E-Pharmacy Market Size, Share, Trends and Forecast by Drug Type, Product Type, Platform, Payment Method, and Region, 2025-2033

E-Pharmacy Market Size and Share:

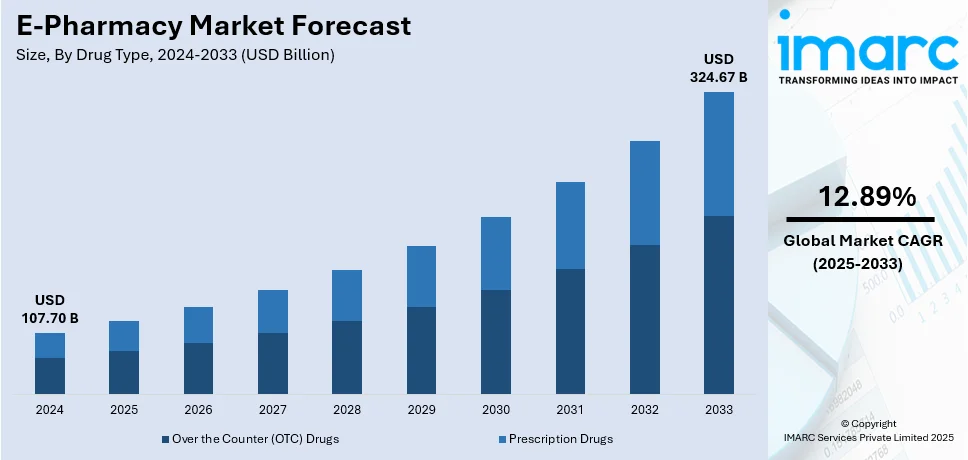

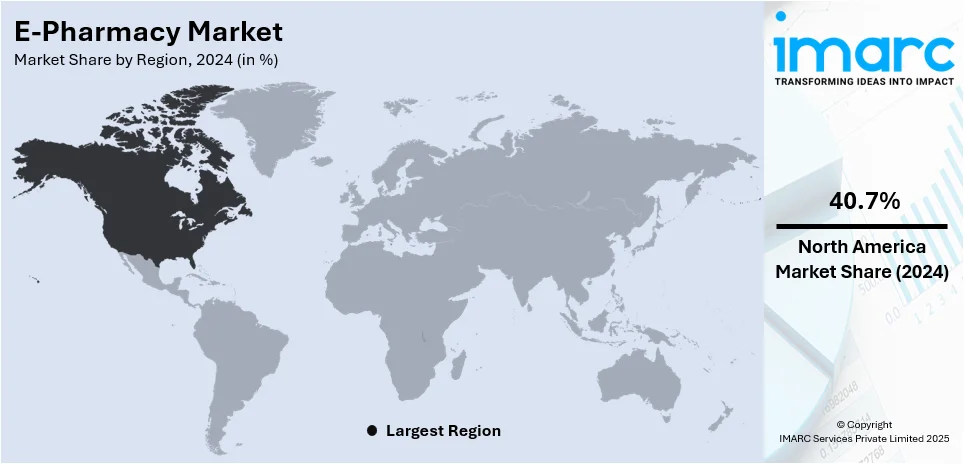

The global e-pharmacy market size was valued at USD 107.70 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 324.67 Billion by 2033, exhibiting a CAGR of 12.89% from 2025-2033. North America currently dominates the market, holding a market share of over 40.7% in 2024. The rising internet penetration, the emerging technological advancement in secure payment gateways, and the significant expansion of online retail are some of the major factors facilitating the expansion of the e-pharmacy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 107.70 Billion |

| Market Forecast in 2033 | USD 324.67 Billion |

| Market Growth Rate (2025-2033) | 12.89% |

E-pharmacies, also known as online pharmacies, provide an avenue for consumers to purchase medications and health-related products through digital platforms, eliminating the need for in-person visits to traditional brick-and-mortar stores. One of the most notable trends in market is the rising adoption of mobile applications and digital platforms for health management. Many e-pharmacy providers have invested heavily in user-friendly apps that allow consumers to manage prescriptions, access drug information, and order medications seamlessly. These apps often integrate features, such as refill reminders, medication tracking, and telemedicine consultations, enhancing customer engagement and retention. As a result, e-pharmacies are increasingly becoming a one-stop solution for comprehensive healthcare needs, thereby offering a favorable e-pharmacy market outlook.

