DNA Data Storage Market Size, Share, Trends and Forecast by Technology, Deployment, End-User, and Region, 2025-2033

DNA Data Storage Market Size and Share:

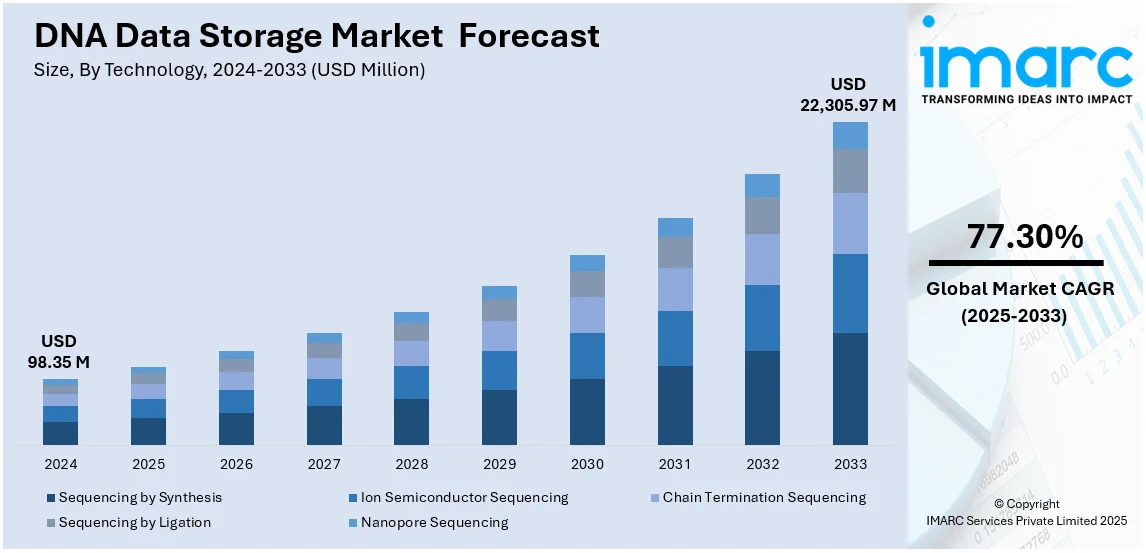

The global DNA data storage market size was valued at USD 98.35 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 22,305.97 Million by 2033, exhibiting a CAGR of 77.30% from 2025-2033. North America currently dominates the market, holding a market share of over 47.5% in 2024. The growing demand for high-density, long-term data storage, rising digital data generation, advancements in DNA synthesis and sequencing technologies, increasing investments in biotechnology and bioinformatics, and the need for energy-efficient archival solutions, particularly in sectors like healthcare, finance, government, and research institutions are some of the major factors augmenting DNA data storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 98.35 Million |

| Market Forecast in 2033 | USD 22,305.97 Million |

| Market Growth Rate 2025-2033 | 77.30% |

The market is majorly driven by the increasing focus on long-term archival storage, which is accelerating demand for DNA-based solutions due to their superior stability and minimal degradation over time. Additionally, continual advancements in enzymatic synthesis and error-correction technologies are improving data retrieval accuracy and enhancing commercial feasibility. Moreover, the increasing production and advancement of synthetic DNA are facilitating the adoption of DNA-based data storage solutions. On September 11, 2024, Northstar Ventures announced an investment of EUR 400,000 (about USD 434,215.34) into NunaBio, a company specializing in synthetic DNA production. This funding aims to enhance NunaBio's capacity to meet the escalating global demand for synthesized DNA, driven by its innovative technology that offers rapid, scalable, and cost-effective solutions. Besides this, increasing government investments in bioinformatics and genomic research are accelerating innovation in DNA-based memory systems. Also, expanding applications in forensic science, where DNA storage enables secure evidence preservation, are further increasing the DNA data storage market demand.

