Dry Beans Market Size, Share, Trends and Forecast by Bean Type, Packaging Type, Distribution Channel, End Use, and Region, 2026-2034

Dry Beans Market Size and Share:

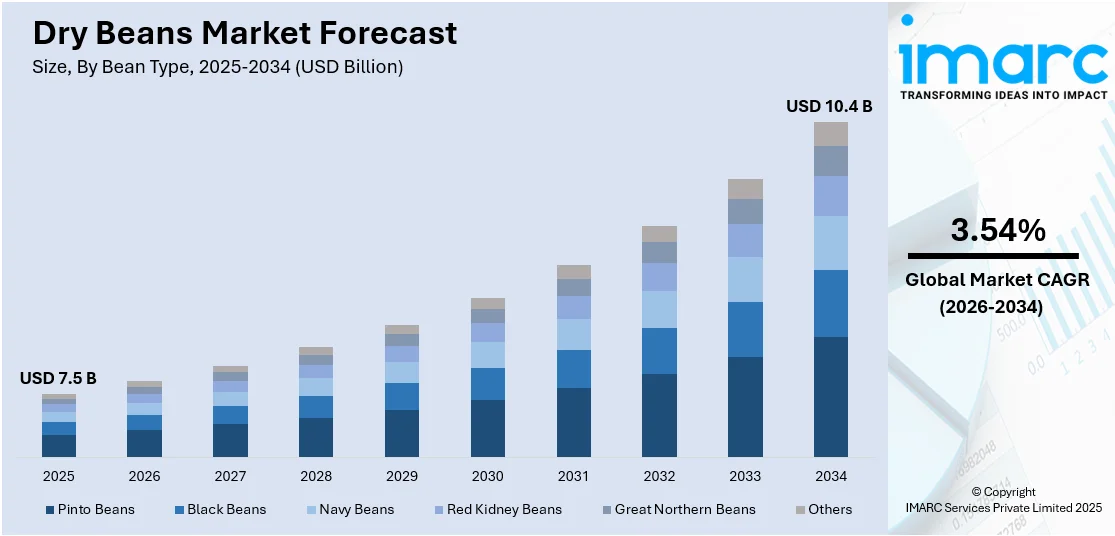

The global dry beans market size was valued at USD 7.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 10.4 Billion by 2034, exhibiting a CAGR of 3.54% from 2026-2034. Asia Pacific currently dominates the market due to the increasing consumption of dry beans, easy product availability via online and offline channels and the growing popularity of vegan and vegetarian diets among the masses represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 7.5 Billion |

|

Market Forecast in 2034

|

USD 10.4 Billion |

| Market Growth Rate (2026-2034) | 3.54% |

One of the most significant drivers in the dry beans market is the growing demand for plant-based protein. As consumers increasingly shift towards vegetarian and vegan diets, dry beans, which are rich in protein, fiber, and essential nutrients, have become an integral part of plant-based meals. This trend is supported by the increasing health awareness, environmental concerns, and the quest for sustainable food sources. Dry beans have much to be loved besides affordability; they are versatile in meals and provide protein from nonmeat sources. Its affordability, accessibility, and health-conducive value continue their increasing popularity among environmentally mindful foodies.

To get more information on this market Request Sample

The U.S. dry beans market plays a significant role globally, fueled by strong domestic consumption and robust export demand. Dry beans are integral to culinary traditions, especially in the Southwest and Midwest, and the growing preference for plant-based diets has increased their popularity as a protein-rich alternative. Advanced agricultural practices and large-scale production ensure a steady supply. In 2023, the U.S. exported dried beans, valued at $8.17 million and weighing 8.4 million kilograms, with major destinations including Mexico, South Korea, Canada, the Netherlands, and Vietnam. This export activity, alongside increasing consumer interest in healthy, sustainable foods, drives continued market growth.

Dry Beans Market Trends:

Rising demand for plant-based proteins:

The increasing shift towards plant-based diets is one of the key trends driving the dry beans market. As consumers prioritize health and sustainability, dry beans, rich in protein, fiber, and essential nutrients, are becoming a popular substitute for animal-based proteins. This trend is driven by rising awareness of the environmental consequences of meat production and the health advantages associated with plant-based diets. Dry beans, being versatile, affordable, and nutritionally dense, are increasingly incorporated into vegan, vegetarian, and flexitarian diets. The rise in demand for meat alternatives in both retail and foodservice sectors is expected to drive further growth in the dry beans market.