The United States has emerged as a major region in the e-pharmacy market owing to innumerable reasons. The addition of artificial intelligence (AI) and machine learning (ML) machineries into e-pharmacy operations is propelling the market growth in the country. These tools are being used to analyze customer purchasing behavior, predict demand for specific products, and provide personalized recommendations. AI-driven chatbots are also used to assist customers with queries, advancing overall customer satisfaction. Furthermore, automated systems for inventory management and order processing have streamlined supply chain operations, ensuring faster and more reliable deliveries. The growing inclination towards contactless services is contributing to the market growth. In 2024, Amazon announced that it will provide same day prescription delivery to twenty more cities by 2025. Owing to this initiative speedy medicine delivery will be conducted in almost half of the US.

E-Pharmacy Market Trends:

The increasing internet penetration

The development of digital technologies and the changing online consumer behavior are fueling the market expansion. Besides that, the popularity of smartphones that is both cheap, fast internet service and inventive digital inclusion programs is leading to this market growth. As per reports, the number of smartphone users is anticipated to reach 6 Billion by 2027 worldwide. Plus, the online community has arrived, which gives businesses the chance to broaden their reach and find new ways to develop. As the digital market enables, people to acquire knowledge and educational readings previously limited by confinement. Social interactions, collaborations, and networking are the basis for the transformations of geographical boundaries, leading to cultural ambiguity, cross-cultural exchanges, and driving cultural diversity. On the other hand, exponential growth in the domain of internet users culminated in the creation of e-commerce ecosystems and contributed to consumer behavior and traditional shop models. Secondly, online marketplaces are emerging and they allow the presentation of goods and services to customers from different countries of the world ensuring the growth of digital entrepreneurship as a whole and feeding the small enterprises with such avenues. Also, the growing e-pharmacy industry demand for digital services like online banking, telemedicine, and work-from-home prospects is reshaping sectors creating convenience in health, education, and financial inclusion, and propelling the e-pharmacy market growth.

The emerging technological advancement

The ongoing state of technological progression in safe payment platforms has a huge positive impact on the digital market, preparing the online transaction execution environment for a new level of security and efficiency. As online financial transactions continue to rise between businesses or consumers, the same necessitates the protection of sensitive data, which also directly acts as a market growth influencer. In addition, the rapid spread of improved encryption technologies with built-in anti-fraud algorithms formed the foundation for an unseen level of deflection from the threats of cyber attacks. The effect was to create a higher level of confidence among consumers in their ability to carry out digital transactions, which contributed a great deal towards the growth of the industry. With that, the use of biometric authentication provided an extra security colander comprising unique biometric markers such as fingerprints, facial recognition, and even iris scans to assure only authorized individuals are able to access vital financial information which explanatorily contributed to the market growth. It eliminates more risks of password verification methods and prevalence of the data breaches by hackers and results in decreased fraudulent activities. As per the IT Governance, the sum of breached records in 2023 was 8,214,886,660.

The significant expansion of online retail

The rise in the online retail market is reshaping how consumers are getting pharmaceutical products and progressing the healthcare delivery system. Along with this, online shopping convenience and accessibility that borders on zero geographical constraints, create the ease with which people can buy a variety of medical products and medication from their homes thus impacting market growth. This affordability has been a game changer, in particular, with people who suffer from long-term conditions and need to take their medicine regularly. The online accessibility to resources such as complete product information, user reviews, and expert tips allows consumers to make well-informed decisions which in turn enrich their healthcare experience. Moreover, the development of e-pharmacies reinforces individualized account management and reminders for refilling medications through online platforms which thereby build a stronger bond between patients and their treatment schedules increasing market growth. In addition, e-pharmacies which are a new phenomenon are a source of life as they provide timely access to essential medications, bring a digital network that fills healthcare gaps, and ensure that anybody can get this amenity without unjustifiable difficulty thus enhancing market growth. According to a study, the online pharmacy market in India is projected to be valued at about three Billion U.S. dollars. This was about an eightfold increase in the market value in comparison to 2019. Major conglomerates such as Reliance, Amazon, and Tata are planning to join the online pharmacy market in the coming years.