The market in the United States is witnessing significant growth, driven by the rising demand for high-density, energy-efficient data storage. According to industry reports, the energy consumption of data centers in the United States has exhibited a sustained upward trend, reaching 176 terawatt-hours (TWh) in 2023. This accounts for 4.4% of the country's total electricity consumption. To reduce energy usage, firms are turning to DNA data storage, which offers a sustainable, long-term solution with minimal power requirements for data retention. In line with this, the presence of leading biotechnology firms and academic institutions is accelerating advancements in DNA storage technologies. Apart from this, the growing concerns over cybersecurity are driving interest in DNA-based encryption, given its potential for ultra-secure data encoding. The expansion of cloud storage providers exploring DNA storage as a long-term archival alternative is further propelling market growth. Also, the development of automated DNA synthesis and sequencing techniques is enhancing scalability, positioning the U.S. as a key player in global DNA data storage advancements.

DNA Data Storage Market Trends:

Strategic Collaborations Driving Innovation

The increase in strategic collaborations between technology firms, research institutions, and biotech companies is positively impacting the DNA data storage market outlook. For instance, on September 29, 2024, the Frontiers SciensuccessfulSynthetic Biology at Tianjin University, in partnership with Tianjin Huanhu Hospital, reported a noteworthy development in the field of data storage based on DNA. They introduced the DNA Palette coding scheme and achieved the successful encoding of 11.28 megabytes of brain MRI data into nearly 250,000 DNA sequences. It reached a data density of 2.39 bits per base. This breakthrough highlights DNA's viability as a stable and efficient medium for long-term medical data storage, and addresses challenges associated with large-scale data retention. These collaborations focus on improving data encoding efficiency, error correction, and storage density. Also, cross-industry partnerships enable the integration of artificial intelligence (AI) and bioinformatics expertise into DNA storage development. As companies and research groups pool resources and expertise, breakthroughs in automation, retrieval speed, and cost reduction are being achieved, thereby paving the way for commercial-scale DNA storage deployment.

Expansion of Research into Error Correction and Encoding Methods

One of the major DNA data storage market trends is the increasing research efforts to improve DNA data encoding and retrieval accuracy. For instance, on October 23, 2024, researchers developed a novel method to encode data into DNA by leveraging a natural biological process known as methylation, significantly enhancing data storage efficiency. This technique allows for the simultaneous writing of 350 bits of information onto a DNA sample, a substantial improvement over previous methods that encoded data one bit at a time. The advancement holds promise for more practical and accessible DNA-based data storage solutions. Unlike traditional binary storage, DNA requires precise encoding to minimize errors during synthesis and sequencing. Research in DNA Fountain and Reed-Solomon error correction techniques is enhancing data fidelity and retrieval reliability. Moreover, researchers are working on encoding redundancy strategies that reduce mutation-induced data loss. Additionally, advancements in random-access sequencing are enabling selective data retrieval rather than full-sequence reading, which improves efficiency.

Artificial Intelligence (AI) Accelerated DNA Data Decoding for Rapid Retrieval

Artificial intelligence is revolutionizing the decoding of digital data stored in DNA, reducing retrieval times from hours to minutes, which is facilitating the DNA data storage market growth. For instance, on February 21, 2025, researchers introduced DNAformer, an AI-based method capable of decoding digital data stored in DNA strands within approximately 10 minutes, a significant improvement over previous techniques that required days. This advancement enhances the practicality of DNA as a medium for data storage, offering a compact and durable alternative to traditional methods. Traditional DNA sequencing methods require extensive computational power to read nucleotide sequences and reconstruct binary data. AI-driven algorithms are significantly improving this process by optimizing pattern recognition, base calling, and error correction. Machine learning models trained on vast DNA sequence datasets can rapidly distinguish meaningful digital data from biological noise, enhancing retrieval speed. Companies are investing in AI-powered DNA decoding systems, enabling real-time data access for archival storage, cloud computing, and high-speed retrieval applications.

