Dog Food Market Size, Share, Trends and Forecast by Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2025-2033

Dog Food Market Size and Share:

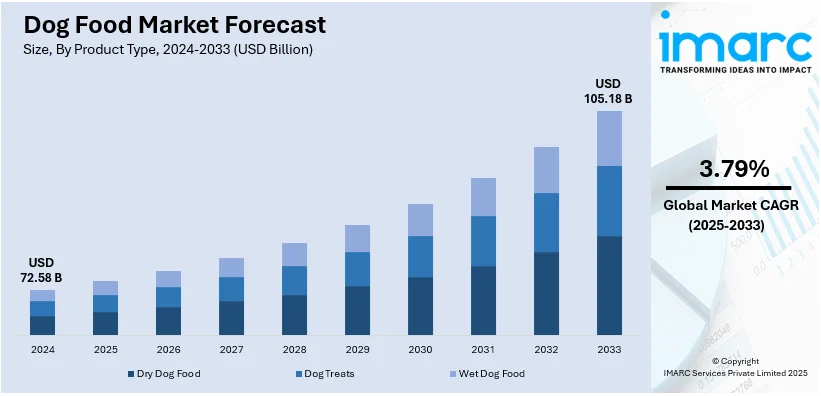

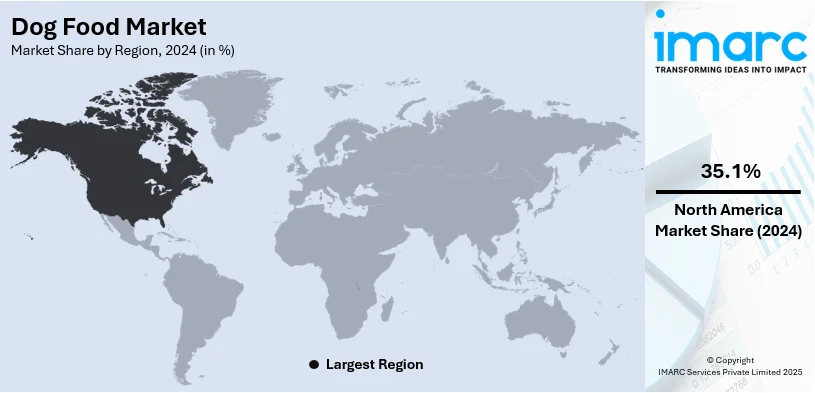

The global dog food market size was valued at USD 72.58 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 105.18 Billion by 2033, exhibiting a CAGR of 3.79% from 2025-2033. North America currently dominates the dog food market share by holding over 35.1% in 2024. The market in the region is driven by high pet ownership rates, increasing humanization of pets, rising demand for premium and natural ingredients, and expanding e-commerce presence.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 72.58 Billion |

| Market Forecast in 2033 | USD 105.18 Billion |

| Market Growth Rate (2025-2033) | 3.79% |

The global dog food market demand is primarily driven by the rising pet ownership, particularly in urban areas, increasing the need for high-quality dog food. In addition to this, the expanding e-commerce and pet specialty stores make purchasing more convenient, enhancing accessibility and driving the market demand. Besides this, the growing awareness of pet health and nutrition is significantly fueling the market demand for functional and fortified foods. Furthermore, innovation in flavors, textures, and specialized diets, such as grain-free and breed-specific formulas, attracts diverse consumer preferences, providing an impetus to the market. For instance, in the United Kingdom, Meatly, in partnership with The Pack, launched "Chick Bites," the first lab-grown meat dog treats available for purchase. This initiative aims to reduce the environmental impact of pet food production. Also, the increasing disposable income enables pet owners to spend more on premium and customized dog food, thus impelling the market growth.

