Durable Medical Equipment (DME) Market Size, Share, Trends and Forecast by Product, End Use, and Region, 2025-2033

Durable Medical Equipment (DME) Market Size and Share:

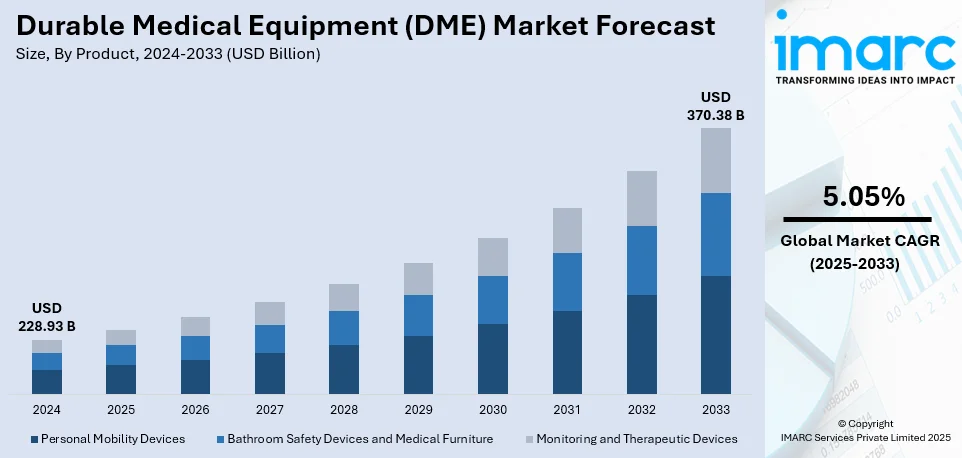

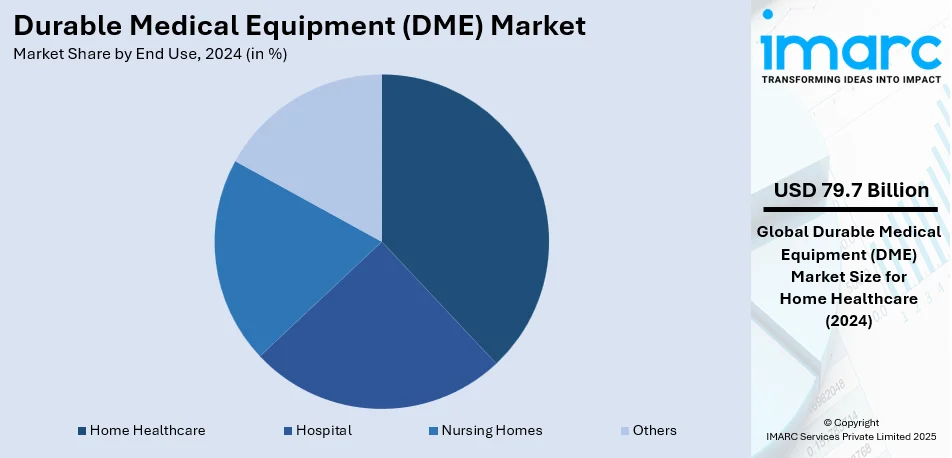

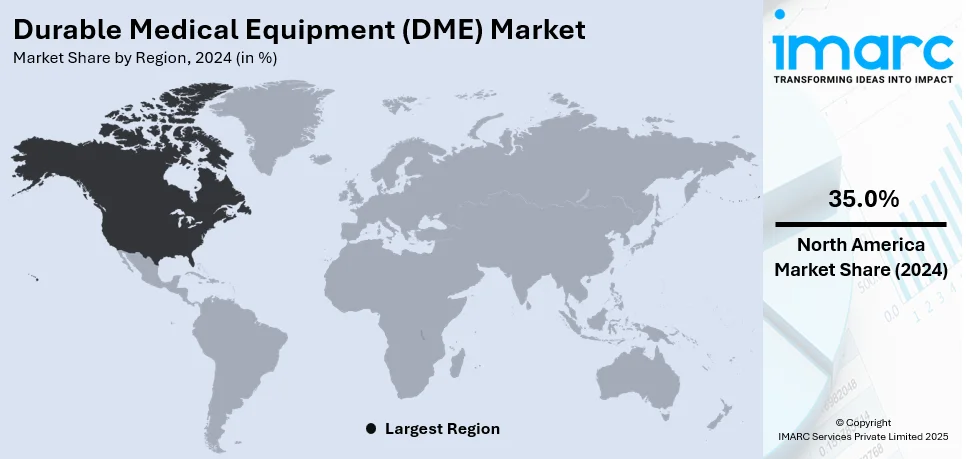

The global durable medical equipment (DME) market size was valued at USD 228.93 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 370.38 Billion by 2033, exhibiting a CAGR of 5.05% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.0% in 2024. The rising focus on preventative healthcare, advancements in AI for personalized treatment, greater patient preference for home care, stronger support from healthcare policies, and enhanced insurance coverage for medical devices are some factors that are positively impacting the durable medical equipment (DME) market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 228.93 Billion |