Focus on sustainable farming practices:

Sustainability is gaining traction in the agricultural sector, with a notable emphasis on environmentally friendly farming methods. Dry beans are often seen as a more sustainable crop compared to other protein sources because they require less water, fertilizer, and pesticide usage. They also improve soil health through nitrogen fixation, reducing the need for synthetic fertilizers. As consumers and farmers increasingly prioritize sustainability, there is growing interest in dry beans for both food production and their role in crop rotation systems. This shift toward sustainable farming is expected to continue to drive demand for dry beans, particularly among eco-conscious consumers and businesses.

Increased adoption of convenience products:

Convenience is a major trend reshaping the dry beans market. With the rise of busy lifestyles, more consumers are looking for fast and convenient meal options. This has led to the rise in popularity of canned, frozen, and pre-cooked dry beans, which offer the same nutritional benefits as their dry counterparts but require less preparation time. These convenient options are especially attractive to urban residents and busy professionals. Additionally, the expansion of ready-to-eat dry bean-based meals and snacks, such as bean dips, soups, and salads, is further fueling growth. The trend towards convenience is expected to continue, as consumers value time-saving, healthy food options.

Dry Beans Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dry beans market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on bean type, packaging type, distribution channel, and end use.

Analysis by Bean Type:

- Pinto Beans

- Black Beans

- Navy Beans

- Red Kidney Beans

- Great Northern Beans

- Others

Pinto beans stands as the largest component in 2025, due to their widespread popularity and versatility in various cuisines. Commonly used in dishes like chili, soups, stews, and Mexican cuisine, pinto beans are favored for their creamy texture and mild flavor. Their high nutritional value, including protein, fiber, and essential vitamins, has made them a staple in plant-based and health-conscious diets. Pinto beans are also known for their affordability, making them an attractive option for consumers seeking budget-friendly, nutritious meals. Additionally, their long shelf life and ease of storage contribute to their dominance in the market. With their broad culinary applications and cost-effectiveness, pinto beans continue to lead the dry beans segment in 2025.

Analysis by Packaging Type:

- Plastic Bags

- Cans

- Jars

- Others

Plastic bags lead the market share in 2025 due to their cost-effectiveness, convenience, and widespread availability. Plastic bags offer a lightweight, affordable packaging solution that helps reduce overall production costs, making dry beans more accessible to a broader consumer base. These bags are versatile, ensuring the safe transportation and storage of dry beans while maintaining product freshness for extended periods. The transparent nature of plastic bags also allows consumers to easily see the product, which is particularly important in retail environments. Additionally, plastic bags are lightweight and take up less space, making them easier to handle and transport. Despite growing concerns over sustainability, their continued dominance in the dry beans market is driven by their practicality and lower price point compared to other packaging alternatives.

