Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region 2026-2034

Drones Market Overview:

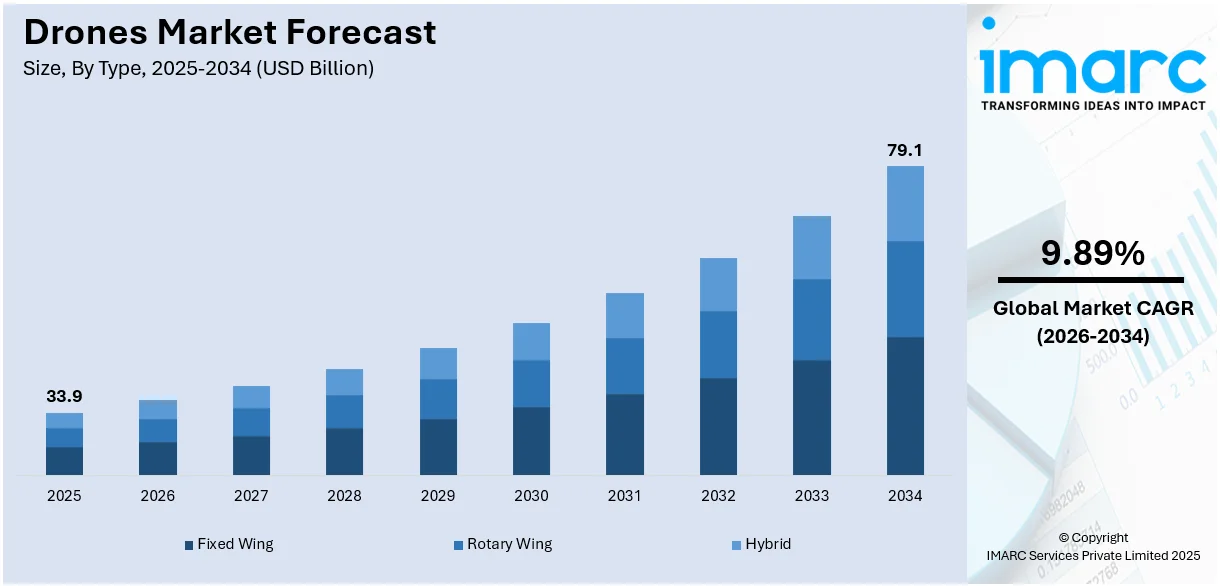

- The Drones market size was valued at USD 33.9 Billion in 2025 and is projected to reach USD 79.1 Billion by 2034.

- The market is estimated to grow at a CAGR of 9.89% from 2026-2034.

- The market is driven by increasing AI adoption for autonomous navigation and analytics, rising demand from smart city initiatives for surveillance and traffic management, and advancements in lightweight materials and battery efficiency. Integration with IoT networks also enhances real-time data capabilities and urban utility.

- In terms of type, the fixed wing segment dominates the drones market.

- Region wise, North America holds the largest share in the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 33.9 Billion |

| Market Forecast in 2034 | USD 79.1 Billion |

| Market Growth Rate 2026-2034 | 9.89% |

The drones market is growing due to enhanced technology, regulatory assistance, and soaring demand in diversified sectors. Batteries, sensors, and AI advancements have uplifted the reliability and accessibility of drones. Improved crop monitoring and yield analysis for farm owners have ensured the adoption of drones in villages. E-commerce and logistics industries are using drones for faster delivery, thus reducing their reliance on traditional transportation methods. Similarly, drones play a critical role in disaster management by enabling efficient search and rescue operations, damage assessment, and delivery of essential supplies to inaccessible areas. Government policies to include drones in the airspace and various commercial applications have boosted growth in the market. Drones are being applied in construction, mining, and oil and gas industries for surveys, inspections, and data acquisition, reducing costs and safety risks. Services enabled by drones, including aerial photography and videography in media and entertainment, continue to drive growth. Additionally, underwater drones market trends highlight expanding use in marine research, offshore infrastructure, and environmental monitoring, reflecting the sector's increasing versatility and demand.

