Dosing Pump Market Size, Share, Trends and Forecast by Type, Flow Rate, End User, and Region, 2025-2033

Dosing Pump Market Size and Share:

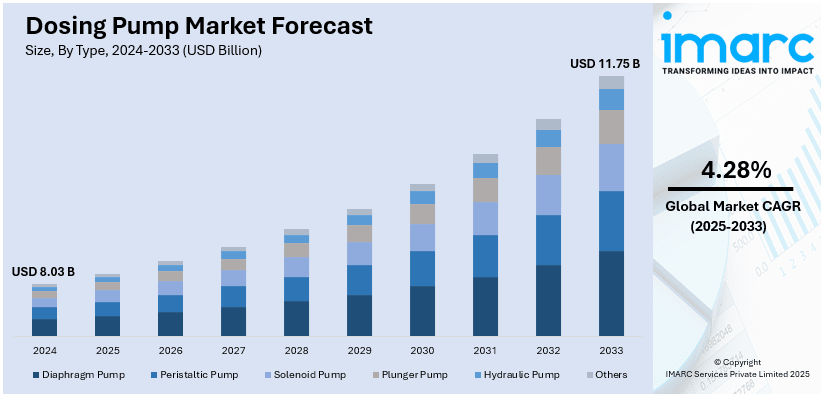

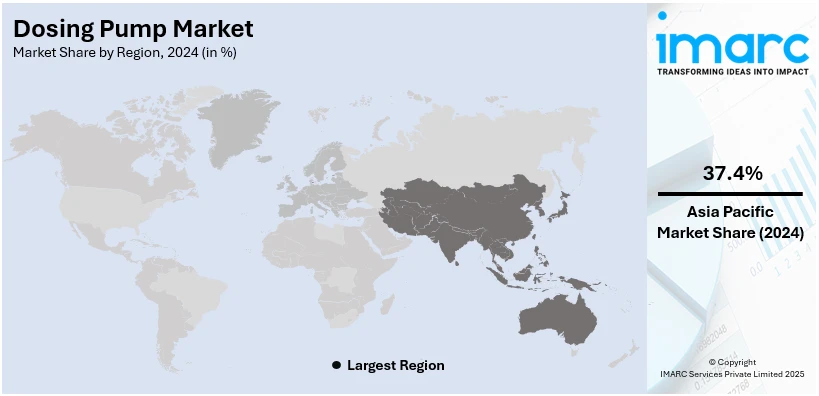

The global dosing pump market size was valued at USD 8.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.75 Billion by 2033, exhibiting a CAGR of 4.28% from 2025-2033. Asia Pacific currently dominates the dosing pump market share by holding over 37.4% in 2024. The market is expanding due to growing urbanization-driven water management projects, surging demand for energy-efficient systems, implementation of various government initiatives, rapid growth in textile and pulp & paper industries, and increasing reliance on precision dosing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.03 Billion |

| Market Forecast in 2033 | USD 11.75 Billion |

| Market Growth Rate (2025-2033) | 4.28% |

The global dosing pump market demand is primarily driven by the rising water and wastewater treatment needs, as industries and municipalities focus on sustainable water management. In addition to this, the expanding chemical and pharmaceutical sectors require precise dosing solutions for manufacturing and research applications, which is aiding the market growth. Moreover, the growing demand in the oil & gas industry for chemical injection processes boosts adoption, providing an impetus to the market. Besides this, ongoing advancements in automation and smart dosing technologies enhance efficiency and accuracy, contributing to the market expansion. For instance, Honeywell International's acquisition of pump-and-compressor maker Sundyne for approximately $2.2 billion aims to bolster its offerings in critical equipment and automation systems. Furthermore, strict environmental regulations drive industries to adopt dosing pumps for controlled chemical usage, thus impelling the market growth.

