E-Learning Market Size, Share, Trends and Forecast by Technology, Provider, Application, and Region, 2025-2033

E-Learning Market 2024, Size and Trends:

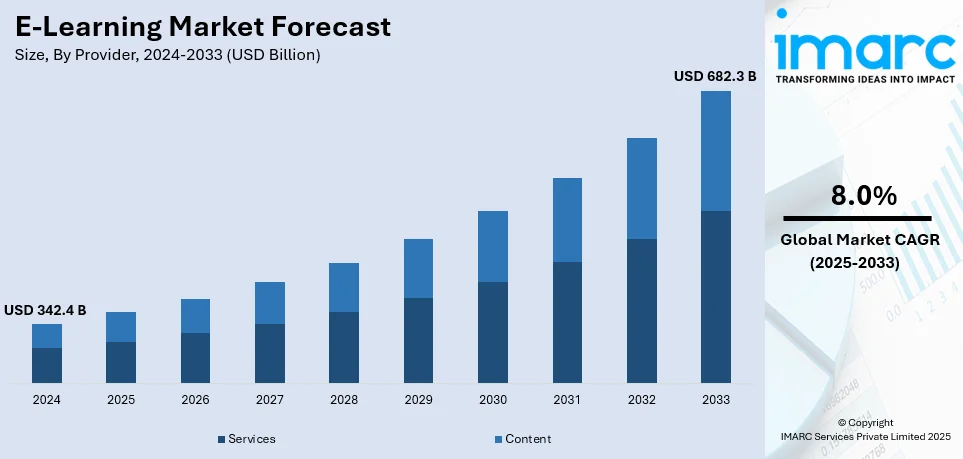

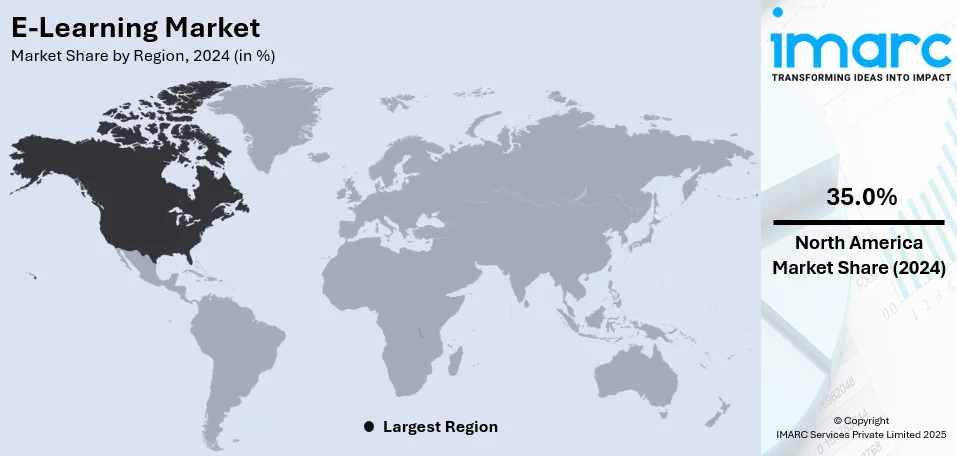

The global e-learning market size reached USD 342.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 682.3 Billion by 2033, exhibiting a growth rate (CAGR) of 8.0% during 2025-2033. North America currently dominates the market, holding a market share of over 35.0% in 2024. The regional market is principally propelled by magnified internet penetration, cutting-edge technological infrastructure, and robust implementation of digital learning solutions across both corporate and educational segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 342.4 Billion |

|

Market Forecast in 2033

|

USD 682.3 Billion |

| Market Growth Rate (2025-2033) | 8.0% |

The global e-learning market is driven by technological advancements, increased internet penetration, and the proliferation of mobile devices, enabling widespread accessibility to online education. Growing corporate demand for cost-effective training solutions and the need for skill enhancement further support market growth. In addition, the adoption of flexible, self-paced learning models by academic institutions and organizations fosters a wider user base. Furthermore, government initiatives promoting digital education and investments in e-learning infrastructure contribute significantly. Moreover, the shift toward remote learning, spurred by changing work environments and educational needs, continues to accelerate market expansion globally.

