Early Toxicity Testing Market Size, Share, Trends and Forecast by Technique, End User, and Region, 2025-2033

Early Toxicity Testing Market Size and Share:

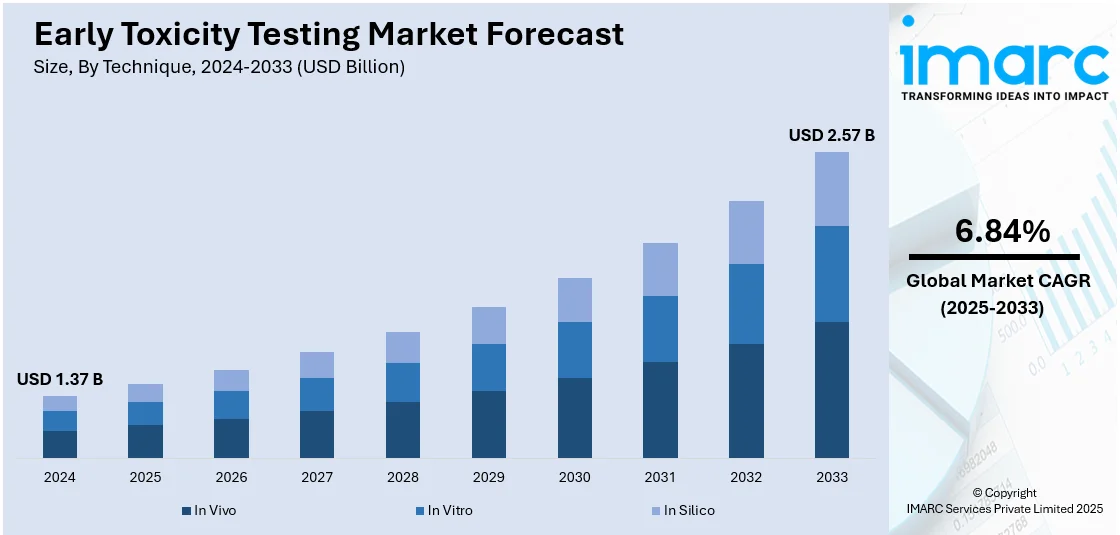

The global early toxicity testing market size was valued at USD 1.37 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.57 Billion by 2033, exhibiting a CAGR of 6.84% from 2025-2033. Europe currently dominates the market, holding a market share of over 34.0% in 2024. The market is experiencing significant growth driven by increasing drug development activities, stringent regulatory requirements, and advancements in alternative testing methods. Growing demand for predictive toxicology solutions and reduced animal testing further fuels market growth, contributing to the expanding early toxicity testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.37 Billion |

|

Market Forecast in 2033

|

USD 2.57 Billion |

| Market Growth Rate 2025-2033 | 6.84% |

Key drivers of the early toxicity testing market include the increasing need to reduce drug development failures, rising regulatory scrutiny and growing concerns about animal welfare. Advances in in vitro and in silico testing methods offer faster, cost-effective and accurate toxicity assessment driving their adoption. Product innovations and advancements in toxicity testing tools are further accelerating market growth. For instance, in February 2025, CN Bio launched its PhysioMimix® DILI assay kit: Human 24 enhancing preclinical toxicology testing. This innovative kit utilizes a human-derived liver micro-physiological system to provide relevant insights into drug safety promoting informed clinical progression and improving efficiency by allowing simultaneous assessment of multiple drug candidates. Additionally, the pharmaceutical and biotechnology sectors are investing in early-stage testing to identify potential safety issues, minimize late-stage failures and reduce development costs. The demand for personalized medicine and the rise in drug discovery activities further drives the early toxicity testing market demand.

Key drivers of the United States early toxicity testing market include the growing emphasis on reducing drug development costs and minimizing late-stage failures. Increasing regulatory requirements from the FDA for stringent safety assessments are accelerating the adoption of advanced in vitro and in silico testing methods. Pharmaceutical and biotechnology companies are focusing on early toxicity screening to ensure drug safety and compliance. Additionally, advancements in predictive toxicology, rising investments in R&D, and the demand for personalized medicine further contribute to market growth in the United States. For instance, in December 2023, Merck announced the launch of AIDDISON™, an innovative AI-driven drug discovery platform that integrates generative AI and machine learning. By evaluating over 60 billion compounds, it identifies drug candidates with desired properties like low toxicity and stability while proposing optimal synthesis routes, significantly enhancing drug development efficiency. The growing preference for high-throughput screening methods for faster and cost-effective testing is driving market expansion. Collaborations between research organizations and industry players are fostering innovation in toxicity assessment technologies.

