E-Bike Market Size, Share, Trends and Forecast by Mode, Motor Type, Battery Type, Class, Design, Application, and Region, 2026-2034

E-Bike Market Size and Share:

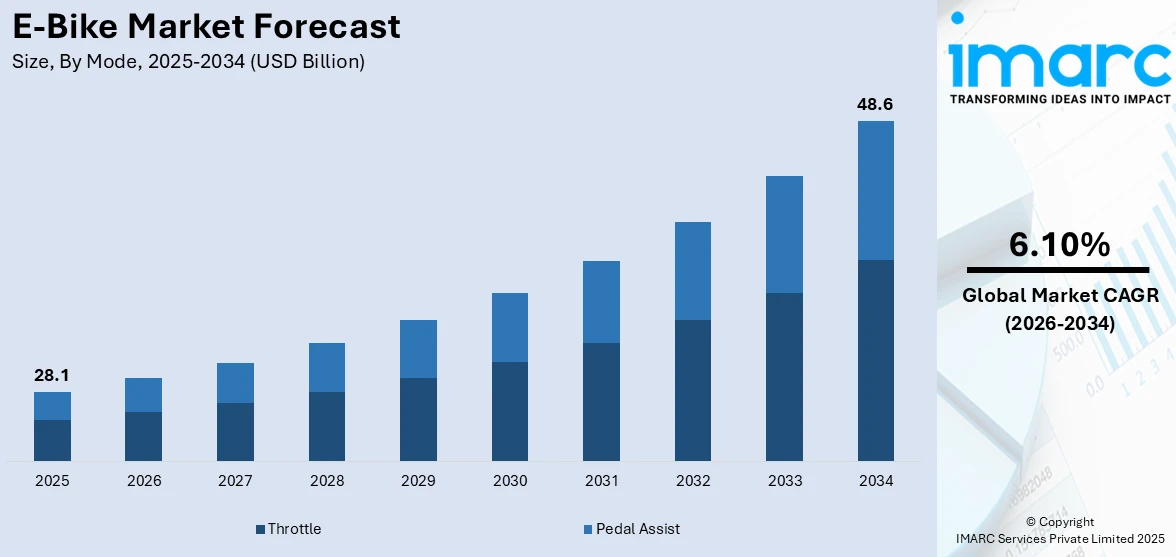

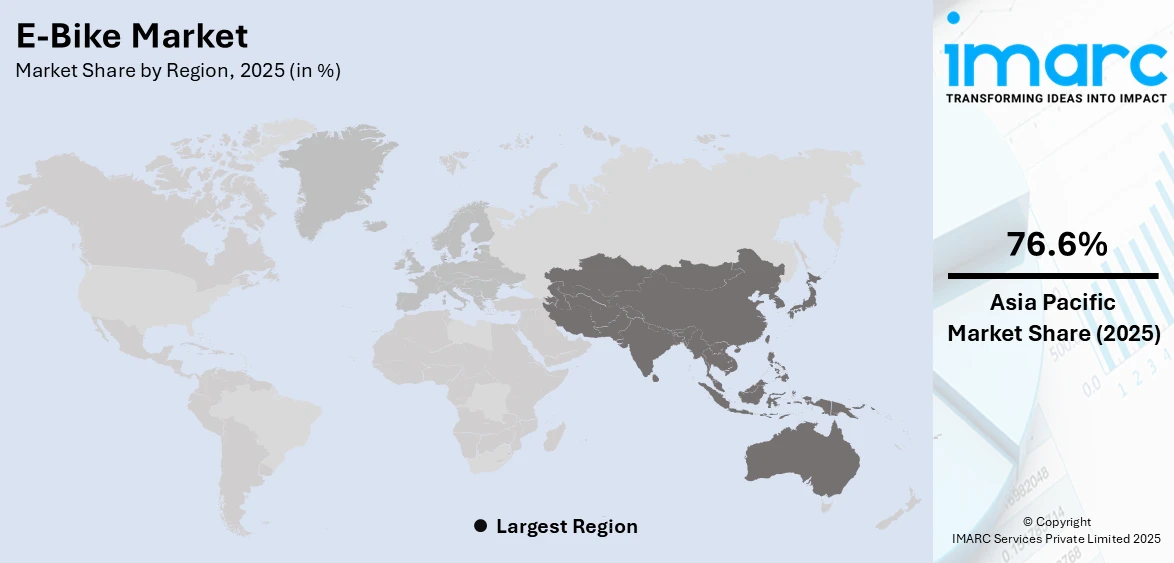

The global e-bike market size was valued at USD 28.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 48.6 Billion by 2034, exhibiting a CAGR of 6.10% from 2026-2034. Asia Pacific currently dominates the e-bike market share by holding over 76.6% in 2025. The market in the region is driven by growing urbanization, increasing government support for electric mobility, rising fuel costs, strong manufacturing capabilities, and expanding consumer demand for affordable, eco-friendly transportation solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 28.1 Billion |

| Market Forecast in 2034 | USD 48.6 Billion |

| Market Growth Rate 2026-2034 | 6.10% |

The global e-bike market growth is primarily driven by rising urbanization and traffic congestion, which are pushing consumers toward e-bikes as a convenient and time-efficient commuting option. In addition, environmental concerns and government incentives are promoting e-bikes as a sustainable alternative to fuel-powered vehicles, aiding the market growth. Moreover, ongoing advancements in battery technology are improving range and efficiency, making e-bikes more attractive, which is providing an impetus to the market. Besides this, the growing health consciousness is increasing demand for pedal-assist models that encourage physical activity, supporting the market growth. Also, the expanding e-commerce and rental services are enhancing accessibility and affordability, which is boosting the market demand. Furthermore, high fuel prices and rising transportation costs are making e-bikes a cost-effective mobility solution, thus impelling the market growth.

To get more information on this market Request Sample

The United States e-bike market demand is expanding due to several unique drivers, such as the increased recreational cycling and outdoor activities, especially for mountain and gravel e-bikes are contributing to the market expansion. In line with this, the aging population and mobility solutions are driving interest in e-bikes as an alternative to traditional bicycles for