Downstream Processing Market Report by Technique (Solid-Liquid Separation, Cell Disruption, Concentration, Purification by Chromatography, Formulation), Product (Chromatography Systems, Filters, Evaporators, Centrifuges, Dryers, and Others), Application (Antibiotic Production, Hormone Production, Antibodies Production, Enzyme Production, Vaccine Production, and Others), End Use (Biopharmaceutical Companies, Contract Manufacturing Organizations), and Region 2025-2033

Downstream Processing Market Overview:

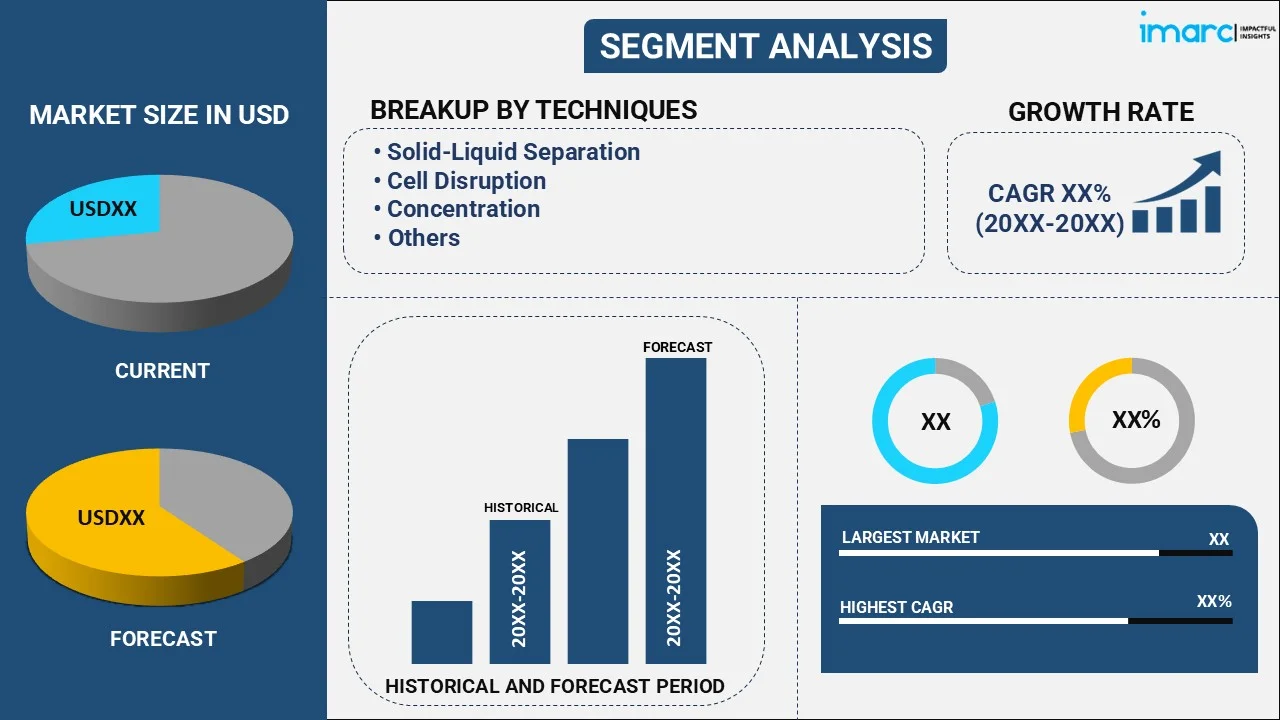

The global downstream processing market size reached USD 34.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 114.9 Billion by 2033, exhibiting a growth rate (CAGR) of 12.45% during 2025-2033. There are various factors that are driving the market, which include the growing demand for biopharmaceutical and biologics, rising collaborations and partnerships among key players, and increasing focus on personalized medicines and gene therapies among individuals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 34.8 Billion |

| Market Forecast in 2033 | USD 114.9 Billion |

| Market Growth Rate (2025-2033) | 12.45% |

Downstream Processing Market Analysis:

- Major Market Drivers: One of the key market drivers include stringent regulatory requirements for the purity and quality of biopharmaceutical products. Moreover, there is an increase in the prevalence of chronic diseases, which is acting as another growth-inducing factor.

- Key Market Trends: Rising collaborations and partnerships among major players and the increasing focus on personalized medicines among individuals are main trends in the market.

- Geographical Trends: North America exhibits a clear dominance, accounting for the biggest market share because it has a highly developed healthcare infrastructure.

- Competitive Landscape: Various major market players in the downstream processing industry are 3M Company, Boehringer Ingelheim International GmbH, Corning Corporation, Danaher Corporation, Eppendorf AG, Lonza Group AG, Merck KGaA, Repligen Corporation, Sartorius AG, Thermo Fisher Scientific Inc., among many others.

- Challenges and Opportunities: Contamination risk represents a key market challenge. Nonetheless, the integration with upstream processes, coupled with the adoption of advanced technologies, is projected to overcome these challenges and provide market opportunities.