DNA Data Storage Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global DNA data storage market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, deployment, and end-user.

Analysis by Technology:

- Sequencing by Synthesis

- Ion Semiconductor Sequencing

- Chain Termination Sequencing

- Sequencing by Ligation

- Nanopore Sequencing

Sequencing by synthesis leads the market in 2024. Sequencing by synthesis (SBS) is a key technology in the DNA data storage market as it facilitates high-throughput and accurate reading of stored encoded information. SBS, which is also commonly applied in next-generation sequencing (NGS), makes possible the accurate decoding of DNA strands used to store digital data. With its capacity to produce enormous parallel sequencing outputs, SBS increases the scalability and efficiency of DNA-based storage systems, solving issues of retrieval speed and error correction. The high fidelity of the method guarantees data integrity, and thus, it is a favored method for reading synthetic DNA archives. The increasing demand for long-term, high-density data storage, makes SBS technology central to creating practical DNA-based solutions. SBS innovations are also propelling advancements in read accuracy and cost reduction, cementing its position in the market.

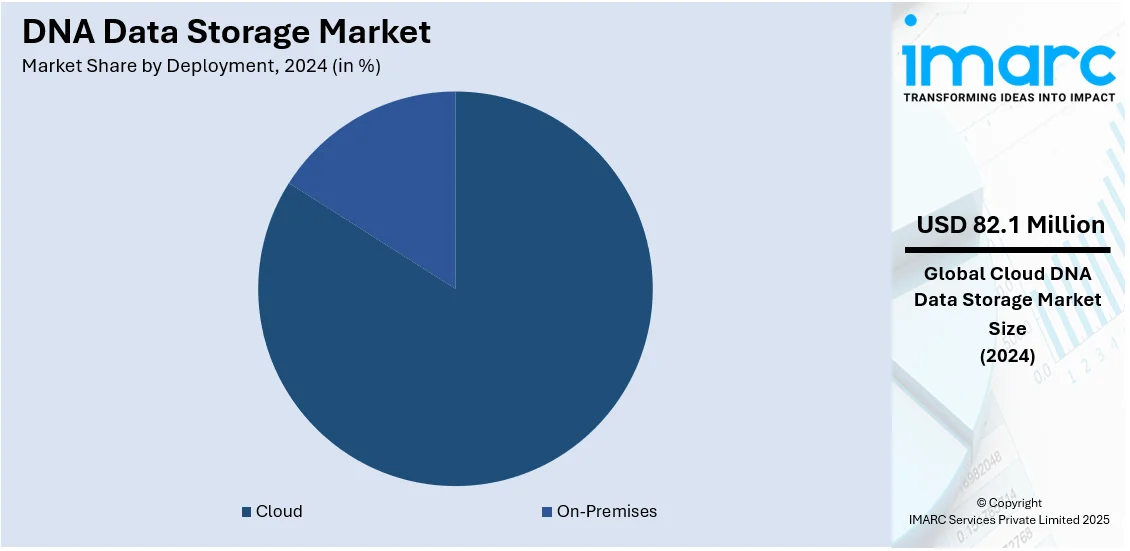

Analysis by Deployment:

- Cloud

- On-Premises

Cloud leads the market with around 83.5% of market share in 2024. Cloud deployment provides scalable infrastructure, remote access, and powerful computational resources for encoding, decoding, and managing data stored in DNA. Since DNA data storage entails intricate processes, such as sequence writing and retrieval, cloud platforms offer the required processing capabilities and storage management facilities to process large datasets effectively. Cloud integration offers enhanced security, backup, and redundancy, which ensures long-term storage with little chance of data loss. Cloud integration also facilitates real-time collaboration, enabling researchers and organizations to access, share, and analyze DNA-encoded data remotely. As demand for high-density, long-term archival solutions increases, cloud deployment is becoming a key enabler, lowering infrastructure expenses while facilitating smooth scalability and integration with existing digital storage ecosystems. This solution accelerates commercialization and industry adoption in areas like healthcare, finance, and government archives.