Early Toxicity Testing Market Trends:

Advancements in Predictive Toxicology

Advancements in predictive toxicology are transforming the early toxicity testing market through the integration of artificial intelligence (AI), machine learning (ML), and big data analytics. These technologies enable the rapid analysis of large datasets to predict potential toxic effects of compounds with higher accuracy. AI algorithms can identify patterns and correlations in toxicity data, improving decision-making during the drug development process. Additionally, predictive models reduce reliance on animal testing, accelerate timelines, and enhance the overall efficiency and safety of pharmaceutical research. For instance, in October 2023, eLabNext announced the integration of Toxometris.ai, an AI tool for in silico toxicity assessments, into its eLabMarketplace. This addition enables faster and more accurate toxicity predictions, reduces reliance on costly wet-lab testing, and supports pharmaceutical researchers in prioritizing drug candidates and minimizing animal testing for safer drug development.

Adoption of Alternative Testing Methods

The adoption of alternative testing methods is significantly driving advancements in early toxicity testing. In vitro techniques, utilizing human cells and tissues, provide accurate insights into a compound's toxic effects. In silico models, powered by computational simulations and artificial intelligence, predict toxicity based on existing data. Additionally, organ-on-chip technology replicates human organ functions, offering realistic assessments of drug responses. For instance, in September 2024, Emulate, Inc., a leading provider of next-generation in vitro Organ-Chip models, announced the launch of its new Chip-R1™ Rigid Chip. This innovative chip is designed to minimize drug absorption and enhance biological modeling for ADME (Absorption, Distribution, Metabolism, and Excretion) and toxicity applications. It features low-drug-absorbing materials, improved shear stress levels, and a preactivated culture membrane, allowing for more accurate drug testing and better cellular interactions. These methods not only reduce the reliance on animal testing but also enhance the accuracy, speed, and cost-effectiveness of toxicity evaluations, contributing to safer and more efficient drug development processes.

Regulatory Support for Non-Animal Methods

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA) are increasingly promoting the use of non-animal methods for toxicity assessment. Encouraged by ethical concerns, technological advancements, and the need for faster, cost-effective testing, these agencies support in vitro, in silico, and organ-on-chip models. Initiatives like the FDA’s Predictive Toxicology Roadmap aim to modernize toxicology testing by reducing animal use while ensuring accurate safety evaluations. This regulatory backing is accelerating the adoption of alternative methods, fostering innovation, and enhancing the efficiency of drug development and chemical safety assessments. These factors are creating a positive early toxicity market outlook across the world.

Early Toxicity Testing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global early toxicity testing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technique and end user.

Analysis by Technique:

- In Vivo

- In Vitro

- In Silico

In vivo stand as the largest technique in 2024, holding around 48.2% of the market. In vivo testing remains the largest technique in the early toxicity testing market, primarily due to its comprehensive and reliable data on the physiological and biochemical effects of substances in living organisms. Despite the growing adoption of alternative methods, in vivo testing is often mandated by regulatory agencies to ensure the safety and efficacy of new drugs. Its ability to simulate real-life biological responses and provide critical insights into systemic toxicity makes it a preferred choice in pharmaceutical and biotechnology research.

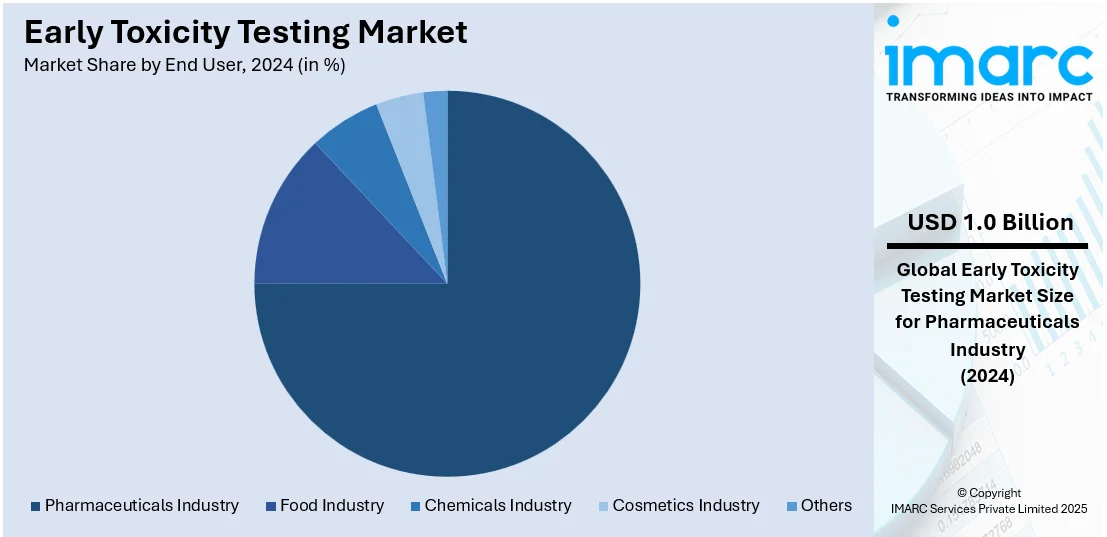

Analysis by End User:

- Pharmaceuticals Industry

- Food Industry

- Chemicals Industry

- Cosmetics Industry

- Others

Pharmaceuticals industry leads the market with around 75.5% of market share in 2024. The pharmaceutical industry dominates the early toxicity testing market, driven by the increasing demand for safer and more effective drugs. With a growing pipeline of drug candidates, companies prioritize early-stage toxicity testing to identify potential safety concerns and minimize late-stage failures. Regulatory requirements for stringent safety assessments further propel the use of advanced toxicity testing methods. Additionally, investments in research and development, coupled with the adoption of in vitro and in silico models, strengthen the pharmaceutical sector’s leadership in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 34.0%. Europe holds the largest share in the early toxicity testing market, driven by stringent regulatory frameworks and a strong emphasis on reducing animal testing. Organizations like the European Medicines Agency (EMA) and the European Centre for the Validation of Alternative Methods (EURL ECVAM) promote the adoption of alternative toxicity assessment methods. Additionally, the region's advanced pharmaceutical and biotechnology sectors, significant investments in research and development, and increasing collaboration between academic institutions and industry players further contribute to Europe's market dominance.

Key Regional Takeaways:

North America Early Toxicity Testing Market Analysis

The North America early toxicity testing market is driven by increasing regulatory scrutiny, a strong pharmaceutical presence, and heightened focus on ensuring product safety. Companies in the region are adopting advanced toxicity testing methods to comply with stringent regulatory guidelines and mitigate potential health and environmental risks. Additionally, growing investments in drug development and biotechnology innovations are fostering the need for reliable toxicity assessments. The emphasis on reducing animal testing has also led to the widespread adoption of alternative methods, including in vitro and computational models. With advancements in predictive toxicology and high-throughput screening technologies, the market is witnessing enhanced efficiency and faster results. Furthermore, collaborations between academic institutions, research organizations, and industry players are driving innovations in toxicity testing. The region’s commitment to ensuring product safety and minimizing adverse effects positions North America as a significant player in the global early toxicity testing market.

United States Early Toxicity Testing Market Analysis

In 2024, the United States accounted for over 93.00% of the early toxicity testing market in North America. The United States early toxicity testing market is primarily driven by increasing concerns over environmental and human health risks, which have led to a growing demand for reliable and efficient toxicity testing methods. The emphasis on safer chemicals and products has also been fueled by legislative measures such as the Toxic Substances Control Act (TSCA) and the Food, Drug, and Cosmetic Act (FDCA), which necessitate comprehensive toxicity assessments before substances are brought to market. The rising prevalence of chronic diseases and the need for better pharmaceutical safety testing have further propelled market growth, as there is an increased focus on the development of new drugs and treatments with minimal adverse effects. According to the Centers for Disease Control and Prevention (CDC), in the United States, approximately 129 million individuals suffer from at least one serious chronic disease. The number of Americans living with numerous chronic illnesses is also rising, with 42% having two or more and 12% suffering from at least five. Other than this, there is a growing emphasis on reducing animal testing and finding alternative, ethical testing methods. The integration of these innovative solutions has resulted in faster and more cost-effective toxicity assessments, further expanding market opportunities.

Asia Pacific Early Toxicity Testing Market Analysis

The Asia Pacific early toxicity testing market is expanding due to rapid industrial growth, increasing regulatory pressures, and a rising demand for safer products. As countries such as China, India, and Japan expand their manufacturing and pharmaceutical industries, there is a greater need for toxicity testing to ensure the safety of chemicals, drugs, and consumer goods. For instance, as per the Press Information Bureau (PIB), the Index of Industrial Production (IIP) in India experienced a 5.2% growth in November 2024, highlighting the robust manufacturing sector in the country. In addition to this, stringent regulations, such as those imposed by the Japan Ministry of Health, Labour and Welfare (MHLW) and China's National Medical Products Administration (NMPA), have heightened the need for effective toxicity assessments. Besides this, the region is experiencing a shift toward more ethical and accurate testing methods, with a growing preference for alternatives to animal testing, including in vitro and computational models. Technological advancements, such as high-throughput screening and 3D cell cultures, are also driving market growth.

Latin America Early Toxicity Testing Market Analysis

The Latin America early toxicity testing market is fueled by increasing investment in biotechnology and pharmaceutical sectors, which require comprehensive safety evaluations for new drugs and chemicals. Growing research collaborations between local and global entities are enhancing the development of innovative testing technologies and driving market growth. Moreover, the region’s rising focus on public health and safety, along with the focus on reducing healthcare costs, encourages more efficient and reliable toxicity testing. For instance, as per the International Trade Administration (ITA), 9.47% of the GDP of Brazil is spent on healthcare, equating to approximately USD 161 Billion. Additionally, numerous governments are gradually implementing stricter environmental regulations, fostering the need for enhanced safety assessments in industrial chemicals and agricultural products, further propelling the demand for early-stage toxicity testing in the region.

