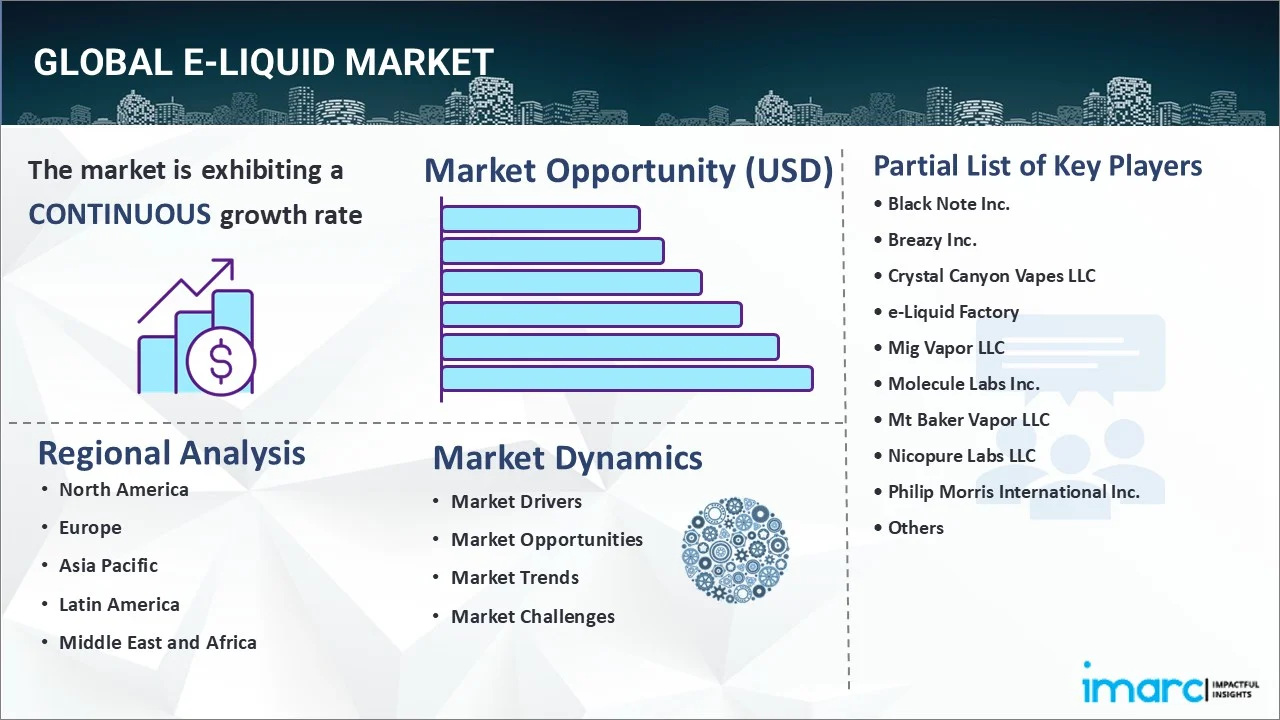

E-Liquid Market Report by Flavor (Menthol and Mint, Tobacco, Dessert, Fruits and Nuts, Chocolate, and Others), Base Type (PG (Propylene Glycol), VG (Vegetable Glycerin), PG and VG), Type (Pre-Filled, Bottled), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Stores, and Others), and Region 2025-2033

E-Liquid Market Size:

The global E-liquid market size reached USD 2.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.7 Billion by 2033, exhibiting a growth rate (CAGR) of 13.1% during 2025-2033. The e-liquid market is growing due to vaping’s appeal as a safer alternative to smoking, attracting health-conscious users. The wide variety of flavors appeals to people with different preferences, which is further catalyzing the overall demand. Additionally, the enhanced accessibility through online sales and marketing strategies makes e-liquids more available to a broader audience. These factors collectively contribute to the expansion of the e-liquid market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Market Growth Rate (2025-2033) | 13.1% |

E-Liquid Market Analysis:

- Major Market Drivers: The e-liquid market is mainly driven by regulatory changes and government policies to ensure consumer safety and product quality, fostering consumer confidence and market stability. Moreover, changing consumer tastes for better options and lifestyles are expanding vaping market demand considering its reduced risks compared to cigarette smoking.

- Key Market Trends: The e-liquid market is witnessing a growing trend of different flavors and e-liquids that cater to various consumer tastes and preferences, along with juices with a range of nicotine strengths. Some of the e-liquid market trends include the introduction of vaping instruments with different battery life modules and smart features developed using the latest technology offering a higher-quality user experience.

