Dynamic Random Access Memory (DRAM) Market Size, Share, Trends and Forecast by Type, Technology, End User, and Region, 2025-2033

Dynamic Random Access Memory (DRAM) Market Size and Share:

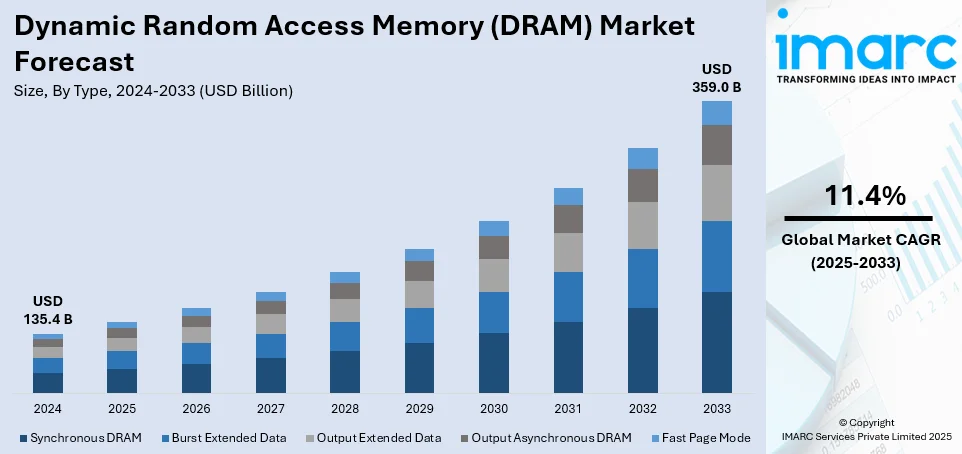

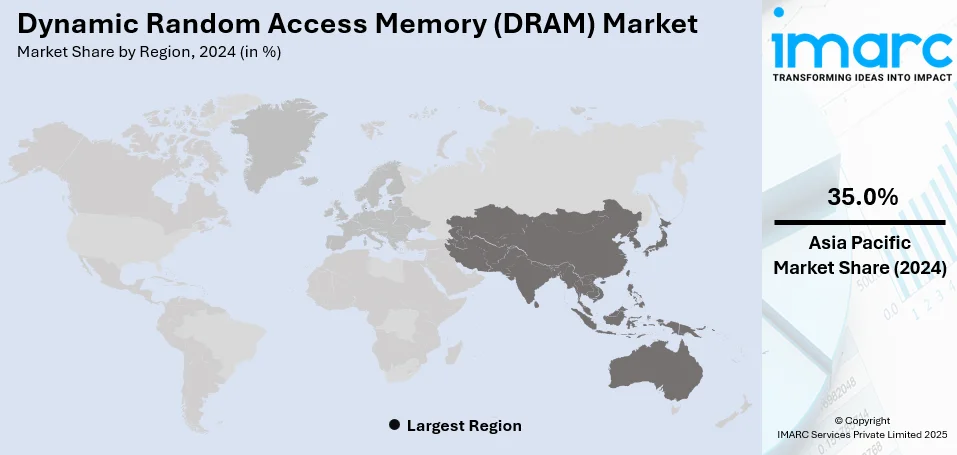

The global dynamic random access memory (DRAM) market size was valued at USD 135.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 359.0 Billion by 2033, exhibiting a CAGR of 11.4% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 35.0% in 2024. The dynamic random access memory (DRAM) market share is expanding, driven by the increasing adoption of artificial intelligence (AI)-focused applications that necessitate significant memory bandwidth and speed to handle extensive datasets instantly, along with the growing focus on sustainability, which encourages the development of modern DRAM chips that are designed to utilize less energy, making them ideal for laptops, smartphones, and data centers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 135.4 Billion |

|

Market Forecast in 2033

|

USD 359.0 Billion |

| Market Growth Rate (2025-2033) | 11.4% |

At present, the rising need for faster and more powerful devices is impelling the market growth. Smartphones, laptops, and gaming consoles need high-speed memory to handle multitasking. Cloud computing and data centers also drive the demand for DRAM solutions, as they require massive amounts of memory to process and store data efficiently. The ongoing adoption of AI, machine learning (ML), and the Internet of Things (IoT) adds to this need since these tools depend on quick data access for smooth performance. Additionally, the automotive industry is employing more DRAM equipment for smart features, infotainment systems, and self-driving technology.

