Down and Feather Market Size, Share, Trends and Forecast by Origin, Application, and Region, 2025-2033

Down and Feather Market Size and Share:

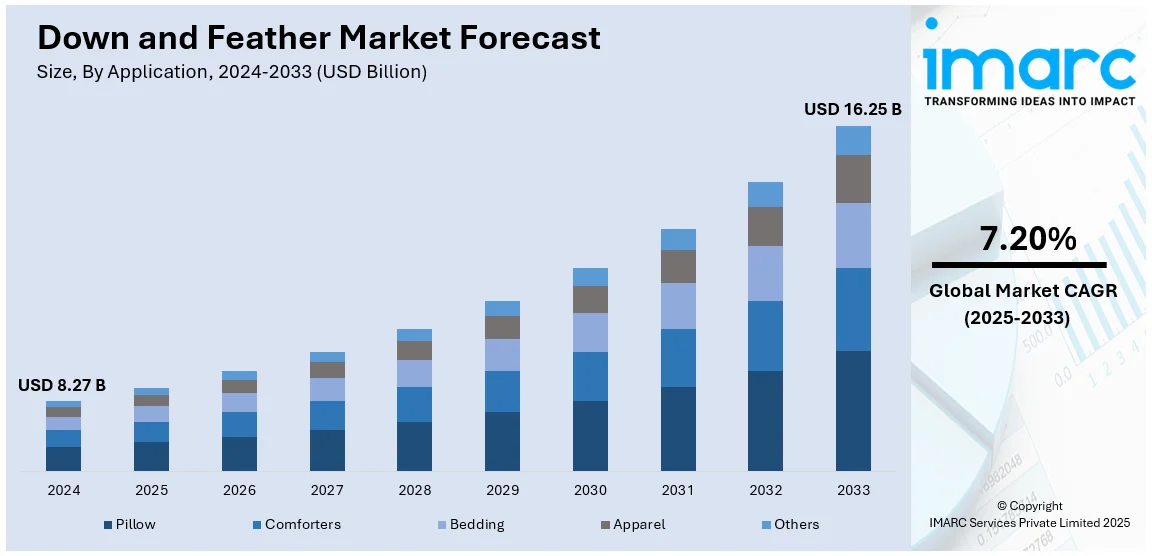

The global down and feather market size was valued at USD 8.27 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.25 Billion by 2033, exhibiting a CAGR of 7.20% from 2025-2033. Asia Pacific currently dominates the market share. The market is primarily driven by an ongoing shift toward sustainability with practices like RDS-certified sourcing and recycled down, significant advancements in insulation technologies enhancing performance and durability, and the rise of luxury down apparel blending functionality with modern fashion trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.27 Billion |

| Market Forecast in 2033 | USD 16.25 Billion |

| Market Growth Rate (2025-2033) | 7.20% |

The global market is majorly driven by the augmenting consumer demand for high-performance insulation materials across various sectors. In line with this, the rising popularity of lightweight, durable, and sustainable bedding products, including comforters, pillows, and duvets, fuels market growth. Additionally, growing disposable incomes and shifting lifestyles are encouraging consumers to invest in premium-quality down and feather-based products. Moreover, the emerging trend toward outdoor and adventure activities further boosts demand for insulated gear like jackets and sleeping bags. A notable development is the November 22, 2024, launch of a 99% biodegradable down jacket by ALLIED Feather + Down, Active Apparel Group, and Templa, which won the 2024 ISPO Award. The jacket will fully biodegrade in approximately five years when placed in an anaerobic environment. Moreover, rising consumer interest in eco-friendly, ethically sourced materials is accelerating, along with advancements in processing technologies that enhance product quality.