Analysis by End-User:

- Pharmaceutical Companies

- Hospitals and Clinics

- Academic and Government Research Institutes

- Biotechnology Companies

Pharmaceutical companies and biotechnology companies lead the market with around 56.7% of market share in 2024. These firms produce huge volumes of sequencing and molecular data, which demand high-density, long-lasting storage solutions that DNA-based systems offer. DNA data storage has unmatchable longevity and stability, thereby research data, clinical trials data, and patient genetic information are reliably preserved for decades. DNA storage also facilitates low-cost storage with low energy draw compared to conventional digital storage. Biotech companies venturing into synthetic biology and gene engineering also gain advantages from DNA storage for maintaining large data sets utilized in computational modeling and artificial intelligence (AI) based drug development. With the increasing acceptance of personalized medicine and genomics-based drugs, DNA data storage is an efficient and scalable option for the management of exponentially expanding biological data without compromising data integrity and accessibility.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share of over 47.5% due to well-developed research facilities, huge investments in synthetic biology, and a high presence of key biotechnology and pharmaceutical players. The area houses leading players in the development of DNA-based storage technologies, supported by established genomic research centers and high next-generation sequencing (NGS) adoption. Government initiatives and grants supporting data preservation and bioinformatics fuel market growth. Growing requirements for high-density, long-term storage solutions by industries such as healthcare, finance, and national security drive innovation. In addition, research collaborations between research institutions, universities, and technology companies in the U.S. and Canada are driving DNA synthesis, sequencing, and error correction methods. With digital data creation booming, North America is becoming a prominent for DNA data storage commercialization, with a high emphasis on scalability, cost minimization, and integration with current cloud and AI-based analytics platforms.

Key Regional Takeaways:

United States DNA Data Storage Market Analysis

The United States holds a substantial share of the North America DNA data storage market, with 90.60% in 2024. The market is expanding due to rising investments in biotechnology, ongoing improvements in synthetic biology, and active government support for genomic research. Major players in the region, such as technology companies and research institutions, are actively engaged in creating scalable and affordable DNA-based storage solutions. The availability of top cloud computing and data storage companies is fueling innovation in the market. The need for high-density DNA storage in healthcare, finance, and defense industries is a major market driver. Also, partnerships between private firms and universities, which result in fast progress in error correction codes and DNA synthesis methods. For example, on October 2024, Arizona State University scientists and their global collaborators came up with a new DNA data storage method that increases capacity and efficiency. The method involves "epi-bits," like movable type in a printing press, which can be reconfigured on a universal DNA template. This method dispenses with the synthesizing of new strands of DNA, thus speeding up and reducing the cost. This technology uses epigenetic concepts to store data, presenting a possible transition from existing storage technologies. Also, regulatory aspects pertaining to biosecurity and moral issues pertaining to DNA data encoding are significant market trends.

Europe DNA Data Storage Market Analysis

The DNA data storage market in Europe is expanding due to strong academic research, government-backed initiatives, and corporate investments in synthetic biology. Countries such as Germany, the United Kingdom, and France are leading in research and development (R&D) activities, supported by institutions like the European Molecular Biology Laboratory (EMBL) and the Wellcome Sanger Institute. European Union (EU) policies promoting digital transformation and sustainable data storage solutions are contributing to market growth. According to industry reports, Europe sets a target of an 11.7% reduction in energy consumption from 2020 to 2030. The major focus is on data centers due to their estimated energy consumption of 2% to 3% of the total energy utilized in the EU. The region's focus on reducing energy consumption in data centers is driving interest in DNA-based storage, which requires minimal power for long-term data archiving. Startups and biotech firms in Europe are actively exploring DNA synthesis and sequencing technologies, further strengthening the market. The increasing volume of genomic and biomedical data is prompting healthcare and pharmaceutical companies to explore DNA storage as an alternative to traditional storage methods. Additionally, data privacy regulations under the General Data Protection Regulation (GDPR) may influence adoption and data security standards.

