E-Cigarette Market Report by Product (Modular E-Cigarette, Rechargeable E-Cigarette, Next-Generation E-Cigarette, Disposable E-Cigarette), Flavor (Tobacco, Botanical, Fruit, Sweet, Beverage, and Others), Mode of Operation (Automatic E-Cigarette, Manual E-Cigarette), Distribution Channel (Specialty E-Cig Shops, Online, Supermarkets and Hypermarkets, Tobacconist, and Others), and Region 2026-2034

E-Cigarette Market Size:

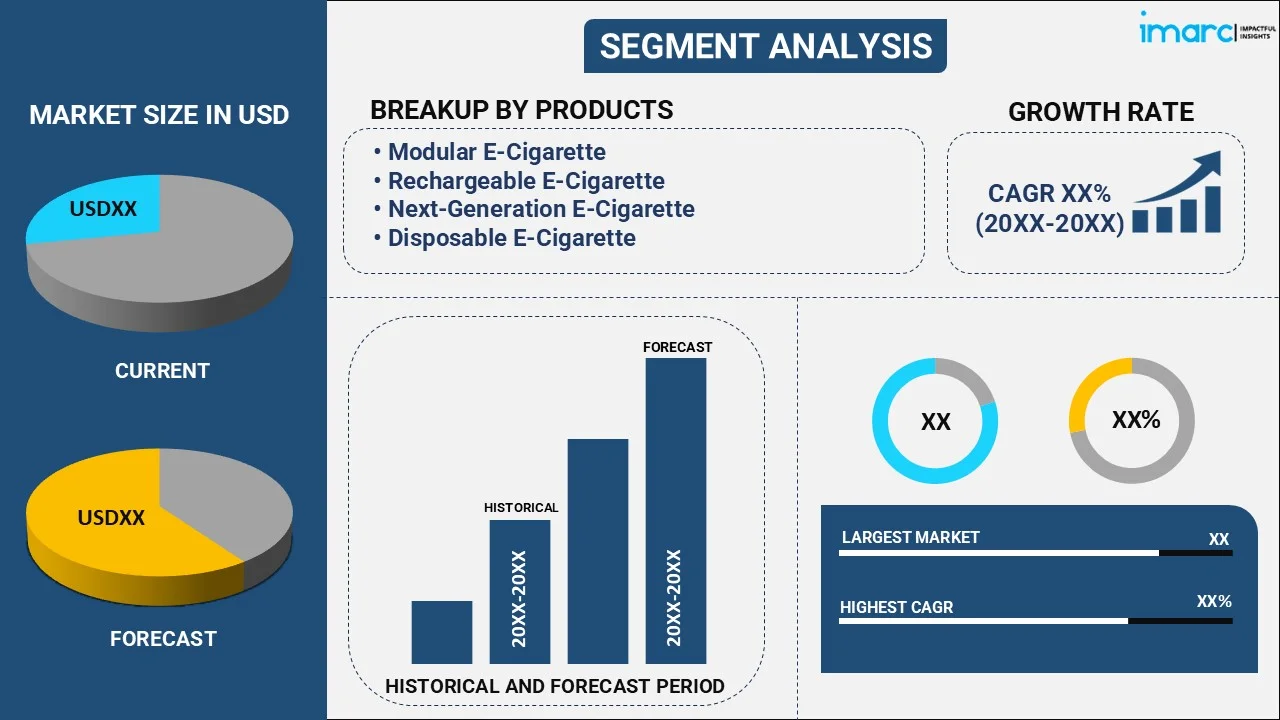

The global e-cigarette market size reached USD 26.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 41.8 Billion by 2034, exhibiting a growth rate (CAGR) of 5.44% during 2026-2034. Rising health consciousness, technological advancements, smoking cessation programs, availability of diverse flavor options, online retail growth, customizable nicotine levels, significant investment in research and development (R&D), and social influences are some of the factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 26.0 Billion |

| Market Forecast in 2034 | USD 41.8 Billion |

| Market Growth Rate 2026-2034 | 5.44% |

E-Cigarette Market Analysis:

- Major Market Drivers: The primary factors propelling the global e-cigarette market share is the increased awareness about the health hazards of smoking traditional cigarettes. This has further boosted the demand for healthier and viable alternatives, such as e-cigarette. In line with this, the burgeoning disposable income and escalating consumer purchasing power in developing economies are driving e-cigarette demand, which is further creating a positive outlook for the market growth. Moreover, the availability of customizable flavors and its aesthetic properties are fueling the market growth. Furthermore, the key market players are investing heavily in new product variants, and are also investing in celebrity endorsements, which is further facilitating the market growth. As per the e-cigarette market forecast, advancements in new technology development, such as battery life enhancement and a better system for delivering nicotine, positively impacts the market’s growth.

