, such as Neapolitan or Roman, and are baked at high temperatures to achieve their distinctive crispy base.

Stuffed crust pizza offers an indulgent twist to the traditional pizza by incorporating cheese or other fillings within the outer edge of the crust. This type of pizza is particularly appealing to consumers who enjoy extra flavors and textures in their meal. Stuffed crust pizzas often feature mozzarella or other types of cheese, however, can also include ingredients such as garlic, herbs, or even meat, adding a rich and flavorful dimension to the pizza-eating experience. In East Africa, the appeal of stuffed crust pizza lies in its novelty and the additional indulgence it offers. This segment targets consumers looking for a premium, indulgent experience and is often marketed as a treat or special occasion food.

Breakup by Distribution Channel:

- Quick Service Restaurants (QSR)

- Full-Service Restaurants

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes quick service restaurants (QSR), full-service restaurants, and others.

Quick Service Restaurants (QSR) play a pivotal role in the East Africa pizza market. QSRs are designed for speed and efficiency, catering to consumers seeking quick, affordable meals. They typically feature a streamlined menu, fast service, and a casual dining environment. The operational model of QSRs emphasizes minimal table service and significant reliance on takeout and delivery orders, which aligns well with the fast-paced urban lifestyle prevalent in many East African cities. QSRs benefit from lower operational costs compared to full-service restaurants, as they require fewer staff and simpler infrastructure.

Full-service restaurants represent another significant segment of the East Africa pizza market, offering a different dining experience compared to QSRs. These establishments provide a more elaborate dining environment, with extensive menus, table service, and often a focus on ambiance and consumer experience. Full-service restaurants cater to consumer looking for a leisurely meal, often attracting families, groups, and diners celebrating special occasions. The pricing at full-service restaurants is generally higher than at QSRs, reflecting the enhanced dining experience, higher quality ingredients, and broader menu options. These restaurants often offer a variety of pizzas, including gourmet options with premium toppings and artisanal crusts.

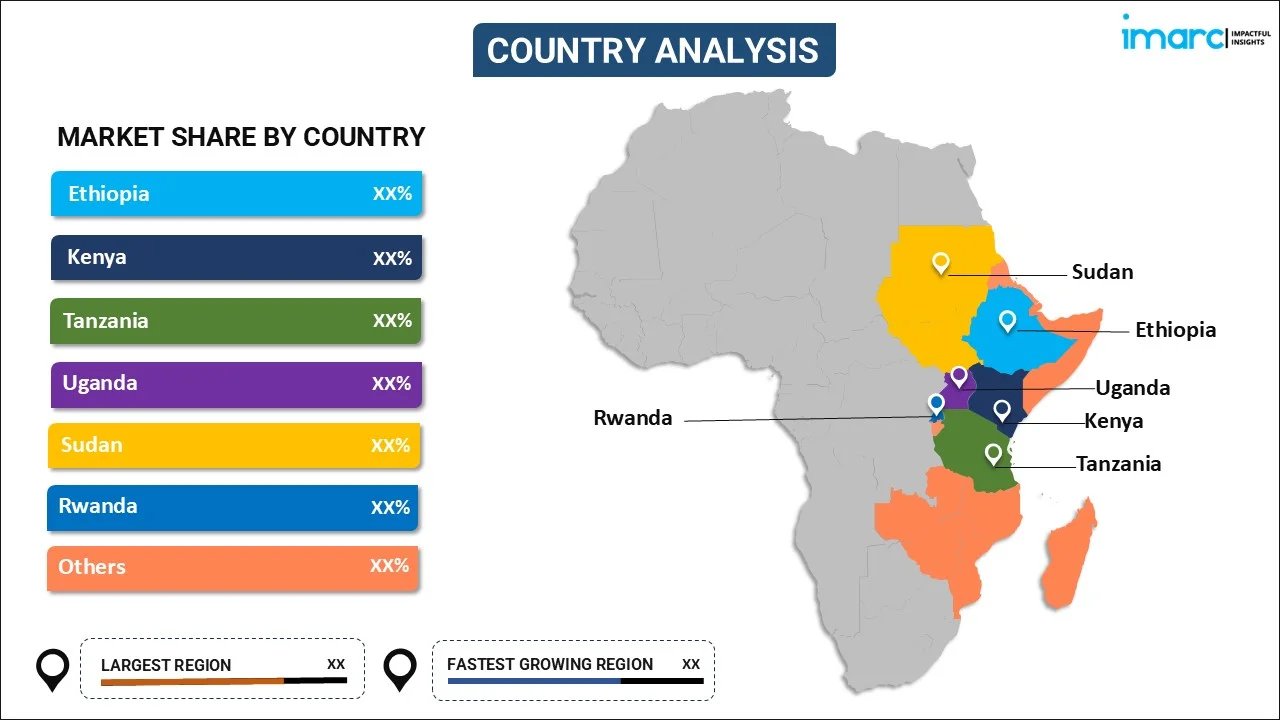

Breakup by Country:

To get detailed regional analysis of this market Request Sample

- Ethiopia

- Kenya

- Tanzania

- Uganda

- Sudan

- Rwanda

- Others

The report has also provided a comprehensive analysis of all the major markets in the region, which include Ethiopia, Kenya, Tanzania, Uganda, Sudan, Rwanda, and others.