Middle East and Africa Early Toxicity Testing Market Analysis

The early toxicity testing market in the Middle East and Africa is being increasingly propelled by growing industrialization, regulatory pressure, and increasing health concerns. As the region's pharmaceutical, chemical, and cosmetic industries expand, there is a heightened need for reliable toxicity testing to ensure product safety. For instance, according to the IMARC Group, the Saudi Arabia pharmaceuticals market is expected to grow at a CAGR of 2.27% during 2025-2033, while the pharmaceuticals market in the UAE is projected to exhibit a CAGR of 7.30% during the same period. Similarly, the Egypt pharmaceuticals market is forecasted to grow at a CAGR of 9.20% during 2024-2032. Additionally, increasing awareness about the potential hazards of chemical exposure, both for human health and the environment, has heightened the demand for safer and more effective testing methods. The adoption of alternative testing methods, such as in vitro and computational models, further supports market growth.

Competitive Landscape:

The early toxicity testing market is characterized by intense competition, with numerous companies striving to enhance their market presence through technological advancements and innovation. Firms are focusing on developing advanced in vitro, in silico, and organ-on-chip models to provide accurate and reliable toxicity assessments. Collaborations and partnerships with research institutions and regulatory bodies are common, facilitating the adoption of alternative testing methods. Additionally, investments in predictive toxicology and AI-driven platforms are driving the market forward. Companies are also expanding their global reach through strategic acquisitions and regional expansions, while maintaining compliance with evolving regulatory standards.

The report provides a comprehensive analysis of the competitive landscape in the early toxicity testing market with detailed profiles of all major companies, including:

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- Charles River Laboratories International Inc.

- Danaher Corporation

- Enzo Biochem Inc.

- Eurofins Scientific SE

- Evotec A.G.

- Merck KGaA

- PerkinElmer Inc.

- SGS S.A.

- Thermo Fisher Scientific Inc.

- WuXi AppTec

Latest News and Developments:

- In March 2025, AsedaSciences, a leader in predictive toxicology and drug development, announced a collaboration with the renowned Tanguay Lab to introduce an innovative zebrafish screening service. This solution offers an efficient and cost-effective method for early toxicity testing. With this new service, scientists in the chemical manufacturing industry can assess chemical safety risks much earlier in their research, while significantly reducing costs compared to traditional animal testing methods through advanced high-throughput technology.

- In July 2024, Schrödinger, Inc. initiated a project aimed at expanding its physics-based computing system, which is transforming the field of materials and therapy discovery, to better predict toxicological risks early in the drug discovery process. The goal of this initiative is to develop a digital approach that will improve the characteristics of new drug candidates and decrease the likelihood of failure during development.

Early Toxicity Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Techniques Covered | In Vivo, In Vitro, In Silico |

| End Users Covered | Pharmaceuticals Industry, Food Industry, Chemicals Industry, Cosmetics Industry, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Bio-Rad Laboratories Inc., Bruker Corporation, Charles River Laboratories International Inc., Danaher Corporation, Enzo Biochem Inc., Eurofins Scientific SE, Evotec A.G., Merck KGaA, PerkinElmer Inc., SGS S.A., Thermo Fisher Scientific Inc. and WuXi AppTec. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the early toxicity testing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global early toxicity testing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the early toxicity testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The early toxicity testing market was valued at USD 1.37 Billion in 2024.

IMARC estimates the early toxicity testing market to reach USD 2.57 Billion by 2033, exhibiting a CAGR of 6.84%.

Key factors driving the early toxicity testing market include stringent regulatory requirements, the increasing focus on reducing drug development costs, growing demand for safer products, advancements in alternative testing methods, and the need for accurate, efficient toxicity assessments to minimize animal testing and ensure human and environmental safety.

Europe currently dominates the early toxicity testing market, driven by stringent regulatory standards, a strong emphasis on reducing animal testing, and the presence of advanced pharmaceutical and biotechnology sectors. The region’s commitment to adopting alternative testing methods and promoting safer chemicals further strengthens its market leadership.

Some of the major players in the early toxicity testing market include Agilent Technologies Inc., Bio-Rad Laboratories Inc., Bruker Corporation, Charles River Laboratories International Inc., Danaher Corporation, Enzo Biochem Inc., Eurofins Scientific SE, Evotec A.G., Merck KGaA, PerkinElmer Inc., SGS S.A., Thermo Fisher Scientific Inc. and WuXi AppTec., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)