- Geographical Trends: Favorable regulatory environments in regions such as North America, Europe, Africa, and Asia have restored consumer confidence and strengthened market growth. Conversely, regions facing stringent regulations are experiencing product innovation tailored to meet compliance standards, thus propelling a diversified range of e-liquids manufactured under proper hygiene.

- Competitive Landscape: The e-liquid market is highly competitive and characterized by numerous regional players trying to outdo one another in terms of product quality, flavor variations, and competitive pricing. According to the e-liquid market research report, key companies are also investing in research and development to create innovative products that comply with regulatory standards and serve evolving consumer requirements.

- Challenges and Opportunities: Strict regulations and health concerns associated with vaping present challenges requiring constant innovation and compliant manufacturing practices. However, this challenging situation also acts as an opportunity, shifting the market towards advanced technologies that enhance the user experience, leading to high-quality, compliant products.

E-Liquid Market Trends:

Health Awareness and Safer Smoking Alternatives

Growing health awareness is leading to the rise of e-liquid usage as more smokers seek safer alternatives to traditional tobacco products. E-cigarettes, which avoid tobacco combustion, offer a reduced harm option for those looking to quit smoking or reduce their nicotine intake. The appeal of e-liquids lies in their ability to provide a similar experience without the harmful tar and carcinogens associated with regular cigarettes. Additionally, the availability of a wide variety of e-liquid flavors caters to diverse user preferences, making the transition from smoking more appealing. This combination of health-conscious choices and a broad flavor selection is catalyzing the demand for e-liquids. As awareness about smoking-related health risks continues to grow, e-cigarettes and their liquid counterparts are positioned to capture a larger share of the smoking alternatives market.

Regulatory changes and government policies

The regulatory environment plays an important role in e-liquid market growth. Along with this, governments across the globe are increasingly implementing stringent regulations and standards to ensure the safety and quality of e-liquid products. This includes mandatory labeling, product restrictions, and age requirements to prevent use by minors. In regions with favorable regulations, increased consumer confidence and market stability are leading to remarkable increases in market growth. These regulatory changes ensure that the market remains safe and reliable, encouraging more consumers to switch from traditional tobacco products to vaping alternatives.

Shifting consumer preferences and lifestyle changes

The demand for a healthy lifestyle among consumers and the growing preference for unique smoking flavors are the key factors driving the e-liquid market demand. With the growing health awareness concerning smoking day by day, buyers are switching to other options available such as e-cigarettes and e-liquids, involving minimal health hazards compared to traditional cigarette smoke. In addition, the section on flavors and nicotine strength in e-liquids is another notch in its favor. Therefore, this is encouraging manufacturers to launch new variations, further propelling the market. Moreover, the growing trend of social and recreational vaping is also giving an impetus to the market. There is a growing trend as consumers are seeking health-enhancing and informed choices and consumers continue to demand e-liquid products that remain satisfying and a less harmful real alternative experience.

Technological advancements in vaping devices

The continuous technological innovations are favoring the e-liquid market. Pod systems, vape mods, and sub-ohm tanks are also factors that are changing how e-liquids are consumed by consumers (over the age of 18). They give better battery life, flavor delivery, and can adjust settings to optimize for the user. In addition to its ability to manage heat, it prevents any leaks from happening, and it is easy to connect this device with its optimal connectivity which has made it convenient and appealing to a broader consumer base. Furthermore, in order to help users track and control their vaping habits, makers have been including smart technology, Bluetooth, and mobile apps that are adding to the demand, thereby fostering the market. These technological advances attract new users and retain existing consumers, creating a positive e-liquid market outlook.

E-Liquid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on flavor, base type, type, and distribution channel.

Breakup by Flavor:

.webp)

- Menthol and Mint

- Tobacco

- Dessert

- Fruits and Nuts

- Chocolate

- Others

Tobacco accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes menthol and mint, tobacco, dessert, fruits and nuts, chocolate, and others. According to the report, tobacco represented the largest segment.

The tobacco flavor category is the most massive section of the e-liquid market as it attracts more and more ex-smokers. Most of the time, when consumers start vaping after smoking regular cigarettes, they do as they want something that tastes similar to the same cigarettes that they were worried they would miss, and the tobacco-flavored e-liquids can be just the inviting and comforting flavor that they are seeking. Additionally, consumers can choose among classic, sweet, and robust, among other flavors to satisfy all taste buds under their beloved tobacco! As stated in the e-liquid market forecast report, the sustained appeal of tobacco-flavored e-liquids, driven by regional regulations that restrict the use of other flavorings, minimizing the success of endeavors that would want to fill the gap, which is strengthening its place as dominant. Furthermore, the introduction of new tobacco flavors is also aiding the market revenue.