E-Pharmacy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global e-pharmacy market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on drug type, product type, platform, and payment method.

Analysis by Drug Type:

- Over the Counter (OTC) Drugs

- Prescription Drugs

Over-the-counter (OTC) drugs stand as the largest component. According to an e-pharmacy industry report, the market is experiencing significant growth due to the increasing demand for over-the-counter (OTC) drugs. The accessibility and convenience offered by online platforms are accelerating the popularity of OTC drugs. OTC drugs, characterized by their availability without a prescription, cater to several range of consumer needs, including minor ailments, preventive care, and wellness enhancement. In addition, the online retail environment provides consumers with a seamless shopping experience, allowing them to browse, compare, and purchase OTC drugs at their convenience, thus influencing the market growth. Besides this, the consumers' increasing confidence in e-pharmacies' quality and authenticity is further improving the market growth. Along with this, verified online platforms ensure that customers receive genuine medications, often backed by established brands and trusted manufacturers, coupled with detailed product information and user reviews fostering a sense of informed decision-making among consumers, thus propelling the market growth.

Analysis by Product Type:

- Skin Care

- Dental

- Cold and Flu

- Vitamins

- Weight Loss

- Others

Skin care leads the market in 2024. The rise of skin care in the market due to the growing awareness of skin health and wellness led consumers to seek effective, personalized skin care regimens. Additionally, e-pharmacies offer numerous types of skin care products catering to various skin types, concerns, and preferences, allowing consumers to curate routines that align with their individual needs, thus influencing the market growth. Moreover, the convenience and accessibility offered by online platforms are significantly improving the popularity of e-pharmacy skin care products, allowing consumers to effortlessly browse through an extensive range of brands and formulations, access detailed product information, and read user reviews, facilitating informed purchase decisions representing another major growth-inducing factor. Besides this, the changing consumer preference toward natural and organic skin care products available on e-pharmacies allows consumers to make informed decisions, thus accelerating the market growth. Furthermore, the growth of telemedicine and virtual dermatology consultations are propelling the demand for prescription-based skin care products available through e-pharmacies.

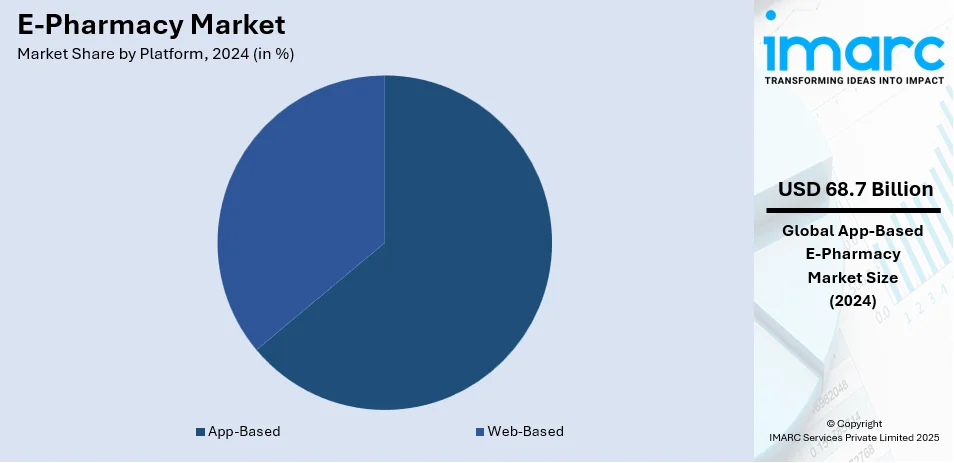

Analysis by Platform:

- App-Based

- Web-Based

App-based leads the market with 63.8% of market share in 2024. App-based platforms offer unparalleled convenience, placing a plethora of pharmaceutical products at users' fingertips, with a simple download, consumers gain instant access to a vast inventory of medications, healthcare products, and wellness essentials. The intuitive user interfaces streamline the shopping experience, enabling users to seamlessly browse, compare, and make informed decisions, all within the confines of their smartphones. Moreover, app-based pharmacies prioritize user experience, providing personalized recommendations based on previous purchases, medical history, and preferences representing another major growth-inducing factor. This level of personalization enhances the shopping journey, fostering a sense of familiarity and trust that is essential in the healthcare sector. Furthermore, app-based platforms are driven by the growing reliance on mobile technology, which effortlessly integrates into users' daily routines, allowing them to manage prescriptions, set medication reminders, and place orders on the go, thus creating a positive market outlook.

Analysis by Payment Method:

- Cash on Delivery

- Online Payment

Cash on delivery (COD) remains a significant payment method in the market, particularly in regions where online payment adoption might still not be available. In addition, COD offers a sense of familiarity and trust to consumers who are apprehensive about sharing financial information online. It provides a convenient option for those who prefer to physically inspect the product before making a payment, contributing to a substantial e- pharmacy market share.

Moreover, the widespread adoption of online payment methods is increasing as consumers become more accustomed to digital transactions. Also, online payments offer a seamless and secure way to complete transactions, often accompanied by various discounts, loyalty programs, and cashback incentives, thus propelling the e-pharmacy growth rate.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.7%. The North America market is primarily driven by easy access to high-speed internet. The smartphone penetration is creating a conducive environment for online shopping and digital healthcare services. People are going to online pharmacies for their convenience, wide choice of products, and extended service hours, consequently increasing the e-pharmacy market demand. Additionally, the existence of mature regulatory frameworks and quality control procedures provides patients with peace of mind regarding the safety and authenticity of medicines bought through online channels. This is an important factor in people’s trust and the use of the e-pharmacy. Besides, the patient-oriented healthcare concept accelerates the virtual pharmacy innovation. Personalized medication management, telemedicine integration, and value-added services are striking a chord with people, improving their health experience and supporting the market's development. Moreover, the IMARC Group predicts that the US digital health market will exhibit a growth rate 17.30% during 2024-2032. This will further drive the need for online medicine delivery among the masses.

Key Regional Takeaways:

United States E-Pharmacy Market Analysis

The United States hold 85.80% share of North America. The United States market is driven by the heightened utilization of digital health systems, aided by a comprehensive healthcare infrastructure and technological advancements. The rising prevalence of chronic diseases, such as diabetes, hypertension, and cardiovascular conditions, necessitates regular medication, fueling demand for online pharmacies that offer convenience, accessibility, and often lower costs as compared to traditional brick-and-mortar pharmacies. According to the National Center for Health Statistics, during August 2021–August 2023, the occurrence of total diabetes was 15.8% in US adults. In line with this, increasing preferences for contactless shopping is catalyzing the demand for e-pharmacy in the country. This shift is further supported by high internet and smartphones usage, making online platforms easily accessible to the majority of the population. Besides this, evolving consumer behavior, with a focus on time-saving and hassle-free healthcare services, enhances the appeal of e-pharmacy services. Moreover, adjustments in policy and progress in regulations, like those implemented by the U.S. Food and Drug Administration (FDA), to guarantee the safety and effectiveness of online pharmacies, are promoting market expansion. These measures aim to curb the proliferation of counterfeit drugs while promoting the adoption of legitimate platforms. Additionally, the increasing availability of telemedicine services complements the e-pharmacy ecosystem, allowing seamless integration of prescriptions and medication delivery.