Asia Pacific DNA Data Storage Market Analysis

The Asia Pacific market is experiencing growth due to rising investments in biotechnology, increasing data generation, and supportive government policies. Countries such as China, Japan, and South Korea are investing in synthetic biology and DNA sequencing technologies. For instance, on September 11, 2024, the CEO of Hong Kong Investment Corp (HKIC) announced plans to invest in a gene sequencing and genetic information exploration project. This initiative underscores the city's commitment to advancing its biotechnology sector, leveraging its existing ecosystem of approximately 250 biotech-related firms and leading universities. The investment aligns with HKIC's mandate to allocate HKD62 Billion (USD 8 Billion) in strategic industries, fostering growth and innovation within Hong Kong's biotech landscape. Additionally, government initiatives promoting next-generation storage technologies, along with advancements in DNA synthesis and nanotechnology, are fueling market expansion. The rapid digitalization of industries, especially in the healthcare, banking, and research sectors, is driving demand for long-term, sustainable data storage solutions. Additionally, geopolitical concerns regarding data security and technology transfer may influence investment decisions in the region.

Latin America DNA Data Storage Market Analysis

Latin America's DNA data storage market is growing, with limited large-scale commercialization but increasing interest from research institutions and technology firms. Countries like Brazil, Mexico, and Argentina are focusing on expanding their biotechnology and genomic research capabilities, which could drive future adoption of DNA-based storage solutions. According to an industry report, Brazil's federal government announced a USD 589 Million investment aimed at enhancing science, technology, and innovation nationwide, with a special focus on the North, Northeast, and West regions. The initiative will center on improving research infrastructure and backing projects fueled by innovation. The increasing government initiatives and investments supporting digital infrastructure and scientific research are creating opportunities for market growth. The healthcare and agricultural sectors, which generate vast amounts of genomic data, are key potential users of DNA storage. With the increasing cost reduction strategies and advancements in synthesis efficiency, DNA storage is expected to gain traction as a long-term data archiving solution in the region.

Middle East and Africa DNA Data Storage Market Analysis

The DNA data storage market in the Middle East and Africa is developing with advancements driven by research institutions and government-backed initiatives. Countries like the UAE and Saudi Arabia are actively investing in digital transformation projects and emerging technologies, creating potential opportunities for the adoption of DNA storage. According to IMARC Group, Saudi Arabia's digital transformation market, valued at USD 10.9 Billion in 2024, is projected to reach USD 82.0 Billion by 2033, growing at a CAGR of 23.1% from 2025 to 2033. This rapid digital expansion underscores the region's increasing focus on innovative data storage solutions, positioning DNA storage as a viable option for future-proofing information management. Countries in Africa, such as South Africa, are strengthening their biotechnology sectors with genomic research projects that could benefit from DNA-based data storage. The region's increasing digital data volumes, especially in sectors like healthcare and agriculture, highlight the need for innovative storage solutions. With the growing cost-effective synthesis and sequencing solutions, the market could see gradual adoption in high-priority sectors.

Competitive Landscape:

The DNA data storage market is highly research-intensive, with biotech companies, data storage companies, and research institutions competing to come up with cost-efficient and scalable solutions. The industry is investing in advancing DNA synthesis, sequencing, and error correction methods to maximize data density and retrieval speeds. Strategic alliances among biotech companies and cloud computing companies are expediting commercialization. Key players focus on optimizing encoding algorithms, error correction methods, and automation to improve read-write speeds. Companies and researchers are trying out new encoding technologies and automation to make DNA-based storage economically feasible. Intellectual property wars and regulatory complexities shape market dynamics and competitive strategies. Government agency and venture capital investments are driving market expansion, and partnerships with universities are propelling advancements in storage density, retrieval quality, and data stability over time.