To get more information on this market Request Sample

The United States emerged as a key market for drones. The market is driven by rapid technological advancements, high government support, and widespread adoption across industries. The Federal Aviation Administration has formulated comprehensive regulations on integrating drones into national airspace and has thus stimulated commercial growth and innovation. Key industries driving the U.S. market include agriculture, where it is used to monitor crops, and precision spray, and in construction, in which it helps increase efficiency in terms of survey and site inspection; logistics giants see drones as viable solutions for last-mile delivery, maximizing operational efficiency. The defense sector is still a significant contributor, as drones are used for surveillance, reconnaissance, and tactical operations. Consumer drones for recreational use also form a growing segment due to affordability and user-friendly features. As demand for drones services continues to rise, the U.S. market benefits from a robust ecosystem of manufacturers, service providers, and research initiatives, solidifying its position as a leader in drones innovation and adoption.

Drones Market Trends:

Technological advancements and innovation

The enhancement in key technologies like GPS, navigation systems, battery life, and sensor capabilities has helped such devices become even more versatile and capable, which is stimulating the global drones demand. Besides this, the integration of cutting-edge features like obstacle detection, artificial intelligence, and machine learning has made the product more functional, in that it could do complex tasks much more efficiently and with greater accuracy. For example, Percepto announced the introduction of a new drones named Air Mobile. According to the company, Air Mobile is best suited for linear inspections and keeps track of short-term projects spread across various sites in sectors such as construction. The Air Mobile drones may be left permanently on-site in their Percepto Bases. The encasements are designed to be low-maintenance and also protect against severe environmental phenomena like hurricanes. Moreover, the need for drones across different sectors including agriculture, construction, defense, and emergency response is growing at a rapid rate due to declining manufacturing costs and increasing affordability which is further catalyzing market growth. Increasing collaboration between stakeholders in the industry, including manufacturers, technology providers, and regulatory authorities, is also positively impacting the demand for drones. For instance, CASA in Australia approved the operation by a drones-in-a-box solutions provider named Percepto to fly beyond a visual line of sight in the country. In addition, Currawong Engineering announced in July 2023 that it will continue its partnership with AeroVironment Inc. by dedicating the ensuing set of High-Performance Velocity Electronic Speed Controllers (ESC) to the company's JUMP-20 unmanned aircraft system (UAS).

Government policies and supportive rules

The implementation of several government policies and supportive legislation plays an imperative role in shaping the global drones market trends. Countries across the world are involved in establishing clear legal systems and regulations under which the application of drones becomes safe and in a responsible manner, which ranges various issues including flight restrictions, issues of privacy concern, safety regulations, and issuance of pilot permits. For example, the FAA in the United States has created rules that stipulate standard rules for drones for legal and safe use within a commercial setup. The FAA further reported about 900,000 registrations of drones within the United States. Lastly, regulatory backing allows innovation to spur investment, coupled with confidence for customers. In addition, rising collaborative work by regulatory authorities, industry stakeholders, and academic institutions for better commercialization and standardization of drones technology is further boosting the global drones market overview. For instance, the Federal Aviation Administration approved the usage of drones in making commercial deliveries by a business owned by Alphabet in the United States. Amazon and DHL are examples of companies that have established their drones delivery systems for making fast deliveries and transferring products.