Kenya is the largest market for pizza in East Africa, driven by its rapidly urbanizing population and growing middle class. Nairobi, the capital city, is a major hub for international pizza chains and local pizzerias, benefiting from a high concentration of expatriates and tourists. The city's well-developed infrastructure supports efficient delivery services, further boosting market growth. Additionally, Kenya's relatively high internet penetration facilitates the growth of online food delivery platforms, expanding market reach.

Ethiopia’s pizza market is emerging, driven by Addis Ababa's expanding urban landscape. The country’s economic reforms and development projects are attracting foreign investments, including in the food and beverage sector. Despite challenges such as limited cold chain infrastructure, the increasing number of international restaurants in Addis Ababa is introducing pizza to a broader audience. Additionally, the rising middle class and improving living standards contribute to a growing demand for Western-style fast food.

Tanzania's pizza market is centered around Dar es Salaam, the commercial capital. The city's vibrant nightlife and diverse expatriate community create a steady demand for pizza. Tanzania's tourism sector also plays a significant role, with tourists seeking familiar Western foods. Local entrepreneurs and international chains are increasingly investing in the Tanzanian market, capitalizing on the favorable demographic trends.

Uganda's pizza market is gaining momentum, particularly in Kampala, the capital city. The growth of the middle class and an increase in disposable incomes are key drivers. Kampala's young and dynamic population is increasingly adopting Western dining habits, including pizza consumption. The presence of international pizza chains and local pizzerias is expanding, supported by a growing online food delivery ecosystem.

Sudan's pizza market is relatively nascent, however shows potential, particularly in Khartoum, the capital. The country's political and economic challenges have slowed market growth, although recent stability and reforms are creating a more conducive environment for business. The rising influence of Western culture and increasing expatriate population are driving demand for pizza.

Rwanda’s pizza market is emerging, driven by Kigali's rapid development. The government's focus on transforming Kigali into a modern, smart city is attracting foreign investments, including in the food and beverage sector. According to the National Institute of Statistics of Rwanda, the urban population is growing at 4.6% annually. Kigali's young and upwardly mobile population is increasingly seeking Western dining experiences, including pizza.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- Key players in the East Africa pizza market are actively driving growth through various strategic initiatives. International chains such as Domino's, Pizza Hut, and Papa John's are expanding their footprint by opening new outlets in major cities such as Nairobi, Addis Ababa, and Dar es Salaam. In accordance to the East Africa pizza market forecast, these brands leverage their global reputation and consistent quality to attract a growing middle class and expatriate community. Local players, such as Debonairs and Naked Pizza, are also making significant strides by tailoring their offerings to local tastes and preferences, incorporating East African flavors and ingredients into their menus. Additionally, these companies are investing in digital transformation, enhancing their online ordering systems and partnering with delivery platforms such as Jumia Food and Glovo to provide seamless and convenient service.

East Africa Pizza Market News:

- December 14, 2023: JUMIA FOOD, a prominent online food delivery platform in Nigeria, has announced a partnership with Domino’s Pizza to offer consumers the convenience of ordering meals from their homes. The collaboration aims to provide quick access to Domino’s Pizza offerings through the Jumia Food platform.

East Africa Pizza Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Non-Vegetarian Pizza, Vegetarian Pizza |

| Crust Types Covered | Thick Crust, Thin Crust, Stuffed Crust |

| Distribution Channels Covered | Quick Service Restaurants (QSR), Full-Service Restaurants, Others |

| Countries Covered | Ethiopia, Kenya, Tanzania, Uganda, Sudan, Rwanda, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the East Africa pizza market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the East Africa pizza market?

- What is the breakup of the East Africa pizza market on the basis of type?

- What is the breakup of the East Africa pizza market on the basis of crust type?

- What is the breakup of the East Africa pizza market on the basis of distribution channel?

- What are the various stages in the value chain of the East Africa pizza market?

- What are the key driving factors and challenges in the East Africa pizza market?

- What is the structure of the East Africa pizza market, and who are the key players?

- What is the degree of competition in the East Africa pizza market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the East Africa pizza market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the East Africa pizza market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the East Africa pizza industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)