Drone Camera Market Size, Share, Trends and Forecast by Type, Resolution, Application, End User, and Region 2025-2033

Drone Camera Market Size and Share:

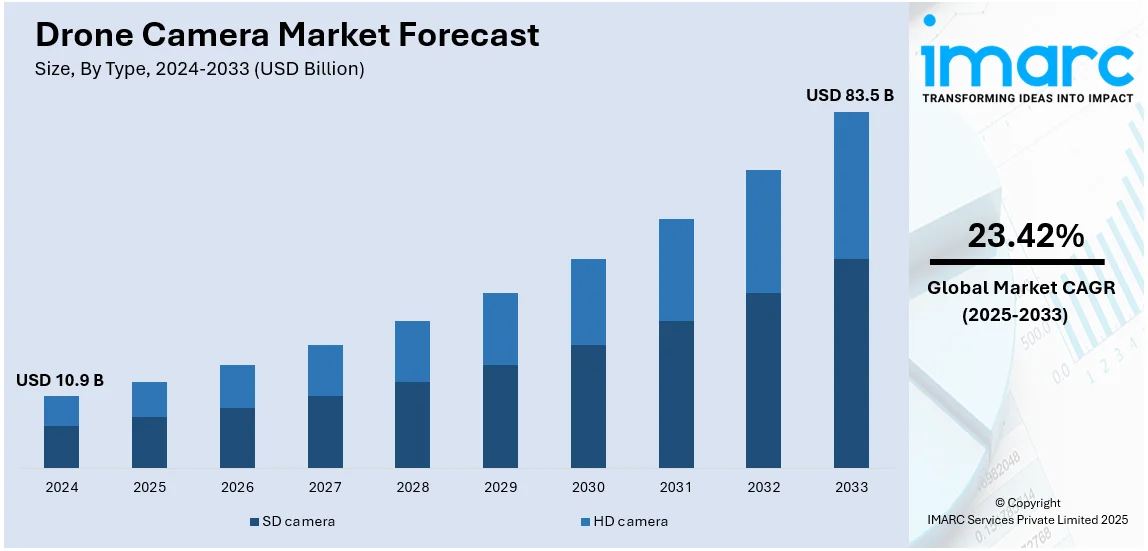

The global drone camera market size was valued at USD 10.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 83.5 Billion by 2033, exhibiting a CAGR of 23.42% during 2025-2033. North America currently dominates the market, holding a significant market share of over 32.9% in 2024. The demand is experiencing steady growth driven by rapid technological advancements, expanding applications of the product, strong regulatory support, decreasing cost of the product, and the growing need for real-time data collection and analysis in various industries is further increasing the drone camera market share across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.9 Billion |

|

Market Forecast in 2033

|

USD 83.5 Billion |

| Market Growth Rate (2025-2033) | 23.42% |

The increasing technology trends, extensive uses across various industries, and encouraging governance are factors driving the global drone market. Improved artificial intelligence, automation, and enhancements in battery life have all expanded the capabilities of drones and made them more efficient at a lower cost. Drones are increasingly used in agriculture, construction, logistics, and defence for precision farming, surveying, aerial deliveries, and surveillance. Increasing e-commerce and the demand for fast, last-mile deliveries help the market further. Investments in drone technology and the integration of 5G networks enhance real-time data transmission, which boosts operational efficiency. According to the IMARC Group, the global 5G services market reached USD 184.6 Billion in 2024. Government initiatives and relaxed airspace regulations in many countries also foster market growth. Drones are essential for reconnaissance and combat missions in the defense sector, which fuels demand. Additionally, the increased use of drones for environmental monitoring, disaster management, and urban planning contributes to market expansion. As technology evolves, drone applications continue to diversify, fueling sustained growth worldwide.