Breakup by Base Type:

- PG (Propylene Glycol)

- VG (Vegetable Glycerin)

- PG and VG

PG (Propylene Glycol) holds the largest share of the industry

A detailed breakup and analysis of the market based on the base type have also been provided in the report. This includes PG (Propylene Glycol), VG (Vegetable Glycerin), and PG and VG. According to the report, PG (Propylene Glycol) accounted for the largest market share.

The largest base type segment in the e-liquid market is Propylene Glycol (PG), which is used due to its improved features in various formulations and higher consumer acceptance compared to other ingredient/base types. E-liquid market analysis states that PG is an essential component in e-liquids as it introduces an intense throat hit (the feeling of a vapor striking at the back of your throat) that is commonly desired by ex-smokers. Furthermore, PG is a crucial flavor concentration carrier, allowing E-Liquids to maintain vibrant, pronounced flavors, and elevates the vape experience. It has a low viscosity which allows for easy wicking and atomization in vaping devices, prevents clogging, and guarantees trouble-free running. The non-toxic and generally recognized as safe (GRAS) status by regulatory authorities of PG-based E-Liquids inherently reinforces its preference among a broader group of consumers as the assurance of its safety for inhalation is perhaps the paramount factor in the buying decision process.

Breakup by Type:

- Pre-Filled

- Bottled

Bottled represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the type. This includes pre-filled and bottled. According to the report, bottled represented the largest segment.

Bottled e-liquids are the most significant type of category in the e-liquid market, due to their use to work on multiple devices. Consumers enjoy a wide variety of flavors, nicotine strengths, and bottle sizes so that the vaping experience can be made more personal, customizable, and unique. The e-liquid market report states that they are especially opted by seasoned vapers who choose to top up their devices themselves in order to have more control over how they vape and how their device performs. Additionally, the well-developed distribution network for this segment of the market, including both brick-and-mortar vape shops as well as online outlets is also propelling the demand. In confluence with this, bottled e-liquids are usually significantly cheaper per milliliter than pre-filled pods or cartridges, making them more attractive to those on a budget. Packaging innovations such as child-resistant caps and tamper-evident seals, which increase safety and are compliant with legal standards, work towards the same goal of increasing consumer confidence. Furthermore, the cost-effectiveness found in bottled e-liquids is also positively influencing the e-liquid market outlook report.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, and others. According to the report, supermarkets and hypermarkets accounted for the largest market share.

The largest distribution channel segment in the e-liquid market is supermarkets and hypermarkets according to the e-liquid market analysis report. This makes these retail giants a one-stop shop, as customers can purchase e-liquids in addition to everyday grocery and household items, significantly helping with making access to users a lot easier and more convenient. The availability of e-liquids at supermarkets and hypermarkets with wide geographic presence targets urban and rural consumers. Moreover, most of these shops have dedicated sections for vaping products, showcasing several E-Liquid brands in different flavors and nicotine strengths for consumers with different preferences. In addition, these retailers also often run promotions, discount coupons, and loyalty programs on their e-liquids to encourage the purchase of e-liquids from a retail store during their routine shopping trips. Moreover, the research report, on the whole, offers a detailed analysis of the nature of competition, product excellence, and economic development, and provides characteristic features within the point of the global consumer armored cables market.