Global implementations to enhance emergency response and disaster management

Drones play a significant role in disaster management and emergency response, thus becoming a massive driver for the growth of the industry. Additionally, the extensive utilization of these devices for providing quick assessment and real-time information during natural disasters, including earthquakes, floods, and wildfires, enabling more effective rescue and relief operations, is positively impacting the global drones market revenue. Furthermore, access to hard-to-reach areas, provision of aerial imagery, and delivery of essential supplies have made drones a valuable tool in emergency scenarios. Apart from this, the integration of these devices by governments, NGOs, and international agencies into their disaster management strategies for saving lives and reducing damage is also catalyzing the global market. Additionally, the launch of favorable initiatives promoting the use of technology in humanitarian efforts is reinforcing the value of drones and fostering collaborative projects across nations, which will bolster the market expansion over the forecasted period. For example, the Defense Acquisition Council (DAC) of India stated in June 2023 that they have planned to purchase 31 MQ-98 Predator drones from General Dynamics Atomics Systems Inc. Its procurement cost stands at USD 3 Billion and will enhance the surveillance capabilities of India beyond its borders.

Drones Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global drones market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, component, payload, point of sale, and end-use industry.

Analysis by Type:

- Fixed Wing

- Rotary Wing

- Hybrid

In 2025, the fixed wing represented the largest segment holding 52.5% of drones market share. Fixed-wing drones are very effective in covering large areas quickly and efficiently, making them highly suitable for various tasks, such as aerial mapping, surveying, agriculture, and environmental monitoring. Their design allows for extended flight times, which is a distinct advantage over multi-rotor counterparts, enhancing their appropriateness for long-range missions. In addition, the growing need for precise geospatial data in various industries such as construction, mining, and agriculture is fueling the global drones market share in this category. Furthermore, regulations that allow for the acceptance of drones in multiple sectors further strengthen the market's growth. For example, Parrot and Tinamu partnered to integrate the Parrot ANAFI Ai drone into Tinamu's automated indoor-monitoring solutions for industries like mining and construction in May 2023. This collaboration aims to create an advanced robotic solution for warehouse inventory management. The ANAFI Ai features 4G connectivity, obstacle avoidance, and complies with GDPR, ensuring secure data handling. Tinamu's innovative software will enhance the drone's capabilities, allowing for reliable and automated indoor flights, improving efficiency and accuracy in inventory monitoring.

Analysis by Component:

- Hardware

- Software

- Accessories

According to the report, hardware represented the largest segment with a share of 65.7% in 2025. The ongoing pursuit of lightweight, high-performance materials and components fuels big leaps in drones hardware. In addition, the growing requirement for specialized sensors, cameras, and communication modules in drones that enhance their functionality, as their adoption increases across various sectors, such as agriculture, infrastructure inspection, and surveillance, is driving the market expansion. In addition, the increasing demand for dependable and accurate navigation, better battery life, and data processing power continues to spur innovation in drones hardware components.

Analysis by Payload:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

The report shows that <25 kilograms had the highest market share of 53.8% in 2025. Drones in this weight class provide an all-purpose solution for industries, including aerial photography, small-scale delivery, environmental monitoring, and infrastructure inspection. Apart from this, the increasing need for cost-effective, agile, and easily deployable aerial solutions in industries also helps to drive demand for drones with payloads under 25 kilograms. Moreover, regulatory frameworks that facilitate the integration of lightweight drones into airspace operations also contribute substantially to the market's expansion. Besides this, technological advancements in miniaturization, battery efficiency, and communication systems further bolster the capabilities of sub-25-kilogram payload drones, making them more efficient and user-friendly. For instance, major logistics and retail companies worldwide, such as Domino’s & Amazon.com, Inc., use drones package delivery to seamlessly deliver products to consumers.

Analysis by Point of Sale:

- Original Equipment Manufacturers (OEM)

- Aftermarket

Original equipment manufacturers lead the market in 2025, with a share of 69.1% according to the report. OEM point of sale is one of the most significant entry points for most businesses to access multiple drones parts. The parts ensure quality, compatibility, and customization. Moreover, as the drones matures, the demand for specialized parts continues to grow, including sensors, propulsion systems, and even communication modules. This requires a reliable supply chain from OEMs, which creates innovation and competition in the market. Furthermore, the growing use of drones applications in agriculture, surveillance, and logistics industries also strengthens the demand for OEMs to offer diverse, high-quality offerings. Moreover, the continuous technological advancements in drones hardware and software also amplify this demand, as OEMs play a central role in introducing cutting-edge features to the market.

