E-Invoicing Market Report by Channel (B2B, B2C, and Others), Deployment Type (Cloud-based, On-premises), Application (Energy and Utilities, FMCG, E-Commerce, BFSI, Government, and Others), and Region 2026-2034

Market Overview:

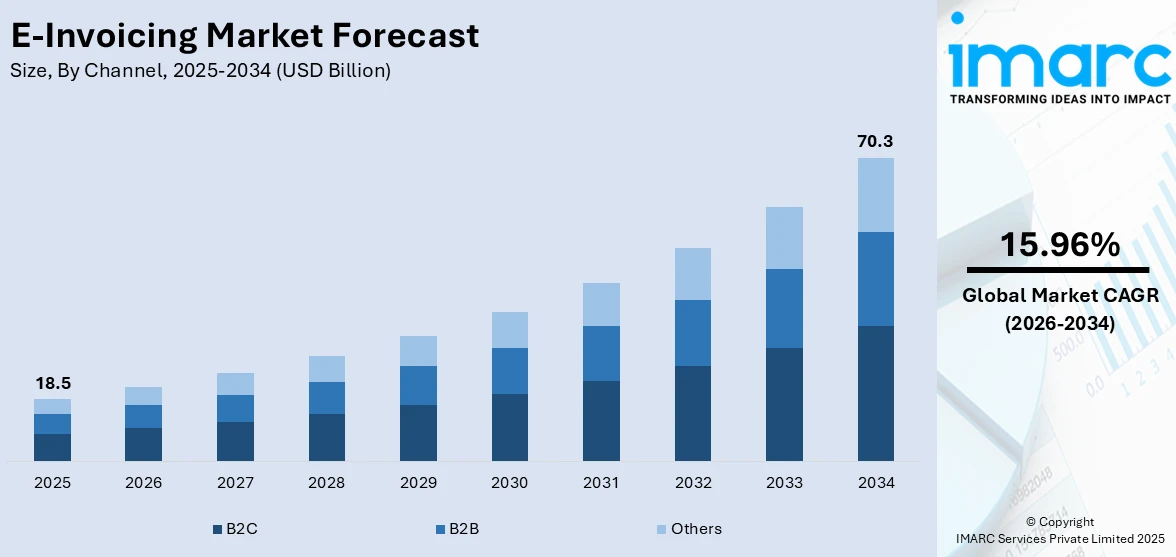

The global e-invoicing market size reached USD 18.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 70.3 Billion by 2034, exhibiting a growth rate (CAGR) of 15.96% during 2026-2034. The expanding e-commerce industry, the widespread adoption of advanced information technology (IT) solutions across various industries, and various technological advancements, such as the development of web and software-based invoicing applications represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 18.5 Billion |

|

Market Forecast in 2034

|

USD 70.3 Billion |

| Market Growth Rate 2026-2034 | 15.96% |

E-invoicing, or electronic invoicing, is a digital method of creating, sending, receiving, and processing invoices between businesses. Unlike traditional paper-based invoicing, which involves physical documents, e-invoicing relies on electronic formats and automated systems to handle the invoicing process. In an e-invoicing system, invoices are generated electronically and can be sent to recipients through various digital channels, such as email, online portals, or electronic data interchange (EDI) systems. These invoices are structured in standardized formats that allow for seamless integration with accounting software, enterprise resource planning (ERP) systems, and other financial management tools.

To get more information on this market Request Sample

The e-invoicing market is being propelled by the global shift toward digitalization and automation. As businesses strive to streamline operations and enhance efficiency, traditional paper-based invoicing processes are being replaced by electronic alternatives that offer faster, more accurate, and cost-effective methods of invoicing. In addition, regulatory initiatives and mandates are playing a significant role in driving the e-invoicing market. Many governments and regulatory bodies are encouraging or even requiring businesses to implement electronic invoicing to curb tax evasion, reduce fraud, and improve overall financial transparency. These regulations act as catalysts, compelling businesses to adopt e-invoicing solutions to remain compliant and avoid potential penalties. The push toward sustainability and environmental responsibility is also fueling the growth of the e-invoicing market. Organizations are increasingly recognizing the environmental impact of paper-based processes, including the consumption of resources and the generation of waste. By transitioning to e-invoicing, businesses can significantly reduce their carbon footprint by minimizing paper usage and waste generation. Furthermore, the expanding global business landscape and cross-border trade are driving the demand for e-invoicing solutions.

E-Invoicing Market Trends/Drivers:

Increasing globalization and digital transformation

The increasing globalization of businesses and the broader digital transformation trend are driving the adoption of e-invoicing. As companies operate across borders, traditional paper-based invoicing becomes inefficient and prone to delays. E-invoicing bridges geographical gaps, enabling seamless and real-time invoice exchange between international partners. Moreover, the ongoing digital transformation efforts of businesses are fostering the adoption of e-invoicing as part of broader digitization initiatives. The shift towards cloud-based solutions, mobility, and remote work is further accentuating the need for electronic and interconnected invoicing processes. E-invoicing aligns with this digital evolution, facilitating faster and more efficient financial transactions in an increasingly connected business environment.