The United States dog food market growth is driven by the rising trend of pet adoption from shelters and rescues, as it increases the need for high-quality nutrition. In line with this, the U.S. holds a significantly share of 87.60% in the dog food market. Additionally, the growing interest in sustainable and eco-friendly pet food options, such as plant-based or insect protein-based formulas, appeals to environmentally conscious consumers, thus strengthening the dog food market share. Concurrently, veterinary recommendations and prescription diets drive sales of specialized and therapeutic pet food, boosting the market demand. Also, subscription-based pet food services offer convenience and personalization, impelling the market growth. Furthermore, the increasing concerns over food safety and transparency push brands to use traceable, high-quality ingredients, which is contributing to the market expansion. Apart from this, social media and influencer marketing significantly shape pet owners' purchasing decisions, thereby propelling the market forward.

Dog Food Market Trends:

Increasing Ownership of Dogs

The global dog food market is witnessing strong growth due to the rising trend that pets are becoming family members. Worldwide pet ownership has experienced a major increase as a result of this transformation. Among all pets, dogs hold the title of most adopted pets across the world by pet parents. Pet food manufacturers reported the largest market value of USD 80.03 Billion in 2022, which represented the total market share of dogs worldwide. A forecast also predicts that the market value will increase to USD 156.60 Billion in 2029. Additionally, dog owners have moved from preparing food at home to commercial pet food options while dog dietary requirements exceed those of other pets and dogs represent a bigger demographic. Moreover, the worldwide population count of dogs reached 604.5 million in 2022 while cats numbered 408.2 million according to reported figures. The growing awareness of pet owners about dog health results in significantly influencing the dog food market trends.

Rising Demand for Nutrition-Packed Dog Food

Health-conscious attitudes among pet owners have become a key factor enhancing the dog food market outlook. Dog parents invest most of their pet expenditure in dog food as they are concerned about their dogs' well-being and are seeking products that cater to specific health concerns like obesity, diabetes, and food allergies in pets. Besides this, manufacturers are increasingly investing in expanding their operations to offer a wide range of specialized products, including those with functional benefits such as enhanced immunity, digestive health, and coat condition. For instance, in October 2023, Nestlé announced the opening of two new production units at its Purina pet food factory in Hungary, increasing output by 66%. The expansion will see the annual production capacity of the facility increase from approximately 150,000 metric tons to 250,000 metric tons. In addition to this, various manufacturers are also offering unique treats since dogs show more preference for treats over other pets. The treats of dog food have three main functions, which consist of training purposes, dental care, and reward systems. The introduction of unique and healthy food variants for dogs is anticipated to propel the dog food market share in the coming years.

Technological Advancements

The ongoing advancements in technology about the production and packaging of dog food are creating a positive outlook for the overall market. The integration of modern technology in manufacturing processes is enabling the production of a wider variety of pet food with improved nutritional value and a longer shelf life. For instance, BrightPet Nutrition Group unveiled a refreshed brand presence for its Blackwood pet nutrition portfolio at Global Pet Expo 2024, held March 20–22 in Orlando. The rebrand precedes several new product launches planned for the brand later this year, including new meal toppers, freeze-dried, single ingredient treats, and granola treats, as well as a new branding for Blackwood's Oven Baked Bites. The new package designs for the Blackwood portfolio aim to communicate freshness, quality, and health benefits to consumers with enhanced formulations. Besides this, numerous leading market players are also incorporating sustainable packaging materials like biodegradable plastics or recyclable materials to reduce environmental impact, which is positively impacting the dog food market forecast.

Dog Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dog food market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, pricing type, ingredient type, and distribution channel.

Analysis by Product Type:

- Dry Dog Food

- Dog Treats

- Wet Dog Food

Dry dog food leads the market with around 65.3% of market share in 2024. This segment is growing as this food type offers convenience, and a longer shelf life compared to wet or semi-moist alternatives. This convenience aligns with the modern lifestyles of pet owners, especially those in urban areas, where time constraints often dictate pet care routines. For instance, dry dog food in the economy range had the highest market value in India, amounting to over USD 238 Million in 2021. This translated to a share of nearly 40% of the total market value for dry dog foods in India during the measured period. Additionally, dry dog food's cost-effectiveness appeals to a broad range of consumers, making it a popular choice across various socioeconomic segments. These factors collectively establish dry dog food as a versatile, accessible, and economical option, positioning it as the dominant force in the dog food industry.