Downstream Processing Market Trends:

Increasing Collaborations Among Key Players

Advanced technology and skills can be shared because of company collaborations. Innovation and the creation of more effective and efficient downstream processing solutions are accelerated by this interchange. Companies that work together might combine resources to invest in new technology or streamline current procedures, which lowers expenses. More cost-effective solutions can be produced as a result of shared facilities and cooperative investments in research and development (R&D) activities. Moreover, strategic partnerships allow companies to enhance their product and service offerings, which is providing a favorable downstream processing market outlook. For instance, Sartorius and Sanofi announced their partnership to develop an end-to-end platform for intensifying downstream processes on 13 May 2024. Sartorius will use its production and technical skills to help commercialize ICB platforms built on Sanofi prototypes. In return, Sanofi will grant Sartorius exclusive access to its know-how and patents related to the ICB platform.

Growing Demand for Biopharmaceutical and Biologics

As per the research report of the IMARC Group, the global biopharmaceutical market reached US$ 300.5 Billion in 2023. Manufacturers are producing larger quantities of complex molecules due to the rising need for biopharmaceuticals and biologics, thereby propelling the downstream processing market growth. There is an increase in the demand for robust and scalable downstream processing solutions to efficiently purify and recover the products at higher volumes without compromising quality. Besides this, the biopharmaceutical industry is highly regulated, with strict guidelines on product purity, safety, and efficacy. Downstream processing plays a crucial role in meeting these regulatory requirements by removing impurities and contaminants. Furthermore, the rising demand for biopharmaceuticals is driving innovation in the market. Companies are investing in R&D efforts to create more efficient, cost-effective, and scalable purification technologies and to increase their downstream processing market revenue. Advanced downstream processing technologies are essential to handle the complexity and ensure that the final products meet stringent regulatory standards.

Rising Focus on Personalized Medicines

The industry is growing because people are becoming more and more focused on tailored medications. Smaller batch sizes are frequently needed for customized medications because they are made for particular patients or patient groups. This shift from large-scale to small-scale production necessitates flexible and adaptable downstream processing solutions. Companies are spending more money on systems that can manage small batches with excellent purity and quality. Furthermore, customized medications like gene and cell therapies require extraordinarily high purity levels to guarantee safety and effectiveness. Removing pollutants and impurities during downstream processing is essential, necessitating sophisticated purification methods including ultrafiltration and high-resolution chromatography. The production of personalized medicines is catalyzing the scalable and flexible downstream processing demand. Modular and single-use systems are becoming increasingly popular because they offer the flexibility needed to quickly switch between different products and scales. Furthermore, companies are engaging in collaborations to introduce advanced solutions to individuals. For instance, on January 5 2023, Sartorius and RoosterBio Inc. renewed their strategic collaborative partnership agreement to address purification issues and set up scalable downstream production processes for exosome-based medicines. Through this partnership, Sartorius and RoosterBio will offer best-in-class solutions for an exosome production platform based on human mesenchymal stem/stromal cells (hMSCs) that achieves industry-leading yield, purity, and potency.

Downstream Processing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technique, product, application, and end use.

Breakup by Technique:

- Solid-Liquid Separation

- Cell Disruption

- Concentration

- Purification by Chromatography

- Formulation

Purification by chromatography accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the technique. This includes solid-liquid separation, cell disruption, concentration, purification by chromatography, and formulation. According to the report, purification by chromatography represented the largest segment.

The rising focus on purification by chromatography due to the need for high versatility and scalability is propelling the market growth. Size exclusion chromatography, ion exchange chromatography, and affinity chromatography are various examples of extremely selective and efficient chromatography methods. Chromatography is a flexible technique, making it suitable in the pharmaceutical, gene therapy, vaccine, and protein purification industries. Furthermore, the development of new resins, membranes, and automated systems assist in enhancing the efficiency and capability of chromatography processes, which is projected to provide a positive downstream processing market forecast.

Breakup by Product:

- Chromatography Systems

- Filters

- Evaporators

- Centrifuges

- Dryers

- Others

Chromatography systems hold the largest share of the industry

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chromatography systems, filters, evaporators, centrifuges, dryers, and others. According to the report, chromatography systems accounts for the largest market share.

Chromatography systems are renowned for their ability to achieve high purity and yield in the separation and purification of biomolecules. This is essential to produce biologics and biopharmaceuticals that meet strict regulatory requirements. From laboratory bench-scale operations to full-scale industrial manufacturing, these systems are easily scaled up. This scalability promises that chromatography will always be necessary from the early stages of development to mass production. Continuous improvements in chromatography media like new resins and membranes, and advances in system automation and control by downstream processing companies enhance the efficiency and effectiveness of chromatography systems.

Breakup by Application:

- Antibiotic Production

- Hormone Production

- Antibodies Production

- Enzyme Production

- Vaccine Production

- Others

Antibiotic production represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes antibiotic production, hormone production, antibodies production, enzyme production, vaccine production, and others. According to the report, antibiotic production represents the largest segment.