The United States stands out as a key reginal market, primarily propelled by the growing consumer demand for premium bedding and outdoor apparel products. Similarly, consumers are increasingly seeking comfort, warmth, and breathability in home textiles like comforters, pillows, and duvets, which augments market growth. Additionally, the expanding outdoor and sports industry, especially winter gear such as jackets and sleeping bags, contributes significantly to the demand for down insulation. The 2024 BEA’s Outdoor Recreation Satellite Account reveals that outdoor recreation generated USD 1.2 Trillion in economic output in 2023, accounting for 2.3% of U.S. GDP, and supporting 5 million jobs. The sector’s growth outpaced the U.S. economy, with outdoor recreation real GDP growing 3.6%, and jobs increasing by 3.3%, compared to the broader economy's growth of 2.9% and 1.8%, respectively. Besides this, the ongoing shift towards sustainability, including ethically sourced and recycled down, is gaining traction as environmentally conscious consumers prioritize eco-friendly choices.

Down and Feather Market Trends:

Sustainable Down Sourcing and Ethical Practices

The down and feather market is increasingly driven by sustainability, reflecting a growing consumer preference for ethically sourced and environmentally responsible products. Manufacturers are adopting certified practices like the Responsible Down Standard (RDS) and Global Traceable Down Standard (GTDS), ensuring humane treatment of animals in the sourcing process. Additionally, the use of recycled down, derived from the food industry, is gaining popularity as a means to reduce waste and mitigate environmental impact. A significant example of this trend is H&M’s announcement on October 10, 2024, to phase out new down feathers by 2025, instead sourcing exclusively post-consumer recycled down and feathers. Currently, 90% of H&M's down products are already recycled. This decision aligns with H&M’s sustainability goals and follows a PETA campaign advocating for more animal-free alternatives, highlighting the shift toward eco-friendly and responsible practices across the industry.

Ongoing Innovation in Down Insulation Technologies

Technological advancements in down insulation are revolutionizing the market by enhancing the performance, versatility, and sustainability of down-filled products. Manufacturers are developing innovative treatments to improve moisture resistance, loft retention, and durability, addressing traditional challenges such as down’s reduced insulating properties when wet. Notably, the ExpeDRY ultra-dry down insulation, introduced by ALLIED Feather + Down on November 26, 2024, which uses gold particles to prevent water vapor condensation. This technology provides superior performance, faster drying, and eliminates the need for harmful chemicals like PFAS. It also aligns with sustainability goals. Water-resistant down, using advanced coatings to protect down clusters from moisture, is becoming increasingly popular. These innovations are expanding down’s use in outdoor apparel and gear, particularly for extreme weather conditions, driving growth in the market for high-performance, weather-resistant products.

Growth of Luxury and Fashion-Forward Down Apparel

The rising popularity of luxury down apparel among the masses is transforming the down and feather market, driven by the consumer demand for high-quality, fashionable outerwear that merges aesthetics with performance. Leading brands are collaborating with designers to produce down-filled jackets and coats that offer superior insulation while aligning with modern fashion trends. This combination of outdoor functionality and urban style broadened the appeal of down apparel, attracting a wider audience beyond traditional outdoor enthusiasts. Stylish parkas, tailored coats, and lightweight puffers are becoming increasingly popular among affluent consumers seeking versatile, functional fashion. For instance, on October 9, 2024, Moose Knuckles, a Canadian luxury outerwear brand, formed a strategic partnership with Bosideng, China’s top-down apparel company, and received financial backing from Cathay Capital. This partnership aims to accelerate Moose Knuckles' global expansion, especially in Asia, blending Canadian craftsmanship with innovative fashion, further driving market growth.

Down and Feather Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global down and feather market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on origin, and application.