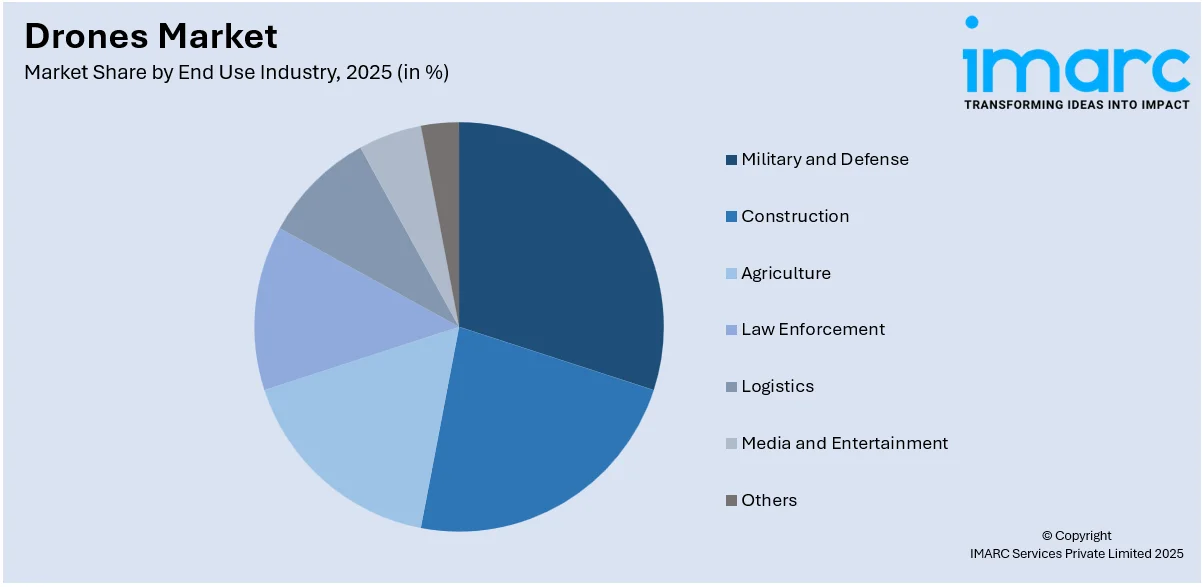

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

According to the report, the market was dominated by military and defense with a market share of 30.5% in 2025. The integration of drones into military and defense has, more than anything, transformed it as they give superior reconnaissance, surveillance, and target acquisition features. Furthermore, this increasing demand for real-time situational awareness, border security, and efforts toward countering terrorism has catapulted the advancement in drones technology. Furthermore, the market expansion in this sector is being accelerated by the continuous development of autonomous and semi-autonomous drones, which provide significant benefits in lowering human danger and boosting operational efficiency. As governments and defense agencies prioritize the integration of drones into their operations, investments in research and development of cutting-edge drones technologies are rising. Furthermore, the strategies of multidomain warfare have emerged as versatile drones that will fly in the land and air as well as sea domains. For example, in July 2023, the Indian Armed Forces issued a notice to purchase 97 medium-category and long-endurance 'Made-in-India' drones. Besides this, Garuda Aerospace and Elbit Systems have signed an agreement at the Defense Expo for the provision of Skylark 3 UAS drones to commercial and government agencies. The Skylark 3 drones undertake large-scale surveying and mapping of government village projects. The IAF, further, said that in April 2024, it is in the process of developing an artificial intelligence-based drones system that would inspect aircraft engines to replace conventional manual methods for the task. The system will include high-resolution cameras mounted on a mini- or micro-drones, with imaging software and machine learning algorithms that detect, identify, and classify defects such as cracks, corrosion, dents, distortion, and damage to both external and, to a lesser extent, internal components.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, as per the global drones market report, North America represented the leading segment of the market with a share of 48.4%. North America leads the global market due to the well-developed and state-of-the-art research and development infrastructure and the rising culture of entrepreneurship. Moreover, the vast use of drones across various sectors such as agriculture, public safety, and infrastructure is also accelerating the drones market growth in this region. Except for that, the continued technological developments and innovation in a range of industries, along with increasing demand for such equipment to gather data and optimize operations are driving the current price of the global drones market significantly. For example, Precision AI, a computer vision and robotics company, secured $20 million in seed funding to enhance sustainable farming in May 2021. The funding, co-led by At One Ventures and BDC Capital, aims to develop a precision farming platform utilizing drone technology for targeted herbicide application. This approach could reduce pesticide use by up to 95% and save farmers approximately $52 per acre annually. Currently, over 80% of herbicides are wasted, highlighting the need for more efficient agricultural practices.

