Dolomite Mining Market Report by Type (Calcined, Sintered), Application (Construction, Agriculture, Animal Feed, Ceramics and Glass, Iron and Steel, Plastic, and Others), and Region 2025-2033

Dolomite Mining Market Size:

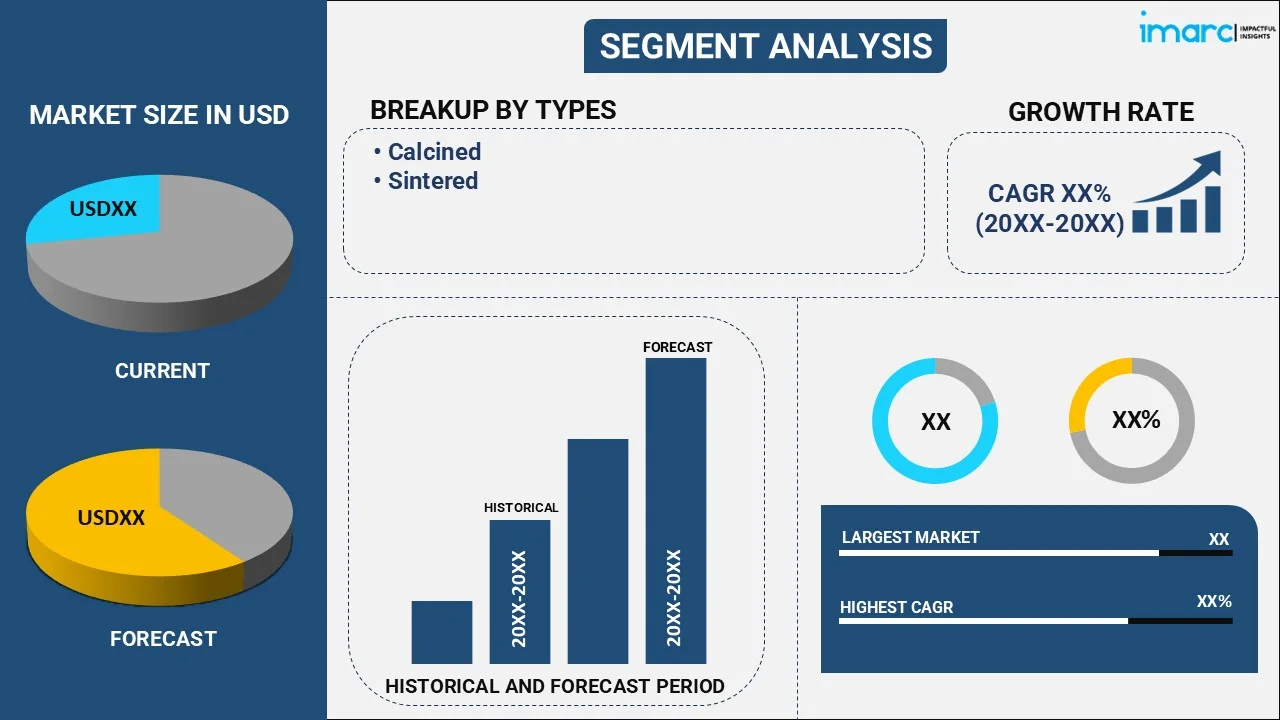

The global dolomite mining market size reached USD 16.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.4% during 2025-2033. The market is primarily driven by the growing demand from industries like construction, steel production and agriculture. Rapidly growing infrastructure projects across the world, particularly in emerging economies, and the gradual use of dolomite in soil conditioning and water treatment are also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.3 Billion |

| Market Forecast in 2033 | USD 22.6 Billion |

| Market Growth Rate 2025-2033 | 3.4% |

Dolomite Mining Market Analysis:

- Major Market Drivers: Key market drivers include the rising demand from construction industry where dolomite is an indispensable component in producing concrete and asphalt mixtures. In line with this, the steel industry also relies heavily on dolomite as a refractory material in the steel making processes. Agricultural applications also drive the market demand of dolomite mainly due to its soil conditioning properties which can further adjust the soil pH levels and enhance overall crop yields. Rapid urbanization and infrastructure development in the emerging economies further creates a positive outlook for the dolomite mining market growth.

- Key Market Trends: Key market trends include the growing focus on sustainable mining practices and environmental stewardship. Companies nowadays are increasingly investing in technologies which reduce environmental impact like water recycling and dust suppression systems. There is also a trend towards vertical integration among major players which ensures a consistent supply chain from mining to processing and distribution. In line with this, there is a growing focus on product diversification and customization in order to cater specific industrial applications. Furthermore, various strategic partnerships and collaborations to explore untapped reserves and expand market reach are becoming prevalent, thereby creating a positive outlook for dolomite mining market growth.