|

Market Forecast in 2033

|

USD 370.38 Billion |

| Market Growth Rate (2025-2033) | 5.05% |

The global market is significantly influenced by the rising geriatric population, which is more prone to disabilities, coupled with the increasing number of elderly care centers. According to the World Health Organization (WHO), one in six individuals worldwide will be 60 years of age or older by 2030. The number of individuals in the world who are 60 years of age or older is expected to increase to 2.1 Billion by 2050. Moreover, DME is getting highly popular everywhere as it is widely used in long-term care post-surgery. Along with this, the COVID-19 outbreak has resulted in a significant need for DME to augment the healthcare capacity in hospitals and healthcare structures locally all around the world.

The United States is emerging as a key regional market, which is driven by the increased health awareness among the masses, prompting them to manage chronic conditions proactively. Also, the increasing implementation of favorable government initiatives, including expanded reimbursement policies and value-based healthcare models, is facilitating the durable medical equipment (DME) market growth. On April 24, 2024, the US Food and Drug Administration (FDA) launched its "Home as a Health Care Hub" program, with efforts to reimagine the home setting as an active part of health care in creating healthier people. This initiative aims at collaborating with patient groups, healthcare providers, and medical device developers in the design and implementation of home-based care models and devices that are especially designed for use at home. In addition, the development of RPM tools and the health system's shift towards home-based care is further driving DME usage.

Durable Medical Equipment (DME) Market Trends

Increasing Prevalence of Chronic Disease

The rise of chronic illnesses like diabetes, heart disease, and respiratory disorders across the globe are directly influencing the durable medical equipment (DME) market demand. According to a CDC report on February 29, 2024, several Americans now live with one or more serious chronic illnesses: 42 percent have two or more, and 12 percent have at least five. Chronic illness has a significant influence on the US healthcare system. Approximately 90% of USD 4.1 trillion spent on health care each year goes toward managing and treating mental health issues and chronic illnesses. With more individuals living with long-term health conditions, there is a growing need for devices that can assist with management and improve quality of life. Such products include glucose monitors, CPAP machines, and insulin pumps, which become essential for everyday life. As chronic disease management gains momentum, healthcare systems incorporate DME into patient care services, thus paving the way for stronger market growth as these devices support the long-term independence of the patients.

Growth in Home Healthcare Solutions

One of the significant durable medical equipment (DME) market trends is the rise of home-based healthcare solutions, which increases the demand. Devices such as oxygen concentrators, mobility aids, and home dialysis machines are seeing higher adoption due to aging populations and patients preferring the comfort and cost-efficiency of home care. Continual innovations in home-based health care are providing a boost to market share. For instance, on July 1, 2024, CareCentrix announced the launch of DME Navigator. It enables efficient ordering, tracking, and fulfillment of essential medical supplies, ensuring that patients receive necessary equipment directly at home. DME Navigator improves home-based healthcare by streamlining workflows and reducing delays. It is set to help support more value-based care models that are put in place with patient convenience, cost efficiency, and better health outcomes in the home. This growing trend is supported by telemedicine and remote monitoring technologies, which will allow healthcare professionals to manage and track their patient's conditions at home. Further, through private insurance reimbursement policies, home healthcare models are impelling the growth of the DME market.

Continual Technological Advancements in DME

The integration of smart technologies improves functionality and user experience, thus creating a favorable durable medical equipment market outlook. Devices like smart wheelchairs, connected blood pressure monitors, and wearables equipped with sensors provide real-time data to healthcare providers to improve patient outcomes. These technologies allow for personalized care, remote monitoring, and data-driven adjustments. Besides, improved AI and ML are helping the DMEs identify patterns of disease prediction. The recent launch of the Performance and Reliability Evaluation for Continuous Modifications and Usability of Artificial Intelligence (PRECISE-AI) program by the Advanced Research Projects Agency for Health (ARPA-H) on August 29, 2024, that aims to develop methods for automatically detecting and correcting performance degradation in AI-enabled clinical decision support tools further propels this trend. This is critical for maintaining peak performance in real-world clinical settings. Such applications will make sure the AI-driven DME product is reliable and efficient, further pushing the need for advanced products in the market.