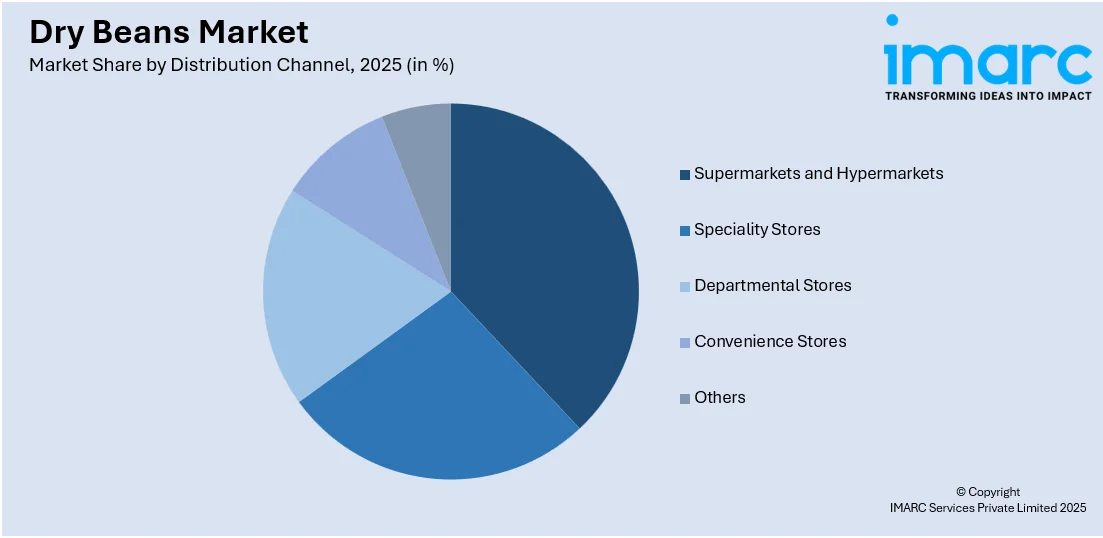

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Speciality Stores

- Departmental Stores

- Convenience Stores

- Others

In 2025, supermarkets and hypermarkets account for the majority of the market due to their broad accessibility and convenience. These large retail stores provide a wide selection of dry beans, meeting various consumer tastes and dietary requirements. Their high foot traffic ensures better product visibility and easier access for shoppers. Additionally, these retailers often provide competitive pricing, promotions, and bulk purchasing options, making dry beans more affordable for households. The large-scale distribution network of supermarkets and hypermarkets also supports the availability of dry beans in both urban and rural areas. With growing consumer demand for health-conscious, plant-based foods, these retail formats continue to be key players in meeting the needs of an evolving market.

Analysis by End-Use:

- Households

- Restaurants and Hotels

- Flour Industry

- Others

Households represented the leading market segment, due to the increasing preference for affordable, nutritious, and convenient food options. Dry beans, known for their long shelf life and versatility, are a popular choice among households looking to maintain healthy eating habits without compromising on cost. The growing awareness of the health benefits of plant-based foods, including high protein and fiber content, has further driven their consumption in households. As more consumers prioritize nutritious meals, dry beans have become a staple in various cuisines, from soups and stews to salads and side dishes. Besides this, innovations in packaging, such as single-serve and pre-cooked options, cater to busy households, making dry beans an ideal choice for convenient and balanced meal preparation.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Poland

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- United Arab Emirates

- Israel

- Others

In 2025, Asia Pacific dominated the market, driven by its vast population, increasing urbanization, and rising disposable incomes. The region's diverse culinary traditions heavily incorporate dry beans, such as mung beans, lentils, and black beans, into staple diets. Rapidly growing awareness of their nutritional benefits has further spurred demand, particularly in countries like India, China, and Indonesia. The expanding plant-based food trend and health-conscious consumer behavior in the region have also contributed to market growth. Additionally, advancements in agricultural practices, government support for legume farming, and improved supply chains have strengthened production and distribution. The increasing adoption of ready-to-cook and packaged dry bean products is further fueling Asia Pacific’s market dominance.

Key Regional Takeaways:

North America Dry Beans Market Analysis

The North American dry beans market is characterized by steady growth driven by the increasing demand for plant-based protein and healthy food alternatives. Dry beans, known for their high nutritional value, are gaining popularity among health-conscious consumers. The growing trend of vegetarian and vegan diets, along with the increasing awareness of the environmental benefits of plant-based foods, is boosting market demand. Additionally, the market benefits from the rising consumption of ethnic foods, where dry beans are a staple ingredient. The United States and Canada are major producers, with crop yields impacted by climate change and weather conditions, which affect supply levels. Furthermore, government support for agriculture and sustainability practices is helping stabilize production. Retail expansion and increased availability in packaged formats are further propelling market growth, alongside innovations in dry bean-based snacks and convenience foods. These factors together contribute to the ongoing development of the North American dry beans market.

United States Dry Beans Market Analysis

The growing trend of urban lifestyles has increased the demand for ready-to-eat (RTE), shelf-stable food products. The dry bean market is in demand as it is cost-effective and nutrient-rich, and the rise in the U.S. urban population, reported by the Census Bureau to be 6.4% between 2010 and 2020, boosts the demand for dry beans and propels market growth to an estimated USD 1.2 Billion annually. These foods are a high-protein, fibre-rich solution that also taps into the growing interest in healthy diets. Plant-based eating trends help encourage consumption because of their versatility in myriad recipes and compatibility with vegan and vegetarian lifestyles. Also, government initiatives supporting sustainable agriculture add further encouragement to the production and distribution of dry beans. New retail innovations, like packaged products, meet the demand of time-constrained households. As awareness about food-related health issues is growing, consumer preference for nutrient-dense food with minimal processing will favor dry beans. The product also helps in providing affordability across vast demographics, thereby enhancing their overall market position.