older adults, fueling the market demand. Concurrently, corporate wellness and employee benefits programs are encouraging e-bike adoption for commuting, providing an impetus to the market. Additionally, the expanding bike lane infrastructure and urban planning initiatives are making cities more e-bike-friendly, strengthening the e-bike market share. For example, New York City lawmakers introduced 'Priscilla's Law,' aiming to require e-bike and e-scooter riders to obtain licenses and register their vehicles. This proposal seeks to enhance street safety and accountability among riders. Furthermore, the rising consumer preference for high-performance and luxury e-bikes is fueling the market growth. Apart from this, the integration of smart and connected technologies is attracting tech-savvy riders, thereby propelling the market forward.

E-Bike Market Trends:

Growing Environmental Concerns

E-bikes are gaining traction as a green mode of transport as they emit zero emissions and leave a significantly smaller environmental footprint than their conventional gasoline-powered equivalents. The rising levels of carbon emission are generating profitable growth prospects for the entire market. For instance, the average passenger car emits approximately 4.6 metric tons of carbon dioxide annually. Additionally, transport accounted for approximately a quarter of the entire carbon emissions in the EU in 2019, with 71.7% of those being from road transport, as per a report by the European Environment Agency. As a result of this, government officials of different countries are initiating efforts to encourage the use of e-bikes, thereby driving the demand for e-bikes. For example, the Government of India has launched a new scheme named the Electric Mobility Promotion Scheme 2024 (EMPS). The government, under the EMPS 2024 scheme, has allocated Rs 500 crore for electric three-wheelers and two-wheelers. Subsidy for electric two-wheelers will be Rs 5,000 per unit of battery capacity, up to a maximum of 15% of the factory price of the vehicle. Similarly, the Uttar Pradesh State Government, exempted 100% of the road tax for e-scooters/e-bikes, whereas 75% had already been exempted for e-cars. The subsidy is applicable for the first 1,00,000 EVs that have been produced and sold in the state.