Durable Medical Equipment (DME) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global durable medical equipment (DME) market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and end use.

Analysis by Product:

- Personal Mobility Devices

- Wheelchairs

- Scooters

- Walker and Rollators

- Cranes and Crutches

- Door Openers

- Others

- Bathroom Safety Devices and Medical Furniture

- Commodes and Toilets

- Mattress and Bedding Devices

- Monitoring and Therapeutic Devices

- Blood Sugar Monitors

- Continuous Passive Motion (CPM)

- Infusion Pumps

- Nebulizers

- Oxygen Equipment

- Continuous Positive Airway Pressure (CPAP)

- Suction Pumps

- Traction Equipment

- Others

Personal mobility products account for the biggest portion of the DME market as these products ensure more independence and freedom for a patient in relation to physical conditions. Wheelchairs, scooters, walkers, and crutches are considered to be most vital for the patient who has a chronic disorder, injury, or age-related issues with their locomotion system. The aging population and the increase in the number of individuals affected by arthritis, stroke, and neurological conditions, boosts the demand for such products. Personal mobility devices enhance the quality of life of the patient. At the same time, these also reduce the dependency on the caregiver and promote active participation in daily activities. As the DME market is expanding further, new technological developments in areas like smart integration and the use of lightweight materials are also adding comfort and functionality to such devices. Moreover, patient-centered care and home healthcare solutions increase the significance of personal mobility devices within the general DME industry.

Analysis by End Use:

- Hospital

- Nursing Homes

- Home Healthcare

- Others

Home healthcare leads the market with around 34.8% of market share in 2024, driven by growing demand for in-home care services. With patients opting for home-based treatment to avoid hospitalization and related costs, home healthcare devices become imperative in the management of chronic conditions, post-operative recovery, and long-term care. These devices, such as the oxygen concentrator, hospital beds, monitoring equipment, and other mobility aids, help the individual to be attended to at their own home. Home healthcare is further promoted due to the increased presence of an aging population and the technological development of telemedicine and remote monitoring in handling healthcare conditions. It also cuts the healthcare load as home health care gives them an opportunity that institutional care has a personal effect while not causing significant economic expense and promotes their use, further establishing a sense of the importance of home health care and products

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.0% due to the presence of increased old age in its population, an advanced healthcare infrastructure, and higher healthcare expenditure. The growing rate of chronic diseases, including diabetes, heart conditions, and arthritis, also supports the demand for DME products such as mobility aids, wheelchairs and home healthcare devices. The well-established healthcare system in the country, along with the high penetration of home healthcare solutions, provides an impetus to the market. In addition, reimbursement policies also support access and affordability towards DME products. Advances in technology, including smart medical devices and telemedicine integration, are further driving the North American market growth. With a high focus on improving patient care and reducing hospital readmissions, the region's DME market is poised for sustained growth and development in the coming years.

Key Regional Takeaways:

United States Durable Medical Equipment (DME) Market Analysis

The United States holds a substantial share of the North American durable medical equipment (DME) market with 83.60%, driven by the increasing shift toward home healthcare solutions. The rising preference for in-home medical care increases the equipment requirement such as mobility aids, oxygen concentrators, and monitoring devices. According to the U.S. Centers for Medicare & Medicaid Services, U.S. healthcare spending grew 7.5 percent in 2023, reaching USD 4.9 Trillion or USD 14,570 per person. As health spending increases, individuals prefer superior quality and trustworthy equipment to obtain superior care outside the hospital. Health infrastructure improvements and a growing awareness of patients help in increasing the proportion with access to supportive healthcare tools for chronic conditions, postoperative recovery, and long-term care. This adoption reflects an effort to reduce hospital stays, improve patient comfort, and minimize costs as technological advancements make devices more user-friendly and efficient. Moreover, the expansion of insurance coverage for medical equipment has made patients more affordable, thus fueling this ongoing growth in adoption.