The United States holds a significant share of 86.20% in the dosing pump market. The demand in the region is driven by the rising adoption of bio-based chemicals in industries like agriculture and manufacturing. In line with this, the growth in the food and beverage (F&B) sector fuels the need for accurate ingredient dosing and sanitation processes, supporting the market demand. Concurrently, the increasing pharmaceutical research and development (R&D) investments in drug formulation is acting as another growth-inducing factor. Additionally, the expansion of shale gas and petrochemical industries boosts chemical injection applications, impelling the market growth. Furthermore, stringent workplace safety regulations encourage automation in hazardous chemical handling, which is boosting the market demand. Apart from this, continuous advancements in energy-efficient pump technologies support sustainability initiatives, thereby propelling the market forward.

Dosing Pump Market Trends:

Environmental and safety compliance

The increasing demand for dosing pumps due to stringent environmental and safety regulations across various industries is influencing the dosing pump market trends. Governing agencies of several countries worldwide are imposing strict guidelines on chemical handling, especially in water treatment, wastewater management, and industrial processes. CPCB norms for sewage treatment plants (STPs) prescribe limits of pollutants in treated water, i.e., BOD (Biochemical Oxygen Demand) is not to exceed 10 mg/L, TSS (Total Suspended Solids) not to exceed 20 mg/L, pH 6.5-8.5, and nitrogen and phosphorus are regulated to avoid eutrophication, making discharge or reuse safe. Dosing pumps play a crucial role in achieving precise chemical dosing, ensuring compliance with these regulations. They help control chemical usage, reduce waste, and minimize the environmental impact of industrial operations. As a result, industries, such as water treatment, pharmaceuticals, and food processing, are adopting dosing pumps to meet compliance standards. This, in turn, is catalyzing the demand for dosing pump as companies strive to maintain regulatory compliance while optimizing their processes.

Increasing emphasis on water treatment and quality

The growing concerns about water quality and the need for effective water treatment solutions among the masses are catalyzing the dosing pump market share. The 2024 UN update reports that 4.8 billion individuals could be impacted by water quality and monitoring issues or threats to livelihoods and health by 2030 if not addressed. Globally, the "good" status of water bodies declined from 57% in 2017 to 56% in 2023. Water treatment facilities, both municipal and industrial, rely heavily on dosing pumps to precisely inject chemicals like disinfectants, coagulants, and pH adjusters into the water treatment process. This precise dosing is essential to ensure safe and clean drinking water and to meet regulatory standards for effluent discharge. Additionally, industries, such as power generation, chemicals, and mining, require water treatment processes for their operations, further contributing to the growth of the market. As the world is facing challenges related to water scarcity and contamination, dosing pumps play a critical role in maintaining water quality, making them indispensable components of water treatment systems.

Rapid industrialization

The ongoing trend of industrialization, coupled with the increasing adoption of process automation, is bolstering the dosing pump market growth. Economic Survey 2023-24 reports a 9.5% growth in India's industry. Manufacturing spearheaded a 5.2% decade-on-decade annual growth, accounting for 14.3% of GVA and 35.2% of output during FY23. Approximately 47.5% of the total value of output is consumed as inputs, and 50% of this comes from manufacturing. The rising demand for dosing pumps in industries, such as manufacturing, petrochemicals, and agriculture, is offering a favorable market outlook. These industries require precise and consistent dosing of chemicals and fluids to optimize their production processes and ensure product quality. Dosing pumps offer a reliable and automated solution for accurately delivering chemicals, reducing manual labor, and minimizing the risk of errors. As industries are investing in automation to enhance efficiency and productivity, the demand for dosing pumps as integral components of automated systems is growing.