The United States has emerged as a major region in the dynamic random access memory (DRAM) market owing to many factors. The country is experiencing a high demand for advanced technology in various industries, which is propelling the dynamic random access memory (DRAM) market growth. With more people using smartphones, gaming consoles, and high-performance computers, there is a constant need for faster and more efficient memory. Data centers and cloud service providers require huge amounts of DRAM to handle big data and AI-driven applications. Besides this, the rise of AI and ML encourages the usage of DRAM tools, as they need quick data processing. Moreover, government expenditure on semiconductor manufacturing and research fuel the market growth, reducing reliance on imports. According to details provided on the official site of the US Department of Commerce, on December 20, 2024, the Biden-Harris Administration revealed that the authority granted Texas Instruments (TI) up to USD 1.61 Billion in investment through the CHIPS Incentives Program’s Funding Opportunity for Commercial Fabrication Facilities. The funding aims to support various initiatives in Texas and Utah, aimed at enhancing the manufacturing of semiconductors essential for US national and economic security.

Dynamic Random Access Memory (DRAM) Market Trends:

Increasing Demand for AI and ML

The growing deployment of AI and ML technologies is positively influencing the market. The global ML market size reached USD 31.0 Billion in 2024. AI-oriented applications, such as chatbots, image recognition, and automation tools require substantial memory bandwidth and speed to process large datasets in real time. Businesses are adopting AI and ML for analytics, automation, and decision-making, which creates the need for faster and more efficient DRAM. DRAM is crucial for training AI models. In August 2024, Samsung teamed up with Nvidia to reveal fifth-generation high bandwidth memory (HBM) chips for utilization in its AI processors. This is expanding the dynamic random access memory (DRAM) market insights. Moreover, companies are developing AI hardware, such as graphics processing units (GPUs) and specialized chips, which depend on advanced DRAM to optimize performance.

Rising Advancements in Supply Chain

The complex nature of DRAM production, along with geopolitical tensions and natural disasters, can lead to supply shortages and fluctuating prices. To mitigate these risks, companies are exploring strategies, such as diversifying their supply chains, establishing long-term contracts with suppliers, and wagering on advanced manufacturing technologies. This is escalating the dynamic random access memory (DRAM) market demand. In April 2024, SK Hynix, the prominent chip maker based in South Korea, revealed its intention to allocate around USD 3.86 Billion for building a chip manufacturing facility for a new DRAM chip production site in the country. Companies employ automation, smart tracking, and better logistics to speed up production and delivery. Improved coordination between suppliers and manufacturers ensures a steady flow of materials. Faster production means DRAM reaches tech companies quicker, catering to its high demand in AI, cloud computing, and consumer electronics. With smoother operations and fewer disruptions, DRAM makers can focus on innovations, bringing faster and more efficient memory to the market.

Growing Need for Higher Bandwidth

The rising demand for higher bandwidth and increased capacity is offering a favorable dynamic random access memory (DRAM) market outlook. This shift is attributed to the need for energy efficiency and faster data processing in industries, such as cloud computing, AI, and big data analytics. Companies work on developing reliable DRAM devices, through government grants. In April 2024, Micron Technology obtained a significant funding increase of USD 6.14 Billion from the US Department of Commerce through the CHIPS and Science Act. This infusion of investment is designated for the enlargement of its DRAM manufacturing facilities situated in Syracuse, New York. According to the dynamic random access memory (DRAM) market leaders, this is supporting the market growth. Modern DRAM chips are designed to utilize less energy, making them ideal for smartphones, laptops, and data centers that need to run efficiently. Additionally, businesses want memory solutions that help to cut electricity costs and improve battery life in portable items.

Dynamic Random Access Memory (DRAM) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dynamic random access memory (DRAM) market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, and end user.

Analysis by Type:

- Synchronous DRAM

- Burst Extended Data

- Output Extended Data

- Output Asynchronous DRAM

- Fast Page Mode

Synchronous DRAM represents the largest segment. It provides quicker and more stable performance than previous asynchronous memory types. It synchronizes with the system clock speed, which ensures quicker and smoother processing of data, and hence is perfect for current computing demands. It is commonly used in consumer devices, such as laptops, mobile phones, and gaming systems where high-speed performance is a requirement. It also finds significant usage in data centers, cloud computing, and AI usage since the latter three demand fast and stable memory access. With synchronous DRAM still being manufactured in bulk by manufacturers due to its balance of performance, price, and power efficiency, newer iterations like DDR4 and DDR5 based on the technology of synchronous DRAM keep the demand going. Since many industries depend on high-speed memory for smooth operations, synchronous DRAM remains the preferred choice.