Europe Dry Beans Market Analysis

The expanding flour industry is bolstering the demand for dry beans as they serve as a critical ingredient in gluten-free and protein-rich flours. The alternative flours preference reflects a growing trend in the acceptance of plant-based diets as well as allergen-friendly diets. Dry beans have nutritional value, in processed flour form, offering the benefits of a balanced source of carbohydrates and protein. For example, using flour with dry beans gives nutritional value, and matches up with the UK's everyday intake of 12 Million loaves of bread, 2 Million pizzas, and 10 Million cakes and biscuits. These flours are increasingly used in innovative baking products, such as high-protein bread and snacks, which cater to evolving consumer preferences. Furthermore, the sustainability of bean cultivation is an attractive factor for eco-conscious buyers, emphasizing low environmental impact. Innovations in product formulations and a focus on clean-label ingredients are also driving manufacturers to incorporate bean-based flours.

Asia Pacific Dry Beans Market Analysis

Rising disposable incomes are fuelling demand for nutritious and affordable protein alternatives, enhancing the appeal of dry beans. These foods provide an economical source of energy and nutrients, catering to both traditional culinary preferences and modern diets. Increasing consumer interest in wellness is boosting their consumption, as they offer health benefits like improving digestion and heart health. Expanding retail networks, including e-commerce platforms, are making them more accessible, catering to both urban and rural areas. According to India Brand Equity Foundation, quick commerce platforms, now used by 31% of urban Indians for primary grocery shopping, driving demand for online purchase of dry beans. Local dishes featuring these ingredients contribute to consistent demand, while the growing trend toward meat substitutes is encouraging wider usage in plant-based diets. Their long shelf life and adaptability in diverse cuisines further enhance their popularity across different markets.

Latin America Dry Beans Market Analysis

The rise in households and increasing disposable incomes are driving the adoption of dry beans as an accessible source of nutrition. According to World Bank, in the past decade, Latin America's middle class grew by 50%, now comprising 30% of the population, driven by rising disposable incomes, which supports increased demand for highly nutritional foods like dry beams. Dry beams affordability and high nutritional value make them an appealing staple for families seeking to stretch budgets while maintaining healthy eating habits. The expanding middle class is also exploring convenience-oriented options, such as ready-to-cook beans, which cater to busy lifestyles. Retailers are offering a broader range of sizes and packaging formats, making dry beans more accessible and suitable for various consumption needs.

Middle East and Africa Dry Beans Market Analysis

The growth of restaurants and hotels is boosting the demand for dry beans as these establishments incorporate them into diverse cuisines to cater to varied palates. According to The Ministry of Economy, UAE, the tourism sector in the UAE is experiencing steady growth as hotel establishment revenues have risen by 7% to about USD 6.7 Billion in H1 2024, driving high demand for dry beans in restaurants and hotels catering to vegetarian tourists. Dry beans' versatility and nutrient-rich profile make them a preferred choice for creating soups, stews, and side dishes. Additionally, their long shelf life ensures cost efficiency for bulk procurement by the food service sector. Restaurants are exploring traditional recipes, while hotels emphasize innovative preparations, leveraging beans to meet the rising demand for plant-based options.

Competitive Landscape:

The dry beans market is highly competitive in nature, with numerous global and regional players; there are large-scale producers as well as smaller specialized companies. Key players have a focus on expanding product portfolios and enhancing distribution networks in line with growing demand for nutritious and sustainable food options. Companies are investing in advanced farming techniques, processing technologies, and packaging solutions to enhance efficiency and product quality. The trend of adoption towards more plant-based diets and sustainable farming practices propels innovation. Moreover, businesses have increasingly adopted strategic mergers, acquisitions, and partnerships, in order to gain a larger share in the market, while spreading out into more geographical locations. Competition still remains extremely intense, while players compete on affordability, quality, and sustainability.

The report provides a comprehensive analysis of the competitive landscape in the dry beans market with detailed profiles of all major companies, including:

- 21st Century Bean Processing LLC

- Kelley Bean Co.