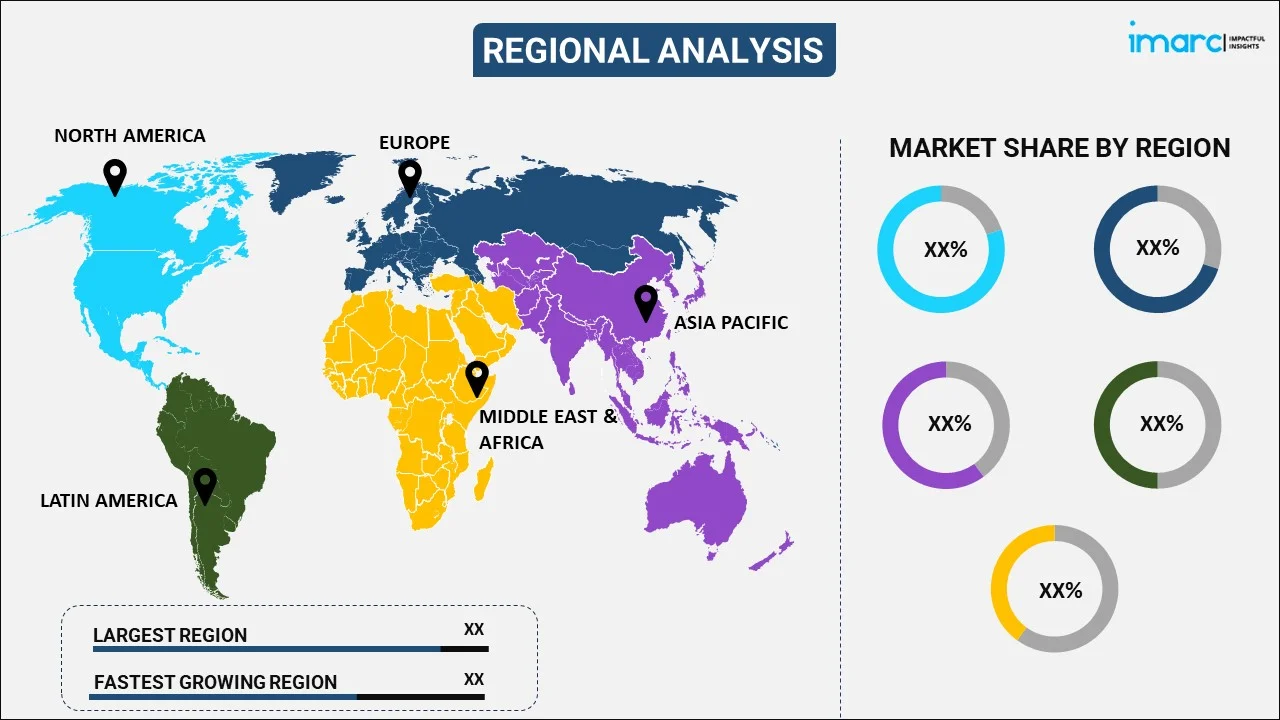

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest e-liquid market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for e-liquid.

North America represented the leading geographical area segment for the e-liquid market and preserved its position throughout the forecasting period due to its well-matured vaping culture. The early adoption of vaping products in the region by consumers and the presence of a large number of key industry players are enhancing the e-liquid market share in the region, thereby fueling the innovation and competitiveness of the market. Along with this, strict regulations in the US and Canada that, whilst ensuring the safety and quality of products, provide an environment that can lead to greater market growth through the reassurance they give consumers that guidelines are in place to protect them. In addition, growth in disposable income and changing preference from conventional alternatives to health-conscious options also enhance the global e-liquids market. The broad spectrum of e-cigarette users in North America from those that vape to kick cigarettes, to those that vape for sport also translates to a wide array of product variety, especially in the purchasing options for flavors and nicotine levels. Moreover, widespread distribution networks such as specialty vape shops, convenience stores, and strong e-commerce platforms further enhance regional product reach.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the e-liquid industry include:

- Black Note Inc.

- Breazy Inc.

- Crystal Canyon Vapes LLC

- e-Liquid Factory

- Mig Vapor LLC

- Molecule Labs Inc.

- Mt Baker Vapor LLC

- Nicopure Labs LLC

- Philip Morris International Inc.

- Turning Point Brands Inc.

- ZampleBox LLC

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

The top players in the e-liquid industry are concentrating on developing new products and adhering to industry standards to maintain some portion of the overall industry. Along with this, the introduction of new flavors is also providing an impetus to the growth of players. The variety of nicotine strengths and formulations is growing each month as companies are creating new products to meet consumer needs. There is increased competition globally as players are using strategic partnerships, acquisitions, and extensive marketing to strengthen their footing in the market. Furthermore, following stricter control measures and abiding by regulatory policies guarantees product safety and enhances consumer confidence.

E-Liquid Market News:

- May 2025: Charlie's Holdings (OTCQB:CHUC) announced the launch of PMTA registry-compliant PACHAMAMA 60ml e-liquids targeting U.S. states with strict vapor regulations. The release includes five award-winning flavors and prioritizes existing retail partners. Charlie's has over 640 PMTAs under FDA review, aiming to solidify market leadership.