Rapid Urbanization and Increasing Fuel Costs

The e-bike market is favorably impacted by the elevating levels of urbanization since densely populated cities require a continent and efficient means of transportation. E-bikes allow riders to navigate through traffic with ease, often taking shortcuts inaccessible to cars and eliminating the need for time-consuming parking searches. Besides this, increases in gasoline costs, traffic congestion during rush hours, and the health advantages of exercise are driving the adoption of e-bikes in several countries, including the United Kingdom and the United States, which is propelling the e-bike market share. With a greater adoption rate in 2019 compared to other regions, Europe was the primary market for the selling of electric bikes. The increasing demand for e-bikes accelerated the adoption rate in 2019 compared to 2018. In line with this, the inflating price of fuel is also prompting individuals to utilize e-bikes for short commutes. For instance, the global fuel energy price index stood at 179.82 index points in March 2024, up from 100 in the base year 2016. This is significantly influencing the e-bike market trends.

Increasing Product Offerings

Various industry players are extensively investing in research and development activities to launch e-bicycles with improved battery life and speed, which is positively impacting the e-bike market outlook. For instance, in April 2024, Decathlon launched a new RR900e hardtail e-bike with a Bosch motor. The Decathlon RR900e is a new hardtail e-bike that has been launched in Europe. The 12-speed model features a mid-mounted Bosch motor, a RockShox suspension fork, and various Shimano parts. Plus, you can connect your smartphone via Bluetooth for Bosch Smart Ebike App controls. In addition to this, the entry of new market players offering e-bikes with next-generation technology at fair prices is also contributing to the market growth. For example, in October 2023, Posco Daewoo, the South Korean business house, made public its intentions to get back to the Indian market. Its return trip is banking on selling e-bikes and e-cycles. The company is hoping that the Indian electric 2-wheeler sector will pick up in the future years at a robust pace. In addition, in April 2024, Hero Lectro, a prominent player in the e-cycle segment, introduced two new e-cycles in Indian markets - the H4 and H7+. The new models are conceived with the particular requirements of Indian customers in mind, providing a combination of style and functionality. The H4 comes for Rs 32,499 as an introductory offer and is available in Mystic Purple and Distance Red. The H7+ is a tad pricier at Rs 33,499, available in Lava Red and Storm Yellow Grey.

E-Bike Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global e-bike market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on mode, motor type, battery type, class, design, and application.

Analysis by Mode:

- Throttle

- Pedal Assist

Pedal assist leads the market holding a share of 66.9%. These e-bikes offer a seamless blend of traditional cycling and electric assistance. This feature appeals to a broad spectrum of riders, including both avid cyclists and those new to biking. Cyclists can choose the level of assistance they require, making it versatile for various terrains and fitness levels. This flexibility encourages more people to adopt e-bikes for daily commuting and recreational purposes. Furthermore, pedal-assist technology promotes an active and healthy lifestyle. As a result, various key market players are increasingly investing in the development of such bikes. For instance, Hyderabad-based EV technology provider Gear Head Motors launched the L 2.0 Series electric cycle at a starting price of Rs. 25,000. The L 2.0 Series e-cycle features a 250-watt GHM motor and has a pedal assist range of up to 30 km. It also features fast-charging capabilities via a 3 Amp fast charger. The company has claimed that the battery on this EV can be charged fully in 2 hours through the battery management system.

Analysis by Motor Type:

- Hub Motor

- Mid Drive

- Others

Hub motors account for the largest share, holding a share of 63.6%. They are designed directly into the wheel hub and can be readily installed and maintained. This user-friendly design attracts a wide range of consumers, including those who may not have extensive technical knowledge. Moreover, hub motors typically require less maintenance than other motor types, reducing ownership costs and enhancing the overall ownership experience. Another major contributor is the silent and stealthy operation of hub motors. They are extremely quiet, with minimal noise generation, providing a smooth and unobtrusive ride. They generate hardly any noise, providing a silky and non-intrusive ride. Additionally, hub motors are often more affordable than mid-drive motors, making them an attractive choice for budget-conscious consumers. Their compatibility with various bike designs, including foldable and city e-bikes, further increases their appeal across different market segments.