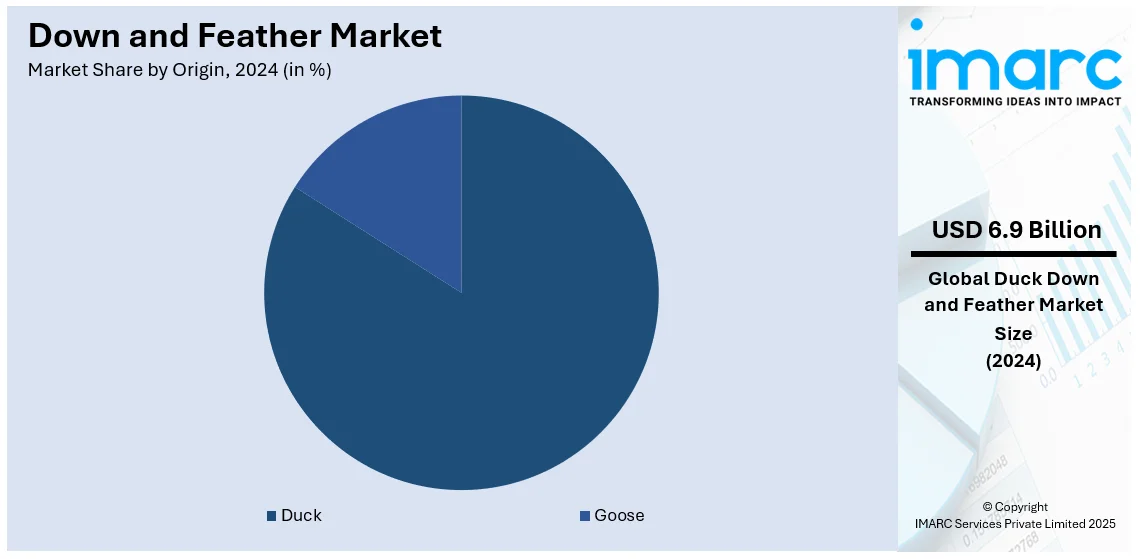

Analysis by Origin:

- Duck

- Goose

Duck leads the market with around 83.7% of market share in 2024 due to their abundant availability and cost-effectiveness compared to geese. Ducks are more widely farmed across the globe, particularly in regions like China and Eastern Europe, making their down more accessible and affordable. Additionally, duck down is lighter and provides a good balance of warmth as well as insulation. Goose down is often considered superior in terms of loft and warmth, whereas duck down is still widely used for its adequate performance and lower price point. As a result, the extensive supply of duck down continues to drive its dominance in the market.

Analysis by Application:

- Pillow

- Comforters

- Bedding

- Apparel

- Others

Pillows dominate the market share, which can be attributed to their high consumer demand, particularly in the bedding sector. Down and feather-filled pillows offer superior comfort, support, and breathability, making them highly desirable for sleep products. The natural insulation properties of down provide a soft and luxurious feel, while feathers offer additional support, making them ideal for various sleep positions. As consumers prioritize comfort and quality sleep, down and feather pillows remain a preferred choice. Additionally, the growing interest in premium bedding products, driven by rising disposable incomes and an increasing awareness of sleep health, further supports the strong market presence of down and feather pillows. This consistent demand fuels market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, Asia Pacific accounted for the largest market share driven by its substantial manufacturing base, particularly in China, India, and Japan. These countries are key producers of down and feather-based products, including bedding and apparel, driven by both robust domestic demand and significant global exports. The growing middle class in the region increasingly invests in premium bedding products and outdoor gear, influencing to the market expansion. A white paper by the China Feather and Down Industrial Association and LUXE.CO reports that China accounts for 70-80% of global down production, export, and consumption. Nearly 40% of consumers consider down apparel essential for winter, with 80% of medium and high-income individuals preferring goose down for warmth. Additionally, significant advancements in down processing technologies and a focus on sustainability reinforce Asia Pacific’s market dominance.

Key Regional Takeaways:

United States Down and Feather Market Analysis

In 2024, the United States represented 78.60% of the share in North America down and feather market, driven by rising consumer demand for premium bedding and outdoor products. Down-filled items such as comforters, pillows, jackets, and sleeping bags are favored for their exceptional insulation properties and comfort. The growing outdoor recreational sector, particularly winter sports, increases the demand for high-performance down insulation. Advancements in sustainable and ethically sourced down, like the Responsible Down Standard (RDS), have further fueled growth, with environmentally conscious consumers seeking transparency. Additionally, the launch of ThermaLoop™ insulation by UNIFI, Inc. on August 20, 2024, offers a sustainable alternative to traditional down. ThermaLoop™ is available in down-like fiber, fiberball, and padding forms. Made from 100% recycled polyester, ThermaLoop™ provides high thermal efficiency, fast-drying features, and is traceable with FiberPrint® technology. UNIFI's efforts align with their goal to recycle 1.5 billion T-shirts worth of textile waste by 2030. The inflating disposable incomes and preference for premium goods also boosts demand for luxury down-filled items. The U.S. market is expected to continue expanding, driven by eco-friendly innovations and sustainable down alternatives in bedding and outdoor gear.