Thriving healthcare and pharmaceuticals industries

According to reports, the global pharmaceutical industry created 74.9 million jobs, of which 7.8 million were directly employed. It contributed USD 2,295 Billion to world GDP, of which R&D contributed USD 227 Billion, 30% of direct contribution to GDP. Dosing pumps are crucial in pharmaceutical manufacturing, where precise dosing of active pharmaceutical ingredients (APIs) and additives is essential for drug formulation. These pumps ensure consistent and accurate dosage, helping pharmaceutical companies meet strict quality and safety standards. Moreover, the healthcare sector relies on dosing pumps for applications, such as intravenous (IV) drug delivery in hospitals and healthcare facilities. The rising demand for dosing pumps in healthcare applications, particularly with the need for reliable infusion systems and patient-specific medication dosing, is propelling the market growth. In addition, the increasing focus on precision and quality in medication delivery and pharmaceutical production processes is enhancing the dosing pump market outlook.

Dosing Pump Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dosing pump market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, flow rate, and end user.

Analysis by Type:

- Diaphragm Pump

- Peristaltic Pump

- Solenoid Pump

- Plunger Pump

- Hydraulic Pump

- Others

Diaphragm pump stands as the largest type in 2024, holding around 44.2% of the market. These pumps are known for their exceptional precision and reliability, making them a popular choice in industries requiring accurate chemical dosing, such as water treatment and pharmaceuticals. In addition to this, the rising demand for diaphragm pumps due to their ability to handle a wide range of chemicals and resistance to corrosion is impelling the market growth. Furthermore, diaphragm pumps are valued for their ability to prevent leakage and contamination, making them ideal for applications where safety and product purity are paramount.

Analysis by Flow Rate:

- Upto 50 (L/min)

- 51 to 100 (L/min)

- More Than 100 (L/min)

Upto 50 (L/min) leads the market with a significant market share in 2024. Dosing pumps with a flow rate of up to 50 liters per minute are commonly used in applications where precision dosing is essential, but lower flow rates suffice. This segment caters to a wide range of industries, including water treatment, agriculture, and food processing, where controlled chemical injection and accurate dosing are critical. Apart from this, dosing pumps in this category are favored for their ability to handle smaller volumes of chemicals with precision, making them ideal for tasks like pH control, disinfection, and nutrient addition.

Analysis by End User:

- Oil and Gas

- Water and Wastewater

- Pharmaceuticals

- Chemicals

- Others

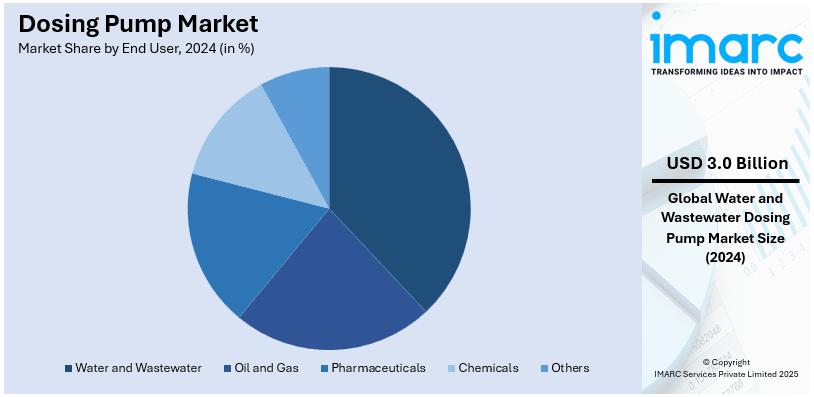

Water and wastewater lead the market with around 37.6% of market share in 2024. This treatment industry relies extensively on dosing pumps to ensure clean and safe water supplies. These pumps are used for the accurate dosing of chemicals, such as chlorine, coagulants, and pH adjusters, to treat drinking water, municipal wastewater, and industrial effluents. Moreover, the need for stringent water quality standards and the increasing emphasis on environmental protection are driving the demand for dosing pumps in this segment. Besides this, dosing pumps help in disinfection, flocculation, and chemical precipitation processes, making them indispensable for water and wastewater treatment facilities worldwide.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 37.4%. The demand in the region is driven by rapid industrialization, urbanization, and infrastructure development. In line with this, the expanding water and wastewater treatment sector fuels demand as governments implement stricter environmental policies. Additionally, growth in pharmaceuticals and specialty chemicals further boosts the need for precision dosing. Rising investments in oil & gas and power generation are also enhancing the market expansion. Additionally, ongoing advancements in automation and smart dosing technologies improve efficiency across industries. Furthermore, the growing F&B sector requires accurate dosing for processing and sanitation. Besides this, increasing government initiatives supporting industrial upgrades further strengthen Asia-Pacific’s dominance in the dosing pump market.