Analysis by Battery Type:

- Lead Acid

- Lithium Ion

- Nickel-Metal Hydride (NiMH)

- Others

According to the e-bike market overview, lithium-ion batteries dominate the market with a 68.6% share, benefiting from their long-established use in various applications. Their proven reliability has fostered consumer confidence, particularly among those hesitant to adopt newer battery technologies. Additionally, lithium-ion batteries are relatively affordable, making e-bikes equipped with them more accessible to a broader consumer base. As demand grows, several battery manufacturers are expanding their lithium-ion operations, especially in emerging markets. For instance, in July 2022, Amara Raja Batteries (ARBL) announced plans to expand its lithium-ion battery business beyond India, targeting regions such as Africa, the Middle East, and Southeast Asia.

Analysis by Class:

- Class I

- Class II

- Class III

Class I e-bikes lead the market by holding a share of 72.2%. They closely resemble traditional bicycles in terms of appearance and operation. They provide electric assistance only when the rider is actively pedaling, ensuring that the riding experience remains familiar to those who have ridden conventional bikes. Class I bikes are usually preferred by consumers who are recreational riders, cycling enthusiasts, and commuters who may be looking for an easier and more enjoyable cycling experience without dramatically altering their riding habits. In response to the escalating demand for class I bikes, various manufacturers are coming up with these models integrated with improved battery life and functionality. For instance, Ride1Up, the San Diego-based electric bike retailer known for some of the best value commuter e-bikes on the market, is updating one of its popular commuter-focused models, the new Ride1Up LMT’D V2. This model comes with several new upgrades. At their head is a new torque sensor that will work to make the bike as responsive and comfortable as possible to pedal. The inclusion of a torque sensor means that pedaling is as efficient and natural feeling as possible.

Analysis by Design:

- Foldable

- Non-Foldable

According to the e-bike market statistics by IMARC, non-foldable e-bikes account for the largest market share, holding 90.5% of the market share. They provide a degree of structural stability and durability that is not available in foldable ones. Such strength is particularly attractive to cyclists who value reliability and longevity in their e-bike purchases. Additionally, non-foldable e-bikes are generally designed to endure daily wear and tear and different types of terrain, hence suitable for both commuting and leisure use. Furthermore, non-foldable e-bikes tend to be available in a broader assortment of styles and configurations to accommodate different consumer preferences. From traditional city commuters, and tough mountain bikes, to efficient road bikes, non-foldable e-bikes provide a very wide range of models to pick from. This diversity allows the rider to obtain a non-foldable e-bike that will suit their own particular requirements and riding style.