- Geographical Trends: Geographical trends in the market indicate varying patterns across regions. In North America, the market is driven by robust infrastructural development and the demand for dolomite in construction materials. Europe shows a steady growth trajectory, supported by increasing applications in steel production and agriculture. Meanwhile, Asia Pacific emerges as a significant player due to extensive dolomite reserves in countries like China and India, bolstered by rapid industrialization and infrastructure projects. In Latin America, growth is influenced by expanding mining activities in countries such as Brazil and Argentina, driven by agricultural and industrial applications.

- Competitive Landscape: Some of the major market players in the dolomite mining industry include Calcinor, Carmeuse, E. Dillon & Company, Essel Mining & Industries Limited (Aditya Birla Group), Imerys, JFE Mineral Co. Ltd. (JFE Steel), Lhoist, Omya AG, RHI Magnesita GmbH and Sibelco, among many others.

- Challenges and Opportunities: Market faces various challenges including environmental concerns related to quarrying and processing, requiring sustainable practices and regulatory compliance. Market volatility in mineral prices poses another challenge further affecting profitability. However, opportunities abound with increasing demand from industries such as construction, agriculture and steel production. Technological advancements in mining processes and equipment offer potential efficiency gains. Moreover, expanding applications in soil conditioners and magnesium production present avenues for dolomite mining market growth.

Dolomite Mining Market Trends:

Rapidly Growing Construction Industry

The growing construction industry is driving increased demand for dolomite as an aggregate in concrete and asphalt. Dolomite enhances the strength and durability of concrete, making it a preferred choice for construction projects. Its properties, such as resistance to weathering and abrasion, improve the quality of asphalt, ensuring longer-lasting road surfaces. The ongoing infrastructure development and urbanization across the globe are boosting the use of dolomite in construction materials, contributing to the overall growth of the dolomite mining market. According to the data published by the Invest India, the Indian construction industry is set to hit $1.4 trillion by 2025. Cities will drive 70% of India's GDP by 2030. The industry spans 250 sub-sectors with connections across various industries. By 2030, an estimated 600 million people will live in urban areas, the increasing demand for 25 million affordable homes. The government has allocated $1.4 trillion for infrastructure development, with substantial investments in renewable energy, roads, and urban infrastructure.

Rising Demand from Steel Industry

The rising use of dolomite in the steel industry as a flux agent is driven by its ability to remove impurities during the steelmaking process. Dolomite enhances the efficiency of steel production by improving slag formation, which helps in refining the metal. This results in higher quality steel and more efficient production, thereby contributing to the increased demand for dolomite in this sector. In June 2024, Essar Group confirmed a $4 billion investment in a green steel plant in Saudi Arabia. The steel project in Ras al-Khair will have a production capacity of 4 million tons per year and is expected to meet the domestic demand for steel in Saudi Arabia.

Rising Demand from Agriculture Sector

The increasing use of dolomite in agriculture as a soil conditioner and feed additive is driven by its ability to neutralize soil acidity, improving nutrient availability and promoting healthier plant growth. Dolomite supplies essential nutrients like calcium and magnesium, enhancing soil fertility and structure. As a feed additive, it provides livestock with necessary minerals, improving overall health and productivity. These benefits contribute to higher agricultural yields and better-quality produce, driving the demand for dolomite in farming practices. In Ausgust 2023, in Muramvya province, a project to distribute dolomite to farmers in Nyagisozi and Masango villages was launched. The initiative aims to combat soil acidity and increase agricultural productivity. The project, in collaboration with the ministry of agriculture, targets 38 communes in 14 provinces. The farmers were educated on the correct application of dolomite, and many expressed optimisms about the potential increase in their agricultural yields through the proper use of dolomite.

Dolomite Mining Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type and application.

Breakup by Type:

- Calcined

- Sintered

Sintered accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes calcined and sintered. According to the report, sintered represented the largest segment.

The dolomite mining market share is predominantly driven by the sintered dolomite segment, which holds the majority share. Sintered dolomite is widely valued for its superior properties, including high density, resistance to corrosion, and enhanced mechanical strength. These attributes make it an essential material in various industrial applications, such as refractory linings in steelmaking, cement production, and the glass industry. The growing demand for steel and construction materials, particularly in developing regions, significantly boosts the need for sintered dolomite. Consequently, its dominant position in the market is expected to strengthen further as industrial activities continue to expand globally.