- February 2025: UK-based e-liquid maker Riot Labs launched a new "supercharged" Riot X range featuring 12 bold e-liquid flavors designed for refillable vapes. The launch aligns with the upcoming UK disposables ban on June 1, aiming to help smokers transition. Flavors include Cherry Ice, Cola Ice, and Sweet Mint, priced from £3.99.

- February 2025: E-cigarette brand ELFBAR launched the ELFBAR 1000 in Romania, its first disposable vape with visible e-liquid. It features a transparent 2ml tank, up to 1000 puffs, and QUAQ MESH heating technology.

- January 2025: Elfbar launched the Dual10k prefilled pod kit, featuring a rechargeable 850mAh battery and the ability to switch between two flavors with a flick of a switch. Available in 20 editions and 40 flavors, it offers 20mg nicotine-strength e-liquid and a QUAQ mesh coil to minimize e-liquid loss.

- September 2024: WASPE launched the 25000 Puffs Original Edition LCD Display Disposable Vape, offering up to 25,000 puffs, customizable nicotine options (0%, 2%, 5%), and 10 flavor choices. The device featured advanced dual mesh coil technology, an LCD display for puff count and e-liquid levels, and a 650mAh battery with Type-C charging.

- August 2024: Philip Morris Limited (PML) launched the VEEV ONE closed-pod vape system in the UK, featuring high-quality e-liquids made from nicotine and food-grade flavorings. The device offers a 99% reduction in harmful chemicals compared to cigarettes and comes in 12 flavors.

- August 2024: Lost Mary launched the BM6000, a reusable and rechargeable vape offering up to 6,000 puffs. The device features a 650mAh battery, a 2ml prefilled pod, and an automatic 10ml e-liquid refill system, lasting up to ten times longer than single-use vapes. Available in 16 flavors, it includes 20mg nicotine-strength e-liquid and is aimed at adult smokers and ex-smokers.

- June 2024: PAVA launched its AI-powered cartridge-based e-cigarettes, the PAVA Horiz Pro and PAVA Horiz Ultra. These devices featured interactive screens, Bluetooth connectivity, and fun features like call reminders and vaping animations. With capacities of 2mL e-liquid, 30W power, and long-lasting batteries, they offered an innovative and personalized vaping experience.

- March 2024: Philip Morris International Inc. announced IQOS ILUMA, the latest and newest addition to its growing line of smokeless products for adults who would otherwise smoke or use nicotine products. These best cigarette alternatives include the IQOS multi-generation leading tobacco heating system.

E-Liquid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavors Covered | Menthol and Mint, Tobacco, Dessert, Fruits and Nuts, Chocolate, Others |

| Base Types Covered | PG (Propylene Glycol), VG (Vegetable Glycerin), PG and VG |

| Types Covered | Pre-Filled, Bottled |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Black Note Inc., Breazy Inc., Crystal Canyon Vapes LLC, e-Liquid Factory, Mig Vapor LLC, Molecule Labs Inc., Mt Baker Vapor LLC, Nicopure Labs LLC, Philip Morris International Inc., Turning Point Brands Inc., ZampleBox LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the e-liquid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global e-liquid market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the e-liquid industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-liquid market was valued at USD 2.3 Billion in 2024.

The e-liquid market is projected to exhibit a CAGR of 13.1% during 2025-2033, reaching a value of USD 7.7 Billion by 2033.

E-liquid, also known as vape juice, is the liquid used in electronic cigarettes or vaporizers. It typically contains nicotine, propylene glycol, vegetable glycerin, and flavorings. It comes in various flavors and nicotine strengths, allowing for a customizable vaping experience. Some e-liquids are nicotine-free for those who want to avoid nicotine entirely.

The e-liquid market is mainly driven by regulatory changes and government policies to ensure consumer safety and product quality, fostering user confidence and market stability. Moreover, changing user tastes for better options and lifestyles are expanding vaping market demand considering its reduced risks compared to cigarette smoking.

North America currently dominates the e-liquid market, attributed to the early adoption of vaping products and the presence of a large number of key industry players. Moreover, widespread distribution networks such as specialty vape shops, convenience stores, and strong e-commerce platforms further enhance regional product reach.

Some of the major players in the e-liquid market include Black Note Inc., Breazy Inc., Crystal Canyon Vapes LLC, e-Liquid Factory, Mig Vapor LLC, Molecule Labs Inc., Mt Baker Vapor LLC, Nicopure Labs LLC, Philip Morris International Inc., Turning Point Brands Inc., ZampleBox LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)