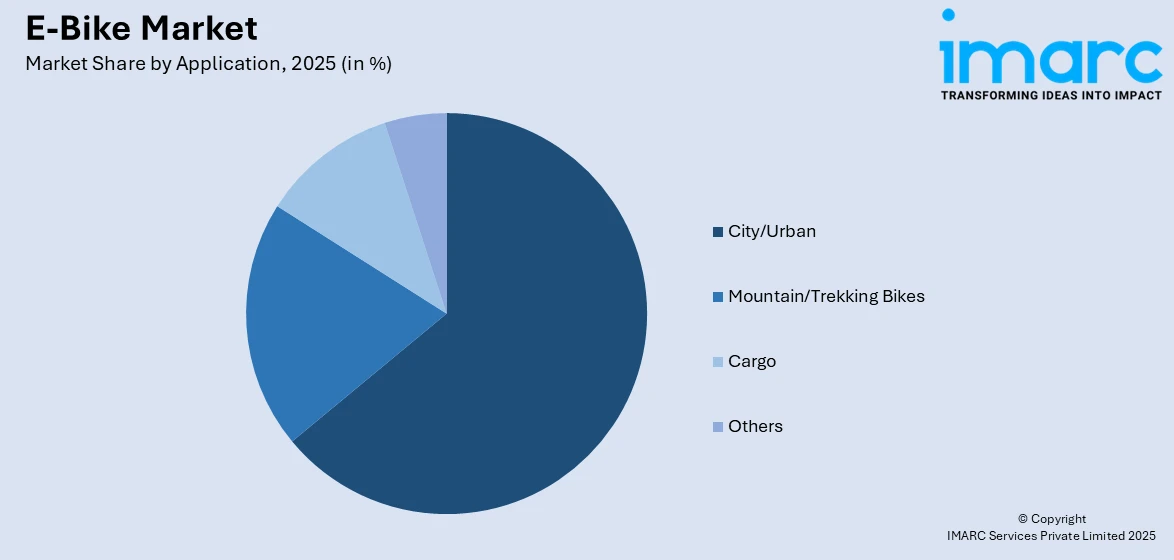

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Mountain/Trekking Bikes

- City/Urban

- Cargo

- Others

City/Urban hold the largest market share of 63.7% in 2025. The e-bike market forecast indicates that these bikes are exceptionally well-suited for urban environments. With the increasing congestion in cities and concerns about air quality, people are seeking efficient and sustainable transportation options. In 2021, the congestion level of Mumbai amounted to 53% each, meaning that it took 53% more time to get from one point to another compared to a free flow situation. Comparatively, the congestion level in Wellington and Singapore amounted to 29 percent in 2021. As a result, consumers living in cities and urban areas are increasingly looking for daily commuting and navigating congested streets like e-bikes.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Asia Pacific dominates the e-bike market by holding a share of 76.6% in 2025. The region has a large share of the world's population, with closely populated cities and an increasing middle class. Additionally, government authorities in many Asia Pacific countries have actively promoted e-bikes as a sustainable and eco-friendly mode of transportation. Subsidies, incentives, and supportive regulations have encouraged consumers to embrace e-bikes as a viable alternative to traditional gasoline-powered vehicles, further boosting the market demand. Besides this, the manufacturing capabilities of Asia Pacific countries, particularly China, have made e-bikes more accessible and affordable. India's Hero MotoCorp revealed plans to introduce its Vida brand electric scooters to the UK and other European markets by mid-2025. This strategic move signifies the company's expansion into developed markets and aligns with global sustainability trends. In the Asia-Pacific electric bike or electric bicycle market, China, Japan, and Indonesia accounted for a major share of overall unit sales in recent years. China held over 90% volume share in the global electric bike market in 2023.

Key Regional Takeaways:

North America E-Bike Market Analysis

The e-bike market in North America is growing quickly, with a boost in demand from consumers looking for environmentally friendly and affordable modes of transportation. Higher fuel costs, environmental concerns, and improved urban cycling facilities are key drivers of adoption. In addition, leisure and off-road cycling activities are driving up demand for cargo and mountain e-bikes. Furthermore, incentives and tax credits offered by governments are reducing the cost of e-bikes. Apart from this, persistent technological innovations, such as smart technologies and enhanced battery performance, are drawing technology-conscious buyers. The growth in e-bike rental and subscription models is further boosting the market size. However, in September 2024, Lyft announced the cessation of its dockless scooter and e-bike operations in Denver. This unexpected move raised concerns about the future of micro-mobility options in the city, especially given the rising demand for alternative transportation. With leading manufacturers focusing on new product development and strategic collaborations, the North American e-bike market is set to expand further in urban commuting and leisure markets.

Europe E-Bike Market Analysis

Europe is witnessing a surge in e-bike adoption due to growing environmental concerns and a focus on carbon reduction, aligning with broader sustainability goals. For instance, the EU has a set target for 2030 of a 55 % net reduction in greenhouse gas emissions. Governments are introducing incentives, subsidies, and regulations to support low-carbon mobility solutions, encouraging consumers to transition to e-bikes. Carbon reduction strategies are influencing urban transportation policies, prioritizing e-bikes as an emission-free alternative to motorized vehicles. Expanding bike-friendly infrastructure, including dedicated lanes and secure parking, is facilitating e-bike usage in urban and suburban areas. Environmental concerns are driving innovation in battery technology, increasing range and efficiency to accommodate various commuting needs. Shared e-bike programs are gaining popularity, integrating with public transport networks to promote seamless multimodal mobility. Awareness campaigns highlight the health and ecological benefits of e-bikes, influencing consumer choices. Carbon reduction initiatives are fostering investments in lightweight, high-performance models.