Europe Down and Feather Market Analysis

Europe remains a key market for down and feather products, driven by demand for luxury and functional apparel, particularly winter clothing. Countries like Germany, France, the UK, and Italy lead in consuming high-quality down-filled jackets, outerwear, and bedding, prized for their lightweight warmth. Eco-conscious consumer behavior shapes the market, with increasing demand for sustainably sourced down, recycled materials, and certifications. Europe’s focus on sustainable fashion and energy-efficient products bolsters demand for eco-friendly alternatives and responsibly sourced down. To illustrate, on 18 November 2024, END. and Timberland launched their “Down Filled” collection, reimagining the Euro Hiker boot with synthetic down-filled panels and a durable Vibram sole. The collection also featured a nylon windbreaker and pants with vintage-inspired co-branding. With strong environmental policies and a preference for premium, ethically produced goods, the European down and feather market continues to grow, supported by advancements in sustainable practices and design innovation.

Asia Pacific Down and Feather Market Analysis

Asia Pacific leads the global down and feather market, with China as the largest producer, exporter, and consumer. The region benefits from a sizable manufacturing base and growing domestic demand for bedding products and outerwear. China’s prominence stems from its production of high-quality down comforters, pillows, and jackets. For instance, on December 20, 2024, it was reported that Qiaoxu Township in Guangxi processes 90,000 tonnes of feathers and down annually, accounting for 28% of China's and 18% of global production. The township, with 150 enterprises and 30,000 employees, generates an annual output of 2.3 Billion Yuan, supported by advanced processing and robust exports. Growing disposable incomes, rising outdoor activities, and a focus on premium products fuel demand for down insulation. Notably, on July 9, 2024, Anta Sports launched the ANTA GUANJUN POLAR SUMMIT DOWN JACKET, blends high performance and sustainability. It features recycled nylon, Dermizax waterproof fabric, and 350g 90/10 goose down for extreme cold protection, with a design optimized for Asian ergonomics. Asia’s cost-effective manufacturing and sustainability trends further propel market growth.

Latin America Down and Feather Market Analysis

The Latin American market is experiencing steady growth, impelled by the augmenting demand for down insulation in apparel, bedding, and outdoor products. As the middle-class population grows in Brazil, Argentina, and Mexico, the inflating disposable income levels are fueling demand for premium down-filled items, including jackets, insulated outerwear, and bedding. Colder winters in southern regions further boost the popularity of down jackets and comforters. Though smaller than markets in North America or Europe, the Latin American market is expanding due to rising consumer awareness about sustainability and ethical sourcing. The trend toward high-quality, performance-oriented products, alongside increased environmental consciousness, is expected to drive further growth in the region, with local manufacturers adapting to these changing consumer preferences.

Middle East and Africa Down and Feather Market Analysis

The Middle East and Africa (MEA) region represents an emerging market for down and feather products, driven by affluent populations in the UAE, Saudi Arabia, South Africa, and Morocco. Demand is growing for premium bedding and outerwear, fueled by rising affluence, a youthful population, and expanding tourism. As per an industry report, in the GCC, over 50% of the youth population is under 25, driving innovation and sustainability trends. While cultural preferences for traditional materials may limit adoption, luxury consumers increasingly favor down-filled apparel. Sustainable sourcing and alternatives are shaping eco-conscious demand, while ongoing economic growth supports the future expansion of the market.