Analysis by Pricing Type:

- Premium Products

- Mass Products

Mass products lead the market with around 64.0% of market share in 2024. This segment is experiencing significant growth as the strategic pricing of mass products extends their accessibility to consumers from varying income levels, which makes them attractive to wide-ranging pet owners. The affordable pricing model matches the wide variety of dog owners worldwide, which builds up a bigger customer demographic. Moreover, mass products maintain affordable costs to reach large volumes of customers, because of manufacturing economies of scale. Furthermore, the market success of mass products enables companies to serve the broad consumer base by providing affordable yet reliable nutritional options for pets without quality compromises.

Analysis by Ingredient Type:

- Animal Derived

- Plant Derived

Animal derived leads the market with around 73.0% of market share in 2024. Dogs are carnivorous by nature, and their dietary needs are inherently tied to animal proteins and nutrients. Animal-derived ingredients, such as meat, poultry, and fish, align more closely with the natural dietary preferences and nutritional requirements of dogs, making them a vital component in formulating balanced and nutritious dog food. Additionally, animal-derived ingredients offer a rich source of essential amino acids, vitamins, and minerals that contribute to the overall health and well-being of a dog. Scientific researchers in Portugal and Germany investigated new protein alternatives for pet food in their study, which appeared in Frontiers in Veterinary Science. The research indicates that dog food should utilize squid meal and shrimp hydrolysate as its protein sources. As a result, pet owners follow the premium and authentic image of animal-derived ingredients because they want to feed their dogs nutrition based on their natural ancestral diet.

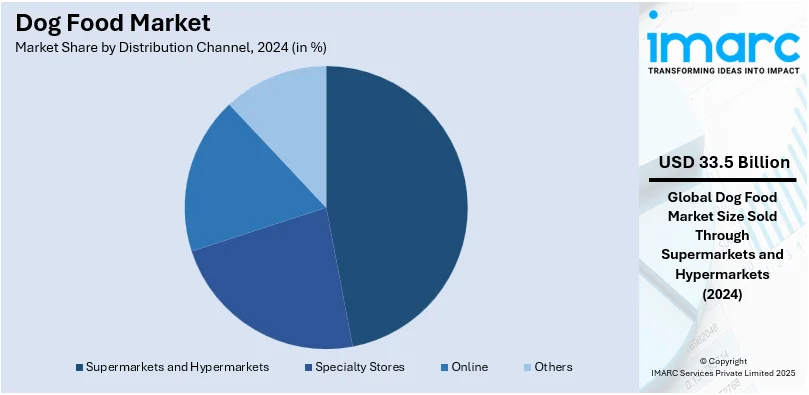

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

Supermarkets and hypermarkets lead the market with around 46.1% of market share in 2024. These retail giants present numerous pet food brands at their facilities, which enables pet owners to complete their shopping needs in a single location. In addition, these retail locations provide pet owners with an efficient shopping destination because they present dog food brands together with other household products during their regular shopping trips. Furthermore, urban pet owners highly value the convenience factor when looking for ways to buy necessary items for their pets. Apart from this, the business advantage of scale enables supermarkets and hypermarkets to carry numerous dog food choices from mass-market and premium categories.

Regional Analysis:

- North America

- Western Europe

- Asia Pacific

- Latin America

- Eastern Europe

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.1%. The region has a significant pet ownership culture, with dogs being prominent companions in many households. For instance, between 2017 and 2018, pet parents who consider dogs as family members accounted for 85% in the United States. Additionally, in North America, there was an increase of 9.6% in the pet dog population between 2020 and 2022 due to the rise in the work-from-home culture and millennials increasingly adopting new pets. Moreover, North American consumers prioritize their pets' health and well-being, leading to a preference for premium and specialized dog food products. As a result, the rising trend of humanization, where pets are regarded as family members, translates into a willingness to invest in nutritionally balanced and tailor-made options, thereby impelling the market growth.