Asia Pacific E-Bike Market Analysis

Asia-Pacific is experiencing rising e-bike adoption due to growing rapid urbanization and increasing fuel costs, prompting consumers to seek efficient, affordable, and eco-friendly mobility alternatives. According to the World Bank Group, by 2036, Indian towns and cities will be home to 600 Million people, or 40% of the population, up from 31% in 2011, with urban areas contributing almost 70% to GDP. Rapid urbanization is leading to increased congestion, making e-bikes an attractive solution for navigating dense city environments. Expanding metropolitan areas are witnessing infrastructure enhancements, such as dedicated bike lanes and improved road connectivity, facilitating e-bike integration. Increasing fuel costs are driving consumers to shift from traditional fuel-powered vehicles to electric alternatives, reducing long-term transportation expenses. The affordability and convenience of e-bikes make them an appealing option for daily commuting in high-density urban regions. Advancements in battery technology and extended range capabilities are supporting e-bike usability for longer commutes. Shared e-bike programs are gaining traction, offering convenient short-distance travel solutions. Rapid urbanization is fostering policies encouraging e-bike adoption as part of sustainable city development initiatives.

Latin America E-Bike Market Analysis

Latin America is seeing increased e-bike adoption due to growing disposable income, enabling a broader consumer base to invest in electric mobility solutions. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. Rising earnings are expanding purchasing power, allowing individuals to consider e-bikes for commuting and recreational use. Consumers are exploring alternatives to conventional transportation, valuing the affordability and convenience of e-bikes. Improved financing options and installment payment plans are making e-bikes more accessible. Lifestyle shifts are influencing mobility choices, with more individuals seeking cost-effective and sustainable travel methods. Urban areas are supporting e-bike adoption with better cycling infrastructure. As disposable income rises, the demand for high-quality e-bikes with advanced features is increasing.

Middle East and Africa E-Bike Market Analysis

Middle East and Africa are experiencing growing e-bike adoption due to growing electric charging infrastructure, improving accessibility and convenience for riders. For instance, the emirate plans to install 70,000 EV charging points by 2030, significantly expanding the current network of around 250 public charging stations. Expanding charging networks are enabling longer travel distances, eliminating range anxiety among users. Public and private investments are driving the development of charging stations, supporting e-bike integration into transportation ecosystems. Urban planning initiatives are incorporating electric mobility solutions, facilitating seamless connectivity. Improved energy access is contributing to the growth of e-bike-friendly infrastructure.

Competitive Landscape:

Market players in the global e-bike industry are actively innovating and expanding to capture growing demand. Leading manufacturers are investing in research and development (R&D) to upgrade battery efficiency, lightweight structures, and smart connectivity features. Strategic alliances, mergers, and acquisitions are growing, with corporations working together on battery technology, supply chain upgrades, and distribution networks. Startups and well-established brands are introducing high-performance variants, such as off-road and cargo e-bikes, to suit various consumer segments. Also, subscription and rental options are on the rise, increasing accessibility to e-bikes. Additionally, investments in factories and localized manufacturing are aiding companies to cut costs and absorb supply chain shocks. Furthermore, sustainability efforts, such as recyclable batteries and plant-based materials, are on the agenda of major players.

The report provides a comprehensive analysis of the competitive landscape in the e-bike market with detailed profiles of all major companies, including:

- AIMA Technology Group Co., Ltd.

- Giant Manufacturing Co., Ltd.

- Kalkhoff Werke GmbH

- Merida Industry Co., Ltd.

- Pedego Inc.

- Riese & Müller GmbH

- Specialized Bicycle Components, Inc.

- SUNRA (Jiangsu Xinri E-Vehicle Co., Ltd.)

- Trek Bicycle Corporation

- Yadea Technology Group Co., Ltd.