Key Regional Takeaways:

North America Dosing Pump Market Analysis

The North America dosing pump market is experiencing steady growth, driven by stringent environmental regulations promoting advanced water and wastewater treatment solutions. The expanding pharmaceutical and biotechnology industries require precise dosing for drug formulation and laboratory applications. Moreover, growth in the F&B sector boosts demand for accurate ingredient dosing and sanitation. Also, the increasing oil & gas exploration and refining activities, particularly in the U.S., fuel chemical injection applications. Additionally, technological advancements in smart dosing systems enhance efficiency and remote monitoring. For instance, settlements, such as Becton Dickinson's agreement to pay a $175 million civil penalty over infusion pump risks, underscore the importance of compliance and risk management in the dosing pump industry. This emphasis on safety and regulatory adherence is encouraging manufacturers to develop more reliable, high-performance dosing solutions, further strengthening market share. Apart from this, the rising investments in industrial automation drive the market expansion, positioning North America as a key player in the global dosing pump industry.

United States Dosing Pump Market Analysis

The United States dosing pump market is mainly influenced by growing demand in water treatment, chemicals, pharmaceuticals, and food processing sectors. Technological advancements, including the growth of smart dosing pumps and automation, are fueling market growth. One of the most important drivers of this growth is the increased demand for accurate chemical dosing, especially in water and wastewater treatment processes, where accurate chemical injection is essential to ensure water quality. In addition, environmental regulations and the need for energy-efficient equipment are promoting the use of advanced dosing pumps. For example, the Biden-Harris Administration's finalized drinking water standard for PFAS safeguards 100 million individuals, with standards for PFAS such as PFOA and PFOS at 4 parts per trillion and PFNA, PFHxS, and GenX at 10 parts per trillion. EPA is spending USD 1 Billion via the Bipartisan Infrastructure Law in supporting states implementing PFAS treatment and testing as part of USD 9 Billion spent to end PFAS pollution. These investments will create a demand for next-generation water treatment systems. With a solid manufacturing and distribution infrastructure, demand for dosing pumps should expand alongside the larger trend toward greener and more efficient industrial practices.

Europe Dosing Pump Market Analysis

In Europe, the market is witnessing significant growth, led by emphasis on sustainable industrial practices and mounting regulatory pressure to ensure proper chemical dosing. The water treatment industry, which is a notable user of dosing pumps, is growing with mounting concern over water scarcity and the need for efficient wastewater management. Germany, France, and the UK are the market leaders in these countries, owing to their established industrial base and continued investment in smart infrastructure. I Squared's USD 200 Million investment in Aurora Utilities on July 30, 2024, to develop the UK's smart grid infrastructure reflects the focus of the region on modernization. The intelligent grid framework will host solutions such as EV charging stations, battery storage facilities, and industry electrification according to the decarbonization requirements of the UK. Europe's stringent environmental regulation, including REACH and the Wastewater Framework Directive, is compelling the industries to increase the use of eco-friendly, accurate dosing solutions. Increasing automation in areas such as pharma and chemical industries also influences demand. Technological advancements in dosing pump technology, such as IoT connectivity and energy efficiency, are also driving market growth.