Key Regional Takeaways:

Western Europe Market Analysis

The Western European pet food market for dogs is growing robustly, fuelled by rising pet adoption and pet care expenditure. As per the European Pet Food Industry Federation (FEDIAF), Europe is home to about 30% of worldwide pet care and pet food sales, positioning it as among the biggest pet food markets. The growth in pet ownership, especially in 2021, drove market growth by a significant extent. As per the Pet Health of Animals Organization, during lockdown, approximately 2 million individuals in the U.K. adopted a pet, indicating a trend toward pet companionship. Consumers are more inclined toward premium, natural, and functional dog food, with a focus on health benefits like better digestion and joint support. Furthermore, with the expansion of e-commerce platforms, access to quality dog food has increased, fuelling market penetration. Stringent European standards on dog food safety and quality also increase consumer confidence. As disposable income increases and knowledge of dog nutrition becomes more widespread, the Western Europe dog food market is poised for further growth.

Asia Pacific Market Analysis

The Asia Pacific dog food industry is observing a dramatic upsurge with the rapid growth in pet adoption in the prominent nations. The Pet Health of Animals Organization shows that China experienced a 113% rise in pet adoption from 2014 to 2019 while South Korea saw a 50% increase during the same period. The pet population in India expanded quickly during 2018 to 2023 at a Compound Annual Growth Rate of 11.7%, resulting in a population shift from 22.1 million to 38.5 million according to AAFC. The market is expanding because dog owners purchase premium healthy meals for their pets as the pet population grows. Pet care spending has increased due to the combination of rising incomes and the trend of urbanization. Moreover, the market now demands premium niche dog food items, including organic, grain-free and functional dog food products, because of the pet humanization trend. Additionally, the growth of e-commerce channels and pet specialty retailers enhances customer convenience in the market. The Asia Pacific dog food market will expand significantly as pet owners gain better knowledge about nutrition and health for their pets.

Latin America Market Analysis

The Latin America pet food market is growing strongly, fueled by the growing number of pets and higher pet care spending. According to reports, Brazil was the third-largest pet market in the world in 2022, after the U.S. and China. Similarly, ITA also reports that Brazil alone has 149 million pets, and the pet products market has almost doubled in the last six years. This quick growth mirrors the increasing pet humanization trend, where pet owners consider pets as part of the family, thus spending more on high-quality and specialty dog food. Concurrently, the increasing disposable incomes and urbanization in Latin America are also driving demand for quality pet nutrition. Furthermore, natural, organic, and grain-free dog food is becoming more popular among consumers, thus propelling the market demand. Additionally, the growth of pet store chains and online stores is also increasing access to varied dog food items. With pet ownership growing steadily in the region, the Latin America dog food market is likely to see consistent growth in the future.

Eastern Europe Market Analysis

The Eastern European market for dog food is growing with increasing pet ownership and changing consumer tastes towards higher-end and niche pet nutrition. According to market reports, dog ownership rates reached 49% in Poland during 2022, while Romania followed closely with 43% and the Czech Republic reached 42% results. The growing number of pet owners is creating demand for premium dog food products including grain-free options, plus organic and functional food items which address specific nutritional needs. Economic uncertainties did not affect the regional pet care market's value growth of 5% during 2023 because premium dog food segments demonstrated a 6% increase in constant unit prices. The Polish pet food market reached PLN 4 billion (USD 924 million) in 2022 and experts predict it will grow at 5% to 7% annually over the next four years according to analysis reports. As a result, the dog food market in Eastern Europe expands due to rising pet humanization levels and the dual factors of urban development and rising economic opportunities.