Asia Pacific Durable Medical Equipment (DME) Market Analysis

In Asia Pacific, the adoption of durable medical equipment is on the rise due to the growing prevalence of neurological conditions, cardiac disorders, and ophthalmic ailments. As per reports, CVDs contribute to almost one-third of deaths in India, with a prevalence rate of about 7.5% to 13.2%. The rising geriatric population, changing lifestyle, and obesity, diabetes, and HT epidemics are projected to contribute significantly to the burden of CVD in the years ahead. The rise in cardiovascular diseases increases the need for monitoring devices such as electrocardiograms and blood pressure monitor along with therapeutic devices. Neurological conditions, which include stroke and Parkinson's disease, require such devices as motorized wheelchairs and patient lifts. With an increase in eye-related problems like glaucoma and macular degeneration, ophthalmic diagnostic devices are being increasingly used. In addition, public awareness programs and government initiatives to detect and control these problems at an early stage pave the way for such auxiliary medical instruments to be accepted. Advanced diagnostic equipment and therapeutic devices are improving accessibility and affordability.

Europe Durable Medical Equipment (DME) Market Analysis

The aging demographics in the European region are a huge influence in pushing durable medical equipment forward, with a notable increase in mobility aids, respiratory care devices, and home-use diagnostic tools. According to reports, more than one-fifth (21.3%) of the predicted 448.8 million individuals living in the EU as of January 1, 2023, were 65 years of age or older. The need for chronic illness management, safety, and independence is higher in older adults. Thus, they demand more user-friendly and advanced equipment. This trend goes with the growing demand for long-term care solutions because healthcare providers and families prefer equipment that improves the quality of life for the elderly. Adjustable beds, patient lifts, and assistive hearing devices have also added fuel to this adoption as they provide customized solutions for age-related needs. At the same time, the availability of trained professionals to assist in equipment usage and the integration of technology for better functionality have contributed to market growth, reflecting the increasing importance of durable equipment in geriatric care.

Latin America Durable Medical Equipment (DME) Market Analysis

The rise in cancer diagnoses significantly influences the adoption of durable medical equipment, particularly for at-home recovery and palliative care. According to reports, Every year, there are an estimated 700,000 cancer-related deaths and 1.5 million new cases throughout Latin America and the Caribbean. Equipment such as infusion pumps, hospital beds, and respiratory support devices are increasingly being used to improve patient comfort and manage treatment side effects. With more people seeking home-based care during recovery, the demand for reliable and efficient medical devices has grown. Advances in equipment technology have also improved ease of use, enabling patients and caregivers to handle complex care needs outside clinical settings. This shift highlights the role of durable medical tools in enhancing patient experiences during challenging treatments.

Middle East and Africa Durable Medical Equipment (DME) Market Analysis

The rapid expansion of healthcare facilities has played a key role in boosting the adoption of durable medical equipment across various settings. The healthcare industry in Dubai is experiencing growth, with 4,482 private medical facilities and 55,208 licensed professionals by 2022. By 2023, facilities and professionals are expected to have increased by 3-6% and 10-15%, respectively, according to a report by the Dubai Healthcare City Authority. Hospitals, clinics, and outpatient centers are increasingly equipped with modern devices such as mobility solutions, diagnostic tools, and respiratory systems to meet growing patient demands. This expansion encourages the procurement of advanced equipment to enhance care quality, improve operational efficiency, and meet rising health needs. Additionally, the increasing focus on equipping new facilities with state-of-the-art tools further contributes to the adoption of durable equipment in diverse medical environments.

Competitive Landscape:

The market is highly competitive, characterized by the existence of established manufacturers, specialized medical device firms, and emerging players focusing on innovation. Companies compete based on product quality, technological advancements, pricing strategies, and distribution reach. Regulatory compliance, reimbursement policies, and stringent quality standards significantly impact market positioning. Research and development (R&D) activities support the development of smart and connected DME solutions that facilitate greater mobility for patients and their remote monitoring. Market players are expanding their portfolios and geographical presence through mergers, acquisitions, and strategic collaborations. Home healthcare equipment demand continues to increase, and firms are looking at offering this equipment as affordable and user-friendly for prospective customers. Emerging players are using digital platforms for direct-to-consumer sales, thereby changing the traditional distribution model.

The report provides a comprehensive analysis of the competitive landscape in the durable medical equipment (DME) market with detailed profiles of all major companies, including:

- ArjoHuntleigh

- Becton

- Dickinson and Company

- General Electric Company

- GF Health Products Inc.

- Hill-Rom Services Inc.

- Invacare Corporation

- Koninklijke Philips NV

- Medical Device Depot Inc.