The United States stands out as a key market disruptor, driven by technological advancements, rising commercial applications, and increasing demand in defense and surveillance. Improvements in camera resolution, AI image processing capabilities, and thermal imaging abilities have enhanced multifunctionality of drones in all industries. The increasing applications of drones for photography in real estate, agriculture, and filmmaking have stimulated demand for high-quality drone cameras. The drones in the defense sector are also widely used with high-end cameras in ISR missions. Law enforcement is also embracing the use of drone cameras for crowd monitoring, border security, and search-and-rescue operations. E-commerce and package delivery companies have further created a positive drone camera market outlook the market because they require the use of drones for aerial logistics.

Drone Camera Market Trends:

Technological advancements

The drone camera market demand has witnessed a remarkable expansion due to ongoing technological advancements. The drone camera has innovated and transformed the arena of photography and videography. Some of the basic features that attributed to the growth of the drone camera market are, firstly the improved version of the camera sensor has enhanced the quality of photos and videos. Having high resolution, dynamics, and low-light performance enables the drone to capture appealing visuals. The drone camera is commonly used for filmmaking, industries, and surveillance. According to reports, in India, the surveillance market is currently valued at approximately USD 4.3 Billion with projections indicating it will exceed USD 15 Billion by 2029. Moreover, the stabilization feature has been improved substantially. It makes the drone footage look professional and smooth. It has also manufactured miniature components which enables powerful imaging features. The inclusion of wireless transmissions and 5G technology enables the high-resolution streaming of footage on mobile phones or any other devices and has increased the drone camera market demand.

Increasing usage of drone cameras

The drone camera market growth has substantially increased by a rise in the usage of drone cameras. Market expansion and diversity have greatly attributed to the increasing usage of drone cameras across diversified industries. The drone camera can be easily accessed by people. Accessibility and affordability have promoted high-quality photography and videography. Nowadays, professionals or individuals can easily use the drone camera. This has substantially increased the demand rate in the market. Moreover, diversified industries including filmmaking, agriculture, construction, environmental department, etc. are using the drone camera consistently which embarks on its versatility and unique features. For instance, as per the industry reports, global construction work done will grow over USD 4.2 Trillion over the next 15 years. The advancement in technology has improved battery life, stability, and other dignified features which has boosted its adoption across industries. Additionally, the ongoing process of the inclusion of artificial intelligence, image processing, and flight capabilities has fuelled the demand in the market.

Decreasing costs of drone cameras

The rapid expansion and transformation of the drone camera have substantially decreased the costs and affected the drone camera market price. There are several factors that attributed to this trend. There has been a sudden increase in the demand for drone cameras in the market. The economic scale and the enhanced manufacturing process have reduced the costs of the production of drone cameras. The manufacturers use bulk production techniques and ideas to reduce the production cost which eventually results in the savings of the consumers. Moreover, the advancement in technology has led to the development of innovative components without compromising quality and performance. The manufacturers have used innovative designs to attain efficiency and affordability. It offers a wider range of options, making it affordable and accessible to consumers. There has been a rapid improvement in the supply chain and distribution networks, facilitating effective delivery to the consumers and thus reduced costs. With reduced costs, the drone camera market has become increasingly accessible to consumers.

Drone Camera Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global drone camera market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, resolution, application, and end user.

Analysis by Type:

- SD camera

- HD camera

HD camera stands as the largest component in 2024, holding around 59.6% of the market. The rise of HD cameras is a crucial factor in the expanding drone camera market. None can beat HD cameras when it comes to image quality and sharpness; these features enable drone operators to make incredible footage at any time for diverse applications like photography, videography, mapping, and surveillance. With customers and companies having an interest in leveraging such professional aerial filming capabilities for both business purposes and leisure activities, there has been a spike in demand for HD cameras in drones. Consequently, this has led to the adoption by businesses in sectors like farming, building, film making as well as public safety thereby bringing about a detailed top view that serves as a reference point especially with regard to crop growth around farms or inspection of other tall structures even when they are not accessible on foot. Also, improved sensors, image processing algorithms, stabilization mechanisms among others have made advancements in HD Camera technology that have boosted their performance and versatility leading to more market growth and innovation.