Latest News and Developments:

- In February 2025: Ola Electric is set to launch its production-ready Roadster and Roadster X e-bikes in India. These electric motorcycles will be available in multiple variants with different battery options. The company had unveiled them in 2024, but deliveries were delayed due to pre-production models. Expect aggressive pricing as Ola expands its e-bike portfolio.

- In July 2024: At Eurobike 2024 in Frankfurt, Germany, Acer unveiled its latest e-mobility innovations, including the new ebii elite, eNomad-R series, and eCargo-M e-bikes. The ebii elite maintains a minimalist design with AI technology, offering enhanced acceleration and climbing capabilities for diverse terrains. Acer's commitment to rider safety is evident with the integration of advanced tracking technology across several models, ensuring users can easily locate their e-bikes.

- In April 2024: Hero Lectro, a key player in the electric cycle segment, launched two new e-cycles to the Indian market - the H4 and H7+. These latest models are designed with the specific needs of Indian consumers in mind, offering a blend of style, and functionality. The H4 costs an intro price of Rs 32,499 and will be offered in Mystic Purple and Distance Red shades. The H7+ will be slightly costlier at Rs 33,499 and will be available in Lava Red and Storm Yellow Grey shades.

- In April 2024: Decathlon launched a new e-bike, the RR900e Bosch Performance CX, in Europe. As its name suggests, the sporty hardtail model is powered by a Bosch motor, mounted in the middle of the frame, with 250W power and up to 85Nm torque. The RR900e has a 625Wh Bosch PowerTube battery which, according to Decathlon, can provide up to 100km (~60 miles) assistance range.

- In March 2024: Gazelle, the very popular Dutch bike brand owned by industry giant Pon Holdings, launched its first Class 3 electric bike in the US. Gazelle said that its new Eclipse is the “first and only Class 3 e-bike in the US to feature Bosch’s Smart System,” which completely combines the bike's motor and electronics with the Bosch Flow app for a customized ride that will get ongoing over-the-air bug fixes and feature updates well after purchase.

E-Bike Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Modes Covered | Throttle, Pedal Assist |

| Motor Types Covered | Hub Motor, Mid Drive, Others |

| Battery Types Covered | Lead Acid, Lithium Ion, Nickel-Metal Hydride (NiMH), Others |

| Classes Covered | Class I, Class II, Class III |

| Designs Covered | Foldable, Non-Foldable |

| Applications Covered | Mountain/Trekking Bikes, City/Urban, Cargo, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | AIMA Technology Group Co., Ltd., Giant Manufacturing Co., Ltd., Kalkhoff Werke GmbH, Merida Industry Co., Ltd., Pedego Inc., Riese & Müller GmbH, Specialized Bicycle Components, Inc., SUNRA (Jiangsu Xinri E-Vehicle Co., Ltd.), Trek Bicycle Corporation, Yadea Technology Group Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the e-bike market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global e-bike market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the e-bike industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-bike market was valued at USD 28.1 Billion in 2025.

IMARC estimates the e-bike market to exhibit a CAGR of 6.10% during 2026-2034, expecting to reach USD 48.6 Billion by 2034.

The e-bike market is driven by rising urbanization, increasing traffic congestion, growing environmental concerns, expanding government incentives, ongoing advancements in battery technology, boosting bike lane infrastructure, rising health consciousness, and the growth of e-commerce and rental services.

Asia Pacific currently dominates the market, accounting for a share exceeding 76.6%. This dominance is fueled by high urbanization, increasing government incentives, strong manufacturing capabilities, widespread adoption in China, affordable pricing, expanding infrastructure, and environmental awareness.

Some of the major players in the e-bike market include AIMA Technology Group Co., Ltd., Giant Manufacturing Co., Ltd., Kalkhoff Werke GmbH, Merida Industry Co., Ltd., Pedego Inc., Riese & Müller GmbH, Specialized Bicycle Components, Inc., SUNRA (Jiangsu Xinri E-Vehicle Co., Ltd.), Trek Bicycle Corporation, Yadea Technology Group Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)