Competitive Landscape:

The market is highly competitive, with manufacturers focusing on product innovation, supply chain efficiency, and sustainability. Smaller regional players emphasize affordability and locally sourced products, while global brands target premium markets with strategies highlighting sustainability and ethical sourcing. Companies are adopting technologies like automated sorting and advanced cleaning to improve product quality, while innovating down blends and lightweight designs for sportswear and extreme weather gear. Collaborations between manufacturers, retailers, and organizations are increasing, leading to exclusive product lines that cater to niche audiences. Notably, on October 7, 2024, the International Down-Market Committee (IDMC) was launched by the China Feather and Down Industrial Association (CFDIA), supported by global organizations like EDFA and ADFC, to combat fraud and ensure authenticity. Direct-to-consumer models as well as e-commerce platforms are reshaping industry dynamics and consumer engagement.

The report provides a comprehensive analysis of the competitive landscape in the down and feather market with detailed profiles of all major companies, including:

- Prauden

- Allied Feather & Down Corp.

- Feather Industries

- United Feather & Down

- Norfolk Feather Company

- Down-Lite International, Inc.

- Hanskruchen Down Design e.K

- Heinrich Häussling GmbH & Co.

- Kwong Lung Group

- Moonlight Feather

- Down-Lite International, Inc.

Latest News and Developments:

- April 19, 2024: HeiQ unveiled its innovative HeiQ Fresh for Feather & Down, a 100% biobased anti-odor technology. Using synbiotics (pre- and probiotics), it eliminates persistent malodors caused by natural oils in feathers. Showcased at Techtextil 2024, this breakthrough removes a major barrier to purchasing feather and down products, enhancing appeal for consumers and manufacturers alike.

- September 23, 2024: YAYA Down Jacket showcased its Black Label Goose collection at Milan Fashion Week, featuring premium Siberian goose down renowned for its warmth and quality. Highlighting global collaborations, including a 2023 partnership with Iceland for eiderdown, YAYA exemplifies the shift from "Made in China" to "Created in China," advancing Chinese brands in the high-end global market.

- November 1, 2024: Canadian Down & Feather Company announced a partnership with Aeroplan for a points multiplier event. From November 4-17, 2024, Aeroplan members can earn 20x points on all purchases through the Aeroplan E-store. This promotion highlights CDFC’s ethically sourced, premium bedding products, aligning with consumers’ comfort and luxury preferences while offering exclusive rewards for Aeroplan members.

- December 3, 2024: GUVET held an event in Budapest, announcing its partnership with FBZ Hungaria Ltd and earning five WRCA world record certifications. The brand launched its global journey, showcasing elite Hungarian goose down and innovative technologies. With 161 patents and a focus on quality and sustainability, GUVET aims to lead the premium goose down jacket market worldwide.

Down and Feather Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Origins Covered | Duck, Goose |

| Applications Covered | Pillow, Comforters, Bedding, Apparel, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Prauden, Allied Feather & Down Corp., Feather Industries, United Feather & Down, Norfolk Feather Company, Down-Lite International, Inc., Hanskruchen Down Design e.K, Heinrich Häussling GmbH & Co., Kwong Lung Group, Moonlight Feather, Down-Lite International, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the down and feather market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global down and feather market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the down and feather industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The down and feather market was valued at USD 8.27 Billion in 2024.

The down and feather market is projected to exhibit a CAGR of 7.20% during 2025-2033, reaching a value of USD 16.25 Billion by 2033.

The market is driven by rising consumer demand for high-performance insulation materials, sustainable and ethically sourced products, advancements in down insulation technologies, growing popularity of premium bedding and outdoor gear, and increasing disposable incomes that encourage investment in high-quality down-based products.

Asia Pacific dominates the down and feather market, fueled by its vast manufacturing base, robust domestic demand, and significant global exports.

Some of the major players in the down and feather market include Prauden, Allied Feather & Down Corp., Feather Industries, United Feather & Down, Norfolk Feather Company, Down-Lite International, Inc., Hanskruchen Down Design e.K, Heinrich Häussling GmbH & Co., Kwong Lung Group, Moonlight Feather, and Down-Lite International, Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)