The United States plays a pivotal role in the global e-learning market, driven by widespread adoption of advanced technologies and a strong digital infrastructure. Key growth factors include increasing demand for flexible learning solutions, a surge in corporate training initiatives, and robust investments in education technology by institutions and businesses. The proliferation of mobile devices and high internet penetration further enhance accessibility to online learning platforms. For instance, as per industry reports, by 2040, the number of smartphone users in the United States is projected to exceed 364 million. Moreover, the U.S. education sector’s focus on personalized and interactive learning experiences, alongside government support for digital education programs, strengthens the country's leadership in the e-learning industry.

E-Learning Market Trends:

Increasing Demand for Remote Learning

The rising demand for remote learning solutions is primarily propelling the growth of the market. Moreover, the inflating need for continuity in education and professional development is augmenting the importance of e-learning, which is creating a positive outlook for the overall market. Additionally, various key market players are extensively investing to expand their operations and offer innovative learning solutions to customers. For instance, in September 2023, Amsterdam-based largest corporate edtech provider in EMEA, Lepaya, raised Euro 36 Million (USD 37.79 Million), one of the biggest rounds raised in this space in all of 2023. With the newly acquired capital, Lepaya will double down on the development and revolution of AI-based corporate learning in various global organizations, including ING, Dell, Maersk, and KPMG Freudenberg. Furthermore, organizations are increasingly recognizing the benefits of e-learning for employee training and development, as it enables them to deliver consistent training materials to a geographically dispersed workforce efficiently. The increasing need for remote learning is anticipated to contribute to the growth of the market in the coming years.

Globalization and Cross-Border Education

Educational institutions and universities are expanding their reach beyond national borders, which in turn is bolstering the need for scalable and accessible training and education solutions. Moreover, e-learning platforms are offering standardized training and educational content to a global audience, which is further creating a positive outlook for the market. In this response, various companies are launching new and innovative platforms of learning that can be accessed from any part of the world. For instance, Spotify, a music streaming and podcasting company, is now venturing into the world of e-learning, offering a new line of content aimed at educating its vast user base. The move comes as Spotify aims to increase user engagement and drive revenue growth, tapping into the burgeoning online education market. Moreover, various market players are raising funding to expand their operations beyond their home countries and increase their customer base. For instance, in an attempt to expand access to an affordable college education for Arabic-speaking students, the University of the People (UoPeople), an American-accredited university, launched an online MBA degree taught in Arabic in February 2024. As per an industry report, the online learning platforms market is projected to have 1.0 billion users by the year 2029.

Integration of Next-Gen Technologies

The increasing integration of next-generation technologies, such as artificial intelligence (AI), augmented reality (AR), and virtual reality (VR), to enhance the learning experience is also propelling the growth of the global e-learning market. Various companies are significantly investing in the development of interactive learning platforms to enhance user engagement and provide them with an immersive experience. For instance, in January 2024, Coursera launched a new AI feature to support the needs of Indian learners. This new initiative includes a large catalog of learning content in Hindi and AI-powered features. Similarly, the Government of India has launched DIKSHA (Digital Infrastructure for Knowledge Sharing) to provide quality e-content for school education and enhance learning outcomes across the country. It provides energized textbooks with QR codes for various grades through a single platform. Integration of such technologies is projected to propel the e-learning market revenue in the coming years.

Cost-Effectiveness and Scalability

Traditional methods of education and training generally involve a substantial cost related to things, including physical infrastructure, printed materials, travel, and instructor fees. On the other hand, e-learning can significantly reduce these expenses by eliminating the need for physical classrooms or training locations. This saves expenditure on maintenance, along with utilities and rent. In addition to this, the digital content can be updated easily, which eventually decreases the printing and distribution expenses. This cost-efficient approach makes online learning an attractive option for both educational institutions and businesses. Besides this, e-learning platforms offer high scalability, as they are capable of accommodating a few learners or expanding up to thousands or even millions of users simultaneously. As a result, various companies are investing in expanding their operations and increasing the student base without opening a physical entity. For instance, in August 2023, an Irish edtech company, Zick Learn, secured Euro 500k (USD 524.69K) in funding to increase its headcount and accelerate growth throughout Ireland, the UK, and across Europe.

E-Learning Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global e-learning market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, provider, and application.