The Asia Pacific region is in the lead position for the global adoption of drones due to rapid urbanization, expansion in industrial sectors, and government policies supporting the inclusion of drones in various industries. China is leading as the world's largest producer and exporter of drones; its advanced manufacturing capabilities and relatively low-cost production are driving this market. In India, Japan, and South Korea, it is widely used in agricultural precision farming, construction surveying, and logistics for efficient deliveries. Rising investments in drone swarms in defense and border surveillance technologies further boost demand, while disaster management and environmental monitoring also play critical roles in expanding usage across the region.

Europe's drones market thrives on innovation and supportive regulatory frameworks established by the European Union, fostering growth in sectors like logistics, agriculture, and infrastructure inspection. Some of the major countries that take the lead in industrial applications use drones, particularly Germany, France, and the UK, mainly in precision agriculture, mapping, and environmental monitoring. Logistics companies also use them to make deliveries on the last mile, and industries such as energy and transportation use drones to inspect their assets. Other factors driving development and deployment in the military sector are defense modernization programs, backed by sizeable R&D investment.

The Latin American drones market is driven by its dependence on agriculture and natural resource industries, where drones are used for crop monitoring, pest control, and resource exploration. Brazil, Argentina, and Mexico are at the forefront, leveraging drones to enhance productivity and efficiency in vast farmlands and the use of drones in energy and mining sites. The diverse geography of the region calls for a strong demand for drones in disaster management, logistics, and infrastructure monitoring in remote or challenging terrains. Emerging startups and collaborations with global manufacturers are driving innovation and broadening the use of drones in Latin America.

The Middle East and Africa drones market is driven by a huge investment in defense, oil and gas, and infrastructure sectors. Countries such as the UAE and Saudi Arabia deploy drones for border patrol, pipeline monitoring, and urban planning; African countries, on the other hand, deploy drones for remote humanitarian aid. The oil-rich Gulf countries take the lead in embracing the newest technologies for the surveillance and maintenance of critical infrastructure, while government-supported initiatives and cooperation with international producers focus on creating local capacity for drones use in logistics, agriculture, and disaster response.

Key Regional Takeaways:

United States Drones Market Analysis

In 2025, the United States held a share of 89.60% for the drones market due to the widespread application of drones in the commercial, military, and recreational sectors. Since it has recently chosen to spend USD 9 Billion through fiscal year 2029 on drones programs, the U.S. Department of Defence remains a giant in this sector. Military drones are mostly applied to intelligence, surveillance, and reconnaissance missions, including the MQ-9 Reaper. On the commercial side, construction, agriculture, and logistics apply drones in last-mile deliveries, aerial surveying, and crop monitoring. Efforts to reduce delivery costs and times led UPS and Amazon Prime Air to test drones delivery systems. In addition, currently, as of 2023, the Federal Aviation Administration (FAA) projects more than 1.47 million drones were registered, in December 2022, establishing a high adoption. The Part 107 rules instituted by the FAA and other liberal U.S. government laws, for example, promote the expansion of commercial drones missions. Moreover, integrating drones into advanced technologies including AI and the 5G network opens new fronts and boosts usage in the field. This situation has led to significant recreational use in the US as well, with hobbyists accounting for 30% of drones registrations, according to reports.