Analysis by Resolution:

- 12 MP

- 12 to 20 MP

- 20 to 32 MP

- 32 MP and above

12 MP leads the market in 2024, pushed by the inclusion of 12 MP resolution cameras. With a combination of image quality and file size, drones can use 12 MP resolution cameras to capture high-definition aerial video that has thorough clarity and detail. This resolution is particularly appealing to both professional and non-professional users who require sharp pictures and videos for various purposes such as photography, videography, mapping, as well as inspection tasks. The adoption of 12 MP resolution cameras in drones by different industries like real estate, agriculture, construction, media production etc, has played an important role in boosting market growth rates. Furthermore, with ease of accessibility to 12 MP resolutions cameras in them democratizing the aerial imaging made enthusiasts and professionals able to maximize their creativity and productivity by making wonderful captures from above the sky. As technology keeps changing, the integration of 12 MP resolution cameras will continue to drive innovation and expansion within the drone camera market.

Analysis by Application:

- Photography and Videography

- Thermal Imaging

Photography and videography leads the market in 2024. The drone camera industry is driven by two main factors, videography and photography. Developed drones with high-quality cameras have changed the aerial photography and videography field thus enabling views that were not envisaged before or even thought of by creative people. Drone cameras are used by professional photographers and filmmakers to capture breathtaking stills and video clips for many purposes including advertising, film-making, landscape documentation, and event coverage among others. Additionally, drone technology has made aerial photography available to all enabling any enthusiast or hobbyist to boldly explore the heavens above and manifest their creativity. The demand for stunning perspective photographs as well as cinematic imagery keeps growing in sectors like real estate, tourism, entertainment as well as media production. This is why the interrelation between photography, videography, and drone technology is an impetus for further development of this branch of production which affects the whole process of visual storytelling creation through drones today directing its course towards future trends.

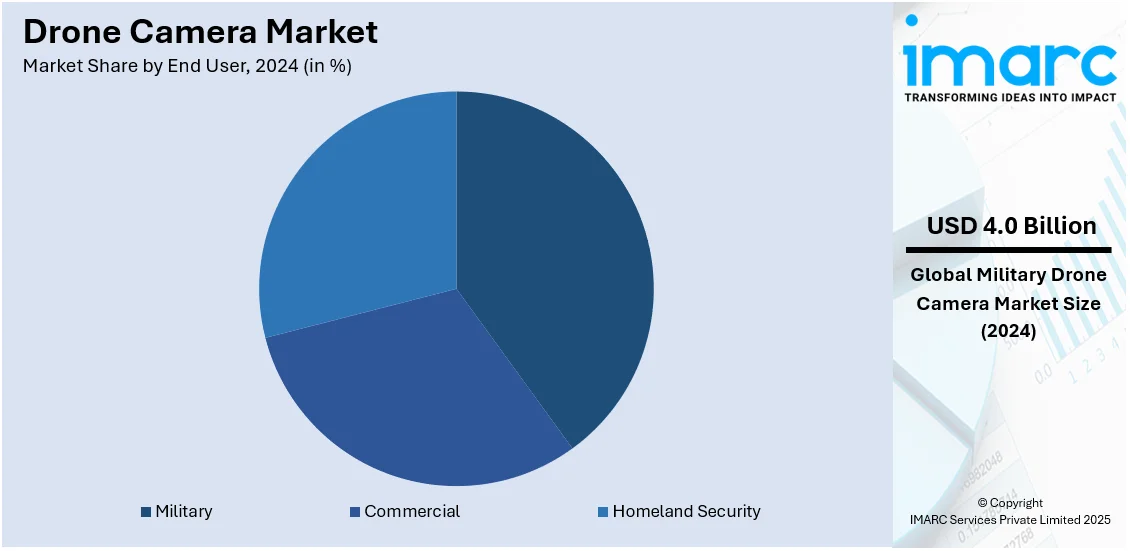

Analysis by End User:

- Commercial

- Military

- Homeland Security

Military leads the market with around 36.7% of market share in 2024. The military sector has a great impact on driving developments and innovations within the drone camera industry. It is important to realize that military applications require highly specialized drone cameras with real-time, high-resolution imagery for reconnaissance, surveillance, and intelligence-gathering purposes. The above-mentioned advanced systems of cameras thus equip soldiers with crucial situational awareness which allows them to comprehend and inspect changeable surroundings exactly. Besides, military drones often have to accommodate special features like infrared imaging capabilities, night vision capacity as well as long-range zoom lenses in order to be efficiently used in different tough environments. In addition, this massive investment by the military into drones leads to new camera technologies while at the same time enabling economies of scale that would result into easier accessibility of these complex imaging technologies to commercial and consumer markets. By 2025, the military sector is expected to account for more than 71% share globally when it comes to the drone market. A significant proportion of the drone market focuses on military uses hence being able to benefit from economies of scale in manufacturing drone cameras. It is possible that increased volumes for production might lead into low costs of production thereby making high-quality drones affordable to commercial and consumer markets.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 32.9%. The drone camera market is driven in large part by North America growth due to a variety of reasons. The region has robust drone manufacturers, innovative start-ups, and camera tech firms that foster a fast-paced environment for technology enhancement and industry growth. North America hosts several end-users including enthusiasts, practitioners as well as industrial players who contribute toward the demand for drone cameras. Additionally, it should be noted that the region is characterized by strong investments in R&D with a high knowledge base regarding the operations of drones thereby driving market growth. The North American drone market is anticipated to surpass USD 12.2 Billion by 2030. As North America pushes ahead with investment into drone technology across its sectors, there will be an increasing need for advanced camera systems driven by the growing demand for drones hence leading to growth in the market for drone cameras.

Key Regional Takeaways:

United States Drone Camera Market Analysis

In 2024, the United States accounts for over 84.00% of the drone camera market in North America. Drone cameras are witnessing significant adoption in the United States, largely driven by their growing usage in the defense sector. For example, the U.S. Army is purchasing hundreds of Coyote counter-drone systems in a contract valued at USD 75 Million. . The integration of drone cameras into military operations has become a pivotal tool for surveillance, reconnaissance, and strategic planning. Advanced imaging capabilities, including high-resolution visuals and thermal imaging, enable defense agencies to gather real-time data and enhance situational awareness. Drone cameras also play a crucial role in monitoring borders, identifying threats, and ensuring national security with reduced human intervention in high-risk environments. The United States' emphasis on modernizing defense infrastructure has fuelled investments in cutting-edge drone camera technologies, enabling drones to operate effectively in various terrains and conditions. Innovations like AI-driven image processing and lightweight designs have further optimized drone cameras for defense missions. Moreover, collaborative efforts between defense agencies and private technology companies have resulted in the development of highly specialized drone camera systems tailored for military applications. The surge in demand for drones equipped with advanced cameras reflects their growing strategic importance, with defense sectors continuously exploring ways to expand their capabilities. This widespread adoption underscores the critical role of drone cameras in shaping the future of defense strategies across the United States.

Asia Pacific Drone Camera Market Analysis

In the Asia-Pacific region, the growing investment in drone manufacturing and emerging startups has led to a significant rise in the adoption of drone cameras. For instance, the Indian drone startups have attracted USD 68 Million. As governments and private sectors increase their focus on drone technologies, funding for research and development has grown substantially. This surge in investments is promoting technological breakthroughs, including lighter, more durable drones with advanced cameras capable of capturing high-quality images and videos. Furthermore, the proliferation of startups in this sector is contributing to rapid innovations in drone capabilities, creating a highly competitive market for drone cameras. With applications ranging from infrastructure inspections to agriculture and logistics, the demand for high-resolution cameras on drones is expected to continue expanding, offering new opportunities in sectors such as logistics, delivery services, and environmental monitoring.