Asia Pacific Dosing Pump Market Analysis

The Asia Pacific dosing pump market is also growing very quickly, driven by thriving industries in China, India, and Japan. Increasing urbanization, especially in India, where it has been estimated that more than 40% of the population will be residing in urban centers by 2030, as per NITI Aayog's reports, is driving demand for effective water treatment systems. In addition, increased concern for environmental sustainability is encouraging sectors such as oil and gas, chemicals, and food processing to implement accurate chemical dosing. India is beset with water issues, and Yale University's 2022 unsafe drinking water index ranks India 141st among 180 countries, and almost 70% of India's water is polluted. India's water demand will be doubled by 2030, as documented in the Interconnected Disaster Risks Report (October 2023). Efficient usage is augmented through technological development such as smart dosing systems, while economical production facilitates massive take-up through dosing pumps. Continued spending on infrastructure and industry automation are pushing the region's market even higher, and the Asia Pacific market continues to expect future growth.

Latin America Dosing Pump Market Analysis

The Latin American market is expanding with the increasing demand for industrial automation, water treatment, and agriculture. The shortage of water and water pollution concerns, highlighted by the World Bank, are driving the need for efficient water treatment technologies and, therefore, market growth. Approximately 150 million of the region's residents live in water-scarce regions, and Brazil, Mexico, and Argentina have multi-year droughts that impact drinking water, irrigation, and hydropower. With the growth of agricultural, mining, and chemical industries, there is greater need for precise chemical dosing systems to increase process efficiency and reduce environmental footprints. The tightening regulatory regime in the region and growing demand for pharmaceuticals also propel the use of state-of-the-art dosing pump technology for compliance and healthcare needs.

Middle East and Africa Dosing Pump Market Analysis

The Middle East and Africa dosing pump market is growing consistently, driven by the requirements of water treatment, oil and gas production, and chemical processing. Water scarcity issues faced by nations such as Saudi Arabia, UAE, and South Africa are propelling investments into water treatment infrastructure, which boosts dosing pump demand. The oil and gas industry also plays a major role, as dosing pumps play a critical role in chemical injection during production. Five of the globe's leading oil producers are situated in the Middle East, according to the IEA, which are Saudi Arabia, Iraq, the UAE, Iran, and Kuwait. Other main natural gas producers include Iran, Qatar, and the UAE. As the industry puts more emphasis on industrial automation as well as sustainability, there will be more need for the more advanced energy-saving dosing pumps, causing this market to further grow with developing industries.

Competitive Landscape:

Market players in the global dosing pump industry are actively engaging in technological innovations, focusing on energy-efficient and smart dosing solutions integrated with IoT and automation for real-time monitoring and control. Strategic mergers and acquisitions are increasing, with companies expanding their product portfolios and market reach. Sustainability initiatives are driving the development of eco-friendly, low-emission pumps to meet stringent environmental regulations. Moreover, rising investments in R&D are leading to enhanced precision and durability in pump systems. Additionally, regional expansions into emerging markets are a key strategy, catering to the growing demand in industries like water treatment, pharmaceuticals, and chemicals. Customization and modular designs are also gaining traction, allowing for industry-specific solutions and improved operational efficiency.

The report provides a comprehensive analysis of the competitive landscape in the dosing pump market with detailed profiles of all major companies, including:

- Aqua Industrial Group

- Blue-White Industries Ltd

- Diener Precision Pumps

- Emec S.r.l.

- Etatron D.S. Spa

- Grundfos Holding A/S

- KNAUER Wissenschaftliche Geräte GmbH

- Longer Precision Pump Co. Ltd. (The Halma Group)

- NETZSCH Pumps & Systems

- Nikkiso Co Ltd

- ProMinent Group

- SEKO S.p.A.

- SPX Flow

- Verder Liquid B.V.

Latest News and Developments:

- February 2025: Aptar Beauty launched HDP, an all-plastic, high-dose dispensing pump for personal care formulations, in North America. Engineered to dispense 3.5 cc per stroke, it is ideal for body, baby, and hair care. HDP features a recyclable design with a metal-free spring, e-commerce capability, and the shortest stack height in the high-dose market (15 mm). Customizable and sustainable, HDP enhances product compatibility, visibility, and transport safety.