Europe Drones Market Analysis

There is growing use in agriculture, logistics, and environmental monitoring besides heavy governmental investments in drones infrastructure, which is driving the European drones business. The European Union's SESAR (Single European Sky ATM Research) program is working actively to develop frameworks for the safe integration of drones into airspace. Precision farming is one of the major drivers in the agricultural sector that utilizes drones to increase crop yields and minimize pesticide use. Another application of drones in this sector will be the spraying of crops from the skies as it consumes 70% of the world's water in agriculture. According to a European Union paper on the use of drones in agriculture, the best level of efficiency can be achieved by combining two steps in the process and starting drones spraying based on the information gathered by a mapping drones. Droness are being quickly adopted by delivery services; successful pilot projects in nations like Germany and Switzerland have been carried out by Wing and Matternet. Security and surveillance applications, disaster relief, and border enforcement now also widely utilize drones. Greater simplification in cross-border activities brought about by the European Drones Regulation 2019/947 and 2019/945 makes faster market expansion possible.

Asia Pacific Drones Market Analysis

According to government initiatives, acceptance within industries, and technology improvement, Asia-Pacific is among the top-growing regions in the drones market. Also, as per drones market growth rate, more than 70% of all exports come from China, and China dominates the list of top global drones manufacturers with DJI and other companies. The China Air Transport Association's 2023-2024 China Drones Development Report reports 2 million drones registered by the end of August 2024, a rise of 720,000 from the end of 2023. China's civilian drones production is expected to break the 200 Billion yuan threshold (USD 27.5 Billion) by 2025. The Indian government through its programs, such as Drones Rules 2021 and the Production Linked Incentive (PLI) program for drones, encourages domestic production and uptake in India. South Korea and Japan have utilized drones for smart agriculture and inspection of infrastructure. The report further states that thirty percent of Japan's major farms use drones for crop monitoring and spraying. Droness are also an essential element of construction activities in the region, which enables project monitoring and great savings in costs. The increasing deployment of drones for rural drones deliveries by Chinese e-commerce giants like JD.com in the hopes of boosting the efficiency of logistics is also adding further momentum to market growth. Increasing defense drones spending in countries such as Australia and India is also aiding this upward trend.

Latin America Drones Market Analysis

Growth of the Latin American market is also being driven by the increasing number of drones deployments in mining, agriculture, and disaster response. Statistics from the Single Foreign Trade Portal Program (Portal Siscomex) indicate that between 2020 and 2023, Brazil's largest agricultural exporter in the region more than 8,000 spraying drones. The mining industry is increasingly using drones in countries like Chile and Peru for surveying and mapping, an activity that can reduce exploration costs by as much as 20-30%. Governments are also using drones to respond to disasters, such as search and rescue operations after floods and earthquakes in Mexico. The logistics sector, which is still at the embryonic stage of accepting drones, is testing delivery systems in remote locations using startups. Laxer laws in countries such as Uruguay and Colombia also help with the use of commercial drones, aiding the business to grow.

Middle East and Africa Drones Market Analysis

The Middle East and Africa market for drones is largely dominated by the various applications of drones in agriculture, oil and gas, and defense. The main players, Saudi Arabia, and the United Arab Emirates use drones for military surveillance as well as infrastructure checking. The Droness for Good Award program from the United Arab Emirates promotes the innovative application of drones for public service. Droness are transforming healthcare logistics in Africa. For example, Zipline's drones delivery network in Rwanda has flown over 300,000 kilometers (km) of commercial deliveries, some carrying as many as 7,000 units of blood, significantly increasing access to healthcare in rural areas, according to an industry report. To boost productivity, the sub-Saharan African agriculture industry is utilizing drones for precision farming. The oil and gas industry in the region also uses drones to inspect pipelines, which saves inspection costs by up to 50%. Government policies also help accelerate market adoption since the creation of drones-friendly regulations is becoming increasingly important to governments.