- Hayes Food Products Inc.

- Goya Food Inc.

- Colin Ingredients

- Harmony House Foods, Inc.

- Eden Foods

- Ruchi Foods LLP

- Garlico Industries Ltd. (Garon Dehydrate Private Limited)

Latest News and Developments:

- In November 2024, Lakeside Foods has acquired Oregon-based Smith Frozen Foods, including its production facilities in Weston and Milton-Freewater. This acquisition expands Lakeside’s frozen vegetable market share and enhances its product base. The deal is expected to finalize by early next week, with plans to retain a substantial number of Smith's employees.

- In December 2024, Tortilla, a leading UK fast-casual chain, partners with Beyond Meat to debut the plant-based Beyond Steak Chimichurri Burrito. Packed with Beyond Steak, chimichurri mayo, pinto beans, and more, it targets flexitarians, vegetarians, and meat lovers. The launch celebrates Veganuary with a bold, sustainable menu addition.

- In August 2024, Louis Dreyfus Company (LDC) has launched a new business unit focused on global pulses commercialization, aligning with its growth strategy and sustainability goals. The unit will capitalize on pulses’ rising demand as plant-based proteins and their environmental benefits. Initially focusing on key pulses like chickpeas, lentils, and beans, the business will leverage LDC’s strong presence in major production and consumption markets.

- In April 2024, Integra Foods, a division of Australian Grain Export, has launched a state-of-the-art faba bean protein facility in Dublin, South Australia, as part of a USD 20 Million value-adding project. The facility aims to produce 15,000 metric tons of sustainable faba bean concentrates annually, driving innovation in Australia's plant protein industry.

- In February 2024, AGT Foods Africa has officially acquired Pannar’s dry bean seed business, expanding its product offerings. The acquisition, confirmed on February 1, 2024, follows discussions that began in March 2023. This strategic move aims to enhance AGT’s presence in the African market, especially with the growing demand for dry beans across the continent.

Dry Beans Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Bean Types Covered | Pinto Beans, Black Beans, Navy Beans, Red Kidney Beans, Great Northern Beans, Others |

| Packaging Types Covered | Plastic Bags, Cans, Jars, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Speciality Stores, Departmental Stores, Convenience Stores, Others |

| End-Uses Covered | Households, Restaurants and Hotels, Flour Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Poland, China, Japan, India, South Korea, Australia, Brazil, Mexico, Turkey, Saudi Arabia, United Arab Emirates, Israel |

| Companies Covered | 21st Century Bean Processing LLC, Kelley Bean Co., Hayes Food Products Inc., Goya Food Inc., Colin Ingredients, Harmony House Foods, Inc., Eden Foods, Ruchi Foods LLP and Garlico Industries Ltd. (Garon Dehydrate Private Limited), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dry beans market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dry beans market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dry beans industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Dry beans are mature, harvested beans that have been dried for preservation. They belong to the legume family and include varieties such as kidney, black, pinto, and chickpeas. Known for their high protein, fiber, and nutrient content, dry beans are versatile, nutritious, and widely used in various cuisines.

The dry beans market was valued at USD 7.5 Billion in 2025.

IMARC estimates the global dry beans market to exhibit a CAGR of 3.54% during 2026-2034.

Key factors driving the global dry beans market include the rising demand for plant-based proteins, increasing health consciousness, growing adoption of sustainable farming practices, and the versatility of dry beans in various cuisines. Additionally, their affordability, nutritional value, and eco-friendly nature contribute to their expanding market presence.

In 2025 pinto beans represented the largest segment by beans type, driven by their widespread popularity, versatility in cooking, and affordability in various cuisines.

Plastic bags lead the market by packaging type owing to their cost-effectiveness, convenience, and ability to preserve product freshness.

The supermarkets and hypermarkets is the leading segment by distribution channel, driven by their wide reach, convenience, and variety of product offerings for consumers.

The household is the leading segment by end use, driven by their widespread use in everyday meals, offering affordability, nutrition, and versatility.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global dry beans market include 21st Century Bean Processing LLC, Kelley Bean Co., Hayes Food Products Inc., Goya Food Inc., Colin Ingredients, Harmony House Foods, Inc., Eden Foods, Ruchi Foods LLP and Garlico Industries Ltd. (Garon Dehydrate Private Limited), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)