- Key Market Trends: The shift towards open-system e-cigarettes that offer users the ability to fill their own vape tanks and control other aspects is one of the primary trends for the market. Moreover, the trend of using nicotine salts is witnessing a significant demand as it offers a smoother and faster way to absorb, which is further propelling the e-cigarette market growth. Another significant driver is the rise of pod systems, revered for their convenience and portability. There is also a trend for the use of organic and natural e-liquids as consumers are becoming health-conscious, which is further stimulating the market growth. As per the e-cigarette market research report, the integration of technology, such as Bluetooth-enabled devices, and growing product popularity on social media are fostering the market growth.

- Geographical Trends: North America holds the largest market share in the global e-cigarette market, which can be attributed to the increasing smoking cessation rates and the presence of leading vendors in the region. The US in particular is a key contributor to the market growth as the country has one of the highest use of e-cigarettes and presence of a favorable regulatory framework. Based on the e-cigarette market insights, Europe is the second major market for e-cigarette, where the U.K. and France are major contributors due to favorable government policies along with high levels of awareness about potential benefits of 2nd generation e-cigarettes. In the Asia-Pacific region, China and India are witnessing a significant surged in the purchasing power, rapid urbanization, and increasing health consciousness among consumers, which is bolstering the e-cigarette market outlook.

- Competitive Landscape: Some of the major market players in the e-cigarette industry include Philip Morris International Inc., Altria Group Inc., British American Tobacco PLC, Japan Tobacco, Inc., Imperial Tobacco Group, International Vapor Group, Nicotek LLC, NJOY Inc., Reynolds American Inc., ITC Limited, and J WELL France, among many others.

- Challenges and Opportunities: As per the e-cigarette market dynamics, the uncertainty of the regulations is one of the largest hindering factors for e-cigarette manufacturers. Additionally, health concerns and bad publicity regarding vaping-related illnesses is another challenge for the market. However, the market also offers umpteen growth opportunities. The market is underpinned by the growth in demand for smoking cessation aids and new trends emerging towards harm reduction provide a robust market foundation. Besides this, product development and technological enhancements are other opportunities for the market.

To get more information on this market Request Sample

E-Cigarette Market Trends:

Rising Health Consciousness

As per the e-cigarette market overview, the increasing consumer health consciousness is one of the major factors driving the market growth. As traditional cigarettes are proven to increase the risks of smoking-related health issues, such as cancer, respiratory and cardiovascular diseases (CVDs), there has been a wider public movement towards improved diet and lifestyle, which has further surged the demand for new product variants. For instance, in India, tobacco related cancers comprised 27% of the total cancer burden in (2020). As a result, e-cigarettes are witnessing a considerable demand as a more secure replacement as they do not contain tobacco that burns and expose users to numerous toxicants of combustion products, which is further providing a considerable thrust to the e-cigarette market revenue.

Advances in Technology

Advancement in the design and technology in terms of the development of more sophisticated, user-friendly product variants is one of the primary factors accelerating the market growth. Temperature control, custom wattage settings, and longer battery life are some of the features offered by modern e-cigarettes. For instance, in 2024, AIR BAR introduce the Diamond Box disposable vape with precision temperature control (PTC) technology. This breakthrough heralds a major step forward in e-cigarette innovation. Moreover, the advancements in heating elements, like ceramic coils and sub-ohm tanks, have contributed greatly to the ability of e-cigarettes to produce vapor that is almost as frequent and similar as a traditional cigarette.

Smoking Cessation Programs

Smoking cessation programs have played a key role in driving e-cigarette product sales around the world. These programs help smokers quit using tools like nicotine replacement therapies and behavioral counseling in a support group. Hence e-cigarettes are starting to become a feature of such programs, on the grounds that they may help users wean off nicotine. Compared with conventional methods of cessation, e-cigarettes provide sustained flexible dosing and mimic some physical effects of cigarette smoking in a way that is familiar to smokers, which can be particularly appealing when withdrawal symptoms are prevalent.

E-Cigarette Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2026-2034. Our report has categorized the market based on product, flavor, mode of operation, and distribution channel.

Breakup by Product:

To get detailed segment analysis of this market Request Sample

- Modular E-Cigarette

- Rechargeable E-Cigarette

- Next-Generation E-Cigarette

- Disposable E-Cigarette

Next-generation e-cigarette accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes modular e-cigarette, rechargeable e-cigarette, next-generation e-cigarette, and disposable e-cigarette. According to the report, next-generation e-cigarette represented the largest segment.