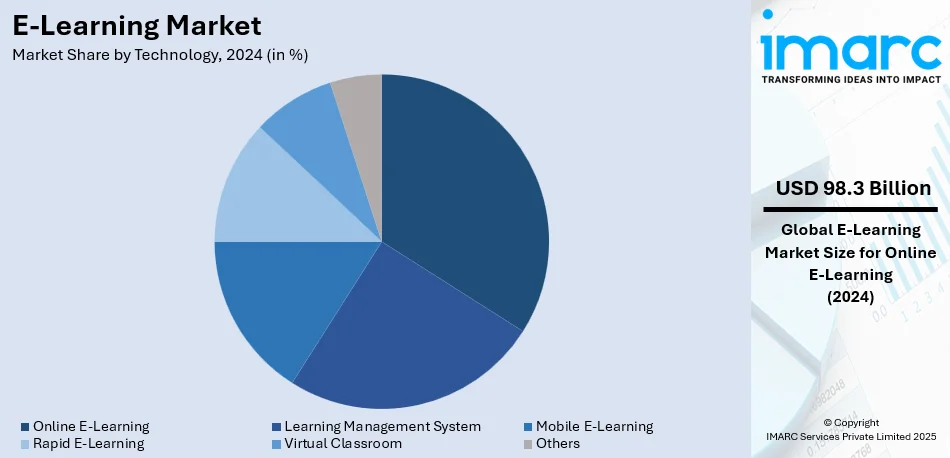

Analysis by Technology:

- Online E-Learning

- Learning Management System

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

Online e-learning leads the market with around 28.7% of market share in 2024. This segment includes a wide range of educational and training materials delivered over the internet, accessible through web browsers and apps. It is favored for its accessibility and convenience, allowing learners to access content from anywhere with an internet connection. Various public and private universities are launching online e-learning programs to assist students in higher education, while they work on their full-time jobs. For instance, The University Grants Commission (UGC) chairman Mamidala Jagadesh Kumar launched the four-year undergraduate program of the Indira Gandhi National University (IGNOU). UGC Chairperson emphasized on the program’s significance at the launch event and regarded it as an important reform in the landscape of Indian higher education.

Analysis by Provider:

- Services

- Content

Content leads the provider segment and is chiefly driven by the growing demand for high-quality and diverse educational materials. Content providers specialize in creating and curating resources such as video lectures, written materials, interactive exercises, and multimedia tools. Furthermore, they offer extensive libraries of courses spanning various subjects and industries, catering to the needs of students, professionals, and organizations. In addition, by collaborating with educational institutions and corporations, they deliver comprehensive e-learning solutions that provide learners with well-structured, engaging, and accessible materials. This focus on innovation and adaptability ensures content providers remain pivotal in shaping the e-learning market's growth and evolution.

Analysis by Application:

- Academic

- K-12

- Higher Education

- Vocational Training

- Corporate

- Small and Medium Enterprises

- Large Enterprises

- Government

Academic lead the market by application and mainly includes educational institutions at all levels, ranging from K-12 to higher education. It also encompasses vocational training, which primarily focuses on skill development and practical knowledge catering to industry requirements. E-learning is rapidly becoming an integral part of modern education, offering flexibility in curriculum delivery and accessibility to a wide range of subjects. Moreover, academic institutions prominently use online learning for remote education, supplemental materials, flipped classrooms, and fully online degree programs. In addition to this, various universities and schools are actively offering online learning courses and degrees for working professionals to facilitate easy higher education learning programs. For instance, in February 2024, Jawaharlal Nehru University launched various short-term online learning programs to enhance e-learning infrastructure.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.0%. The growth of the e-learning market in North America can be attributed to the early adoption of technology, well-established educational institutions, and a strong corporate focus on training and development. Countries, including the United States and Canada, have widely integrated e-learning into academic institutions, corporations, and government agencies. For instance, in 2017, about 77% of U.S. corporations said that they used online learning. Meanwhile, almost all of the companies (98%) planned on implementing e-learning methods by 2020. This same study revealed that around 98% of the corporations indicated plans to deploy video under their digital learning objective. Moreover, the wide presence of major companies, a tech-savvy population, and high-speed internet infrastructure are contributing to the e-learning market share in this region.