Various technological advancements

The rapid advancements in technology and the growing emphasis on automation are fundamentally transforming the e-invoicing market. Automation technologies such as artificial intelligence (AI) and machine learning are being integrated into e-invoicing platforms to streamline and optimize the entire invoicing process. These technologies enable the extraction of relevant information from invoices, validation of data accuracy, and even prediction of potential discrepancies. Additionally, blockchain technology is gaining traction in the e-invoicing sector due to its ability to provide secure and immutable records of transactions. Blockchain ensures data integrity and reduces the risk of fraudulent activities. The integration of such technologies enhances the efficiency and accuracy of invoicing and contributes to building trust among stakeholders.

Expanding e-commerce industry

The e-commerce industry's remarkable growth has resulted in a surge of transactions conducted online. This surge has led to a higher volume of invoices that need to be generated, sent, received, and processed. E-invoicing provides a solution to efficiently handle this increased workload. Moreover, the e-commerce landscape often involves various stakeholders, including sellers, buyers, and intermediaries. E-invoicing platforms offer the necessary structure to manage these multiple parties and their associated invoicing needs seamlessly. Moreover, e-commerce transactions often occur in real-time, demanding equally prompt invoicing. E-invoicing systems facilitate instant generation and delivery of invoices as soon as transactions are completed. This responsiveness enhances customer experience and ensures that payments are initiated promptly.

E-Invoicing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global e-invoicing market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on channel, deployment type and application.

Breakup by Channel:

- B2B

- B2C

- Others

B2C represents the most leading channel

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others. According to the report, B2C represented the largest segment.

B2C transactions involve a large volume of individual customers making purchases from businesses. In this context, e-invoicing streamlines the payment process for consumers. Customers appreciate the convenience of receiving invoices directly via email or online portals, enabling them to settle payments promptly without the need for physical paperwork. As consumers become accustomed to digital interactions in various aspects of their lives, e-invoicing aligns with their expectations for efficient and digital-driven experiences. Moreover, implementing e-invoicing in the B2C context offers cost-saving advantages for businesses. Traditional paper-based invoicing involves printing, postage, and administrative expenses. Transitioning to e-invoicing reduces these costs significantly, contributing to improved operational efficiency and profitability.

Breakup by Deployment Type:

- Cloud-based

- On-premises

Cloud based deployment hold the largest market share

A detailed breakup and analysis of the market based on the deployment type has also been provided in the report. This includes cloud-based and on-premises. According to the report, cloud-based deployment accounted for the largest market share.

Cloud-based e-invoicing solutions offer unparalleled accessibility. Businesses can access their invoicing systems from anywhere with an internet connection, enabling remote work and facilitating collaboration among distributed teams. This flexibility is crucial in today's dynamic business environment. Moreover, cloud-based e-invoicing can easily scale to accommodate growing transaction volumes without the need for extensive hardware investments. This scalability is particularly advantageous for businesses experiencing seasonal fluctuations or rapid growth, allowing them to manage their invoicing processes efficiently. Besides, this deployment eliminates the need for businesses to invest in and maintain on-premises infrastructure. This significantly reduces upfront capital expenditures and ongoing maintenance costs.

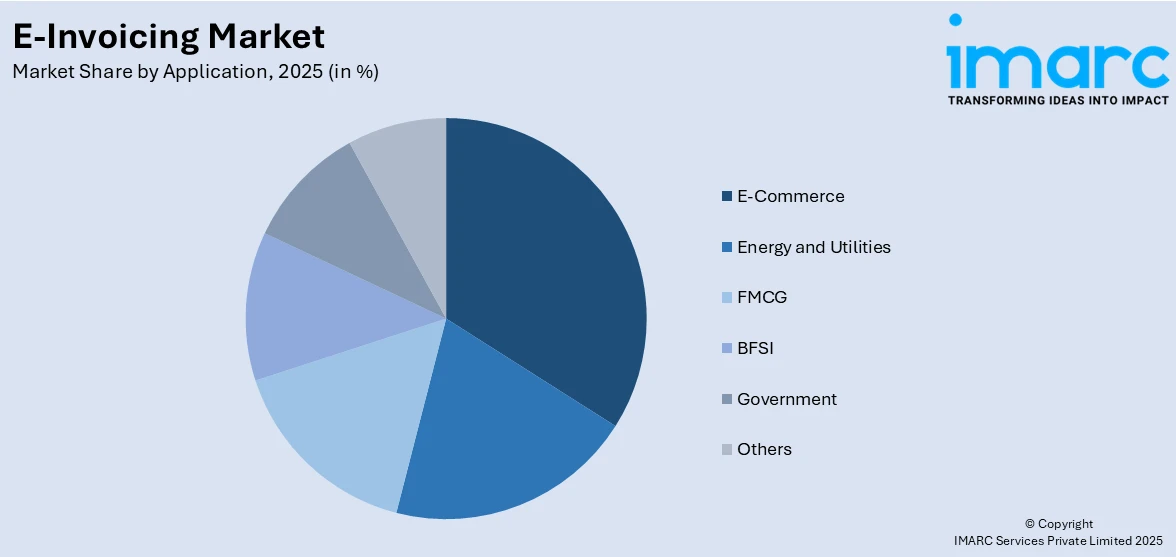

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

E-commerce holds the largest market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others. According to the report, e-commerce holds the largest market share.