Analysis by Technology:

- DDR4

- DDR3

- DDR5/GDDR5

- DDR2

DDR4 holds the biggest market share. It strikes a better balance between speed, power efficiency, and cost than previous and subsequent generations. It has faster data rates and reduced power consumption than DDR3, and it is therefore well-suited for laptops, desktops, and data centers. Most organizations and individuals use DDR4 since it is commonly available and supports the majority of contemporary processors. DDR4 is also a top preference for gaming PCs, cloud computing, and AI applications where reliability is key. Manufacturers continue producing DDR4 in large volumes, keeping costs reasonable and ensuring steady demand. They continue refining DDR4, improving speeds and reliability while keeping it compatible with existing infrastructure. Since many sectors depend on DDR4-based systems, it remains the dominant DRAM technology. With the high requirement, DDR4 is the go-to option for high-performance memory solutions.

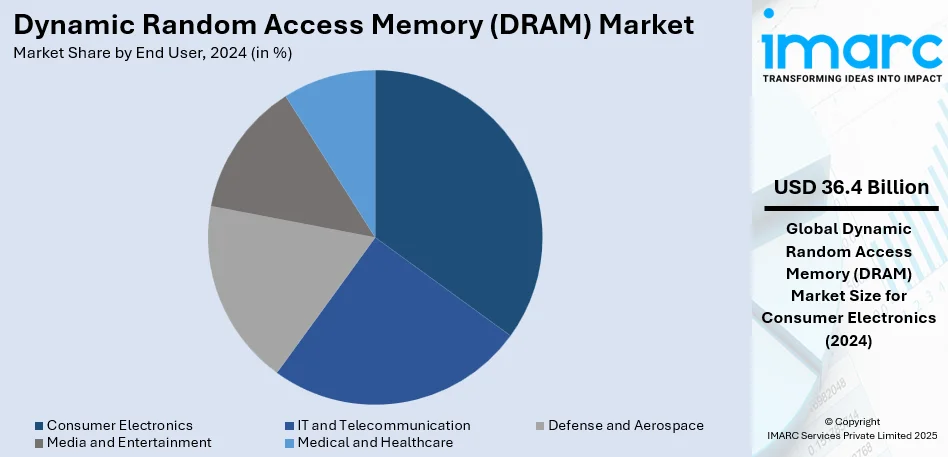

Analysis by End User:

- IT and Telecommunication

- Defense and Aerospace

- Media and Entertainment

- Medical and Healthcare

- Consumer Electronics

Consumer electronics leads the market with 26.9% of the market share. Smartphones, laptops, tablets, and gaming consoles all require quick and responsive memory to operate effectively. With more number of people streaming, gaming, and multitasking on their devices, the demand for high-performance DRAM is high. Smartphone companies fill their new devices with greater amounts of RAM to accommodate advanced apps, AI capabilities, and 5G capabilities. Laptops and computers also encourage the use of DRAM since people need improved memory for work, entertainment, and creative activities. Gaming computers and high-end gaming PCs need efficient DRAM for seamless gameplay and quicker loading. Since people update their devices so often, DRAM is an essential element that manufacturers continually advance. The increased use of smart devices, from wearables to smart TVs, creates additional demand for stable memory hardware. As consumer electronics are ubiquitous, they remain the industry leaders, having memory makers in a state of constant innovation.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for 35.0%, enjoys the leading position in the market. The area is characterized by the large number of leading memory chip producers, which control global production. The firms continue to innovate and advance DRAM technology, hence making the region a market leader. The demand for smartphones, laptops, and gaming consoles in nations, such as China, South Korea, India, and Japan is also high, and this stimulates the use of DRAM since these products require high-speed memory. Also, the Asia-Pacific region boasts a solid data center industry foundation with cloud computing and AI-driven applications growing rapidly. Apart from this, the expansion of smart factories, IoT devices, and 5G networks increases the demand for DRAM. The regional government agencies also bet on semiconductor manufacturing and AI development, fortifying local production and minimizing imports. In March 2024, India approved an investment of INR 103 Billion (USD 1.25 Billion) in AI projects, which involve the improvement of computer infrastructure and the creation of large language models.

