Dyspnea Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

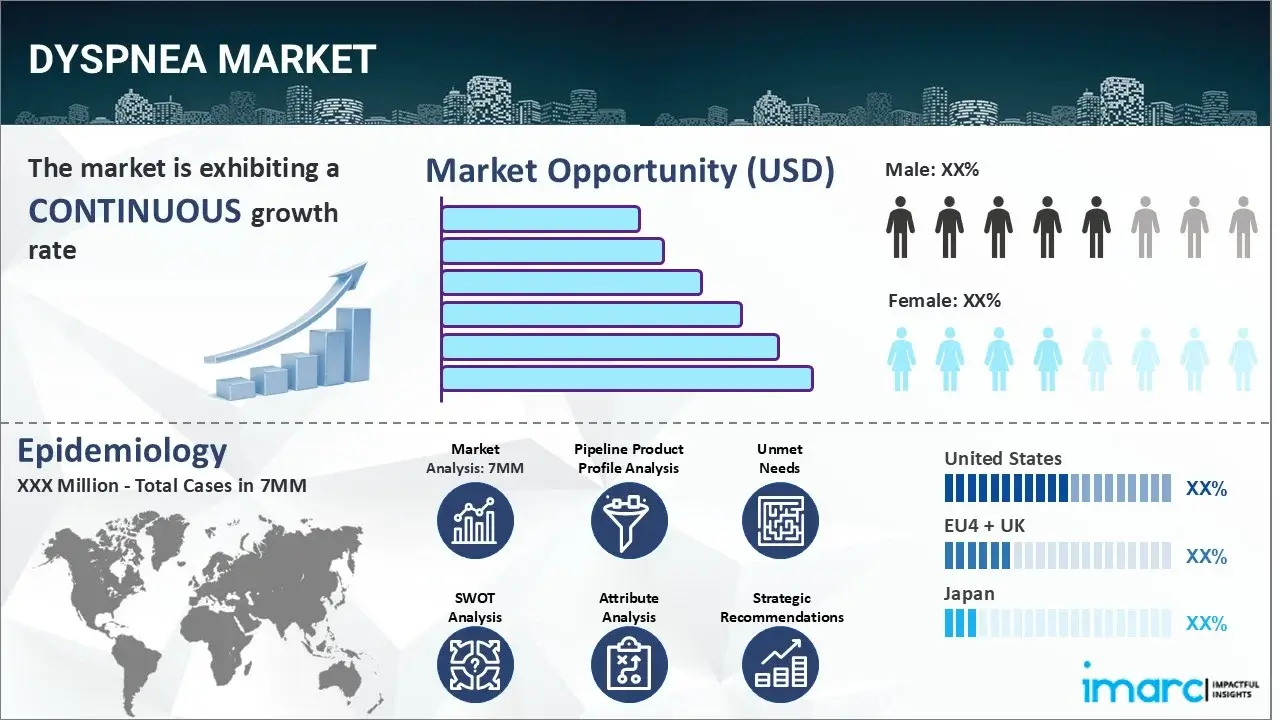

The dyspnea market reached a value of USD 6,893.2 Million across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 11,827.3 Million by 2035, exhibiting a growth rate (CAGR) of 5.03% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2035

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6,893.2 Million |

| Market Forecast in 2035 | USD 11,827.3 Million |

| Market Growth Rate (2025-2035) | 5.03% |

The dyspnea market has been comprehensively analyzed in IMARC's new report titled "Dyspnea Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Dyspnea, also known as breathlessness or shortness of breath, is a subjective sensation that refers to the difficulty or discomfort in breathing. This condition can be categorized as acute or chronic. Acute dyspnea occurs suddenly and lasts for a short time, while chronic dyspnea persists for an extended period or recurs frequently. Individuals suffering from this ailment may experience rapid or shallow breaths, a feeling of suffocation or the inability to get enough air, tightness or heaviness in the chest, wheezing, abnormal breath sounds, an increased respiratory rate, distress, etc. In some cases, the condition can significantly impact a person's ability to engage in physical activities, like climbing stairs or practicing exercise. The diagnosis of dyspnea is mainly based on a thorough clinical feature review, a medical history evaluation, and a physical examination. The healthcare professional may perform pulmonary function tests to assess lung function and measure parameters, such as forced vital capacity (FVC), forced expiratory volume in one second (FEV1), lung volumes, etc. A chest X-ray is also utilized to validate a diagnosis and rule out other possible causes of the underlying symptoms.

To get more information on this market, Request Sample

The increasing prevalence of respiratory conditions, such as asthma, chronic obstructive pulmonary disease, pneumonia, etc., that damage lung tissue as well as narrow or block the airways, is primarily driving the dyspnea market. Apart from this, the rising incidences of various associated risk factors, including anxiety or panic disorders, obesity, anemia, allergic reactions, certain medications, etc., are also bolstering the market growth. Furthermore, the widespread adoption of bronchodilators and corticosteroids as treatment options for dyspnea, since they provide symptom relief by minimizing inflammation in the lungs, is creating a positive outlook for the market. Besides this, the escalating utilization of chest physiotherapy techniques, on account of their several advantages, such as improved airflow, enhanced strength of respiratory muscle, and reduced disease progression, is also augmenting the market growth. Additionally, the emerging popularity of non-invasive positive pressure ventilation therapy that helps to promote an exchange of gases in the lungs, thereby maintaining the amount of oxygen available for the body, is expected to drive the dyspnea market in the coming years.

IMARC Group's new report provides an exhaustive analysis of the dyspnea market in the United States, EU4 (Germany, Spain, Italy, and France), the United Kingdom, and Japan. This includes treatment practices, in-market and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for dyspnea and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the dyspnea market in any manner.

Key Highlights:

- The prevalence of dyspnea in the overall adult population is 10%.

- The condition is more common in the <20 age group.

- Females are more likely to report dyspnea (44.8% vs. 31.7% for males).

- The majority of cases (85%) were caused by asthma, pneumonia, myocardial ischemia, interstitial lung disease, congestive heart failure, chronic obstructive pulmonary disease, or psychological factors such as panic disorder and anxiety.

- A study indicated that 56.5% of individuals with a family history of dyspnea experienced dyspnea.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the dyspnea market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the dyspnea market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current dyspnea marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Key Questions Answered in this Report:

Market Insights

- How has the dyspnea market performed so far, and how will it perform in the coming years?

- What are the market shares of various therapeutic segments in 2024, and how are they expected to perform till 2035?

- What was the country-wise size of the dyspnea across the seven major markets in 2024, and what will it look like in 2035?

- What is the growth rate of the dyspnea across the seven major markets, and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of dyspnea across the seven major markets?

- What is the number of prevalent cases (2019-2035) of dyspnea by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of dyspnea by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of dyspnea by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with dyspnea across the seven major markets?

- What is the size of the dyspnea patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend dyspnea of?

- What will be the growth rate of patients across the seven major markets?

Dyspnea: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for dyspnea drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the dyspnea market?

- What are the key regulatory events related to the dyspnea market?

- What is the structure of clinical trial landscape by status related to the dyspnea market?

- What is the structure of clinical trial landscape by phase related to the dyspnea market?

- What is the structure of clinical trial landscape by route of administration related to the dyspnea market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)