Europe Drone Camera Market Analysis

In Europe, the rise in drone camera adoption can be attributed to the growing demand for high-quality photography and videography, particularly in the tourism sector. For instance, in 2022, Europe emerged as the world's most-visited region, with 594.5 Million tourist arrivals. As more tourists seek visually captivating experiences, the use of drone cameras has become increasingly popular for capturing aerial shots and videos of iconic landmarks, natural landscapes, and events. With the growth of social media platforms and video-sharing websites, content creators and travellers alike are utilizing drones to enhance the visual quality of their content. The increasing popularity of drone filming has led to an influx of tourists seeking destinations where they can experience unique perspectives of famous locations. Consequently, the tourism sector is embracing drone technology to offer unparalleled views, and the demand for sophisticated drone cameras that can produce stunning imagery is expected to rise steadily. This growing trend highlights the key role that drone cameras now play in shaping the future of tourism-related content.

Latin America Drone Camera Market Analysis

In Latin America, the adoption of drone cameras is gaining momentum due to the growing significance of the agricultural sector. For instance, in September 2024, Brazilian agribusiness exports reached an all-time high of USD 14.19 Billion, marking a 3.6% increase compared to the same period in 2023. Drones are becoming an indispensable tool in precision agriculture, providing farmers with real-time visual insights to monitor crop health, optimize irrigation systems, and identify potential pests or diseases. By capturing aerial images, these drones enable farmers to make more informed decisions about land management, enhancing efficiency and productivity. The ability to quickly assess large areas of farmland, track seasonal changes, and apply targeted treatments has led to an increasing demand for high-performance drone cameras that offer clear and reliable visuals. With agriculture being a vital sector in the region, the growing need for precision farming tools is expected to continue driving the adoption of drone cameras for agricultural purposes.

Middle East and Africa Drone Camera Market Analysis

In the Middle East and Africa, the construction industry is increasingly incorporating drone technology, fuelling the demand for high-performance camera-equipped drones. According to reports, Saudi Arabia's construction sector is booming, with over 5,200 projects currently underway, valued at USD 819 Billion. Drones are widely used for site surveys, mapping, and monitoring construction progress, helping engineers and project managers gain a bird's-eye view of construction sites. As construction projects in the region become more complex, drones equipped with advanced cameras provide crucial visual data that assists in tracking progress, detecting potential issues, and ensuring safety standards. The ability to capture detailed images and videos of construction sites from above allows for more accurate assessments and better project management. The expanding scope of construction projects, including urban development and infrastructure initiatives, is expected to further accelerate the adoption of drone cameras, offering more efficiency, safety, and precision in construction processes.

Competitive Landscape:

With regards to technological innovation, strategic partnerships, and new applications, growth in the drone camera market will be fueled by key players in the market. Companies like DJI, Parrot, and Skydio invest heavily in AI, machine learning, and high-resolution imaging, which is believed to further boost camera performance and automation. These major players focus on improvements related to battery efficiency, stabilization, and low-light capabilities, targeting the increased commercial and defense-related demand. Many firms are also incorporating 5G connectivity and cloud-based data analytics to make real-time video transmission possible. Therefore, drone cameras are gaining effectiveness for security, inspection, and media applications.

The report provides a comprehensive analysis of the competitive landscape in the drone camera market with detailed profiles of all major companies, including:

- AiDrones GmbH

- Canon Inc.

- Gopro Inc.

- Guangzhou EHang Intelligent Technology Co.Ltd.

- Kespry Inc.

- Panasonic Corporation

- Parrot SA

- Quantum-Systems GmbH

- Shenzhen Dajiang Lingmou Technology Co.Ltd. (iFlight Technology Company Limited)

- Skydio Inc.