- September 2024: Embecta announced FDA clearance for its disposable insulin delivery system. The tubeless patch pump, designed for adults with Type 1 and Type 2 diabetes, features a 300-unit insulin reservoir tailored to the needs of those with Type 2 diabetes, who require higher daily doses. The system includes a Bluetooth-enabled controller and aims to simplify insulin management. Future developments include a closed-loop version.

- June 2024: Hydraulic Technologies, Inc. released the PE60 Series hydraulic pump. The new pump offers enhanced control, auto-cycle functionality, longer runtime, and customizable "plug and play" accessories. It is designed for high-pressure bolting tool applications in sectors like power generation and construction. Features include an improved hand control pendant for reduced operator fatigue, LCD models with diagnostic data, and easy installation of accessories like oil coolers.

- May 2024: Xeris Biopharma unveiled an exclusive global partnership with Beta Bionics to create a glucagon product based on Xeris' XeriSol technology for application in Beta Bionics' bi-hormonal pump devices. The collaboration is intended to accelerate dual-hormone pumps for diabetes care, with glucagon being supplied in the pumps by Xeris. It stands to receive development payments and royalties.

- April 2024: Xylem launched the Jabsco PureFlo 21 single-use diaphragm pump, which boasts a pressure relief valve that is adjustable for greater safety and low fluid contamination. The pump is specifically designed for environmentally friendly pharma production and uses 40% less material, with low pulsation and five pumping chambers. It meets European and UK regulations as well as GMP requirements.

- April 2024: Baxter announced FDA clearance for its Novum IQ large volume infusion pump (LVP) and Dose IQ Safety Software. This advancement integrates large volume and syringe infusion pumps with shared digital health solutions, improving patient safety and clinician efficiency. The platform aims to enhance care delivery through a common interface and streamlined training.

Dosing Pump Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Diaphragm Pump, Peristaltic Pump, Solenoid Pump, Plunger Pump, Hydraulic Pump, Others |

| Flow Rates Covered | Upto 50 (L/Min), 51 To 100 (L/Min), More Than 100 (L/Min) |

| End Users Covered | Oil and Gas, Water and Wastewater, Pharmaceuticals, Chemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aqua Industrial Group, Blue-White Industries Ltd, Diener Precision Pumps, Emec S.r.l., Etatron D.S. Spa, Grundfos Holding A/S, KNAUER Wissenschaftliche Geräte GmbH, Longer Precision Pump Co. Ltd. (The Halma Group), NETZSCH Pumps & Systems, Nikkiso Co Ltd, ProMinent Group, SEKO S.p.A., SPX Flow, Verder Liquid B.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dosing pump market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dosing pump market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dosing pump industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dosing pump market was valued at USD 8.03 Billion in 2024.

IMARC estimates the dosing pump market to exhibit a CAGR of 4.28% during 2025-2033, expecting to reach USD 11.75 Billion by 2033.

The dosing pump market is driven by rising demand for water treatment, industrial expansion, growing chemical, pharmaceutical, and food industries, increased investments in oil & gas and power generation, and continuous advancements in pump technology for precision chemical dosing.

Asia Pacific currently dominates the market, accounting for a share exceeding 37.4% in 2024. This dominance is fueled by the growing demand in water treatment, rapid industrialization, expanding chemical, pharmaceutical, oil & gas, power generation, and food processing industries, and increasing infrastructure investments.

Some of the major players in the dosing pump market include Aqua Industrial Group, Blue-White Industries Ltd, Diener Precision Pumps, Emec S.r.l., Etatron D.S. Spa, Grundfos Holding A/S, KNAUER Wissenschaftliche Geräte GmbH, Longer Precision Pump Co. Ltd. (The Halma Group), NETZSCH Pumps & Systems, Nikkiso Co Ltd, ProMinent Group, SEKO S.p.A., SPX Flow, Verder Liquid B.V., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)