The report provides a comprehensive analysis of the competitive landscape in the DNA data storage market with detailed profiles of all major companies, including:

- Twist Bioscience Corporation

- Catalog Technologies

- Molecular Assemblies Inc.

- DNA Script

- Evonetix

- Zymo Research Corporation

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- IBM Corporation

- Microsoft Corporation

Latest News and Developments:

- June 18, 2024: BioCompute, a startup leveraging DNA for data storage to cut data center emissions, secured India’s largest non-equity climate entrepreneurship grant of INR 31 lakh (approximately USD 35,650) at SusCrunch 2024, hosted by the Sustainability Mafia (SusMafia). The "Big Pie" grant, a joint initiative by the Pilani Innovation and Entrepreneurship Development Society and SusMafia, aims to position BioCompute at the forefront of global climate change mitigation efforts.

- July 1, 2024: Genomika, together with Kaunas University of Technology (KTU) and global partners, unveiled a project worth EUR 5 Million (approximately USD 5.4 Million) aimed at creating autonomous solutions for DNA data archiving. This initiative responds to the rising global demand for data storage, given that conventional data centers currently account for 1.5% of global electricity consumption and an annual CO₂ emission of 200 Million Tonnes. The project aims to develop a modular DNA-based storage device that enables users without specialized knowledge of genetics to read and write digital information, providing a sustainable and efficient alternative to traditional storage methods.

- December 10, 2024: Biomemory, a well-known DNA data storage company, announced securing USD 18 Million in Series A funding, which was led by Crédit Mutuel Innovation. This investment will enable Biomemory to advance the development of its molecular storage technology, aiming to offer eco-friendly, ultra-dense, and durable data storage solutions. The company's DNA-based method tackles essential problems in conventional data storage, such as sustainability, longevity, and density. It has the capability to store all of humanity's data within a single 19-inch rack in a data center.

- February 13, 2025: Mimulus Technologies, recognized as a pioneering innovator in data storage, declared a strategic alliance with Expand Entertainment Inc., an influential entity in the entertainment sector. With this collaboration, Expand Entertainment has given the rights to promote and sell Mimulus's state-of-the-art DNA Digital Data Storage solutions. This collaboration seeks to transform data storage within the entertainment industry by utilizing the cutting-edge molecular technology of Mimulus.

DNA Data Storage Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Sequencing by Synthesis, Ion Semiconductor Sequencing, Chain Termination Sequencing, Sequencing by Ligation, Nanopore Sequencing |

| Deployments Covered | Cloud, On-Premises |

| End-Users Covered | Pharmaceutical Companies, Hospitals and Clinics, Academic and Government Research Institutes, Biotechnology Companies |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Twist Bioscience Corporation, Catalog Technologies, Molecular Assemblies Inc., DNA Script, Evonetix, Zymo Research Corporation, Illumina, Inc., Thermo Fisher Scientific Inc., IBM Corporation, Microsoft Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the DNA data storage market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global DNA data storage market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the DNA data storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The DNA data storage market was valued at USD 98.35 Million in 2024.

The DNA data storage market is projected to exhibit a CAGR of 77.30% during 2025-2033, reaching a value of USD 22,305.97 Million by 2033.

The market is driven by increasing data generation, rising limitations of traditional storage, growing demand for long-term archival solutions, continual advancements in DNA synthesis and sequencing, declining costs. Additionally, increasing government and private investments in biotechnology and data storage further accelerate growth of the market.

North America currently dominates the DNA data storage market, accounting for a share of 47.5 % in 2024. The dominance is fueled by strong investments in genomics, collaborations between tech and biotech firms, and implementation of government initiatives supporting advanced data storage technologies. The region also benefits from a robust research and development (R&D) ecosystem.

Some of the major players in the DNA data storage market include Twist Bioscience Corporation, Catalog Technologies, Molecular Assemblies Inc., DNA Script, Evonetix, Zymo Research Corporation, Illumina, Inc., Thermo Fisher Scientific Inc., IBM Corporation, and Microsoft Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)