The next-generation e-cigarette segment is driven by the increasing demand for innovative and technologically advanced vaping solutions. As consumer preferences shift towards products that offer enhanced user experiences, manufacturers are focusing on developing e-cigarettes that integrate smart features such as Bluetooth connectivity, customizable settings, and improved battery life. This segment is also propelled by the growing health consciousness among smokers who perceive e-cigarettes as a less harmful alternative to traditional tobacco products. The rise in health awareness is encouraging smokers to switch to e-cigarettes, which are marketed as being safer due to the absence of tar and other harmful substances found in combustible cigarettes. Additionally, the influence of social media and digital marketing plays a significant role in driving the next-generation e-cigarette segment.

Breakup by Flavor:

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

Tobacco holds the largest share of the industry

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes tobacco, botanical, fruit, sweet, beverage, and others. According to the report, tobacco accounted for the largest market share.

The tobacco segment is driven by the increasing consumer shift towards reduced-risk products and the growing awareness of the health hazards associated with traditional smoking. As consumers become more health-conscious, there is a noticeable decline in the consumption of conventional cigarettes, prompting tobacco companies to diversify into the e-cigarette market. E-cigarettes are perceived as a less harmful alternative, offering a similar sensory experience to traditional smoking without the combustion of tobacco, which produces harmful tar and toxins. This perception is bolstered by various public health bodies that have recognized e-cigarettes as a potential tool for smoking cessation and harm reduction. Additionally, the regulatory environment is gradually evolving to accommodate these products, providing clearer guidelines and standards that legitimize their use. Moreover, the development of innovative and appealing products, such as flavored e-liquids and technologically advanced devices, attracts a broad range of consumers, including former smokers and those attempting to quit smoking.

Breakup by Mode of Operation:

- Automatic E-Cigarette

- Manual E-Cigarette

Automatic e-cigarette dominates the market

The report has provided a detailed breakup and analysis of the market based on the mode of operation. This includes automatic e-cigarette and manual e-cigarette. According to the report, automatic e-cigarette represented the largest segment.

The automatic e-cigarette segment is driven by the increasing consumer demand for convenience and ease of use. Unlike manual e-cigarettes, automatic e-cigarettes activate through inhalation, eliminating the need for buttons and making them more user-friendly, especially for beginners. This simplicity appeals to a broader audience, including those transitioning from traditional cigarettes who seek a familiar smoking experience. Additionally, the advancement in technology has led to more reliable and efficient automatic devices, which enhances user satisfaction and drives market growth. The growing awareness of the health risks associated with smoking traditional cigarettes has also played a significant role, as consumers look for less harmful alternatives. Moreover, the sleek and discreet design of automatic e-cigarettes attracts style-conscious users who prefer a more sophisticated device. The availability of a wide range of flavors and nicotine strengths in the automatic segment further caters to diverse preferences, increasing its appeal.

Breakup by Distribution Channel:

- Specialty E-Cig Shops

- Online

- Supermarkets and Hypermarkets

- Tobacconist

- Others

Specialty e-cig shops is the predominant market segment

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty e-cig shops, online, supermarkets and hypermarkets, tobacconist, and others. According to the report, specialty e-cig shops accounted for the largest market share.

The specialty e-cig shops segment is driven by the increasing consumer demand for personalized and diverse vaping experiences. As vaping enthusiasts seek more tailored options, specialty shops offer a wide array of products, from premium e-liquids to advanced vaping devices, which cater to both novice and experienced users. These shops provide an environment where customers can receive personalized advice and hands-on demonstrations, fostering a community-oriented atmosphere that enhances customer loyalty and repeat business. Additionally, the rising awareness of the health risks associated with traditional smoking has propelled more individuals towards vaping as a perceived safer alternative, thereby boosting foot traffic in these specialty stores. The ability to try different flavors and nicotine strengths in-store before making a purchase is another significant draw for consumers, setting specialty e-cig shops apart from general retail outlets and online stores.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

North America leads the market, accounting for the largest e-cigarette market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, North America represents the largest regional market for e-cigarette.