Key Regional Takeaways:

United States E-Learning Market Analysis

In 2024, United States accounted for the 86.70% of the market share in North America. E-learning has been rapidly growing in this region because of various causes that include a shift towards distance learning, technology advancement, and for the growing need of tailored instruction. Due to the growing need for lowering training costs and efficiency in workforce performance, most American businesses provided online training by 2023. For instance, Coursera, a platform for e-learning reported that 17 million American people came on the board to learn from the platform-the highest worldwide. The situation is also transforming due to the deployment of AI -powered learning technologies, especially adaptive learning platforms, which make education more efficient and tailored.

According to the National Centre for Education Statistics, during the 2022–2023 school year, 53% of students in America were participating in at least one online course. Increasing acceptance of micro-learning programs and massive open online courses or MOOCs is further expected to propel market growth. Furthermore, as per the data by Training Magazine, companies in the United States invested USD 100 Billion in corporate training programs in 2022, demonstrating the corporate sector's adoption of e-learning for skill development. Additionally, gamification strategies in education and the growing popularity of mobile learning apps both add to the allure of e-learning solutions.

Europe E-Learning Market Analysis

This is the segment where the European e-learning sector, particularly in countries such as Germany, the UK, and France, is gaining momentum because of its increasing trend towards digital education and skill development. E-learning is much facilitated by the EU's digital education programs that place emphasis on digital literacy and accessibility. One such initiative by the European Union (EU) is the Digital Education Action Plan (2021–2027), which sets out a shared vision for high-quality, inclusive, and accessible digital education in Europe and seeks to help Member States adapt their educational and training systems to the digital age. About Euro 2.6 Billion (USD 2.73 Billion) in Cohesion Policy money had been promised or paid by the end of 2021 for the digitisation of European schools. With online certifications, virtual classrooms, and industry-recognised courses becoming increasingly popular, the market has grown further in the IT and health sectors. Additionally, the corporate e-learning market in Europe is expanding. According to an industrial report estimate, 60% of the businesses provide their staff with online training. Besides, one of the significant drivers for the market is the requirement for reskilling and upskilling in light of the automation and digital transformation of industries. As the European Commission encourages digital tools for schools, e-learning solutions are increasingly being incorporated into the curriculum in the K–12 sector. Furthermore, mobile learning is also on the rise; it is expected that mobile learning platforms would grow by 18% annually across the region, as per an industry report.

Asia Pacific E-Learning Market Analysis

The Asia-Pacific e-learning market is growing at a rapid pace due to increased desire for skill development, better internet connectivity, and the expanding use of smartphones. Data from IABM, an international trade firm, indicates that the number of Chinese online learners has risen by more than 50% since the epidemic started, with the figure growing from approximately 230 Million in June 2019 to 420 Million in March 2020, with a 46.8% utilisation increase. Furthermore, in both rural and urban parts of India, the expanding middle class and programs such as the National Mission on Education via ICT are promoting e-learning.

The Asia-Pacific corporate sector is investing heavily in online learning platforms to bridge the skill gap in the manufacturing and technology sectors. The high penetration rate of mobiles across the region also contributes to the growth of mobile-based learning solutions. As per industry reports, 63% of the total Asia Pacific population, accounting for 1.8 Billion individuals, were found to have mobile services subscription in 2023. The region's e-learning sector is also being driven by the increasing demand for digital certifications and the popularity of language learning sites such as Duolingo.

Latin America E-Learning Market Analysis

E-learning market is growing substantially in Latin America due to increased demand for flexible and easily accessible educational choices. Brazil and Mexico are the two biggest markets in the region, and the market is suspected to expand further. Moreover, the popularity of online learning platforms providing courses in business, healthcare, and information technology subjects is increasing rapidly in the region. Industry reports claim that 65% of the total Latin America's population, i.e., 418 million individuals leveraged mobile internet in 2023. This further strengthens the market. Additionally, government initiatives to enhance digital literacy, such as Brazil's digital education strategy, have high probability to accelerate the growth of the market even more. The expansion of online education solutions worldwide is also being supported by the growing edtech businesses, especially in Brazil and Argentina.