Antibiotic production is essential for treating a variety of bacterial infections. The high and consistent demand for antibiotics drives the need for efficient downstream processing to ensure adequate supply. Antibiotic production involves large-scale manufacturing processes to meet global demand. Efficient downstream processing is crucial to handle these large volumes, ensuring high yield and purity. Antibiotics must meet strict regulatory standards for purity and safety. Advanced downstream processing techniques, including filtration, centrifugation, and chromatography, are essential to remove impurities and ensure the final product's quality.

Breakup by End Use:

- Biopharmaceutical Companies

- Contract Manufacturing Organizations

Biopharmaceutical companies exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes biopharmaceutical companies and contract manufacturing organizations. According to the report, biopharmaceutical companies account for the largest market share.

Biopharmaceutical companies are focusing on treating various diseases, including cancer, autoimmune disorders, and infectious diseases. Biopharmaceutical companies are investing in R&D to innovate and improve downstream processing technologies. This investment is leading to the development of more efficient and effective purification methods, which helps them maintain their market leadership.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest downstream processing market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for downstream processing.

On 5 June 2023, Waters Corporation, headquarter in the United States and Sartorius announced a new collaboration to develop integrated analytical solutions for downstream biomanufacturing, expanding their joint agreement that began with upstream bioprocessing analytics. Software and hardware integrations between the Waters™ PATROL™ UltraPerformance Liquid Chromatography (UPLC™) Process Analysis System and the Sartorius™ Resolute® BioSMB™ multi-column chromatography platform will give bioprocess engineers access to more comprehensive analytical data for downstream batch and continuous manufacturing. North America, particularly the United States, is home to a well-established and mature biopharmaceutical industry. Major pharmaceutical and biotechnology companies are headquartered in this region, driving significant demand for downstream processing technologies and services. North America has a highly developed healthcare infrastructure, supporting the production and distribution of biopharmaceuticals. The presence of advanced hospitals, research institutions, and regulatory bodies ensures a robust market for high-quality biopharmaceutical products. As a result, these factors provide a downstream processing market overview in the North America region.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the downstream processing industry include 3M Company, Boehringer Ingelheim International GmbH, Corning Corporation, Danaher Corporation, Eppendorf AG, Lonza Group AG, Merck KGaA, Repligen Corporation, Sartorius AG, and Thermo Fisher Scientific Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the market are investing in advanced technologies, engaging in partnerships, and expanding their product portfolio, which provides major downstream processing market recent opportunities. Companies are developing new and improved downstream processing technologies such as high-performance chromatography systems, single-use technologies, and continuous processing systems. Many companies are partnering with academic institutions, research organizations, and other industry players to advance their R&D efforts and accelerate the development of innovative solutions. They are also forming joint ventures with other biopharmaceutical companies or technology providers to combine expertise and resources for developing more efficient and cost-effective downstream processing solutions. Furthermore, market players are acquiring smaller companies or startups to expand their product portfolios and market reach. For instance, on 3 January 2023, LOTTE BIOLOGICS acquired the manufacturing facility of Bristol Myers Squibb in Syracuse, New York. The company purchased operations and assets, which includes the property, plant, and equipment.

Downstream Processing Market Recent Developments:

- 31 May 2024: South Korean CDMO Lotte Biologics and Merck KGaA signed a partnership deal focused on expanding biopharmaceutical production and process development. Under terms of the agreement, the two companies will work together to ensure supplies of essential raw materials, establish a stable supply chain for raw materials, and create a support system for the “Bio Venture Initiative” at Lotte’s Songdo Bio campus in South Korea.

- 18 October 2023: SCHOTT introduced ViewCell™ flow cell that adds flexibility to biopharmaceutical process by optimizing downstream processes. The innovative process analysis technology (PAT) component acts as a sterile interface between product and optical measurement systems.

Downstream Processing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Techniques Covered | Solid-Liquid Separation, Cell Disruption, Concentration, Purification by Chromatography, Formulation |

| Products Covered | Chromatography Systems, Filters, Evaporators, Centrifuges, Dryers, Others |

| Applications Covered | Antibiotic Production, Hormone Production, Antibodies Production, Enzyme Production, Vaccine Production, Others |

| End Uses Covered | Biopharmaceutical Companies, Contract Manufacturing Organizations |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Boehringer Ingelheim International GmbH, Corning Corporation, Danaher Corporation, Eppendorf AG, Lonza Group AG, Merck KGaA, Repligen Corporation, Sartorius AG, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global downstream processing market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global market?

- What is the impact of each driver, restraint, and opportunity on the global market?

- What are the key regional markets?

- Which countries represent the most attractive market?

- What is the breakup of the market based on the technique?

- Which is the most attractive technique in the market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the market?

- What is the breakup of the market based on the end use?

- Which is the most attractive end use in the market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global downstream processing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the downstream processing industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)