Asia Pacific E-Pharmacy Market Analysis

The Asia Pacific market is undergoing swift expansion, facilitated by rising internet access, smartphone usage, and growing healthcare consciousness throughout the area. According to reports, India’s smartphone market shipped 146 Million smartphones in 2023, with a nominal 1% growth YoY (year-over-year). Countries like China, India, and Southeast Asian nations are leading the charge due to their large populations and expanding middle class, which is increasingly inclined toward digital solutions for healthcare needs. A key driver is the affordability and accessibility of e-pharmacies in rural and semi-urban areas where physical healthcare infrastructure may be limited. For instance, in India, government initiatives like Digital India are promoting e-commerce and healthcare digitalization, making medications available to underserved regions. Additionally, the rapid urbanization and changing consumer lifestyles are pushing demand for convenient and time-saving healthcare services. Besides this, people are turning to online platforms to avoid exposure to crowded retail pharmacies, and this behavioral shift has become a lasting trend. Moreover, partnerships between e-pharmacy platforms and healthcare providers are strengthening the ecosystem, offering individuals access to telemedicine and online consultations alongside medication delivery. Another important factor is the region's supportive regulatory environment. Governments are introducing guidelines to ensure the legitimacy of e-pharmacies and reduce the prevalence of counterfeit drugs.

Europe E-Pharmacy Market Analysis

The high healthcare expenditure, a well-developed pharmaceutical sector, and the increasing adoption of digital health technologies is supporting the market growth. Countries, such as Germany, the UK, and France, are at the forefront of this growth due to their advanced infrastructure and supportive regulatory frameworks. One of the key drivers is the growing preference for online shopping across all age groups, including older populations, who are significant consumers of medications. On 1 January 2023, the EU population was estimated at 448.8 Million people and more than one-fifth (21.3 %) of it was aged 65 years and over. E-pharmacies provide a convenient solution for these demographics, especially in regions with high internet penetration and robust logistics networks. Additionally, the availability of e-prescriptions in many European countries is simplifying the process of purchasing medications online, further boosting market adoption. Furthermore, the prevalence of chronic diseases, such as diabetes and cardiovascular conditions, necessitates regular access to medications. E-pharmacies address this need by offering timely delivery, cost transparency, and access to a wide range of products, including over the counter (OTC) drugs and wellness supplements. Moreover, people are increasingly relying on e-pharmacies for safe and contactless delivery. This trend has been supported by government policies encouraging online healthcare services as a way to reduce strain on physical pharmacies and hospitals.

Latin America E-Pharmacy Market Analysis

The increasing smartphone penetration and the expanding middle class is bolstering the market growth. Nations such as Brazil, Mexico, and Argentina are at the forefront, driven by increasing internet access and awareness of digital health services. Chronic disease prevalence, particularly diabetes and hypertension, is a significant driver, creating consistent demand for prescription drugs and wellness products. As per reports, the number of individuals with diabetes are expected to reach 19,224.1 by 2030 in Brazil. E-pharmacies offer a convenient and often cost-effective alternative to traditional retail pharmacies, especially in underserved areas with limited access to healthcare facilities. Apart from this, administration initiatives to raise digital healthcare solutions are also propelling market growth. The area's youthful, technology-oriented residents rapidly embrace e-commerce trends, which boosts the uptake of e-pharmacies. Furthermore, the ongoing improvements in logistics and delivery networks enable timely medication delivery, addressing a key barrier in rural and semi-urban regions. These factors collectively support the rapid growth of the market in Latin America.

Middle East and Africa E-Pharmacy Market Analysis

The increasing awareness among individuals about digital healthcare solutions is strengthening the market growth. Nations such as the UAE, Saudi Arabia, and South Africa play significant roles in market growth thanks to their advancing healthcare systems and favorable regulations. One of the primary drivers is the convenience offered by e-pharmacies, particularly in remote and underserved areas where access to physical pharmacies is limited. Additionally, the rising prevalence of chronic ailments like diabetes and cardiovascular conditions is creating a demand for medications, which e-pharmacies fulfill efficiently. Furthermore, environmental sustainability trends, such as eco-friendly packaging and green logistics solutions by e-pharmacies, align with individual values, further driving market growth. Another key driver is the demographic shift toward an aging population. Older adults often require frequent medical prescriptions, and e-pharmacies provide them with a convenient option for refilling medications without leaving their homes. According to reports, the elderly population in the GCC nations aged 60 and above hit 2.6 million individuals, accounting for 4.5% of the overall population in 2023. Finally, the presence of subscription models and loyalty programs offered by e-pharmacies encourages customers to make repeat purchases, aiding in market growth.