Middle East and Africa Market Analysis

The Middle East and Africa dog food market is also experiencing high growth, spurred on by the growing number of pet owners and spending by consumers on pet care. The pet industry in the UAE, presently valued at USD 300 Million, will increase 500% by 2025, as a measure of the growing pet care business in the region, as per reports. Pet ownership accelerated by 30% amid the pandemic, translating into increased demand for premium and specialized canine diets, as reported in the industry. Besides this, rapid urbanization increased disposable income, and a growing appreciation of pet nutrition and health are primary drivers for the trend. Regional pet owners are gravitating toward high-end, grain-free, and organic dog food. Also, increasing expansion of pet retail chains, veterinary clinics, and online platforms has made a wide variety of pet food more accessible. With augmented investment in the pet care industry and changing tastes among consumers, the Middle East and Africa dog food industry is likely to witness strong growth over the next few years.

Competitive Landscape:

Leading players make constant investments in research and development (R&D) to develop innovative dog food compositions. This comprises launching specialized foods for particular health requirements, the use of superior and natural ingredients, and new flavor and texture explorations responding to changing consumer tastes. Besides this, acknowledging the importance of animal health, industry leaders focus on nutrition. They work with animal nutritionists and veterinarians to create well-balanced recipes that meet nutritional needs as well as overall wellness, which is of interest to health-aware pet owners. Moreover, due to increasing consumer interest in sustainability, major players are introducing ethical sourcing principles, traceable ingredients, and green packaging. Clear labeling and explicit information on sourcing give pet owners assurance regarding the quality and origin of the products they opt for. Apart from this, through the use of technology, businesses interact with pet owners via the internet, social media, and mobile applications. They provide informative content, product suggestions, and customized feeding schedules, improving the consumer experience and creating brand loyalty.

The report provides a comprehensive analysis of the competitive landscape in the dog food market with detailed profiles of all major companies, including:

- Mars Petcare, Inc.

- Nestlé Purina Pet Care

- Hill's Pet Nutrition

- Del Monte Foods

Latest News and Developments:

- June 2024: Notti Pet Food received a seed investment worth USD 500,000 from the investment firms 500 Global and First Move. The company intends to create new product lines and enter the Philippines and Singapore markets using the received capital.

- April 2024: Bowlers from Allana introduced Nutrimax as their new revolutionary dog food series under their established pet health brand. The innovative product line serves a pet market segment focused on providing total nutritious diets that maintain outstanding food quality.

- January 2024: The pet food company PawCo Foods introduced its two novel vegan dog food products LuxBites and InstaBites to the market. The AI systems at PawCo Foods enhance both nutritional value and taste quality of their products.

Dog Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dry Dog Food, Dog Treats, Wet Dog Food |

| Pricing Types Covered | Premium Products, Mass Products |

| Ingredient Types Covered | Animal Derived, Plant Derived |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online, Others |

| Regions Covered | North America, Western Europe, Asia Pacific, Latin America, Eastern Europe, Middle East and Africa |

| Companies Covered | Mars Petcare, Inc., Nestlé Purina Pet Care, Hill's Pet Nutrition, Del Monte Foods, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dog food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dog food market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dog food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dog food market was valued at USD 72.58 Billion in 2024.

IMARC estimates the dog food market to exhibit a CAGR of 3.79% during 2025-2033, expecting to reach USD 105.18 Billion by 2033.

The dog food market is driven by rising pet ownership, demand for premium and natural ingredients, increasing focus on pet health, growth in e-commerce, innovations in specialized diets, and sustainability trends. Additionally, convenience-driven subscription services and social media influence further boost the market demand for high-quality pet food.

North America currently dominates the market, accounting for a share exceeding 35.1% in 2024. This dominance is fueled by the rising demand for premium and natural pet food, high pet ownership rates, strong e-commerce growth, increasing pet humanization, veterinary-recommended diets, and sustainability-focused products.

Some of the major players in the dog food market include Mars Petcare, Inc., Nestlé Purina Pet Care, Hill's Pet Nutrition, Del Monte Foods, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)