Competitive Landscape:

The global drones market is witnessing major growth as many research and developments on drones capacity are going ahead. These include developments in flying stability, in the battery's life, ranges, and payload, along with advanced sensor and camera technology for better information gathering and analysis. Besides this companies are also trying to make drones for industrial purposes, such as in agriculture construction, mining and oil and gas, environmental surveys, and even public safety areas. In the middle of this progress, drones market research highlights a strong push toward creating autonomous and semi-autonomous systems, reducing the need for manual control and skilled labor. Additionally, evolving software platforms for flight planning, data processing, and analytics, along with seamless integration of third-party components, continue to strengthen the market’s expansion.

The report provides a comprehensive analysis of the competitive landscape in the drones market with detailed profiles of all major companies, including:

- Delair

- Draganfly Innovations Inc.

- Parrot Drones SAS

- Skydio, Inc

- SZ DJI Technology Co., Ltd.

- Terra Drone Corp.

- The Boeing Company

- Yuneec

Drone Market News:

- April 2024: QinetiQ achieves UK’s first jet-to-jet teaming between aircraft and autonomous drones. The trial took place in collaboration with the Defense Science and Technology Laboratory (Dstl), the Royal Navy, and the Air and Space Warfare Centre (ASWC).

- April 2024: The Indian Air Force (IAF) is developing an artificial intelligence-based drones system to carry out inspection of aircraft engines that would replace the conventional manual methods of carrying out such checks.

- April 2024: Northrop Grumman has received a US USD 387 Million foreign military sales contract for sustaining Italy, Japan, and South Korea's RQ-4 Global Hawk drones. The Pentagon said the contract is part of the US Department of Defense's foreign military sales to the Government of Korea, Japan's Ministry of Defense, and the North Atlantic Treaty Organization (NATO).

Drones Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | 25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Point of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Delair, Draganfly Innovations Inc., Parrot Drones SAS, Skydio, Inc, SZ DJI Technology Co., Ltd., Terra Drone Corp., The Boeing Company, Yuneec, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the drones market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global drones market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A drones is any unmanned aerial vehicle (UAV) that may be controlled by a remote controller or fly automatically. Drones have sensors, cameras, or other payloads for multiple purposes such as surveillance, delivery, photography, agriculture, and military applications. Their versatility in accessing inaccessible areas makes drones valuable tools for many industries.

The global drones market was valued at USD 33.9 Billion in 2025.

IMARC estimates the global drones market to exhibit a CAGR of 9.89% during 2026-2034.

The global drones market is driven by consumer interest in recreational activities, including drones racing and personal photography, and is also due to the implementation of 5G, IoT, and augmented reality technologies. Regulating bodies must also establish supportive guidelines and policies.

In 2025, fixed wing represented the largest segment by type due to their ability to cover vast areas with higher endurance and higher speeds than rotary-wing and hybrid counterparts.

Hardware leads the market owing to ongoing pursuit of lightweight, high-performance materials and components.

The <25 KG is the leading segment as they provide an all-purpose solution for industries, including aerial photography, small-scale delivery, environmental monitoring, and infrastructure inspection.

In 2024, original equipment manufacturers (OEM) represented the largest segment, driven by their accessing quality, compatibility, and customization of drones parts.

Military and defense leads the market owing to their superior reconnaissance, surveillance, and target acquisition features.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global drones market include Delair, Draganfly Innovations Inc., Parrot Drones SAS, Skydio, Inc, SZ DJI Technology Co., Ltd., Terra Drone Corp., The Boeing Company, Yuneec, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)