Competitive Landscape:

Key are leveraging robust technologies such as artificial intelligence (AI), machine learning (ML), and data analytics to improve operational efficiency and improve customer experiences. AI-powered tools are being used to analyze purchasing behavior, optimize inventory management, and provide personalized recommendations to customers. To improve the speed and reliability of deliveries, key players are investing heavily in their supply chain and logistics infrastructure. This includes setting up regional distribution centers, partnering with third-party logistics providers, and incorporating advanced tracking systems for real-time shipment updates. In 2024, Flipkart announced its plan to launch rapid medicine delivery system to cater to orders within 10 minutes. The brand initiative onboarding local pharmacies in metro areas to maintain medicine supply via its platform.

The report provides a comprehensive analysis of the competitive landscape in the e-pharmacy market with detailed profiles of all major companies, including:

- CVS Health Corporation

- DocMorris (Zur Rose Group AG)

- Express Scripts Holding Company (Cigna Healthcare)

- Giant Eagle Inc.

- Lloyds Pharmacy Limited

- Optumrx Inc. (Unitedhealth Group Incorporated)

- Rowland Pharmacy

- The Kroger Co.

- Walgreen Co. (Walgreens Boots Alliance Inc.)

- Walmart Inc.

Latest News and Developments:

- November 2024: Apollo 24/7 launched 19 minute delivery of medical supplies in Delhi and Noida to compete with other quick commerce platforms.

- November 2024: The Online Order and Home Delivery of Medicines (OnHOME) Alliance launched in Brussels. The event's launch urged policymakers to act in order to facilitate online access to prescription drugs for every patient throughout the European Union.

- May 2024: Bond Vet launched an online pharmacy that offers home delivery for people. The newly launched BondRx service is available for regions where the company offers its solutions. With the help of the BondRx portal, filling or refilling a prescription can be made easier for consumers.

E-Pharmacy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Over the Counter (OTC) Drugs, Prescription Drugs |

| Product Types Covered | Skin Care, Dental, Cold and Flu, Vitamins, Weight Loss, Others |

| Platforms Covered | App-Based, Web-Based |

| Payment Methods Covered | Cash On Delivery, Online Payment |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CVS Health Corporation, DocMorris (Zur Rose Group AG), Express Scripts Holding Company (Cigna Healthcare), Giant Eagle Inc., Lloyds Pharmacy Limited, Optumrx Inc. (Unitedhealth Group Incorporated), Rowland Pharmacy, The Kroger Co., Walgreen Co. (Walgreens Boots Alliance Inc.) Walmart Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the e-pharmacy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global e-pharmacy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the e-pharmacy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-pharmacy market was valued at USD 107.70 Billion in 2024.

The e-pharmacy market is projected to exhibit a CAGR of 12.89% during 2025-2033, reaching a value of USD 324.67 Billion by 2033.

Key factors driving the e-pharmacy market include rising chronic disease prevalence, increasing internet penetration, growing smartphone adoption, and demand for convenient healthcare solutions. Other drivers include cost-effectiveness, government regulatory support, expanding access to medications in remote areas, and consumer preference for contactless services and personalized healthcare options.

North America currently dominates the e-pharmacy market, accounting for a share of 40.7%, driven by increasing chronic disease prevalence, widespread internet penetration, and rising demand for convenient healthcare solutions. Key trends include the integration of telemedicine, personalized medicine offerings, subscription-based models, and regulatory advancements, alongside growing consumer trust in online platforms for medications and health-related products.

Some of the major players in the e-pharmacy market include CVS Health Corporation, DocMorris (Zur Rose Group AG), Express Scripts Holding Company (Cigna Healthcare), Giant Eagle Inc., Lloyds Pharmacy Limited, Optumrx Inc. (Unitedhealth Group Incorporated), Rowland Pharmacy, The Kroger Co., Walgreen Co. (Walgreens Boots Alliance Inc.) Walmart Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)