- Medline Industries Inc.

- Medtronic PLC

- Omron Corporation

- Siemens Healthineers AG (Siemens AG)

- Stryker Corporation

Latest News and Developments:

- January 8, 2024: Sunrise Medical announced the launch of the Switch-It Vigo head control, a wireless, proportional device enabling power wheelchair users to operate their chairs and other devices through subtle head movements. Developed by Now Technologies LTD, Vigo features an unobtrusive headset design that maintains the user's field of vision and facilitates social interaction. Its advanced sensors accurately detect head positions, ensuring smooth wheelchair operation and customizable settings allow for personalized adjustments to meet individual user needs.

- January 9, 2024: Medline announced the launch of the OptiView Transparent Dressing with HydroCore™ Technology, a pioneering wound care solution designed to enhance pressure injury prevention. Innovative dressing features a clear design that allows caregivers to inspect and monitor at-risk skin without removing the dressing, thereby reducing the risk of skin breakdown. ThdroCore Technology incorporates a gel center that redistributes pressure and draws heat away from the skin, creating a cooling effect to mitigate the development of pressure injuries further.

- March 20, 2024: The Indian Institute of Technology Madras (IIT Madras) unveiled 'NeoStand,' India's most customizable, indigenously developed electric standing wheelchair. Designed by the TTK Center for Rehabilitation Research and Device Development (R2D2) at IIT Madras, NeoStand enables users to transition seamlessly from sitting to standing positions with the touch of a button, enhancing accessibility and reducing health risks associated with prolonged sitting. Tata Elxsi sponsored the project, which intends to enhance wheelchair users' quality of life and social engagement.

- March 21, 2024: Stryker announced the launch of the next-generation LIFEPAK CR2 automated external defibrillator (AED) at the Criticare National Conference in Kolkata, India. The LIFEPAK CR2 features QUIK-STEP™ electrodes for rapid application, ClearVoice™ technology that allows for rapid adjustments in noisy settings and CPR coaching that offers immediate feedback on hand placement, depth, and compression rate. Furthermore, Stryker unveiled an Evacuation Chair that makes it easier to evacuate patients with restricted mobility in an emergency.

- November 26, 2024: Beurer India Pvt. Ltd. launched the GL 22 Blood Glucose Monitor, unveiled by brand ambassador Sourav Ganguly. Manufactured under the "Make in India" initiative, this device provides thorough monitoring features, such as average readings over 7, 14, 30, and 90 days, which closely match HbA1c levels to improve blood sugar control over the long run. By working with groups and medical professionals to organize health camps, offer diabetes care training, and instruct users on the proper use of health monitoring equipment, the company hopes to improve community outreach.

Durable Medical Equipment (DME) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Uses Covered | Hospital, Nursing Homes, Home Healthcare, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ArjoHuntleigh, Becton, Dickinson and Company, General Electric Company, GF Health Products Inc., Hill-Rom Services Inc., Invacare Corporation, Koninklijke Philips NV, Medical Device Depot Inc., Medline Industries Inc., Medtronic PLC, Omron Corporation, Siemens Healthineers AG (Siemens AG), and Stryker Corporation., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the durable medical equipment (DME) market from 2019-2033.

- The durable medical equipment (DME) market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the durable medical equipment (DME) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The durable medical equipment (DME) market was valued at USD 228.93 Billion in 2024.

The durable medical equipment (DME) market is projected to exhibit a CAGR of 5.05% during 2025-2033, reaching a value of USD 370.38 Billion by 2033.

The market is driven by the rising prevalence of chronic diseases, increasing geriatric population, advancements in assistive technologies, growing demand for home healthcare, favorable reimbursement policies, and expanding healthcare infrastructure. Technological innovations in mobility aids and monitoring devices further accelerate market growth.

North America currently dominates the durable medical equipment (DME) market, accounting for a share of 35.0% in 2024. The dominance is fueled by high healthcare spending, favorable insurance coverage, strong distribution networks, and the widespread adoption of technologically advanced DME products in the region.

Some of the major players in the durable medical equipment (DME) market include ArjoHuntleigh, Becton, Dickinson and Company, General Electric Company, GF Health Products Inc., Hill-Rom Services Inc., Invacare Corporation, Koninklijke Philips NV, Medical Device Depot Inc., Medline Industries Inc., Medtronic PLC, Omron Corporation, Siemens Healthineers AG (Siemens AG) and Stryker Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)