Breakup by Application:

- Construction

- Agriculture

- Animal Feed

- Ceramics and Glass

- Iron and Steel

- Plastic

- Others

Construction holds the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction, agriculture, animal feed, ceramics and glass, iron and steel, plastic, and others. According to the report, construction accounted for the largest market share.

The construction sector dominates the dolomite mining industry, accounting for the largest market share. Dolomite's extensive use as an aggregate in concrete and asphalt mixtures, as well as in the production of cement, makes it indispensable for construction activities. Its properties, such as durability, hardness, and resistance to weathering, contribute to the strength and longevity of construction materials. Rapid urbanization and infrastructure development, especially in emerging economies, drive the demand for construction materials, thus boosting dolomite consumption. As construction projects proliferate globally, the reliance on dolomite as a key component is set to maintain its significant market share.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest dolomite mining market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for dolomite mining.

North America leads the dolomite mining market, accounting for the largest share due to its extensive industrial base and robust infrastructure development. The region's abundant dolomite reserves and advanced mining technologies ensure a steady supply to meet the high demand. Key industries, such as construction, steelmaking, and agriculture, heavily rely on dolomite for its beneficial properties. The U.S., in particular, drives the market with significant investments in construction and manufacturing sectors. In May 2024, the United States and Angola celebrated the signing of finance agreements for $1.3 billion infrastructure projects in the Lobito Corridor. These projects include clean power, radio connectivity, and transportation initiatives, showcasing a strong commitment to economic investment priorities. Additionally, stringent environmental regulations promote the use of dolomite in soil conditioning and water treatment, further cementing North America's dominance in the global dolomite mining industry.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the dolomite mining industry include Calcinor, Carmeuse, E. Dillon & Company, Essel Mining & Industries Limited (Aditya Birla Group), Imerys, JFE Mineral Co. Ltd. (JFE Steel), Lhoist, Omya AG, RHI Magnesita GmbH and Sibelco, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The dolomite mining industry is characterized by intense competition among key players such as Lhoist Group, Imerys, and Sibelco. These companies compete on factors like product quality, price, and supply chain efficiency. Innovation and technological advancements play crucial roles, with market leaders investing in sustainable mining practices and advanced processing techniques to enhance product purity and performance. Regional players also contribute to the competitive landscape, leveraging local resource advantages and cost efficiencies. Strategic partnerships and acquisitions are common strategies to expand market presence and improve competitive positioning in the global dolomite market.

Dolomite Mining Market News:

- In June 2024, Sibelco successfully acquired North America's prominent glass recycler, Strategic Materials, Inc. The acquisition cements Sibelco's global position in glass recycling and expands its presence outside of Europe. With 42 sites across North America, SMI processes around 2 million tonnes of cullet annually, adding to Sibelco's existing capacity in Europe. SMI's President & CEO emphasizes Sibelco's understanding and commitment to glass recycling, foreseeing the combined expertise leading to further growth.

- In December 2023, Imerys and Seitiss formed a Joint Venture called Seitiss Imerys Minéraux Circulaires, aiming to develop circular economy solutions using waste minerals from various industrial activities. Imerys brings its expertise and international capabilities, while Seitiss contributes innovative digital tools for locating and utilizing waste. The partnership addresses the need for better waste recovery in industrial sectors and aims to reduce the environmental impact of industrial waste.

Dolomite Mining Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Calcined, Sintered |

| Applications Covered | Construction, Agriculture, Animal Feed, Ceramics and Glass, Iron and Steel, Plastic, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Calcinor, Carmeuse, E. Dillon & Company, Essel Mining & Industries Limited (Aditya Birla Group), Imerys, JFE Mineral Co. Ltd. (JFE Steel), Lhoist, Omya AG, RHI Magnesita GmbH, Sibelco, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dolomite mining market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global dolomite mining market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dolomite mining industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global dolomite mining market to exhibit a CAGR of 3.4% during 2025-2033.

The rising demand for dolomite mining across the construction industry for producing paints, varnishes, steel, cement, and flooring tiles, is primarily driving the global dolomite mining market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for dolomite mining.

Based on the type, the global dolomite mining market has been segregated into calcined and sintered, where sintered currently holds the largest market share.

Based on the application, the global dolomite mining market can be bifurcated into construction, agriculture, animal feed, ceramics and glass, iron and steel, plastic, and others. Currently, construction exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global dolomite mining market include Calcinor, Carmeuse, E. Dillon & Company, Essel Mining & Industries Limited (Aditya Birla Group), Imerys, JFE Mineral Co. Ltd. (JFE Steel), Lhoist, Omya AG, RHI Magnesita GmbH, and Sibelco.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)