E-commerce transactions are characterized by a substantial volume of sales, purchases, and payments between businesses and consumers. This high transaction volume necessitates a streamlined and efficient invoicing process. E-invoicing's automation capabilities cater to this demand, enabling the swift generation, delivery, and processing of invoices on a large scale. Moreover, e-commerce inherently operates in a digital environment, where online platforms serve as the primary channels for transactions. E-invoicing seamlessly integrates with these digital ecosystems, allowing businesses to generate and send invoices electronically through the same platforms where transactions occur. This natural integration enhances customer experience and drives the adoption of e-invoicing.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (United States, Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others); Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others); Latin America (Brazil, Mexico, Others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share.

European governments have been proactive in promoting e-invoicing through regulatory mandates and standardization efforts. Initiatives like the European Directive 2014/55/EU mandate the use of e-invoicing in public procurement processes across member states. These regulations create a standardized framework for electronic invoicing, encouraging businesses to adopt digital invoicing practices. Moreover, Europe has a history of early technology adoption and a strong digital infrastructure. This tech-savvy environment has facilitated the adoption of e-invoicing solutions by businesses of all sizes. Additionally, the widespread use of electronic banking and digital payments in Europe has created a natural alignment with e-invoicing practices.

Competitive Landscape:

The competitive landscape of the market is characterized by a dynamic interplay of established players, innovative startups, and technology giants striving to capture market share. Nowadays, leading players are investing in research and development to integrate advanced technologies like artificial intelligence (AI), machine learning, and blockchain into their e-invoicing solutions. Moreover, emphasizing cloud-based deployment, players are offering scalable and flexible solutions that adapt to the changing demands of businesses. Cloud solutions facilitate remote work, scalability, and real-time accessibility. They are also diversifying their offerings beyond e-invoicing and provide value-added services such as supplier financing, spend analysis, and supply chain visibility, creating comprehensive solutions for businesses.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Basware Oy

- Comarch SA

- Coupa Software Inc

- EDICOM

- Esker

- International Business Machines Corporation

- Nipendo

- Open Text Corporation

- Pagero

- PaySimple

- Sage Group plc

- SAP SE

- Tradeshift Holdings, Inc.

- Vertex, Inc

Recent Developments:

- Araize, Inc. has released a new version of its e-invoicing software, which includes enhanced features for invoice tracking, payment reminders, and invoice customization. The software also offers integration with popular CRM and accounting systems.

- The Sage Group has introduced AI-powered capabilities to its e-invoicing software, enabling users to automate invoice creation, approval workflows, and payment processing. The software also offers real-time analytics and reporting features.

- SAP Ariba, a subsidiary of SAP SE, introduced enhancements to its e-invoicing and procurement solutions. These improvements focus on improving supplier collaboration, optimizing procurement processes, and enhancing end-to-end supply chain visibility.

E-Invoicing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-Based, On-Premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Basware Oy, Comarch SA, Coupa Software Inc, EDICOM, Esker, International Business Machines Corporation, Nipendo, Open Text Corporation, Pagero, PaySimple, Sage Group plc, SAP SE, Tradeshift Holdings, Inc., Vertex, Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the e-invoicing market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global e-invoicing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global e-invoicing market was valued at USD 18.5 Billion in 2025.

We expect the global e-invoicing market to exhibit a CAGR of 15.96% during 2026-2034.

The expanding e-commerce sector, along with the rising integration of cloud-based and on-premises solutions, for providing improved invoice accuracy, faster invoice-processing time, and transparency, is currently driving the global e-invoicing market.

The sudden outbreak of the COVID-19 pandemic has led to a significant shift from brick-and-mortar distribution channels towards e-commerce platforms which, in turn, is augmenting the utilization of e-invoicing system.

Based on the channel, the global e-invoicing market can be categorized into B2B, B2C, and others. Among these, B2C channel exhibits a clear dominance in the market.

Based on the deployment type, the global e-invoicing market has been segmented into cloud-based and on-premises. Currently, cloud-based solution represents the largest market share.

Based on the application, the global e-invoicing market can be bifurcated into energy and utilities, FMCG, e-commerce, BFSI, government, others. Among these, the e-commerce sector accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Europe currently dominates the global market.

Some of the major players in the global e-invoicing market include Basware Oy, Comarch SA, Coupa Software Inc, EDICOM, Esker, International Business Machines Corporation, Nipendo, Open Text Corporation, Pagero, PaySimple, Sage Group plc, SAP SE, Tradeshift Holdings, Inc., and Vertex, Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)