Middle East and Africa E-Learning Market Analysis

The increasing adoption of digital education and skill development in the countries of the Middle East and Africa, including the United Arab Emirates, Saudi Arabia, and South Africa, is significantly propelling the e-learning market. The internet penetration across the region has increased, which has simplified the process of accessing online learning platforms. Moreover, the MENA region has 400 Million unique mobile customers, which translate to about 65% of the entire population as of 2020, as per industry reports. Two key programs that will make online learning popular in educational institutions are the UAE's Smart Learning Program and Saudi Arabia's Vision 2030. Furthermore, the corporate sector, particularly in the oil, gas, and healthcare sectors, also increasingly requires e-learning as companies place more importance on training and development. The region's strong growth in mobile learning and language courses is further stimulating the market.

Competitive Landscape:

The market is currently exhibiting intense competition, with leading companies actively diverting towards tactical acquisitions, advancements and partnerships to fortify their market reach. For instance, in September 2024, FLOWSPARKS, a prominent SaaS software-based e-learning solutions company, formed a tactical partnership with We Are Learning, a well-established content company, to offer an adaptable, comprehensive solution that improves the learning services. Beside this, key players are increasingly focusing on customized learning experiences and varied course offerings. Furthermore, regional firms and emerging startups also support the robust market dynamics by providing cost-efficient solutions and localized content. Technological innovations, mainly including VR/AR incorporation and AI-powered learning platforms, further improve competitive differentiation. In addition, corporate training requirements and government ventures in digital education programs are bolstering new opportunities, magnifying rivalry among industry players. Consequently, the competitive landscape highlights a blend of adaptive newcomers and established players, steering a revolutionizing and dynamic market environment.

The report provides a comprehensive analysis of the competitive landscape in the e-learning market with detailed profiles of all major companies, including:

- Adobe Inc.

- Anthology Inc.

- Cisco Systems Inc.

- Coursera, Inc.

- Docebo, Inc.

- edX LLC

- LinkedIn Corporation

- Oracle Corporation

- Pearson Plc

- SAP SE

- Skillsoft

- Udemy, Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- May 2024: Accenture strengthened its digital upskilling and reskilling efforts by completing the acquisition of Udacity, a top online learning platform. This change, which was announced in 2024, is to improve Accenture's capacity to provide innovative, sector-relevant training programs that are suited to the requirements of both individuals and businesses.

- April 2024: The Government of Andhra Pradesh, India signed MoU with the e-learning platform, edX, to offer higher education courses to youth. The agreement paves the way for more than 12 lakh students to pursue 2,000-plus edX courses offered by world's top-notch universities and other educational institutions, free of cost along with their regular courses.

- November 2023: Asia Society Texas (AST) announced the launch of “Asia in the Classroom”, an innovative online learning platform for K-12 students that will exponentially advance essential tools needed by students and educators to learn the untold narratives of Asia and Asian Americans.

- September 2023: Lepaya, an Amsterdam-based edtech, secured USD 37.77 Million to AI-revolutionize the corporate learning market. With the newly acquired capital, Lepaya will double down on the development and expansion.

E-Learning Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Online E-Learning, Learning Management System, Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| Providers Covered | Services, Content |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adobe Inc., Anthology Inc., Cisco Systems Inc., Coursera, Inc., Docebo, Inc., edX LLC, LinkedIn Corporation, Oracle Corporation, Pearson Plc, SAP SE, Skillsoft, Udemy, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the e-learning market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global e-learning market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the e-learning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

E-learning refers to the delivery of educational content through digital platforms, enabling remote access to courses and training programs. It incorporates various technologies, such as online portals, virtual classrooms, and multimedia tools, offering flexibility and scalability for learners and institutions in both academic and professional settings.

The e-learning market was valued at USD 342.4 Billion in 2024.

IMARC estimates the global e-Learning market to exhibit a CAGR of 8.0% during 2025-2033.

The market is driven by technological advancements, increasing internet penetration, rising demand for flexible learning solutions, and the growing adoption of mobile devices. Additionally, corporate training initiatives, cost-effective education models, and government investments in digital education infrastructure further propel the market's growth.

According to the report, online e-learning represented the largest segment by technology, driven by widespread adoption of internet-based education platforms.

Content leads the market by provider, driven by increasing demand for diverse educational materials.

Academic is the leading segment by application, driven by the amplifying need for scalable education solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global e-learning market include Adobe Inc., Anthology Inc., Cisco Systems Inc., Coursera, Inc., Docebo, Inc., edX LLC, LinkedIn Corporation, Oracle Corporation, Pearson Plc, SAP SE, Skillsoft, Udemy, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)