- Sony Group Corporation

- Yuneec International

Latest News and Developments:

- January 2025: DJI has launched the DJI Flip, an all-in-one vlog camera drone weighing under 249g with foldable, full-coverage propeller guards for ultimate safety. It captures 48MP photos and 4K videos using a 1/1.3-inch CMOS sensor, making aerial photography accessible to all. The drone also features AI subject tracking and intelligent shooting modes for easy, stunning footage.

- September 2024: Leading Japanese drone maker ACSL announces a new thermal camera featuring a 640x512 resolution Boson sensor and a 3-axis gimbal, ideal for fieldwork. The camera, which captures 4K video and 64MP photos, will be available for purchase by the end of 2024. ACSL also appoints three new advisory board members, showcasing its growth and innovation.

- September 2024: Quantum Solutions and TOPODRONE launched the Q.Fly, a DJI-compatible SWIR camera for UAVs. Designed for DJI Matrice 300 and 350 RTK drones, it offers real-time video streaming and seamless integration. The Q.Fly provides precise imaging and easy control through the DJI remote.

- May 2024: Phase One, a global leader in digital imaging technology, continues to set new standards with its high-resolution and multispectral aerial imagery cameras for drones/UAVs. The company’s cutting-edge imaging solutions, spanning industries from aerial mapping to heritage digitization, offer unmatched quality. With over 30 years of innovation, Phase One pushes the boundaries of imaging excellence.

- May 2024: DJI has launched the Zenmuse H30 Series, an all-weather, multi-sensor aerial payload designed for public safety and energy inspection. The H30T model integrates five modules, including thermal and zoom cameras, while the H30 includes four, both offering enhanced clarity day or night. Compatible with DJI Matrice drones, these payloads feature intelligent algorithms for improved visual accuracy.

-

November 3, 2023, Canon Inc. announced the release of the RF200-800mm f/6.3-9 IS USM, a super-telephoto zoom lens that marked a first for Canon in extending to 800mm. This lens promises outstanding image quality and versatility for professionals and enthusiasts.

Drone Camera Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | SD camera, HD camera |

| Resolutions Covered | 12 MP, 12 to 20 MP, 20 to 32 MP, 32 MP and above |

| Applications Covered | Photography and Videography, Thermal Imaging |

| End Users Covered | Commercial, Military, Homeland Security |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AiDrones GmbH, Canon Inc., Gopro Inc., Guangzhou EHang Intelligent Technology Co.Ltd., Kespry Inc., Panasonic Corporation, Parrot SA, Quantum-Systems GmbH, Shenzhen Dajiang Lingmou Technology Co.Ltd. (iFlight Technology Company Limited), Skydio Inc., Sony Group Corporation, Yuneec International, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the drone camera market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global drone camera market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the drone camera of substitution. It helps stakeholders to analyze the level of competition within the drone camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The drone camera market was valued at USD 10.9 Billion in 2024.

The drone camera market is projected to exhibit a CAGR of 23.42% during 2025-2033, reaching a value of USD 83.5 Billion by 2033.

The worldwide drone camera market is propelled by improvements in imaging technology, growing use in commercial and military sectors, heightened need for aerial monitoring and instantaneous data gathering, along with the incorporation of AI, 5G, and cloud analytics.

North America currently dominates the drone camera market due to strong government and defense investments, advanced technological infrastructure, and widespread adoption across industries such as agriculture, real estate, media, and logistics.

Some of the major players in the drone camera market include AiDrones GmbH, Canon Inc., Gopro Inc., Guangzhou EHang Intelligent Technology Co.Ltd., Kespry Inc., Panasonic Corporation, Parrot SA, Quantum-Systems GmbH, Shenzhen Dajiang Lingmou Technology Co.Ltd. (iFlight Technology Company Limited), Skydio Inc., Sony Group Corporation, Yuneec International, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)