Key Regional Takeaways:

United States Dynamic Random Access Memory (DRAM) Market Analysis

The United States hold 86.80% of the market share in North America. The market is witnessing strong growth, owing to the rising demand for advanced technologies, including ML, AI, and cloud computing. As the US AI market is set to expand from USD 31,807.6 Million in 2023 to USD 97,084.2 Million by 2032, with a CAGR of 12.8% during 2024-2032, the requirement for high-performance memory solutions like DRAM will expand. This is due to the substantial increase in data processing, storage needs, and real-time analysis across industries, such as healthcare, automotive, and telecommunications. The rise of 5G-enabled devices, IoT adoption, and the growing number of smart devices further drive the demand for DRAM. Additionally, consumer electronic items, including laptops, gaming systems, and smartphones, are being adopted in the country, creating the need for memory solutions. The United States is also noted for its strong government initiatives that promote the domestic manufacturing of memory technologies, further fueling the market growth. The transition to more energy-efficient, and high-capacity DRAM is another important factor, as businesses and users seek sustainability in their technology.

Europe Dynamic Random Access Memory (DRAM) Market Analysis

In Europe, the market is expanding, owing to the growing usage of IoT, AI, and automation technologies across various industries. According to reports, 29% of EU enterprises employed IoT devices in 2021, mainly for premises security, showcasing the rise in reliance on connected items. This trend is accelerating, as industries like automotive, healthcare, and manufacturing integrate IoT solutions, requiring significant memory resources to support data processing and storage. The demand for DRAM is further heightened by the growing deployment of AI-powered applications, which need high-performance memory solutions to enable real-time data analysis and ML. Additionally, the advancement of smart city infrastructure and the rise in digital transformation of European businesses are contributing to the market growth. The automotive industry, particularly autonomous driving technology and electric vehicles (EVs) is another key driver, with DRAM being essential for processing large volumes of data from onboard sensors and systems. Moreover, the EU’s commitment to sustainability and energy efficiency is encouraging the creation of low-power and high-capacity DRAM solutions.

Asia-Pacific Dynamic Random Access Memory (DRAM) Market Analysis

The APAC region is a major driver of the global market, with substantial demand from nations, such as China, Japan, and South Korea. According to GSMA, by the end of 2023, South Korea recorded 31.3 Million 5G connections, making up more than 48% of the nation’s overall mobile connections, whereas China had over 700 million 5G connections, which accounted for 41% of all mobile connections in the Asia-Pacific area. This surge in 5G adoption drives the demand for DRAM since the need for quicker and higher-capacity memory solutions rises to support data-intensive applications, such as cloud computing, smart devices, and AI. Furthermore, the usage of gaming services and the expansion of data centers across the region promote the utilization of DRAM. With rising IoT adoption and advancements in mobile technology, the APAC region will catalyze the demand for DRAM, as the foundation for high-performance computing and mobile services.

Latin America Dynamic Random Access Memory (DRAM) Market Analysis

Because more people are adopting smart devices and using mobile internet, the Latin American market is expanding quickly. In 2018, Latin America had 326 million users of mobile internet. By 2025, that number is predicted to rise to 422 Million. DRAM is required as a result of this increase in connection, especially in consumer electronics and cellphones. Digital services, gaming, and e-commerce all increase the need for top-tier memory solutions. The demand for DRAM to enable data processing, storage, and real-time applications is growing since the region adopts 5G technology and smart cities, which is driving market expansion.

Middle East and Africa Dynamic Random Access Memory (DRAM) Market Analysis

The DRAM demand is rising quickly in the Middle East and Africa due to the continuous deployment of 5G and digital transformation. By the end of 2022, Saudi Arabia will have more than 11.2 Million 5G subscriptions, accounting for more than 25% of the region's whole mobile market. The requirement for dependable memory solutions like DRAM is being accelerated by the emergence of 5G as well as rising investments in smart devices, infrastructure, and the IoT. The demand for effective data processing and storage keeps driving the MEA market's expansion, as the region uses new technologies.