The North America regional market is driven by the increasing acceptance and adoption of e-cigarettes as a viable alternative to traditional tobacco products. This shift is primarily fueled by heightened health consciousness among consumers, who perceive e-cigarettes as a less harmful option due to the absence of tar and reduced levels of certain carcinogens compared to conventional cigarettes. Additionally, aggressive marketing campaigns by e-cigarette manufacturers, which often highlight the variety of flavors and the customizable nature of vaping devices, have played a significant role in attracting a wide demographic, including younger adults. Technological advancements in e-cigarette design and functionality, such as improved battery life, temperature control, and compact, user-friendly designs, have also contributed to their growing popularity. Moreover, the presence of a robust regulatory framework in countries like the United States and Canada, which ensures product safety and quality standards, has bolstered consumer confidence.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the e-cigarette industry include Philip Morris International Inc., Altria Group Inc., British American Tobacco PLC, Japan Tobacco, Inc., Imperial Tobacco Group, International Vapor Group, Nicotek LLC, NJOY Inc., Reynolds American Inc., ITC Limited, J WELL France, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the e-cigarette market are engaging in a variety of strategic initiatives to solidify their market position and drive growth. They are heavily investing in research and development (R&D) to innovate and enhance their product offerings, focusing on improving battery life, flavor diversity, and device efficiency. This includes the introduction of advanced vaping devices with customizable features, such as temperature control and modular designs, catering to the preferences of a broad range of consumers. Additionally, these companies are expanding their product portfolios to include nicotine salts and other novel e-liquid formulations that provide a smoother vaping experience and higher satisfaction levels. Marketing strategies are also a critical focus, with significant resources allocated to digital marketing campaigns, social media presence, and influencer partnerships to increase brand visibility and appeal to younger demographics.

E-Cigarette Market News:

- In 2024, Altria Group's subsidiary NJOY received FDA marketing authorizations for its menthol e-cigarette products, including NJOY ACE Pod Menthol and NJOY DAILY Menthol varieties. This approval marks NJOY as the first to obtain FDA authorization for menthol e-cigarette products, reinforcing Altria's commitment to transitioning adult smokers to potentially less harmful alternatives. NJOY plans to expand its distribution network significantly, aiming to reach 100,000 stores by the end of 2024.

- In 2023, Imperial Brands launched the Pulze 2.0 heated tobacco device, emphasizing innovation and consumer convenience. Pulze 2.0 boasts a compact, all-in-one design, offering 25+ sessions per charge and pairing with iD sticks available in ten flavors. This device aims to provide a less harmful alternative to traditional cigarettes by significantly reducing harmful chemical emissions. Initially launched in Italy, Poland, the Czech Republic, and Greece, it will expand to other European markets throughout 2023.

- In 2024, the U.S. Food and Drug Administration (FDA) authorized the sale of Reynolds American Inc.'s tobacco flavored Vuse e-cigarettes. This approval is significant as it marks one of the few e-cigarette products to receive such authorization under the FDA's stringent regulatory framework. The decision was based on scientific evidence indicating that the tobacco flavored Vuse products are appropriate for the protection of public health, particularly as they offer a potentially less harmful alternative for adult smokers who switch completely or significantly reduce their cigarette consumption.

E-Cigarette Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Modular E-Cigarette, Rechargeable E-Cigarette, Next-Generation E-Cigarette, Disposable E-Cigarette |

| Flavors Covered | Tobacco, Botanical, Fruit, Sweet, Beverage, Others |

| Mode of Operations Covered | Automatic E-Cigarette, Manual E-Cigarette |

| Distribution Channels Covered | Specialty E-Cig Shops, Online, Supermarkets and Hypermarkets, Tobacconist, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Philip Morris International Inc., Altria Group Inc., British American Tobacco PLC, Japan Tobacco, Inc., Imperial Tobacco Group, International Vapor Group, Nicotek LLC, NJOY Inc., Reynolds American Inc., ITC Limited, J WELL France, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the e-cigarette market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global e-cigarette market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the e-cigarette industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global e-cigarette market was valued at USD 26.0 Billion in 2025.

We expect the global e-cigarette market to exhibit a CAGR of 5.44% during 2026-2034.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of e-cigarettes.

The increasing consumer awareness towards the negative health impact of smoking tobacco, along with the advent of extensive range of innovative e-cigarette flavors, is primarily driving the global e-cigarette market.

Based on the product, the global e-cigarette market has been divided into modular e-cigarette, rechargeable e-cigarette, next-generation e-cigarette, and disposable e-cigarette. Among these, next-generation e-cigarette exhibits a clear dominance in the market.

Based on the flavor, the global e-cigarette market can be categorized into tobacco, botanical, fruit, sweet, beverage, and others. Currently, tobacco flavored e-cigarettes hold the majority of the total market share.

Based on the mode of operation, the global e-cigarette market has been segmented into automatic e-cigarette and manual e-cigarette, where automatic e-cigarette represents the largest market share.

Based on the distribution channel, the global e-cigarette market can be bifurcated into speciality e-cig shops, online, supermarkets and hypermarkets, tobacconist, and others. Among these, speciality e-cig shops account for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Some of the major players in the global e-cigarette market include Philip Morris International Inc., Altria Group Inc., British American Tobacco PLC, Japan Tobacco, Inc., Imperial Tobacco Group, International Vapor Group, Nicotek LLC, NJOY Inc., Reynolds American Inc., ITC Limited, J WELL France, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)