Competitive Landscape:

Key players work on developing and improving memory technology to meet the high needs. They wager on research and development (R&D) activities to create faster, more efficient, and higher-capacity DRAM chips for different industries. Big companies invest in scaling up production to fulfill the growing demand from smartphones, laptops, gaming consoles, and data centers. By upgrading manufacturing processes, they reduce costs and enhance performance, making DRAM more accessible. They also work closely with tech firms to optimize memory for new devices. Additionally, competition among these key players promotes advancements like DDR5, which enhances speed and power efficiency. They emphasize innovations, production, and collaboration to ensure that the market keeps growing to meet the requirements of changing technology. For instance, in April 2024, SK Hynix revealed its intention to invest around USD 3.86 Billion to develop a chip production facility for DRAM production in South Korea.

The report provides a comprehensive analysis of the competitive landscape in the dynamic random access memory (DRAM) market with detailed profiles of all major companies, including:

- ATP Electronics Inc. (Orient Semiconductor Electronics Ltd.)

- Etron Technology Inc.

- Integrated Silicon Solution Inc.

- Kingston Technology Corporation

- Micron Technology Inc.

- Nanya Technology Corporation

- Powerchip Semiconductor Manufacturing Corp.

- Samsung Electronics Co. Ltd

- SK Hynix Inc.

- Transcend Information Inc.

- Winbond Electronics Corporation

Latest News and Developments:

- January 2025: Realme introduced the 14 Pro+ smartphone in India, which boasts a 6.83-inch AMOLED screen, Snapdragon 7s Gen 3 chipset, and a triple rear camera setup that inculcates a 50MP primary sensor and 120x zoom capability. The device comes in two RAM configurations- 8GB with 128GB of storage and 12GB with 256GB of storage, each providing dynamic RAM options of up to 12GB and 14GB, respectively.

- January 2025: Micron was selected as the main supplier of LPDDR5 DRAM for Samsung's Galaxy S25 series, taking over its earlier position as a secondary supplier. After assessing performance, pricing, and various other factors, Samsung's MX Division reached the decision. The Galaxy S25, S25+, and S25 Ultra were unveiled during the Galaxy Unpacked event on January 22, with the official launch scheduled for early February.

- April 2024: Samsung introduced the first-ever low-power double data rate 5X (LPDDR5X) DRAM chip, which is made for AI uses. This novel memory solution provides improved performance and efficiency, meeting the increasing needs of AI processing. It emphasized the company’s dedication to improving memory technologies for future applications.

Dynamic Random Access Memory (DRAM) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Synchronous DRAM, Burst Extended Data, Output Extended Data, Output Asynchronous DRAM, Fast Page Mode |

| Technologies Covered | DDR4, DDR3, DDR5/GDDR5, DDR2 |

| End Users Covered | IT and Telecommunication, Defense and Aerospace, Media and Entertainment, Medical and Healthcare, Consumer Electronics |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | ATP Electronics Inc. (Orient Semiconductor Electronics Ltd.), Etron Technology Inc., Integrated Silicon Solution Inc., Kingston Technology Corporation, Micron Technology Inc., Nanya Technology Corporation, Powerchip Semiconductor Manufacturing Corp., Samsung Electronics Co. Ltd, SK Hynix Inc., Transcend Information Inc., Winbond Electronics Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dynamic random access memory (DRAM) market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dynamic random access memory (DRAM) market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dynamic random access memory (DRAM) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dynamic random access memory (DRAM) market was valued at USD 135.4 Billion in 2024.

The dynamic random access memory (DRAM) market is projected to exhibit a CAGR of 11.4% during 2025-2033, reaching a value of USD 359.0 Billion by 2033.

The rise of AI, ML, and IoT devices is driving the demand for DRAM, as these technologies depend on high-speed memory for real-time processing. Additionally, advancements in semiconductor technology are leading to better-performing and more power-efficient DRAM chips. Moreover, the increasing adoption of EVs and advanced automotive systems, with modern cars employing DRAM for infotainment and autonomous driving features, is propelling the market growth.

Asia-Pacific currently dominates the dynamic random access memory (DRAM) market, accounting for a share of 35.0% in 2024, due to the presence of top manufacturers, rising need for tech devices, and increasing investments in semiconductor production. The growing AI, cloud computing, and 5G adoption further solidify the region’s dominance.

Some of the major players in the dynamic random access memory (DRAM) market include ATP Electronics Inc. (Orient Semiconductor Electronics Ltd.), Etron Technology Inc., Integrated Silicon Solution Inc., Kingston Technology Corporation, Micron Technology Inc., Nanya Technology Corporation, Powerchip Semiconductor Manufacturing Corp., Samsung Electronics Co. Ltd, SK Hynix Inc., Transcend Information Inc., Winbond Electronics Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)